Latest Post | Last 10 Posts | Archives

Previous Post: Cullerton backs conference committee ideas

Next Post: Yet another twist in legislative salary case

Posted in:

* This doesn’t look too bad…

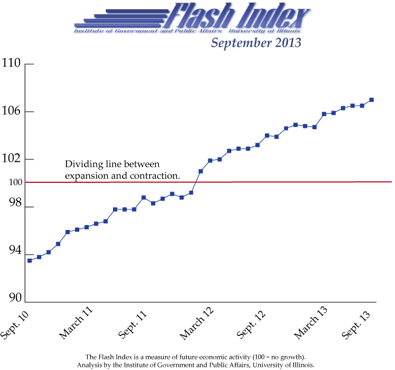

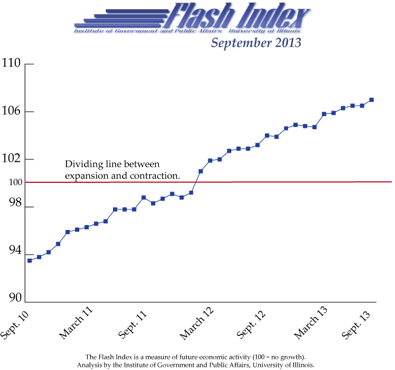

The University of Illinois flash index jumped from 106.5 in August to 107 in September — its highest level in more than six years.

The index is considered a barometer of the Illinois economy. The last time it was this high was April 2007, when the index stood at 107.4.

Generally, readings above 100 indicate the economy is growing, while readings below 100 show the economy is shrinking.

The index is a weighted average of Illinois growth rates in corporate earnings, consumer spending and personal income.

To reflect those, economist J. Fred Giertz looks at Illinois corporate income tax receipts, retail sales tax receipts and individual income tax receipts.

In September, all three components were up, when adjusted for inflation, from September 2012.

* There’s a catch, of course…

However, a disconnect remains between the unemployment rate and other measures of economic activity such as the Flash Index and GDP. The national unemployment rate has fallen over the past year, but remains well above 7 percent, which is high in comparison to past recoveries.

“Unemployment in Illinois is even more dire than the national rate,” said economist J. Fred Giertz, who compiles the index for the university’s Institute of Government and Public Affairs. “The state rate is 9.2 percent. This is the same as one year ago, and the second highest in the nation; only Nevada’s rate is higher.”

The expanding Illinois economy has not experienced sufficient growth to reabsorb the unemployed while creating jobs for new workforce entrants.

* Economic growth for the past three years has been steady, but it’s not strong enough…

* To put this into some more perspective, the highest Flash Index rating since 1981 was a robust 120.3, way back in January of 1985. The lowest was an anemic 85.9 in April of 1983.

posted by Rich Miller

Thursday, Oct 3, 13 @ 10:10 am

Sorry, comments are closed at this time.

Previous Post: Cullerton backs conference committee ideas

Next Post: Yet another twist in legislative salary case

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

=== a disconnect remains between the unemployment rate and other measures of economic activity ===

This tells us that productivity gains are not being shared across all of society but rather are being concentrated in a select minority.

Comment by Bill White Thursday, Oct 3, 13 @ 10:17 am

—

=== a disconnect remains between the unemployment rate and other measures of economic activity ===

This tells us that productivity gains are not being shared across all of society but rather are being concentrated in a select minority.

—

Or it could match the idea that we keep a corporate headquarters, but the business expands and builds new facilities else where. Now you get some increased tax revenue but no job growth here.

its not always a “evil” business thing.

Comment by RonOglesby Thursday, Oct 3, 13 @ 10:26 am

This book is a partial explanation of where I am coming from:

http://www.hmhbooks.com/newgeographyofjobs/

Comment by Bill White Thursday, Oct 3, 13 @ 10:34 am

@Bill,

might have to read it…

“In fact, Moretti has shown that for every new innovation job in a city, five additional non-innovation jobs are created, and those workers earn higher salaries than their counterparts in other urban areas.”

Comment by RonOglesby Thursday, Oct 3, 13 @ 10:41 am

There has been a lot of discussion about jobs and unemployment. I think people need to remember what a huge part of the economy the real estate industry was until the bubble burst in ‘07 or ‘08.

So many jobs were lost in this industry, and have simply not come back yet. For example, look at this article about how there has been a boost in construction jobs:

http://chicago.cbslocal.com/2013/08/12/construction-employment-in-chicago-sees-positive-turnaround-from-year-ago-levels/

This article is interesting because it cites a Bureau of Labor Statistics report that shows that there are still 60k fewer people working in construction in just the Chicago area than during the peak. That is just one part of the industry!

I think the challenges going forward will be trying to figure out how to replace these jobs with jobs in different (and more sustainable) sectors of the economy. Im not a fan of corporate welfare, but I also understand that corporations do not have to create jobs simply for the sake of employing people.

Comment by Anonymous Thursday, Oct 3, 13 @ 10:53 am

Moretti discusses how housing bubble construction jobs masked an underlying decline in traditional manufacturing jobs. When the bubble popped, employment figures collapsed.

Those high wage assembly line jobs are gone and they aren’t coming back.

===

A Keynesian might assert that re-building our crumbling infrastructure would create jobs and be an investment in our future (i.e. bridges that don’t fall down) however everyone knows Keynes was wrong. /snark

Comment by Bill White Thursday, Oct 3, 13 @ 11:01 am

Spot on Bill White. To the anti-sprawl contingent, you have opposed development outside cities, but what jobs have been created where a BS or BA is not required? Construction filled that need until 2007.

The issue is a complicated one.

Comment by Darienite Thursday, Oct 3, 13 @ 12:05 pm

This index does not tell us the state of the economy, it only tells us about the dynamics of the economy, whether it is going up or down. It is not an indicator of employment nor the level of economic production.

Illinois is still down, not able to fully use the economic capacity that businesses have. That is because of a lack of demand, not a lack of production capacity. It will be a slow recovery process, maybe a decade, without more government stimulus to jumpstart greater demand.

Comment by cod Thursday, Oct 3, 13 @ 12:11 pm

=== That is because of a lack of demand, not a lack of production capacity. ===

Yes, and a hypothetical Keynesian would argue that infrastructure projects - at a time when interest rates are low and the building trades are slow - are a terrific mechanism for decreasing unemployment and increasing aggregate demand.

But we cannot do that. Why not? Freedom!

Or maybe, Hayek!

Comment by Bill White Thursday, Oct 3, 13 @ 12:35 pm

=== A Keynesian might assert that re-building our crumbling infrastructure would create jobs and be an investment in our future ===

Keynes is a legend and a genius, as are Friedman, Hayek and many others. One need not agree with another’s conclusions to respect their work.

That said, we implemented a federal stimulus plan in February of 2009.

To help ensure job creation, Illinois then provided additional stimulus by implementing the first capital bill in over a decade.

For some reason, this combination of state and federal government spending does not appear to be having as much impact as hoped for or promised here in Illinois.

Government infrastructure spending was very effective in helping pull America out of the Great Depression. Why a double dose is proving less effective in Illinois following the Great Recession remains unexplained to the best of my knowledge.

Something is missing from this equation, and it remains unclear exactly what that is.

Comment by Formerly Known As... Thursday, Oct 3, 13 @ 12:39 pm

Perhaps, the disparity arises from the jobs that are available and the skill set and/or educational level of the unemployed. You could also add in the unwillingness or inability of individuals with a skill set without demand in Illinois to move to where there is demand.

I go back to the Clinton/Gore years when, primarily Al Gore, emphasized the future of computers in the workplace and the need to upgrade skill sets in that technology and generally. And I am amazed at how many unemployed people, mostly older, I encounter who lack rudimentary computer skills. Add in poor public education in large swaths of Illinois’ most populated area, namely Cook County, and it is not too difficult to understand the high unemployment rate.

You are not entitled to a job. You must earn it.

Comment by Cook County Commoner Thursday, Oct 3, 13 @ 1:11 pm

I think it shows that businesses have learned to do more with less people.

I think the recent econimic collapse made businesses look real hard at where they might have surplus.

And I think we have all seen this but we have gotten used to it over the last couple years so it isn’t glaring. I have found that many businesses where I used to be able to find a clerk readily, it is now a little harder. I have been in many stores where the stock on the shelves is not what it used to be. Many times I have been in our local WalMart and not been able to find several things I needed because they were out of stock.

Comment by Irish Thursday, Oct 3, 13 @ 2:04 pm

@Cook County Commoner - interesting points. The availability of jobs and willingness to relocate are likely factors, as are disparities in skills and education.

I tend to think there is another element of human failure at work here, this one on the bureaucratic and political level.

Just as it was during the stimulus programs of the Great Depressions, the money is still green. The roads are still paved with asphalt and the buildings still constructed with brick. Those things have remained fairly constant.

The weak link is the human element. Poor planning, targeting, oversight and implementation seems a possible explanation.

Putting money in the stimulus package to buy flat screen tvs for the State Department and similar expenditures were less than “stimulating” ways of spending the cash. It seems the government spending during the Great Depression was more strictly focused and directly targeted on the goal of hiring people to work and do very specific jobs. Build that dam. Repair that road. Clear that path.

It seems doubtful that spending on foreign made tvs or overseas research programs studying exotic ants would have made it through the domestic stimulus program during the Great Depression.

And while “pork” spending has always been around, a fair bit of the spending this time wasn’t even pork that created lasting jobs or research that lead to broader advancements in technology or medicine.

Would spending those billions instead on projects targeting infrastructure, as in the Great Depression, have made a major difference in today’s unemployment rate? There is no way to know for certain.

We do, however, know for certain that there is a major difference in the nature of spending projects approved in the Great Recession stimulus as compared to the Great Depression stimulus.

Politicians making different spending choices may = different levels of stimulus impact.

Comment by Formerly Known As... Thursday, Oct 3, 13 @ 2:11 pm

FKA,

You have to realize this is a different world than the Great Depression days. Globalization, outsourcing, cheap labor, laxed environmental controls, etc. are all a factor today where it wasn’t so much the case back then. Im not saying that better decisions can’t be made. Im’m just saying its sorta like comparing apples and oranges.

Comment by Anonymous Thursday, Oct 3, 13 @ 2:20 pm

@Anonymous - valid points. We are a more global, connected society than back then.

I think that’s why some of the research projects are just as surprising as some of the construction projects. Replacing windows on a building abandoned in 2007 seems just as odd as photographing and cataloging a foreign ant species; at least, that is how it seems when the goal is to create jobs via construction or research leading to tech and med breakthroughs (thus creating more jobs).

That is not to say there weren’t many effective projects this time around. I just wonder if those unusual projects might have helped us get over the economic recovery “tipping point” had they been focused more directly on the core goal of creating jobs.

@Irish - also good points. I have noticed the same in a number of stores. Places sacrificed customer service and haven’t brought those employees back yet. For now, it’s just us searching the aisles and hunting shelves on our own.

There is also some great analysis out there concerning the conflict between technology and reduced staffing requirements.

Comment by Formerly Known As... Thursday, Oct 3, 13 @ 3:34 pm

Much of the growth in the United States right now is tied to the energy boom, of which we are not yet a direct participant.

It’s led to a boom in truck sales, too. Ford is making a fortune off the F-Series, as are GM and Chrysler on their pickups. Those are high-margin vehicles.

Comment by wordslinger Thursday, Oct 3, 13 @ 3:52 pm

“Steady as she goes!” So not so bad, Captain Quinn…arrrrgh…!(And yet, as noted already, not overly impressive either).

Comment by Just The Way It Is One Thursday, Oct 3, 13 @ 9:44 pm

It’s worth posting again: Coyote Logistics in Illinois, startup to $800 million revenue in seven years.

Brains and hustle, it can happen here. It’s not like the trucking business is an easy racket.

http://roadshow.slate.com/how-chicagos-coyote-logistics-went-from-startup-to-the-middle-market/

Comment by wordslinger Thursday, Oct 3, 13 @ 11:24 pm