Latest Post | Last 10 Posts | Archives

Previous Post: Jackson tried to report to prison early, turned away, now in custody

Next Post: Bulldozer in a china shop

Posted in:

* SJ-R…

A new study predicts the state will continue to face deficits for years to come even if the temporary income tax increase is made permanent.

If a major portion of the tax hike is allowed to expire at the end of 2014 as the law now stipulates, the problems will be even worse, says the Fiscal Futures Project of the Institute for Government and Public Affairs.

“It seems clear that Illinois’ current revenue and spending policies are unsustainable,” the report concludes. “Illinois has a chronic structural fiscal problem and must either take action to reduce spending, increase revenue, or some combination to avoid fiscal imbalances for years to come.” […]

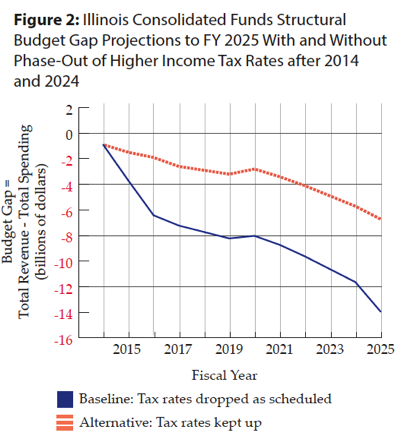

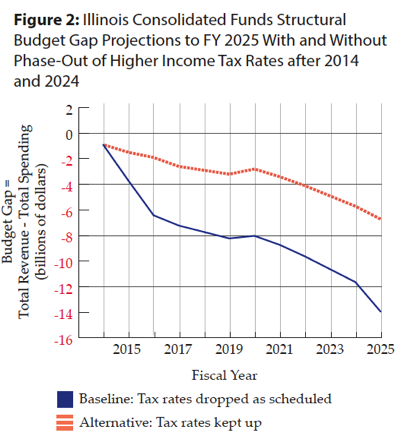

If the rates are allowed to drop, the report predicts the state’s deficit will increase by $13 billion by the year 2025, based on estimates of state revenue growth and spending. However, even if the tax hike is made permanent, the report concludes that the state’s deficit will increase by more than $6 billion over the same period.

Those would be annual deficit numbers, not accumulated debt. So, we’re looking at a $13 billion a year deficit by 2025 without the tax hike, but a $6 billion a year deficit if the tax hike stands.

* The full report is here. A handy graph…

In other words, if you read the report you’ll see that if the income tax is made permanent, there is still a lot of cuts which will need to be made, but if those cuts are made early it is somewhat manageable, although still quite painful. Significant baseline spending will have to be cut (even above and beyond what they do with pensions, if anything) and the growth of all spending will have to be extremely limited.

If the tax hike is allowed to expire, however, the cuts will have to be gigantic - the annual deficit in FY 2016 alone will be close to $7 billion.

…Adding… Fiscal and economic news roundup…

* State prisons’ overtime costs jump 34 percent

* Quinn is asking lawmakers for additional money

* Police, fire pensions face underfunding

* Moody’s downgrades CTA’s credit rating

* Strong increase in U of I Flash Index signals economic growth, but unemployment remains unchanged

* Where the housing recovery is only a faint hope: Prices in some south suburbs have dropped to where they were in 1992

posted by Rich Miller

Tuesday, Oct 29, 13 @ 11:08 am

Sorry, comments are closed at this time.

Previous Post: Jackson tried to report to prison early, turned away, now in custody

Next Post: Bulldozer in a china shop

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

PQ - “I intend to appooint a blue ribbon panel to study this matter. Whew, that should buy me some time until after the election.”

Comment by Darienite Tuesday, Oct 29, 13 @ 11:14 am

Isn’t “structural” the key word here? If one listens to Ralph Martire, our tax policy is based upon a “goods and services” economy…we are service-oriented and have been for some time, now. We will never catch up without completely changing the tax policy!

Comment by southof80 Tuesday, Oct 29, 13 @ 11:20 am

Hard enough to row upstream, without going down steep rapids.

And people claim there’s no “fiscal emergency?”

Comment by walkinfool Tuesday, Oct 29, 13 @ 11:22 am

So, Cullerton was right. There is no “Pension Crisis”, it’s just a plain old “Budget Crisis”. Whew, I was worried.

Comment by Bogart Tuesday, Oct 29, 13 @ 11:27 am

Obviously the tax increase is necessary, but maybe PQ and the legislature should’ve tried big cuts first and big taxes later. They might have even been able to get a bigger (and necessary) tax increase. Should’ve done it like Jerry Brown.

Comment by Precinct Captain Tuesday, Oct 29, 13 @ 11:44 am

Time for the fair tax amendment.

Comment by Reality Check Tuesday, Oct 29, 13 @ 11:46 am

Seems the PR machine is up and running to keep the “Temporary” tax increase.

Fixing the states horrible workers comp laws would help grow the economy. Passing the gambling expansion for a casino in Chicago, south suburbs and downstate with video gaming at midway & O hare would help boost revenue. Then maybe Cullerton and Madigan can try and be honest for the first time about taxes and services.

Comment by Fed up Tuesday, Oct 29, 13 @ 11:51 am

===Seems the PR machine is up and running to keep the “Temporary” tax increase.===

You mean as opposed to the pr machine of IPI and the Civies that we’ve been subject to for years that has been blaming our debt problem on pensions? Yep, I agree with you about those PR machines. Unfortunately, they can be used to obfuscate the true problems that this state faces in the name of ideological vendettas. Those ideological vendettas seem to be the political soup du jour on a variety of fronts lately. How’s that been workin for us?

Fixing the pension ramp and the funded percentage targets would alliviate a lot of the deficit pressure, but truly reforming state revenue policy is the fix that is needed to fix the structural deficit problem. Martire has been proved right as time goes on here. Maybe his ideas ought to finally be given a reasonable look-see huh?

Comment by PublicServant Tuesday, Oct 29, 13 @ 12:12 pm

Cost shift anyone?

Comment by Ubecha Tuesday, Oct 29, 13 @ 12:13 pm

I think the term pension “crisis” means that those in the pension funds are finally onto the fact that they’ve been ripped off and are expected to continue to be ripped off ala providing freebies to everyone courtesy of their retirement savings so that no one will have increased taxes. That’s probably the crisis according to the civvies. Darn, we had a good thing going.

Comment by Anonymous Tuesday, Oct 29, 13 @ 12:25 pm

REALITY

What is this “Fair Tax Amendment” you mentioned?

Please explain.

Comment by MOON Tuesday, Oct 29, 13 @ 12:26 pm

Just more support for my long held contention that the temp income tax needs to be reinstated at a higher level than today or that we need to explore additional revenue sources.

Comment by RNUG Tuesday, Oct 29, 13 @ 12:28 pm

Moon,

That is another name for a graduated income tax. Ralph Martire and his CTBA have a proposal on their web site. They also have a lot of other good budget analysis.

http://www.ctbaonline.org/

Comment by RNUG Tuesday, Oct 29, 13 @ 12:31 pm

Precinct Captain

Brown has done an excellent job in CA, but let’s not forget their state constitution doesn’t protect government pensions. That made things easier for him.

Comment by Anyone Remember? Tuesday, Oct 29, 13 @ 12:52 pm

When I read the stories about various cities with police and firefighter pension fund problems, my first thought is why aren’t those organizations part of IMRF?

Comment by RNUG Tuesday, Oct 29, 13 @ 12:54 pm

@Anyone Remember - CA pension reform only affected new hires, we did that here in 2010. Pensions aren’t the Illinois problem, they’re the victim.

Comment by PublicServant Tuesday, Oct 29, 13 @ 12:56 pm

Anyone Remember? @ 12:52 pm:

The other thing CA did was make thier tax increase permanent.

Comment by RNUG Tuesday, Oct 29, 13 @ 1:02 pm

RNUG

Why is a graduated income tax called a “Fair Tax”?

I agree it would tax the higher income people more

but what makes that a “Fair Tax”? Under the present system the more you make the more yuo pay.

The correct label for the so called Fair Tax is the “Redistribution Tax”. In other words take from those who have and give it to those who have not.

Comment by MOON Tuesday, Oct 29, 13 @ 1:06 pm

Moon,

I didn’t put the label on it. Ask the people that did.

As far as the tax goes, there are two different opinions on tax “fairness”. One school, usually the wealthy / conservative, believes in a flat percentage. The other school, usually the progessive / poor, believes in a progessive percentage.

Regardless of personal opinion, in a lot of states and at the federal level, the decision was to use a progessive tax. Of course, at the federal level, if you know your tax history, originally it was only aimed at the “rich” and it was never going to be higher than “x%”.

Comment by RNUG Tuesday, Oct 29, 13 @ 1:26 pm

Moon, wouldn’t that label apply to a flat tax too, according to your definition? Redistribution occurs in many forms. Studies show that almost all of the gains in wealth over the past decade at least, have gone to the top 1 percent, while the other 99% wages and salaries have been either stagnant or falling relative to inflation. Redistribution from the poor and middle class to the rich is already occuring.

People at lower income levels don’t have the wherewithal to save. They spend 100% of their income on goods and services. Their spending is your income. Thus the multiplier effect of spending. Every additional dollar earned above a certain threshold doesn’t contribute to the economy as it would if earned by a lower income individual because it increasingly isn’t needed to support current consumption, so taxing those marginal dollars as a graduated income tax would hurts the economy less. In addition, the more you’ve marginally benefitted from US society the greater your marginal burden should be. Thus many people’s conclusion that a progressive income tax is a fair tax. Now that’s not a radical idea. Most states have progressive income taxes. CTBA has charts that show what our Gross State income tax revenue would be if Illinois adopted the tax structure of any one of our neighboring Midwestern states. Even allowing for some individual relocation, the revenue that would be generated would more than solve the current structural deficit, and lower the tax burden for many in the lower and middle classes in this state. Check it out at CTBAOnline.ORG. Look for “The case for creating a graduated income tax in Illinois”.

Comment by PublicServant Tuesday, Oct 29, 13 @ 1:30 pm

Combine the flat and progressive concepts to produce the same result - set a flat rate but have a large exemption such that the low income pay nothing. For example, maybe the rate is 7% but $12k per person is exempted. A family of 4 earning less than $48k would owe no tax and even that same family making $96k would have a 3.5% effective rate. It’s flat but still accomplishes the goal of a progressive tax to remove the tax burden from those at or near poverty. And it has the added benefit of not requiring a constitutional amendment.

Comment by thechampaignlife Tuesday, Oct 29, 13 @ 1:36 pm

In addition, 5% is a relatively low tax rate compared to others. Yes, 7 states have no state income tax (of FIFTY!) but having friends living in those states–that income has to generated somewhere. Usually it’s property taxes that are much higher. That would be getting higher amounts of taxation from wealthier property owners…….. If Illinois allows the temporary tax to expire, we’ll be one of the absolute lowest tax states of those who have state tax. A state that says we are broke. Wonder why.

Comment by Anonymous Tuesday, Oct 29, 13 @ 1:37 pm

==Why is a graduated income tax called a “Fair Tax”?==

Let’s say a family has a $20,000 taxable income for Illinois income tax purposes. With Illinois’ 5% rate, they will pay $1000 in state taxes, and have $19,000 left over for housing, transportation, food, sending their kids to school etc. That $1000 tax payments makes a huge difference in their lives.

On the other hand, a family that has a $200,000 taxable Illinois income, with the 5% flat tax will pay $10,000 in state income taxes and have $190,000 left over for everything else. That $10,000 in taxes is mainly a small inconvenience in their lives, when they still have $190,000 left over.

The flat tax hurts those with low and moderate incomes more than it does those with high incomes. This could be even more so, if Illinois would eventually just raise their flat tax rather than go to a progressive tax structure. 34 of the 41 states that have state income taxes, have progressive tax rates, including our neighboring states of Wisconsin, Iowa, Missouri, and Kentucky.

Comment by Joe M Tuesday, Oct 29, 13 @ 1:43 pm

==In other words take from those who have and give it to those who have not. ==

Ugh, I hate it when these sorts of talking points pop up on this blog.

Taxes are all redistributive in one form or another.

Comment by Demoralized Tuesday, Oct 29, 13 @ 1:58 pm

But I thought this was just supposed to be a 1% surcharge for education?

At least, that’s what Governor Quinn told me.

Comment by Formerly Known As... Tuesday, Oct 29, 13 @ 1:59 pm

SO, they clearly need to keep the tax hike permanent. But I’ve thought for a long time that three percent was way too low; I was astounded when Blago made his no new taxes pledge in the 2002 campaign, and horrified when he kept it. Perhaps it’s time that some budgetary cod liver oil was swallowed all around, on taxes, on pensions, on revenue sharing, on everything.

Comment by Angry Chicagoan Tuesday, Oct 29, 13 @ 2:11 pm

Perhaps Elizabeth Warren described it best, when she described it the social contract. And some people are in a better position to contribute as part of that social contract than others are.

“There is nobody in this country who got rich on their own. Nobody. You built a factory out there - good for you. But I want to be clear. You moved your goods to market on roads the rest of us paid for. You hired workers the rest of us paid to educate. You were safe in your factory because of police forces and fire forces that the rest of us paid for. You didn’t have to worry that marauding bands would come and seize everything at your factory… Now look. You built a factory and it turned into something terrific or a great idea - God bless! Keep a hunk of it. But part of the underlying social contract is you take a hunk of that and pay forward for the next kid who comes along.” - Elizabeth Warren

Comment by Joe M Tuesday, Oct 29, 13 @ 2:15 pm

Elizabeth Warren is a Socialist. I want no part of her ideas.

A person who pays $10,000 in taxes vs. someone who pays $1,000 in taxes has more than fulfilled his obligation. In other words he has met his “Social Contract” obligation.

Comment by MOON Tuesday, Oct 29, 13 @ 2:26 pm

Elizabeth Warren says a lot of things.

www.cbsnews.com/8301-503544_162-57444534-503544/warren-concedes-she-told-harvard-and-penn-about-native-american-ancestry/

The question is, does she say things with your benefit in mind? Or her own personal and political benefit?

She does a very good job, like most politicians, of playing to her base and saying what will get her elected.

Comment by Formerly Known As... Tuesday, Oct 29, 13 @ 2:37 pm

The Fire and Police Unions want it that way (thus the GA obliges). The idea was recently floated for state-wide systems for the two to make more efficient investment decisions and create a larger pool, but the unions prefer the local control and got the masses all worked up about it. They fear the State will try to take/borrow from state-wide pensions (Blago tried to swallow IMRF into the State pension pool before). Meanwhile, IMRF is the best run plan in the State and cities and counties are obliged to contribute and yet no one wants to emulate it. Go figure.

RNUG - Tuesday, Oct 29, 13 @ 12:54 pm:

When I read the stories about various cities with police and firefighter pension fund problems, my first thought is why aren’t those organizations part of IMRF?

Comment by Shemp Tuesday, Oct 29, 13 @ 2:39 pm

Enough about Warren. Back to the topic, please.

Comment by Rich Miller Tuesday, Oct 29, 13 @ 2:39 pm

If Illinois had the same graduated income tax rates as New York, California, or even Wisconsin, our State’s deficits would vanish. It is simple, and it is what needs to be done.

The only real blockage to this simple solution are the members of the Civic Committee and their excessive wealth, a few crumbs of which are “invested” in campaign causes. That unfair influence is the problem.

This so-called “scholarly” institute is revealed, by their position on converting pension plans to defined contribution plans, as being under the influence of the financial industry, which is desperate to get their hands on that money.

Comment by cod Tuesday, Oct 29, 13 @ 2:41 pm

Every reporter should have this to put in front of any candidate who says they are going to let the tax increase expire and ask them which 30% of the budget they are going to cut to make up for the revenue loss.

Comment by Demoralized Tuesday, Oct 29, 13 @ 2:44 pm

Shemp @ 2:39 pm:

It’s not universal in LE; only some of the LE systems have opted out of IMRF. A close friend is retired from both city and county LE and he was part of IMRF. And you’re right, IMRF is the best funded … primarily because the municipalities couldn’t skip the payments into it.

As far as I’m concerned, the ones who opted like Chicago and the Quad Cities simply wanted skip paying their pension obligations.

Comment by RNUG Tuesday, Oct 29, 13 @ 2:53 pm

MOON,

OK, you don’t want a graduated income tax. So, given that the State:

a) legally owes the $100B to the pension funds

b) has about $7B in backlogged bills

c) underfunds schools by at least 15%

d) has a structural deficit of about $10B that just gets shuffled from FY to FY via slight of hand

e) has cut budgets about 10% each of the last 2 years

f) is losing about $5B annually with the temp income tax sunsetting

What is your solution for the state’s revenue problems?

Comment by RNUG Tuesday, Oct 29, 13 @ 3:04 pm

RNUG

The income tax rate should not be cut.

I am not as sure as you that $100B is “legally owed” the pension fund. Also the pension funds should be changed to 401k’s.

Local school districts should be resposible for the funding of teachers pensions.This also applys to community colleges.

Comment by MOON Tuesday, Oct 29, 13 @ 3:16 pm

More reasons for a graduated income tax:

Average household income gains since 2009:

Lowest 5th of U.S. households: -0.8%

Second 5th of U.S. households: -1.2%

Third 5th of U.S. households: -1.2%

Fourth 5th of U.S. households: -1.2%

Top 5th of U.S. households: +2.0%

Top 5% of U.S. households: +5.2%

And this trend has continued since the 1960’s

http://www.census.gov/hhes/www/income/data/historical/household/index.html

Comment by Joe M Tuesday, Oct 29, 13 @ 3:16 pm

I can’t imagine there is any “news” in that study to anyone who reads this blog, or to anyone who pays much attention to state government in general. Duh!

Comment by steve schnorf Tuesday, Oct 29, 13 @ 3:19 pm

MOON @ 3:16 pm:

One of the outcomes of IFT (1975) was a conclusion by the ISC that, while the state could fund the pensions any way the state wanted to, the pensions have to be paid when due.

Comment by RNUG Tuesday, Oct 29, 13 @ 3:20 pm

RNUG, Don’t forget about the 70B we owe to bondholders.

Comment by PublicServant Tuesday, Oct 29, 13 @ 3:21 pm

JOE M

Your numbers may be correct.

If you are looking for the reason why, consider who is in the White House. By the way Obama has never seen a tax increase he did not like.

Comment by MOON Tuesday, Oct 29, 13 @ 3:21 pm

yes, moon, Obama is definitely to blame for Illinois’ fiscal problems. Now just rest for a while, OK? (who is this guy anyway?)

Comment by steve schnorf Tuesday, Oct 29, 13 @ 3:27 pm

MOON @ 3:16 pm:

Also, other ISC decisions have upheld current rules for existing employeees, so your proposed 401K change has to be either voluntary or only for new employees (some employees already have a 401K option). If voluntary, since the State can’t pay back the missing funds now, where will the State get the money to do a “conversion” to place all the currently owed money in the 401Ks? And going the 401K route will also require the state to start paying into SS for the roughly 70% (all TRS / about half SURS / a few SERS) that are currently SS exempt.

I assume you want a typical 401K with employer match. The State hasn’t been able to do a 4% or 8% match in the past but now you want the state to do that match plus pay 6.2% employer match to SS …

Yep, that’s going to save the state money …

Comment by RNUG Tuesday, Oct 29, 13 @ 3:32 pm

PublicServant @ 3:21 pm:

Thanks. I forgot that one because it’s pretty much guaranteed it will get paid come hell or high water.

Comment by RNUG Tuesday, Oct 29, 13 @ 3:34 pm

steve,

I agree it’s old news to most of us … but now the public is starting to get the picture.

Comment by RNUG Tuesday, Oct 29, 13 @ 3:35 pm

Moon,

The current president hasn’t been in the White House since the 1960s.

“And this trend has continued since the 1960’s”

http://www.census.gov/hhes/www/income/data/historical/household/index.html”

Why don’t you take a look at the Census Bureau’s figures?

Comment by Joe M Tuesday, Oct 29, 13 @ 3:35 pm

Steve

The reason the economy is doing so poorly is a result of Obama and the Dem. senators and reps social agenda.With the correct policies the economy would be in much better shape.

Comment by MOON Tuesday, Oct 29, 13 @ 3:37 pm

Joe, facts and figures just confuse the world that MOON inhabits ok. Oh, and you’re a socialist too!

Comment by PublicServant Tuesday, Oct 29, 13 @ 3:39 pm

Here is another radical idea. The “Flip it to Fix It” folks point out that those in Illinois in the bottom 20% of income, pay 13% of their income to state and local taxes.

Those in the top 20% pay 6.2% of their income to state and local taxes. If the middle 60% were left alone, and the bottom and tops percentages were changed, it would generate an additional $30 billion annually in revenue for state and local government.

Comment by Joe M Tuesday, Oct 29, 13 @ 3:45 pm

JOE/PUBLIC SERVANT

If my memory is correct the “Great Society” started under Pres. Johnsonin the 60’s. That is when the “War on Poverty” started. Then the free handouts started for the lower 40 or so percent of the population. The attitude of many of these people is why work when its free.

Comment by MOON Tuesday, Oct 29, 13 @ 3:49 pm

RNUG: It’s universal for cities over 5,000 in population. Cities don’t get to choose to skip IMRF for fire and police, they must: (40 ILCS 5/3-101 and 103)

http://www.ilga.gov/legislation/ilcs/ilcs4.asp?DocName=004000050HArt.+3&ActID=638&ChapterID=9&SeqStart=15700000&SeqEnd=24100000

It’s not universal in LE; only some of the LE systems have opted out of IMRF. A close friend is retired from both city and county LE and he was part of IMRF.

As far as I’m concerned, the ones who opted like Chicago and the Quad Cities simply wanted skip paying their pension obligations.

Comment by Shemp Tuesday, Oct 29, 13 @ 3:52 pm

MOON @ 3:16 pm:

Let’s go back to basics. Both lines go down on the chart. That means that, even if the current temp income tax is extended, that is NOT enough and the state still will NOT take in enough money to meet all the bills? And that the chart shows that the problem just gets worse every year? In order for the line to remain level or go up on the chart (and we want it to go up so we can pay off some of the backlog of bills), income tax rates need to be HIGHER than today.

Comment by RNUG Tuesday, Oct 29, 13 @ 3:58 pm

Shemp @ 3:52 pm:

Thanks. Goes to prove I learn something new almost every day about the pensions.

My friend worked for a small town that, when he started, it was probably under 5,000. It’s not that far over 5,000 today. Later he worked for the county, which he retired from.

Comment by RNUG Tuesday, Oct 29, 13 @ 4:04 pm

RNUG

Let me ask you a question. When your expenses exceed your income what do you do?

When I am in a similar position I cut my expenses.

Comment by MOON Tuesday, Oct 29, 13 @ 4:09 pm

RNUG

Your solution is to knock on your neighbors doors and tell them you are broke and they must solve your problem.

Comment by MOON Tuesday, Oct 29, 13 @ 4:18 pm

@MOON:

I’m all ears for your ideas on how to cut $14 BILLION from the budget. And please stop with the partisan talking points. Thanks.

Comment by Demoralized Tuesday, Oct 29, 13 @ 4:25 pm

@MOON:

I’m all ears for your ideas on how to cut $14 BILLION from the budget. And please stop with the partisan talking points. Thanks.

Comment by Demoralized Tuesday, Oct 29, 13 @ 4:25 pm

Joe M — What Warren and the president said about how “you didn’t build that” sounds nice, but as an argument for higher taxation, it doesn’t hold up to any kind of analysis. I have the exact same access to those roads and that educated work force, and everything else (including my own public education), but I didn’t have a million-dollary concept or build a million-dollar business. I would suggest that the reason Bill Gates makes a lot more than my 6-figure salary is because he is giving his customers (and society) a lot more than I give for my salary. The difference is due to what he built compared to what I built.

Comment by Anon. Tuesday, Oct 29, 13 @ 4:27 pm

–Let me ask you a question. When your expenses exceed your income what do you do?

When I am in a similar position I cut my expenses. –

My, aren’t we full of folksy homilies today. Socialism, the Great Society handouts, you’re bringing a lot to the table.

How do you propose paying for your 401K Plan? Green stamps, or do you have a big jar of pennies in the basement?

Comment by wordslinger Tuesday, Oct 29, 13 @ 4:29 pm

DEMORALIZED

I refer you to my posts of 3:26, 4:09 AND 4:18.

I do not know what you mean by partisan talking points

Comment by MOON Tuesday, Oct 29, 13 @ 4:31 pm

MOON,

In my case, I cut expenses where I can, pay the bills I am contractually obligated to pay, delay what I can delay, and increase income if I can.

The state has cut expenses at least 10% each of the last two years. The problem is there isn’t much still left to cut in the state budget. Note: most welfare is federal pass-thru money. Things like the pensions and bonds are contracts that must be honored. And that’s not me saying it, that is the state and federal contract clauses, the ISC and SCOTUS. And the state has done such a good job of delaying things that vendors get paid up to a year late. So I don’t see a lot of wiggle room left for those actions.

The problem, as every study has shown, is for many years the state refused to raise revenue and papered over the deficits by not making the full pension payments, in effect, borrowing from those funds. I could list each Gov and what they did or didn’t do, but the people here know that litinay. If you don’t, I’ll cite Rich’s line: “Google is your friend”.

The pension “crisis” today was pretty much brought about by Quinn’s determination to actually pay the (1995 ramp) scheduled pension fund payments in full every year he has controlled the budget. It is now coming to a head because revenue will be dropping off next fiscal year (FY15, which runs from July 1 2014 to June 30 2015) when the temp income tax expires.

I’ll go back to my original question. There is a list of the state debts. You can find the state budget online. Where are you going to cut or where are you going to raise the revenue? Be specific … there are plenty of knowledgable people here who can run the numbers. Heck, we’ve even got one of the former BoB Directors …

Comment by RNUG Tuesday, Oct 29, 13 @ 4:31 pm

==What Warren and the president said about how “you didn’t build that” sounds nice==

I see that we are still on ridiculous talking points on this particular topic.

==I would suggest that the reason Bill Gates makes a lot more than my 6-figure salary is because he is giving his customers (and society) a lot more than I give for my salary. ==

I disagree that somebody like Bill Gates or others that have money are providing more to society than you or I. Money doesn’t determine who is more beneficial to society.

Comment by Demoralized Tuesday, Oct 29, 13 @ 4:34 pm

==I do not know what you mean by partisan talking points ==

Oh please. I’m not sure how many times you can blame the woes of society on Obama and the Democrats, especially in the case of Illinois where, if you knew any history whatsoever, you would know that we are pretty equal opportunity in this state as far as state finances go.

Comment by Demoralized Tuesday, Oct 29, 13 @ 4:37 pm

@MOON:

Also, we are still waiting for your list of cuts that add up to $14 billion.

Thanks.

Comment by Demoralized Tuesday, Oct 29, 13 @ 4:38 pm

RNUG

I refer you to my post 3:16.

I must admit, I cannot remember when I have had as much fun on this blog. I thank all of you who have responded to my posts.

Comment by MOON Tuesday, Oct 29, 13 @ 4:38 pm

Moon,

Where are your numbers? I know them but apparently you don’t. Keeping the income tax still leaves you short. Shifting the normal (annual) cost of the TRS / half SURS pensions doesn’t plug the gap for more than one year.

I repeat, what are you going to cut or where are you going to raise revenue?

Comment by RNUG Tuesday, Oct 29, 13 @ 4:47 pm

RNUG

I will make it as simple as possible so you can understand. In addition to my post of 3:16 I would cut across the board whatever is needed.

You are aware of the term sequester. Those cuts have had little impact on the economy so the cuts across the board I am proposing are similar.

What don’t you understand?

Comment by MOON Tuesday, Oct 29, 13 @ 4:52 pm

PublicServant

Municipalities in CA can skip payments to CalPERS, whereas in IL municipalities who don’t pay IMRF have their state aid intercepted by the Comptroller and forwarded to IMRF to satisfy any amount owed.

Comment by Anyone Remember? Tuesday, Oct 29, 13 @ 4:57 pm

–You are aware of the term sequester. Those cuts have had little impact on the economy so the cuts across the board I am proposing are similar.–

You live in a dream world.

http://thehill.com/blogs/on-the-money/budget/313555-cbo-sequester-cuts-would-cost-16m-jobs-through-2014

Comment by wordslinger Tuesday, Oct 29, 13 @ 4:59 pm

Moon,

What I understand is you refuse to discuss the specific numbers and the specific cuts, instead falling back on “cut everywhere”. I’ve stated your cuts don’t add up; prove they do.

Comment by RNUG Tuesday, Oct 29, 13 @ 5:26 pm

**==I would suggest that the reason Bill Gates makes a lot more than my 6-figure salary is because he is giving his customers (and society) a lot more than I give for my salary. ==

I disagree that somebody like Bill Gates or others that have money are providing more to society than you or I. Money doesn’t determine who is more beneficial to society.**

Yeah, people just give Gates money because of his nice smile. If you don’t like using Gates as an example, try doctors. There is a reason people give them more money for what they do than they give to the person working the counter at a fast food place — the doctor is giving them greater value.

Comment by Anon. Tuesday, Oct 29, 13 @ 9:26 pm

Bill Gates makes a lot because he had the vision to ride a wave of computing change. He built the company and made it integral to business and personal needs. He’s also paid a lot of taxes.

Bill Gates is a bad example if you’re trying to show the rich don’t uphold their “social contract”. He and his wife give away a lot of their money to their charitable foundation; think the total is up to about $28B donated so far.

Comment by RNUG Tuesday, Oct 29, 13 @ 10:11 pm

MOON, Bill Gates thinks you’re a chump.

–In an interview with the BBC, the co-founder and Chairman of Microsoft said Obama’s revival of the so-called “Buffett Rule” — named after his friend, billionaire Warren Buffett, who has spoken out against a tax code he says favors the wealthiest Americans - is necessary to pay down the country’s formidable budget deficit.

“The United States has a huge budget deficit, so taxes are going to have to go up. I certainly agree that they should have to go up more on the rich than everyone else. That’s just justice,” Gates said.–

http://www.foxbusiness.com/technology/2012/01/25/bill-gates-says-higher-taxes-on-wealthy-is-justice/

Comment by wordslinger Tuesday, Oct 29, 13 @ 10:57 pm

And pointing out what is just to people like MOON may be his biggest societal gift.

Comment by PublicServant Wednesday, Oct 30, 13 @ 8:55 am

Possible solutions to generate income for Illinois:

1) Extend the time to increase pension funding to 100 %. Funding it by 2045 was an arbitrary year. Noone knew we would go through the “great recession”, equivalent to the depression of the 30s. Why not set it to a more manageable year; however, insure that the pension payments are fully funded and no more pension “holidays” can be enacted. Also, this allows the new Tier II pension savings to be realized.

2) Enact state taxes on the service industry. A complete evaluation of this was done by the CGFA at the following link:

http://cgfa.ilga.gov/upload/servicetaxes2011update.pdf

3) Keep the current income tax percentage the same and/or increase the sales tax. Quite simply, if you can’t afford to buy an item because of the increased sales tax, you won’t buy it. More of a “fair” tax. Take a look around next time you are out and notice how many of the younger generation have iphones and android phones with all the options. Is this a necessity? No! These same young people are getting food stamps and state aid which enable them to pay the high monthly payments for these phones. Being retired, I can’t even afford this type of cell phone. Kind of sent off on a tangent. Sorry.

Comment by Mix_It_Up Wednesday, Oct 30, 13 @ 10:35 am