Latest Post | Last 10 Posts | Archives

Previous Post: Don’t Let Psychologists Prescribe

Next Post: SUBSCRIBERS ONLY - Early voting numbers

Posted in:

* From a Daily Herald story originally entitled “Suburbs would pay more under graduated income tax”…

A growing campaign for a graduated income tax in Illinois could push more of the total tax burden onto some areas of the suburbs, where median incomes far outpace state averages, critics say. […]

The suburbs’ higher incomes suggest a graduated tax, whatever it eventually looked like, could be a battleground issue locally. […]

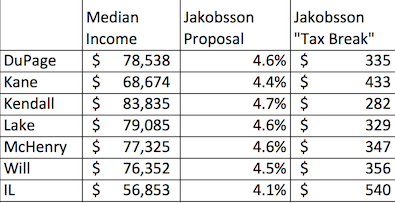

The median annual household income in most suburban counties is higher than the Illinois average of $56,853, census data from 2008 to 2012 shows.

The median household income is $78,538 in DuPage County, $68,674 in Kane County, $83,835 in Kendall County, $79,085 in Lake County, $77,325 in McHenry County and $76,352 in Will County.

In Cook County including Chicago, the median household income is $54,648. However, it’s higher in most suburban Cook County towns, like a median of $71,306 in Streamwood and $81,105 in Hoffman Estates, for example.

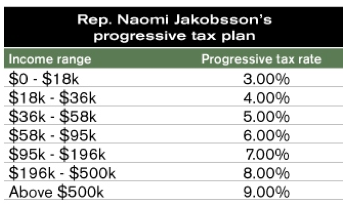

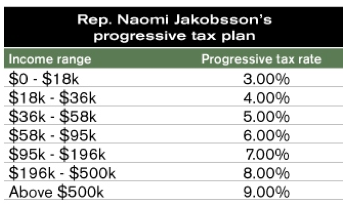

* OK, the first thing you really need to understand about a graduated tax is that once you reach a higher tax threshold your increased tax rate does not apply to your full income. It applies only to the income above your new rate level. So, for instance, here are rates that Rep. Naomi Jakobsson has suggested, via the Illinois Policy Institute…

A person making $60K under Jakobsson’s plan would not be paying 6 percent on that entire 60 grand. That person would be paying six percent only on $2,000, and etc. down the line.

* The folks at A Better Illinois, which is advocating for a graduated Illinois tax and is backed by organized labor, among others, put together actual tax rates for all those suburban counties in the Daily Herald article and compared them to today’s current income tax rate. I’ve adjusted the headings a bit to make it more clear that these are Jakobsson’s proposed rates.

Again, this chart compares the current income tax rate of 5 percent to what the actual rate would be for median income in the suburbs if Rep. Jakobsson’s rates were enacted…

You can check their math by clicking here.

* So, under this particular proposal, people earning around the median income would be paying less than they are now, not more.

Then again, if the income tax is allowed to expire on schedule and the graduated tax was implemented down the road, there would most definitely be a tax hike for median earners, but not as high as they’re paying today.

* It should also be noted that the group doesn’t actually support Rep. Jakobsson’s tax rate plan, calling it “less progressive than what’s most likely to be attached to a Fair Tax.”

posted by Rich Miller

Thursday, Mar 6, 14 @ 1:07 pm

Sorry, comments are closed at this time.

Previous Post: Don’t Let Psychologists Prescribe

Next Post: SUBSCRIBERS ONLY - Early voting numbers

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

–OK, the first thing you really need to understand about a graduated tax is that once you reach a higher tax threshold your increased tax rate does not apply to your full income–

Kind of a major point, if you’re going to write a news story about it.

Comment by wordslinger Thursday, Mar 6, 14 @ 1:12 pm

Current law is a 3.75 percent income tax in 2015, which is when a progressive tax would go into effect. That is the fair apples to apples comparison. Her plan has the makings of a major tax hike for those communities. They will get slammed regardless because they are “rich” compared to everyone else.

Comment by Bars Thursday, Mar 6, 14 @ 1:18 pm

If this passes the first thing I would expect to see is an attempt at taking away retirees state tax exemption and reducing our pensions by another 5 to 7 percent.

Comment by Nieva Thursday, Mar 6, 14 @ 1:18 pm

So, what rates does the group propose/ support? Jakobsson is the sponsor, so her plan seems pretty relevant. I don’t see how they can ask people to support this if they are asking folks to just trust legislators to do right by the taxpayers.

Comment by JSlim Thursday, Mar 6, 14 @ 1:18 pm

just one more reason to pack up and leave this state

Comment by arsonpi Thursday, Mar 6, 14 @ 1:27 pm

@Bars - that is an excellent point, one I had not considered.

Comment by Formerly Known As... Thursday, Mar 6, 14 @ 1:29 pm

Several points:1) Doesn’t the Herald know that suburbs don’t pay income taxes, suburbanites do. Under a graduated plan, a Chicagoan making $1 million would pay a higher rate than a Du Page resident making $70, 000. Suburbs doesn’t pay more, wealthier people pay more.

2) Illinois voters adopted a constitution that stipulates you must have a flat tax. The voters who approved it had no guarantee what that rate would be. Why would you want to lock a graduated rate into the constitution? It may well need to be adjusted over time, but it would still have to be enacted into law by a legislature and signed by a governor.

3) A graduated tax is not such a novel idea. Almost all states have one as does the federal government. If Washington decided to move to a flat tax while generating the same money it now does, the wealthy would pay less and the less wealthy would pay more.That’s upside down

Comment by truthteller Thursday, Mar 6, 14 @ 1:36 pm

What good does it do to poor people making less than $18,000 to take 3% of their income? That rate should be zero if we truly care about helping the poor.

Comment by Jeff Trigg Thursday, Mar 6, 14 @ 1:37 pm

A Better Illinois’ math is faulty at worse, incomplete at best, because they ignore the personal exemption. As for a “doomsday” scenario — multiply the rates by 2 and you’re probably closer to reality. Remember when Quinn’s “no more than” 33% magically became 67% w/ the 2011 rate hike?

Comment by Mom Thursday, Mar 6, 14 @ 1:37 pm

Actually, considering all the deductions and exemptions, none of this mathematics is relevant either.

Comment by Blah Thursday, Mar 6, 14 @ 1:43 pm

Because Illinois has fiscal problems because the state and local governments do not have a spending problem but too little to spend?

Comment by Under Further Review Thursday, Mar 6, 14 @ 1:52 pm

Thanks for the info, but this is backwards thinking. How much revenue would this generate? And what is the revenue goal for any new income tax schedule? Let’s agree on the goal before we start fighting about how to get there.

We should be backing into a goal for a revenue number, not taxing way way more first and then spending later.

In principle, I think a progressive income tax rate does have merit - but the numbers you put up here as Jakobsson’s seem much too high to me. But it’s hard to really know if we can’t see the revenue projections at the same time.

Comment by Siriusly Thursday, Mar 6, 14 @ 1:53 pm

Thought it was the stupidest headline in the DH in a long time. It doesn’t charge suburbs more, it charges the wealthiest people more, and really isn’t targeted at suburbs per se.

I guess you can find victimhood any where, if you’re really desperate for it.

And most residents of each of those suburbs would probably pay less than today, depending on income distribution within them.

Comment by Walker Thursday, Mar 6, 14 @ 1:55 pm

Pack up and leave this state? The choices of where to go will be slim. Most states have a graduated income tax structure. A few states have no income tax but we’re talking few. Some in this state act like this is Armageddon. Funny how other states have a graduated tax but do NOT have our financial problems. Do you think there’s a correlation? If people want services they have to pay for them. You can’t keep ripping off the pension funds anymore. Find the money legitimately.

Comment by AnonymousOne Thursday, Mar 6, 14 @ 2:00 pm

Following up on What Walker Said: Median income doesn’t tell you much where the Pritzkers and Sam Zells live in IL. That 9% “above 500K” is going to pull in a lot of the actual cash, in a state where income is distributed as unevenly as it is here.

So my hunch is that Lake County would emerge as a much bigger net payer, even though its -median- income is below Kendall’s, because the really big houses are in Lake (not to mention the overall population differences). And as noted, suburban Cook (they’ll love this proposal in Kenilworth).

But Chicago’s .01 percent would be chipping in a good deal too. If you’re not looking at where the 1% and .01 percent are distributed, this county-by-county median income analysis is only going to give you a sketch.

Comment by ZC Thursday, Mar 6, 14 @ 2:10 pm

===because they ignore the personal exemption===

Which is paltry to begin with and would likely apply in both cases.

Comment by Rich Miller Thursday, Mar 6, 14 @ 2:11 pm

===Lake County would emerge as a much bigger net payer===

Most probably so, but people pay taxes, not counties.

Comment by Rich Miller Thursday, Mar 6, 14 @ 2:13 pm

For those wondering, the break-even point (ignoring exemptions) between the 5% flat tax and the Jakobsson proposal would be $103,500.

To Bars point, at a 3.75% flat tax, the break-even income would be $43,200. Pretty significant difference when discussing whether this is a tax break for average households.

Comment by Dr Voodoo Thursday, Mar 6, 14 @ 2:24 pm

@Bars - I just ran the numbers.

This particular proposal would raise taxes on any tax return reporting over $43,200 in AGI.

At $43,200, you would pay $1,620 in taxes whether the rate was 3.75% as determined by current law or higher as under Jakobsson’s proposal.

The maximum “tax break” you could possibly receive under this proposal would be for those making exactly $18,000. Their “tax break” would save them $135.

Tax filers reporting $36,000 would save $90 under this proposal.

Tax filers reporting over $43,200 would, obviously, save nothing and in fact pay more under this proposal.

Comment by Formerly Known As... Thursday, Mar 6, 14 @ 2:29 pm

So, let’s just pretend the original legislative promise to make the 67% state income tax increase temporary, was never made. Now let’s change the question to whether or not we will move to a graduated income tax. We voters are so stupid we will never catch on to this ploy!

Comment by one of the 35 Thursday, Mar 6, 14 @ 2:40 pm

isn’t this the real reason Rauner wants to be Gov? to stop this from happening? so he and his billionaire contributors don’t get a graduated tax. forget the 67% hike, this would be a 300% hike on the 3% they paid four or five years ago.

Comment by PoolGuy Thursday, Mar 6, 14 @ 2:44 pm

One, what’s the ploy?

Most of the income tax increase will sunset without another positive vote in the GA and signature of the governor.

A graduated income tax will require a constitutional amendment.

Comment by wordslinger Thursday, Mar 6, 14 @ 2:45 pm

==How much revenue would this generate?==

The revenue projected from the Jakobsson schedule would be approximately 5% more than the current 5% flat tax. So it is almost revenue-neutral, based on that benchmark.

Comment by jake Thursday, Mar 6, 14 @ 2:58 pm

@wordslinger - it appears @one of the 35 was referencing the claims made by A Better Illinois and certain legislators.

A good example of this would be the chart above, which claims the graduated income tax proposal would provide filers in Kendall County making $83,835 with a “tax break” of $282.

In fact, those filers would be facing a tax INCREASE of $766.29.

Comment by Formerly Known As... Thursday, Mar 6, 14 @ 2:59 pm

Well, flat rate or progressive rate under someone making more income will pay more in State income taxes.

I did a little math on what it would cost someone making $500,000. I hope this impacts me someday, but it does not at all.

In general, if I made $500,000 under the current law in 2015 I would pay $18,750 in taxes ($500,000 X .0375). Under the progressive income tax I would pay $47,922 (using the income range per tax rate as Rich mentioned above.

In 2015 I would be paying $29,172 more in taxes.

Over a 10 year period assuming my income stayed at $500,000, I would pay $291,720.

This sounds like a great revenue opportunity for the State. Of course, if that’s me, I’m probably moving to Tennessee, or some other state where there is no income tax and the State looses my tax revenue.

Maybe tax reform (expanding taxes to services) and spending reform would be a better solution. Maybe in the short term we should look at sun setting the income tax at a slower rate, maybe 1/4% a year until we’re at 3.75% to deal with our obligations and look toward policies that will create more jobs and revenue that comes with those jobs.

Comment by Ahoy! Thursday, Mar 6, 14 @ 3:02 pm

You can bet when things go bad that they will try to tax the money from Pensions and retirement accounts….a drowning rat has no morales

Comment by What is to bo done? Thursday, Mar 6, 14 @ 3:06 pm

I just did the calculation for my family which we are are below the Illinois Medium income and I would pay $800 more a year under the progressive income tax plan that I would under current law of 3.75% in 2015.

Comment by Ahoy! Thursday, Mar 6, 14 @ 3:08 pm

Here are the effective tax rates for various incomes under this proposal:

$18,000 3.00%

$24,000 3.25%

$36,000 3.50%

$43,200 3.75%

$54,000 4.00%

$64,000 4.25%

$74,667 4.50%

$89,600 4.75%

$103,500 5.00%

$118,286 5.25%

$138,000 5.50%

$165,600 5.75%

$201,500 6.00%

$268,667 6.50%

$403,000 7.00%

$602,000 7.50%

$903,000 8.00%

$1,806,000 8.50%

Comment by Southwest Cook Thursday, Mar 6, 14 @ 3:10 pm

@jake - do you know where we can find those numbers to better educate ourselves?

Because according to an article quoted in an earlier CapFax post, https://capitolfax.com/2013/10/07/progressive-income-tax-would-be-a-very-tough-thing-to-do/

Sen. Jakobsson says that

=== Her tax schedule also would yield about 15 percent more revenue for the state ===

as compared to the existing 5% tax rate.

And I don’t see a revenue analysis prepared by the state for the legislation on the ILGA website.

Comment by Formerly Known As... Thursday, Mar 6, 14 @ 3:12 pm

Also worth noting that the effective tax rates will differ if, say, there’s a two person household or a single earner household. On the median of $56,000, A couple making $25k and $31k will pay almost $1k less in taxes than the single earner making $56k.

Comment by Mittuns Thursday, Mar 6, 14 @ 3:33 pm

Looking only at personal income tax results in a misrepresentation of the true effect of a graduated tax. The lower and middle income groups have a much higher effective overall tax rate to start with once all other taxes and fees are included, like sales tax, gasoline tax, property tax, etc.

I recall CTBA doing such an analysis. Where are they in the debate?

Comment by Anonymous Thursday, Mar 6, 14 @ 4:14 pm

I would gladly agree to a graduated income tax plan like this rather than another increase in cigarette tax and/or gambling expansion which are, in effect, a tax increase that disproportionately impacts low income taxpayers. (And I do neither!)

Ahoy, do you think there will be a $500,000/year job waiting for you in Chattanooga!?

Comment by Original Rambler Thursday, Mar 6, 14 @ 4:29 pm

Has anyone stopped to consider that Rep. Jakobsson won’t be in the legislature to promote her tax plan, assuming the General Assembly puts it on the ballot and voters approve it. Talking about these various plans as if they really mean something is pointless because the numbers won’t be determined for a year, if at all.

By the way, is it unfair to point out that Jakobsson and her professor husband won’t be paying income taxes on their retirement income because it’s exempt from state taxation.

Comment by jim Thursday, Mar 6, 14 @ 4:33 pm

- Anonymous - Thursday, Mar 6, 14 @ 4:14 pm:

From their studies, I would say CTBA is in favor of a graduated tax.

Comment by RNUG Thursday, Mar 6, 14 @ 4:34 pm

=I recall CTBA doing such an analysis. Where are they in the debate?=

Where they always are. No tax increase is excessive enough, and no burden is too much to bear for non-union taxpayers.

Oh, and don’t forget that six figure pensions at age 55 and salaries given out to gym teachers in Illinois for nine months work are never a problem with CTBA and Martire.

Good policy spending is never on Martire’s agenda, only soaking the taxpayers for all he can get is.

Their tax policy is simple.Charge no or low income taxes on 60% of the voters so that they don’t care if you raise taxes to outragous levels on the remaining 40%. That’s been the Ilinois Dems strategy, as well as Detroit’s, for several decades now.

Sadly, it keeps them in power.

Comment by Arizona Bob Thursday, Mar 6, 14 @ 4:36 pm

Over a period of timemore and more higher income individuals will leave the state. It will not be instantaneous but it will happen.

And what about a graduated income tax for businesses? Will that be next?

There is no end to this and the money will be spent with little accountability just like it is now. The state has a $35 billion GRF and another $25 billion fromnthe FEds. But it is never enough.

Of course, pensions will be blamed for the state’s problems. That is what politicians too often do, blame the victim and use them as the scapegoat if they can drum up that support.

Would it pass? I doubt it. Takes 60% to pass.

Comment by Federalist Thursday, Mar 6, 14 @ 4:48 pm

New York the highest tax state in the country. Why aren’t they fleeing? Besides, where will they all go? Illinois is a low tax state. Check it out.

http://money.cnn.com/pf/features/lists/total_taxes/

Comment by AnonymousOne Thursday, Mar 6, 14 @ 4:54 pm

@Arizona Bob

Their tax policy is simple.Charge no or low income taxes on 60% of the voters so that they don’t care if you raise taxes to outragous levels on the remaining 40%.

Unfortunately, this comment has too much truth. It certainly is done at the federal level and in my opinion makes for a more dysfunctional democracy where fewer citizens really care about economic and taxation policies.

Comment by Federalist Thursday, Mar 6, 14 @ 5:05 pm

Sorry Jake, but a 5% increase does not mean revenue neutral. That’s almost $2 billion more in actual people’s money you’re talking about. How is that neutral?

Comment by Siriusly Thursday, Mar 6, 14 @ 5:16 pm

@ AnonymousOne

The data source you give appears to give 2002 data.

And it provided no info on Corporate taxes.

More recently New York has been breaking its back to give all types of tax incentives for businesses to come to NY. To me. this is a bad policy.

I will stand by my original analysis.

Comment by Federalist Thursday, Mar 6, 14 @ 5:23 pm

Tax the rich, feed the poor

Till there are no rich no more

I’d love to change the world

But I don’t know what to do

So I’ll leave it up to you

Comment by What is to be done? Thursday, Mar 6, 14 @ 6:17 pm

If those who support a graduated tax why did the stop at $500,000.

Why not conitnue it for the really wealthy?

%500-1000K 10%; $1000-2000K 11% and keep going.

Really this mostly targets the upper middle class and not the truly rich in terms of 2014 financial realities.

Comment by Federalist Thursday, Mar 6, 14 @ 6:19 pm

Taxing pensions may cause a mass exodus of retirees. High property taxes coupled with a tax on pensions would cause me and others to consider moving to TN, Fl, Tx, or maybe NV. Only thing keeping me in Illinois now is family and friends, sure isn’t the weather!

Comment by Pacman Thursday, Mar 6, 14 @ 6:29 pm

=== Why aren’t they fleeing? ===

“New York State continues a long-standing trend of seeing more residents move to other states than move in, and gains in international migration have not overcome the loss, according to census data released this week.”

http://www.newsday.com/long-island/census-trend-continues-as-more-people-leave-ny-than-move-in-1.6874080

“The frustration over taxes and registration fees is driving more people to leave New York than any other state in the nation. That means fewer people paying taxes, buying homes and going to restaurants.”

http://www.whec.com/article/stories/s3196897.shtml

Comment by Formerly Known As... Thursday, Mar 6, 14 @ 6:33 pm

There goes the last high wage earners to Florida residency. Lets all wave BYE BYE! STOP_STOP_STOP trying to fix this State by taxing more. Stop spending first at all levels. The state brings in an exorbitant amount of money. Make due with it!

DO THE MATH, taking 7% of a 400k family removes almost $2500 a month from them. Good luck with that, I’m sure they will not plan around that! BYE, BYE last high wage earners.

Comment by Anonymous Thursday, Mar 6, 14 @ 6:55 pm

I’m leaving this Liberal experiment. Enjoy what will be left. Look at the business and industrial park vacancies as they are now! My wife and I will be gone this summer for good. Sorry to abandon ship but this is the Titanic and I have seen the future!

Comment by Anonymous Thursday, Mar 6, 14 @ 6:59 pm

–Ahoy, do you think there will be a $500,000/year job waiting for you in Chattanooga!?–

If you have a skill set that warrants $500,000 a year, can pretty much live anywhere you want. Maybe even in Chattanooga , but maybe Nashville, Memphis, San Antonio, Dallas, Austin, Miami, Orlando, etc.

Comment by Ahoy! Friday, Mar 7, 14 @ 8:55 am