Latest Post | Last 10 Posts | Archives

Previous Post: *** LIVE *** Session coverage

Next Post: Fighting fire with fire?

Posted in:

* Tom Corfman writes in Crain’s about revenue options for fixing the budget hole…

One option to balance the budget is reducing the state’s contributions to the retirement plans, which are the most underfunded in the nation. The state’s scheduled $6.6 billion pension payment in fiscal 2016 is larger than the entire deficit. Such a move would give the state some breathing room “for a few years” but would threaten its credit rating, Durkin says.

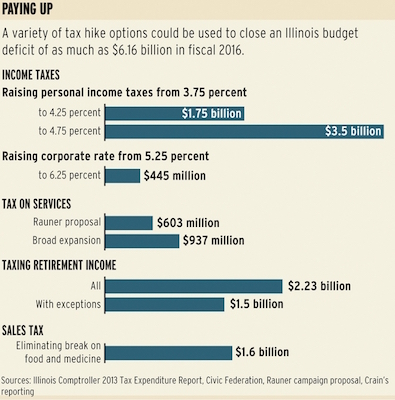

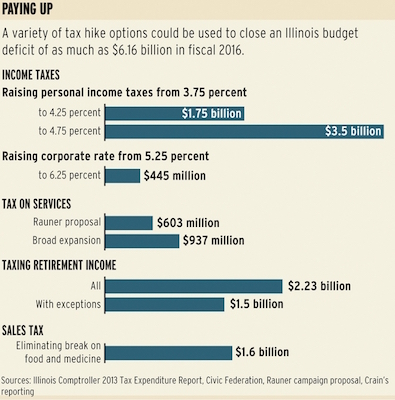

One big target to bolster revenue: income taxes. Increasing the personal tax rate to 4.75 percent—a quarter-point below the temporary tax hike—would raise $3.5 billion, according to the Civic Federation, which favors increasing the rate to 4.25 percent. Raising corporate taxes to 6.25 percent from 5.25 percent would add $445 million. The federation supports upping the corporate rate to 6.0 percent. […]

Other options include expanding the sales tax to 32 services, a move Rauner proposed during the campaign as a way to generate more than $600 million in revenue. An even broader expansion would raise $937 million, the federation says. […]

Taxing retirees with an annual income of at least $50,000, not counting Social Security, would generate between $1.5 billion and $2.0 billion a year, the Civic Federation says.

“Everything has to be on the table, at least for discussion,” says state Sen. Kwame Raoul, D-Chicago, co-chairman of the General Assembly’s conference committee that produced the pension bill two years ago. “The pension problem is not just a pension problem. It came about as a result of the state balancing its budget on the back of the pension system.”

When Minnesota jacked up income taxes, it back-dated the hike to January 1st. That would bring in a whole lot more revenue, but it would also hit the poor and middle class particularly hard.

Retiree taxes are almost assuredly off the table, but one never knows, I suppose. Service taxes can’t be implemented right away, but the future revenues can be bonded for a capital plan.

And, of course, the final option is to do essentially nothing and let Gov. Rauner take the heat.

* A handy Crain’s chart…

posted by Rich Miller

Monday, May 18, 15 @ 10:55 am

Sorry, comments are closed at this time.

Previous Post: *** LIVE *** Session coverage

Next Post: Fighting fire with fire?

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

The tax on retirement income should be imposed at the time of contribution (Roth-style). In fact, Roth contributions are already taxed in Illinois as far as I can tell. If we applied that to Traditional and pension contributions as well, this would generate needed income now and avoid the feared retiree flight. It also taxes the income in the State where it was earned - earnings which in no small part resulted from our tax investments in infrastructure.

Comment by thechampaignlife Monday, May 18, 15 @ 11:07 am

- it would also hit the poor and middle class particularly hard. -

Let’s not forget the Civic Federation also has called for increasing the state’s Earned Income Tax Credit, to take at least some of the sting out of an income tax hike for poor and middle class workers.

Comment by Linus Monday, May 18, 15 @ 11:07 am

The message will soon be “go big or go home”.

Once you raise one tax you might as well spread out the pain.

Comment by Cassiopeia Monday, May 18, 15 @ 11:08 am

I think that when Quinn raised taxes last time that wasn’t so unpopular as the fact that he too made it retroactive to the beginning of the year. It’s difficult to budget for such surprises. A better and fair option would be a future effective date.

Comment by A Jack Monday, May 18, 15 @ 11:11 am

Crain’s sure knows how to make raising the corporate tax look unimportant!

Comment by crazybleedingheart Monday, May 18, 15 @ 11:12 am

== The message will soon be “go big or go home”. ==

I agree. In terms of new taxes, most voters will give them ONE chance to get it right. If they get it wrong and have to go back before the 2016 elections, we’ll have a whole new crop of legislators …

Comment by RNUG Monday, May 18, 15 @ 11:15 am

Would the state employee unions go to court, claiming that the taxation of the pension benefit diminishes the pension?

Comment by M Python Monday, May 18, 15 @ 11:16 am

@A Jack - Yes, give us some notice this time so we can plan our move.

Comment by DuPage Moderate Monday, May 18, 15 @ 11:17 am

A lot of options, but not much will.

Don’t make vacation plans.

Comment by Norseman Monday, May 18, 15 @ 11:17 am

The good ole Civic Committee never tires of attacking state pensions one way or the other.

By the way there are $8.95 billion in ‘tax expenditures’ in this state. But attacking pensions is the target.

Comment by Federalist Monday, May 18, 15 @ 11:21 am

== Would the state employee unions go to court, claiming that the taxation of the pension benefit diminishes the pension? ==

I think it would depend on how it was structured. Tax all pensions and there would be no cause. Try to get fancy and you would be open to an unequal treatment claim.

Comment by RNUG Monday, May 18, 15 @ 11:22 am

“Everything has to be on the table, at least for discussion,” says state Sen. Kwame Raoul, D-Chicago, co-chairman of the General Assembly’s conference committee that produced the pension bill two years ago. “The pension problem is not just a pension problem. It came about as a result of the state balancing its budget on the back of the pension system.”

Yes, amen to that and also it is not a “pension” problem it is a debt problem! We have to start separating out “pensions” from “debt”. The core issue as the Sen. pointed out is the failure to address our structural deficit which to take care of we ran up a pension “DEBT”. We are dealing not with a pension problem but a pension DEBT problem.

Comment by facts are stubborn things Monday, May 18, 15 @ 11:22 am

> 4.75% income tax, PLUS

> HJRCA0051 (millionaire’s tax), PLUS

> pension cost shift (local pain mitigated by HJRCA0051)

Voila! Budget deficit eradicated.

Comment by Bill White Monday, May 18, 15 @ 11:26 am

= I think that when Quinn raised taxes last time that wasn’t so unpopular as the fact that he too made it retroactive to the beginning of the year. =

Quinn signed that bill on 1/13/2011, with the tax backdated to January 1. Most employer withholding was updated to the higher 5% rate in time for February.

Assuming an income tax increase bill is passed and signed into law by Gov. Rauner in early June (which is far from a done deal), I find it highly unlikely that it would include a backdating to January 1 - the same ex post facto argument that was mentioned in the pension ruling would certainly be tested. IMHO, I could see an endgame in which Rauner signs a tax bill in mid-July backdated to July 1, or in mid-August backdated to August 1, both similar timespans to Quinn’s experience.

Comment by cover Monday, May 18, 15 @ 11:26 am

@ RNUG - Monday, May 18, 15 @ 11:22 am:

=I think it would depend on how it was structured. Tax all pensions and there would be no cause. Try to get fancy and you would be open to an unequal treatment claim. =

I totally get what you are saying, and I suspect you may be correct but what if the tax rate on retirement income was set at 50%? I think it is not only that you tax all retirement income but also the rate. A tax on retirement income does diminish that benefit just like higher contribution rates. I suspect, which is what I believe you are correctly alluding to, that if a tax of say 3.75% was assessed on all retirement income above a certain exemption that would pass constitutional muster, but I am not certain about that.

Comment by facts are stubborn things Monday, May 18, 15 @ 11:27 am

“Would the state employee unions go to court, claiming that the taxation of the pension benefit diminishes the pension?”

Good question. One could say that if they taxed all pensions/SS of whatever nature then this would not be targeting state pensions exclusively and therefore constitutional.

However, one could also say that is irrelevant. and that taxation of such pensions after decades of not being taxed is still a diminishment, regardless. So goes for exempting part of it when it is not done on an across the board percentage as our present Constitution calls for.

I am just throwing out possibilities as I have no idea how the ISC would rule.

Any thoughts out there?

Comment by Federalist Monday, May 18, 15 @ 11:27 am

“final option is to do essentially nothing and let Gov. Rauner take the heat.”

Tell me that isn’t the smartest thing for Democrats to do politically and might obliterate what’s left of the Republican and the Rauner party. It’d be consistent with Rauner’s first “victory” he was given. Plus, Rauner might view this as a victory as well. This state is in so much trouble….

Comment by Anonymous Monday, May 18, 15 @ 11:28 am

Sorry, Anonymous comment above is mine.

Comment by AC Monday, May 18, 15 @ 11:30 am

==Taxing retirees with an annual income of at least $50,000, not counting Social Security, would generate between $1.5 billion and $2.0 billion a year, the Civic Federation says.==

The Civic Federation seems to be saying Social Security should be exempt, but not public pensions? If Social Security is going to be exempt, then public pensions that replace Social Security should also be exempt. Otherwise, as others have mentioned, there could be lawsuits based on unequal treatment.

Comment by Joe M Monday, May 18, 15 @ 11:33 am

Retirees from Illinois that have moved to other states already pay taxes on their pensions in those other states (obviously Florida and Texas and other states are excluded).

It would be a very hard argument to make that pensions couldn’t be taxed if they are uniformly taxed with 401(k)s and private sector pensions. I think the private sector would have a better uniformity challenge if the GA taxed all retirement income except Illinois pensions.

Comment by Salty Monday, May 18, 15 @ 11:37 am

@ Federalist - Monday, May 18, 15 @ 11:27 am:

Please read my post just above yours. I also am questioning the conventional wisdom on the taxing of pension income being legal as long as all retirement income is taxed. I think it is all a mute point, because I don’t see any chance of a tax on all retirement income passing anytime soon.

Comment by facts are stubborn things Monday, May 18, 15 @ 11:39 am

Taxing retirement income has a nice synergy with helping to fund retirement pension benefits.

Comment by Anonymous Monday, May 18, 15 @ 11:41 am

Tax pensions and force people to move to states, that do not tax pensions. This will be the reason I need to move!

Comment by Anonymous Monday, May 18, 15 @ 11:43 am

About half the States do not tax social security income. For the federal tax return, social security benefits are not included in adjusted gross income - but are accounted for in combined income and then taxed based on certain thresholds.

As long as the exclusions are uniform I think there would be little chance of a successful court action claiming diminishment of the pension benefit. The fact that most/many individuals do not receive social security if they earned an Illinois pension (and would pay taxes) is incidental to the exclusion of social security income in a tax scenario. It may not be as fair as we would like, but probably legal.

Frankly, it would probably be politically easier to raise the income tax another 0.3% (or whatever it would take for $1.5 billion) than to start to tax retirement income.

Good discussion, though. Once the legislators get done wringing hands over pension reform (and realizing little can be done) the serious work of balancing income and expense can begin.

Comment by archimedes Monday, May 18, 15 @ 11:59 am

Raising taxes. Why is this the only solution? Why are cuts never part of the equasion? If taxes are raised, we all know what will happen. Spending will increase by AT LEAST an amount equal to the additional revenue. And where will that leave us? Nowhere.

Comment by A realistic citizen Monday, May 18, 15 @ 12:06 pm

Military income also isn’t taxed. Other states do tax military pay. Granted it is probably only a drop in the bucket, but may make other tax increases easier to swallow. Although a case could be made for exempting a big chunk of it for the enlisted. However, when you get up into the officer levels, they make some pretty big salaries.

Comment by A Jack Monday, May 18, 15 @ 12:15 pm

== Why are cuts never part of the equasion? ==

The budget was cut 10% or more each of the previous 3 fiscal years under Quinn. About out of cuts unless you start eliminating programs.

Comment by RNUG Monday, May 18, 15 @ 12:21 pm

There are 12 states that fully tax SERS pensions and 23 states that tax SERS pensions if the pension amount exceeds certain limits.

Comment by Emily Booth Monday, May 18, 15 @ 12:24 pm

This is according to the last retirement workshop I attended which was in 2011 (above post).

Comment by Emily Booth Monday, May 18, 15 @ 12:26 pm

Shouldn’t we also be discussing the impact of new taxes on Illinois’ dismal unemployment and labor force participation rates? And what about underemployment which is troublesome? What impact will specific tax increases have on the poor and lower middle classes?

Comment by Cook County Commoner Monday, May 18, 15 @ 12:28 pm

CCC

See Minnesota!

Comment by very old soil Monday, May 18, 15 @ 12:41 pm

Retiremnt taxes are off the table. Why, is it not time to have this legislative body step up and recognize the fiscal mess they have created and fix it. Mederate tax increases across the board are needed with all extra revenue to the pensions to fix that mess. Then we could talk about reducing taxes in future years. But first and foremost freeze the budget. No new or expanded programs until the fiscal mess is cleaned up.

Comment by Anonymous Monday, May 18, 15 @ 12:50 pm

Tax food. Purchases with SNAP are not taxed by Federal law, so the people who actually need the help won’t be affected. the State already collects it in the municipal share, and in NE Illinois, the RTA taxes it. All the retailers have to do is reprogram their cash registers, it could be implemented in a month. Full 5% probably worth about $500M, maybe more.

Then tax retirement income, maybe at half-rate or maybe with an exclusion equal to max Social Security, another $1Bn at least.

Take the income tax back to where it was in 2014.

These should all be no-brainers and failing to do them just tells Wall Street that we are not serious about putting our house in order.

Comment by Harry Monday, May 18, 15 @ 12:51 pm

The budget was cut 10% or more each of the previous 3 fiscal years under Quinn. About out of cuts unless you start eliminating programs.

Then Why not start eliminating obsolete or non cost effective programs.

Comment by Anonymous Monday, May 18, 15 @ 12:53 pm

Well said.

Start with grants. They are a corrupt mess.

Comment by A realistic citizen Monday, May 18, 15 @ 1:04 pm

The one thing to consider when taxing Social Security is that, unlike pension and 401k contributions, employees have already paid taxes on those contributions.

Sadly, SSI is slowly evolving away from a supplemental retirement entitlement to a needs-based welfare program. If you think the payback for what you contribute is bad today, wait until you see how truly horrible it will be 20+ years from now.

Comment by nixit71 Monday, May 18, 15 @ 1:04 pm

===4.75% income tax, PLUS HJRCA0051 (millionaire’s tax)===

Wouldn’t the implementation of a Millionaire’s Tax amount to implementing a graduated income tax, thus requiring a Constitutional amendment to Article IX, Section 3? Also, wouldn’t such a change open Pandora’s box for future graduated rate changes?

My biggest concern with the Millionaire’s Tax has been that it was Madigan’s way to get around the Constitution under the guise of just millionaire’s paying more, then changing the rules and thresholds in future years.

Comment by nixit71 Monday, May 18, 15 @ 1:14 pm

===get around the Constitution under the guise of just millionaire’s paying more===

Um, the “CA” in HJRCA0051 means it is a constitutional amendment.

Sheesh.

Comment by Rich Miller Monday, May 18, 15 @ 1:15 pm

===Then Why not start eliminating obsolete or non cost effective programs.=== Such as? And please be specific. You must have a very specific idea of the non-mandated spending that can be cut to fix this problem.

Comment by pundent Monday, May 18, 15 @ 1:25 pm

My own opinion.

Tax ALL $8.95 of ‘tax expenditures’. No exceptions!

I know that my exemption is better than yours and vice versa and that businesses and the poor and whomever else would scream.

Lower income tax rate back to 3.0%

Yes, this would cost me on my pension. But I firmly believe that low tax rates across the board on all income is best.

If it is felt that taxing retirement income drives some people away from the state ( I believe it would for those who pay income tax beyond any pension income tax) then there is a simple fix. Any amount they owe on income tax would be lowered by the amount they pay on non-penion/SS income.

Comment by Federalist Monday, May 18, 15 @ 1:43 pm

Written like a true tax and spend liberal. You forget that the income tax was raised one early morn in Jan and it did nothing to bring down the deficit because Ed, Bill and Pat had more money to give away and buy more votes. Until fundamental changes are made no taxes should be increased. Madigan can do all the grandstanding in the legislature he wants to, truth is he doesn’t have a clue how to reign in the budget without a tax increase, the last 10-15 years prove that. Its their mess and they expect the taxpayers to fix it

Comment by Short Bus Rider Monday, May 18, 15 @ 1:44 pm

===Until fundamental changes are made no taxes should be increased===

Easier said than detailed, bub.

Also, meeting your obligations is a pretty darned conservative principle.

Comment by Rich Miller Monday, May 18, 15 @ 1:45 pm

I’d love to hear some of Short Bus Rider’s specific ideas for fundamental changes to address this year’s budget challenges.

Comment by Tournaround Agenda Monday, May 18, 15 @ 1:53 pm

**A realistic citizen: “Raising taxes. Why is this the only solution? Why are cuts never part of the equasion?”**

You would that someone calling themselves “realistic” would know and understand that realities of what cuts have occurred over the past several years.

Comment by AlabamaShake Monday, May 18, 15 @ 1:58 pm

==it did nothing to bring down the deficit ==

It made the pension payment. Pay attention.

==Until fundamental changes are made no taxes should be increased==

Clueless. That’s all I’ll say about that comment.

==Its their mess and they expect the taxpayers to fix it==

It’s everybody’s mess.

Comment by Demoralized Monday, May 18, 15 @ 2:50 pm

Who are Ed and Bill?

Comment by Precinct Captain Monday, May 18, 15 @ 2:55 pm

Anyone who thinks that these or any tax increases would occur without significant spending cuts, many of which already have occurred or are already certain for next year, isn’t paying attention.

It will undoubtedly be both serious cuts and more taxes to balance the 2016 budget.

Comment by walker Monday, May 18, 15 @ 3:15 pm

Tax retirees who leave the state before the money leaves the state?

Comment by SallyD Monday, May 18, 15 @ 3:26 pm

No can do Sally D. I pay 7.5% on a large portion of my State of Illinois pension to the state where I now live. You don’t get a piece of it. Sheesh!.

Comment by kimocat Monday, May 18, 15 @ 3:36 pm

== it did nothing to bring down the deficit because Ed, Bill and Pat had more money to give away and buy more votes. ==

The pension payments were made, about 80% of which is paying on the accumulated pension debt. That payment on the accumulated debt was between $4B and $5B a year.

The current owed bill backlog went from about $9B to about $4.5B during the period the temporary increase was in place.

Comment by RNUG Monday, May 18, 15 @ 3:39 pm

Great chart. If nothing else, it is a clear demonstration of the skill with which corporations avoid paying taxes, not that there’s anything wrong with that, as Seinfeld might intone…

Comment by chiatty Monday, May 18, 15 @ 3:54 pm

kimocrat -

More specifically, federal law prohibits states from taxing the retirement income of “non-residents.”

Comment by Juvenal Monday, May 18, 15 @ 4:07 pm

Thanks Juvenal — much better said.

Comment by kimocat Monday, May 18, 15 @ 4:24 pm

The cuts in operating expenses over recent years have included elimination of literally hundreds of programs or grants to organizations. Rauner’s budget proposal included a couple of hundred million in unnamed efficiencies. So much for “waste”.

Time to have a serious discussion, and get away from simple slogans.

Comment by walker Monday, May 18, 15 @ 4:27 pm

“Sadly, SSI is slowly evolving away from a supplemental retirement entitlement to a needs-based welfare program. If you think the payback for what you contribute is bad today, wait until you see how truly horrible it will be 20+ years from now.”

SSI is for the aged and disabled who do not have qualifying quarters for RSDI. It truly is federal welfare. If RSDI is less than the SSI payment level, SSI is usually issued to supplement it.

Comment by Emily Booth Monday, May 18, 15 @ 4:36 pm

“Sadly, SSI is slowly evolving away from a supplemental retirement entitlement to a needs-based welfare program. If you think the payback for what you contribute is bad today, wait until you see how truly horrible it will be 20+ years from now.”

A lot of truth here. That is the reason those on the Left want to tax all earned income for SS- no limits. To the more uninformed this seems to solve nothing as the high contributors would get proportionately more in their SS check. However, the goal is to redistribute much of those ‘contributions’ to lower income groups.

This has already been done in Medicare.

Comment by Federalist Monday, May 18, 15 @ 5:02 pm

everyone knows what must be done. The question is when will state officials find the guts to do it.

I think we have the perfect moment to get it all done. Both parties are back into budget discussions, we have a Democratic legislature and Republican governor so both political parties get both the blame and the credit, and when it gets done everyone can blame the courts.

We will never have a better opportunity to do what everyone knows must be done. So do it!

Comment by Capitol View Monday, May 18, 15 @ 9:06 pm