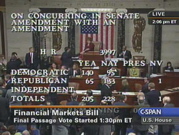

* As you probably already know, the financial systems bailout bill just failed in the US House. The roll call is here.

* Illinois congresscritters voting “Yes” - with those who have serious or semi-serious November opposition in bold…

* Bean (D)

* Bean (D)

* Davis (D)

* Emanuel (D)

* Foster (D)

* Gutierrez (D)

* Hare (D)

* Kirk (R)

* LaHood (R)

* Schakowsky (D)

* Illinois congresscritters voting “No” - with those who have serious or semi-serious November opposition in bold…

* Biggert (R)

* Costello (D)

* Jackson (D)

* Johnson (R)

* Lipinski (D)

* Manzullo (R)

* Roskam (R)

* Rush (D)

* Shimkus (R)

Congressman Weller was the only member of the US House recorded as not voting. Typical.

*** UPDATE 1 *** From a press release issued by Congressman Jesse Jackson, Jr….

“To heal the systemic problems in our financial system we need to treat the cause, not only the symptoms. Congress needs to pass and the president needs to sign into law the following provisions: 1) a second stimulus to help those squeezed by the financial crisis; 2) a substantial investment in infrastructure which could jump start the economy while creating jobs, and; 3) a program that helps keep taxpayers in their homes. This bill does not contain provisions that explicitly help borrowers restructure their mortgages. Buying ‘trash (bad mortgages) for cash ($700 billion bailout)’ may not cure our financial system, since it was these bad mortgages that engineered this market collapse,” said Jackson.

*** UPDATE 2 *** Suburban context from the Daily Herald…

From the start, Bean was working to win support for Paulson’s $700 billion plan.

Bean’s challenger, Steve Greenberg, supported the proposal as well.

Foster was also an early backer, despite facing attacks from challenger Jim Oberweis in the largely Republican 14th District in the far western suburbs.

Roskam and Manzullo were the most skeptical from the start.

*** UPDATE 3 *** Finger-pointing…

After the vote, Republicans claimed that the Democratic leadership had been warned that fewer than 60 Republicans would vote for the bill. Democrats denied the claim, saying they never would have brought the bill to the floor if they had been told there was so little Republican support.

“We delivered our votes,” Rep. Rahm Emanuel (D-Ill.) said.

*** UPDATE 4 *** Judy Biggert explains her opposition to Chicago Public Radio.

BIGGERT: Everybody seems to be in such a hurry to go home that I don’t think Congress is thinking clearly.

Biggert says the proposal the House voted on today did not go through the normal committee channels, which hurt its odds of passing. She says she would like a rescue bill to include a measure that would beef up the number of FBI inspectors looking into mortgage fraud.

*** UPDATE 5 *** From a Phil Hare press release…

“It was not a gift or a blank check. It provided the federal government the authority to loan money to certain financial institutions so they could resume lending to ordinary Americans. This would have allowed more families to afford their homes, cars and tuition payments and enabled our farmers to continue buying equipment, seed and fertilizer.

“Now it is imperative that we go back to the drawing board and craft new bipartisan legislation that protects Main Street from Wall Street. As we consider our next steps, I will continue to fight to enact stronger protections for homeowners facing foreclosure, something this bill lacked.

“We should also pass an economic stimulus package that creates jobs by investing in our crumbling infrastructure.

*** UPDATE 6 *** From Peter Roskam’s press release…

“While action is necessary to keep our economy on track, the heavy-handed push from the Bush Administration and this Democrat majority places too great a burden on taxpayers with no guarantee of success. The plan voted on in the House incorporated watered down aspects of executive compensation limits and provided for insufficient use of private capital.

“Unfortunately, negotiations were unable to produce a solution to keep our economy on track without exposing taxpayers to extraordinary risk – this is why the bill failed.

*** UPDATE 7 *** From a John Shimkus press release…

“The free market system can deal with the crisis on its own. The free market system is not compassionate, but it is the quickest way to turn an economic crisis around.”

*** UPDATE 8 *** Another explanation…

Prior to the vote, LaHood, R-Peoria, said he would back the $700 billion plan because changes made to it in recent days ease the concerns he previously had.

“I think it will give confidence to the market. I think it will give confidence to investors. I think it will give confidence to the American people,” LaHood said.

*** UPDATE 9 *** From Melissa Bean…

“I voted to support Secretary Paulson’s proposal only after working to improve it with limits on executive compensation for those who got us into this mess. I pushed for a strong equity stake for taxpayers, so that when the financial sector profits, taxpayers profit too. And I pushed for strong bipartisan oversight of this unprecedented authority.”

*** UPDATE 10 *** From Rep. Bill Foster…

“Nobody likes the situation we are in, and this bill was far from perfect, but today, in an extremely tough and close vote, I supported the Emergency Economic Stabilization bill to ensure the economic hardships facing our middle-class families and small businesses all over the 14th District would not worsen,” Rep. Foster said. “The bill was the tough medicine we needed to get the economy back on solid footing.”

After the bill failed, as a result political gamesmanship, the New York Stock Exchange lost 777.78 points or 7%. The NASDAQ lost more than 9 percent. According to Bloomberg News, $1.2 trillion in market value was erased from American equities.

Said Foster, “We now know the price of inaction — $1.2 trillion lost today alone. You don’t have to be a scientist or a businessman to know that the $350 billion we were committing to stabilize the market – with good prospects for most of the money being returned over time — was a much better deal for Americans than what happened as a result of the bill being defeated.”

*** UPDATE 11 *** Schock and Callahan both would have voted “Yes”…

Both the Democrat and Republican candidates for the 18th District Congressional seat say they would have voted for the bailout bill. […]

“Those questions I did have, have been answered. And as distasteful as this bailout is, I could and would vote for this package,” said Democratic candidate Colleen Callahan.

“Something has to be done. To do nothing in this case, absolutely nothing, would wreak havoc on our economy in this country,” said Republican candidate Aaron Schock.

* Bean (D)

* Bean (D)

- Bill Baar - Monday, Sep 29, 08 @ 1:56 pm:

This is a fascinating list.

- Mason-Dixon - Monday, Sep 29, 08 @ 1:56 pm:

South and Southwest side and suburbs (with the exception of absentee Weller) votes NO, while the north and northwest side and subrubs votes YES

- Bill Baar - Monday, Sep 29, 08 @ 1:59 pm:

…the level of anger is immense… that Oberweis TeleTown hall was something else and you could tell who was planted to ask q’s and who was really ticked off…. Foster the Biz Man may have blown it.

- Mason-Dixon - Monday, Sep 29, 08 @ 2:01 pm:

The bigger picture appears as though Pelosi has some insurgency concerns within her own caucus; and could run the risk of being struck by friendly fire even before, but certainly after the election.

- GOP - Monday, Sep 29, 08 @ 2:06 pm:

This gives great hope to Obie over Foster…maybe even a Bean loss. Let’s hope!

- Pot calling kettle - Monday, Sep 29, 08 @ 2:10 pm:

It’s hard to imagine a good plan being developed this quickly. Washington was not built to work that way. There needs to be a lot more explainin’ about what is needed and why. And, I hope, Congress will stop giving more and more power to the President.

Interesting: Overall, there were more Democratic no’s than Republican aye’s.

Also interesting: The House voted first, keeping the Presidential nominees off the official record.

- Mason-Dixon - Monday, Sep 29, 08 @ 2:13 pm:

{a program that helps keep taxpayers in their homes. This bill does not contain provisions that explicitly help borrowers restructure their mortgages. Buying ‘trash (bad mortgages) for cash ($700 billion bailout)’ may not cure our financial system, since it was these bad mortgages that engineered this market collapse,” }

Bad credit, is bad credit irrespective of the terms and conditions voluntarily agreed to by both parties to the mortgage contract. There is no guaranty that even when re-engineered, that new and improved mortgages will be paid; and paid on time.

Bailing out the investment banks; and in a scatter shot fashion, was bad public policy. Having the federal government step in and bail out one neighbor while the other neighbors pays his own mortgage and assumes the bad debt and credit risk of the first neighbor is bad public policy as well.

- frustrated GOP - Monday, Sep 29, 08 @ 2:17 pm:

Let’s see. The market drops 500 points on the failure of the bill. I would think anyone with investments and maybe geeting close to retirement might look at that list of No’s in an unfavorable light.

- Judgment Day Is On The Way - Monday, Sep 29, 08 @ 2:27 pm:

“…a program that helps keep taxpayers in their homes. This bill does not contain provisions that explicitly help borrowers restructure their mortgages”

That’s what (in RE terms) is called a “Cram-Down”. There’s both pluses and minuses to doing it, but the simple reality is that any bill such as this one with any substantive form of a “RE mortgage cram-down” provision in it was a dead duck. Honestly, there are very good reasons to avoid the entire “cram-down” issue, unless your primary goal is full employment for lawyers.

- Bill Baar - Monday, Sep 29, 08 @ 2:29 pm:

“We delivered our votes,” Rep. Rahm Emanuel (D-Ill.) said.

What list for Illinois is he looking at?

- Rich Miller - Monday, Sep 29, 08 @ 2:31 pm:

BB, this was a strutured roll call. That means some people were given a pass on each side.

- Mr. Ethics - Monday, Sep 29, 08 @ 2:31 pm:

maybe our congresscritters can get together and sneak a $5 billion appropriation to bail out the State of Illinois

- LadyR - Monday, Sep 29, 08 @ 2:35 pm:

Just an observation but I really don’t believe that the majority of Americans truly understand the dire circumstance that this country is in. As long as it doesn’t effect their pocketbook, they don’t care and if you don’t have money in the stock market people haven’t seen the impact of this disaster.

Rich, do you think this vote is going to impact any of the congressional races??

- Louis G. Atsaves - Monday, Sep 29, 08 @ 2:37 pm:

How about this to consider:

Try to fix the problem first, then argue over who caused it later?

A second stimulus bill, “we delivered our votes” and Pelosi’s speech before the vote blaming it all on Republicans and Bush economic policies, fixes nothing at the moment. The rancor and partisanship in politics these days is just sickening.

Maybe some real extensive and long term extended financial pain will wake up this country and its so-called leadership.

I didn’t see either McCain or Obama come up with any long term serious solutions other than to quibble over minutia. Stuff those greenbacks under your mattresses for now.

- North of I-80 - Monday, Sep 29, 08 @ 2:39 pm:

I like the way the Dems are blaming the Repubs for this not passing. Don’t the Dems control BOTH houses of Congress? Maybe why congress’ approval rating is 9%. How about a LOAN or INSURANCE program instead of a reward for failure Buyout?

- Pat collins - Monday, Sep 29, 08 @ 2:42 pm:

Pelosi lost 90+ of her votes, on a key national bill.

Poster girl for “loser Speaker of this century, and the last one”

Rahm is just having down a BS smoke screen.

- stones - Monday, Sep 29, 08 @ 2:44 pm:

Weller = weasel

Must have been in Nicaragua during our country’s biggest financial crisis since the Great Depression????

- Pat collins - Monday, Sep 29, 08 @ 2:45 pm:

How many times did Hastert pass tough bills with 60 or FEWER D votes? A LOT.

She got 40% of the Rs and can’t pass it?

- Bill Baar - Monday, Sep 29, 08 @ 2:46 pm:

A friend writes me…

…it shows how weak Pelosi really is a strong speaker could have moved he dozen votes she needed out of -6 nays

- Rich Miller - Monday, Sep 29, 08 @ 2:48 pm:

===How many times did Hastert pass tough bills with 60 or FEWER D votes? A LOT.===

I would venture a guess that none of those bills were anything close to this one as far as toughness was concerned.

I would also guess that there will be another bill soon, perhaps without Repubs, perhaps with. We’ll see.

- Lefty Lefty - Monday, Sep 29, 08 @ 2:53 pm:

I agree with BB and GOP, and I still am voting for him. Foster blew it. Some day the Democratic Party will grow some, but not in the near future. A massive no-strings-attached bailout for Wall Street should be on the short list of “Things Democrats Should Never Vote For.”

- Pat collins - Monday, Sep 29, 08 @ 3:02 pm:

I would venture a guess that none of those bills were anything close to this one as far as toughness was concerned.

She only needed 12 more votes. Out of 95. Granted this was not a perfect bill, BUT it was better than the first one, and far better than nothing.

When it was gut check time on the hill, Weller wasn’t the only one AWOL.

- fedup dem - Monday, Sep 29, 08 @ 3:02 pm:

I guess Cong. Weller was busy checking into prime Central American real estate, or converting dollars into euros, or something to that effect.

- Rich Miller - Monday, Sep 29, 08 @ 3:03 pm:

PC, take a breath. If the bill had passed I imagine that quite a few partisans, perhaps including yourself, would’ve been blaming Pelosi for that.

Keep the DC talking points crud off this blog please.

- VanillaMan - Monday, Sep 29, 08 @ 3:05 pm:

The bill was an orphan. No one wanted it. Supporters felt blackmailed into supporting it, but opponents didn’t.

Pelosi was correct in avoiding the bill last week. Those who claimed she could have passed the bill without GOP support were wrong. She couldn’t get enough Democrats to support it.

The President isn’t listened to by anyone. The GOP abandoned him last month in St. Paul and the split was final. His failure to get anyone to listen to him simply confirms this.

Neither Obama nor McCain wanted anything to do with this bill either. Both men could have fought for it, but after McCain was ambushed for stepping out and taking a stand, both nominees gave it nothing but lip service. Instead of grasping an opportunity to really change how candidates campaign, Obama’s spin to counter McCain killed it. Obama reaffirms the old truth not to expect any political campaigner to take a stand during actual emergencies.

What we have is a giant festering economic mess demanding responses, but showing up too close to a presidential election for the game players to address. McCain’s risky suspension of his campaign was an attempt to change this set up, but his failure to find other political mavericks willing to take risks fell short.

It is politics as usual, and we will continue to see two campaigners refusing to take either a stand or lead as our economy seriously collapses.

We are witnessing history.

- Captain America - Monday, Sep 29, 08 @ 3:06 pm:

Check out politicalwire.com OOPS!McCain spokesman declared yesterday that McCain’s leadership had delivered the Republican votes neceessary to pass the bailout bill.

A majority of House Democrats supported the bill. Two-thirds of House Republicans voted against the bill.

I can’t help but note the irony - the free market fundamentalists and deregulators, most resposnible for the current financial meltdown, oppose the bailout engendered by their rabid free market ideology.

And now the deluge on Wall Street!

Even though I realize the situation is quite complex, my conviction is that it was important to do something constructive today to try to ameliorate the economic liquidity crisis.

By blocking action on the bailout, I think the House Republican ideologues have unleashed the dogs of recession , and ensured that none of us will have a Merry Christmas or a Happy New Year.

It’s extermely Hooveresque - personal ideology triumphs over pragmatism.

I’m actually quite concerned about the economic implications of the House’s failure to approve the bailout. Given the gravity of the situation, it gives me no great pleasure to declare that Obama has now won this election by a veritable landslide. The Republican will reap the seeds of the economic whirlwhind they have now sown.

I’m happy that Obama undoubtedly will win. I’m not religious myself. But I sincerely mean it when I declare: God help us all survive the economic maelstrom that may ensue.

- montrose - Monday, Sep 29, 08 @ 3:07 pm:

*She only needed 12 more votes. Out of 95.*

You could make basically the same statement about Boehner. Why could he not get a few more votes on? I think this goes beyond strong leadership for both. It is the perfect storm in terms of not being able to keep members of your party in line.

- Rich Miller - Monday, Sep 29, 08 @ 3:12 pm:

===Check out politicalwire.com OOPS!McCain spokesman declared yesterday ===

Actually, the McCain campaign was taking credit for passage as late as this morning.

That’s what I mean about DC talking points. You can make any point you want.

Leave it at the door.

- Dan S. a Voter and Cubs Fan - Monday, Sep 29, 08 @ 3:13 pm:

By the looks of the market mt 401K just became a 2001/2K.

- scoot - Monday, Sep 29, 08 @ 3:14 pm:

The Dems control both houses of congress and could have passed the “bailout” if they wanted to. Instead Pelosi brings it to action (instead of taking more time)…then gives a horribly partisan rant before the vote…it’s her fault this was called…What is she thinking?

The majority of Americans do not want a bailout…and nobody trusts Congress to do anything right…like a 9% approval rating. They need to go back to the drawing board..leave McCain-Obama out of it.

- Rich Miller - Monday, Sep 29, 08 @ 3:15 pm:

scoot, take a breath, please. You’re talking out of both sides of your mouth in that post. Breathe deeply.

- scoot - Monday, Sep 29, 08 @ 3:17 pm:

Lol..I know, I know…

- Rich Miller - Monday, Sep 29, 08 @ 3:19 pm:

:)

- Captain America - Monday, Sep 29, 08 @ 3:19 pm:

After just reading the ridiculous Shimkus quote, in the update I guess I should rephrase my sincere wish: “Adam Smith/the invisible hand” help us all survive the economic maelstrom that may ensue.

I feel compelled and justified in reiterating the adjective “Hooveresque” to describe the superstitious/ideological failure to support a bailout bill, as suucinctly captured by the Shimkus excerpt.

- Anonymous - Monday, Sep 29, 08 @ 3:21 pm:

Anyone been getting the “Birk Bailout Plan” emails - kind of a spoof/spam thing. It divided the $85B bailout among all 200M+ adult U.S. taxpayers, collects income tax back on it (to the tune of $25B), and liquidates AIG. Kinda thought provoking…

- Rich Miller - Monday, Sep 29, 08 @ 3:23 pm:

It’s an idiotic spam email. Do the math. It claims something like $450,000 per family or something. It’s actually $450.

Yep. Thought-provoking all right.

- Greg - Monday, Sep 29, 08 @ 3:28 pm:

I think the response so far has been anything but Hoover-like, but rather quite intervenionist. Ignoring AIG, BSC, etc for a moment, consider the short-sell ban. It’s a major issue that’s received almost no attention. Yet its prohibition (or at least that which applies to the most meaningful names) distorts the market like none other. That step alone is highly, highly aggressive.

PS: The scary thing about the 8% drop today is what would have happened in a legitimate market (ie, you can short.)

- anon - Monday, Sep 29, 08 @ 3:30 pm:

Scoot is right - pretty underhanded to deal all this way and put her plan together with the Bush admin., then go to the floor and sell them out. The Speaker Pelosi and Bush plan didnt work.

- Bill Baar - Monday, Sep 29, 08 @ 3:35 pm:

There is nothing Hoover like about virtually nationilizing key parts of the banking industry.

It’s more Norman Thomas like…

If the ACORN subsidy was still in there Pelosi would have swung some of those lefty votes… but have fatally trashed Obama’s chances.

- Shelbyville - Monday, Sep 29, 08 @ 3:39 pm:

By far, though, people on the street did not want this bill passed. The phones have been ringing off the hook in the congressional offices for 5 days, with people saying they did not want this bill.

Congress should represent their district and I would hope that is what happened.

- wordslinger - Monday, Sep 29, 08 @ 3:41 pm:

This was more political at the beginning than it was economic.

But Paulson and Bernanke approached this problem with all the coolness and shrewdness of Chicken Little. They panicked and went all-in at the beginning and now it’s in all our interests that they “win” something.

Pelosi’s the Speaker so she wears the jacket. The whole world was watching — you can’t call something like this for a vote unless it’s a lock, structured roll call or not.

Something will get passed and everyone will move on — but credit is still going to be relatively tight for a while, and that’s probably a good thing so everyone can sober up.

In the long run (we’re all dead, Mr. Keynes said) , let’s look back at all those Glass-Steagall firewalls between commercial and investment banking we knocked down. Maybe it’s not a good idea for the same financial entities to profit from the origination fees on a bunch of lousy loans then turn around tout, sell and take commissions on them as “securities.”

We’re talking possibly pumping, over time, $700 billion into a world economy where the US GDP alone is $14.5 trillion. Just like in RTC, we’ll get a lot of it back. Everybody calm down — there’s a certain narcissism at work to believe that we’re at particularly “historic” times.

- Jaded - Monday, Sep 29, 08 @ 3:42 pm:

People don’t want the bill because they don’t get it. Sometimes statesmen have to do what’s right even when it is not politically popular. Politcians never do. We need more statesmen and fewer politicians in Washington and Springfield, and we have needed that for some time now.

- Rich Miller - Monday, Sep 29, 08 @ 3:43 pm:

===People don’t want the bill because they don’t get it===

I get it, and I thought the bill stunk.

- Broke Dem - Monday, Sep 29, 08 @ 3:49 pm:

Well, judging by the vote, it appears Congress has finally acted Bi-Partisan-to put us in a depression.

- Nearly Normal - Monday, Sep 29, 08 @ 3:49 pm:

Once again, my congressman did not vote. Probably not even in DC. Probably not in the U.S. of A.

I am going to illustrate a picture book. Scenes from Central America in which you have to find Jerry. Call it “where’s Weller.”

Should go over big in the district.

- archpundit - Monday, Sep 29, 08 @ 3:50 pm:

The Republicans promised 70 votes–they delivered 65–actually 66 until one saw it was going to fail and switched. There were Democratic votes to match those five votes plus 5 more, but some of those willing to vote for it would only do it if there were enough total votes–without the promised 70 Republicans, there weren’t.

- Rich Miller - Monday, Sep 29, 08 @ 3:51 pm:

I’ve purposely held my tongue on this, but passing an intrinsically flawed bill because we “have to do something” is never the way to go. Better to wait a few days. Wall Street can whine all it wants that it isn’t getting its wealth transfer bill today, but Congress shouldn’t be panicked into voting on a bad bill. Wait a few more days and work on the thing.

- Jaded - Monday, Sep 29, 08 @ 3:53 pm:

Fine, then let’s do nothing and let the market correct itself. I’m fine with that, I will survive just fine. Others won’t.

- Steve - Monday, Sep 29, 08 @ 3:55 pm:

Is Rahm Emanuel about to become the most famous former Freddie Mac board member?

- archpundit - Monday, Sep 29, 08 @ 4:07 pm:

The problem is bigger than what you are saying Rich–there should have been no mad rush. There’s a problem and in the short term a far smaller deal could have held us over for a week or two. Then you methodically put together a plan to get you through January given the political clock.

Essentially politicians on both sides pushing for this solution as the only solution and it must be immediate set themselves up to create a panic on Wall Street and in credit markets that wouldn’t have happened if the process had been more deliberate.

- wordslinger - Monday, Sep 29, 08 @ 4:09 pm:

Rich, I understand where you’re coming from, but if Congress is going to get into the “restoring confidence” game, then it has to play it to win and have its ducks in a line.

- Rich Miller - Monday, Sep 29, 08 @ 4:10 pm:

I fully agree. This whole thing was nuts from the Paulson three-page goofy get-go.

- leigh - Monday, Sep 29, 08 @ 4:10 pm:

Pelosi seemed to have made a decision to sink this bill by the partisian and bitter speech she made before the vote. Her style of leadership reminds me of our very own governor.

- Rich Miller - Monday, Sep 29, 08 @ 4:16 pm:

Leigh, if any legislator votes against a gigantic bill like this ONLY because his/her feelings are hurt by a fairly mild speech (and I listened to it - no biggie), then that person should be immediately drummed out of Congress and banished from society forever.

Seriously. What a pathetic buncha fools they are to admit they’re such delicate flowers.

- Amy - Monday, Sep 29, 08 @ 4:19 pm:

if it were not so crucial to the economy, it would be plain old

fun to watch this in action. while it may be true that some

were allowed to vote against the set position of a leader, it may

be more true that the public is angered and confused enough

that it makes it difficult to see how to vote for the bill. there

is a great deal of email traffic in an anti Community Reinvestment Act pitch, blaming the sub prime crisis on

the CRA. and the likes of Cong. Tancredo pitch blame on

illegal immigrants who got sub prime mortgages and walked

away from the houses. these are clearly silly claims, but

indicative of the games, fearmongering and confusing atmosphere in which the legislating is in play. also, that

very large protest on Wall Street did not get much attention

in the news, but it is something which makes you stop

and think. Meanwhile, the market drops….

- Bill Baar - Monday, Sep 29, 08 @ 4:20 pm:

Rich…considering the drama from who we in Illinois send to Springfield, I’m not sure any of us are in a position to call out DC Pols for ruffled feelings. Our politics in Illinois is all personal.

- Rich Miller - Monday, Sep 29, 08 @ 4:21 pm:

=== Our politics in Illinois is all personal.===

And it gets bashed here on a regular basis.

- Greg - Monday, Sep 29, 08 @ 4:21 pm:

Can I ask a very dumb question? (I promise I googled it, but I can’t find an answer I trust)

If the House comes back next month but they barely have a quorum (presumably since many are campaigning), does the House need merely a majority of the present congressmen to pass a bill? Or always 218?

- Pot calling kettle - Monday, Sep 29, 08 @ 4:40 pm:

How about this: Pelosi knew it was not going to pass and gave a speech that reflected that.

Obama is correct that the Presidential candidates involving themselves (in the minor way they likely would) will only lock the process up, because neither side wants the other guy to notch up a “win.” In addition, the Bush proposal was a big power grab for the exec, so it would be tough for a Presidential candidate to vote no.

With the Republican’s on their heels this fall, they are not willing to give up a nice potential wedge issue and the Dems don’t want to give them one.

As in Illinois in Washington, we lack true leaders who are willing to put their heads in the line of fire to LEAD the Congress. McCain flies back to Washington, then works the phones in private. If he were a true maverick, he’d put up a plan and call everyone out.

If we had a true leader running from either party, they’d be prepping a plan with their advisers to present by the end of the week. It would be a carefully nuanced balance of “Wall-Street” and “Main Street” relief and Exec and Legislative control based on alleviating the actual problems as opposed to the perceived ones. To sell it, this “leader” would buy some TV time and spend a half-hour explaining the problem and solution. Might not work, but neither has anything else; at least, this would be LEADING.

Whoa, my pipe is empty, need a refill…

- archpundit - Monday, Sep 29, 08 @ 4:40 pm:

Greg, the magic number today would have been 217 since one spot is vacant and Weller was out so I believe (and am happy to be corrected if I’m wrong) it’s only a majority of the quorum.

- Just the Facts - Monday, Sep 29, 08 @ 5:07 pm:

Shimkus must be channeling Herbert Hoover.

- A Citizen - Monday, Sep 29, 08 @ 5:11 pm:

Within the next few days we will experience a very advantageous investment period. Buy low but sound stocks and plan to hold for a year or two. This may not be good advice if there is a full blown depression but I really can’t see that being allowed to happen. Anyway if a depression does come about we’ll be in the breadlines but we can use our stock to wallpaper our bathrooms, A Good Thing.

- Truthful James - Monday, Sep 29, 08 @ 5:22 pm:

If it were to be done, Paulson is not the man to manage it. Need a separate manager appointed by the President and with the oral agreement of the two candidates.

But this was a one time opportunity for a full bore statesmanship to bring the other areas which are a drag on productivity up for approval. That would include fiscal and tax policy, foreign trade policy, energy policy. It is the increase in productivity which would minimize the future pain to the American taxpayers.

This is not something which can be solved by the financial markets alone.

- cermak_rd - Monday, Sep 29, 08 @ 5:27 pm:

The problem is not the falling stock market. Markets fall and markets rise and the government should not be involved one way or the other. The problem is the threat of the credit market freezing up to where companies can’t even get the credit needed to meet their payroll.

- Bill Baar - Monday, Sep 29, 08 @ 5:28 pm:

Paulson is not the man to manage it.

I don’t think he was planning to stick around to manage it.

- zatoichi - Monday, Sep 29, 08 @ 5:29 pm:

Probably a good thing this did not pass since it will require back to the drawing board. I can’t see the Feds putting together anything in the record time they tried to solve this monster problem. Get more economic geniuses in the room and battle it out to determine the ripple effect of what they are doing. Do some of the big stuff, but I would like to see more concepts aimed directly at the small guy: raise FDIC to $250,000 or $500,000. Checks to Investment bankers? How about $50,000 to each family to pay off that mortgage/credit card/loan or simply put away for savings. Money to employers, electronically transferred to local small bankers, to pay employee salaries. Raise taxes to offset the increase. Will some people blow the bucks? Always will be, but it also makes the dollars available to keep the economy moving. I don’t see a parachute of any kind coming my way in the current plan regardless of the spin being thrown around.

- Rich Miller - Monday, Sep 29, 08 @ 5:31 pm:

=== The problem is the threat of the credit market freezing up to where companies can’t even get the credit needed to meet their payroll.===

True enough. I don’t think that anyone has adequately or even mostly explained how this particular plan would work and not be simply a huge wealth transfer.

You don’t go to war with only “Stage One” plans. This is along those very same lines.

- Rich Miller - Monday, Sep 29, 08 @ 5:40 pm:

===$50,000 to each family to pay off that mortgage/credit card/loan ===

100 million households times $50,000 each equals $5 trillion.

- 47th Ward - Monday, Sep 29, 08 @ 6:29 pm:

Sorry, anon 6:26pm was 47th Ward.

- Arthur Andersen - Monday, Sep 29, 08 @ 7:11 pm:

Rich, I would personally agree with you that this was/is a flawed bill. Once it got “fixed” to apply to where old AA gets his paycheck, I started liking it better, but it’s still not fixing the underlying problems (subprime lending, unqualified borrowers, uninsured deposits, and more) that got us here.

OTOH, $1.4 trillion in MV went out the window today when we could have capitalized the Bank of Hank for only half that.

Part of the problem that the Federal Government has now is that they have started picking winners and losers in this mess, followed by the always-winning “take it or leave it” lobbying strategy, and many of the participants in the markets made decisions assuming that the bailout would move forward. The market reaction was to be expected.

The hysterical media reaction is not helpful. For example, AA will have his favorite Stetson for lunch if someone here can identify one real, viable business or one real qualified homeowner in Sangamon County unable to obtain conventional market rate financing in the past 30 days solely due to the credit crisis.

Yes, the easy, stupid money has dried up. Equity? Collateral? Credit History? Yep, you’re gonna need all that if you want to borrow money now.

If the Congress, Feds, et al, keep dithering, it will get worse and we will feel it locally.

For you all with a lot of T.V. as POA would say, tomorrow is a great time to buy stocks. Not all of them, but AA does not give investment advice.

- Black Ivy - Monday, Sep 29, 08 @ 7:14 pm:

My spin-free position - this debacle is simply unbelievable!

- Wumpus - Monday, Sep 29, 08 @ 7:50 pm:

Rich, I cannot believe you don’t have Brian Fellows, err Antoine Members as serious competition for Rush.

- Lefty Lefty - Monday, Sep 29, 08 @ 8:35 pm:

The problem isn’t illiquidity. The problem is insolvency. The problem isn’t the CRA or sub-prime loans. The problem is what Wall Street did with these loans and what lenders not governed by conventional lending regulations did to give out loans.

I refinanced 3 times for different reasons in the last 6 years and had to go through due diligence every time, and the lender was a friend of mine! There are right ways and wrong ways to lend money, and giving it away to anyone with a pen and then packaging them up to sell and trade and resell is the height of stupidity. These people have to pay.

The government can fix illiquidity with reasonable amounts of well-placed cash. Helping Wall Street and its outrageous leveraging of crappy “assets” through a $700 billion giveaway is just stupid. There are trillions of dollars of losses out there that the fat cats are sitting on, making these firms insolvent. They simply can’t be saved. Let them eat it while helping the economy with a sound plan.

- Some Guy - Monday, Sep 29, 08 @ 9:48 pm:

Pot calling Kettle:

“Also interesting: The House voted first, keeping the Presidential nominees off the official record.”

US Constitution, Article 1, Section 1:

“All bills for raising revenue shall originate in the House of Representatives”

- Snidely Whiplash - Monday, Sep 29, 08 @ 10:54 pm:

They ALL need to stop playing politics and do SOMETHING, and fast! This is meant to keep our economy from collapsing, to keep money flowing through the economy to fund construction, business and jobs. Golden parachutes were very rightfully barred. Likewise, so was relief for irresponsible people who took on mortgages (often fraudulently) on houses they KNEW they couldn’t afford.

Rather than buy the mortgage securities, lend money to ANY company willing to put them up as security, and get the money back into the economy. We lost 1.2 TRILLION dollars in market value over a failure to pass a $700B purchase agreement. Lend out the whole $1.2T, if need be.

People need to get past emotions and realize that, yes, these greedy millionaires caused this, but if we DON’T bail them out, we’ll ALL suffer along with them. The problem is, they can afford it; the rest of us CAN’T.

- elgin - Monday, Sep 29, 08 @ 11:12 pm:

Does anyone know where Oberweis stands on this bill?

- Bill Baar - Tuesday, Sep 30, 08 @ 5:57 am:

Elgin, Check Illinoize… I posted O’s press release. He was against. He also did a TeleTown hall I live bloggeed over on Illinoize. This is right up his ally and I thought he talks pretty intellgently on it… considering he defused callers who wanted to send all the illegals home as part of a solution.. O did pretty well taking sensee instead of going along with some hysteria.

- train111 - Tuesday, Sep 30, 08 @ 8:13 am:

So is the 1.2 trillion, or 1.4 trillion lost in the economy yesterday actually real money or is it just ‘accounting gimmick funny money’?

My gut tells me it is more of the latter than of the former. Being a ‘paper millionare’ comes alot easier than being a real one.

train111

- Fan of the Game - Tuesday, Sep 30, 08 @ 8:20 am:

Every time Shock opens his mouth, a fraction of my inclination to vote for him disappears.

- Truthful James - Tuesday, Sep 30, 08 @ 8:32 am:

What Main Street sees is that the solution is to let all the bad guys go free, stay in business.

Due diligence in this mess failed across the Board. The heads of the investment banking firms (Paulson used to be one, remember) did not know what their quants had wrought and were happy as a pig in s–t with the profits. They bet the ranch. Goodbye, Lehman. Goodbye Merrill.

The quants themselves conned the Bond Rating Services and the Bond insurance companies into passing out their highest ratings blindly. They were happy as the aforementioned pigs with the high fees.

The banks which were so used to putting Ginnie (a straight government guarantee) and Freddy and Fannie (implied guarantees) pools in their portfolio of assets were happy to put the dreck created by the quants in their portfolios — evidence of social engineering lending to satisfy the regulators.

The regulators, bless their little stupid hearts, relied on the high ratings given to the dreck, backed as they were by credit default agreements with the high rated investment banks,

Everybody relying on the apparently graven truth that regardless of supply, demand or the economy, housing values — unlike stock values — go consistently upward.

But the quants in all the players companies — like the Nobel economists at Long Term Capital Management were wrong.

Mortgage brokers and commercial lenders saw the writing on the wall more mortgages to low income groups — OR ELSE. Low Docs and No Docs were just a tool.

But we saw this before in the 1960s with the FHA 222 program failures. FHA did low down no doc loans People with no history of being able to manage money, no money or skills to do the normal upkeep on houses. go shelter. They thought they could hack it. They did keep up with the rents in their prior residences. They defaulted and walked away.

There are 800K more houses on the market today than there are qualified buyers. Given conversion and construction in the interim, that his a huge workout. So mortgages have to be written down to the rental value of the houses in default and debt. Simple as that.

700 Billion worth? I think not. Neither does Main Street.

The credit markets are still there, still operational. Normal loans and lines of credit are being made at the neighborhood bank level. Credit Cards are still being offered around with abandon.

We have gone through a period when tens of thousands of mortgages were made which should not have been made. We should have been promoting multi-family middle income rental property. At the low end, we have the absolute disgrace of public housing. The answer was demolishing. It was the wrong answer. Proper rehabilitation could have turned that “rental housing” into low income condominium or at least into residential savings accounts which would give occupants an interest in self maintenance as well as a nest egg to make a down payment when a family moved out. Instead we strangled our people with non working elevators sub standard maintenance to favored political contractors. But that is another story for another day.

- Snidely Whiplash - Tuesday, Sep 30, 08 @ 8:38 am:

Train,

It’s a little of both. Examples of how it’s “real” include diminished values of people’s 401k’s, diminishment of the value of government & private pension funds, loss of ability to borrow using the value of stocks as collateral, and loss of the collateral value to a lender, etc.

It is also a reflection of our economy as a whole. It is an effective decrease of close to double-digit percentage points in the value of our entire market value in a single day. Two more such days this week and our economy WILL collapse.

- Rich Miller - Tuesday, Sep 30, 08 @ 9:12 am:

train111 is right. Anyone who compares a $700 billion taxpayer bailout (real money) to a DJIA loss (voluntarily invested paper loss) is being disingenuous.

- Truthful James - Tuesday, Sep 30, 08 @ 9:56 am:

Lefty –

What Wall Street did in effect, through the packaging and selling was generate a huge amount of additional money for funding sub prime (the growth market) mortgages which in turn would be packaged and sold. Repeat both steps, endlessly.

By creating a huge pool of ready mortgage money it

1. drove up housing prices

2. invited in ever so many more underqualified home buyers.

3. Satisfied the regulators that social mortgages were being made, saving originators of the mortgages and the holders of the pooled CDO and SIV from heavy fines and opprobrium for not being responsible citizens.

Snidely,

Don’t panic. That is what the leaky rowboats who would be bailed out want you to do.

- Bill Baar - Tuesday, Sep 30, 08 @ 10:32 am:

From a column today that convinced me passing this bill would have been a very bad thing…

What attracted far less notice in the bill was a set of provisions that would have given Treasury Secretary Henry Paulson virtually unfettered authority to set up and run the new organization designed to stabilize the financial system — bypassing federal acquisition rules and competitive hiring procedures in the process.

The 2008 Emergency Economic Stabilization Act would have allowed Paulson and his eventual successor to waive provisions of the Federal Acquisition Regulation “upon a determination that urgent and compelling circumstances make compliance with such provisions contrary to the public interest.”

[***]

While few other details emerged about the contracting provision, it appears the language would have given Treasury the ability to award contracts of nearly any value without any competition. The prospect of a government agency with unlimited and unregulated purchasing power concerned some government observers.

Speculate on the next SecTreas… than thank those who voted no.

- iamconcern - Thursday, Oct 2, 08 @ 12:39 am:

Dear all House Members,

PLEASE HELP

Please don’t bailout these companies by any means!

Please don’t allow the Fed to further bailout others like they have been for the last few months.

Please don’t add other few hundred billion dollars (or even trillions dollars) to our national debt!

We will have to live with a few less companies, banks, etc., even though this will cost jobs and a deep recession. We’ll get through it… were Americans !

It’s very important that you don’t allow our Fed to continue bailing out these institutions, by whatever means or names we call it, including buying non-performing assets or useless notes.

Please don’t try to save us by passing any “bail-out” bills.

Please however increase the amount of FDIC insurance to over $100k and firm up the FDIC insurance system requirements so we can make it through a very serious recession (possibly depression).

I realize this week maybe the last chance WE have to really draw the line in the sand.

My last comment;

You do realize, this is way to little bail-out money and its NOW much to late to act. The bankers will not be convinced to loan to each other until enough of the failing companies have failed or been successfully consumed (by the federal supported institutions) and the dust has settled. Neither your plan nor Mr. Paulson’s actions can change this outcome.

Thank you,

US citizen