Latest Post | Last 10 Posts | Archives

Previous Post: Governor Flatline

Next Post: And here comes the blowback

Posted in:

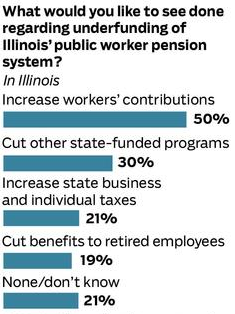

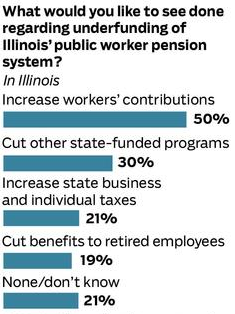

* Keep in mind when reading this Tribune poll result that respondents were allowed to choose more than one response…

* According to the Tribune, 65 percent of collar county voters and almost 60 percent of Republicans favor the “workers pay more” option. More…

[On cutting benefits for current retirees] Opinion was divided along income levels, with 13 percent of those earning less than $50,000 a year supporting benefit cuts for retirees, and 28 percent of voters earning more than $100,000 a year favoring it. […]

30 percent of voters would support cutting other state programs to better fund pensions. Opinion is heavily divided along partisan lines, with just 17 percent of Democrats supporting that idea compared with 50 percent of Republicans.

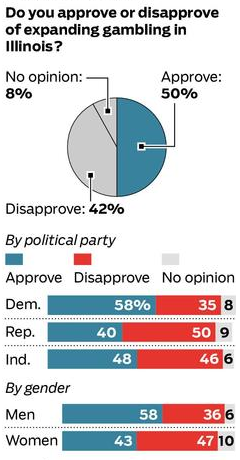

* In other polling news, the Tribune’s question on gaming expansion could’ve been fleshed out better…

Do you approve or disapprove of expanding gaming in Illinois?

The debate right now isn’t so much whether to expand gaming, it’s about how to do it. But here are the results…

Discuss.

posted by Rich Miller

Friday, Feb 10, 12 @ 9:44 am

Sorry, comments are closed at this time.

Previous Post: Governor Flatline

Next Post: And here comes the blowback

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

===”…regarding the underfunding of the Illinois Worker Pension System.===

I wonder what the percentages would have been had the Trib asked the question without obfuscating who caused the underfunding (the state), and also stating that the employees have always made their required contributions?

Comment by PublicServant Friday, Feb 10, 12 @ 10:04 am

Was there a question asking respondents if they knew how much state employees currently pay into the system already? Or if they know what the state hasn’t paid, causing this problem? Nice polling depth, Trib.

Comment by Burnham Wannabe Friday, Feb 10, 12 @ 10:12 am

We think they should ask if the expansion benefits Mr. or the Pritzkers

Comment by circular firing squad Friday, Feb 10, 12 @ 10:17 am

The promised pensions are actuarially unsustainable. Raise the contribution level to a proper amount and and figure out how to apportion that amount between the employer and worker.

Otherwise you are taking away resources from the needy.

Comment by Plutocrat03 Friday, Feb 10, 12 @ 10:21 am

Negotiate (at least for those represented by unions) a reasonable solution that is balanced, progressive and phased-in taking into consideration long-term vested workers. Upper (6-figure salaried) managers, especially the “golden parachuters”, can and should pay more. And perhaps, like Social Security, payments would be discounted for those early retirees with additional earned income above a certain limit.

Comment by ANAL Friday, Feb 10, 12 @ 10:22 am

Interesting breakdown on the gambling graphic. Not sure why conservatives are so against gambling. Happens all the time. It’s a perfect way to raise funds, make people enjoy giving their money away, and could help balance the budget if the state ran games. NFL lines would probably help the state, and federal, government tremendously. Vig would probably be less too.

Comment by beserkr29 Friday, Feb 10, 12 @ 10:32 am

===”The promised pensions are actuarially unsustainable.”===

You want to provide some backup for that statement Pluto? Or did you get your “facts” from your home planet.

Comment by PublicServant Friday, Feb 10, 12 @ 10:40 am

ANAL @ 10:22,

Since they are based on years of service, SERS pension payments are already discounted for early retirees … you only get paid for the years you worked. Work 30 years, you get one amount … work 45 years, you get a bigger amount (subject to minimum service time of 8 years and age).

And just like Social Security, the amount is also based on what you earned. The one difference is how your earning are calculated; SS is tilted a bit in favor of low earners because it was conceived much as a social welfare program than as a retirement plan (you get about 80% of the maximum benefit for the first 2x% of contributions plus it caps the max benefit for high earners) whereas the State formula is just a straight line based on the amount you earned, with an equal benefit for each additional dollar earned.

Comment by Retired Non-Union Guy Friday, Feb 10, 12 @ 10:45 am

Plutocrat03 @ 10:21,

the IMRF example says there were / are sustainable HAD the payments been made when they should have been …

Comment by Retired Non-Union Guy Friday, Feb 10, 12 @ 10:47 am

It makes more fiscal sense to cut the state employees’ wages than to make them pay a bigger percentage into the pension fund. If, instead of making an employee contribute an extra $1,000, you cut his pay by $1,000 and put the savings into the pension fund, the fund gets the same amount of money AND the employee’s pension will be reduced, lowering the funding requirement. Also, if the employee is subject to Social Security, the state and the employee still have to pay Social Security tax on any wages he has to contribute to the pension fund, but cutting his wages eliminates the tax. So a $1,000 pay cut only reduces his pay by about $930, and saves the state about $70, too. This is why it was smart of the state to pick up the employees’ share of pension contributions 20 years ago in lieu of pay raises (a deal Blago revoked). This also shows why any talk about whether employees contribute “enough” to their pensions is nonsense. The real issue is what their total pay package is worth.

Comment by anonymice Friday, Feb 10, 12 @ 10:48 am

The reality is that if we expect employees to pay more for their retirement benefits, they (and their unions) are going to expect offsetting salary increases to pay for those benefits. I think it is foolish to think it will be otherwise. In the end, we save nothing.

Comment by Kerfuffle Friday, Feb 10, 12 @ 11:12 am

@Anonymice - First, if you pay people marginally less they marginally quit. I know it goes against republican dogma, but, just as the private sector pays a reasonable enough wage to keep good employees satisfied, the state wants to retain their good employees too. So, cutting wages all willy-nilly is definitely doesn’t make fiscal sense simply because of the loss of institutional knowledge and the time needed to train a new replacement.

As for “The real issue is what their total pay package is worth.” Several studies show that public sector workers total compensation, when compared to private sector workers whose positions require comparable levels of education, is less than those in the private sector. And that disparity increases the higher you move up the educational ladder.

Comment by PublicServant Friday, Feb 10, 12 @ 11:17 am

Something absolutely has to be done, but changing the rules of the game on retirees AFTER they retire is really wrong on the part of the state. Working people have the ability to go out and make extra cash either waiting tables, cutting grass, delivering pizzas or whatever to make up a difference if necessary. That’s not necessarily the case with retirees - especially when all or part of their retirement limits any additional income they can receive. The state made a deal - whether you agree it was a bad deal or not - and the state has to live up to that deal. What the state does with its employees beginning “tomorrow” is debatable, but cutting benefits to those already retired is just wrong to this 40-something not employed by government.

Comment by Amuzing Myself Friday, Feb 10, 12 @ 11:17 am

I refuse to pay more than the 8% of my salary, period.

And it ticks me off that people who are only paying 4.1% of their salary towards social security are telling me to pay more.

Comment by Stuff happens Friday, Feb 10, 12 @ 11:17 am

=== Plutocrat03 @ 10:21 am === figure out how to apportion that amount between the employer and worker.—

I think that was done, only no one figured out how to make the employer pay their portion. That is why we are where we are. Now the Trib wants the employees to pick up part of the employer share also. But per their SOP they don’t give out the information that would provide a fair assessment of the situation. They reveal only what makes their position look right.

Comment by Irish Friday, Feb 10, 12 @ 11:30 am

Stuff,

The problem is that their are many different pension rules. Some workers pay over 9% some pay 8% all the way down to some paying none. Obviously 8-9% of you salary seems reasonable and fair but it is hard to say those paying less than that shouldn’t have to pay more. Anyone paying 0% should of realized that if a deal looks to good to be true it probably is.

Comment by Fed up Friday, Feb 10, 12 @ 11:34 am

anonymice @ 10:48 said: (a deal Blago revoked)

It actually was revoked years before Blago during one of the annual budget crises. As a non-union person, I wasn’t given a 4% raise to offset it (2% immediately + 2% six months later) like the union people were. And yeah, I’m still bitter over it because that not only cut my salary by 4% plus the compounding over the years, it resulted in my receiving a lower pension (due to the lower salary)

Comment by Retired Non-Union Guy Friday, Feb 10, 12 @ 11:43 am

For years there’s been rhetoric about Social Security going broke (longer than our pensions issue here). Why is it not as fashionable a suggestion that SS contributions increase for the general public the same way? Ty?

Comment by Money Spent Elsewhere Friday, Feb 10, 12 @ 11:48 am

Irish hit on something there. If this discussion was about a multi-billion-dollar corporation that went decades without paying an agreed-upon amount into a retirement system, then asked current employees and retirees to make up the difference, the outcry from the media and from the left would be deafening. When it’s government, it’s no less onerous and outrageous, but it garners only shrugs and polling disingenuously pitting taxpayers against the workers (who are incidentally also taxpayers).

Comment by Amuzing Myself Friday, Feb 10, 12 @ 11:49 am

Anonymice, do you really want to tell prison guards, state police, prosecutors, and all the rest that they are going to have their salaries cut so they will receive lower pensions, too? I think there are lots of possible consequences for that, none of them good.

Comment by Aldyth Friday, Feb 10, 12 @ 11:54 am

==And it ticks me off that people who are only paying 4.1% of their salary towards social security are telling me to pay more.==

For what it’s worth, your benefit is probably more than twice what social security benefits are.

Don’t want to pay more than they pay in the private sector? Take a benefit cut. But don’t complain that you have to pay more for much higher benefits.

Comment by Jimbo Friday, Feb 10, 12 @ 12:01 pm

As an employee of a state university, I have paid into the retirement plan every month, for years. Because of this, I pay nothing to Social Security. Some years ago, Illinois politicians, elected by the people of Illinois, decided to raid the pension funds, rather than increase taxes or cuts programs. Now they want me to pay more? Something stinks to high heaven here. Mostly because, it seems, no one wants to admit what acutally happened. If the state politicians had done what they were supposed to do, this wouldn’t be an issue. What gives?

Comment by SURS Friday, Feb 10, 12 @ 12:03 pm

To PublicServant and Aldyth — making the employees contribute more to the pension fund reduces their take-home pay, too. I was just pointing out that the state could be fiscally better off by a straightforward cut in pay by the same amount as any proposed additional contribution. That also means the state could use a cut in pay that is smaller than the additional contribution it would have to take from the employees’ pay to achieve the same fiscal result. But none of this can even be considered when the issue is phrased as “state employees don’t contribute (enough) to their pensions.”

Comment by anonymice Friday, Feb 10, 12 @ 12:21 pm

State Pensions (Contractually and Constitutionally Deferred Compensation) are not comparable to the federal social security trust fund. The former is an employer benefit designed to increase employee longevity, the latter is non-employer-based, not meant to be deferred compensation, and was design as a minimal financial safety-net for elderly Americans via a social contract.

Good luck changing either.

Comment by PublicServant Friday, Feb 10, 12 @ 12:44 pm

As a state employee of over 20 years I have been dutifully paying into SERS for that period of time. I agreed to forgo a raise back in the ’90s with the raise to go to my pension. While I am willing to pony up some more in order to help the system get on better financial footing, I am NOT confident that my partner (GA/Gov, etc) will hold up their end of the bargain. Since we elect these folk to represent us, and then beg them for more programs that we don’t want to pay higher taxes for, the temptation to borrow from MY pension plan to pay for those programs is overwhelming and is fiscally irresponsible on an astronomical scale. If there can be a way to prevent that from happening it would help out, no?

Comment by dupage dan Friday, Feb 10, 12 @ 12:44 pm

dd-Exactly why I’m not going to roll over as easy as you.

Comment by PublicServant Friday, Feb 10, 12 @ 12:49 pm

PS, only trying to sound reasonable. Besides, ain’t my call whether or not I pay more into SERS. I’m just a guy in a small office with a telephone. Bottom of the heap.

Comment by dupage dan Friday, Feb 10, 12 @ 1:08 pm

Since you can’t obligate future legislative sessions to make specific payments, you have to figure out another way to get them to actually pay it.

Off the top of my head, only one approach comes to mind. General Obligation bonds do obligate the State to repay the bonds in the future. Funding pensions should qualify since GO bonds have been used in the past to not only retire a portion of the debt but also to make the then current fiscal year’s payment to the pension funds.

The State should issue general obligation bonds in the amount needed to immediately fund the pensions at the (pick one, 80%, 90%, 100%) level.

If the State can make the bond payments, the annual payment to stay current will be relatively painless.

I have no idea if the math works; it probably doesn’t or they would have already taken this action. But this is what we should be demanding the legislature do …

Comment by Retired Non-Union Guy Friday, Feb 10, 12 @ 1:24 pm

Unique idea, Retired. Only makes sure it’ll never fly. Like it, tho.

Comment by dupage dan Friday, Feb 10, 12 @ 2:01 pm

Nothing like including options in your poll that are impossible or illegal.

It’s like asking voters whether they’d like gov’t to balance the budget by increasing taxes, cutting services, or “eliminating waste.”

Might as well have thrown “Plant money trees” in there.

On the other hand:

Anybody else notice that “closing corporate loopholes” wasn’t on the table?

Neither was “taxing millionaires” or “increasing [insert sin tax]”.

In every poll I’ve seen about revenue, those options are included.

They also did a nice job of asking the corporate tax and individual tax question as a pair.

Not a well-worded question at all.

On the bright side, if you’re the unions, you’ve got to be jumping for joy.

You know that raising employee contributions can’t be done unilaterally. Unconstitutional.

And you can tell lawmakers “Even the Tribune poll says 80% of voters don’t want you to touch the benefits of current retirees.”

Comment by Yellow Dog Democrat Friday, Feb 10, 12 @ 2:23 pm

===You know that raising employee contributions can’t be done unilaterally. Unconstitutional.===

Check the Fax from earlier this week.

Comment by Rich Miller Friday, Feb 10, 12 @ 2:27 pm

@Jimbo:

“Don’t want to pay more than they pay in the private sector? Take a benefit cut. But don’t complain that you have to pay more for much higher benefits.”

Jimbo, I’m perfectly happy already paying nearly 2x what other people pay into social security. But asking me to pay beyond that is ridiculous. I’ve paid my dues, taken furlough days, and skipped raises for many years.

Truth be told, I would have preferred to pay into social security. The state told me that wasn’t an option. Now they’re floating insane numbers like 16% of my salary, and they’ll only contribute 4.4% on top of that.

When they raise our contributions, we’ll see a mass exodus — greater than we’ve seen in the past few years. And in some circles (i.e. universities) you’re going to see a lot of salary increases to compensate, so the state’s going to pay one way or another.

Comment by Stuff happens Friday, Feb 10, 12 @ 2:33 pm

I didn’t have time to add this, but my salary is already 70% below industry standards. I accepted it because the work was interesting and I could do some good, but also because the pension had value.

If Illinois can’t hold up its end of the bargain I’m off to the private sector, rolling my pension over into a 401k (which the state has to pay out now instead of defer).

This is where having a 90% funded pension comes into play — if you’re forcing everyone to leave, then it *has* to be at 90% or greater.

Comment by Stuff happens Friday, Feb 10, 12 @ 2:54 pm

“Might as well have thrown “Plant money trees” in there.”

YDD-

I generally disagree with everything you post, but this was pretty funny. Thanks for the chuckle.

Comment by Anonymous Friday, Feb 10, 12 @ 3:09 pm

===Check the fax from earlier this week===

Come on Rich…Just this once.

Comment by PublicServant Friday, Feb 10, 12 @ 4:08 pm