Latest Post | Last 10 Posts | Archives

Previous Post: Yet another state’s attorney creates own concealed carry rules

Next Post: A new record

Posted in:

* I’m not sure many people realize this, but after a very steep payment ramp the past several years, the state’s pension payment increases will slow down considerably starting in Fiscal Year 15, which begins a little over a year from now. From the state’s Commission on Government Forecasting and Accountability…

The FY 14 certified contribution appropriation for the five retirement systems is a combined $6.8 billion. This is an increase of $965 million, or 16.4% compared to the current fiscal year. Under current law, estimated payments in fiscal years 2015 and 2016 are $7.0 billion and $7.2 billion, respectively. The FY 15 estimated payment is an increase of $200 million, or 3% over FY 14. The increase in FY 16 is an additional $204.7 million (3%).

Those are relatively manageable increases, as long as the income tax hike doesn’t start to go away.

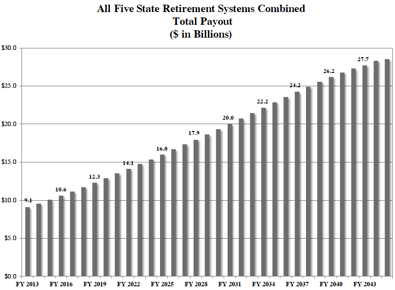

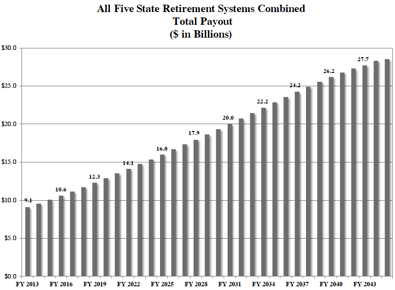

* But don’t get your hopes up too high. From a different COGFA report, here’s the expected state pension funding payout chart for the next 30 years. Click the pic for a larger image…

Oof.

posted by Rich Miller

Wednesday, Jun 12, 13 @ 8:21 am

Sorry, comments are closed at this time.

Previous Post: Yet another state’s attorney creates own concealed carry rules

Next Post: A new record

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

There is not crises, but there is an obligation of the State of Illinois to honor their legal contracts. The only crisis is one of ethics and respect for law.

Comment by facts are stubborn things Wednesday, Jun 12, 13 @ 8:32 am

That charts shows the pension benefits that the systems will pay out not the State’s contribution.

Comment by Pensions! Wednesday, Jun 12, 13 @ 8:40 am

=== facts are stubborn things ===

=== There is not crises ===

I find your statement ironic in light of your name.

Comment by Fred's Mustache Wednesday, Jun 12, 13 @ 8:41 am

Only way out is to grow our way out of this problem. We need someone that understands job creation and economic development.

As I’ve noted previously, an economist recently noted that improving our economy to a 4% growth rate would solve nearly all our budget deficits, state and national.

Comment by Downstate Wednesday, Jun 12, 13 @ 8:42 am

Payments will smooth out if discount rates stay the same. But they won’t stay the same. Some or all of the funds will continue to lower the rate at which they discount future liabilities. This will increase the current estimated value of unfunded liabilities - which in turn will increase payments.

Comment by Collin Hitt Wednesday, Jun 12, 13 @ 8:48 am

Pensions! Wow, that’s a lot of retiree money circulating back into the Illinois economy. If the state cuts retiree benefits I hope Dennys and Buick are prepared for the repercussions.

Comment by Michelle Flaherty Wednesday, Jun 12, 13 @ 8:49 am

Why do legislators get paid anything when they act like a bunch of buffoons and cause a pension crisis, like this, for the state. Make no mistake this was not caused by employees but by elected officials.

Comment by BMAN Wednesday, Jun 12, 13 @ 8:51 am

We have had a pension FUNDING crisis for, oh, say, 40 years now. In addition, we have had a lack of revenue crisis. After all, if they’d have had the guts to make the public actually pay for what they got, instead of raping those that paid faithfully into the pension funds from their paychecks, we wouldn’t have this so-called pension crisis. We have a revenue crisis whether anyone wants to admit it or not. The revenue crisis created theft that resulted in a gaping hole in the pension funds. Why those whose money was unethically taken should be paying yet again still amazes me. They’re looking at the wrong people to fix it.

Comment by Nickname Wednesday, Jun 12, 13 @ 8:51 am

No one with a brain would take a home mortgage out with this type of repayment plan. Politicians did his. This is the what Ralph Martire has been talking about for years - the debt service on what the state barrowed and redirected to pork barrel projects.

Quinn states he will not approve a gambling bill until there is pension reform. Without new revenue streams there is no way to met this debt. Yet he and the Illinois congress still passed an expenditure bill to fund a board for a third airport which will never be built and an expansion of McCormick Place -already underutilized- to create more patronage jobs. The definition of insanity is……

Comment by Rollo Tomasi Wednesday, Jun 12, 13 @ 8:52 am

BMAN, technically speaking if there were no employees there’d be no pension crisis. So, yeah, the employees are to blame.

Comment by Michelle Flaherty Wednesday, Jun 12, 13 @ 8:52 am

Did this have any input from an actuary? Factoring in baby boomers and life expectancy? Tables 19 - 23 in the SERS section stop at 2012 and subsequent tables continue to 2040.

Comment by Anon. Wednesday, Jun 12, 13 @ 8:54 am

“BMAN, technically speaking if there were no employees there’d be no pension crisis. So, yeah, the employees are to blame.”

Well, employees are fine– it’s retirees that are the problem. Time for the Logan’s Run solution?

Comment by Anonymous Wednesday, Jun 12, 13 @ 8:54 am

Anon — good point. This pension reform brought to you by soylent green.

Comment by Michelle Flaherty Wednesday, Jun 12, 13 @ 8:57 am

where’s the like button?

Comment by Anonymous Wednesday, Jun 12, 13 @ 9:12 am

Flaherty: A cut to pension would also cause MCL cafeteria stock to tank.

Comment by Give Me A Break Wednesday, Jun 12, 13 @ 9:13 am

Fahner must not have stock in MCL.

Comment by Michelle Flaherty Wednesday, Jun 12, 13 @ 9:14 am

“This will increase the current estimated value of unfunded liabilities - which in turn will increase payments.”

The bad thing is that at the same time more money is needed to pay pensions while the states ability to pay will be decreased unless two things change. The first problem is the ending of the current income tax rates. The current tax rate is only ‘temporary’. If it lapses there will be less income for Illinois.

The second issue was raised in a long article in todays Wall Street Journal. Under the headline “Illinois Dinged by Downgrade”, the effect of the last credit downgrade by Fitch and Moodys was described as to its effect on yesterdays bond sale by the state. I found the best quote in the article to be

“The Illinois label is radioactive for some investors”

Spending more on interest means less money to fund pension liabilities. In effect Illinois will be under pressure from both the income and the expense side due to the continued failure of the GA to come up with a solution to the pension issue.

Comment by Small Town Taxpayer Wednesday, Jun 12, 13 @ 9:24 am

A cut to pensions will force a cut in spending for the vast majority of pensioners. If the business climate is of utmost importance to the state’s health, it’ll take a hit when a significant number of consumers tighten their belt. I can’t imagine how anyone would expect otherwise.

Comment by Nickname Wednesday, Jun 12, 13 @ 9:26 am

= But they won’t stay the same. Some or all of the funds will continue to lower the rate at which they discount future liabilities. This will increase the current estimated value of unfunded liabilities - which in turn will increase payments. =

Hey Colin Hitt, stop drinking the Koch Bros. kool-aid. YOU (nor anyone else) cannot predict the future of the investment markets. Folks who understand this issue way better than you have accepted reasonable and accurate discount rates. If you look at the history of the systems’ investment returns, 10,20,25,30 year periods all exceed the assumed rates. The last few decades have experienced multiple wars, multiple recessions, the worst financial crisis since the great depression,9-11, tech bubbles, etc., and guess what, the Systems have exceeded their current rates of return.

NO ONE can predict future investment returns, and the funds, which collegectively have over $60B in assets, will meet that mark over the long term, which is how the discount rate is designed.

Comment by Dirt Diver Wednesday, Jun 12, 13 @ 9:27 am

27.7B from 9.1B total payout sounds bad, but 2013-2043 annual growth rate is 3.8%, not as bad as I feared.

Comment by Robert the Bruce Wednesday, Jun 12, 13 @ 9:28 am

=== No one with a brain would take a home mortgage out with this type of repayment plan. ===

Actually they did… a lot of people. Think balloon mortgages. Apparently kicking the can down the road seems popular with the electorate as well.

And I know what you are thinking. Before slamming all people who took out balloon mortgages as those without a brain, remember that for a period of time, they were very attractive for people who felt like they can purchase a home and then resell it or refinance it due to the added appreciation of the real estate market.

Comment by Fred's Mustache Wednesday, Jun 12, 13 @ 9:28 am

And it will be interesting to see how things look after the current fiscal year closes. The pension systems have all had investment income well above the assumed levels.

But Rich made the key point - the increase in payments isn’t that dramatic and is manageable as long as the income tax increase doesn’t go away.

The sunset to 3.75% from the current 5% is $5 billion. This is a much greater loss in revenue (pretty much double) than any amount saved by any of the pension reform, including SB1.

Kind of makes for an intersting topic for candidates for elective office to address….

Comment by archimedes Wednesday, Jun 12, 13 @ 9:29 am

how bout the employees paying in 1% more a year for the next 4 years. Then the only money that teh state needs to pay in is the money they did not or reallocated. The pension funds are not a piggy bank for the state so it needs to stop being used as such.

Comment by simple solusion Wednesday, Jun 12, 13 @ 9:29 am

The state needs state workers. State workers don’t make decision on their pension plan, the legislators do. So stop blaming the state workers. I have many friends who work for the state and work very hard. The fact that the state made them a promise that it now can’t keep is not their fault.

Comment by cynical Wednesday, Jun 12, 13 @ 9:34 am

=Payments will smooth out if discount rates stay the same. But they won’t stay the same. Some or all of the funds will continue to lower the rate at which they discount future liabilities. This will increase the current estimated value of unfunded liabilities - which in turn will increase payments.=

Quotes like the one above provided by Colin Hitt are exactly why I am so tired of this debate. This is why I no longer listen to floor debate. Teabaggers argue that the problem is much worse than it is by stating biased “opinions” as facts such as the fact that the assumed rate of return is to high. McSweeney and Ives might be legislators who have made more false statements as it relates to pension reform than any other legislators this year, although Cross is up there as well.

Nobody can predict how the next several decades will unfold in the markets, but the best way to gauge such future is to look at how the funds have done over the past. As it has been mentioned, the Systems have exceeded the mark over the longterm.

Anyone that knows anything about public retirement plans knows that they are designed for the long-term. Private pension plans are designed for the short term given the history of pension fund raids during corporate buyouts and corporate banktruptcy. The federal government created 2 different sets of rules for private sector defined benefit plans and public defined benefit plans for a reason.

Comment by Denim Chicken Wednesday, Jun 12, 13 @ 9:38 am

The payout ramp is driven in part by demographic driven baby-boomer retirements but primarily by the 3% COLA, for those retirees that get it. This will double payouts approximately every 24 years (by applying Rule of 72). Presumably, the ramp also considers increased longevity.

Add in pretty much the same fiscal pension armageddon brewing in many of the local pension plans, I suspect there will be vicious competition among the state and local pensions for funding.

Did I read this morning that Chicago Mayor Emmanuel is seeking an increased property tax cap hike, in part to fund teachers’ pensions?

You can delude yourselves with misguided notions of morality, legality and ethics requiring payment of these pensions and ignore that the deals that created and enhanced them often had little to do with those laudable qualities.

The arithmatic cannot be ignored.

Comment by Cook County Commoner Wednesday, Jun 12, 13 @ 9:43 am

I’d love for someone to post the chart demonstrating the yearly pension obligations as a percentage of the annual budget over the next 10-20 years.

Comment by biased observer Wednesday, Jun 12, 13 @ 9:44 am

Look’s like a very smooooth geometric increase. To smooth in fact. A lot of variables in there I suspect. As for the comment about Buick’s and Denny’s, that is to presuppose any retiree is staying in Illinois.LOL

Comment by Friedman Wednesday, Jun 12, 13 @ 9:46 am

cook county commoner is exactly right. there just isn’t enough money for the state of Illinois (and many local govt units) to meet their current obligations. it just isn’t there.

Comment by biased observer Wednesday, Jun 12, 13 @ 9:46 am

Solve the problem? Tie state employee retirement age to Social Security age. Additionally, everyone over 65 gets placed in the medicare system with the state paying the supplement insurance @ about 125 per month. The local paper has had no less then 6 teacher retirements of people in their mid 50’s. They should not be able to draw until at least 62 and then not 100% unless they are 67.5. Multiply this by the complete system and the required payouts would drop over the next 20 years plus this should pass any lawsuits.

Comment by Anonymous Wednesday, Jun 12, 13 @ 9:52 am

The COGFA chart is also assuming that all the state employees that retire in 2013 will still be alive and collecting a pension in 2043. I’m sure of them will be gone by then.

Comment by rusty618 Wednesday, Jun 12, 13 @ 10:08 am

Commoner, Wrong. No. The 3% COLA does not “double the payout every 24 years.” (Kudos for knowing the Rule of 72, though.) The COLA cost doubles the percentage of payout that is devoted to paying COLAs every 24 years, not the entire payout. COLA as percentage of total payouts vary by system, but are around 25 percent iirc.

Look at the chart. Payouts change at varying rates over time.

If you read the report, always a good idea, the primary determinant of funding status, and hence the curve of the ramp, is past underfunding. Investment returns below the assumed rate and changes to actuarial assumptions are the next-highest contributors.

Comment by Arthur Andersen Wednesday, Jun 12, 13 @ 10:12 am

AA,

past underfunding is irrelevant to current problem solving. what has been underfunded in the past will never be underfunded again. COLA is with us forever until it is changed.

Comment by biased observer Wednesday, Jun 12, 13 @ 10:17 am

–Solve the problem? Tie state employee retirement age to Social Security age. Additionally, everyone over 65 gets placed in the medicare system with the state paying the supplement insurance @ about 125 per month. The local paper has had no less then 6 teacher retirements of people in their mid 50’s. They should not be able to draw until at least 62 and then not 100% unless they are 67.5. Multiply this by the complete system and the required payouts would drop over the next 20 years plus this should pass any lawsuits–

it is impossible to make arguments against ideas like this from a fairness perspective. this is much more in line with most citizens of this state so it is fair.

this is why the argument for the union folks always ends up being the “unconstitutional” argument against pension reform. because they know they cant refute the above rational suggestion on its merits alone. it is a fair suggestion.

Comment by biased observer Wednesday, Jun 12, 13 @ 10:21 am

Biased, I’m not up for a debate with you. You don’t understand the past or the future if you think cutting COLAs and not addressing the structural underfunding is problem solving. Bye.

Comment by Arthur Andersen Wednesday, Jun 12, 13 @ 10:22 am

Can anyone guess why it stops at 2043?

Comment by nothin's easy Wednesday, Jun 12, 13 @ 10:28 am

Fairness is like beauty, it’s in the eye of the beholder.

Honoring contracts would also logically be on most people’s lists of “fair” things.

Changing the retirement age is a fair topic for discussion-but how many of you want 65 year old prison guards? 67 year old State Troopers?

Comment by Arthur Andersen Wednesday, Jun 12, 13 @ 10:29 am

Question for those who know more about this issue - reports always indicate that the state pension funds are underfunded at about 100 billion. However, there are 5 state pension funds. Are there any statistics showing the amount of underfunding of each of the pension funds? Are they all underfunded at the same percentage or are some more solvent than others?

Comment by RetiredArmyMP Wednesday, Jun 12, 13 @ 10:31 am

Unbiased Observer - It is impossible to MAKE the arugment for the suggestion, to change the system for people that are already through the system, from a fairness perspective. Geez, even ERISA would not allow that to happen.

Change the system going forward? That has legs.

But tell everyone (even those already retired) that you don’t get the compensation you have already performed the work for is not fair.

You always argue that the vast majority of common folk would agree with you. I don’t think so - most people are more ethical than that.

That said - let’s see of there can be an agreement or compromise so that members of the pension system might give up some of the compensaiton they have already earned. Say, something like SB2404.

But,

Comment by archimedes Wednesday, Jun 12, 13 @ 10:40 am

Retired MP, you can find that answer by reading the report you can access at the following link:

http://cgfa.ilga.gov/Upload/FinCondILStateRetirementSysFY2012Feb2013.pdf

By the way, thank you for your service.

Comment by Norseman Wednesday, Jun 12, 13 @ 10:55 am

@Norseman

Thank you. And thanks for the link.

Comment by RetiredArmyMP Wednesday, Jun 12, 13 @ 11:07 am

biased observer @ 10:21 am:

Previous IL SC rulings have said you can’t change the terms of the retirement deal … and they were explicitly on point in terms of raising the age of retirement, so that probably won’t be legal.

Comment by RNUG Wednesday, Jun 12, 13 @ 11:21 am

RetiredArmyMP 10:31 am:

The specific numbers are in the individual annual reports of each retirement system. You can find them all online.

Comment by RNUG Wednesday, Jun 12, 13 @ 11:23 am

I’ve been trying to tell people this for a few months… if the new 2014 budget holds up, by next Spring the General Assembly may decide pension “reform” isn’t such a big deal after all. The increases will be in line with normal year-to-year growth across the whole budget, and the pension contribution will be in the baseline. Yes, they might like to not spend so much, but it won’t look like a crisis, just another big expense item growing at the same rate as everything else (actually it may grow slower for a while as Tier 2 kicks in for a larger share of the State workforce).

That’s IF the budget holds up, and barring nasty shocks such as another market crash.

Comment by Harry Wednesday, Jun 12, 13 @ 12:00 pm

@Harry - And, if, they don’t take any more whimsical and euphemistic “Pension Holidays”…

Also, since it won’t appear as much of a crisis in a year, it’s even more of a crisis for the sky-is-falling folks now. The Civic Committee and other Plutocrats hate to let a good recession go to waste don’t you know…

Comment by PublicServant Wednesday, Jun 12, 13 @ 12:25 pm

I agree with Harry.

But I do wonder if all of this doomsday talk on the part of our Democratic leaders–Quinn, Cullerton, and Madigan–has less to do with fiscal responsibility and integrity and more to do with making more taxpayer cash available for other stuff, like pork and (Democratic) patronage. Otherwise, really, why the rush? In other words, what are they gonna do with all the money they “save” via pension reform.

If a reform bill is passed this month, I suppose the best state retirees can hope for is that a stay will be in place while the court process goes on. By the time the court rules, perhaps perspectives on the “crisis” will have changed, and cutting middle-class pensions via cola reduction or other means will appear less urgent as the economy improves. Or at least the arguments, weaker.

Comment by WilliamO Wednesday, Jun 12, 13 @ 12:27 pm

Perfect! Since I plan to die when I turn 90, in 2043, and that is the year the money runs out, I won’t have to worry about a messy will or estate! I can save the lawyer money! Woo-hoo! Lunch on me!

Comment by lincolnlover Wednesday, Jun 12, 13 @ 12:32 pm

Fred’s Mustache - Wednesday, Jun 12, 13 @ 8:41 am

Below I have presented the definition of a crisis. I do not bleieve our current situation risis to a reasonable reading of this definition. There is nothing unexpected or dangerous about our pension path. Nothing is happening that has not been in the process for 50 years or more. The state has many measures it can take to remedy the pension issue. Nothing about the pension situation is leading to an unstable path other then our state putting together a legal plan forward. We have no emergency event. The only crisis would be if the state does not uphold the sanctity of law and of contracts. Then you would have the potential for instability and a dangerous path for society etc. A crisis would be a catostrophic event that rendered the state and our scociety in peril. It would be something we can not predict and would not have the options available to remidy without drastic measures. This “crisis” is self made and has been buiding for 50 years. It was anticipated in the 1970 constitutional convention which is why they added the “no diminishment clause” to the IL constitution.

A crisis (from the Greek κρίσις - krisis;[1] plural: “crises”; adjectival form: “critical”) is any event that is, or expected to lead to, an unstable and dangerous situation affecting an individual, group, community, or whole society. Crises are deemed to be negative changes in the security, economic, political, societal, or environmental affairs, especially when they occur abruptly, with little or no warning. More loosely, it is a term meaning ‘a testing time’ or an ‘emergency event’.

Comment by facts are stubborn things Wednesday, Jun 12, 13 @ 12:39 pm

==what has been underfunded in the past will never be underfunded again.==

Really? You can’t talk about things being “underfunded again” until they stop being underfunded, and this whole crisis is caused by unwillingness or inability to live with the “ramp” whose purpose is to pay off the underfunding. Being able to talk about “underfunding in the past” is a long way off unless the State can reneg on its contractual obligations.

Comment by Anon. Wednesday, Jun 12, 13 @ 12:44 pm

This whole pension issue comes down to people wanting to hold on to power. Spend the penson dollars to keep power and then pay the pension dollars back by taking it from those who have earned it — to keep power. If the GA told the truth, then they would be held accountable and might not be put back into office ie. loss of power.

Comment by facts are stubborn things Wednesday, Jun 12, 13 @ 12:54 pm

MJM needs to bring SB2404 to the House for a vote!! Even with all the proposed legislation there are NO guarantees in place that the General Assembly will meet their yearly obligations and if the past is any indication they won’t! They also need to reign in spending!! Otherwise they will be back blaming the retirees again in a few years!!

Comment by Union Man Wednesday, Jun 12, 13 @ 1:00 pm

I assume the chart relates to projected payouts to retirees from the five state pension systems. Between 2013 and 2043, the annual growth rate is only 3.78%, which is less than the CBO’s and most economists’ projections of 4-4.5 percent annual long-run growth in nominal GDP. So the pension payouts, relative to the size of the economy, are expected to actually get progressively less burdensome to the state over time. Where is the crisis?

P.S. the numbers for Social Security and Medicare look much worse (payouts from these programs are projected to grow much faster than nominal GDP over the next 30 years) and I have not heard a single politician advocate for 20% benefit cuts (as the Madigan Bill does) for current beneficiaries. Obama’s proposal to use the chained CPI to index SS benefits would represent at the absolute most a 2-3% cut in the present value of a typical recipient’s benefit stream.

Comment by Andrew Szakmary Wednesday, Jun 12, 13 @ 1:16 pm

==Additionally, everyone over 65 gets placed in the medicare system==

Everyone already goes into Medicare at that age.

Comment by Demoralized Wednesday, Jun 12, 13 @ 1:25 pm

==As I’ve noted previously, an economist recently noted that improving our economy to a 4% growth rate would solve nearly all our budget deficits, state and national.==

Sure, but achieving 4% sustained growth is an Amity Shlaes/conservative nonsense fantasy.

http://go.bloomberg.com/bgov-briefs/2013/03/18/four-percent-grwoth-great-for-deficit-control-hard-to-achieve/

Comment by Precinct Captain Wednesday, Jun 12, 13 @ 2:00 pm

Demoralized @ 1:25 pm:

Actually, those who never paid into SS (read teachers and some others) don’t have to go into Medicare (Part A) because they don’t get it for free; they have to pay for it if the choose to enroll in Medicare. (Note: they also can’t get Part B without paying for Part A.) They can (today, anyway) choose to continue to keep their existing health insurance and fore-go Medicare.

Comment by RNUG Wednesday, Jun 12, 13 @ 2:35 pm

In discussing GDP growth it is crucial to distinguish between nominal and real GDP. Based on breakeven rates between ordinary Treasury Bonds and indexed (TIPS) bonds, inflation is expected to average around 2.2% over the next 30 years. So 4.2% growth in nominal GDP implies only 2% growth in real GDP, which is historically subpar for the U.S.

Comment by Andrew Szakmary Wednesday, Jun 12, 13 @ 2:35 pm

The year I turn 101 it gets really bad.

Comment by wishbone Wednesday, Jun 12, 13 @ 3:19 pm

Wishbone - that’s poor planning. You need to die one year earlier. Crisis solved!

Comment by lincolnlover Wednesday, Jun 12, 13 @ 3:28 pm

I think the members of this and previous general assemblies weren’t informed that there is a Baby Boomer generation.

Comment by Guessing Wednesday, Jun 12, 13 @ 4:21 pm