Latest Post | Last 10 Posts | Archives

Previous Post: *** UPDATED x1 - A badly blown hit *** Kirk, Hare hit over semantics

Next Post: Support drops for imprisoning Blagojevich

Posted in:

* On Friday, Fitch became the second ratings service in a week to downgrade Illinois’ credit rating…

The rating downgrade, to ‘A’ from ‘A+’, reflects the continuing unwillingness of the state of Illinois to take action to address its significant budgetary problems. The recently enacted FY 2011 budget does not begin to address the current operating gap, relying almost entirely on various forms of deficit financing to close the gap. The state is facing a growing budget deficit, very high accounts payables, and a significant structural gap for which solutions have been difficult to identify and implement.

Illinois entered this economic cycle with little financial flexibility to handle a downturn. It came out of the last recession relatively late and did not take actions to build its reserves or restructure its finances as its economy and the national economy grew over the five years leading into this recession. While the extent of the current fiscal problem was clear midway through FY 2009 as revenue estimates were downsized, comprehensive solutions have been repeatedly delayed. Faced with reduced revenues and an aversion to broad based tax increases, the FY 2010 enacted budget relied heavily on non-recurring revenues, particularly the use of debt to finance current operations. Declining revenues and an inability to achieve enacted budget solutions contributed to a $2 billion gap (7% of general fund resources) opening in the FY 2010 budget, for which no solutions were proposed other than to delay payments to vendors and schools districts and other entities that rely on state payments. Taking into account the pension payment that was effectively covered by a $3.5 billion GO issuance rather than general fund resources, the budgetary deficit has grown to almost $6 billion, 22% of general fund resources. The cumulative deficit, reflecting the pension borrowing but including the carryover of $3.7 billion in prior year deficits, is now projected to be $6.1 billion, or 19% of general fund resources.

Fitch indicated in December 2009 and in March 2010 that future rating action would be taken if the state did not address its operating deficit, its growing structural deficit, and its accumulated liabilities in a comprehensive way in the context of its FY 2011 budget. The enacted budget continues to push solutions out to the future; budgetary balance will continue to rely on sizeable borrowing, and those reliant on state payments will continue to have long waits to be paid. While the enacted budget for FY 2011 does include $1 billion in spending cuts, it leaves a $5.9 billion funding gap (21.3% of FY 2011 expected revenues) that is expected to be closed by issuing bonds, interfund transfers, and securitization of tobacco settlement revenues, and carries over $6 billion in accounts payable through another fiscal year.

And it’s already costing us more money…

Yields on some Illinois bonds on Friday rose above those of California, the poster child for local financial problems. The state’s 10-year bonds were quoted at 4.20 per cent while California’s 10-year bonds were quoted at 3.95 per cent, according to one trading desk.

“The market is growing more careful about Illinois,” said Matt Fabian, managing director at Municipal Market Advisors. “Higher yields are one of the costs of a poorly balanced budget.”

“Something significant needs to happen on either side of the budget – either cutting spending or raising revenues,” said Karen Krop of Fitch. “Now they are relying on deficit borrowing.”

Ms Krop said Illinois has budgeted to raise more than $8bn with bonds in the current and next fiscal years. “There doesn’t seem to be an endgame,” she said.

- Eight U.S. states, including California, Pennsylvania, New Jersey and Illinois, risk lower credit ratings because they lack completed budgets less than three weeks before the start of their new fiscal years.

A ninth, New York, has operated without one since its year started April 1. All are gripped by political stalemates over how to cope with a collapse in tax revenue that included a $67 billion decline in the 12 months ended June 30, 2009, according to the Census Bureau. The Nelson A. Rockefeller Institute of Government called that the biggest on record.

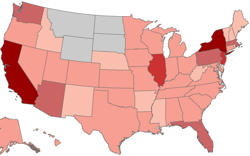

* Two maps. The first is state budget gaps. Click the pic for more info, but the redder the state, the higher the gap…

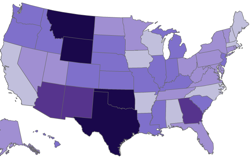

The bluer the state, the higher the revenue shortage…

* Related…

* Big State, Big Cuts, Little Room: As the new head of the Illinois Department of Human Services, Michelle R.B. Saddler knew she would confront tough choices in preparing a budget that juggled rising needs for services with tumbling state revenue. But she wasn’t prepared for the long list of mandates and governor’s priorities that tied her hands. She wasn’t supposed to eliminate services required by law or court order. She was to spare Medicaid-eligible services and food-stamp benefits. And she couldn’t jeopardize residents’ safety or well-being. “What’s left?” she said.

* State’s budget crisis could get worse

* Steinberg: Accept grim truth — Illinois is broke

* Herald & Review: State finances founder as ‘leaders’ fail

* Pantagraph: Bond-rating drop should push politicians to act

* RR Star: Illinois continues to fail to live up to pension obligations

* Sun-Times: Pension borrowing a matter of survival

* Illinois Lottery tops $2 billion in sales for 4th year

* Tribune: Another video gamble

* Quinn signs Seth’s Law in Harrisburg

* Quinn announces $6M grant to broadcast museum

* Former prisoners aren’t landing tech jobs, so state revamping program

* State DNA database more than 20,000 samples behind

posted by Rich Miller

Monday, Jun 14, 10 @ 10:29 am

Sorry, comments are closed at this time.

Previous Post: *** UPDATED x1 - A badly blown hit *** Kirk, Hare hit over semantics

Next Post: Support drops for imprisoning Blagojevich

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

–**Only two states, Montana and North Dakota, have not reported budget shortfalls–

Revenues off 20% in Okie, 15% in Texas. A big bowl of bad all over.

Comment by wordslinger Monday, Jun 14, 10 @ 10:48 am

Is the Quinn admin limited to $1 billion in fund sweeps? Are there legal or fiscal barriers to sweeping more, say, $2 billion, $3 billion? If not, and the money is there, now might be the time to use it to reduce interest costs from borrowing.

The Obama admin is proposing $50 billion in additional relief for the states, which is still up in the air but definitely a possibility. Surely Illiois would get at least a billion.

Sure, the legislature isn’t pure here, but the executive branch is led by Quinn, who signs giveaway agreements with employee unions, can’t bring himself to support the end of free senior rides or make modest adjustments in lavish state early retiree health benefits, appears uduly frightened of “lawsuits” and has a Blago-like fondess for giving out money here and there and attending associated ribbon-cuttings.

Can we believe him when he says tough decisions are needed especially when he never makes them. Anyway, how tough is a decisions to increase the amount from fund sweeps or accept federal largesse.

Comment by cassandra Monday, Jun 14, 10 @ 10:55 am

More and more borrowing is just bad policy. This what 8 years of creating new programs with no plan (or cares) of how to pay for them. More revenue may be needed but bigger cuts need to be made.

Comment by Fed up Monday, Jun 14, 10 @ 10:57 am

As usual, Cassandra, you dump on state employees, retired and current, as reasons the state is broke. Please open your eyes and realize the rank and file employees of this state DID NOT cause the current crisis. They, as many other employees at other companies, have seen their numbers shrink and are being asked to do much more with much less. When I started at the state 22 years ago, there were 6 employees in my office. Now there are 2. I never have time to plan my work because I am constantly putting out fires because there are not enough people to do the work. When I went to the dentist last week, I had to pay the $150 up front because the self-insured state is not paying its medical claims for its employees. The GA constantly steals from my retirement fund, which I am required to pay %4 of my salary into - no choice! State employees are no different than other employees who suffer similar or worse at their jobs, but the point is, we have already been cut and will continue to be cut. Cassandra, LAY OFF!!

Comment by Anonymous Monday, Jun 14, 10 @ 11:15 am

Anon. If you are only contributing 4% towards your pension that is a huge part of the problem. That cannot be sustained.

Comment by Fed up Monday, Jun 14, 10 @ 11:48 am

There are many examples of Quinn’s inability to make the tough decisions he is always declaiming about.

The free senior rides and the free state retiree health benefits are among those cited frequently

in the press as examples of low hanging fruit in the budget cuts department. But Quinn has flip and flopped on both, and ultimately backed off.

My point has nothing to do with state employee benefits. It has to do with trust, actually, can we trust Quinn’s administration to present all the possible alternatives to sinking deeper into the budget crisis. Examples-larger funds sweeps, more help from Washington, and, I might add, a much tougher look at state contracts, many of which could probably go on a diet. I would also add that some of this additional money could be

used to pay at least part of this year’s pension debt–I doubt that the law says the state has to pay all or nothing.

Comment by cassandra Monday, Jun 14, 10 @ 12:18 pm

The tragedy is that the powers that be have spent the last few decades trying to turn everyone into a dependent. They have succeeded to a large extent.

As the flood of tax money has eroded, it become harder and harder to unwind the benefits bonanza promised.

The only thing to remember is that the politicians will save themselves first. The rest will have to swim on their own.

Comment by Plutocrat03 Monday, Jun 14, 10 @ 12:38 pm

Actually, Fitch does a pretty good job of laying it out, don’t they? If you don’t use the relatively good times to get ready for the bad times, and you aren’t willing to act during the bad times, that leaves you pretty much screwed, and that’s us.

Comment by steve schnorf Monday, Jun 14, 10 @ 1:50 pm

Steve, you said it well. Hat tip to you, sir.

Comment by Team Sleep Monday, Jun 14, 10 @ 3:19 pm

“Interest rates are low!” - Krugmaniancs

Just borrow the funds. No need to change the pension system where the top 100 pensioners will cost almost a billion dollars if they max out. And that’s just the schools.

==Surely Illiois would get at least a billion.==

Should you consider what Illinois already gets back for every $1 it sends to DC? If so, then it’s only 780 million.

But hey. This is money pulled out of a tree and it’s Obama with his adopted home field advantage. Plus Illinois is broke. Make it 2 billion.

Comment by Brennan Monday, Jun 14, 10 @ 4:50 pm

Hey - Who has the last dollar bill? We have only one left and it gets passed around the country in order to pretend to pay for things. Who has it?

China? Oh crap!

Comment by VanillaMan Tuesday, Jun 15, 10 @ 8:57 am

Didn’t the GA give PQ some emergency powers to cut where he thought should be cut before they crawled home to their districts to campaign? Here is a golden opportunity for PQ to really shows us his quality. I ain’t holdin’ my breath.

Comment by dupage dan Tuesday, Jun 15, 10 @ 9:49 am