A little good news for a change

Monday, Oct 17, 2011 - Posted by Rich Miller

* Crain’s Chicago Business takes a hard look at Illinois’ business climate and finds some things aren’t as bad as we may think…

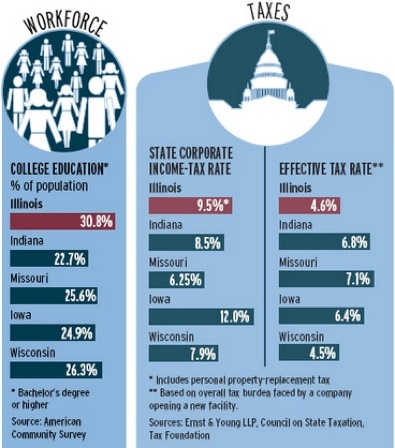

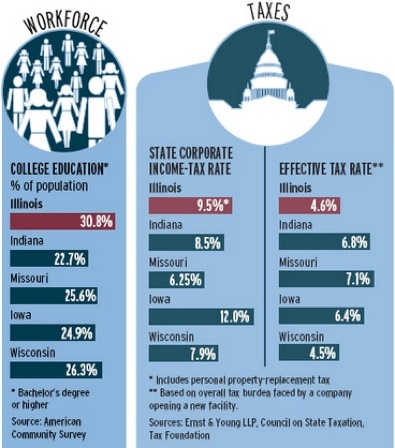

[A] business owner wondering where to open a new facility might be surprised to discover the overall tax burden actually could be lower in Illinois than in surrounding states. When all state and local taxes are considered, Illinois has the fifth-lowest effective tax rate in the country, at 4.6%, according to a 2011 study by Ernst & Young LLP. The study is based on data that don’t reflect the recent income tax hike, but Ernst & Young says the impact of the increase on Illinois’ effective tax rate would be relatively minor.

Among neighboring states, only Wisconsin is lower, at 4.5%. Missouri is highest, at 7.1%, followed by Indiana’s 6.8% and Iowa’s 6.4%.

How can that be? Corporate income taxes are just one piece of the overall tax burden — and not always the biggest. Franchise taxes, property taxes, sales taxes, gross-receipts taxes and levies on machinery and equipment add more to a company’s total tax bill.

“The two biggest are sales and property taxes,” says Donald Bruce, a University of Tennessee professor of business. “Income taxes are nowhere near the top of the list.”

And…

For many businesses — especially tech companies, professional services firms and ad agencies, which need highly skilled workers and pay them well — talent is the critical factor in deciding where to set up shop.

Accenture PLC, the global consulting firm, announced last week it would add 500 jobs in Chicago, its largest operation in North America, with 5,000 workers.

“It’s a real talent magnet for all the kids who go to college in the Midwest,” says Jorge Benitez, Miami-based CEO of Accenture’s U.S. business. “Getting the best people is paramount to what we do.” […]

About 31% of Illinois’ workforce has at least a bachelor’s degree, and 11.5% a graduate degree — both above the national average, according to federal data. Wisconsin and Missouri come closest at about 26% with a bachelor’s degree or more, followed by Iowa at 25% and Indiana, 23%.

A chart…

* In other news, it looks like the UAW may actually approve its contract with Ford…

Now, with two days of voting left at Ford plants, momentum has swung toward ratification, said Bernie Ricke, president of UAW Local 600, which represents workers at the Rouge.

“The longer people had the facts, and the more we cleared up the misinformation that was out there, the more support the agreement got,” Ricke said.

As of Friday morning, only 50.8% had voted in favor of the deal. By Sunday night, 62% of all votes counted were in favor of the deal. The national tally was boosted by Local 600’s 62% approval and 90% in Kansas City.

“If this were a political election, it would be viewed as a landslide,” said Harley Shaiken, a labor relations expert at the University of California Berkeley.

- just sayin' - Monday, Oct 17, 11 @ 8:34 am:

So you mean all the IL GOP’s efforts to talk down the economy for political gain are failing? Imagine that.

- 47th Ward - Monday, Oct 17, 11 @ 8:55 am:

So what are all the whiners going to talk about now? I figure Ernst & Young has given us at least a year of peace from the U-Haul crowd.

- Hobo on the Rails - Monday, Oct 17, 11 @ 9:24 am:

Someone please send this article to whiny CME and Sears and tell them to stick it.

- Wumpus - Monday, Oct 17, 11 @ 9:47 am:

And what do the people who are owed a collective BBBBBBBBillions in fees for services do?

- so... - Monday, Oct 17, 11 @ 10:07 am:

Does Ernst and Young consider the high cost of workers comp relative to surrounding states? How about the unemployment insurance surcharge Illinois employers will be paying shortly?

- Dooley Dudright - Monday, Oct 17, 11 @ 10:11 am:

Thank you, Ernst and Young. You’ve just provided the Illinois Department of Commerce and Economic Development with everything it needs for its next “mascara on a gorilla” marketing campaign.

- Dooley Dudright - Monday, Oct 17, 11 @ 10:13 am:

Oooops, “Department of Commerce and Economic Opportunity.”

- Bob - Monday, Oct 17, 11 @ 10:17 am:

Guess you guys forgot to read this part of the article: “The study is based on data that don’t reflect the recent income tax hike.”

- Angry Chicagoan - Monday, Oct 17, 11 @ 10:31 am:

@Bob, even if that’s the case, we’re still more competitive than any of our neighbors except Wisconsin.

The real problem in Illinois with the tax code isn’t the increase, it’s the way the state almost arbitrarily picks winners and losers depending on industrial sector, occupation and political clout. The culture of single-industry tax breaks and “targeted” economic development needs to give away to standardized treatment for everyone.

- Angry Chicagoan - Monday, Oct 17, 11 @ 10:36 am:

Worth also noting, Ernst & Young say the impact of the increase on the effective tax rate on their study would be “relatively minor.” In all likelihood what that means is that for most businesses this increase is no big deal but the effect is intensified on the small handful like CME that pay something approaching the listed tax rate. If I recall correctly CME’s effective rate is only a percent or two below the listed rate.

- wordslinger - Monday, Oct 17, 11 @ 10:38 am:

–So what are all the whiners going to talk about now? I figure Ernst & Young has given us at least a year of peace from the U-Haul crowd.–

Don’t count on it. This report will be wiped from the memories, maintaining the eternal gloom of the spotless mind.

–Guess you guys forgot to read this part of the article: “The study is based on data that don’t reflect the recent income tax hike.” –

No, but I also remember everything I’ve read about the large percentage of Illinois corporations that don’t pay any income tax at all.

What do they care if there is an increase?

- walkinfool - Monday, Oct 17, 11 @ 11:13 am:

Comparative tax burdens, are usually not the reasons companies come or go from Illinois — despite what many will say when parroting their political ideology.

It has been, and remains: regulatory burdens with associated bureaucracy, workers’ comp issues, and

legal risk environment, all of which are arguably worse in Illinois than some competing states.

Those who don’t know reality, always focus on taxes as their shortcut to dissatisfaction.

Of course these negatives can be offset by a lot of positives for companies in this state, depending on their needs.

- Edmond - Monday, Oct 17, 11 @ 11:17 am:

The study is a joke. Doesn’t mention workers comp or lawsuit climate. How in the hell could they leave those factors out? They are huge.

- Quinn T. Sential - Monday, Oct 17, 11 @ 11:40 am:

No slots at tracks; no slots at Fiargrounds, no slots at Airports, no Chicago Gaming Authority as regulator;

New Bill, new process, no “trailer bill”, geti it right the “first time”

- Quinn T. Sential - Monday, Oct 17, 11 @ 11:50 am:

Change the tax structure of the proposed bill to protect education.

Change the Video Gaming legislation to require communities to specifically “opt in” through local ordinance, rather than the current requirement which allows video gambling unless they “opt out”.

- Shemp - Monday, Oct 17, 11 @ 12:02 pm:

You have to keep reading the article. Only the positives were cherry picked. The article does address work comp, unionization rules, the state’s fiscal stability, fiscal trend, higher operating costs, business (un)friendliness.

- Usual Illinois Liberal - Monday, Oct 17, 11 @ 12:04 pm:

Oh keep pumping Illinois richie boy. Those studies do not include the state fee structures compared to other states and let us not forget the workmans compensation and liability insurance rates for the Illinois cesspool that you and your voting buddies created

- Kevin - Monday, Oct 17, 11 @ 12:25 pm:

I think it is a little ironic that the example used in the article of corporate job growth is Accenture that had been a part of Arthur Anderson, a large Illinois business before its demise. Accenture left the states to be domiciled in Bermuda, a tax haven, and has since moved HQ’s to Ireland which now has the lowest Corporate Tax rate in the developed economies.

If Illinois is so attractive, why do companies keep leaving?

- mokenavince - Monday, Oct 17, 11 @ 12:27 pm:

Once in a while it’s good to get some good news

about our State.Thanks for some good news.

- wordslinger - Monday, Oct 17, 11 @ 1:09 pm:

My, such anger in some circles for a rather dispassionate comparison of tax burdens. Do the numbers hurt the head or something? Or is the anger just because it takes away a silly, self-loathing talking point?

It’s nothing personal, folks, it’s just Crain’s Chicago Business.

- WizzardOfOzzie - Monday, Oct 17, 11 @ 6:54 pm:

The tax increase is making companies leave Illinois for neighboring states!!! Oh wait, the effective tax rate is lower than our neighbors?

Oh, then companies must be leaving because of worker’s comp. Oh yeah, that’s it. Oh, and lawsuits too. Lots of people sue in Illinois.

Give me a break. Illinois continues to be a great place to locate a company and Chicago is a world class business city for all the reasons cited in the article that actually matter to companies… highly educated work force, access to transportation, nice place to live.

- Rich Miller - Monday, Oct 17, 11 @ 10:30 pm:

===Oh keep pumping Illinois richie boy.===

Apparently you missed the ten zillion negative stories about Illinois and its political establishment I’ve written. Indeed, the title of this post is, “A little good news for a change.”

So, bite me.