Latest Post | Last 10 Posts | Archives

Previous Post: Quote of the day

Next Post: Question of the day

Posted in:

* Just lousy…

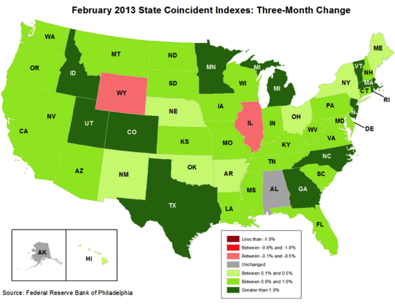

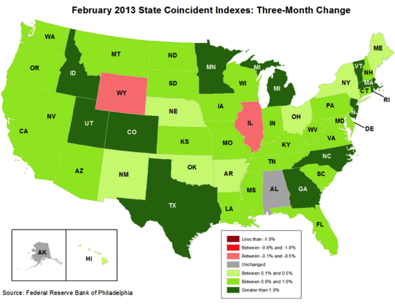

The Federal Reserve Bank of Philadelphia has released the coincident indexes for the 50 states for February 2013. In the past month, the indexes increased in 45 states, decreased in three (Alabama, Illinois, and New Mexico), and remained stable in two (Hawaii and Wyoming), for a one-month diffusion index of 84. Over the past three months, the indexes increased in 46 states, decreased in two (Illinois and Wyoming), and remained stable in two (Alaska and Alabama)

* The national map…

* The explanation…

The coincident indexes combine four state-level indicators to summarize current economic conditions in a single statistic. The four state-level variables in each coincident index are nonfarm payroll employment, average hours worked in manufacturing, the unemployment rate, and wage and salary disbursements deflated by the consumer price index (U.S. city average). The trend for each state’s index is set to the trend of its gross domestic product (GDP), so long-term growth in the state’s index matches long-term growth in its GDP.

[Hat tip: IR]

…Adding… Related…

* Governor Quinn in Mexico for trade mission

* Business groups blast Quinn’s plan to close ‘corporate loopholes’ - Governor should curb spending before raising taxes, critics say

* Corporate Tax Policy Tug Of War Begins

* Business, advocacy groups split on Quinn tax plan

* Business groups blast Quinn’s loophole plan

* Illinois legislators consider tax on speculative trading

posted by Rich Miller

Thursday, Apr 4, 13 @ 10:41 am

Sorry, comments are closed at this time.

Previous Post: Quote of the day

Next Post: Question of the day

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Waiting for someone like Small Town to pop on and tell us how all these stats are bunk and Illinois just needs to tax a little more.

If we want to keep doing what we are doing in this state (social services, programs, etc) we need an expanding tax base and expanding out put. The private sector going gang busters is the best thing you can do for social safety nets and other government programs.

Comment by RonOglesby Thursday, Apr 4, 13 @ 10:47 am

Is anyone really suprised?

Comment by Fair Share Thursday, Apr 4, 13 @ 10:55 am

Yep Ron, it’s the high taxes and providing basic social services that’s causing this. Just like in those other two liberal wackaloon states: Wyoming and Alabama. /snark

Comment by Jimbo Thursday, Apr 4, 13 @ 11:01 am

Regarding the fed data: They’ll be plenty attempting to highlight the significance of this data (cut social services now).

IL is between a negative tenth of a percent and one-half of a percent while about a dozen states have something (?) over 1 percent and the rest are in between.

Most of the states have a change as small as two tenths of a percent greater than IL or as large as 1%.

Maybe they ought to use hundredths of a percent for greater emphasis.

Comment by Kasich Walker, Jr. Thursday, Apr 4, 13 @ 11:11 am

The spreads are awfully small, it’s three months. In all honesty I don’t even know what this survey means.

But if we’re going to jump to conclusions, Ron, explain Minnesota and Michigan being dark green? Does that have something to do with their lower taxes and lack of social programs?

Comment by wordslinger Thursday, Apr 4, 13 @ 11:25 am

I figure we’re just backing up so that we can get a good run at it.

– MrJM

Comment by MrJM Thursday, Apr 4, 13 @ 11:48 am

It is weird to say this, but I agree with Rich Whitney — a tax on speculative trading makes lots of sense.

Comment by soccermom Thursday, Apr 4, 13 @ 11:55 am

MN has higher taxes than us a progressive income tax I think like Iowa and Wisconsin

It cant just be our corruption New York matches us they just had a big bribery bust this morning.

While It probably doesn’t mean much I will blame it on..drastic state budget cuts

Comment by RNUG Fan Thursday, Apr 4, 13 @ 11:56 am

===a tax on speculative trading makes lots of sense===

Nationally, perhaps. State? Not so much. The trading houses won’t stay around if the state does that.

Comment by Rich Miller Thursday, Apr 4, 13 @ 12:02 pm

Rich, not many states offer the infrastructure necessary to accommodate these high-tech trading floors. This is a tiny, tiny tax and will be felt largely by foreign investors. I think it’s worth exploring this one.

Comment by soccermom Thursday, Apr 4, 13 @ 12:12 pm

Soccermom, while I empathize, I think recent history has shown that Illinois is bipartisanly wired for tax breaks for financial exchanges, not the other way around.

Comment by wordslinger Thursday, Apr 4, 13 @ 12:18 pm

Word — deep and profound sigh.

Last quarter, one of my professors told the story of a New York-based exchange paying huge sums to move its data farm a half-mile closer to the trading floor, so they could gain a few milliseconds of competitive trading advantage. So I don’t think we have to worry about these trading floors moving to Montana…

Comment by soccermom Thursday, Apr 4, 13 @ 12:23 pm

We’re Number 1!

What? Oh. Never mind.

Comment by titan Thursday, Apr 4, 13 @ 12:28 pm

So much is regional; I think my little corner of Illinois is actually doing considerably better. Then again, it helps when you shut down the cash spigot our corrupt comptroller was using to steal millions per year in a tiny community…

Comment by Liandro Thursday, Apr 4, 13 @ 12:36 pm

Soccermom, the NASDAQ doesn’t even have a trading floor — they’ve always been totally electronic.

Yet they choose to locate in lower Manhattan, home to the most expensive office real estate and total income taxes in the country.

I hear Central London is not the cheapest place to do business, either. But I haven’t heard that The City financial industry is moving to Slough or Swindon anytime soon.

Comment by wordslinger Thursday, Apr 4, 13 @ 12:37 pm

“Business groups Blast Quinn’s loophole plan - Critics claim the proposal would harm businesses without addressing the state’s overspending issues that have led to the current budget crisis.”

State employees now have to pay for the state’s overspending, so why not share the burden.

Comment by rusty618 Thursday, Apr 4, 13 @ 12:46 pm

Could easily be a data problem. There’s been a recent rash of late data reporting issues in different government reporting that has resulted in these types of ‘odd trends’ for specific states, so not overly concerned.

Comment by Judgment Day Thursday, Apr 4, 13 @ 12:50 pm

There’s another aspect to this. The most recent (over the last week) reports on the Chicago PMI, manufacturing ISM, ADP March private job numbers, and the Non-manufacturing ISM have all had big misses (and not in a good way).

Time to pull out the Magic 8 ball - “Ask again later” (maybe tomorrow).

Comment by Judgment Day Thursday, Apr 4, 13 @ 1:02 pm

“… New York-based exchange paying huge sums to move its data farm a half-mile closer to the trading floor, so they could gain a few milliseconds of competitive trading advantage”

Much of it is to gain an advantage in HFT (high frequency trading) related business, a/k/a “Home of the ‘Flash Crashes’” in the markets.

Comment by Judgment Day Thursday, Apr 4, 13 @ 1:05 pm

To soccermom:

“not many states offer the infrastructure necessary to accommodate these high-tech trading floors. This is a tiny, tiny tax and will be felt largely by foreign investors. I think it’s worth exploring this one.”

The trading floors are down to doing maybe 10 to 12 percent of the volume. So, the floors aren’t going to be around. The bigger question is: why should the server for the exchange be in Illinois if there’s a transaction tax?? Why not Texas?? Anyone who thinks Illinois can unilaterally slap on a transaction tax on trading financial instruments is dreaming. I know it’s hard for some commenters of this website to understand but there’s other places in America besides Illinois.

Comment by Steve Thursday, Apr 4, 13 @ 1:12 pm

The study period is short, so it’s hard to say that it indicates a trend, but it doesn’t look good for Illinois, that’s for sure.

Comment by Fan of the Game Thursday, Apr 4, 13 @ 1:27 pm

- just needs to tax a little more. -

Funny, I don’t recall arguing any time recently that we “just need to tax a little more”. Maybe before the income tax increase, something tells me we’d be in worse shape if that hadn’t happened.

Comment by Small Town Liberal Thursday, Apr 4, 13 @ 1:29 pm

I am happy to pay an STL surtax. How about a voluntary checkoff — one buck per taxpayer?

Who’s with me?

Comment by soccermom Thursday, Apr 4, 13 @ 1:45 pm

I am keenly aware that there are other states in the nation. I have visited 45 of them, with Idaho, Alaska, North Dakota and Maine still on the list. My point is that most states cannot match Illinois’ technological infrastructure, and that those who benefit from it should help to support it.

Comment by soccermom Thursday, Apr 4, 13 @ 2:02 pm

Not sure what the study really means. Seems to be a tiny difference between the worst performers and best.

Should continue to make State attractive to new business. However don’t give away the store to get a new business. E.g. Make sure energy development taxes are in line with surrounding states. There are reports that the proposed taxes may be lower than they need to be.

If a 66 percent tax was not enough, what makes you think that a “little more” would solve the problems.

Too much magical thinking out there…..

Comment by Plutocrat03 Thursday, Apr 4, 13 @ 2:07 pm

Liandro, that Dixon story is incredible. How did it go on so long — so much money stolen, and she living so large?

Comment by wordslinger Thursday, Apr 4, 13 @ 2:09 pm

Mom, I’m in for that dollar and Alaska is definitely worth the trek.

On the other hand, the well-regarded UI “Flash Index” of Illinois economic indicators rose two points last month according to a story in yesterday’s Champaign News-Gazette.

Comment by Arthur Andersen Thursday, Apr 4, 13 @ 2:18 pm

Well, we have an archaic commission form of government, so only two people were even really paying attention to her (finance commissioner and mayor). Both of them are/were part-time. She had been working for the city for decades, and everybody knew/trusted her. She basically had created the system they were using. There had been calls in the past for various changes, but they were always met with “this is how it’s always been done” pushback.

Story short, she was her own auditor, and the firms paid to audit the city worked directly with her to get it done (and are currently being sued). There was no city manager or administrator, and it was all buddy-buddy. Her elected “bosses” relied on her for all their financial info.

Given the MASSIVE amounts stolen per year (especially in comparison to the roughly $8M annual operating budget), none of the above is any kind of excuse. So, really, I have no idea. As a business owner, it still blows my mind that someone could be losing close to a third of their annual operating budget yet not notice…

Comment by Liandro Thursday, Apr 4, 13 @ 2:42 pm

Liandro, I hope you guys take those outsize auditors for all they have. Given the sums involved, it’s hard to see how they weren’t in on it.

Comment by wordslinger Thursday, Apr 4, 13 @ 2:50 pm

Illinois has a persistently high unemployment rate, which is likely the biggest factor in our decrease. I think if the sequester continues you’ll see quite a few other states joining us. Virginia and Maryland are two obvious possibilities.

This isn’t a pretty picture at all.

Comment by 47th Ward Thursday, Apr 4, 13 @ 3:02 pm

What’s our takeaway from this data? Mine is perception is reality.

Word rightly points out (all the time) what a great state Illinois is. Our infrastructure, agriculture, transportation, higher education system and the many intangibles associated with Chicago are second to none, certainly in the Midwest if not the nation.

Why then are we not a job creating machine?

Something, or some combination of things, seem to be inhibiting job creation in Illinois. Whether it is the partially reformed workers comp system, tax structure, state finances, state regulations, some combination of all or some of those or other things, I can only guess.

But the perception that Illinois is worse off that it may be has become the perception, both for employers within the State, and without.

Comment by Cincinnatus Thursday, Apr 4, 13 @ 3:25 pm

But the perception that Illinois is worse off that it may be has become the *reality, both for employers within the State, and without.

Comment by Cincinnatus Thursday, Apr 4, 13 @ 3:26 pm

SoccerMom I am in tech. Have been for 15+ years designing datacenters and network infrastructure. hell I’ve written books on x86 virtualization.

you do not know what you are talking about. Thinking Illinois/Chicago is unique in “infrastructure” What would that be that is unique? power? data throughput/network options?

Yes, the middle of montana in a town of 100 people doesnt. But middle of Illinois in a town of 100 doesnt either.

Check Dallas, Colorado, Seattle, Houston, any major city and please point out to me the unique “infrastructure” that IT support for traders and financial exchanges are unable to do without.

Comment by RonOglesby Thursday, Apr 4, 13 @ 3:30 pm

47th ward.

Ahh because a 2% cut when the federal budget has been growing 6-8% per year is world ending.

I just cant buy it. This year, even with sequester EVERY GOV AGENCY still has more money than it did last year. sequester is a scare.

Comment by RonOglesby Thursday, Apr 4, 13 @ 3:32 pm

Ron, we don’t make navy ships in Illinois so we aren’t going to be hurt as badly, but all those businesses who supply the defense department are sending out layoff notices.

Ask the people receiving them if the sequester is scary.

Comment by 47th Ward Thursday, Apr 4, 13 @ 3:41 pm

47th…

that is to “make it hurt”

Someone needs to do simple math. They are choosing where to stop spending. A 2% reduction. Think about that. after 6-8% increase even for the 2013 budget. So still more money than last year right?

Only in gov could people see a decrease in the increase as the end of the world.

Comment by RonOglesby Thursday, Apr 4, 13 @ 3:59 pm

Ron, if the federal budget was about simple math there might be a simple solution. It ain’t, so there ain’t.

Instead, we have ludicrous things going on like frontline, combat ready fighter squadrons not flying because their gas has been sequestered. If, God forbid, the balloon goes up with that little twerp in Pyongyang, don’t you want the folks who may have to respond to have flown something other than a desk recently?

Comment by Arthur Andersen Thursday, Apr 4, 13 @ 4:12 pm

@Ron:

It depends on what the increases are for. If you have salaries of X and you are only give Y to pay for them, sure it may be an increase over the last year but if it isn’t enough to pay those salaries then yes there is a problem with a decrease to the increase. Simple math, isn’t it?

Also, government isn’t the private sector. You don’t always get to cherry pick what you want to cut. Moreover, the feds are already halfway through their fiscal year so any cut is going to be magnified because you only have 6 months to save that money. Simple math, isn’t it?

More money doesn’t mean a thing unless you know what it’s going to. The governor budgeted more money in next year’s budget but guess what? It’s all going to pensions. You say more money but it’s really not from an operational point of view. Simple math, isn’t it?

Comment by Demoralized Thursday, Apr 4, 13 @ 4:18 pm

–Why then are we not a job creating machine?–

Like I said earlier, I’m not even sure what this report says. I’ve never seen it before.

I am well aware, though, that we are still in the midst of a long slog, and things are not hunky-dory.

We’re a mature economy. A stable population base. Increases in efficiency lead to less employment.

For a long time until 2007-2008, the big driver was real estate development, whether residential or commercial. The state bird was the Crane, with people from all over the metro and beyond building up the west and south loops, the suburbs and the university towns.

That’s not happening now.

In addition, people were drawing on their home equity and spending. They can’t do that now.

There’s no doubt that we need growth industries. I think we need to better leverage the universities.

I’m cool with regulated fracking.

I want to grow marijuana and industrial hemp.

I think we need to free farmers from the welfare of corn and beans crop insurance (which benefit the chemical companies more than anyone) and build incentives for other crops.

I think we need to better market tourism, especially the low-hanging fruit of home-grown tourism. Spring in Southern Illinois is beautiful, folks.

I’m sure there’s more. But I ain’t going anywhere.

Comment by wordslinger Thursday, Apr 4, 13 @ 5:05 pm

Steve @ 1:12 pm,

Soccermom actually has a point.

In a former life, I used to plan large data centers connected with tons of dark fiber where I had basically unlimited bandwidth … which is one of the requirements for handling massive amounts of data traffic … but I still couldn’t overcome the physical limitation of the speed of light. Propagation delay is a physical fact, x msec per mile. You also have to add in a msec or so for conversion from electronic signal to light and back to electronic signal; it all adds up. As a rough rule of thumb, if you’re working a synchronous positive response protocol (issue order, wait for definite confirmation), assuming minimal actual transaction processing time, 1 miles as the fiber runs is going to be about 3 - 4 msec. of delay depending on light spectrum used on the fiber.

In trading, and especially computerized trading, those milliseconds matter. The traders want to be as physically close to the servers as they can be; closer is faster.

The other issue is disaster avoidance. All three coasts have storm issues, most the west coast also has earthquake issues. Yes, the mid-west has tornadoes … but you can harden buildings for that kind of threat.

Chicagoland isn’t perfect, but it would be high on my personal list of “ideal” locations for locating something like the CBOT servers …

Comment by RNUG Thursday, Apr 4, 13 @ 11:30 pm