Latest Post | Last 10 Posts | Archives

Previous Post: *** UPDATED x1 *** Filing day is here, and two are claiming victory so far

Next Post: *** UPDATED x1 *** Now it’s Alexi’s turn

Posted in:

* A little more management, please…

In one of the first major provisions of federal health-care reform, states were supposed to establish temporary high-risk insurance pools for people with pre-existing conditions by July 1.

But Illinois won’t make that deadline. It probably won’t start enrolling people in its pool until mid- to late August because legislators in Springfield failed to pass legislation necessary to set up the new program, the Chicago Sun-Times has learned.

It wasn’t just the GA’s fault. There was no immediate fallback position by the administration. What we have is yet another embarassment.

Gov. Quinn, however, steadfastly maintains that he’s doing the best job possible…

According to state records, Illinois had set aside more than $3.3 billion in money for public works projects this year. From that $3.3 billion, almost $464 million already has been spent on projects, while another $585 million is reserved under contract.

That leaves $2.3 billion still on the table for dozens of projects around the state.

Quinn said state agencies and public bodies have to go through detailed procedures before releasing the money and starting work.

“You’ve got to have bidding and you’ve got to have competitive bidding and you’ve got to do all the policies right,” he said. “The bottom line is we have more construction going right now in Illinois that any other time in our state history.”

* More lack of management and leadership…

It doesn’t take a political expert to figure that Sen. Larry Bomke, R-Springfield, would be a focus of this arm-twisting [to pass the pension borrowing bill]. He obviously represents large numbers of state employees. He’s in a better position than his GOP colleagues to vote for borrowing as something that’s good for his constituents and to argue that it’s the best of a bunch of bad alternatives.

However, Bomke said last week he hasn’t heard from the governor since the end of May, when the two talked about the pension borrowing and Bomke said he’d keep an open mind.

* Oof…

Every month, the state pays out about $2 billion in bills. The biggest chunk of that money doesn’t go to state services, salaries or to help bring down the backlog.

Rather, every month, the state spends about $500 million simply to pay back loans it took out in an earlier round of borrowing.

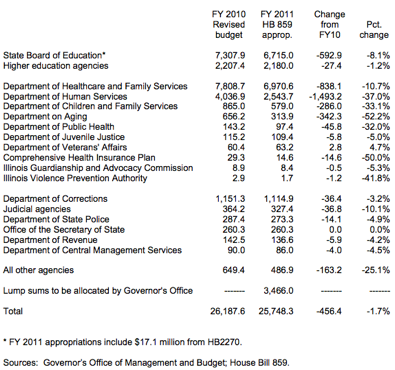

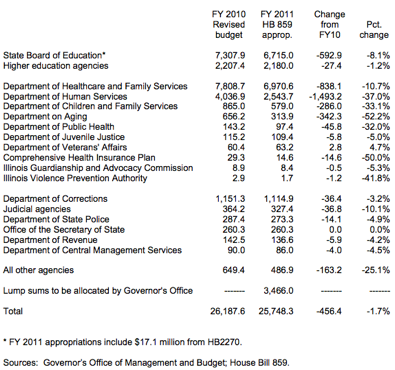

* Our chart of the day is from Voices for Illinois Children. Click the pic for a better view…

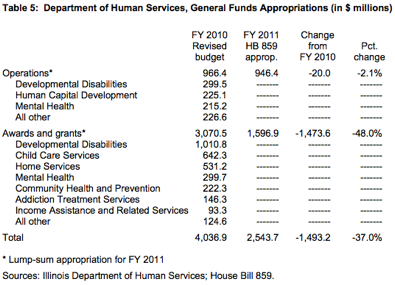

OK, here’s another one showing some details of the hits within the Department of Human Services budget…

The screaming is about to get much, much louder.

The full report is here.

* It’s been an article of faith among conservatives and quite a few moderates that states which hiked taxes on the rich suffered a mass exodus. Ezra Klein points to a roundup of some studies that suggest otherwise…

1) Economist Andrew Leigh did a national study (PDF) looking for effects of state income tax rates on migration patterns. He could not find a statistically significant relationship.

2) After Maryland instituted higher tax rates on wealthy individuals in 2007 and 2008, tax returns from millionaires dropped. But the Institute on Taxation and Economic Policy found (PDF) that the drop was not due to millionaires leaving, but to the recession making them no longer millionaires.

3) The California Budget Project notes (PDF) that California imposed a temporary tax increase on high earners from 1991 to 1995, and the number of millionaire filers increased by 33.4 percent. Another high-income tax hike was implemented in 2005, and the number of millionaire filers increased by 37.8 percent.

4) New Jersey increased taxes on high earners in 2004, and Princeton researchers did find (PDF) that New Jersey lost $37.7 million in tax revenue after migration by wealthy tax payers. However, that number was dwarfed by the more than $1 billion overall revenue gain from the tax increase, and the number of high-income filers still increased between 2004 and 2006.

* Related…

* Treatment center faces hard choices because of state’s budget woes

* Meals program ending over Illinois financial woes

* Quincy Public Library renovation project on track; bids ‘lower than expected,’ but state hasn’t approved grant

* High-speed rail slow in coming

* Author shows why closing book on libraries is a bad idea: Legislators didn’t vote to shut down the regional [library] systems; they just didn’t act as the state stopped paying the money it had appropriated. The North Suburban Library System was the first to run out of money, shrinking to a skeleton operation, and others are facing the same budgetary squeeze.

* How to fix the calamity that is Illinois

* Trolling for martyrs

* State sales tax holiday wouldn’t apply to everything

* Her Tollway road map

posted by Rich Miller

Monday, Jun 21, 10 @ 11:00 am

Sorry, comments are closed at this time.

Previous Post: *** UPDATED x1 *** Filing day is here, and two are claiming victory so far

Next Post: *** UPDATED x1 *** Now it’s Alexi’s turn

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Private schools that serve severly mentally ill children and meals on wheels programs are the tip of the iceberg. It only a matter of time before the big programs in the large cities start to go under. What will Quinn and the legislature do when they have tens of thousands of hungry seniors? When they have thousands more homeless because the homeless prevention programs are gone?

What excuses are they planning for when we have a human services meltdown in Illinois?

Comment by Aldyth Monday, Jun 21, 10 @ 11:12 am

The declines in the breakdown on the first chart look scary, but the TOTAL is only down 1.7% taking into account the lump sums to be allocated.

If the total decline is just 1.7% this should be manageable and small relative to what most private businesses have had to address.

Is that lump sum a normal procedure or is there an attempt here to make the budget declines look dramatic, when in fact additional funds will be allocated?

Comment by Another Anonymous Monday, Jun 21, 10 @ 11:20 am

This administration and the previous one have increased the power of CMS beyond any other previous administration. The reason why agencies are not getting their projects started is because they are all being held up in CMS. I have heard from pretty reliable sources that no expenditures are being okayed by CMS at this time. Whether this will change at the beginning of the new fiscal year remains to be seen.

There is already talk of new purchasing rules that will include the requirement of a public hearing for any expenditure over a certain dollar amount and no one is willing to put a figure to that dollar amount.

The restrictions that are put on purchasing makes it almost impossible to get anything done. Some needed items and very minor projects that I know of have been waiting for over three months for approval.

These rules cost the taxpayers more than we used to do things before CMS took everything over. For example, we can no longer request a new computer and if money is available have it purchased for us. All new computers are leased at a yearly cost of $1500.00 These are very basic computers. I could go out and buy a comparable one new at Best Buy for about $1000.00. We keep our computers for about seven years or so. Leasing one for that time period will cost over $9,000.00. This is ridiculous. I hope Brady’s audit looks hard at CMS and what they are not saving us.

Comment by Irish Monday, Jun 21, 10 @ 11:29 am

http://www.forbes.com/2010/06/04/migration-moving-wealthy-interactive-counties-map.html?preload=39099

Of course the map posted last week if you toggle the counties in these states that jacked up taxes you’ll see a lot more red lines than black. New York had a few million people move away in the past couple of years. Ezra Klein may want to play with that map for a while.

Comment by Segatari Monday, Jun 21, 10 @ 11:29 am

You forgot to include the final paragraph of the Klein article -

As the New Jersey numbers suggest, it would be going too far to say that state tax rates have no effect on cross-state migration. However, you have to balance that against evidence that the revenue generated by state tax increases on high earners overwhelms that lost from taxpayers’ leaving.

Even as a conservative, I find that final paragraph correct. You want to penalize citizens earning over a specific dollar amount by forcing them to pay more? OK. Just recognize that there is a limit to the number of golden eggs those geese lay, and that geese migrate.

Comment by VanillaMan Monday, Jun 21, 10 @ 11:36 am

Geese are migrating less and less, VMan, so I’m not sure that’s the analogy you want to use.

Comment by Rich Miller Monday, Jun 21, 10 @ 11:39 am

You think Illinois would be tripping over itself to get the high risk pools set up, with all the money they’ll be saving by doing so.

Comment by Leroy Monday, Jun 21, 10 @ 12:05 pm

In some ways this is a legacy of Rod and how bad this state has gotten at the basics of governing. If it is appointing board members to boards or getting federal dollars, this state is bad at ironically being a state.

Comment by OneMan Monday, Jun 21, 10 @ 12:54 pm

Wow another pat Quinn accomplishment. Quinn actually makes Blago look competent. Im guessing Quinn will be working for a non profit next year where results dont really matter.

Comment by Fed up Monday, Jun 21, 10 @ 1:02 pm

The damage that is being done will last a very long time. The human services infrastruce built upon the non-profit community services provider system is in danger of dieing. These agencies were built by community residents, their facilities, their staffs - to serve their communities - mental health, addictions treatment, aging - if these are not there when all of the dust settles - we will have lost a great deal in this state. We already lost many of our rural hospitals and other health care providers.

Comment by um Monday, Jun 21, 10 @ 1:03 pm

That study on wealth migration certainly begs more study.

There are “millioinaires” for whom location is discretionary, and those who can maintain their business and profession from just about any location.

This is the group that states are at risk to lose by raising taxes, and are not coincidently the main engines of private sector job growth.

If you’re a multi-millionaire lawyer parisitically sucking wealth from the Illinois tort system, for example, a 1% income tax hike won’t get you to move.

If you’re a Californian who became a “real estate bubble millionaire” in 2005 (and there were many), you’re not going to migrate because of an state income tax hike.

While I admit I haven’t studied the article yet, intuitively its conclusions seem not entirely accurate.

There’s no doubt that the low income and real estate taxes in Nevada led to massive migration from California, and that the unbelievably low real estate taxes in Arizona also contributed to the California exodus.

It also would be interesting to see how the paradigms have shifted since the 2008 economic and real estate meltdowns.

I believe that California, New York and Illinois lead national out-migration over the last few years.

The biggest fear is what increasing tax burden does to private sector jobs and the economy.

In California, the building boom from irrationally low rate lending to unqualified borrowers due to Federal policy made taxes an insubstantial cost compared the golden opportunities in the industry.

When the boom busted, many “millionaires” moved their assets elswhere, and professional taxpayers were replaced by low skilled workers who often were taking more in government services than they were producing in the private economy.

Meltdown.

This most effects Illinois in what it does to the professional service industry environment. That’s where the growth will be in the next decade, as well as in energy resources.

Tax services, and you reach a “tipping point” where the burden of incompetent and corrupt mismanagement of state and local finances, as well as an anti-business political culture which supports union greed over the people’s need, and Illinois quickly became, and sadly will remain, “Dead State Walking”!

Comment by PalosParkBob Monday, Jun 21, 10 @ 1:08 pm

I absolutely agree that a 1.7 percent drop seems reasonable, during this persistent recession.

The distribution seems to be problematic, and Voices for Children doesn’t explain that part well. So this seems like a bit of rabble rousing to me.

Voices for Children is one of the many advocacy groups who have little respect for the middle class pocketbook. They think we should pay up on demand via a substantive income tax increase and be grateful for the chance. Rampant corruption is just part of the deal–stop whining. Those who raise questions are loser right wingers who should go live in the hills.

Comment by cassandra Monday, Jun 21, 10 @ 1:08 pm

On the management sde I wonder if this is an artifact or Quinn not having nuts and bolts experienced people around him. h has some good subject matter people, but not a lot of just wheels donw on the ground State operations experience (lik a schnorf)

Comment by Ghost Monday, Jun 21, 10 @ 3:21 pm

Mike McRaith personally screwed up the federal health care implementation by trying to go way above and beyone requirements. He wanted to change current programs and impose $100 million in new fees on insurance companies and emmployers. He wanted to make other changes that were not required by the feds. He lost credibility with legislators by claiming they were needed.

Business and insurance agreed to a simple implementation but McRaith wanted to bite off more than he could chew.

Comment by 4 percent Monday, Jun 21, 10 @ 4:34 pm

Thankfully someone like McRaith is in Springfield fighting for families and argueing against the lies of health insurers like those written by 4 percent. McRaith proposed only what is in national health reform almost word for word — all of which Illinois insurance companies will ignore for as long as possible. The insurers lie to the legistlators just like they lie to their policy holders.

Comment by Rustyandgreta Monday, Jun 21, 10 @ 5:29 pm

4 percent - McRaith has nothing to do with the reason that health reform implementation didn’t move forward. The bill was blocked by certain Senators who are completely and utterly at the beck and call of the insurance industry. And the industry apparently doesn’t understand that the high-risk pool is good for their bottom line because it take really sick, expensive people off their books. McRaith’s bills would have helped businesses by making insurance companies more transparent and accountable, so when the ins cos raise premiums by 50%, they’d have some recourse.

Comment by JP Monday, Jun 21, 10 @ 5:41 pm

I have no knowledge of what Mr. McGraith may or may not have tried to do, but when I see “fighting for families” and assertions that an industry doesn’t understand how supporting a government program will save them money, my BS alarm goes off. How about some facts, instead?

Having actually read some of the federal bill, I could easily accept an explanation that “nothing got done because no two people could agree on what the bill requires/allows to be done”. If that were true, of course, it should be relatively easy to come up with an example.

Comment by Justme Monday, Jun 21, 10 @ 6:22 pm

The issue is not the appropriation. The issue is the failure to pay. I can double your appropriation. But if it takes nine months to get your January check, the reality is — your funding got cut in half. So don’t look at appropriations. Look at the checks that actually got cut in fiscal 2010. Then look at the revenue projections for 2011 and start planning lots and lots of bake sales…

Comment by Hey Voices Monday, Jun 21, 10 @ 8:15 pm

That lump sum distribution will only be available if the pension borrowing is approved. Even with the budget cuts, there’s not enough revenue coming in to pay The FY11 costs let alone the backlog in bills. GRF has only paid debt service, payroll and some school aid payments since mid-May.

Comment by LTSW Monday, Jun 21, 10 @ 8:20 pm