Latest Post | Last 10 Posts | Archives

Previous Post: Question of the day

Next Post: Impeachment call rebuked

Posted in:

Also contrary to popular belief, the state does not tax its citizens more heavily than its neighbors. While Illinois ranks near the top nationally in property tax collections — all of which go to school districts and other local governments — the state is more middle-of-the-pack for state income and sales taxes as a percentage of personal income, according to the Federation of Tax Administrators.

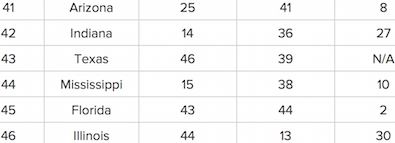

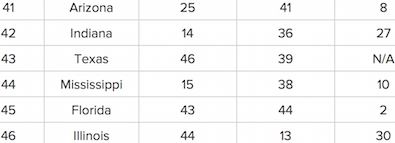

* WalletHub recently ranked Illinois 46th worst for overall tax fairness. The first number is the overall rank, the second is for dependency on property taxes, the third is for dependency on income taxes and the fourth is dependency on other taxes…

You just can’t ignore property taxes. Yes, they’re local, but they’re high because of a lack of state support and because some governments are just way over-spending.

Those high property taxes meant WalletHub ranked Illinois as 10th worst for the middle class and 3rd worst for the bottom 20 percent.

Hooray for us.

* Back to Illinois Issues…

As Senate President John Cullerton has argued for years, Illinois would be in much better financial shape if it had the exact same tax laws as some of its neighbors. For example, if Illinois had Wisconsin’s revenue structure — higher income tax rates, a tax on retirement income, sales tax on services — the Prairie State would collect almost $10 billion a year more than with its current taxing provisions, more than enough to cover Munger’s projected shortfall.

Or they would’ve already squandered it.

* None of this is to suggest that the state has no revenue deficiency problem. It obviously has one and raising income tax rates isn’t a killer on its own. But it also has a serious problem with high property taxes outside of Chicago, and even that’s about to change now. Those taxes should be factored into the equation, so something needs to be done about them alongside state revenue solutions.

posted by Rich Miller

Thursday, Sep 24, 15 @ 12:21 pm

Sorry, comments are closed at this time.

Previous Post: Question of the day

Next Post: Impeachment call rebuked

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

So true, Rich: “Or they would’ve already squandered it.”

Comment by Anon Thursday, Sep 24, 15 @ 12:28 pm

If this was the gov big ask, and he dropped the anti-union vengeance thing, i bet a property tax freeze could be passed.

Comment by Ghost Thursday, Sep 24, 15 @ 12:37 pm

There you go again, go after the pensioners. How about forgetting Walker’s Wisconsin and copy Iowa? Graduated income tax. 34 states have it. Illinois, as a % of Gross State Product, over spends by 5 billion but under taxes by 10 billion. The Walmart greeter pays 13.2 combined taxes on income, Rauner 4.6%. Any questions?

Comment by rural observer Thursday, Sep 24, 15 @ 12:42 pm

Rich, you’re going to make Raunerbot heads explode. They think you just parrot the Madigan “party line.”

You make a very good point. Too bad a needed review of the state’s tax structure is being superseded by Rauner’s anti-union crusade.

Comment by Norseman Thursday, Sep 24, 15 @ 12:42 pm

“Or they would have already squandered it.”

See example: 2011 income tax increase. Increased revenues went to pay pensions (the good), but the state did not restrain spending in any real fashion (exacerbating the structural deficit).

The state has a problem identifying and prioritizing what its essential functions are that require state funding.

Comment by unclesam Thursday, Sep 24, 15 @ 12:42 pm

It’s odd that Illinois tends to vote more D than R compared to the average state, but overall has less progressive taxation than most states.

Comment by Robert the Bruce Thursday, Sep 24, 15 @ 12:43 pm

Since IL does not tax retirement income, the only major way state and local govts can access retiree “wealth” is via property taxes. And even then seniors still get an exemption.

And Cullerton’s assessment is over-simplistic as he does not factor in cost of living. In WI, my income would be 10% lower, but my housing and transportation costs would be 25% lower. And if my salary is 10% lower, that is less income to tax.

Comment by nixit71 Thursday, Sep 24, 15 @ 12:50 pm

A constitutional change would be needed for the Grand Bargain (Progressive, broadened income tax and lower property/sales taxes that Cullerton identifies. We should be about the business of getting that on the ballot.

Comment by PublicServant Thursday, Sep 24, 15 @ 12:50 pm

I would also remind you that Cook County recently raised it taxes, the City of Chicago is about to raise taxes, and the teacher’s union is also calling for more tax revenue for Chicago schools. Are there any governmental bodies that are NOT raising taxes?

Comment by Just Me Thursday, Sep 24, 15 @ 12:53 pm

1. It’s important to not that the WalletHub survey is based on what the public THINKS is fair, which is that people who make more should pay more. So of course Illinois is considered less fair because of heavy reliance on sales and property taxes.

2. It is worth noting that Indiana, Texas and Florida are ranked 42, 43 and 45 Rich, so as we look for role models we probably want to look elsewhere.

3. Wallethub glosses over the fact that Illinois has a flat income tax, which might even push its overall ranking lower.

4. The Tax Foundation does a great study comparing the combined tax burden of both state and local taxes as a percent of household income, which is really helpful because it allows you to see that while Illinois is on the “high end”, it’s relative tax burden of 10.2% is not far off from the national average of 9.8%.

As for the “squandered” rationale…I think it is fair to say that state government is much more transparent in it spending that local bodies.

Comment by Juvenal Thursday, Sep 24, 15 @ 12:59 pm

I must have missed Senator Cullerton introducing bills that would allow for our tax structure to be the same as our neighbors. The last tax increase was only temporary with a 4 year sunset passed after the election by lame duck legislators. That was a real profile in courage.

Comment by Shoedoctor Thursday, Sep 24, 15 @ 1:04 pm

unclesam

“See example: 2011 income tax increase.”

Actually, not so much. As Dan Rutherford told WBBM on April 23, 2012, the entire income tax increase went to cover pension costs.

Comment by Anyone Remember Thursday, Sep 24, 15 @ 1:11 pm

The property tax element remains somewhat misleading because it varies widely and is a matter of local and consumer choice.

I chose to live in Oak Park when we started having kids for the schools, the park district, the libraries, etc. There are surrounding communities that tax a lot less — and get much more state money for schools — but again, that was my choice, to tax myself at a higher rate.

Same goes for people in Evanston, Hinsdale, Winnetka, etc.

Cry me a river if you don’t like high property taxes in Lake Forest. Just move up the road a piece to North Chicago.

Comment by Wordslinger Thursday, Sep 24, 15 @ 1:18 pm

**while Illinois is on the “high end”, it’s relative tax burden of 10.2% is not far off from the national average of 9.8%.**

FWIW, the Tax Foundation numbers are from last year, when the state income tax was still at 5%.

Comment by AlabamaShake Thursday, Sep 24, 15 @ 1:25 pm

Sorry not sorry, but asking me to entrust extra tax funds to people who couldn’t run or manage a lemonade stand and then have them “promise” that my property taxes would be lowered isn’t a good sell.

Comment by Team Sleep Thursday, Sep 24, 15 @ 1:31 pm

Ratings agencies and others have repeatedly said Illinois needs a combo of cuts and tax increases. I would like to see some progressivity in our taxes and think it’s kind of a big deal. Some apparently think it’s okay to grind Illinois to a halt unless union rights are severely limited. There’s the other side of the reform coin that doesn’t seem to have much clamor right now, and that’s raising the state income tax on the wealthy.

A progressive income tax bill failed twice recently, once this year (millionaire surcharge) and once last year or the year before, when the coalition “A Better Illinois” pushed for it.

On one hand, we have wealthy think tank types screaming about leaving Illinois upon an income tax increase. On the other we have retiree types screaming that they will leave the state if there’s a pension tax. I wish this would stop, since we all paid a low state income tax when it was an average of 2.75% for decades.

Comment by Grandson of Man Thursday, Sep 24, 15 @ 1:32 pm

Unless I buy a new car, sales tax doesn’t amount to much. Food at a grocery store, one of the larger outlays a family makes, is taxed at 1%.

The ever increasing real estate taxes, of which 62-63% goes to the local school district, is outrageously high.

We are not comparing apples and oranges here, we are comparing a huge watermelon to a single pea.

Comment by anon Thursday, Sep 24, 15 @ 2:30 pm

==The first number is the overall rank, the second is for dependency on property taxes, the third is for dependency on income taxes and the fourth is dependency on other taxes==

Might wanna check that. It looks like the 2nd is for property taxes, 3rd is for sales taxes, and 4th is for income taxes.

Comment by Anon Thursday, Sep 24, 15 @ 2:32 pm

Land tax not much

Comment by Big foot Thursday, Sep 24, 15 @ 2:37 pm

@Grandson - “A Better Illinois” was the union storefront (Citizen Action) of a union storefront (AFSCME, SEIU) calling for not just progressive but higher taxes on pretty much the entire state population.

So if we’re going to stop the wealthy folks screaming about higher taxes and retirees screaming about retirement taxes, shouldn’t we stop the public sector unions screaming about higher taxes?

Comment by nixit71 Thursday, Sep 24, 15 @ 2:46 pm

note number 45. you know, that state that everyone says they are moving to to escape illinois’ “high taxes.” florida. where high taxes are paired with low wages! we call it the sunshine tax. enjoy the sunshine, but realize you will make more money elsewhere!

i love florida. i love coming from florida. but don’t try to tell me florida has lower taxes than illinois…

Comment by bored now Thursday, Sep 24, 15 @ 2:48 pm

WORDSLINGER…Your comment assumes everyone has the ability to move. Just asking, but do you think its fair that in Cook County you almost have to live in some of those suburbs you listed in order to get any kind of a DECENT EDUCATION? City schools other than magnet schools are mostly terrible. Southern Cook has no tax base and some very bad school districts with 20 to 30 % property tax rates! I’m SURE EVERYONE WOULD LOVE TO MOVE TO OAK PARK WITH YOU AND YOUR GREAT SCHOOLS. If they could afford to. The State of Illinois is not funding education, paying its bills on time and borrowing more money every year it can’t AFFORD TO BORROW. Why? Because we’re a low tax State if you have money. We’re a high tax State if you don’t have money. Regressive taxation policies are killing the middle class in Illinois. Time to join the 21st century and tax consumption by expanding the State sales tax to all services. Paying someone to do something for you is the new economy and people have a choice to consume those services. They can’t choose to move to Oak Park or not pay property taxes. Time for those who benefitted the most by our regressive tax policies to pay up. A completely new way to fund the State coffers has to be developed and what is Gov. Raunger should be working toward by holding up the budget, not his BS turnaround ideas!

Comment by qualified somebody nobody sent Thursday, Sep 24, 15 @ 2:58 pm

Word, I don’t understand where you’re coming from on this. Your “choice” of a town that has higher property tax rates, in the name of better schools, park districts, libraries, etc., indicates to me that the next town “up the road a piece” must not have equally good schools, park districts and libraries that are more highly funded by the state, or you would have chosen to go there and pay less taxes. If that’s the case, then you have the opportunity to make that choice only because you earn more money and can afford to do so. I don’t see that as a “choice” a whole lot of people have the ability to make.

Comment by Kodachrome Thursday, Sep 24, 15 @ 2:59 pm

One can argue that Mike Madigan has helped to create a tax regime that serves his interests.

It’s friendly to the rich, because Madigan is rich. Not uber-rich like Rauner of course, but rich enough that with a typical graduated income tax — unlike the unusual “millionaire tax” proposal — the vast majority of his income would be taxed at the highest marginal rate.

Overall, taxes are high on the middle and working classes, allowing public employees to be relatively well compensated. This is characteristic of a patronage system, where generous compensation inspires the fierce loyalty that protects the patron.

Comment by Anon Thursday, Sep 24, 15 @ 3:04 pm

@Qualified-Is a “decent education” reflective of the educational resources or those being taught? If you flip-flopped the Oak Park and Austin kids, would their grades flip-flop as well? Doubtful.

As Wordslinger said, he already pays proportionately more for education than those in Austin, both via higher property taxes and less state and federal assistance. So how much more cost can the Wordslingers of the state bear in order to have more “equitable” funding. Because the next question is going to be “Why am I paying so much?”

Comment by nixit71 Thursday, Sep 24, 15 @ 3:14 pm

nixit 71…Again is it fair that only some kids in Cook County have a chance for a good education? Or only kids of affluent parents? Isn’t it the responsibility of State government to make sure its way of funding education is equitable for all taxpayers? The State is and has been not doing this job! 20% of education costs are paid by State money raking us at or near the bottom annually. Regressive taxes are wrong! If you have personally benefitted from the archaic Illinois taxation policies…GOOD FOR YOU. You going to being paying a fairer share soon because the reality is that our current revenue stream doesn’t pay the bills!

Comment by qualified somebody nobody sent Thursday, Sep 24, 15 @ 3:37 pm

anon 3:04

“One can argue that Mike Madigan has helped to create a tax regime that serves his interests.

It’s friendly to the rich, because Madigan is rich.”

So Mike Madigan was rich in 1970 and single handedly wrote the flat income tax provisions of the Illinois Constitution?

Comment by Anyone Remember Thursday, Sep 24, 15 @ 3:40 pm

Come up with a grand bargain that has:

a) a graduated income tax

b) service (use) tax on everything

c) the state fully funding all early learning through 12 education at the today’s (last years?) average per student level counting all revenue sources, including what the state is supposed to be paying into the teacher pensions .. and then index the state support level to the federal CPI

d) since it was included in the calculation in (c), shift the normal pension cost payment responsibility to the local school district and REQUIRE the pension payments be made like under IMRF … and if the district doesn’t make the pension payments, then the state automatically makes the payments for them by deducting any shortage from the next year’s school funding for that district. Since the total state support is tied to the CPI in (c), the local school boards will have an incentive to limit raises and spiking to control their future pension costs

e) reset the local school property tax to between zero and 1/4 of the current level, and let local voters decide if they want to put more money into the school districts

f) for higher education funding, mandate a maximum percentage of total spending that can be spent on administration / overhead … which includes all management at the university / college, and when I say all, that includes the president and any payments for committee assignments, etc.

g) for that matter, consider placing that administrative cap / mandate on the local school districts also

I have no idea what rate(s) should be assigned to the use and graduated income tax but I’m sure the staff at Revenue can model any scenarios the legislature might want to consider. The one thing I am sure of is the overall amount of taxes paid / raised at the state level will have to be drastically higher than today.

This plan even has a number of things that Rauner wants:

a) better than the requested property tax freeze, it actually reduces local property taxes

b) it increases the state portion of the school funding

c) by slashing the local school district property tax and allowing for voters to increase it, it returns control to the local voters just like Rauner wants

d) implements a service tax, just goes a bit father than envisioned by Rauner

e) TRS pension reform is included, even though Rauner might not view it as reform

Even though there is no union busting, there is enough that Rauner and company can legitimately claim some victories.

It’s somewhat logical and the math could be made to work, so it will never pass.

Comment by RNUG Thursday, Sep 24, 15 @ 3:47 pm

nixit71,

The call for higher taxes goes beyond public unions, as ratings agencies and others like the Civic Federation support raising taxes as a key component in bettering Illinois’ fiscal situation. Those who know the call to raise taxes goes beyond public unions and don’t acknowledge it do so willfully.

We have to come to terms with the fact that for decades we enjoyed a low state income tax, which has been a large factor in our current fiscal crisis. This does not exclude that we may have to take other steps beside raising taxes to help our finances.

Comment by Grandson of Man Thursday, Sep 24, 15 @ 3:58 pm

@RNUG-

=e) reset the local school property tax to between zero and 1/4 of the current level, and let local voters decide if they want to put more money into the school districts=

Help me understand your rationale here. What is the basis for the 0-1/4 reset? My concern- the state fully funding at least year’s or today’s level (your c) does not and then reducing local funding by 75% or more leaves most districts massively short of funding.

Going to the voter’s, I get where you are going with that but that takes significant time and couldn’t happen fast enough for current fiscal conditions. The voter’s elected the school board so they have had their say anyway.

If these efforts fall short what then? Your could be talking about a 60% budget shortage. Add in cost shift without the option of levying for that additional cost and wow are schools in huge trouble.

I would suggest that the state start with fully funding the current GSA foundation of $6119 plus fully fund all MCAT claims at 100%. the Flat Grant would be de-funded. THEN, review or revise the funding formula within two years, then implement cost shift.

This a) gives time for schools that are in fiscal trouble to get their feet under them.

b) allows the state to understand and experience what the full effect will be, particularly with revenue before going completely live with their largest cost (cost shift is $1.6 billion and declining thanks to Tier 2)

c) allows districts time for financial planning based on a detailed understanding of what the new revenue levels will be.

d)You could do this while implementing PTELL across the state (rate freeze not revenue freeze)

e) then implement a property tax reduction of 25% to 30%

f) must allow districts the option of levying for cost shift (local control)

If you are going to do your “g” then there should also be one for teachers. There are thousands of teachers that make more than me in Illinois with less experience, education, responsibility, accountability.

BTW- Rauner does not want local control. He wants to put it on locals do reduce the pay of middle class workers because he does not want to own it.

Comment by JS Mill Thursday, Sep 24, 15 @ 4:11 pm

“Help me understand your rationale here. What is the basis for the 0-1/4 reset? My concern- the state fully funding at least year’s or today’s level (your c) does not and then reducing local funding by 75% or more leaves most districts massively short of funding.”

Sorry, I barely passed typing in high school..should have read-

Help me understand your rationale here. What is the basis for the 0-1/4 reset? My concern- the state fully funding at least year’s or today’s level (your c) does not GET SCHOOLS TO THE FOUNDATION LEVEL WHICH IS MORE THAN 7 YEARS OLD NOW AND BELOW EFAB RECOMENDED LEVELS and then reducing local funding by 75% or more leaves most districts massively short of funding. LAST YEAR’S LEVEL WAS IN THE $4700 RANGE.

Comment by JS Mill Thursday, Sep 24, 15 @ 4:14 pm

I’m so sad. I started reading some interesting posts on how to revise Illinois’ tax structure to try and improve school funding, address concerns about high property taxes, and start digging the state out of it’s hole. I was heartened by the thought of a serious adult discussion by our political leaders. Alas, I then discover that it was blog leaders RNUG and JS Mill. Sigh.

Comment by Norseman Thursday, Sep 24, 15 @ 4:26 pm

Koda, others, you’re really missing my main point, which was that a statewide property tax factor for judging overall tax burden is misleading as they vary widely.

A secondary point and that if you choose to live in Oak Park, or Lake Forest, or Wilmette, it’s pretty silly to complain about high property taxes. It’s like moving next to O’Hare and complaining about jet noise.

You generally get what you pay for, and you knew that when you made the choice.

Comment by Wordslinger Thursday, Sep 24, 15 @ 4:44 pm

@qualified - I agree with you, but when you look at the premium folks are already paying in those more affluent districts, you have to wonder how much more cost those folks can absorb. For every Winnetka, there are many more Tinley Parks populated by working class folks already paying similarly high property taxes.

So in order to make education funding more equitable, the “haves” - who really don’t have as much as you think - will be forced to pay even more. Can they? The folks in Tinley Park would say no.

The next question will then inevitably be, “Why are we ALL paying so much?!”

Comment by nixit71 Thursday, Sep 24, 15 @ 4:49 pm

JS Mill,

Either I wasn’t clear or you read past it. When I said all, I meant ALL.

Total up all the money the school district gets from federal grants, the state, property taxes and whatever the state’s “normal” pension contribution should be. If you were sure the federal money would be there, then just total the state and property tax and “pension” money. Have the State pay all of it.

In theory, on average, that would require zero local property taxes for preK-12 schools. In other words, it should be hold harmless. Since I said to use a state-wide average, I recognize that would leave some districts short, so I could live with the local districts taxing level above zero. I wouldn’t want it above 25% of the current amount but that should still leave most districts with more $’s than they have today. And if they wanted even more int he future, then let them raise it by referendum from the local voters.

And thinking it through a bit more, maybe there could be an adjustment upward in school funding based on either percentage of special ed students and / or students below the poverty line and / or based on community cost of living. I’m sure Andy Manar could refine my suggestion a bit but the end goal in my vision is to have the local districts only paying 5% - 10% of the total school bill.

Comment by RNUG Thursday, Sep 24, 15 @ 5:11 pm

@Grandson - Understood. I think we are on the same page on some things. Tax services at some level to reflect our service-based economy. Tax retirement income (your statement “for decades we enjoyed a low state income tax” implies retiree didn’t pay their fair share, no?).

My biggest gripe is no tax on retirement income. I say tax that first at the current rate, then decide on a new flat or progressive tax rate for EVERYONE. As Quinn said, “Everybody in. Nobody left out.”

All income is not created equal. As a private sector worker paying state income taxes, SS/Med, and my own retirement income, my take home pay is 30% less than a retiree even though our gross “wages” are the same. If a retiree has a gross pension/IRA of $65K, I have to make $78K just to be on equal footing. And my income is not guaranteed, nor is it guaranteed to compound 3% per year, etc. My SS is essentially a welfare tax someone else will consume. No middle age exemptions.

So working folks like me have all these things already stacked against them. And then you have a retiree at the exact same income level as me, but his income isn’t good enough to tax and mine is? Not very progressive, if you ask me.

Comment by nixit71 Thursday, Sep 24, 15 @ 5:14 pm

Let’s Talk Taxes:

Increase IL state income tax to 6%, or

Increase IL state income tax to 5% but include all retirement income

Leave the property taxes alone. We want local control of schools.

Comment by Enviro Thursday, Sep 24, 15 @ 5:18 pm

@Enviro - Or…

a. Leave IL state income tax at 3.75%, or

b. Increase IL state income tax to 4.75% but include all retirement income

If the retired think we have a revenue problem, then then can jump on board with the higher tax rate and join the party. If not, we cut, cut, cut. Cuts that will eventually impact them.

Your suggestion basically gives retirees the choice of paying 5% or increasing taxes on everyone else another 60% and continue to pay nothing. The portion of the population that votes in droves. In other words, you just sentenced working folks to a very big tax hike.

Comment by nixit71 Thursday, Sep 24, 15 @ 5:33 pm

My suggestion had nothing to do with taxpayer choice.

This is all about the state legislators’ and the governor’s choice.

Comment by Enviro Thursday, Sep 24, 15 @ 5:37 pm

A tax hike for working folks? I would gladly take a minimal tax hike if the none paying citizens are paying the same as I am. With a flat tax eliminate income tax, gasoline tax (one of the highest in the country), and minimize property tax. The flat tax will also maximize visitor purchases in the state.

Comment by bull47 Thursday, Sep 24, 15 @ 5:40 pm

The state & local tax burden is around 16% of state gross domestic product. The national average is 18%. Illinois is not over-taxed.

Comment by C.L. Ball Thursday, Sep 24, 15 @ 6:26 pm

@RNUG- Yup, I missed it apologies. That changes my thoughts on what you proposed quite a bit. I liked most everything else. Property taxes need to be addressed. 10 years ago HB 750 (supported by Martire) tried and failed.

There is a study through National Lewis University and Michelle Mangan that examines/proposes a different mode for school funding called evidence based funding. It looks at desired outcomes and then determines costs and accountability. I wonder what your suggestion would develop in a per pupil number versus the evidence based model.

I like your proposal.

Comment by JS Mill Thursday, Sep 24, 15 @ 6:38 pm

The focus of the study you cite is the progressiveness or regressivness of the tax system, not whether the state is taxed too much overall. (Other commenters have spoken to this: Illinois is not overtaxed). But the WalletHub study shows that Illinois’s tax burden is unfairly distributed. The logical conclusion you should reach, based on the evidence you cite, would be Cullerton’s: that Illinois’s regressive tax structure is a scandal–especially in a blue state–and should be changed. Instead, you mistakenly cite that study as evidence for an argument that it actually undercuts….

Comment by Zeppo Thursday, Sep 24, 15 @ 9:04 pm

== Increased revenues went to pay pensions (the good), but the state did not restrain spending in any real fashion. ==

Other than debt service and a few other costs the State has to pay, where did spending increase? Most sectors of the budget have taken a big hit in constant dollars over the last few years. CTBA has done a analyses showing the declines in discretion

ary spending.

Comment by nona Thursday, Sep 24, 15 @ 9:27 pm

== Is there any unit of government .taxing less. ==

The Village of Schaumburg has lowered its property tax levy in each of the last 5 years.

Comment by nona Thursday, Sep 24, 15 @ 9:30 pm

-Nona: lowering the tax levy in no way correlates to keeping expenditures in line. This village may be one of the few rare communities and taxing districts in the Land O Lincoln that experienced either increased EAV or some growth (wal-mart/Costco?).or did you have some white-flight?

Comment by Blue dog dem Thursday, Sep 24, 15 @ 11:11 pm

anon said: “Unless I buy a new car, sales tax doesn’t amount to much. Food at a grocery store, one of the larger outlays a family makes, is taxed at 1%. The ever increasing real estate taxes, of which 62-63% goes to the local school district, is outrageously high. We are not comparing apples and oranges here, we are comparing a huge watermelon to a single pea.”

A huge watermelon (property taxes) compared with a single pea (sales taxes)? I don’t think so. Total collected property taxes in Illinois are about twice the amount of total collected sales taxes. In 2000, total collected property taxes were $16 billion in Illinois compared to $8 billion in total collected sales taxes. I doubt that this ratio has changed much.

Comment by Ultimata Thursday, Sep 24, 15 @ 11:39 pm

anon said: “Overall, taxes are high on the middle and working classes…”

Actually, in Illinois the poor pay a higher percentage of their income on taxes than the working/middle class or the rich. The rich pay the lowest percentage of their income on taxes. Illinois (including local government) has a very regressive tax structure. I suspect the role of ‘big money’ in Illinois politics is a major reason why nothing is being done to fix this problem.

Comment by Ultimata Thursday, Sep 24, 15 @ 11:52 pm

I find it odd that

1) at the state level many are clamoring for a graduated income tax and;

2) at the federal level many are clamoring for a flat tax.

Comment by Late to the Party Friday, Sep 25, 15 @ 6:36 am

BDD, “white flight” from Schaumburg?

You started the weekend early.

Comment by Wordslinger Friday, Sep 25, 15 @ 6:47 am

==Actually, in Illinois the poor pay a higher percentage of their income on taxes than the working/middle class or the rich. The rich pay the lowest percentage of their income on taxes.==

Yet the top 20% taxpayers in the state already pay 70% of the total individual income taxes collected.

Comment by nixit71 Friday, Sep 25, 15 @ 9:31 am