Latest Post | Last 10 Posts | Archives

Previous Post: STOP THE SATELLITE TV TAX!

Next Post: Minow also backed George Ryan over Poshard

Posted in:

* The reaction to House Speaker Michael Madigan’s proposal to add a three percent surcharge to annual incomes over a million dollars kicked up some dust. Bruce Rauner’s campaign…

Chip Englander, campaign manager for Bruce Rauner, issued the following statement regarding the tax proposal announced by House Speaker Mike Madigan:

“Bruce is happy to pay more to support education - in fact he’s been doing that personally for decades, but he doesn’t support what looks like a first step towards empowering Mike Madigan and Pat Quinn to raise taxes on the middle class, small businesses and family farms. The last time they raised taxes, they hit every Illinoisan with a 67% increase, and they still turned around and cut funding for education. We need to grow our economy and create jobs, so we can fund education at levels far above what we’ve seen under Pat Quinn. We need to take a look at our entire tax system to make Illinois more competitive and lower the tax burden on the people of Illinois.”

* House Republican Leader Jim Durkin…

“The race for Governor has started and today made its way into the Illinois House. Why wasn’t this proposal introduced last month or last week? The timing is obvious. Families and business are fleeing the state, this proposal will only perpetuate this human tragedy.

“Three and a half years ago, the House Democrats passed a 67% income tax increase on Illinois families and business all under the guise to pay our bills.

“That never happened. The Democrats running this state can no longer be trusted.

“This proposal will not grow our economy and will not put Illinoisans back to work.”

* American’s for Prosperity Illinois…

Americans for Prosperity’s Illinois State Director issued the following statement in reaction to Speaker Madigan’s proposal to amend the Illinois Constitution to impose a new tax on millionaires:

“With the second highest unemployment rate in the nation, one would think the Democrat leaders of Illinois would want to grow jobs for our families. Unfortunately, yet again they choose to pursue policies that will push more jobs out of the Land of Lincoln by punishing job creators.

This new tax is designed to further polarize the state in a bid for short-term political gain, while diverting attention from the majority’s intention to go back on its commitment to keep the 67% tax hike permanent.”

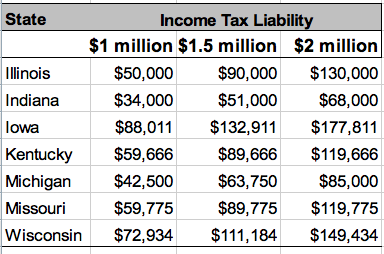

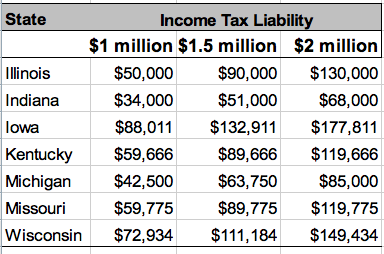

NOTE: The chart provided to media by the Speaker’s Office comparing the tax rate in neighboring states for incomes over $1 million assumes a 5% tax rate, not the 3.75% tax rate scheduled for 2015.

* The chart…

So, yeah, if the scheduled 2015 rates are used, the overall burden would be significantly less here.

posted by Rich Miller

Friday, Mar 21, 14 @ 9:19 am

Sorry, comments are closed at this time.

Previous Post: STOP THE SATELLITE TV TAX!

Next Post: Minow also backed George Ryan over Poshard

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

I love how Rauner is complaining about the high taxes Illinois citizens pay, yet the tax on $1 mil income is higher in 4 of the 6 nearby states, including Wisconsin, beloved by all the Tea Partiers & constantly used as an example of how Illinois should be run.

Comment by AFSCME Steward Friday, Mar 21, 14 @ 9:28 am

Funniest coverage came from the Mitt Rauner in house newslatter (AKA Chicago Tribune) who labeled their new story as class warfar

GOPies always want full services, but when asked to pay they whine.

Comment by circularfiringsquad Friday, Mar 21, 14 @ 9:29 am

I’m not shedding too many tears over asking somebody who makes that much money to pay a little more.

Comment by Demoralized Friday, Mar 21, 14 @ 9:33 am

Class warfare !!!

http://religiousleftlaw.typepad.com/.a/6a0120a69a468c970c019b01f9f2d7970d-pi

Comment by Bill White Friday, Mar 21, 14 @ 9:33 am

Why is that nice Mr. Walker and his GOP legislature taking so much money from everyone in Wisconsin?

That can’t be right. After nearly four years in power, haven’t they made the Dairyland a tax-free utopia, with Ayn Rand replacing Bucky Bagder as the state mascot?

Big Brains Kass and Dennis Byrne tell us that Illinois refugees are pouring over the northern border in search of lower taxes.

Could it be, they’re…… willfully ignorant? And write for the Chicago Tribune?

Comment by wordslinger Friday, Mar 21, 14 @ 9:36 am

The AFP should have been a bit less rushed in it’s reaction.

They made one key grammatical error saying the Dems want to go back on their commitment to keep the current rate permanent, and their comment on the chart is also backwards. If the chart used the rates they complain should have been used, Illinois would look even better than the other states with this proposal.

As to Rauner’s comment — very few “middle class” folks or “small business” owners take home more than a million dollars in net taxable income after deductions. This won’t hit the vast majority of them.

Rauner does know that, doesn’t he?

Comment by Walker Friday, Mar 21, 14 @ 9:39 am

Great! Let’s tax our way to prosperity!

Let’s send more tax dollars to the clowns who mismanaged the funds in the first place because they promise that they will do better this time.

Seriously, the politicians sold the state income tax increase as a temporary measure to pay the backlog of bills. What happened? They engaged in new spending and the debts are still unpaid.

Comment by Upon Further Review Friday, Mar 21, 14 @ 9:40 am

I say it does not go far enough. Increase the taxes of the millionaires, but also the poor. If we have a higher rate on the poor, they would be motivated to work harder to reach a lower tax bracket.

Comment by Wumpus Friday, Mar 21, 14 @ 9:42 am

I am guessing this is the first shot of many we will see throughout the next 8 months.

When I first heard about this, my initial react was Mikey’s baiting Brucey.

Expect no real work to get done in the GA this year cause everything will be about the election. But isn’t it always?

Comment by Irish Friday, Mar 21, 14 @ 9:45 am

Theme song?

On, Wisconsin! On, Wisconsin!

Grand old Walker State!

“We”, thy loyal G.O.P.ers.

Hail thee, good and great.

On, Wisconsin! On, Wisconsin!

Champion of the “Right”.

“Shutdown!”, our motto,

“We” will give thee might!

Well, I feel better…

Comment by Oswego Willy Friday, Mar 21, 14 @ 9:46 am

As Citizen Rauner would say, “Let the voters decide!”.

Comment by Wensicia Friday, Mar 21, 14 @ 9:47 am

Rauner really stepped in it.

Chip and Shrimp, you ain’t dealing with the Other 3, anymore, or some kumbiyah-singing Cheeseheads.

As YDD pointed out yesterday, Rauner has floated taxing pension income as an option.

But a millionaire’s surtax is off the table?

So…. tax grandma on a fixed income more, but not Bill Griffin?

Why? Is he still paying for his Versailles wedding? You’d think the guests would have covered their plates, at least.

Geez, that was too easy. Watch out for that MJM, Baron. He’s a troublemaker.

Comment by wordslinger Friday, Mar 21, 14 @ 9:49 am

MJM is proposing to cut taxes for the middle class, small businesses and family farms and institute a surtax on incomes over $1 mil. Unless Rauner is anticipating hyper inflation over the next few months, this means a vast majority of Illinois residents will receive a tax cut. So in reality, Rauner is opposed to a tax cut for the “middle class, small businesses and family farms”.

Comment by AFSCME Steward Friday, Mar 21, 14 @ 9:50 am

regarding the chart, since it is just state taxes, it does not take into account some Indiana counties that collect a county-level income tax, up to 3%. so some Indiana counties would be up to 6.4% with state and county income taxes.

Comment by PoolGuy Friday, Mar 21, 14 @ 9:52 am

““With the second highest unemployment rate in the nation, one would think the Democrat leaders of Illinois would want to grow jobs for our families. Unfortunately, yet again they choose to pursue policies that will push more jobs out of the Land of Lincoln by punishing job creators.”

Perhaps if we raised out taxes to Wisconsin rates the state’s unemployment rate would improve.

Comment by AFSCME Steward Friday, Mar 21, 14 @ 9:52 am

–Seriously, the politicians sold the state income tax increase as a temporary measure to pay the backlog of bills. What happened? They engaged in new spending and the debts are still unpaid.–

Show me.

Comment by wordslinger Friday, Mar 21, 14 @ 9:56 am

This was not filed under “Opinion” or “Commentary.” This is apparently what “reporting” will look like from the Trib for the next 8 months….

Illinois Democrats go all-in on class warfare theme

Illinois Democrats went all-in Thursday with their election-year class warfare theme as Speaker Michael Madigan pitched the idea of asking voters to raise taxes on millionaires, Senate President John Cullerton advanced a minimum-wage increase and Gov. Pat Quinn compared wealthy opponent Bruce Rauner to TV villain Mr. Burns.

wow.

Comment by Jimmy CrackCorn Friday, Mar 21, 14 @ 9:56 am

@Oswego Willy:

Wisconsin has a surplus. Illinois should be so lucky.

Last time, I checked the shutdown was caused by the Wisconsin Democrats.

Yes, Illinois is not Wisconsin. More’s the pity when it comes to government finances.

Comment by Upon Further Review Friday, Mar 21, 14 @ 10:00 am

Rauner and the likes are stunned. Plan was for 1%ers to rightfully claim their aristocratic authoritarian position and slash and burn all those lazy 99%ers. The spotlight was not, repeat not supposed to be the aristocrats! It was supposed to be a swift takeover before anyone could figure it out, because, you see, anyone who is not in the 1% must be dumb because they haven’t figured out how to swindle it out of others. Seems like anyone with common sense would reason that millionaires could spare a few more dollars than 88 year old nursing home retirees, but then again, the power of cash reserves held by the 1%ers can make miracles happen before our very eyes.

Comment by AnonymousOne Friday, Mar 21, 14 @ 10:00 am

“The race for Governor has started and today made its way into the Illinois House. Why wasn’t this proposal introduced last month or last week? The timing is obvious. Families and business are fleeing the state, this proposal will only perpetuate this human tragedy.

“Three and a half years ago, the House Democrats passed a 67% income tax increase on Illinois families and business all under the guise to pay our bills.

“That never happened. The Democrats running this state can no longer be trusted.

“This proposal will not grow our economy and will not put Illinoisans back to work.”

Rep Durkin, I challenge you, as the House Minority Leader: what is your plan to solve the Illinois unemployment level? All I hear from you & the rest of the ILGOP is opposition to everything the Democrats propose. I am looking for a concrete well vetted plan, not sound bites. Not a tax cuts. Not Workers Comp cuts. Real solutions. Real solutions to paying the backlog of bills. Real, not unconstitutional, pension solutions. Realistic revenue needs, not pipe dream tax cut schemes. The ILGOP has become the party of zero ideas. That is why it is irrelevent. ILGOP, come up with real answers to Illinois’ problems. It starts by being for things, not against. Be a solution, not an opposition. These days I really am ashamed to call myself a Republican.

Comment by AFSCME Steward Friday, Mar 21, 14 @ 10:02 am

- Jimmy CrackCorn - Friday, Mar 21, 14 @ 9:56 am:

I saw that this morning and was shocked that it wasn’t in the opinion section. That’s some next-level homering.

Comment by Served Friday, Mar 21, 14 @ 10:03 am

Did anyone notice the photos from the Democratic “Unity” breakfast at the Billy Goat Tavern yesterday? Rahm Emanuel looked annoyed or bored to be in attendance. It really seemed as if his heart was not in it.

Comment by Upon Further Review Friday, Mar 21, 14 @ 10:03 am

Thanks Wordslinger!

According to Rauner, everything should be on the table except asking millionaires to pay more.

We can tax our way to prosperity you say?

Um, if we invest the money wisely in education we can.

I know its true because I have heard Republicans say it about 50 million times.

Wait for the chart that shows how much more money downstate schools would get under this plan.

Next time, Chip: “I havent seen the Speaker’s amendment.”

Comment by Yellow Dog Democrat Friday, Mar 21, 14 @ 10:06 am

–Yes, Illinois is not Wisconsin. More’s the pity when it comes to government finances.–

Another liberal tax and spend maniac.

Comment by wordslinger Friday, Mar 21, 14 @ 10:06 am

Three words about Madigan’s move: remap, remap, remap. MJM and the Dems can’t afford a GOP governor who runs for re-election in 2018.

Comment by Chicago Publius Friday, Mar 21, 14 @ 10:07 am

Did American’s for Prosperity Illinois have anything to say when Rauner was talking about lowering the minimum wage? Did they come out swinging about punishing workers? Apparently it’s ok to punish the little guy but ask a millionaire to pay anything and the world comes to an end.

Comment by Demoralized Friday, Mar 21, 14 @ 10:09 am

Looking at their chart I guess millionaires have been pouring into Illinois from neighboring states for some time.

Give Madigan credit, he undercut any hope of Rauner getting momentum off his primary victory. Rauner was totally unprepared for this and the statement he offered is undercut by the facts. You are in the big leagues now Bruce, you need to establish your own ground beyond the pithy slogans. Shaking up the political oligarchy in Illinois is going to take a lot more than a cheap watch and an ugly vest.

Comment by truthteller Friday, Mar 21, 14 @ 10:11 am

Illinois is not Wisconsin.

=== Why is that nice Mr. Walker and his GOP legislature taking so much money from everyone in Wisconsin? ===

Gov Walker and the GA up there in cheesehead land are putting the final touches on a $500,000,000 tax refund to Wisconsin citizens. Yep, Wisconsin is nothing like Illinois.

Comment by dupage dan Friday, Mar 21, 14 @ 10:12 am

Upon Further Review - @ 10:03 am: I had the same reaction. Both dinners were staged but the Dems didn’t look as enthused as the GOP group. I know PQ and Rahm are not close, but it was obvious that Rahm hated the whole unity thing.

On the flip side I was surprised at Bill Brady’s enthusiasm at being at the dinner. Maybe he had put all his money into his campaign and was looking forward to a good meal but it was almost like he was there expecting something. Like a cabinet position?

“I am telling you Mr. Rauner the only reason I stayed in the race is to take a share of the votes from them other two so you would win. Really, scout’s honor.”

Comment by Irish Friday, Mar 21, 14 @ 10:13 am

SJ-R headline: “Madigan proposes taxing millionaires”.

Tribune headline: “Democrats up class war ante”.

Oh Tribune, why do I still subscribe to thee? Could it be the arts coverage? Maybe the sports? The travel section? Or is it because you fit so perfectly at the bottom of the bird cage?

Note to self: Make sure today’s front page faces up when changing the bird’s papers.

Comment by Sangamo Sam Friday, Mar 21, 14 @ 10:14 am

Could we get a real economist to explain to Republican spinmeisters that there is no direct correlation between raising marginal tax rates at the top end and employment rates. How do that think that works anyway? Rich people have extra money so they hire more workers? Employment levels are directly tied demand for products in a consumer economy like ours. Real simple, people buy more stuff, demand increases and employers hire more workers to keep up with demand. This whole trickle down theory has been debunked a thousand times over. Republicans need to find a better line for why the rich shouldn’t pay their fair share. Jeez!

Comment by Labordude Friday, Mar 21, 14 @ 10:14 am

I’ve justified keeping my Tribune subscription because my kids actually read the comics (pretty retro, I know). Disgusted enough by the headline this morning to bring that to an end.

Comment by davidh Friday, Mar 21, 14 @ 10:15 am

Isn’t part of the issue here that 3% will just be the beginning? Remember, income taxes for everyone used to be 3%, before they became 5%. When will the ramp come for millionaire tax? And why stop at 3%? If millionaires can afford 3%, surely they can afford 10%. And while we’re at it, why pretend that $10 an hour minimum wage will lift people out of poverty? Why not propose $15/hour? Why not $50?

Comment by So. ILL Friday, Mar 21, 14 @ 10:22 am

So. ILL

You are correct…..that is exactly the scare tactic Republicans always use. Rich Republicans like Rauner say, “I would be happy to pay more in taxes to help our public schools, but it won’t stop with me. THEY will raise your taxes next!”

Comment by Labordude Friday, Mar 21, 14 @ 10:25 am

=== This whole trickle down theory has been debunked a thousand times over ===

Exactly.

Also, we need to disaggregate Chicago area business climate and unemployment from downstate business climate and unemployment.

Both are equally vital and deserve equal attention however the same solutions probably won’t work in both instances.

However, modestly higher taxes on Chicago area billionaires spent to pay downstate teacher salaries probably is a small step in the right direction.

Comment by Bill White Friday, Mar 21, 14 @ 10:27 am

Poolguy is correct-The tax listed for Indiana is only the base tax rate. There are local taxes based upon your county that you have to pay on top of the state tax. And 2013 is the first year that Lake county Indiana has adopted a county tax. So in effect taxes were raised for one of the most populated counties in the great R state of Indiana. Why didn’t Americans for Prosperity fight that? Oh wait…

Comment by carbaby Friday, Mar 21, 14 @ 10:28 am

“Class warfare” is off the table as a drinking game until Thanksgiving. Save our livers!

Look, the Tribbies are being shopped, desperately.

Oaktree Capital Management and JP Morgan Chase wanted to be rid of that albatross months ago. But the phone ain’t ringing off the hook with potential buyers.

The likes of Kass and Big Brain Bruce need a fool billionaire to save their phony-baloney jobs. So you’re going to get a lot of “class warfare” out of that crew in hopes that they can attract one.

Comment by wordslinger Friday, Mar 21, 14 @ 10:28 am

Labordude - so, taxes in IL have gone down? I’m not following.

Comment by So. ILL Friday, Mar 21, 14 @ 10:29 am

Indiana also has massive license plate fees.

Comment by Labordude Friday, Mar 21, 14 @ 10:30 am

===@Oswego Willy:

Wisconsin has a surplus. Illinois should be so lucky.

Last time, I checked the shutdown was caused by the Wisconsin Democrats.

Yes, Illinois is not Wisconsin. More’s the pity when it comes to government finances. ===

Yeah but Wisconsin’s surplus is temporary. Which is why GOP legislators were resisting Walker’s efforts to cut taxes in the state.

Comment by CollegeStudent Friday, Mar 21, 14 @ 10:32 am

It’s comical to watch this blog at times. Last I checked even the most passive observer of political goings on could simply compare the number of Governors arrested over the last 25 years between Illinois and Wisconsin and draw a clear conclusion. Compare the stagnant economy in Illinois vs. 6 consecutive months of declining unemployment in Wisconsin according to the U.S. Bureau of Labor Statistics. I am not arguing the fact that Wisconsin has raised taxes, and that accounts for some of the revenue increases. However, Illinois has done plenty of revenue increasing over the last decade in the form of taxes and fees on everything from Soda to socks, and the outcomes are obviously different. So, pontificate all you want, and throw stones at Wisconsin if you want to, it just makes you look like a knee jerk Cheerleader for Illinois government, instead of a critical thinker on even the most basic level.

Comment by John A Logan Friday, Mar 21, 14 @ 10:33 am

If there were some perfect state to live comfortably in, with abundant great paying employment, great weather, low cost housing and property taxes, minimal taxes (of every kind), don’t you think everyone would be living there? There is always so much more to the picture.

Comment by AnonymousOne Friday, Mar 21, 14 @ 10:35 am

Madigan will get this passed on a party line vote. Many Republicans will get to beat their chests over it. The masses love the mantra “The rich don’t pay taxes” which isn’t close to true and “Sock it to the rich” which is being done already. Truthfully, it wouldn’t be hard to poll those over 1 million dollar earners and ask them to support this to help the state and everyone in it. It would be a PR extravaganza and let everyone save a little face. I’d try it. Bet it would work.

Comment by A guy... Friday, Mar 21, 14 @ 10:40 am

To “Wisconsin”,

I was waiting for some react, and the reality is that all the true economics, and the GA in both states, the demographics,…

Illinois is Illinois. Challenges, successes, failures, Illinois can’t be pigeon-holed as like Wisconsin.

Can’t wish it, can’t hope it.

This plan by Madigan has Illinois optics to it, and applying Wisconsin rosey sunglasses to it does not make the rebuttals valid.

Argue “Illinois v. Illinois” economics, then you have my attention.

On Wisconsin, get past Wisconsin too.

Comment by Oswego Willy Friday, Mar 21, 14 @ 10:42 am

If we’re socking it to the rich, man, I’m pretty sure that it was, at most, a glancing blow…just sayin.

Comment by PublicServant Friday, Mar 21, 14 @ 10:42 am

After Further Review: What about having higher taxes, for years, in Wisconsin, and having a government surplus, don’t you get?

Of course it’s not as simple as that.

But neither do lower taxes automatically magically produce surpluses.

And it’s been proven again and again, that state corporate tax rates have a minimal impact on decisions to move a company — per the relocation decision-makers in those companies.

People tend to oversimplify the solutions.

Comment by Walker Friday, Mar 21, 14 @ 10:45 am

Let’s be very clear about “shutdown”

Republican Nominee, Bruce Rauner (Raunerite, Winnetka/Chicago) has been quoted as saying he would “Shutdown” Illinois government, if need be.

Use your “search” key. Not difficult to find.

So, Rauner made it an issue. Point to Wisconsin or anywhere and blame Dems, but Rauner believes its in the arsenal. Can’t govern with things shutdown and seem … open to working with others, and then back off the rhetoric in a General Election.

Lots of quotes out there. Lots of video out there. Lots of tape… out there.

Comment by Oswego Willy Friday, Mar 21, 14 @ 10:49 am

Public Servant: Respectfully, the unions only solution has been a tax increase, raising taxes, we pay too little, etc. Madigan is moving in the direction of taxing the truly wealthy for the sake of everyone else. I’d get them to be voluntary in this measure and appeal to their philanthropy for education. A well thought out PR effort could be very successful here and let the air out of the balloon. As many have said, don’t demonize the unions- agreed. Don’t demonize wealthy job creators either. If one group leaves the state, it would be sad. If the other goes, it’s devastating. Just think about it man.

Comment by A guy... Friday, Mar 21, 14 @ 10:52 am

It’s really tiresome to keep hearing the Rauner/Koch spiel about how awful Illinois is, about how businesses are fleeing the state, about the supposed high tax burden in Illinois, etc. The above tax chart shows once again what a huge lie that spiel is, as does this Site Selection report from today, which found that Chicago secured more corporate facility investment projects than any other city in the U.S. this past year. As the report notes, it wasn’t even close: “With 373 facility deals, Illinois’ largest city easily outdistanced its closest competition — second-place Houston with 255 projects and third-place Dallas-Fort Worth with 178. Atlanta (164) and Detroit (129) rounded out the top five.” So rather than investment leaving Illinois, it seems investors are very bullish on our future. An increase on some rates that still leaves Illinois income tax rates lower than many states won’t stop that trend. On the other hand, hopefully it will prompt a few of the “diss-Illinois-every-chance-we-get” types to leave.

Comment by OldSmoky2 Friday, Mar 21, 14 @ 10:54 am

Maybe this isn’t a bad idea, but let the “millionaires” decide to which schools they want their tax dollars to go through a tax credit.

Let them donate it to any educational institution, private,charter, or public, K-12 or university they choose. The only stipulation would be that the educational institution must be in Illinois.

This funnels the resources to the most deserving schools, not those that provide the most union payoffs and campaign contributions to Dems and Dillard (there’s a difference?).

After all it’s their money, right?

Giving freedom to the taxpayers to reward those institutions that get the job done and shift resources way from those that don’t makes sense in a GOP message.

Comment by Arizona Bob Friday, Mar 21, 14 @ 10:56 am

How about IL adopting the WI tax system, with its graduated income tax and scores of service taxes? Emulating WI would produce several $billion more in revenues annually. I say let’s go for it.

Comment by Anon Friday, Mar 21, 14 @ 10:58 am

=== Yeah but Wisconsin’s surplus is temporary ===

What difference does that make? I would love to see any type of surplus in the general operating fund in Illinois - isn’t that a better sign of fiscal health than billions of dollars in deficits tied, in large part, to the fiscal irresponsibility of Illinois state gov’t?

Comment by dupage dan Friday, Mar 21, 14 @ 10:59 am

labor Dude and So Ill.

it is easy to say the state Dems cant be trusted to just tax millionaires, remeber how the last tax was passed in the lame duck session after Quin Lied about vetoing any tax increase over 4% and then bought of losing members with promise of state jobs. while I dont care for Rauner,Quinn or madigan it is easy to see this is another lie. No way it raises 1 Billion dollars and just like the lottery it wont go to education.

Comment by fed up Friday, Mar 21, 14 @ 11:00 am

I liked MJM’s give-and-take with the reporters. “The speaker was asked if the tax hike would apply to him.”

“Do I make a million dollars? … The answer to your question, in a good year, I would be subject to this.”

“Asking if he’s been having good years, the soon-to-be-72-year-old speaker replied, ‘At my age, any year is a good year.’”

This guy should give news conferences more often.

Comment by ZC Friday, Mar 21, 14 @ 11:03 am

OldSmoky, also don’t leave out Site Selection had Illinois the #3 state behind Texas and Ohio, who coincidentally both have no corporate income taxes (both have GRT though). Illinois was right behind 2 states with no corporate taxes for the number of new and expanded facilities for 2013. so terrible right?

I know IL has its problems, but you won’t hear Site Selection rankings in Trib editorials or from the Illinois Policy Institute. they just will say people are fleeing the state in droves.

also to people who think this post in bashing Wisconsin. I remember last year Gov Perry of Texas coming to Chicago to poach IL businesses, and Indiana has part of their economic development plan posting billboards and signage in Illinois to get IL businesses to leave.

and Wisconsin does its share to bash our state, while their income tax rates are higher and Walker has fallen quite short on delivering 250,000 new jobs since he took office.

personally I despise other states bashing and poaching each other as an economic development strategy. very shortsighted especially when taxes are the main selling point.

Comment by PoolGuy Friday, Mar 21, 14 @ 11:11 am

–What difference does that make? I would love to see any type of surplus in the general operating fund in Illinois –

Another vote for the Wisconsin graduated income tax, top rate 7.65%. A rate of 6.27% over $29,090.

You guys crack me up.

Comment by wordslinger Friday, Mar 21, 14 @ 11:12 am

== it just makes you look like a knee jerk Cheerleader for Illinois government==

I would argue that it makes people look smart for pointing out the absurdity of the Wisconsin-Illinois comparison.

==No way it raises 1 Billion dollars and just like the lottery it wont go to education.==

I would love to see your analysis of why you have so forcefully stated this. Also, the lottery money does go to education. At least be accurate if you are going to make an argument.

Comment by Demoralized Friday, Mar 21, 14 @ 11:14 am

After seeing that chart, I now understand why so many businesses are fleeing Chicago to go to Detroit…

Comment by Soccermom Friday, Mar 21, 14 @ 11:16 am

==Giving freedom to the taxpayers ==

Sure. We should all be able to direct our tax dollars where we want them to go. Brilliant idea.

Comment by Demoralized Friday, Mar 21, 14 @ 11:17 am

“With 373 facility deals, Illinois’ largest city easily outdistanced its closest competition — second-place Houston with 255 projects and third-place Dallas-Fort Worth with 178. Atlanta (164) and Detroit (129) rounded out the top five.”

All fine and dandy, but my question is: how many new jobs does each “corporate facility” actually create? If lots of new corporate facilities = booming economy, why isn’t Detroit doing better, seeing as it’s 5th on the list?

It seems to me, just from giving the Site Selection article a quick read, that a lot of the corporate facilities in question are small tech start-ups that employ only a few highly trained people. It goes without saying that every added job is a good thing; but a small tech start up can’t possibly have the same overall economic effect as a new factory or a new corporate headquarters or a new distribution facility that could provide jobs to dozens or even hundreds of people who don’t all have to be tech geeks with advanced degrees.

Comment by Secret Square Friday, Mar 21, 14 @ 11:26 am

Might be good marketing move to change the name from Millionaire to “Millionearner”.

More correctly identifies who will be affected.

Comment by x ace Friday, Mar 21, 14 @ 11:29 am

DuPage Dan, glad to see you leading the way for a Wisconsin-model graduated income tax.

Tell me: after Walker’s “tax refund,” what are the effective personal and corporate income tax rates in Wisconsin compared to Illinois? Higher or lower?

And how about that state property tax rebate in Wisconsin? What’s the Illinois property tax rate?

Like I said, you crack me up.

Comment by wordslinger Friday, Mar 21, 14 @ 11:37 am

“It seems to me, just from giving the Site Selection article a quick read, that a lot of the corporate facilities in question are small tech start-ups that employ only a few highly trained people.”

Give it another quick read then, as it references significant investments from companies such as Equinix, Latisys, Google, Gogo, Groupon, Paylocity, Huron Consulting, and Hyatt. Those aren’t small start-ups. They are bringing big dollars to Chicago, more than anywhere else. And our income tax rates aren’t stopping them. This hard truth doesn’t fit the Rauner/Koch narrative. Maybe it’s the narrative that’s wrong, and not so much the business climate of Illinois.

Comment by OldSmoky2 Friday, Mar 21, 14 @ 11:43 am

Demoralized

here is some info on the lottery,

“We thought that it would be a windfall” says Michael Johnson, executive director of the Illinois Association of School Boards. He says the idea that lottery money adds to education funding is a myth.

“The general public — they were fooled by this,” he says. “The belief that that’s additional money, above and beyond what we would normally get, that’s the part that’s not true.”

“Well, it’s certainly one of the worst votes I ever made,” says former Illinois State Senator Dawn Netsch.”

not sure if your ignorant or willfully towing the party line.

want to bet say $1000 on this raising one billion dollars,

Comment by fed up Friday, Mar 21, 14 @ 11:47 am

A Guy

“I’d get them to be voluntary in this measure and appeal to their philanthropy for education”

Are you really serious about this ? You expect voluntary contributions from the same milluionaires that use all sorts of dodges to pay their fair share ?

“Don’t demonize wealthy job creators either”

OK, how many jobs has your wealthy friend Rauner created ? Aren’t millionaires like him actually job crushers, buying up companies, stripping of them of their assets & then go bankrupt ? The real truth is that we have a selfish class of people that only think of themselves, cheat wherever they can, buy off the system to protect themselves and constantly complain that they pay too much. I pay a straight percentage of what I make. No loopholes. No tax shelters. They should pay the same straight percentage that I do, without all the game playing.

Comment by AFSCME Steward Friday, Mar 21, 14 @ 11:50 am

====== Yeah but Wisconsin’s surplus is temporary ===

What difference does that make? I would love to see any type of surplus in the general operating fund in Illinois - isn’t that a better sign of fiscal health than billions of dollars in deficits tied, in large part, to the fiscal irresponsibility of Illinois state gov’t? ===

Apologies. Let me rephrase that.

Wisconsin’s surplus is temporary under the projected revenues BEFORE any Walker tax cut. All a tax cut would do is make the anticipated future deficits worse.

Comment by CollegeStudent Friday, Mar 21, 14 @ 12:46 pm

To the people who think this will be like the lottery or used for another purposes by the State, explain how Illinois could avoid paying directly to the school districts based on the language in the Constitutional Amendment without having to pass another amendment. I’m not a lawyer but it seems pretty clear cut.

http://www.ilga.gov/legislation/fulltext.asp?DocName=&SessionId=85&GA=98&DocTypeId=HJRCA&DocNum=51&GAID=12&LegID=81543&SpecSess=&Session=

Comment by MyTwoCents Friday, Mar 21, 14 @ 1:06 pm

@fed up:

You said the lottery money doesn’t go to education. I simply corrected your erroneous statement as it does, indeed, go to education. Whether it added to it is another story but that isn’t what you said.

As for towing the party line, I think you better read your own comments a little more critically before you accuse others of towing the party line. It’s laughable for you to make such a statement.

In terms of the potential revenue raised I have no idea what the number will be but if you want to be so certain of your genius then I’ll take your bet.

Comment by Demoralized Friday, Mar 21, 14 @ 1:09 pm

Lottery money does go into the school fund, but the legislature reduced its support for the same fund, so… it wound up as a wash.

Comment by Upon Further Review Friday, Mar 21, 14 @ 1:23 pm

Chicago would be broke if it played by the Milwaukee rules. No city vehicle sticker required if you regularly park your car in the driveway or a garage overnight.

In Chicago, the city stickers generate a significant amount of municipal revenue.

Comment by Upon Further Review Friday, Mar 21, 14 @ 1:29 pm

“Those aren’t small start-ups. They are bringing big dollars to Chicago, more than anywhere else. And our income tax rates aren’t stopping them.”

They are, as I noted on another thread. Creating at least 50 jobs is one of the criteria for being cited in the article. So jobs ARE being created, but perhaps not the kind that are visible to, or open to, many of the middle/working class people displaced by the jobs that have left Illinois (e.g. factories).

If new jobs ARE indeed entering the state but the majority of the electorate doesn’t know about them or doesn’t meet the qualifications for them, how much of an impact can they have?

Comment by Secret Square Friday, Mar 21, 14 @ 1:34 pm

===If new jobs ARE indeed entering the state but the majority of the electorate doesn’t know about them or doesn’t meet the qualifications for them, how much of an impact can they have?===

What? All of those jobs have an economic impact on this state regardless of whether most people either know, or meet the qualifications for them. Your statement doesn’t make sense. I’d also point out that one high tech job helps the Illinois economy much more than 4 texas burger-flipper jobs, especially when those burger flipper’s wages aren’t enough to survive on without taxpayer support.

Comment by PublicServant Friday, Mar 21, 14 @ 1:50 pm

Afsme Steward, you’ve just made the case for why you shouldn’t be anywhere near the negotiation and policy making on this issue. And yes, I’m serious. Paying a surcharge on income over $1M beats the hell out of any ‘progressive tax’ and they could look philanthropic doing it. I presented an idea. Like always, you just whined and said nothing new. We taxpayers owe you. They just went to the polls and told you they’ve had it with you. When does your mind begin to process what’s going on in voter land. MJM heard them and here’s a new proposal. You hear them and present the same “no solution solution”. Your bantering about bankrupting companies and eliminating jobs, blah,blah,blah. Don’t be jealous of success. Take advantage of it.

Comment by A guy... Friday, Mar 21, 14 @ 2:12 pm

Historical point of information–

In fact, the Illinois lottery was NOT established to provide funding for education. Instead, its purpose was as a revenue source to replace state dollars that were expected to subsidize Chicago area mass transit under a new Regional Transportation Authority.

Moreover, during the House debate on the lottery proposal, several legislators stated they would vote against the measure because it did not earmark proceeds from the new lottery for the schools.

Both the lottery bill and the RTA legislation passed in late 1973 and were signed into law by Gov. Dan Walker.

On a personal note, I believe I’m particularly well-qualified to address the topic, because I covered the issue for the Chicago Sun-Times and was the author of the page 1 story that reported the passage of the lottery proposal.

Charlie Wheeler

Comment by Charlie Wheeler Friday, Mar 21, 14 @ 2:15 pm

Way to go, Charlie, bringing real history and facts into the discussion, lol.

Where did the legend of the “lottery and education” originate? Because it is out there, everywhere.

Comment by wordslinger Friday, Mar 21, 14 @ 2:18 pm

“All of those jobs have an economic impact on this state regardless of whether most people either know, or meet the qualifications for them. Your statement doesn’t make sense.”

Perhaps I should clarify. I mean “impact” in the sense of impacting the general public’s perception of Illinois as an economic basket case. If thousands of Average Joe/Jane working class people have lost their jobs at the factory, office, etc. or know people who have, and don’t know about or can’t get these high tech STEM jobs in the Loop, or are considering moving due to high property taxes, etc., then, their perception that the economy is going to hell in a handbasket is not going to change. That’s what I’m talking about.

Comment by Secret Square Friday, Mar 21, 14 @ 2:31 pm

In other news, on ESPN, Coach K out of Weber High just threw freshman Jabrari Parker out of Simeon under the bus for losing to Mercer.

Way not cool.

You got out-coached, dude. Sometimes, you have to do more than just show up. Show some class. More Dean Smith, less Bob Knight.

Comment by wordslinger Friday, Mar 21, 14 @ 2:35 pm

Wordslinger,

Dont let Chicago Sun Times and Facts ever be used together.

Comment by fed up Friday, Mar 21, 14 @ 2:42 pm

A Guy

“Afsme Steward, you’ve just made the case for why you shouldn’t be anywhere near the negotiation and policy making on this issue.”

I didn’t know I was a policy maker & never claimed to be.

“Like always, you just whined and said nothing new. We taxpayers owe you.”

Just for your information, Sir Raunerbot, I also pay taxes & have been paying taxes since 1969.

“They just went to the polls and told you they’ve had it with you. When does your mind begin to process what’s going on in voter land.”

What exactly did happen in voter land ? Rauner the GOP primary in an election that he excited the voters so much that it resulted in a near record low turn-out. Additionally, if you know how to add & subtract, more people chose to not vote for Rauner than voted for him.

“Your bantering about bankrupting companies and eliminating jobs, blah,blah,blah. Don’t be jealous of success. Take advantage of it.”

So you consider bankrupting companies to be a success. Dope.

Comment by AFSCME Steward Friday, Mar 21, 14 @ 2:47 pm

That should read. Too much multi-tasking.

Rauner won the GOP primary in an election that he excited the voters so much that it resulted in a near record low turn-out.

Comment by AFSCME Steward Friday, Mar 21, 14 @ 2:54 pm

“Respectfully, the unions only solution has been a tax increase, raising taxes, we pay too little, etc. Madigan is moving in the direction of taxing the truly wealthy for the sake of everyone else.”

Guy, AFSCME has proposed that for years.

Comment by Pensioner Friday, Mar 21, 14 @ 3:01 pm

Fed Up, if you’re questioning Charlie’s institutional memory, knowledge or credibility, than you are a……. fool.

Nicest word I could come up with, under the rules of the house.

Comment by wordslinger Friday, Mar 21, 14 @ 3:06 pm

fed up, you’re an idiot. Either stop it or go away or I’ll make you go away. Your choice, dude.

Comment by Rich Miller Friday, Mar 21, 14 @ 3:15 pm

Thank you, Charlie Wheeler, for distinguishing between fact and opinion. You seem to be about the only poster on this blog who can do so. I would bet that Charlie also knows the difference between “your” and “you’re” and “towing” and “toeing” the line.

Comment by Perry Noya Friday, Mar 21, 14 @ 3:16 pm

==Don’t be jealous of success. Take advantage of it.==

The same could be said for those lamenting about public sector workers, @A guy.

Comment by Demoralized Friday, Mar 21, 14 @ 3:21 pm

The Wisconsin tax refund is just part of the “Walker for President” campaign.

Comment by Buzzie Friday, Mar 21, 14 @ 3:37 pm

–The Wisconsin tax refund is just part of the “Walker for President” campaign.–

Meh, not going to happen. Eyes almost crossed, staring at the nose, like out of “Deliverance.”

Christie, Paul or Santorum.

Don’t count out Santorum. The GOP likes to take the second-place guy from before, and he has a real sugar daddy to keep him in the game.

Comment by wordslinger Friday, Mar 21, 14 @ 3:45 pm

The original lottery bill was sold to the public exactly as Charlie recalls it. It was never originally meant to be for education.

The idea that gambling revenues should be somehow sequestered and go for education first came up many years later, as an argument for a proposed expansion of other types of gambling. People then began to claim “just like the Lottery was.”

The public, and then politicians, deliberately misremembered it. It became a meme for those opposed to any tax increases, to claim that their opponents could not be trusted. Now the Tribune even reports it as if it were fact.

Watch Murphy attempt to do exactly the same thing with the last tax rate increase on another thread today.

Comment by Walker Friday, Mar 21, 14 @ 3:55 pm

The temporary increase in the Illinois income tax reportedly raised an additional $31 million dollars over the past four years. Where did it all go?

Comment by Upon Further Review Friday, Mar 21, 14 @ 4:13 pm

$31 billion… sorry.

Comment by Upon Further Review Friday, Mar 21, 14 @ 4:14 pm

From many of the responses I’ve read here, many of you need to take economics 101. Yes, this state has been doing just great with these tax policies huh??? People & jobs fleeing this state2nd so lets just keep going down this road - wake up people!!!! More Taxing is NOT the answer - a responsible government is - we don’t have one.

Comment by sr Wednesday, Mar 26, 14 @ 8:48 am