* From the Heartland Alliance…

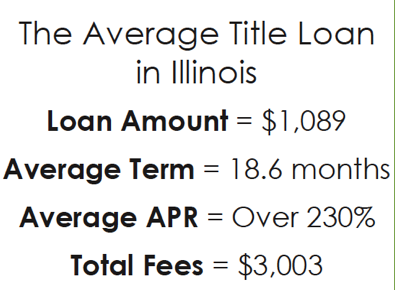

Many Illinois families are financially fragile. Unfortunately, the increase in auto title lending in our state is only exacerbating the problem. IABG, in partnership with Woodstock Institute, recently released “No Right Turn: Illinois’ Auto Title Loan Industry and its Impact on Consumers.” The report finds that increasing numbers of Illinois consumers are turning to title loans in an attempt to make ends meet, and ending up in a long-term cycle of debt due to triple-digit interest rates and long loan terms. Not only are we seeing an increase in the number of title loans, but we are also seeing an increase in length of the loan and the amount of fees. The report found that the average length of a title loan is now over 18 months with consumers spending a total of $25.5 million a month to title lenders.

* The full report is here…

Title loans in Illinois are exceptionally harmful because of their combined high interest rate and long loan terms. While traditional and installment payday loans have high APRs (up to 400 percent), those loans have maximum term lengths of 120 and 180 days, respectively, enabling borrowers to pay back loans in installments, but ensuring that borrowers are not paying high rates for excessive periods of time. Small consumer installment loans have longer terms (over 180 days), but are capped at 99 percent APR. Under current Illinois law, title loans have no APR cap and no maximum term, so borrowers can be trapped into paying high rates for years at a time. […]

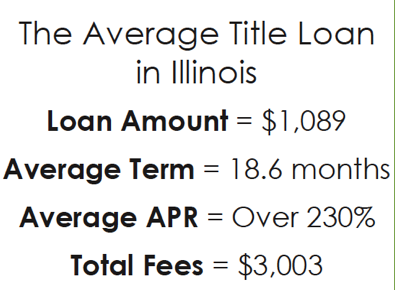

As the default rate data show, over a quarter of all Illinois title loan borrowers were unable to make payments and defaulted. This means that one in every four title loan borrowers in Illinois lost the means for commuting to work, going to the doctor, or transporting kids.

* One of their charts…

Oy.

* Some of their proposals…

The Illinois legislature strengthen the Consumer Installment Loan Act to require stronger ability-to-repay standards, maximum loan terms, and a rate cap of 36 percent APR.

The Illinois Department of Financial and Professional Regulation (IDFPR) publicly release loan-level data from the state database to allow for a more detailed analysis and monitoring of small-dollar lending in Illinois.

Financial Institutions create and market affordable small-dollar loans with ability-to-repay standards as alternatives to high-cost, predatory products.

- Niblets - Thursday, Oct 29, 15 @ 9:51 am:

Can this be real? Over 230%? Where is a mob loan shark when you need one? Should be illegal.

- Niblets - Thursday, Oct 29, 15 @ 9:54 am:

I should add “join a credit union if at all possible.”

- Team Sleep - Thursday, Oct 29, 15 @ 9:58 am:

For people who say this is “highway robbery” and “loan sharking”…what do you say about credit card companies and store credit card issuers who have rates of 15-25% APR and can (at times) impact your FICO scores as much as an auto loan or mortgage? The amount of time and capital it takes to pay off a maxed out credit card through a major issuer is not much better - and, quite frankly, is likely worse.

- Robert the Bruce - Thursday, Oct 29, 15 @ 10:03 am:

==Has GTCR ever been in the consumer credit/loan business?==

Yes. Homebanc in Georgia. They may have done predatory loans. https://capitolfax.com/2014/09/30/todays-assignment/

- Niblets - Thursday, Oct 29, 15 @ 10:04 am:

I hate the high credit card rates and think they are awful. I would like it to be clear that I don’t think 25% APR and 230% APR are the same cost.

- LizPhairTax - Thursday, Oct 29, 15 @ 10:19 am:

In a lot of places, and not just exurban and rural areas, once you lose your car you are screwed.

These are loans of last resort.

- Honeybear - Thursday, Oct 29, 15 @ 10:22 am:

It’s so so common in the impoverished communities of the Metro East. These loan shops are every where.

- Mouthy - Thursday, Oct 29, 15 @ 11:06 am:

These places should be put out of business. For you folks that complain about credit card rates you should either pay them off every month, or heaven forbid, hold off on your purchases until you can afford what you want. Works for me. I’d hate giving people money just because I just had to have it today. I haven’t paid interest on anything beside a mortgage for a long time.

- vinron - Thursday, Oct 29, 15 @ 11:09 am:

Change the rules so that banks can offer small loans (and join a credit union if at all possible)

http://nyti.ms/1GM0OkH

- Cheswick - Thursday, Oct 29, 15 @ 11:14 am:

@Mouthy, well good for you. But for people living near the edge of poverty, paying off every month is not an option, and the purchases you want them to hold off making are oftentimes necessities.

- Amalia - Thursday, Oct 29, 15 @ 11:27 am:

our society is so acquisitive, people are rarely praised for the size of their account, but the size of the handbag, yes. it’s not just a problem of flashy lending practices, although that is certainly a big issue (time for bills and hearing again, State Legislature). there are people who cannot meet their daily needs, but there are many people who do not realize that their daily needs are not a new car or the latest purse. Credit unions are an awesome way of decent lending and close advice on being smart about spending and borrowing money.

- LizPhairTax - Thursday, Oct 29, 15 @ 11:29 am:

@Mouthy

Agree with you in theory but the Dave Ramsey stuff doesn’t always work in the real world. What’s his number one suggestion for side income? Deliver pizzas. Can’t do it with no car.

- Mouthy - Thursday, Oct 29, 15 @ 11:38 am:

=- LizPhairTax - Thursday, Oct 29, 15 @ 11:29 am:

@Mouthy

Agree with you in theory but the Dave Ramsey stuff doesn’t always work in the real world. What’s his number one suggestion for side income? Deliver pizzas. Can’t do it with no car.=

I don’t listen to Dave Ramsey. This is basic life stuff. The title loan and payday places are around for only one reason and that’s because they know how to suck the financial life out of someone that’s on their way to financial destruction. They lend money to people that they know can’t pay it back. It’s despicable.

- Ghost - Thursday, Oct 29, 15 @ 11:50 am:

whats missing is that most folks pay back the proncipal amount many times over before they default…. and lose their car anway.

we need real usary laws, and 36% is rediculous. the high interest loans get people with low incomes locked in anforever payment cycle. those pay fay loans ate not limited to 180 days btw. they just do a nee loan when the old one isnt paid off!

no one should ever have tompay more then 20% on a loan. the companies say they need the interest due to the high risk, but look at their numbers… they make their principal back 99.9% of the time, they do better then banks! the defaults occur on the constant unending interest payments that ate many tomes the principal amounts

- better days - Thursday, Oct 29, 15 @ 12:07 pm:

What a scam lawmaker’s let these title loan outfits pull on Illinois consumers.

A secured loan on a title yields 300-400 per cent interest charge .. This is loan sharking .. shame on lawmakers for not looking out for their voters

- better days - Thursday, Oct 29, 15 @ 12:08 pm:

Mob loan sharks Shame

- Cheryl44 - Thursday, Oct 29, 15 @ 1:00 pm:

I don’t understand how these places can be legal. They really ought to be run out of business and not just in Illinois.

Also Mouthy? Having no debt at all is bad for your credit score.

- Arthur Andersen - Thursday, Oct 29, 15 @ 1:15 pm:

Um Cheryl, if you have no debt, you tend not to worry too much about the FICO.

- Mouthy - Thursday, Oct 29, 15 @ 1:29 pm:

=- Cheryl44 - Thursday, Oct 29, 15 @ 1:00 pm:

I don’t understand how these places can be legal. They really ought to be run out of business and not just in Illinois.

Also Mouthy? Having no debt at all is bad for your credit score.=

I just got a credit card from my Credit Union and I believe she said my score was 862.

- Joe M - Thursday, Oct 29, 15 @ 1:44 pm:

== there are people who cannot meet their daily needs, but there are many people who do not realize that their daily needs are not a new car==

Amelia, I think you are confusing loans to purchase cars, with these loans that put one’s car up as collateral for these high interest loans to get money to pay the rent or whatever else someone might need money for fast. Granted, some people may take these loans out for unnecessary purchases or to put up bail money, but I would bet the majority of these loans are for things like rent, food, and other necessary bills that require money right away. And I would bet virtually none of them are taken out to purchase another car.

- Mouthy - Thursday, Oct 29, 15 @ 1:48 pm:

Rent to own places are almost as bad. Just a bit ago I got in the mail one of those multi page ad flyers. In it were two ads for rent to own. Let me give you a real example:

Store A:

Samsung 65 inch tv (The model numbers in the ads can’t be found because it’s either an old model or a special number given to the chain)

Big Box Retailer: $1,627.50

RTO - Everyday Low Price: $2,278.49

RTO - 24 Mo payments: $4,010.16

(All prices include tax)

Store B:

Sansui 65 in LED 1080P:

Big Box Retailer - $962.44

90 days Same as Cash - $1302.00

78 Weeks (aprox. 1 1/2 yrs) - $2,538.90

All these places, title loans, payday loans, and rent to own, have one thing in common. Their relationship with the people who walk through their doors is that they are the predator and their customers are the prey..

- Dudeman - Thursday, Oct 29, 15 @ 2:09 pm:

Vultures preying on the poor and financially illiterate.

- IL17Progressive - Thursday, Oct 29, 15 @ 2:33 pm:

Predatory lending is rampant across this country - military installations are a prime target, low wage areas another.

Simple loans are basic Hr. High Math — BUT — these predators mix all variety of other sales hype to draw the person in - Like Best Buy’s want insurance on that? at check out.

So it is indeed the responsibility of those that know what is taking place to insure others are not scammed.

Where’s the Chamber of Commerce when deal with these ‘capitalists entrepreneurs? Might have a brochure to give out while in the back room every member desires a piece of the action.

- Formerly Known As... - Thursday, Oct 29, 15 @ 3:00 pm:

==But for people living near the edge of poverty==

Bingo. If anything unforeseen occurs…

Who is protecting these places? smh

- Langhorne - Thursday, Oct 29, 15 @ 3:15 pm:

The highest possible FICO score is 850.

- Mouthy - Thursday, Oct 29, 15 @ 5:13 pm:

=- Langhorne - Thursday, Oct 29, 15 @ 3:15 pm:

The highest possible FICO score is 850.=

That’s what I thought also. I used to have 812. According to the Credit Union banker here last week the top number is 50 points higher. I had to take her at her word. In reality, I don’t really worry about it…

- Big foot - Thursday, Oct 29, 15 @ 8:31 pm:

These folks can’t afford Dave Ramsey course to start with…