Latest Post | Last 10 Posts | Archives

Previous Post: Timing is everything

Next Post: It’s all one thing

Posted in:

* The Daily Herald looks at what the compounding of annual pension cost of living increases has done to the system…

Retired Illinois teachers received a collective $900 million bump above their original pension benefits last year.

These “cost-of-living adjustments” amounted to 21.3 percent of the $4.2 billion total retirement benefits paid to 101,288 former educators from around the state, officials from the Illinois Teachers’ Retirement System reported. That’s up from 18 percent of the total teacher pension payout just five years ago. […]

Simply compounding a 3 percent increase to the current average teacher pension of $46,452 over a 25-year period produces an additional $114,238 over that span, compared to the same 3 percent increase if it had not been compounded. In year 25, the teacher’s compounded pension would be $94,427. Not compounded, the pension would amount to $79,897.

* But not everybody is convinced that getting rid of compounding COLAs is the right answer…

West Chicago Republican state Rep. Mike Fortner said he’d prefer to see an increase to employee contributions rather than risk a protracted legal battle over changing employee retirement benefits. He said increasing teacher retirement contributions by 1 percent would essentially pay for the compounded pension bump perk.

“They can keep the compounded plan as long as they’re paying for it,” Fortner said.

If Fortner is right, why wasn’t that route taken instead? The teachers’ unions reportedly offered to kick in two more percentage points into the system. We need more data. Fast.

*** UPDATE 1 *** Rep. Lisa Dugan just called to say that she asked that very question and was told in no uncertain terms that the additional kick-in by employees wouldn’t produce nearly enough cash to solve the compounding problem.

*** UPDATE 2 *** From AFSCME…

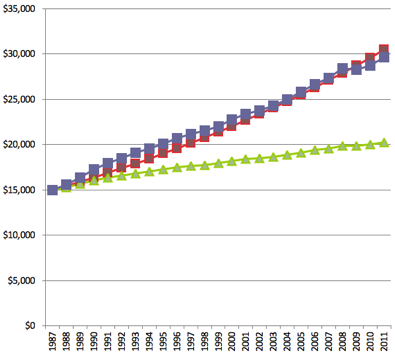

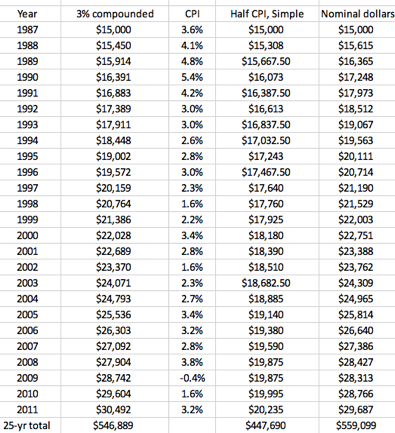

This chart shows how the 3% compounded COLA is critical to protecting retirees from inflation. Imagining someone who retired with a $15,000 pension in 1987, the chart shows the amount of their pension in each of the 25 subsequent years under two scenarios: Red is what the retiree has earned under current law, with a 3% annual compounded COLA; green is what they would have earned if the Tier 2 COLA provision had been in place (half of CPI capped at 3%, simple). The purple line shows the amount the retiree would have needed in each year for the pension to keep pace with the actual rate of inflation.

Under current law, the 1987 retiree is today an aggregate $12,000 behind, or 2% less than, the amount required to keep pace with CPI for the period. The benefit has exceeded the real value of the base plus inflation in just 3 of the 25 years. Had the Tier 2 COLA been in effect, the retiree would have lost $111,000 or 20% of the value of the base plus inflation.

Chart…

More info…

posted by Rich Miller

Wednesday, Jun 6, 12 @ 10:08 am

Sorry, comments are closed at this time.

Previous Post: Timing is everything

Next Post: It’s all one thing

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

I’m not sure Fortner is right…though, the guy is pretty good with numbers. I kept hearing all spring from people involved with the pension working group that the increased contributions just didn’t move the needle enough and that the only way to address the long-term costs was to attack the COLA.

It’s worth pointing out that the COLA was not “compounded” until 1989. That — and the skipped payments — put us in the pension death spiral we are in right now.

Rich is right about the need for more data. We’re just guessing until we see some actual math.

Comment by Franklin Wednesday, Jun 6, 12 @ 10:24 am

The cost of living (ie inflation) has increased 3 percent a year over the past 25 years.

Inflation, of course, is compounded.

The COLA is not “additional” — it helps the pension retain the same buying power.

Someone retiring on a $15,000 annual pension 25 years ago would have collected $546,889 over that span. If they instead received a COLA equal to CPI, they would have collected $559,099. So even with the 3% compounded COLA, over the past 25 years retirees have lost about 2% of the value of their pension.

Comment by Reality Check Wednesday, Jun 6, 12 @ 10:30 am

SURS covered employees have been paying something to support the COLA. (I think it is 1/2 of 1% of salary). Don’t know how the math works out. The 3% seems arbitrary–it would not be nearly enough in a period of high inflation, like the 1970s. Occasionally, like now, it is a bit high. Tax revenues, salaries and retirement income however need to be linked to inflation in some manner. For social security, it is automatic and does not take a separate appropriation.

Comment by red eft Wednesday, Jun 6, 12 @ 10:31 am

A solution that combines slightly reducing the compounding with increasing the contribution instead of losing health care might be sellable. We know that additonal contributions wouldn’t be enough alone, but for people who aren’t medicare or social security elegible and about to retire right now, taking the option to keep the health care isn’t really a choice.

Comment by are you serious? Wednesday, Jun 6, 12 @ 10:36 am

Similarly, to Nekritz’s claim in the piece that “If you retired in 1995 with a $65,000 pension, you’d be getting more than $100,000 today.”

The value of $65,000 in 1995 is equal to $96,000 today. So she’s actually saying the COLA has enabled the pension benefit to retain its value, protected from inflation. As if that’s a bad thing.

(Side note - almost retiring in 1995 had a $65,000 pension. The average is $32,000 today and was much lower then. Typical example of using outrageously high numbers to misinform and induce panic.)

Comment by Reality Check Wednesday, Jun 6, 12 @ 10:38 am

The CPI, or average cost of living, also compounds every year. There’s nothing wrong with the concept, provided you use the correct rates. It also doesn’t have to be unaffordable, provided you have properly kept up with the pension contributions.

One political issue is whether staying even with the cost of living is what retirees should expect from their guaranteed benefit pensions, given that it doesn’t occur any more for most private sector retirees.

We also know that the required pension contributions were not fully made, and that the harder financial problem for both the state and the retirees is rising healthcare costs. Getting more individual contributions to support full COLAs doesn’t solve the bigger problems.

p.s. Good article by the Daily Herald.

Comment by mark walker Wednesday, Jun 6, 12 @ 10:42 am

Per the TRS annual report for for FY11, page 96, the total salary for all TRS members was $8.844 billion. If members contributed an addition 1%, that would result in the system receiving $88 million more. Then the state could likely contribute $88 million less. Not much of a dent when I believe the payment to TRS was around $3 billion.

Comment by Just a Guy Wednesday, Jun 6, 12 @ 10:48 am

===We need more data. Fast.===

This gets back to your post from the other day. You would think everyone of the groups and legislative caucuses would have detailed spreadsheets and answers to every thinkable scenario by now. If we pick option A it costs X or saves Y. If we pick option B it costs 2X and saves 1/2 Y. Etc.

Comment by Been There Wednesday, Jun 6, 12 @ 10:48 am

Since the pursuit of unconstitutional solutions hasn’t produced any revenue so far, and it is unlikely to even if it is passed, perhaps legislators should resign themselves to failure. Alternatively, the could move slowly toward a workable solution. Perhaps employee contributions combined with CPI (not 1/2, not max 3%, but actual CPI) increases would help reduce costs during low inflation years and also help retirees when the economy is better and rates of inflation are higher. Since, historically, CPI is around 3%, this might not be considered a diminishment.

Comment by AC Wednesday, Jun 6, 12 @ 10:59 am

=== The CPI, or average cost of living, also compounds every year. ===

Interesting point. The problem is not necessarily the compounding. The problem is the fiscal mismanagement. That adds another layer of context to the Daily Herald piece.

Now if we can just freeze payments by eliminating COLA all together, our pension problem will fix itself as a result of inflation and higher contributions in about 100 years or so. No more cuts! Problem solved!

Wait, you mean it doesn’t work like that? Back to the drawing board.

Comment by Freeman Wednesday, Jun 6, 12 @ 11:02 am

As a retired teacher, we were told we were told, we could buy health insurance with state from the state, and would receive a 3% raise yearly upon reaching the age of 61. This was what we were promissed upon retirement. If we knew that the state was not going to honor their promise, many of us would not have retired. This is why these cuts will not hold up, for retired teachers, under a court challenge! The state breaking what was promissed in writing.

Comment by Billy Wednesday, Jun 6, 12 @ 11:02 am

@red eft is correct SURS employees pay extra to cover the COLA. The universities even put on the table the option to increase by 3% the pay in the system (increasing an active employees contribution from 8.5% to 11.5%)and use this increase to cover COLAs for the retirees. Like Rich said data is needed, but we also need someone to listen and then negotiate. Somehow I have a feeling that the legislators are deciding pension reform more based on what it means to them and their pensions vs. the rest of the employees of the state.

Comment by illilnifan Wednesday, Jun 6, 12 @ 11:22 am

Wont the ~ $88 million in additional contributions also compound year over year? Compounding works both ways…

Comment by Ghost Wednesday, Jun 6, 12 @ 11:26 am

www.Openpensions.org estimates that the 3% compounding COLA accounts for 30% of the overall lifetime value of a retiree’s pension specifically for Cook County. Reducing the 3% compounding COLA to a 3% simple or half of the CPI would reduce overall pension fund liabilities by $1.61 billion for the County Fund. For current employees only the COLA reduction reduces fund liabilities by $793.5 million.

Comment by Sara T. Wednesday, Jun 6, 12 @ 11:27 am

The cost of any retirement plan can be measured in terms of the fraction of salary one needs to put aside each month in order to have enough saved to get the desired benefit. That fraction is called the normal cost. During discussions over SB 512 in 2011 the normal cost for teachers in TRS was calculated to be between 19 and 20% of salary to pay for the current benefits.

If the state were a private employer they would typically contribute 6.2% for social security and at least 3% for a 401k plan. That is a 9.2% total employer contribution. Add that to the 9.4% of salary teachers currently pay and the total is 18.6%. That leaves about 1% remaining to equal the normal cost of the teachers’ pension plan.

In HB5754 I proposed splitting the normal cost 50-50 but with a recalculation every three years so both the employees and state share the risk of changes due to markets and other factors. In that bill I also proposed capping pensionable salaries for high wage earners to eliminate the incentive for end of career salary boosts designed to add to the pension.

Comment by State Rep Mike Fortner Wednesday, Jun 6, 12 @ 11:34 am

@ state rep fortner interesting info about TRS and the amount of contribution needed. For me this reinforces the need to negotiate each part of the pension issue separately since the normal cost would definitely be different for SERS. Why not try to do this reform in part. Get SERS done and get that system moving toward stability. Then look at GARS, TRS, SURS and JRS individually as well. This would allow the changes to be better understood and more transparent. The money is not pooled, so why not make the changes in stages. The TRS issue affects so many other costs including property taxes and what the state is supposed to provide in funding to education, so that is most likely one of the hardest pension issues to address.

Comment by illilnifan Wednesday, Jun 6, 12 @ 11:49 am

The reason an increase in employee contribution isn’t enough to “move the needle” is simply because the Unfunded Liability. Not the pension structure. Changing the COLA for across the board changes the accrued benefits as well as future benefits. Changing the employee contribution rate only changes the revenue stream going forward - it does nothing to lessen the Unfunded Liability (which, by definition, is the value of the already accrued benefits).

Comment by Archimedes Wednesday, Jun 6, 12 @ 12:01 pm

The cost of the COLA as part of normal cost is around 3.5% with employees contributing .5% and the employer portion being 3.0%. The employer portion fluctuates some but not much each year.

Comment by Did the Math Wednesday, Jun 6, 12 @ 12:08 pm

Without compounding COLAs, retirees get poorer every year. I have no idea why this is considered desirable, except that it might encourage retirees to die earlier.

Comment by lincoln's beard Wednesday, Jun 6, 12 @ 12:18 pm

I applaud Rep. Fortner for his constructive proposal. If he were negotiating with union leaders, I suspect they’d reach consensus about how to improve the system for all concerned.

Comment by reformer Wednesday, Jun 6, 12 @ 12:27 pm

It is true that private company employees no longer tend to receive fixed payment pensions. However, one has to consider that it was that promise, the pension that attracted quality candidates to state and federal jobs that often came with lower salaries and limited mobility (having to live in Springfield for instance when one might prefer Chicago or Galesburg).

I remember when I was in college, I went to an interview and got an offer from the federal government for an amount $10K less than I could get from any other company in Chicagoland. And I would have had to live in DC. I chose the $ and Chicagoland and I’m not sorry. But I’ll be danged if I’m going to take away the winnings of people who made the other choice.

Comment by cermak_rd Wednesday, Jun 6, 12 @ 12:28 pm

Pretty doggone sure that when the state put in the 3% COLA they thought they were LIMITING the state’s exposure to increased costs due to inflation.

Comment by Excessively Rabid Wednesday, Jun 6, 12 @ 12:29 pm

So what you are advocating is a protected class of a proportionately small group of people who are protected from inflation and also pay no income taxes.

While the funding of said pensions is borne by people who do not benefit from the ability to avoid income taxes on their income.

What a deal!

Comment by Plutocrat03 Wednesday, Jun 6, 12 @ 12:30 pm

@Plutocrat, most public employees don’t have Social Security - they have a pension instead.

Both Social Security and pension benefits are protected from inflation by a compounded COLA.

Both Social Security and pension benefits are exempt from Illinois state income tax.

Pensions are funded by the “three-legged stool” of employee contributions, employer contributions and investment gains. (Not, as you suggest, solely by the income taxes paid by private-sector workers.)

Try bringing some facts to the discussion next time.

Comment by Reality Check Wednesday, Jun 6, 12 @ 12:34 pm

Rep Fortner should be gov!But he too sane

SURS has been paying for the COLA for years and that has never been challanged. I see no reason something cant be worked out …oh because now Quinn has ticked everybody off

Comment by western illinois Wednesday, Jun 6, 12 @ 12:56 pm

Regarding the AFSCME chart, it would be educational to juxtapose the retirement of a similarly situated private sector employee and his or her retirement prospects both with and without the costs paid via taxes to support public employee pensions. While tinkering with data and projections, we seem to be losing sight of the fact that the federal, state and local governments have created a class of workers with benefits that economic realty prohibits the rest of us from enjoying, but nevertheless we must pay the cost through additional government debt, higher taxes and deferring our own retirements. Sooner or later this surreal dichotomy will offend the notions of equal protection, due process and fundamental fairness which supposedly are the cornerstones of our nation. If the proponents of a “new normal” of structural higher unemployment and flat private sector wages are accurate, the present configuration of public sector largesse will face a significant political backlash as soon as any cost shifting occurs.

Comment by Cook County Commoner Wednesday, Jun 6, 12 @ 1:06 pm

Reality - perhaps you are in a distortion field or you are simply parroting party talking points.

Never said solely, buy the drag on the general fund created by underpayments and investment underperformance force a greater reliance on income taxes. Without the pension problems, the 66% income tax increase could have been avoided.

Social security payments are tiny for private sector retirees in comparison to their working wage. Private employees have to rely on savings and investments to make up the difference. That income from savings and investment is taxed.

Personally, everyone should be in the Social Security trick bag. This special treatment for special people is creating great damage to the fabric of the country.

Comment by Plutocrat03 Wednesday, Jun 6, 12 @ 1:13 pm

Most employees I talked thought we would get hit with increased contributions of 3%. And required to pay for some portion of health insurance. But nobody thought we have a gun pointed at our heads — agree to reduced cola or NO health insurance at all.

Comment by RSW Wednesday, Jun 6, 12 @ 1:19 pm

The chart that AFSME provided is misleading for this conversation. The proposal was to use a simple COLA instead of Compounded. What we have is compounded vs. 1/2 simple. This is apples and oranges for the current conversation of simple vs. compounded COLA’s.

Do retirees what to get a compounded COLA? Of course they do, who in the world is going to turn down more money when it doesn’t cost them anything? The problem is, it’s costing our state a lot of money and we need to look into simple COLA. Retiree’s would still get a bump in their pensions every year, just not as much as some want. I understand that people want their free healthcare and their compounded COLA, but this is what the rest of us call life, we don’t get everything we want.

Comment by Ahoy! Wednesday, Jun 6, 12 @ 1:29 pm

Here is what I’d like to know….

With the current system and an employee starting today at $30,000. What with they contribute for 35 years of work with say a 2% increase in salary a year, taking into account the interested earned on that money according to what the retirement systems anticipate.

Then what is the payout over the next 20 years including the COLA increases but also taking into account the interested being earned on the principle the employee contributed.

Comment by Choice? Wednesday, Jun 6, 12 @ 1:36 pm

I’m not yet eligible for Medicare; close, but not there yet. I’m not giving up my 3% compounded COLA - ever. The Illinois constitution guarantees it and the constitution is what I will abide by. Whatever I have to do to obtain insurance until I reach Medicare age, I will do - regardless of the cost. I’ve got Deferred Comp to draw off of for this. I will come out on top in the end. Then you know what, the State won’t have a damn thing it can threaten me with. What’s their Plan B if a majority of retirees do the same? Coercion and being lied to at the time of my retirement will cause this whole mess to be in the courts for a long, long time. Maybe I WILL be Medicare eligible by the time it’s finally settled.

On the other hand, I have no problem starting tomorrow paying for half of what the State says it costs for my insurance; and half for my spouse as long as I can keep my compounded COLA. My part of the shared sacrifice. I would only insist that the money I pay be put into the pension fund every month as long as I am drawing a retirement from the system. After all, it’s about reducing the Pension liability isn’t it? Or is it really? Or would the State just take the monthly insurance premiums and spend it on other programs? There’s no doubt in my mind that they would do that just like they’ve done in the past - that’s why we have the mess we have now.

But, I won’t do both. I mean, I’d be paying for half of my insurance premiums through the State insurance plan for life even after I gave up my 3% compounded COLA. I’ll keep my COLA and take my health insurance ‘business’ elsewhere. And wait for vindication by the courts.

Comment by Jechislo Wednesday, Jun 6, 12 @ 1:37 pm

The proposal was to use a simple COLA instead of Compounded. What we have is compounded vs. 1/2 simple. This is apples and oranges for the current conversation of simple vs. compounded COLA’s.

You’re wrong, the chart is right. The bill, like the chart, provides for a simple COLA at the LOWER of 1/2 CPI or 3%.

Comment by Reality Check Wednesday, Jun 6, 12 @ 1:38 pm

@Choice - why assume a 2% raise each year? Most of the state employees I’ve talked to lately don’t get raises very often.

Comment by titan Wednesday, Jun 6, 12 @ 1:44 pm

Reality Check,

This post is regarding compounded vs. simple COLA, there is no mention of specific legislation in this post. While the chart might be a good example of the legislation that was proposed, it is not a good example for this specific blog post.

Comment by Ahoy! Wednesday, Jun 6, 12 @ 1:44 pm

there is no mention of specific legislation

Perhaps you should actually read the article we are discussing, which states, “the proposal [includes] a non-compounded annual raise that would be based on half of the consumer-price index or 3 percent, whichever is lowest”.

Sheesh.

Comment by Reality Check Wednesday, Jun 6, 12 @ 2:03 pm

Ahoy! - Wednesday, Jun 6, 12 @ 1:44 pm:

Uh, read the article on the front page of today’s Springfield Journal Register that quotes Cullerton.

Comment by Jechislo Wednesday, Jun 6, 12 @ 2:21 pm

Getting back to the Daily Herald article.

Using their example, starting with $46,452 - the total dollars @3% compounded versus simple is $1,693,606 versus $1,579,368, a difference of $114,238 or 7.23% more with compounding.

But let’s introduce Present Value. TRS pays this out over time, so TRS needs $614,528 up front to pay the $1,693,605 over those 25 years (using their discount rate of 8.5%) versus $589,865 with the simple increases - a difference of $24,664 or 4.18% between the two. So the difference between the compounded versus simple COLA - as far as TRS is concerned - is $24,664.

TRS might reduce their discount rate this year - let’s say it goes to 8%. The difference between simple and compounded then becomes $26,780, or 4.33%. They would need $645,005 up front for the compounded pension versus $618,225 up front for the simple COLA pension.

Comment by Archimedes Wednesday, Jun 6, 12 @ 2:45 pm

If we make smoking mandatory for all state employees, we can kill two birds with one stone: fund Medicaid and reduce our pension obligations.

Logan’s Run, anyone?

Comment by Yellow Dog Democrat Wednesday, Jun 6, 12 @ 2:58 pm

Cook County commoner and all those who can’t stop whining that private sector employees face a significantly worse retirement scenario, where is YOUR cold hard data and math? The Social Security portion of your retirement gets a real COLA tied to the actual CPI which historically has been slightly higher than 3%. Plus, the portion of your retirement which comes from savings, 401(1)(k) plans etc. will of course grow over the years by - guess what? - compounding interest!!! I haven’t seen anything to suggest that a private employee in a similar job with a large employer will find their future retirement stream of income diminished radically as would be the result of these legislative proposals to eliminate/reduce COLAs or compounding.

Comment by Gov't worker Wednesday, Jun 6, 12 @ 3:39 pm

There are some 166K active TRS members and some 100K TRS retirees. Assuming retirees average a pension equal to 66% of an active person’s salary, wouldn’t an increase of 1% on active members’ pay cover 2.5% of the current 3% annual COLA for current retirees? So just a bit more would cover all 3%? Am I missing something? I wouldn’t be surprised if my math or assumptions are off but at a glance it seems that a pay-as-you-go system for the COLA would work.

Comment by thechampaignlife Wednesday, Jun 6, 12 @ 4:11 pm

@thechampaignlife - your calculation makes sense to me. So if 1% covers 2.5%, 1.2% would cover 3%.

1) What is the expected future salary increases are for active TRS members - if those salary increases would average 3% (I have no idea if this is a reasonable assumption), then it seems to me that your math would still hold.

2) Since people are living longer, is the 166K vs. 100K ratio likely to get worse? Probably, so consider boosting hte increase on active members’ pay to 1.5%-2%?

Comment by Robert Wednesday, Jun 6, 12 @ 4:34 pm

Maybe I’m an idiot, but why all this talk about keeping pace with inflation? Is there some sort of statute that requires that? (No.) And no one can possibly make the claim, with a straight face, that not keeping pace with inflation is a diminshed benefit can they?

Guess what - you’re not going to earn as much in retirement as you did working. It was that way for my grandparents, my parents and it’ll be that way for you and me too. The only folks who live as well in retirement are wealthy and/or exceptionally great planners.

Comment by Randolph Wednesday, Jun 6, 12 @ 5:02 pm

A reader above commented that teachers contribute 9.4% to their pensions. Often that is not true. Remember that in the majority of school districts in Illinois, teachers and administrators contribute little to nothing to their TRS pensions. In most school districts in Illinois, the school district (employer), makes most or all of the 9.4% employee contribution. Education employees say this is “in lieu” of a salary increase. Well, in many districts, employees received one whopper of a raise in the year the “pension pick-up” perk was added. So when you look up teacher and administrator pay on a public database, to get an accurate representation of “overall compensation” you also need to ask your school district if teachers, administrators, or both are receiving the “pension pick-up” perk. It’s extremely rare in private enterprise for the employer to pick up the the employee portion of the social security, 401k, and private pension contribution. Remember the employee already receives the in essence “matching” on-behalf contribution from the State of Illinois which was basically set up to be about 9.4%.

Comment by Mark Wednesday, Jun 6, 12 @ 5:42 pm

“Protected Class” - You mean employees with contracts that have agreed to provide their services for the contracted for and earned current and deferred benefits of said employment? See ya in court.

Comment by PublicServant Wednesday, Jun 6, 12 @ 5:50 pm

- PublicServant - Wednesday, Jun 6, 12 @ 5:50 pm:

Amen.

Comment by Jechislo Wednesday, Jun 6, 12 @ 6:17 pm

Why don’t the Tribbies and Republicans call for emasculation of the Social Security COLA? If it’s good enough for state retirees, why not half of CPI for Social Security retirees?

Comment by reformer Wednesday, Jun 6, 12 @ 6:46 pm

Reformer. Divide and Conquer. SS is next.

Comment by PublicServant Wednesday, Jun 6, 12 @ 7:01 pm

“But I’ll be danged if I’m going to take away the winnings of people who made the other choice.”

The alternative is probably a 10% state income tax. Everyone ready for that?

Comment by wishbone Wednesday, Jun 6, 12 @ 10:41 pm

If it’s a graduated tax, it won’t effect 94% of taxpayors, Wishbone. See CTBA for details.

Comment by PublicServant Thursday, Jun 7, 12 @ 5:10 am

“If the state were a private employer they would typically contribute 6.2% for social security and at least 3% for a 401k plan. That is a 9.2% total employer contribution. Add that to the 9.4% of salary teachers currently pay and the total is 18.6%. That leaves about 1% remaining to equal the normal cost of the teachers’ pension plan.”

Hey, the reason we aren’t in SS is because the State wouldn’t be able to defer SS payments or take it for something else.

Comment by State employee Thursday, Jun 7, 12 @ 8:28 am

By the way, I willing to pay more if they would stop screwing around and find renue resources as well. There are ways to obtain revenue without raising taxes. Also, I do pay taxes on my regular salary.

As I recall, if you put a limited amount in to an IRA you can get a tax deduction until you take it out.

Besides the real problem is JARS and GAR who seem to get an extra 3% for every year they work past retirement age. Hmm… SURS doesn’t have that. After year 35 it you max out and it stops going into retirement.

Seems to me, it should keep going in- not to increase the retirees payment, but to help fun the system. It seems only far with the tier 2 paying in more.

Comment by State employee Thursday, Jun 7, 12 @ 8:41 am

I will not give up my cola for one reason. The state can raise my insurance cost every single year. I give up my cola and say in 3-5 years my insurance with the state is the same as in the private market. My cola is then gone and I have lost it all. Madigan said last week in a radio show he will not give up his cola under these thems. Writting is on the wall !!

Comment by sgtstu Thursday, Jun 7, 12 @ 8:48 am