Latest Post | Last 10 Posts | Archives

Previous Post: The Miami connection

Next Post: Question of the day

Posted in:

* A new CNN/Opinion Research national poll taken Aug. 6-10 shows strong support for the federal state aid law…

Do you favor or oppose a bill in which the federal government would provide 26 billion dollars to

state governments to pay for Medicaid benefits and the salaries of public school teachers or other government workers?Favor 60%

Oppose 38%

No opinion 2%

I’m assuming, since this state is more liberal and more pro-Obama than average and since our budget situation is so bad, that the number is even higher here. Some are calling this a sop to the unions, but most people obviously see it for what it is: A relatively modest attempt to keep states and school districts from meltdowns.

* Bill Brady, however, thinks the bill was a mistake…

Republican candidate for governor Bill Brady said Thursday that Congress was wrong to pass an aid package that will give Illinois nearly $1 billion for teachers and health care.

Brady said the $26 billion legislation will increase the federal deficit and leave Illinois with a bigger budget hole to fill next year.

“These are just typical Washington games, digging a deeper hole,” Brady told reporters as he prepared to march in the Illinois State Fair Twilight Parade. “I don’t know where they’re going to get the money.”

But Brady also said the state should take the money to get its fair share.

…Adding… I forgot to post this story…

Gov. Pat Quinn tamped down speculation Thursday that lawmakers would have to return to the state Capitol this summer to deal with a new influx of federal funds.

Speaking to reporters at the launch of the Illinois State Fair parade, Quinn said he doubted a special legislative session would have to be called for the state to spend more than $400 million for education.

“I don’t think there’s a need for that,” Quinn said.

I followed up with the governor’s office this morning to ask how they would appropriate the money without a special session and received this e-mail…

We are reviewing the legislation to determine our options. We hope to make a final determination shortly.

OK, so the guv says no need for a special, but his office says it hasn’t been determined yet. Great.

* Mark Kirk voted against the state aid bill because he said it added to the deficit. He has also repeatedly attacked his US Senate opponent Alexi Giannoulias for opposing an extension of the Bush-era tax cuts. But the nonpartisan Joint Committee on Taxation has just released a new report showing that extending the cuts would add $36 billion to the deficit next year alone…

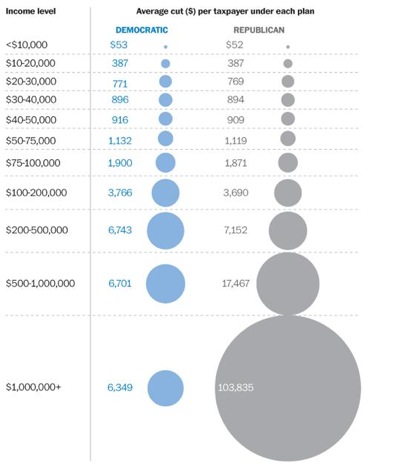

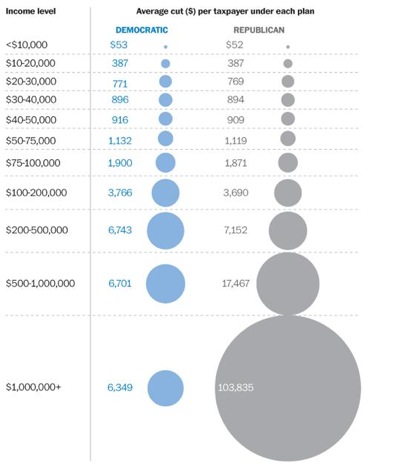

A Republican plan to extend tax cuts for the rich would add more than $36 billion to the federal deficit next year — and transfer the bulk of that cash into the pockets of the nation’s millionaires, according to a congressional analysis released Wednesday.

New data from the nonpartisan Joint Committee on Taxation show that households earning more than $1 million a year would reap nearly $31 billion in tax breaks under the GOP plan in 2011, for an average tax cut per household of about $100,000.

$36 billion added to the deficit in one year for the tax cut extension that Kirk supports, compared to $5 billion or so over ten years for a bill he opposed.

WBEZ asked Kirk about his support for extending those tax cuts, which greatly benefit the wealthy. Kirk gave a short answer about trying to avoid “class warfare.” Here’s a handy graphic which shows the difference between the plan Kirk supports and the president’s proposal. A larger version is here…

Asked by WBEZ where he’d cut the budget to pay for those tax breaks, Kirk refused to be pinned down.

* Other campaign stuff…

* ADDED: Breaking News: Auchi attorneys go after Illinois Review

* ADDED: Brady Can’t Tell Us Where He’ll Cut The Budget. But That’s Quinn’s Fault

* RNC passes resolution calling for repeal of Obamacare

* Adam Kinzinger Among GOP Young Guns Taking Aim at Democratic Seats

* New scramble afoot for temporary Joyce seat

* 10 Ways Anyone of Hispanic Heritage Could Be a Republican

* Political fund-raising down to an art form

posted by Rich Miller

Friday, Aug 13, 10 @ 12:21 pm

Sorry, comments are closed at this time.

Previous Post: The Miami connection

Next Post: Question of the day

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

In a high unemployment state like Illinois wages could be cut and/or government workers could be replaced with new workers making less money. Not that it’s going to happen. This is a union problem. We’ll be hearing , next year, about how Illinois needs another bailout from the federal government because how could Illinois survive without so many schools and 6 six salaries?

Comment by Luke Friday, Aug 13, 10 @ 12:28 pm

If they point out the huge differences in per student numbers between districts that are right next to even near each other I think the support numbers might dip.

For example it’s $508 per student in the East Aurora district and $41 per student in Yorkville.

You think the Yorkville parents are going to like that when they find out?

Comment by OneMan Friday, Aug 13, 10 @ 12:34 pm

What good are these type of polls that ask obvious questions without giving the full context of where the money is coming from. “Do you want to receive more money?” How about, “Knowing that the money is coming from X, do you support giving it to Y.”

Comment by whatever Friday, Aug 13, 10 @ 12:35 pm

OneMan, you’re asssuming the state uses GSA. That’s not been determined yet. But even if they do use the formula, that’s an institutional device long used to distribute school funds.

Comment by Rich Miller Friday, Aug 13, 10 @ 12:36 pm

===Kirk gave a short answer about trying to avoid “class warfare.”===

Lol. That is rich.

Comment by 47th Ward Friday, Aug 13, 10 @ 12:38 pm

Has there ever been a more “bought and paid for” politician than Mark Kirk? I’m sure there has but I just can’t think of one.

Comment by The Captain Friday, Aug 13, 10 @ 12:44 pm

The Hispanic reply to Harry Reid is a worthwhile read.

Comment by Responsa Friday, Aug 13, 10 @ 12:44 pm

I get that state’s need money and the public constantly hears states are struggling, hence the support for the aid.

But, it’s as if the public doesn’t get that it (the public) is the money source for federal money. The public sometimes acts as if federal money comes free or from source other than the U.S. taxpaying citizens. And if the money is borrowed then the U.S. taxpaying citizen is still on the hook for it.

I think Gov. Mitch Daniels spoke to this issue very well when he appeared on Fox New Sunday. Some states (e.g., Illinois—PAY ATTENTION PAT QUINN) are suffering because of their own fiscal mismanagement and waste/abuse over the years, which if not the factor was certainly a major contributing factor in state fiscal crisises across the land, why should tax payers bail them out? Why should someone in Indiana pay for Blago’s poor management and derelict fiscal behavior when he governed illinois?

prior to its 2010 fiscal year, california repeatedly asked the Obama administration for help and was rejected each time on the grounds that if we help 1 we would have to 47 others coming with hands out.

“but most people obviously see it for what it is: A relatively modest attempt to keep states and school districts from meltdowns.”

ok. but where and when will it stop? when governments can’t pay their pension obligations, then what will be the federal response? social security? isn’t that jacked up beyond repair too?

Comment by Will County Woman Friday, Aug 13, 10 @ 12:45 pm

First off - wordslinger is right.

But the nonpartisan Joint Committee on Taxation has just released a new report showing that extending the cuts would add $36 billion to the deficit next year alone…

Yeah! Of course it would! But extending the tax cuts are the only way to prevent a totally disasterous 2011! Have you seen the fiscal news over the summer? It is total panic! We need to see some stability. Allowing the tax laws over the past decade to expire is going to create even more instability. The panic we are seeing right now is partly due to folks who are expecting the tax laws to expire, and for their taxes to go through the roof. This is completely unnecessary!

This is so obvious that key Democrats in Washington are already floating trial balloons in order to try instilling some market calm.

$36 billion? We’ve been stimulating this dead horse economy with a whole lot more than that. The “Stimulus” spent that much on fraud alone.

Keep the tax laws where they are until some of the dust settles. $36 billion is going to stabilize this economy better this way, than the billions being spent on boondoggles within the supposed “Stimulus” package.

Nonpartisan? I’d say Nonsensical!

Comment by VanillaMan Friday, Aug 13, 10 @ 12:47 pm

Mark Kirk votes with Republicans’ Rubber-stamp Congress during Bush administration’s reckless spending spree, including budget-busting tax breaks for the richest of the rich AND trying to keep two wars out of the regular budget? Check.

Mark Kirk bleats “Deficit! Deficit, DEFICIT!” along with Repbublicans as soon as Barack Obama takes office? Check.

Mark Kirk supports typical Republican hypocritical argument that the richest of the rich deserve more tax breaks than the rest of us (and the deficit be damned)? Check.

Another vote for Alexi Giannoulias? Check.

Comment by Northsider Friday, Aug 13, 10 @ 12:51 pm

Well the state gave numbers to the Beacon News as if they were using the GSA.

So imagine challengers using those numbers in mailers saying they were provided by the state pointing out how Timmy is getting screwed over.

Until it is decided how they are going to decide who is going to get what that’s the numbers they are going to use in the mailings.

Just showing the difference under the current estimates between most suburban districts and the City of Chicago is going to be helpful in the collars to challengers.

You vs. Them is always a successful campaign theme.

Comment by OneMan Friday, Aug 13, 10 @ 12:52 pm

Spot on, Rich. The absolute best arguments for the Quinn and Giannoulias campaigns are Brady and Kirk.

Comment by Reality Check Friday, Aug 13, 10 @ 12:54 pm

Heck yeah, we’ll take the money.

Brady said he won’t deny Illinoisans their “fair share”.

Kirk says differently.

These aren’t surprises when we consider the offices they are running for. While this appears hypocritical and contradictory, we are talking about two different perspectives on two different people running for two different public offices in two different levels of government.

Voters are afraid. The market is unstable. Voters want to horde. They will take whatever they can. They want the money, but they do not want to spend the money.

Since 2008, voters have been focusing on paying off their debts and trying to stay ahead. So, they are borrowing when they can and hording what they can. They do not want to spend. Spending is way down.

So Brady is right, in that he wants the money.

Kirk is right, because we also want the spending to stop.

Yeah - it’s crazy out there!

Comment by VanillaMan Friday, Aug 13, 10 @ 12:56 pm

The state bailout is simply another kick of the can.

They will take the money and operate like business as usual for another year. The money will be gone, the debt will be higher, the automatic raises will kick in and the budget hole will be bigger.

What do you expect will happen in the next budget cycle?

Kirk is right! Allowing the tax cuts to expire will work like the massive tax increase it is and prolong the recession. Kirk is right again.

Illinois will remain mired in it’s own disaster until someone finds a way out. The can fell off the cliff. It can’t be kicked any further down the road.

Comment by Plutocrat03 Friday, Aug 13, 10 @ 1:12 pm

I’m trying to get an understanding on this. Kirk is “bought and paid for” because he voted No on the federal aid and he has also received campaign money from someone like the CoC, but if a Democrat votes Yes, that Democrat is not “bought and paid for” even though they received campaign cash from Unions directly affected by the aid?

Comment by Davey Boy Smithe Friday, Aug 13, 10 @ 1:16 pm

The problem, DBS, is that Kirk said he was leaning towards voting for it the day before.

Comment by Rich Miller Friday, Aug 13, 10 @ 1:19 pm

The bill Kirk voted against does not increase the federal deficit according to the Congressional Budget Office, the nonpartisan authority on this subject. Why does the media continue to allow Republicans to make stuff up? Why doesn’t anyone challenge these guys?

I mean, why even have a CBO if we aren’t going to accept its conclusions?

Comment by 47th Ward Friday, Aug 13, 10 @ 1:24 pm

well, rich, it’s not like he hasn’t fooled us before by telling us something that wasn’t true.

mark kirk is supremely loyal to his party’s leadership. it didn’t matter what he told *us,* it’s what they told him. this was a whipped vote and he couldn’t get permission to weasel out of it. that happens sometimes. but kirk has always done what the whip has told him to do (unless he got permission to oppose his leadership on a whipped vote). every. single. time.

mitch mcconnell and the southern conservative republican leadership in the senate will be grateful if illinois votes to send kirk to the senate. no muss, no fuss, a vote in the pocket of a very powerful man…

Comment by bored now Friday, Aug 13, 10 @ 1:30 pm

To br fair, the Gov said he didn’t initially *think* there would be a need for special session. And in the parade video said they were reviewing the legislation and would be speaking with school folks soon. That’s not completely unlike what his office said.

And Brady, as usual, said he was against the funding but gladly takes it. He’s also said he was against borrowing to balance the budget (after saying he was for it) and has now gone back to saying he was for it. And, he didn’t mind the federal stimulus when it helped his own business, kept him from paying taxes, and provided a huge transportation center in his hometown (which he was plenty happy to attend the groundbreaking and photo-op for).

Comment by ShadyBillBrady Friday, Aug 13, 10 @ 1:37 pm

The main point of this post is how schizo or two faced the republican (Kirk) argument is about reducing deficits. They practice class warfare repeatedly yet they don’t want to be called on it. Those who call them on it are the class warriors! What tricksters these republicans.

A very small percentage of those impacted by rescinding the tax cuts on those earning over $250,000 are small business owners. And many of these people are lawyers and doctors in private practices that would be classified as small businesses. So, there would not be much impact on hiring from rescinding this Bush tax cut.

Recession or not, it is the right thing to do. Should have been done years ago to pay for the freaking wars!

Comment by Vole Friday, Aug 13, 10 @ 1:37 pm

Mark Kirk isn’t loyal to anyone but Mark Kirk. He’s only thinking about how a particular vote might affect his next election.

Comment by Luke Friday, Aug 13, 10 @ 1:38 pm

VMan,

Either the budget deficit is a major issue or it isn’t.

I don’t think you are getting that the GOP wants its both ways.

When it comes to putting money in the pockets of unemployed people, the GOP is outraged over the impact on the deficit

But when it comes to putting money in the pockets of the rich, the GOP does not care about the deficit.

Either it matters or it doesn’t. The GOP doesn’t seem to know.

However, it sure seems to boil down to their view that money to rich people is good and money to poor people is bad.

Comment by Skeeter Friday, Aug 13, 10 @ 1:42 pm

Skeeter, you’re on to something there. Of course money to rich people is good. They create ALL the jobs and the money trickles down to the rest of us, right? Oh and they invest it all in American companies and not overseas, and they pay huge chunks of taxes (well, except when they take advantage of all the deductions, the estate tax and shelters like real estate to avoid paying taxes).

And regarding the bigger questions about GSA and school funding … if the folks in Yorkville or elsewhere get upset because of the way the formule works, maybe it will be a good thing. People need to start realizing that the current system that is so heavily reliant on property taxes is, in fact, not fair.

Comment by ShadyBillBrady Friday, Aug 13, 10 @ 1:51 pm

I don’t think you are getting that the GOP wants its both ways.

But I do. This is how voters want it, and the GOP is following them. The GOP is playing politics with this. It is an election year.

Comment by VanillaMan Friday, Aug 13, 10 @ 2:03 pm

I think Brady understands you can’t just keep borrowing your way out of debt, paying one credit card off with another. Brady would rather stop wasting $550 million on free bus rides for seniors many who can afford it themselves or Tax holidays for pencils and pay our bills. Brady’s not the governor right now so he has to respond to the questions as they are presented if the people of Illinois and their children our going to have to pay off the debt on their share of this $26 billion dollars of stimulus then they should get some of the money.

Comment by GOPnotincharge Friday, Aug 13, 10 @ 2:26 pm

Rich and all, a little different take on new stimulus money. It is excerpts from an editorial in the Las Vegas Review Journal.

No, the money must grow stretched education budgets, and as a condition of accepting the money, states must agree to maintain or increase education spending, as a percentage of total state revenues, next fiscal year.

It is, as Mississippi Gov. Haley Barbour said, a “federal government hijacking” of state budgets that will force lawmakers everywhere to raise taxes or slash spending elsewhere over the next year.

Next year, when the 2011 Legislature is in session and lawmakers are building the two-year budget, the voting public will be subjected to months of moaning that unless taxes are raised through the roof.

Congress provided nothing more than the means to grow government payrolls, expand union membership and boost union dues and donations to the Democratic Party. States will be coerced into hiring workers they can’t afford. The wheels will be greased for the tax increases that will allow public employees everywhere to keep their generous salaries and expensive medical and retirement benefits. The tough fiscal decisions states need to make on their own will be delayed again — until the next federal, strings-attached bailout.

This isn’t saving jobs. This isn’t permanent job creation. This is coercion. This is bribery. This is wrong.

Comment by Truth Seeker Friday, Aug 13, 10 @ 2:47 pm

V Man is once again spot on with his analysis…a 2-fer in one day…I digress. A tax cut doesn’t cost the government, only on paper, since the revenue growth far outweighs the “cut”. Keeping more of your own money should not be compared with spending more of your own money, e.g., government stimulus spending versus extending tax cuts…its not apples to apples.

Comment by Captain Illini Friday, Aug 13, 10 @ 2:54 pm

Intereting Captain.

So, if you give rich people money, it will cause revenue growth, but if you give poor people money it will not.

Let’s ponder that a moment. Hmmn. Who is more likely to spend money? A rich person, or a poor? Seems like there’s a pretty easy answer to that one.

Comment by Skeeter Friday, Aug 13, 10 @ 2:57 pm

@GOPnotinchatrge, you “think Brady understands you can’t just keep borrowing your way out of debt”. Really? That’s not what he has said. Well he has said it, and then he has said the opposite.

@TruthSeeker … say what?

@Capttain Illinois … “A tax cut doesn’t cost the government, only on paper, since the revenue growth far outweighs the “cut”.” Is that argument based on facts and figures or ideaology? And if you claim facts and figures, prove it.

Comment by ShadyBillBrady Friday, Aug 13, 10 @ 2:58 pm

===since the revenue growth far outweighs the “cut”===

LOL

Comment by Rich Miller Friday, Aug 13, 10 @ 3:03 pm

I’m not really arguing for any tax cuts. As a matter of fact, over the past decade, these “Bush tax cuts” were merely tax laws politically labeled as such.

We need market stability. So we need to keep the current tax laws in place until the market stabilizes. We can do this by stating that the tax laws enacted to expire at the end of this year, continue. This will help a lot of the chaos right now.

You can’t plan for building businesses in this climate. You can’t hire. You don’t know what your health care costs are. You only know that consumers are not consuming, except when replacing items such as cars.

We need to keep the tax laws in effect at least for another 12 months. Then we can take a look at the economic situation.

The Bush tax cuts helped shorten the 2000 recession by allowing businesses to see a tax window of ten years ahead. We need to do that again.

The prospect of raising taxes in January 2011 is a real market irritant at this time.

Comment by VanillaMan Friday, Aug 13, 10 @ 3:12 pm

VM is right. Not extending the “Bush tax cuts” is truly a tax increase and is the wrong move in a struggling economy. You don’t kick start an economy by taking money out, you have to put the money in.

Comment by A.B. Friday, Aug 13, 10 @ 3:16 pm

VMan,

You really think a lot of people are saying “I’m not going to try to make money, since next year the tax rates are going up”?

I’ve heard of the markets being irrational.

However, your post was the first to suggest that they may suffer from clinical depression.

Comment by Skeeter Friday, Aug 13, 10 @ 3:18 pm

===You don’t kick start an economy by taking money out, you have to put the money in. ===

Then pay for it.

Comment by Rich Miller Friday, Aug 13, 10 @ 3:18 pm

A.B, tax cuts take money out of the economy. So you are correct, we need to get rid of all these tax breaks and start putting money into the economy by having the govt pay its bills and und its infrastructure and other obligations.

Comment by Ghost Friday, Aug 13, 10 @ 3:19 pm

OK VM and other supply-siders/deficit hawks:

If the tax cut gets extended, what should be cut from next year’s budget to pay for it? Please be specific?

Comment by 47th Ward Friday, Aug 13, 10 @ 3:20 pm

===what should be cut from next year’s budget to pay for it===

And do that without damaging the current, fragile economy. If we’re all about immediacy and not long-term, then stick to the here and now, please.

Comment by Rich Miller Friday, Aug 13, 10 @ 3:22 pm

How many times do I need to point this out?

48th Ward,

The union bailout was balanced by cutting food stamps, about the most cynical move Democrats can make since EVERYBODY KNOWS food stamp programs, if fraud free, are a necessary role in our current environment. The Democrats will bring up restoring food stamp cuts, and anyone who stands up will get beaten about the head and face with a club.

The Democrats also used the typical shenanigans used by both Democrats and Republicans of promising that future Congresses will make cuts that save money. The CBO is forced to use those imaginary budget cuts in their analysis. The joke here is that one Congress cannot compel another Congress to do anything.

So, the CBO says budget neutral. The Democrats cut food stamps, and made promises they cannot make (future) cuts.

What the net effect is that they channeled current food stamp monies (from our poorest citizens) and future promises (that our children will pay back) they cannot fulfill, to current union employees.

Despicable, cynical election year politics by Obama and the Democrats. Did I mention Alexi thought this was a good idea?

Comment by Cincinnatus Friday, Aug 13, 10 @ 3:24 pm

since the revenue growth far outweighs the “cut”

That really isn’t a given under the current circumstances. We know it can happen, and it has happened, but things have changed significantly with some variables to make that a certainty.

Look, a number of experts thought that the path taken in 2009 was the right one and it has turned out to be a dead end. A real reason is due to the changes in the domestic and global markets since it was last tried.

I think letting people keep more of their own wages is the right thing to do, but they are taking those wages and paying off personal debt and saving it. They are paying down their debts and hording it. There is no increase demand for consumption as a consequence, even with government spending money it doesn’t have.

Businesses are doing the same thing. They are paying down debt and sitting on what is left. Profits are being made, but production is still down. Businesses are not expanding.

The candidate which best reflects the thinking voters have regarding today’s fiscal crisis is going to be the ones voted into office. Kirk is doing that, and so is Brady, even though their political stands appear counter-intuitive or hypocritical, because the voter’s stands are too.

Comment by VanillaMan Friday, Aug 13, 10 @ 3:25 pm

Man 47th Ward and others, you just don’t get it!

Extending the tax cuts won’t require anything to be cut from the budget. The revenue will far outweight the cuts. I know, I know … it hasn’t happened yet - but it will!

I mean, we may have to start getting the middle class to keep giving up more so that the rich can get richer. And we may have to decrease the minimum wage as well. But trust me, having lots of public-sector employees out of work and lots of private-sector employees making less than the current minimum wage will help the economy.

Just trust me.

Comment by ShadyBillBrady Friday, Aug 13, 10 @ 3:26 pm

“Despicable, cynical election year politics by Obama and the Democrats. Did I mention Alexi thought this was a good idea?”

So did Kirk, at least until his bosses in the GOP House leadership told him how to vote.

Oh, I forgot. Couldn’t have happened that way. He would never vote the way he’s told to vote. Commander Kirk is a real leader. /snark/

Comment by Skeeter Friday, Aug 13, 10 @ 3:27 pm

- 47th Ward - Friday, Aug 13, 10 @ 3:20 pm:

OK VM and other supply-siders/deficit hawks:

“If the tax cut gets extended, what should be cut from next year’s budget to pay for it? Please be specific?”

Farm subsidies and all subsidies to mass transit. Eliminate the post office. Eliminate the Department of Education and all related unfunded mandates to the states. How many billions you looking for again?

Comment by Cincinnatus Friday, Aug 13, 10 @ 3:28 pm

Banana Man: “You only know that consumers are not consuming”

The proposed tax plan will not impact about 96% of consumers. This is what the businesses will be scoping the next ten years.

What should be on their minds is the entire paradigm of consumerism. I think it has run its course for generating the kind of growth needed to sustain capitalism as we know it. And what really put a huge hurt on our economy was the financial sector’s excessive looting of our wealth instead of investing it in productive businesses. This entire tax discussion is a diversion in many ways.

Comment by Vole Friday, Aug 13, 10 @ 3:28 pm

- Skeeter - Friday, Aug 13, 10 @ 2:57 pm:

Intereting Captain.

“So, if you give rich people money, it will cause revenue growth, but if you give poor people money it will not.”

Ahem… nobody is proposing giving rich people money. It’s theirs already. The government is TAKING their money.

Comment by Cincinnatus Friday, Aug 13, 10 @ 3:30 pm

Cincinnatus, how about cuts that don’t damage our fragile economy in the near term? Cutting all mass transit and ag funding would surely do that.

Comment by Rich Miller Friday, Aug 13, 10 @ 3:33 pm

Ghost - Friday, Aug 13, 10 @ 3:19 pm:

“A.B, tax cuts take money out of the economy.”

Other way around, Ghost. Every dollar taken by the government is a dollar taken out of the private economy.

Let’s not even consider government overhead due to administration and inefficiency. And let’s not consider which dollar, public or private has the larger economic “multiplier.”

Comment by Cincinnatus Friday, Aug 13, 10 @ 3:34 pm

The longer this Great Recession continues, the longer this horrific job unemployment continues, the longer we do not see 4% quarterly economic growth, the worse this entire situation gets because we are running against a clock here.

When the Stimulus was passed, it was our last shot. It had to work. It had to do something. We had to see some improvement somewhere enough to begin paying it back. It has been too long for this kind of result, or lack thereof. So, we are digging a hole quicker and deeper than ever.

Will we need to raise revenue? Yes! How can we do that when everyone with a buck is sitting on it? Take it from them as taxes? Perhaps. That TARP, that Stimulus and that Obamacare has to be paid somehow. Their clocks started running the instant the President’s signature was dry. Worse, with Obamacare, we will have to pay taxes for four years for NOTHING until we see even the first dollar benefit.

We really can’t put this off. The bills are due.

So, that $36 billion estimated to cost keeping the tax laws currently in place, in place at least another year - may be worth it, just to calm market and business jitters enough for folks to open their wallets again. Consider what we have spent, that isn’t very much.

Comment by VanillaMan Friday, Aug 13, 10 @ 3:34 pm

===How many times do I need to point this out?===

You keep saying, in effect, that, yes this is deficit neutral, but that some future act may make it cost more than the CBO score today suggests. I’ve heard you.

Get back to me when that future act occurs and I’ll join you in criticizing it. Until then, just agree that the $26B bill is paid for and that Kirk, Brady, Boehner et al are living in an alternate reality when they say it is not.

Comment by 47th Ward Friday, Aug 13, 10 @ 3:35 pm

The proposed tax plan will not impact about 96% of consumers. This is what the businesses will be scoping the next ten years.

Oh please. Why do you still write that? We all know that business taxes get passed right along to consumers.

Insurance companies are already raising their costs due to the unknown costs of Obamacare three years from now. Consumers are already paying the higher taxes in the form of higher insurance premiums.

What are you going to do? Start demanding that higher taxes on businesses be paid only out of the profits made by businesses currently? If you could actually do that, (an awful idea), it would just bankrupt the businesses and throw more folks out of work. Who do you think has all this extra money? Santa? Scrooge McDuck? Cruella DeVil?

Even if you could force dead people to pay the taxes from their estates, all it does is just short more money out from the market, into government pyramid schemes, hurting everyone that way.

Comment by VanillaMan Friday, Aug 13, 10 @ 3:44 pm

Rich,

Short of dissecting the budget line item by line item, how would you have answered 47th Ward’s question which was obviously meant to inflame?

I would also question how bad eliminating AMTRAK funding would be other than to the elites in the Washington-Boston corridor that make up a vast majority of the travellers.

Agriculture cuts. We are hitting consumers at least four times taxing farm products. Once with the subsidy to grow. Once at the end use. Once with ethanol subsidies. Once at the gas pump. There are probably more instances of these types of taxes/subsidies in the supply chain, bit those are off the top of my head.

Education. Why is this a Federal role to begin with. How can a weenie in Washington have a clue what’s going on in some large city like Chicago, one of Chicago’s suburbs, or a downstate school district. Why does the Department of Education give the states unfunded mandates. I see very little use for the Feds here. If we are going to redistribute wealth, which I see as the primary function of the Feds, let’s do it locally at least. Geesh.

Let’s for a moment imagine that we reigned in spending and kept taxes where they are. There would be an explosion in the private sector. Bazillions of new jobs. This isn’t even a supply side argument (which doesn’t hold up in my mind once you get taxes somewhere in the “correct” range).

Comment by Cincinnatus Friday, Aug 13, 10 @ 3:46 pm

Cincinnatus, you and VMan have been some of the loudest voices on here about the perils of the deficit and the perils of the current economy. So, pay for your tax cut without imperiling the short-term economy, is all I’m saying. You haven’t yet, by the way.

Comment by Rich Miller Friday, Aug 13, 10 @ 3:48 pm

47th,

Okay. Food Stamp money was taken from the poor and given to the public employee unions. I hear ya.

Comment by Cincinnatus Friday, Aug 13, 10 @ 3:48 pm

47th,

“but that some future act may make it cost more than the CBO score today”

I just reread this statement and should have included it above.

It’s way more cynical that you state, 47th. It’s not a future Congress taking action that makes the price go up. It is that a current Congress is making a guarantee that a future Congress WILL do something. No present Congress can bind a future Congress to an action. I am saying the following without snark: Can you see the difference between what you said and what I said? It’s a subtle difference in language, but a huge consequence is attached.

The track record on this accounting method is close to 100% inaccurate. I can’t find the source that I read about the actual number, but it was way north of 95%

Comment by Cincinnatus Friday, Aug 13, 10 @ 3:57 pm

Rich,

I guess simply stopping spending. Do not spend the remaining unspent Stimulus.

Do not use TARP anymore. tt was originally intended to free capital from the large banks, and those large banks have almost repaid the loans. Since then TARP has bought controlling interest in GM, allowed the unions to take controlling interest in Chrysler and acted as a slush fund to bail out small banks that would have and should have gone belly up.

These monies alone are several hundred billions of dollars.

Comment by Cincinnatus Friday, Aug 13, 10 @ 4:04 pm

It wasn’t just food stamp money Cinci,

We also took money from US companies who ship jobs overseas and gave it to public employee unions too.

Thank God we can’t off-shore teachers, cops and firefighters.

Comment by 47th Ward Friday, Aug 13, 10 @ 4:04 pm

So, pay for your tax cut without imperiling the short-term economy, is all I’m saying.

I can’t! What I am saying is the short-term economy is already in peril and pouring more pork gravy over it isn’t going to make this $h!* sandwich any tastier. So it is time to hold our noses and get it done! The longer we wait, the more stale it gets.

Hey, Paul Green told his class a looong time ago that the way the economy was headed, if you think it stunk before - it is going to get a lot worse.

The past decade was nothing more than putting off the inevitable. Here in Illinois, we were told this was going to happen before Blagojevich was elected. After 9/11 - the entire economy was propped up, hoping for salvation. We cannot get a free ride when the taxi is out of gas and you sold the tires to foreign investors.

I see no magic bullets and no magic beans. Obama got a dying economy and started applying leeches to it. Right now I think the economy is still alive, but I don’t see any more places to stick a leech.

Comment by VanillaMan Friday, Aug 13, 10 @ 4:15 pm

Just sayin’

Comment by VanillaMan Friday, Aug 13, 10 @ 4:16 pm

VanMan:

“Oh please. Why do you still write that? We all know that business taxes get passed right along to consumers.”

The original subject was rescinding the personal income tax rate cut on the wealthy, or about 3% of the taxpaying population. And among this population, a very small percentage are small business owners. You are making this out to be the fall of the Roman Empire.

For the 96% of taxpayers who will be paying the same federal income tax rate please consider that probably one of the least appreciated factors that will hinder our future capacity for growth and recovery are oil price shocks: http://motherjones.com/kevin-drum/2010/08/chart-day-oil-shocks

The long emergency lies ahead. This tax issue is just small potatoes in comparison to the gauntlet we are entering.

Comment by Anonymous Friday, Aug 13, 10 @ 4:48 pm

Brady can’t figure out where the state is spending money? He’s going to “sanction” an audit by the auditor general, a constitutional officer who does audits all-day long already?

Based on those statements, Brady either does not have the brains to perform the duties of the office he is running for, or he is an incredibly cynical, um, prevaricator. That’s a nicer sounding word.

Comment by wordslinger Saturday, Aug 14, 10 @ 11:16 am