Latest Post | Last 10 Posts | Archives

Previous Post: Question of the day

Next Post: Moody’s likes the new pension law

Posted in:

* University of Illinois President Robert Easter sent a “Dear colleague” e-mail this week outlining a possible new supplemental retirement program for university employees…

The changes made to reduce the cost of the pension systems to the state and fully fund them within 30 years falls, to a large extent, on employees and retirees, including those of us at the University of Illinois. We are keenly aware of the negative impact of these changes for all of us in the university community and are committed to maintaining a competitive retirement program.

To this end we are exploring potential options including a supplemental retirement plan offered by the University. We expect to be able to provide additional information in time for the Board of Trustees meeting in January.

* Meanwhile, let’s take a look at some other pension-related stuff. Bruce Rauner tweeted this after the governor signed the pension bill into law…

Not surprising that a flawed, insider deal crafted behind closed doors is signed behind closed doors too. #twill #BringBackIL

— Bruce Rauner (@BruceRauner) December 5, 2013

Did [Sen. Linda Holmes], a Democrat, believe that politics were at play to give Democrat Quinn a re-election bump?

“On the political end, I think this was done to give the governor a win,” she said. “And I don’t think that’s worth forsaking benefits for anybody.”

* Treasurer Dan Rutherford opposed the bill on constitutional grounds. The impact on Rutherford’s pocketbook is significant, however…

The Republican from Chenoa said he has not taken the time to calculate the effects of the landmark legislation on his own pocketbook.

“I’ve been busy looking at the constitutionality of it,” Rutherford said.

But, according to a database created by the Center for Tax and Budget Accountability, Rutherford could see a significant loss in buying power if the pension proposal goes into effect next year.

If he were to retire next year, Rutherford would receive a pension worth about $115,000, based on his current $135,600 salary. While that amount will grow on a yearly basis, the database shows the pension changes would decrease the amount of growth by $44,800 in the first five years.

After 15 years, the database shows Rutherford would see $392,000 less than he would under the current pension setup. Two decades from now the projected loss would be $719,000.

The online database — http://www.weareoneillinois.org/documents/COLA-cut-spreadsheet.xlsx — is designed to show current state employees and retirees how a reduction in the state’s current 3 percent cost-of-living adjustment would affect worker pensions over a period of years.

* As Eric Zorn points out, Arizona has been waiting a very long time for the courts to rule on a state pension reform law…

In February, 2012, Maricopa County Superior Court Judge Eileen Willett issued a stinging rebuke to the legislature, declaring a key reform element unconstitutional in an action that had been filed by a group of schoolteachers.

“When the plaintiffs were hired as teachers, they entered a contractual relationship with the state regarding the public retirement system of which they became members,” said Willett’s written opinion. “Their retirement benefits were a valuable part of the consideration offered by their employers upon which the teachers relied when accepting employment.” […]

In May 2012, the state lost again in court, this time when Maricopa County Superior Court Judge John Buttrick used a similar constitutional rationale when ruling if favor of judicial retirees who’d challenged changes in the cost-of-living formula that was part of the pension-reform effort.

That case was fast-tracked to the Arizona Supreme Court on appeal, and three other legal challenges to the reforms were put on hold pending the outcome. But despite the attempted hurry-up, the justices didn’t hear oral argument in the case until June of this year and have yet to issue their ruling.

More than two and a half years after Arizona took the step that Illinois took this week, the reforms remain in legal limbo.

* Illinois Supreme Court Chief Justice Rita Garman was asked this week about pension reform…

News conferences — let alone a media scrum — are rare for a Supreme Court justice.

Maybe that’s due to the tensions between a judge’s analytical nature, the fact that they typically don’t comment on pending or potential litigation and the answer-me-now inquiries reporters can feel compelled to ask — something that showed up in the third question Garman faced.

“You’re coming in at a time when a potential pension case could come up,” one of the reporters stated. “How is that going to — what kind of dynamic will that mean?”

Behind Garman, the court’s spokesman bristled. The question presumably is about how Illinois’ high court would rule on a legislative change to the state’s pension laws — should such a bill make its way through the legislature, be signed into law, be challenged with a lawsuit and, finally, make its way to the Supreme Court.

“We deal with all the difficult cases,” Garman said, her deep blue eyes remaining fixed on the questioner. “As I tell my law clerks, if the cases weren’t tough, they wouldn’t need us. So we’re used to dealing with very difficult issues and we know that we are the ultimate decision-maker as to the constitutionality of laws that are passed in the state of Illinois.”

Despite her willingness to outline the question, it was nearly impossible to answer.

* I’ve linked a couple of times now to Bruce Rauner’s WLS interview this week on pension reform. Here’s the candidate struggling to remember the state Constitution’s protections of government pensions…

“Reduced or impaired, or something like that.”

The actual language…

Membership in any pension or retirement system of the State, any unit of local government or school district, or any agency or instrumentality thereof, shall be an enforceable contractual relationship, the benefits of which shall not be diminished or impaired.

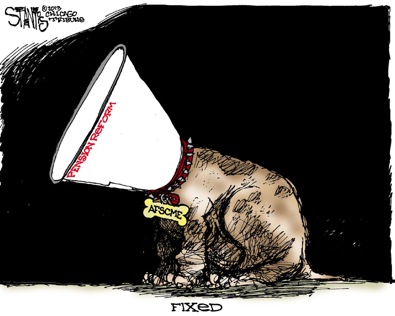

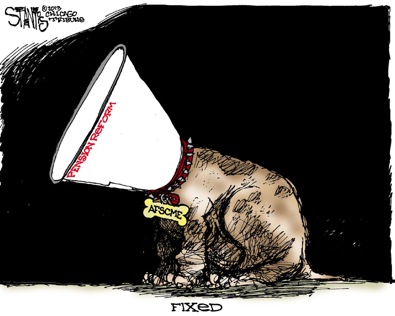

* And the IEA’s spokesman was not happy at all with this Tribune editorial cartoon…

From the teachers’ union flak…

Oh, how the patrons of Chicago’s exclusive private clubs must have laughed at that cartoon.

I imagine men in very nice suits, surrounded by the aroma of expensive cigars, holding brandy snifters, elbowing each other in the ribs and pointing to the part of the dog that’s been “fixed,” chortling all the while.

Sickening.

The men and women of AFSCME provide services on which the people of our state rely. They work hard and have negotiated with their employer for compensation that is commensurate with the effort and skill involved in their jobs.

I’ll bet the original version of this cartoon had the dog tag reading “Unions,” but then someone probably pointed out that that would mean the paper would be taking a repugnant cheap shot at teachers, police officers and firefighters; people the paper would be less comfortable attacking.

As crack journalist Ron Burgundy likes to say, “stay classy.”

posted by Rich Miller

Friday, Dec 6, 13 @ 1:48 pm

Sorry, comments are closed at this time.

Previous Post: Question of the day

Next Post: Moody’s likes the new pension law

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

This seems to go to the proverbial question, if a tree falls in the forest and nobody’s there to hear. Does it make a sound?

If a classless act is perpetrated by an unread paper. Does anyone care?

Comment by Norseman Friday, Dec 6, 13 @ 1:59 pm

Maybe Fido got a little too frisky with the neighbors dog…

Comment by PhoenixRising Friday, Dec 6, 13 @ 2:01 pm

I’d like to have a penny for every word that is going to be written about this before it get resolved …

Comment by RNUG Friday, Dec 6, 13 @ 2:03 pm

=== a flawed, insider deal crafted behind closed doors ===

Radogno and Durkin must be loving this guy.

Comment by Raymond Friday, Dec 6, 13 @ 2:04 pm

I was going to say that the Trib clearly doesn’t have any senior editors anymore, but then I remembered Big Brain Bruce has been on the job for a while.

So, take it for what it is. It’s the collective opinion of the deep-thinkers in Tribune Tower that public employees are dogs who need their cojones clipped.

Glad they cleared that up for you.

Comment by wordslinger Friday, Dec 6, 13 @ 2:05 pm

Lots of organizations around the world are worried about unsustainable defined benefit plans. Here is a pretty good article on some of the latest thinking:

http://www.economist.com/news/finance-and-economics/21590586-finding-better-way-deliver-pensions-get-big-or-die-trying

Comment by 47th Ward Friday, Dec 6, 13 @ 2:07 pm

Relating to the U of I exploring supplemental retirement plan for employees, this is intended to address the retention and recruitment issues that face universities. However, this will come at the expense of even higher tuitions or reductions in other services.

Speaking of a quality Illinois university, the NIU Huskies are going for another MAC Championship tonight as well as a 2nd BCS Bowl Bid.

Comment by Norseman Friday, Dec 6, 13 @ 2:08 pm

Will this new plan be actuarial sustainable? What will happen if the supremes find the pension fix unconstitutional? Would the old plan be reinstated, would the new plan remain allowing the beneficiaries twice the pension?

Looks like an eternal employment act for the attorneys

Comment by Plutocrat03 Friday, Dec 6, 13 @ 2:17 pm

Find myself agreeing with Linda Holmes again… I need to find some ibuprofen…

Comment by OneMan Friday, Dec 6, 13 @ 2:20 pm

“Reduced or impaired, or something like that.” — Details, details.

Comment by Roland the Headless Thompson Gunner Friday, Dec 6, 13 @ 2:23 pm

Thanks, 47th Ward, for that article. How do we address this issue, realistically? It appears that even the best managed defined benefit plans face actuarial realities (money in, rate of return, longevity of recipients, etc) that imperil the systems. According to some here, SSA is just fine, thank you very much. When compared to more competently managed funds around the world I wonder about that. A multitude of sins can be glossed over in good times with serious problems ignored or kicked down the road. We are caught up in the bad times, now. Do we just pine for the good old days or do we take stock of reality and act on it?

This law seems to play on our fears of collapse without addressing the real causes for same. Never gave it much thought when I joined state employment lo those many years ago. Given what I know now, I would have opted for my own plan. Uncertainty in the market is easier to digest than the smiling b@st@rds waiting for the dust to settle so they can go back to their ole spending ways.

Comment by dupage dan Friday, Dec 6, 13 @ 2:26 pm

47th,

The writer is mostly taking about defined benefit pensions systems outside the US where it is government providing either all or most of the pension, and it is supplemented by an “occupational” pension. He does talk a bit about the problems in the US, but it was mostly to take a swipe at the public sector plans.

Then he goes on to talk about the idea of a mix of the two in what is labeled a “defined ambition” plan. I was actually taking his proposals seriously until he got to the “notational” part. Seen that before and it can be abused.

From that point I read the article more skeptically, to where it ended up talking about how only governments have attempted it and a call to only have pensions done by the “experts”.

After reading it, I think the writer has a personal agenda behind the story … just not sure exactly what it is since those systems have different considerations from what we are used to looking at. Maybe this is just an extension to the “privatize all pensions” campaign.

Comment by RNUG Friday, Dec 6, 13 @ 2:35 pm

To this end we are exploring potential options including a supplemental retirement plan offered by the University. We expect to be able to provide additional information in time for the Board of Trustees meeting in January.

I’m guessing this will only be for Faculty/Academic Professionals, and Staff employees will be left out. Even if Staff employees were included, for those of us at retirement age, it would be no benefit at all, some of us would have to work until we’re 90 to benefit, so we’re just out of luck if the pension theft bill is ruled constitutional. The State of Illinois really knows how to give a Christmas present to it’s employees, doesn’t it?

Comment by Huggybunny Friday, Dec 6, 13 @ 2:36 pm

That’s not how I read it, RNUG, but you’re the expert, not me.

The point it makes about defined benefit plans is simple though: things are tough all over. It isn’t just Illinois struggling with this.

Comment by 47th Ward Friday, Dec 6, 13 @ 2:44 pm

===The point it makes about defined benefit plans is simple though: things are tough all over===

Maybe the writer should’ve looked at IMRF. Just saying…

Comment by Rich Miller Friday, Dec 6, 13 @ 2:47 pm

For once the Trib got something right. Castration is indeed what it was.

Does that qualify as “impaired” or as “diminished”?

Comment by cod Friday, Dec 6, 13 @ 2:49 pm

“Maybe the writer should’ve looked at IMRF. ”

Really. A sliver of my pension is SERS. The majority is IMRF, and I am so very glad.

Comment by Joan P. Friday, Dec 6, 13 @ 3:00 pm

“The problem for any system that involves a guaranteed income is, first, that it is only as good as the guarantor…”

I think that covers your point about IMRF. Their rules require full payment and they don’t ignore their rules, ergo, they have been an outstanding guarantor.

Comment by 47th Ward Friday, Dec 6, 13 @ 3:02 pm

47th Ward - Friday, Dec 6, 13 @ 2:44 pm:

I’m no expert. I just read a lot about the issue.

You could well be right, but that article just seemed to have a hidden agenda to me.

Comment by RNUG Friday, Dec 6, 13 @ 3:07 pm

Well it’s the Economist, which isn’t exactly a liberal publication. Generally speaking, they play it pretty straight in my opinion, but it’s certainly biased toward free market thinking. So they definitely have an agenda, but I don’t think it’s hidden and I don’t think it’s partisan.

Comment by 47th Ward Friday, Dec 6, 13 @ 3:11 pm

I also get the castration part of the cartoon. The cartoon has some other interesting messages.

1) Democrats are not controlled by AFSCME, and by extension, public worker unions.

2) The pension crisis is “fixed” to the conservative, anti-union Trib editorial board, which means there’s no need to move all workers into 401(k)’s, and thus Rauner’s position is really extreme.

Comment by Grandson of Man Friday, Dec 6, 13 @ 3:12 pm

The 1961 Illinois Supreme Court case Bardens vs. Board of Trustees (22 Ill.2d 56) established the principle that a

ii

voluntary participant in a public pension plan was entitled to receive a pension based on the laws in effect at the time he or she began participating in the system, regardless of subsequent legislative enactments that might reduce a member’s pension benefits prior to retirement.

Comment by Liberty First Friday, Dec 6, 13 @ 3:25 pm

“..her deep blue eyes remained fixed on the questioner…”

Who wrote the Garman story—Barbara Cartland?

Comment by qcexaminer Friday, Dec 6, 13 @ 3:27 pm

“Maybe the writer should’ve looked at IMRF. Just saying… ”

Doing this from memory, about 10-12 years ago IMRF had their own little ’scandal’ where IMRF board members were living a little too high on the hog. They got replaced, and the new Board members got religious in the sense that they were adamant that IMRF pension funds had to be fully protected.

And they put numbers out to their membership that had units of local government screaming, but they stuck to it. I remember 12%+++ annual increases in pension funding rates year after year. At the time, brutal.

Paid off.

There’s some folks out there who were on the IMRF board at the time who are owed apologies for all the grief they took.

Comment by Judgment Day (Road Trip) Friday, Dec 6, 13 @ 3:34 pm

One thing we haven’t discussed very much is the UoI proposal for yet another supplemental plan. Having spent a lot of time discussing pensions with a retired university professor going over their variations, it will be interesting to see what might get proposed that is new and different.

Comment by RNUG Friday, Dec 6, 13 @ 3:35 pm

For the link to figure out someones changed pension:

When looking at the percent of money lost, you also have to factor in the retirement age increase for younger workers as well.

Comment by Person 8 Friday, Dec 6, 13 @ 3:42 pm

Rich, thanks for taking note of Rauner’s “struggle to remember” the pension language in the constitution, that I noted yesterday.

I’m not sure which is worse, ignorance of the constitution by a gubernatorial candidate, or the potential that he deliberately did not say “diminish.” He used the word “impair” several times, however, never uttered “diminish.” Relative to one another, impair is a weaker term, than diminish, when applied to the concept of a protection. When the word “reduced” was mentioned by the host, he tacked on, “or something like that,” as though the constitutional were vague on the issue and that a single, specific, word doesn’t have a dramatic impact on interpretation.

One may be inclined to believe that his comments were the product of clever and on-point messaging, rather than an inability to recite constitutional language verbatim. I believe time will give us the answer. Will Rauner continue to evade saying “diminish,” or quickly polish his ability to cite the constitution in a more accurate fashion?

Either way, thanks for taking note.

Comment by W.S. Walcott Friday, Dec 6, 13 @ 3:59 pm

=To this end we are exploring potential options including a supplemental retirement plan offered by the University. We expect to be able to provide additional information in time for the Board of Trustees meeting in January.=

Does anybody know or think one of these potential options is going to be increasing the cost of tuition on students? In-state tuition for students at the University of Illinois is already one of the highest in the country.

Comment by Almost the weekend Friday, Dec 6, 13 @ 4:11 pm

The U of I folks are really onto something here. It would take some deep thinking, but all of (or most of) these pension systems could leverage their assets together to create this supplemental pension plan that could be privately managed by a trustee from each group and escape any wrangling from political forces. The asset strength could be amazing and use some of the very same investors that public plans use with success. It would need to be purely voluntary in terms of contributions. It would be taxable income, but could probably be deferred until retirement to ease that burden. It could be utterly ingenious.

Comment by A guy... Friday, Dec 6, 13 @ 4:18 pm

I don’t understand how Eric Zorn can tolerate all those Neanderthals at the Tribune.

Comment by Wensicia Friday, Dec 6, 13 @ 4:21 pm

We didn’t hear one word during the “debate” on the pension theft bill about any of the potential long term impacts of these ill-thought out “reforms.” It has always been difficult in state government to attract and keep highly skilled people in positions of great responsibility. It has always been hard to attract the best and the brightest to go into teaching. And the U of I is the first to acknowledge that the best academicians do not have to settle for such lousy compensation packages. Experienced, credentialed professionals do not have to put up with this kind of treatment. The Civic Committee and their ilk will ultimately get what they want — they will ruin state government and public schools so that they privatize more services and enrich themselves even further. Goodbye middle class.

Comment by kimocat Friday, Dec 6, 13 @ 4:52 pm

Well, maybe, but where are they gonna go? There are a few high-powered universities which have lush endowments and can afford to pamper their stars, but how many stars are there. Many if not most other universities and colleges are struggling for students and cash.

This is not to say I don’t approve of supplemental pensions. But they should be available to all govt employees–in fact, I would expand to all Illinoisians–who want to pay into them. No special deals. Everybody. The more retirement savings options the better, assuming they are fiscally sound. And that’s why making the pensions worse through this pension “reform” is a step backward not a step forward. Someday everybody will see that.

Comment by Cassandra Friday, Dec 6, 13 @ 5:35 pm

About the link for projections on benefits:

When looking at the “Working age” tabs, the multiplier would never start at $1,000 for someone who retires after 2015, so these numbers are a little misleading; and

If you use a $30,000 annuity with 30 years of service at retirement (final average salary of $45,455) there is no change.

Comment by Anon Friday, Dec 6, 13 @ 5:46 pm

regarding defined benefit pensions, IMRF is doing just fine because nobody gets to skip payments.

Comment by jkw Sunday, Dec 8, 13 @ 9:32 pm