Revenue options detailed

Tuesday, May 5, 2015 - Posted by Rich Miller

* From a press release…

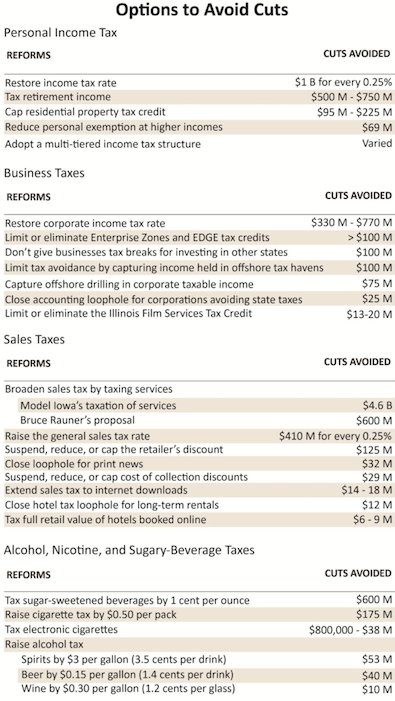

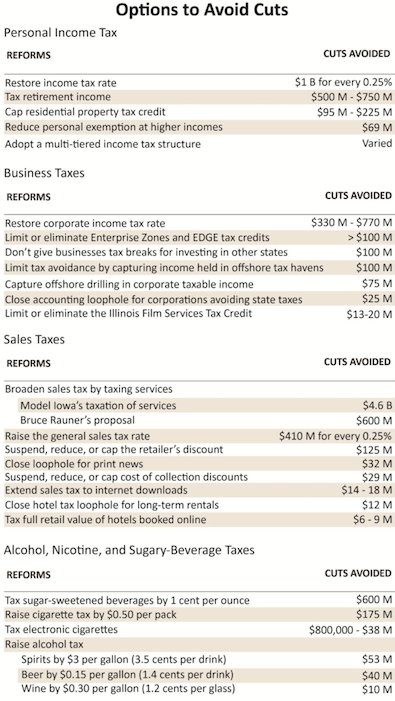

A new report by the Fiscal Policy Center at Voices for Illinois Children shows that lawmakers can avoid cutting services for families and communities by choosing to raise revenue.

By allowing income tax rates to roll back in January, lawmakers created an over $6 billion hole in the state budget for next fiscal year. So far, Governor Rauner has maintained deep cuts that hurt children, families, and communities are necessary to balance the budget.

But the Fiscal Policy Center report highlights a broad range of available revenue options, and shows that Governor Rauner and lawmakers have many choices they can make to avoid cutting services for children with epilepsy and autism, police and fire protection, and in-home services for seniors and people with disabilities that help keep them out of expensive nursing homes.

Choosing to invest in children, families, and communities is the best thing we can do to propel our state toward economic prosperity. That’s why lawmakers and the Governor must choose to develop new revenue instead of cutting the services that make Illinois families and communities strong.

* The full report is here. Revenue options…

Which ones do you like/hate the most?

- Wumpus - Tuesday, May 5, 15 @ 10:56 am:

I like the E cig tax. Mainly, because it taxes those smug little jerks.

- PMcP - Tuesday, May 5, 15 @ 10:58 am:

Um… what the hell does Iowa do? Because that pretty much solves your problem.

- Mouthy - Tuesday, May 5, 15 @ 10:59 am:

I like all the ones that don’t affect me and I hate all the ones that do, signed typical taxpayer…

- RLG - Tuesday, May 5, 15 @ 11:00 am:

Broadening the sales tax to almost everything you buy. Even CapitolFax subscribers.

- Joe M - Tuesday, May 5, 15 @ 11:01 am:

==what the hell does Iowa do?=

For those not acquainted with Iowa’s state income tax, its rates are:

Iowa:

– 0.36 percent on the first $1,428 of taxable income.

– 0.72 percent on taxable income between $1,429 and $2,856.

– 2.43 percent on taxable income between $2,857 and $5,712.

– 4.50 percent on taxable income between $5,713 and $12,852.

– 6.12 percent on taxable income between $12,853 and $21,420.

– 6.48 percent on taxable income between $21,421 and $28,560.

– 6.80 percent on taxable income between $28,561 and $42,840.

– 7.92 percent on taxable income between $42,841 and $64,260.

– 8.98 percent on taxable income of $64,261 and above.

- Anon - Tuesday, May 5, 15 @ 11:03 am:

We’re partly in trouble because folks paying a 2% - 3% income tax wanted services without paying for them. Now that some of those folks have retired and are receiving retirement income, they’ve effectively run out on the check.

The retirement income tax subtraction does nothing for seniors who are actually low income because they already have a Federal AGI of zero.

How about some generational equity? Lets tax retirement income.

- PMcP - Tuesday, May 5, 15 @ 11:05 am:

@Joe M, that says Iowas sales tax, not income tax. I’m assuming it’s all services essentially but that’s kind of a big deal right there.

- anon - Tuesday, May 5, 15 @ 11:05 am:

Hey Joe M., how do real estate taxes compare? Cost of living? Sales tax, especially compared to Chicago?

- justhefacts - Tuesday, May 5, 15 @ 11:05 am:

Income/excise “sin” are the least bad.

Sales tax is very regressive, business taxes hurt the economy.

- Joe M - Tuesday, May 5, 15 @ 11:06 am:

I don’t like raising the general sales tax as that would be a regressive tax that affects the poor much more than it affects the affluent.

I am also concerned about taxing retirement income, unless at least the first $25,000 or preferably $50,000 or so is exempt.

- Say It Ain't So!! - Tuesday, May 5, 15 @ 11:06 am:

How about we pass a constitutional amendment to enforce the “millionaires tax” which got more votes than King Rauner got in the last election??

- Rod - Tuesday, May 5, 15 @ 11:07 am:

It could be argued, and I think will be argued, that many of the voters for Governor Rauner rejected the revenue options being put forward by Voices for Illinois Children in the report Rich linked to and similar revenue proposals put forward by the Responsible Budget Coalition and the Center for Tax and Budget Accountability prior to Governor Quinn’s defeat.

The choice the people of Illinois made in electing Governor Rauner have consequences. Mr. Rauner as a candidate never hid the fact that Illinois was going to have to experience significant reductions in funding for a wide variety of things. I am afraid buyers remorse will only take place after multi-billion cuts take place and not before they take place.

- Maybe? - Tuesday, May 5, 15 @ 11:08 am:

Raising sales tax, because that hurts low income and middle class families.

- Ghost - Tuesday, May 5, 15 @ 11:08 am:

hate sin taxes on Tabaco and alcohol.

I would leave retirement income alone.

I like removing exemptions and raising rates. actually I would give large reduce corp tax breaks for workers that live in Illinois, and collect the taxes from the employees while giving an incetive to a company to move workers in state

- OneMan - Tuesday, May 5, 15 @ 11:10 am:

Mouthy….

That is called OneMan’s TOoP tax plan

Taxes On other People

For example, tax lite beer…

- Joe M - Tuesday, May 5, 15 @ 11:11 am:

PMcP, I’m sorry, I missed that your comment was directed at the $4.6 billion Iowa raises in taxation of services. I’d be interested to see what that model is.

- Jimmy CrackCorn - Tuesday, May 5, 15 @ 11:11 am:

Lots of regressive stuff in here. I’d also prefer we leave tourism, film and brewers alone since all have been growth industries of late. EDGE also seems to be a good bargain and is unfortunately necessary in the State job poaching era we live in.

Governor Rauner says he admires Governor Walker who is a GOP Prez front runner. If we adopted Governor Walker’s progressive income tax rates most of our problems would be solved.

- Salty - Tuesday, May 5, 15 @ 11:14 am:

Here is a good list of services that Iowa taxes. At the very bottom, they list some of the exemptions.

https://tax.iowa.gov/iowa-sales-and-use-tax-taxable-services-0

- Juice - Tuesday, May 5, 15 @ 11:14 am:

Rod, I hate to disagree with you, but I am forced to. The Governor certainly did hide the significant reduction that would have to be made if we lost billions of revenue. He pledged he would spend more on education, despite the first bill he signed actually cutting education, send he would spend more on economic development and natural resources, was fairly silent on human services, was going to be able to cut taxes by an additional $3 billion from where they are now, and magically fill the hole with mysterious savings at CMS. But the lie sounded so good, people went for it.

- Linus - Tuesday, May 5, 15 @ 11:15 am:

Rod @11:07am: Respectfully, the people of Illinois have not only chosen to elect Rauner governor, they also repeatedly choose to speak against cuts in core services for kids with autism, for families needing child care, for burial of indigent folks, etc. It’s not like the 2014 general election was the one and only opportunity that Illinoisans have for speaking up over the next several years.

Cuts are a given, at some level. But common sense and harsh realities — political, fiscal, and otherwise — also call for some balance, meaning some new revenues. This shouldn’t be treated as an “either/or” discussion, but a “both/and” discussion.

- 47th Ward - Tuesday, May 5, 15 @ 11:15 am:

===Close loophole for print news===

That’s the easiest $32 million ever saved.

- Joe M - Tuesday, May 5, 15 @ 11:16 am:

==Hey Joe M., how do real estate taxes compare? Cost of living? Sales tax, especially compared to Chicago?==

State Sales tax: Illinois: 6.25%; Iowa: 6.0%

The issue at hand being discussed in this thread is our state budget. Not a penny of property taxes go to the state. Nor is cost of living in a community directly a state budget issue either.

- MickJ - Tuesday, May 5, 15 @ 11:17 am:

This is what a real think tank does: presents facts and options in understandable form. Compare to hacktastic, shrill advocates and IPI pretend “think tank.”

- Frenchie Mendoza - Tuesday, May 5, 15 @ 11:18 am:

Doesn’t matter what we like or don’t.

The issue is that Rauner is determined to forge ahead and do what Brownback is doing to Kansas. This is — and has been — the plan from the get go. He wants the disaster. Once you’re at the bottom, there’s nowhere to go but up — and this will be the rallying call and mission for the next three years.

- Enviro - Tuesday, May 5, 15 @ 11:18 am:

Iowa taxes a long list of services.

https://tax.iowa.gov/iowa-sales-and-use-tax-taxable-services-0

- Just askin' - Tuesday, May 5, 15 @ 11:19 am:

I prefer a progressive income tax on all income- including retirement income. Provide a generous enough personal exemption so low income persons and families don’t pay a disproportionate share of the income tax.

- Joe M - Tuesday, May 5, 15 @ 11:25 am:

After looking at Iowa’s long list of taxable services, taxing many of those services would also be a regressive tax that hurts the poor and middle class far more disproportionally than it hurts the wealthy.

- 47th Ward - Tuesday, May 5, 15 @ 11:27 am:

Not to pour cold water on a really good idea, but can we please forget about a progressive income tax for now? By the time it got approved, the deficit would be about 3 times as high as it is now. Tax fairness is important and I’d love to see it happen some day, but it’s pie in the sky for now. The General Assembly needs to find a lot of new revenue and it needs to be on-line immediately, if not sooner.

Then we can have a worthy discussion about how to change the constitution and modernize our income tax rate(s).

- Sir Reel - Tuesday, May 5, 15 @ 11:31 am:

Eliminate tax credits and deductions, and economic development incentives. Then and only then, restore some of the income tax.

- AnonymousOne - Tuesday, May 5, 15 @ 11:31 am:

Oh, to have that 5% back. Bills were being paid.

- BIG R. Ph. - Tuesday, May 5, 15 @ 11:32 am:

Tax Services and raise the individual income tax rate 0.5%. Solves the problems and everyone shares in the pain.

- Juice - Tuesday, May 5, 15 @ 11:34 am:

To add to what 47th was saying, implementing new services taxes would also likely take a year to get up and running, and the need kicks in less than two months from now.

I also don’t entirely see what this adds to the discussion. The Governor knows the revenue debate. That’s not what this is about. He’s hoping to get a group of Democrats so terrified of the cuts that they are willing to throw the middle class overboard to protect programs. That is what he wants, that is what he is counting on. This plays into his hands, and allows him to get the “leverage” that he’s looking for.

- Georgeatt - Tuesday, May 5, 15 @ 11:38 am:

The huge source of possible tax revenue not even mentioned: legalized marijuana.

- east central - Tuesday, May 5, 15 @ 11:40 am:

They need to implement a pension debt repayment tax, in whatever form, as soon as the court rules. A non-permanent tax of $5-6B can be blamed on the ruling and it largely solves the revenue problem.

It will be a singular opportunity.

If taxing retirement income above median income level is included, then they can say that pensioners are contributing.

- anon - Tuesday, May 5, 15 @ 11:45 am:

Hey Joe M., what is the sales tax in Chicago? And where I live the sales tax is not 6.25%! Just sayin.

And, somewhat conveniently, you didn’t address real estate taxes.

- DuPage - Tuesday, May 5, 15 @ 11:48 am:

Put the income tax back at 5%. If Rauner shuts down the state, the Democrats should “reset” the 5% income tax using the veto-proof majority. Increase the gas tax a few cents and use it only for bridges, highways, and related expenses. All other things, leave as they are.

- Soccermom - Tuesday, May 5, 15 @ 11:51 am:

Close loopholes? Why didn’t I think of that????

- AmericanPie - Tuesday, May 5, 15 @ 11:53 am:

Focus and simplicity often sell best, so I like: 1) Iowa model service tax; 2) tax on sugar sweetened beverages; and 3) restore 0.25% of income tax rate. That gets you to $6.2 bn, no? Then, no cuts.

- Rod - Tuesday, May 5, 15 @ 11:55 am:

To Juice and Linus time will provide the answer to the question whether the people of Illinois feel they were massively deceived by the potential cuts. If that is the case we should see Rauner’s polling numbers tank. My guess is there will be limited poling consequences until the cuts actually bite the average citizen in Illinois.

Ogden & Fry on February 11, after Rauner’s first 30 days in office, showed the governor’s approval rating at 43 percent. So if Rauner’s numbers drop into the 20s then many revenue options become clearly politically viable. But as we have all been reminded repeatedly, Rauner as a candidate predicted his actions as elected Governor could potentially make him a one term Governor, he said in several speeches that he did not care if he was reelected.

- Chris - Tuesday, May 5, 15 @ 11:58 am:

“I am also concerned about taxing retirement income, unless at least the first $25,000 or preferably $50,000 or so is exempt.”

Why is it that retirees are *less* able to share the cost of government?

Let’s exempt the first $25,000 of *everyone’s* income–individuals, businesses, *everyone*, and all income, whether OI, dividend, pension, cap gains–and then tax all the income at the same rate. That will reduce the degree of tax incentives toward one sort of income over another.

- Excessively Rabid - Tuesday, May 5, 15 @ 11:59 am:

Use Federal taxable income. That means after the exemptions and standard or itemized deductions. Then eliminate the state giveaways from the tax code like the real estate property tax credit, the tuition tax credit, and the state EIC. Then adjust the rate (down!) for the necessary level of revenue.

- Chris - Tuesday, May 5, 15 @ 12:02 pm:

“If Rauner shuts down the state, the Democrats should “reset” the 5% income tax using the veto-proof majority.”

hahahahahahaha. Madigan has already said that that won’t happen.

“Increase the gas tax a few cents and use it only for bridges, highways, and related expenses.”

Until the next time a phony budget gets passed, and there is a sweep of the accounts. For that to work right, need to use a securitization vehicle–which would get the $$ in the door now, and have 100% of the $0.XX/gallon completely beyond the reach of the Legislature and Guv under the bonds are repaid.

- Rich Miller - Tuesday, May 5, 15 @ 12:04 pm:

===the Democrats should “reset” the 5% income tax using the veto-proof majority===

Ever hear of Jack Franks?

- Wordslinger - Tuesday, May 5, 15 @ 12:04 pm:

Get rid of EDGE credits. No one has demonstrated that they produce any additional benefit.

- Chris - Tuesday, May 5, 15 @ 12:07 pm:

“He’s hoping to get a group of Democrats so terrified of the cuts that they are willing to throw the middle class overboard to protect programs.”

Ok, I’ll ask again, in a different way: what are the cuts that will “throw the middle class overboard”? Assuming (perhaps stupidly) that education funding is genuinely not getting cut.

I’m asking seriously, as I do not understand.

- Chris - Tuesday, May 5, 15 @ 12:08 pm:

“If taxing retirement income above median income level is included, then they can say that pensioners are contributing.”

There are those who have asserted that that would constitute an unconstitutional diminishment. Which I think if completely unsupportable, but means that it is reasonably likely to be litigated, too.

- Juice - Tuesday, May 5, 15 @ 12:12 pm:

I was talking more about the turnaround agenda, which is largely centered on reducing pay and benefits in the public and private sector. That’s his real goal, to the Governor, the budget is nothing more than a tool that can be used to apply pressure on the GA.

And Rod, I agree that the public will continue to largely be indifferent to this discussion until the cuts are actually implemented, if they are ever implemented.

- Beanish - Tuesday, May 5, 15 @ 12:22 pm:

Were Illinois to adopt Washington State’s liquor tax, Tennessee’s beer tax, and Kentucky’s wine tax, the State would have an additional $800 million in Revenue. The $100 million increase suggested above is far too timid.

An 80% Gaming Tax on Video and Table games in excess of $1 million dollars would bring in another $800 million. The financial ‘crisis’ is caused by the GA refusing to give up taxing working families incomes to provide the $6 to $10 billion dollar subsidy to the alcohol and gaming industries.

In 2011 the CDC published a study on the Alcohol Subsidy and Illinois is estimated to have a 73 cent per drink or $4 billion subsidy, minimum. We subsidize birth defects, wife beatings, drug abuse, poor school outcomes and special education, as well as create higher medical and property casualty insurance rates. The $279 million the Alcohol tax brings in is pennies on the dollar compared to the more than $4 billion subsidy. Working people with kids who need shoes have to pay income tax to support the alcohol and gaming industries.

Yeah for Professor Jon Kindt, anti-gaming crusader.

- Anon - Tuesday, May 5, 15 @ 12:25 pm:

Good suggestions, but why isn’t legalization of marijuana at least thrown out for discussion as a revenue source when it’s working for other states? Is IL still just too conservative to consider it when there’s an “emergency” going on?

- Andy S. - Tuesday, May 5, 15 @ 12:57 pm:

With the Iowa-style service tax, a 1% increase in the sales tax, and a restoration of the 5% income tax, I count somewhere between 14 and 15 Billion per year in potential additional revenues. All are unpopular, to be sure, but all are perfectly legal and constitutional. So where is the fiscal emergency that justifies the imposition of police powers to break contracts?

- 1776 - Tuesday, May 5, 15 @ 1:03 pm:

Eliminate that tax exemption on food and medicine.

Eliminate the child tax deduction.

These are the two LARGEST tax expenditures by the state of Illinois.

- Educated in the Suburbs - Tuesday, May 5, 15 @ 1:09 pm:

Wow, I’m suddenly in favor of taxing soda. I had no idea 12 cents a can would bring in so much money! That seems like a no-brainer. I would even be happy to pay 12 cents a can on my aspartame-sweetened diet soda even though it’s only probably giving me some rare form of cancer and not directly contributing to obesity. (What if aspartame, sucralose, and other fake-sweetened beverages were taxed at 1/2 cent an ounce?)

- Lt.Simms - Tuesday, May 5, 15 @ 1:27 pm:

None of them, slash and Burn. Slash and burn.

- foster brooks - Tuesday, May 5, 15 @ 1:41 pm:

Alcohol tax would be devistating

- Anon. - Tuesday, May 5, 15 @ 1:58 pm:

==Use Federal taxable income. That means after the exemptions and standard or itemized deductions.==

That would include retirement income, but otherwise would reduce the tax base.

==Eliminate the child tax deduction.==

Done! (At least, I can’t find it in the existing statutes, anyway).

- AnonymousOne - Tuesday, May 5, 15 @ 2:55 pm:

I tried to find out what the average retirement income is in Illinois. Couldn’t find much but did find this. After you get past the first 2 cities in Illinois, it looks pathetic. Taxation, anyone?

http://www.usa.com/rank/illinois-state–average-retirement-income-per-household–city-rank.htm

- PublicServant - Tuesday, May 5, 15 @ 3:06 pm:

The key is to tax those marginal dollars of income over a certain level that are less likely to be spent in a way that contributes to the Illinois economy. Increases in sales taxes are regressive because (1) people at lower income levels spend all their money, so taking more of those dollars in tax hurts the economy, and (2) it does nothing to correct the rampant income inequality faced by the nation. That’s why I’d go with their recommendation for a multi-tiered income tax structure.

- AnonymousOne - Tuesday, May 5, 15 @ 3:13 pm:

The link posted above apparently did not come through. In looking at another source, it listed average retirement income in Illinois at $47,000, second lowest only to those under age 25. Point being, this is not a gold mine. But the better question is why are some so eager to tax people who basically spend what they have to live? Do people really think that those with over a million dollar income would suffer hardship if their taxes rose a few percentage points? More hardship than, say one earning 50k, 75k, even 100k compared to millions? If so, how?

- Anonymous Retiree - Tuesday, May 5, 15 @ 3:28 pm:

They are nuts

- Honeybear - Tuesday, May 5, 15 @ 4:07 pm:

Wordslinger- at this point the EDGE credits are a necessity. If we unilaterally dropped them the surrounding states would slaughter us. The deal with EDGE is not to allow them to be sellable, assignable, or transferable as is proposed (SB 1660) If they pass this then we will be on the hook for every EDGE credit that gets approved. As it stands only about a third of them actually get redeemed. It’s like rebates for your contacts, so many hoops that you forget or don’t fill the stuff out right and you don’t redeem the rebate. That’s simplistic, I know, but the concept is the same.

- Wordslinger - Tuesday, May 5, 15 @ 4:24 pm:

HB, I’m suggesting the concept of state handouts has never been proven to move the needle.

The idea that the United States is made up of 50 separate economic duchies is unsupported as well.

Do they teach that at the universities somewhere? That economic growth has ever been determined by state tax policy or handouts?

It’s a scam. A few companies get handouts and politicians make bloated claims of “creating jobs” on the taxpayer dime.

- Arizona Bob - Tuesday, May 5, 15 @ 5:00 pm:

“Voices” has never been about “the children”, it’s always been about the bureaucracy SERVING the children. Or is it the other way around? The public unions are the ones keeping “Voices” lights on. There will never be enough revenue for them, much as is the case with the likewise union owned CTBA and Ralph Martire.

I went to their seminars early on, and whenever you brought up ways that the bureaucracy’s interests conflicted with the best interests of “the children” and fair ways to cut costs to provide better service to the kids, they’d cut off the conversation pronto.

That being said, I have to agree that taxing services in our service economy makes sense if revenues are needed. That cost gets passed off to consumers anyway, so it won’t affect business viability much. I’d tax at a much lower level, however, maybe 4-6% total.

In Arizona we’re charged for our license plates based upon the value of the car, like a “property tax”. Luxury cars may have license fees as much as $300 per year. I guess if you can waste $50K+ on a car you shouldn’t complain about a few hundred more in taxes. The fees go down as the vehicle loses value.

We’re also charged a monthly fee on rental income. A house I rent out for $1700/mo. costs about $32/mo in “rental” taxes. Just a cost of doing business. Of course, when you’re only paying $1500/yr in real estate taxes in a very good school district, you can’t complain.

I wouldn’t raise the personal or corporate income tax rates, nor the sales or motor fuel tax. Say all you will, but Illinoisans still pay among the highest prices per gallon of any metro area in the US because of the sales and motor fuel taxes (and BP and Exxon manipulating the market, but that’s another subject).

- King George - Tuesday, May 5, 15 @ 6:38 pm:

Tax Sugar!!!