Latest Post | Last 10 Posts | Archives

Previous Post: Time to update the talking points

Next Post: Let it play out a bit more

Posted in:

* From Crain’s…

posted by Rich Miller

Monday, Apr 4, 16 @ 9:57 am

Sorry, comments are closed at this time.

Previous Post: Time to update the talking points

Next Post: Let it play out a bit more

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Looks like the sooner we raise our taxes, the better. We probably need to get rid of that pesky retirement income tax subtraction too, so the folks that weren’t paying enough taxes decades ago don’t get to run out on the bill either.

Comment by Anon Monday, Apr 4, 16 @ 9:59 am

https://www.google.com/imgres?imgurl=http://www.gastropods.com/Shell_Images/P-R/Penion_waitei_1.jpg&imgrefurl=http://www.gastropods.com/1/Shell_3201.shtml&h=417&w=408&tbnid=XGbVyAK1J8Gt2M:&docid=YNhCVDyXWgFFGM&ei=JYECV86ZHeK4jgSD8oawDQ&tbm=isch&ved=0ahUKEwiOwPi4n_XLAhVinIMKHQO5AdYQMwgdKAAwAA

Comment by MissingG Monday, Apr 4, 16 @ 9:59 am

Let’s not forget $5 billion for Cook County, which Chicagoans are also on the hook for.

Comment by nixit Monday, Apr 4, 16 @ 9:59 am

It’s scary how much it’s grown worse since the first misguided pension “fix” was proposed. How much more will it grow until our elected “leaders” quit avoiding the inevitable?

Comment by Sir Reel Monday, Apr 4, 16 @ 10:01 am

How does the following pension funds look

legislature

and the

Judges?

Comment by Mama Monday, Apr 4, 16 @ 10:01 am

Loving God….loving, loving God.

Comment by Honeybear Monday, Apr 4, 16 @ 10:04 am

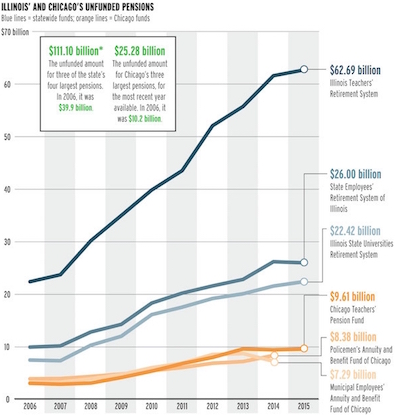

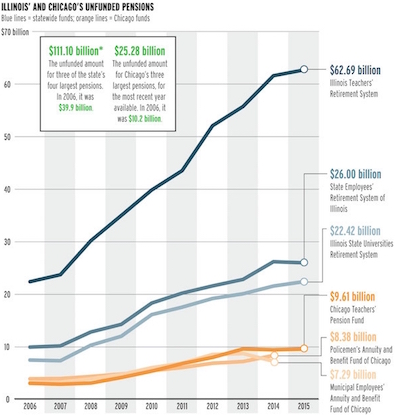

Needs to have three more lines: Actuarial payments that should have been made, Edgar Ramp payment schedule, and payments that were actually made.

Comment by RNUG Monday, Apr 4, 16 @ 10:04 am

This would be comical if this wouldn’t be so detrimental to the state. Only putting in 9% of your retirement while the state picks up the other 91% can only be sustainable for so long.

I firmly believe once Tier 2 employees and elected officials run the state will there be legitimate motivation to put a constitutional amendment on the ballot to change the pension clause.

Side Note: Does anybody know how much money was lost during the financial crisis, and how much was recovered? I’m sure the unfunded liability would still be substantial, but an increase of $80 billion over ten years is fairly large… Unless it was because of the Jim Edgar pension ramp.

Comment by Almost the Weekend Monday, Apr 4, 16 @ 10:05 am

Sometimes a simple picture is the most compelling story. It’s clear to me that Illinois can’t continue without pension reform.

Comment by FAIRNESS AND FAIRNESS ONLY Monday, Apr 4, 16 @ 10:06 am

Misspelled word in title — ‘penion’

Comment by Formerly Known as Frenchie M Monday, Apr 4, 16 @ 10:06 am

Man this makes me really want to study gov’t finance. Especially as to how to arrive at these numbers for all the pensions and their effects on bond ratings for example.

Comment by Levois Monday, Apr 4, 16 @ 10:07 am

“Only putting in 9% of your retirement while the state picks up the other 91% can only be sustainable for so long.”

So…..you are saying that earnings play no part in keeping a pension fund healthy. These earnings add up faster when the state pays its yearly share. Works even better if they pay the actuarily-required amount rather than what they choose to pay.

Comment by Ole' Nelson Monday, Apr 4, 16 @ 10:12 am

RNUG,

===Needs to have three more lines: Actuarial payments that should have been made, Edgar Ramp payment schedule, and payments that were actually made.===

I don’t think the authors of this graph wanted to provide enough detail to understand that this situation was entirely self created by our elected leaders refusing to fund our future commitments. The moral hazard of the Edgar Ramp should be the stuff of legend in public budgeting but it’s poorly understood.

I find it disconcerting that most of our leaders want to do anything but pay the bill.

Comment by Anon Monday, Apr 4, 16 @ 10:12 am

Right to work, and term limits will fix that. If that darn Madigan would just quit playin games

Comment by Saluki Monday, Apr 4, 16 @ 10:13 am

== How does the following pension funds look

legislature and the Judges? ==

They’re a rounding error in the $111B pension debt and less well funded than the others.

From FY15 reports:

JRS - funded @ about 35% level, about $1.5B short

GARS - funded @ about 16% level, about $0.3B short

Comment by RNUG Monday, Apr 4, 16 @ 10:13 am

===Especially as to how to arrive at these numbers for all the pensions and their effects on bond ratings for example.===

The effect to the bond ratings should actually be very moot. One of the issues with ratings for municipal bonds is that when you look at decades of data, B rated municipal bonds have lower default rates than AAA rated corporate bonds. Dodd-Frank was supposed to address this by requiring credit rating agencies to account for the lower default rates starting in July of 2014, but that doesn’t actually seem to have occurred. This could be due to the fact that credit rating agencies now face potential liabilities.

Illinois bond rates, and the last issue of general obligation bonds, are higher than what the market would bear which is why they were so oversubscribed.

The City of Chicago is a different matter, of course.

Comment by Anon Monday, Apr 4, 16 @ 10:15 am

===…constitutional amendment…===

===…pension reform…===

A Constitutional Amendment won’t do anything.

The only pension reform this state needs is to pay back the money that was used to paid other state bills. Ya know, just like the rest of us do.

Comment by PublicServant Monday, Apr 4, 16 @ 10:17 am

The only rational basis to continue “as is” would be the possibility of federalization of the state and local pension debts under Hillary, which Dems would love. Or, perhaps eventual authority for states to go bankrupt, which the GOP would love. No matter what, it seems we are past the tipping point.

Comment by chad Monday, Apr 4, 16 @ 10:17 am

Would probably be worth adding information as to when the systems made assumption changes, since the TRS spike in 2014 I believe was largely caused by their decision to change the assumed rate of return.

Comment by Juice Monday, Apr 4, 16 @ 10:25 am

===Only putting in 9% of your retirement while the state picks up the other 91% can only be sustainable for so long.===

Let me correct this on two levels: first, employee contributions make up more then 9% of the funding for pensions.

Second, and more importantly, 100% of the funding comes from the state. If the state gives me a dollar and then deducts a dollar from my paycheck to put towards the pension, this is the same as if they hadn’t given me the dollar in the first place and had instead directly put the dollar into the pension fund. All compensation, whether it is salary, health insurance, or retirement funding comes from the state. The idea that any is ‘paid’ by employees is simply an accounting fiction.

Comment by Darren72 Monday, Apr 4, 16 @ 10:25 am

From what I understand, these estimates are based on the 7-8% calculated returns the Legislature put in a few years ago to make them sound better.

In the new normal, pension funds will be lucky to do 3-4% annual returns, so the $110B is more like $150B.

There is no taxation scenario that can fix this. Even a 300% property tax and 12% state income tax wouldn’t fix this disaster.

Hello bankruptcy court.

Comment by Rhino Slider Monday, Apr 4, 16 @ 10:25 am

Rich, there is something wrong with the page margins on this article. The other ones are ok.

Comment by Mama Monday, Apr 4, 16 @ 10:26 am

== In the new normal, pension funds will be lucky to do 3-4% annual returns, so the $110B is more like $150B. ==

Institutional investments are still doing 8% - 2% or better.

Slightly tongue in cheek, the pension funds could just buy the state debt owed to vendors and wait for it to get paid, earning 9% (annualized) the first year and 12% (annualized) the second year.

Comment by RNUG Monday, Apr 4, 16 @ 10:30 am

@ATW - The state does not pick up “the other 91%.” Public employees earn investment returns on their pensions just like us 401k’ers. When the employer doesn’t make the proper payments, you lose out on those investment gains as well.

Comment by nixit Monday, Apr 4, 16 @ 10:30 am

=== It’s clear to me that Illinois can’t continue without pension reform.===

Two other options are increasing taxes and cutting spending on other things (schools, human services, etc.). It appears to me that the courts have spoken clearly on cutting any of the existing promised benefits.

Comment by Hit or Miss Monday, Apr 4, 16 @ 10:31 am

Institutional investments are still doing 8% - 12% or better.

Comment by RNUG Monday, Apr 4, 16 @ 10:31 am

@Juice - What’s scary is that the assumptions were reduced a mere 1/2 percent for 3 funds, but the result was a $7 billion increase in the total unfunded liability.

http://cgfa.ilga.gov/Upload/1115%20SPECIAL%20PENSION%20BRIEFING.pdf

And let’s not forget…every pension liability assumption and debt re-amortization plan being peddled today assumes Tier 2 benefits will remain intact, which they most certainly will not.

Comment by nixit Monday, Apr 4, 16 @ 10:37 am

July 2007: Illinois House votes 107-0 to defeat the the Gross Receipts Tax that would have raised $6-7 billion/year.

When Rod said, it was “basically an Up Day,” I think we now know what that means.

Comment by okgo Monday, Apr 4, 16 @ 10:38 am

===Ya know, just like the rest of us do.===

The state is the rest of us! We each just need to pony up about 10k to pay for the services people got decades ago. It’s only rotten if, you know, you just moved into the state or something.

Though to be reasonable, this should just be expressed as a percentage of the state’s GDP.

Comment by Anon Monday, Apr 4, 16 @ 10:42 am

Need a companion chart showing how much money Illinois taxpayers saved (compounded) over the years as the State as employer skipped and modified its pension contributions in order to keep a 3% state income tax rate for 20 years. But the piper has to be paid as some point.

Comment by Joe M Monday, Apr 4, 16 @ 10:43 am

==This would be comical if this wouldn’t be so detrimental to the state. Only putting in 9% of your retirement while the state picks up the other 91% can only be sustainable for so long. ==

Presumably, you have been sending your 6.20% to Social Security, as has your employer. You expect that money to be invested and with the magic of compounding give your x amount per month. Where do you think that x amount comes from - because your contribution is a mere pittance of your benefit. Again, due to the magic of compounding. Why is that acceptable for you but not for people with pensions?

The formula doesn’t work when the state keeps the contributions and/or borrows from the pension funds for years. Before you say ‘ the union should have prevented that’… there were court cases where the unions were told they didn’t get to force contributions, they got to force payment of the pension to the retiree.

Comment by thoughts matter Monday, Apr 4, 16 @ 10:44 am

What percent of the pension payments are going to pay the actual pension debt as opposed to the interest on the debt?

Comment by TinyDancer(FKA Sue) Monday, Apr 4, 16 @ 10:45 am

http://wgntv.com/2016/03/27/political-pulse-illinois-pension-crisis/

Senator Cullerton interview by Paul Lisnek, at approximately the 2:30 mark regarding not being able to go back to change the Constitution Pension Clause.

Also, looks like they will be trying the “consideration” approach again.

Comment by Tsavo Monday, Apr 4, 16 @ 10:46 am

Do these figures really take into account t 2 payments and much much lower benefits over time….I don’t think it does. It’s today’s snapshot.Right now we need a budget and some mental stability or we will have an even more expensive hole to dig out of.

Comment by illinois manufacturer Monday, Apr 4, 16 @ 10:46 am

Looks like the big boys should have listened to Ralph a lot earlier!

Comment by forwhatitsworth Monday, Apr 4, 16 @ 11:10 am

So, this is the scenario with current low state income tax rates, corporate welfare, and the Edgar pension ramp (not to mention bad bond deals with outrageous interest rates.)

Did anyone do a chart using a higher tax rate (like most other states), corporations actually paying the taxes they owe, and without the ramp? (Not even mentioning - refinancing the debt.)

Comment by TinyDancer(FKA Sue) Monday, Apr 4, 16 @ 11:13 am

Blago, how does that no-new-taxes pledge look now?

Comment by Angry Chicagoan Monday, Apr 4, 16 @ 11:14 am

Do’t know if anyone actually noticed but the Teachers Retirement System liability is where the problem lies. The rest of the systems are not that bad.

Why punish the rest of the Systems with reform when the TRS is where the problem lies.

Comment by Elementary Monday, Apr 4, 16 @ 11:18 am

Illinois gross domestic product is $720 B per year. https://research.stlouisfed.org/fred2/series/ILNGSP and Illinois collect $22 B per year http://www.revenue.state.il.us/Publications/AnnualReport/2015-Table-1.pdf So let’s just put those large numbers in context of the state’s economy.

Comment by NoGifts Monday, Apr 4, 16 @ 11:20 am

== What percent of the pension payments are going to pay the actual pension debt … ==

Only about 23% of the payment is for current employee pension “debt”. The rest is to make up for the skipped contributions and less than actuarially required Edgar Ramp payments.

Comment by RNUG Monday, Apr 4, 16 @ 11:38 am

== Do these figures really take into account t 2 payments and much much lower benefits over time….==

Unfortunately, they do account for that.

Comment by RNUG Monday, Apr 4, 16 @ 11:40 am

There are solutions. Every day that passes, the problem gets worse. Courts have ruled. There appears to be no option other than to pay back the debt. Where are the adults?

Comment by AnonymousOne Monday, Apr 4, 16 @ 11:45 am

Elementary, do some homework before reading a graph and asserting that all the trouble is at one fund.

TRS has a larger unfunded liability because it has more members and retirees than SERS and SURS combined. In reality, over the past 20-30 years the 3 systems’ funded ratios have been relatively similar, with SERS falling back a bit after the 2002 ERI.

Comment by Arthur Andersen Monday, Apr 4, 16 @ 12:01 pm

RNUG, since the carrying cost on the unfunded liability is close to $8B, without new normal costs included, I would say accurately none of the current state contribution goes to lessen the unfunded liability, since it continues to grow. And, in fact, the state was making less than the actuarially required contribution before the Edgar ramp and still (obviously) does after the ramp, since the liability continues to grow, as does, with few exceptions, the misunderstanding on this site (teachers contribute only 9% of the pension payment?)

Comment by steve schnorf Monday, Apr 4, 16 @ 12:42 pm

Steve Schnorf, good point. On paper, they are paying current cost, in fact, they aren’t.

As I noted at 10:04am, there really needs to be 3 more lines on the chart.

Comment by RNUG Monday, Apr 4, 16 @ 1:00 pm

“not making” obviously. Sorry.

Comment by steve schnorf Monday, Apr 4, 16 @ 1:01 pm

The law is clear for anyone willing to deal with reality — pensions are a constitutional promise that must be paid. The sooner the legislature and the Gov. get on with how to do it the better.

The first thing you need to do when you find yourself in a whole is to quit digging. Also, there is nothing structurally wrong with the pension system, other then it was not properly funded.

This graph also points out that citizens have received billions of dollars of state services that they have never paid for.

Comment by Facts are Stubborn Things Monday, Apr 4, 16 @ 2:21 pm

@FAIRNESS AND FAIRNESS ONLY - Monday, Apr 4, 16 @ 10:06 am:

=Sometimes a simple picture is the most compelling story. It’s clear to me that Illinois can’t continue without pension reform. =

the state already has and it is called tier 2.

Comment by Facts are Stubborn Things Monday, Apr 4, 16 @ 2:25 pm

==This graph also points out that citizens have received billions of dollars of state services that they have never paid for.==

But were the citizens properly informed? As a teenager many moons ago up to now, I worked and dutifully paid my taxes, assuming the budget was balanced properly and obligations were properly accounted and paid for at that time. They obviously weren’t. I already paid what you told me, now I have to pay more? If Blockbuster came knocking on my door today saying I was supposed to have paid $40 per rental, I wouldn’t have went there to begin with.

Comment by nixit Monday, Apr 4, 16 @ 2:45 pm

==- RNUG - Monday, Apr 4, 16 @ 10:13 am: == How does the following pension funds look

legislature and the Judges? ==

They’re a rounding error in the $111B pension debt and less well funded than the others.

From FY15 reports:

JRS - funded @ about 35% level, about $1.5B short

GARS - funded @ about 16% level, about $0.3B short

Thanks RNUG

Comment by Mama Monday, Apr 4, 16 @ 6:32 pm