Latest Post | Last 10 Posts | Archives

Previous Post: A truly bizarre turn of events

Next Post: Pat, I kinda think they already know who you are

Posted in:

* Greg Hinz…

A war of statistics has broken out over a proposal to institute a graduated income tax in Illinois, with varying camps presenting it as a battle between “fairness” and a potential business flight from the state.

Both sides [yesterday] offered a flood of competing facts, figures and charts—all accompanied by lots of spin—with one group contending that the plan would give Illinois the third-worst business tax climate of the 50 states. […]

At issue, as previously reported, is a pending bill by Rep. Lou Lang, D-Skokie, to revamp the state’s current 3.75 percent individual income tax. The rate in the lowest bracket would go down to 3.5 percent, enabling Lang to contend that “99.3 percent” of individual filers overall would pay less. But the rate would soar to 8.75 percent for income above $500,000 a year for individuals ($750,000 for married couples filing jointly) and a cool 9.5 percent for income above $1 million a year for individuals ($1.5 million for joint filers). […]

In a report and at a Springfield news conference, [the Tax Foundation] said owners of small businesses, who often just “pass through” their business income to their personal tax return, will be put at a huge disadvantage relative to other states. In fact, they note, since pass-through businesses also have to pay the state’s 1.5 percent corporate personal property replacement tax, the combined top rate would be 11.25 percent—higher than any other locale except California and New York City, and higher than the combined 7.75 percent paid by big C corps.

Greg thinks the truth is somewhere in the middle, but I think the Tax Foundation’s numbers make the case that a relatively tiny number of people will take a big hit.

* But the group is also misleading as heck. Check out this bit of Tax Foundation “analysis”…

Despite the more than $30 billion raised by the temporary tax increases, Illinois still has over $7.2 billion in unpaid bills

That mountain of unpaid bills was a whole lot lower before the tax hike partially expired. And it’s that high now because the tax hike expired, not “despite” the 2011 tax hike.

I mean, really. C’mon, people.

* Read on…

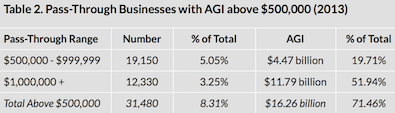

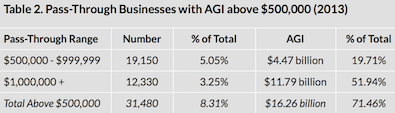

Of particular note, the companies responsible for over half of all small business income would be subject to a top marginal rate of 11.25 percent, which is significantly higher than Illinois corporate income tax rate of 7.75 percent. Even businesses with income above $500,000 but not more than $1 million would pay more as pass-through entities than they would under the corporate income tax were this plan adopted. The table below gives a sense of how many Illinois small businesses would be adversely affected by the tax increase, and the percentage of total pass-through AGI they represent.

The table…

So even the Tax Foundation admits that just 8.31 percent of pass-through business owners would pay more - and that could be way off because if those business owners are married then the tax hike wouldn’t kick in until $750,000.

* Rep. Lou Lang…

“The majority of Illinois small businesses in Illinois, 73% are pass through entities and pay the individual income tax rate and over 90% of those businesses have an adjusted gross income of $200,000 or less. All of those small businesses would get a tax cut under my plan.”

The reality is that a comparatively tiny number of pass-through business owners (12,330, according to the Tax Foundation - roughly the size of a single Springfield ward) make up a very large (51.94 percent) chunk of total adjusted gross income in this state. Those are the owners who would pay the most. They are at the center of this argument. And they are also making a whole lot of money. That’s not a bad thing. It’s just a fact.

* And speaking of which…

.@ingramlaw @StateRepLouLang’s narrative around his $2 billion tax hike is even worse pic.twitter.com/QDf1HNQDYF

— Illinois Policy (@illinoispolicy) April 27, 2016

The small number of people who would pay more are, indeed, Illinoisans. Rep. Lang should know better.

posted by Rich Miller

Wednesday, Apr 27, 16 @ 1:56 pm

Sorry, comments are closed at this time.

Previous Post: A truly bizarre turn of events

Next Post: Pat, I kinda think they already know who you are

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Yes a 2 billion tax hike on a small group of Illinoisans who can totally totally afford it and have managed to avoid paying more by buying and manipulating our political system.

Comment by Honeybear Wednesday, Apr 27, 16 @ 2:05 pm

If we are going to have a constructive and intellectually honest debate on this proposal, we are going to have to agree on what qualifies as a “small business.”

And please help me with this, but the tax would be on the business’s profit, not there gross income, right? And it’s a marginal rate, meaning a business filing as an individual would only pay the increase on profits over the initial $500,000 they net, right?

Comment by Freddy K Wednesday, Apr 27, 16 @ 2:06 pm

The Policy Institute seems to be having a lot of fun with Lou Lang, but let’s be real about this; they’re intentionally misleading with that statement.

Comment by Anonymous Wednesday, Apr 27, 16 @ 2:11 pm

==…have managed to avoid paying more by buying and manipulating our political system==

Do you have any details supporting this blanket smear of these folks?

Comment by Lomez Wednesday, Apr 27, 16 @ 2:17 pm

IPI is intentionally attempting to mislead with semantics. Lang is intentionally telling the truth, wholly, with empirical data about the TOTAL impact, and the breakdown as to who is impacted and how much.

Comment by out of touch Wednesday, Apr 27, 16 @ 2:18 pm

The easy solution for those “small business people” to avoid the higher rate then is to incorporate as an S Cor, or C Corp. If they are making enough money to pay a higher personal tax rate, it shouldn’t be too much trouble for them to incorporate. My wife started a small business, and she only wishes that paying income taxes would be a concern. She’ll be in the red for a while, and she would love to pay 10% in taxes one day when she is making enough money to do so!

Comment by mollly maguire Wednesday, Apr 27, 16 @ 2:25 pm

All of Illinois tax payers will pay less on their first half-million dollars of annual income?

Gee, I guess I could live with that…

– MrJM

Comment by @MisterJayEm Wednesday, Apr 27, 16 @ 2:28 pm

==The Policy Institute seems to be having a lot of fun with Lou Lang, but let’s be real about this; they’re intentionally misleading with that statement.==

I wonder how it must feel to not only be one of the people who would shoulder this $2B hike, but then be treated as some phantom resident group when talking about the impact. His careless wording reveals the way he and many others feel about the wealthy* (*as determined by AGI round numbers)

Perhaps one day we could say –

“Thanks.”

Comment by Lomez Wednesday, Apr 27, 16 @ 2:29 pm

All this leads to Russell Long’s famous quote “Don’t tax you, don’t tax me, tax that fellow behind the tree!”

Comment by A Watcher Wednesday, Apr 27, 16 @ 2:32 pm

So what is to prevent these job-creating producers from establishing a residence in Florida?

Half of Jupiter Island and Naples residents now are former Illinoisans!

Comment by Formerpol Wednesday, Apr 27, 16 @ 2:34 pm

These people don’t deserve their wealth. Never mind that many went years without turning and a profit. Who cares if some work 70 hours a week and never take vacation. They deserve no more than those of us who work 37.5 hours a week and retire at 55.

Comment by Robert the 1st Wednesday, Apr 27, 16 @ 2:36 pm

IPI refuses to identify their donors, claiming privacy and citing the 1950’s NAACP ruling. Now we get a better glimpse of who their donors are.

Comment by Elo Kiddies Wednesday, Apr 27, 16 @ 2:46 pm

the IPI statement seems to be one that would be rated as Half-True (at best) by Politifact. Yes, there are billionaires who are Illinoians and would be impacted, but the vast majority of Illinoians would not be impacted and would receive a tax break, using the current numbers in the bill.

Comment by Name Withheld Wednesday, Apr 27, 16 @ 2:49 pm

I hope someday to suffer the burden of being in the highest possible tax bracket, because it will mean I’m in the highest possible income bracket.

Comment by AC Wednesday, Apr 27, 16 @ 2:52 pm

Only in the fantasy world of progressive liberals is the government underfunded, tax monies spent wisely and well, government pronouncements accepted as truth revealed, and successful Illinoisans will stay in place and not relocate to escape taxation, regulation, and the declining quality of life around them. It’s why ‘progressive liberal governments’ like Cuba sometimes have to build walls to keep their citizens in.

Comment by Maguffin Wednesday, Apr 27, 16 @ 2:55 pm

If someone would be willing to raise my family’s income to over a million dollars I promise not to complain about being in Lang’s targeted tax bracket.

Comment by Dance Band on the Titanic Wednesday, Apr 27, 16 @ 2:59 pm

What happens if the so called 1% leave and we don’t get their tax money. Who do we gouge then. Put in the bill that the tax rates can’t be raised for 20 years. Because as soon as possible the money grabbers will be looking to raise more money and more money and it’s only fair you pay more since you got up and went to work today. Codify no rates increase for a long time. Because the supposed revenue increase won’t materialize but the spending sure will then the money grabbers will be looking squarely at the middle class.

Comment by Just wondering Wednesday, Apr 27, 16 @ 3:03 pm

“they are also making a whole lot of money. That’s not a bad thing. It’s just a fact.”

Implying that they’re high on the hog is disingenuous. How much of that money is reinvested back into the business? And how much wouldn’t be when they start paying the second-highest small biz tax among the 50 states?

Comment by Anonymous Wednesday, Apr 27, 16 @ 3:05 pm

===How much of that money is reinvested back into the business?===

Please be so kind as to Google “Adjusted Gross Income.”

Comment by Rich Miller Wednesday, Apr 27, 16 @ 3:06 pm

Just out of curiosity, how many of those 12,330 small business owners are currently serving in the Legislature?

Comment by Bryan Murley Wednesday, Apr 27, 16 @ 3:08 pm

==Who cares if some work 70 hours a week and never take vacation. They deserve no more than those of us who work 37.5 hours a week and retire at 55.==

Some is the operative word. If men and women making $500K in profits a year can’t leave their business behind for even a few scattered vacations then I would probably say they may want to seriously consider taking some of that profit and hiring someone capable of running the show in their absence. Again some of these millionaires like Rauner have 9 vacation homes and can just pack up and take the family wherever they want and whenever they want.

Believe me I understand nobody wants to be taxed. Remember also that many of these millionaires are paying only a 15% capital gains tax on a huge chunk of their income. Ask Bruce if he’d rather bay the highest federal rates on his stock gains or pay a higher amount on the state income tax.

Comment by CrazyHorse Wednesday, Apr 27, 16 @ 3:08 pm

=== Put in the bill that the tax rates can’t be raised for 20 years===

The last permanent income tax increase was in 1991 - 25 years ago. They aren’t common occurrences.

Comment by Rich Miller Wednesday, Apr 27, 16 @ 3:09 pm

So what does it say about successful Illinoisans who leave the state after (and while) accumulating their wealth by way of the labors and earnings of their fellow Illinoisans and by way of the regressive tax policies of Illinois government?

Comment by Vole Wednesday, Apr 27, 16 @ 3:11 pm

Lou Lange is occupying a fantasy. His proposal has ZERO chance of being approved even in his own caucas. Enough Ddms recognize they can ill afford to make the State even less attractive to business then it already is. Out of 20 major metropolitan areas- Chicago has had the second worst housing recovery and our employment is still lagging. News flash Lou- those folks in the population you are targeting can readily move

Comment by Sue Wednesday, Apr 27, 16 @ 3:11 pm

Taxes are going to go up. So the argument is how best to do it. The sooner everyone accepts that the better because then you can start to have reasonable discussions.

Comment by Demoralized Wednesday, Apr 27, 16 @ 3:14 pm

The real problem with Lang’s plan is that the numbers are too low.

$250,000 is a nice number for a tax increase. In years that I’ve made more than that, I always felt it was reasonable to pay more in federal taxes. Above that number, I never was too concerned about school tuition for the kids or taking nice vacations. My $350,000 years meant a decent amount of time was spent on an island. If I can afford 10 nights on an island, I can afford an extra 0.25% or and extra 0.50% in taxes on income over $250,000.

We are in tough times. Those of us who benefit most should pay a bit more.

Are “Illinoisans” going to pay more under Lang’s plan? Sure they are, but at his numbers, there is no question but that they benefited and can afford it.

It is time for Lang and other Democrats to stand up and own this. Darn right some people will pay more. They need to stop playing these games of denial. Tell the truth and moderates will understand. Lang is never going to convince the far right on any tax increase. Act reasonable and honest and he can convince the middle.

Comment by Gooner Wednesday, Apr 27, 16 @ 3:17 pm

For all of the talk about Illnois needing more revenue to fund a minimum 4 billion dollar deficit how does this solve the problem? Lou Lang and the rest of the supporters of this bill apparently believe we can keep spending as we have been and only raising taxes on the 1 percent and all of our problems will be solved. Are there any estimates of how many jobs are in jeopardy if we do in fact have the third highest tax on successful small business?

Comment by Lucky Pierre Wednesday, Apr 27, 16 @ 3:21 pm

If a tax increase isn’t part of the answer, what is? Even Rauner’s proposed budget required a tax increase to be balanced, and the bill backlog was smaller then than it is now.

Comment by AC Wednesday, Apr 27, 16 @ 3:21 pm

The threat of these small business owners leaving because they’ll need to pay marginally more on their net income over $750,000 is a joke. There are many others waiting in the wings for their marketshare. Go ahead and leave. Illinois will be fine.

Comment by PublicServant Wednesday, Apr 27, 16 @ 3:22 pm

Lomez @ 2:17

Type the following words in your search engine “Rauner, Bruce”

Comment by Jocko Wednesday, Apr 27, 16 @ 3:23 pm

Sue - every state around Illinois, except Indiana, has a progressive tax. How exactly has having a progressive tax harmed businesses and individuals in Wisconsin, Kentucky, Missouri, and Iowa? Are those states business unfriendly because of their progressive tax?

Comment by Name Withheld Wednesday, Apr 27, 16 @ 3:26 pm

There’s a nice chart at the bottom showing the rates and brackets for all the states. http://taxfoundation.org/article/state-individual-income-tax-rates-and-brackets-2016

Comment by NoGifts Wednesday, Apr 27, 16 @ 3:26 pm

Of the number of entities identified as pass thru and realizing net incomes of $500000+, how many are investment partnerships located in Chicago which are exempt from the 1.5% per Illinois Income Tax Act Section 205(b)? Many I’m sure. These partnerships realize large capital gains that go untaxed in IL at the entity level, nor do they have much in the way of employees so they’re really not job creators either. If the owner moves to FL and the business remains here in IL, the owner would still pay IL tax on the flow thru because the income was derived in IL.

Comment by Headed to the exit Wednesday, Apr 27, 16 @ 3:35 pm

Elo Kiddies @ 2:46 pm:

Kindly name a 501(c)3 that discloses their donors.

Misericordia should have to disclose all of their donors too. After all, they were actively “lobbying” on HB 6304 and SB 2610.

Comment by MacombMike Wednesday, Apr 27, 16 @ 3:36 pm

Rich - In the United States income tax system, adjusted gross income (AGI) is an individual’s total gross income minus specific deductions. Taxable income is adjusted gross income minus allowances for personal exemptions and itemized deductions.

Companies invest in their businesses from the AGI by buying equipment, hiring employees, and the like.

@Molly - you told small companies to choose to be a Subchapter S Corp or C Corp. Subchapter S are taxed at the higher rate under this plan.

Comment by 4 percent Wednesday, Apr 27, 16 @ 3:38 pm

Ironically, I’m probably more in favor of a graduated income tax with Rauner in office. Previously I suspected that the Dems would just use it to ratchet up spending. Now that Rauner is a check on spending, it seems more reasonable to establish a fairer tax regime.

Comment by Anon Wednesday, Apr 27, 16 @ 3:38 pm

4 percent

If the business reinvests profits by purchasing equipment and hiring employees, those would then be deductions and “agi” would be reduced. Thus if an entity realizes “agi” of $500,000, that’s net of any reinvestment with the net going to the owner.

Comment by Headed to the exit Wednesday, Apr 27, 16 @ 3:44 pm

It would be wonderful if some in the ILGOP would see this as a win-win for Illinois citizens.

Supply-side economics don’t work. Ever. Luckily, The Bernake didn’t try to stimulate the economy during Recession by lowering tax rates of the wealthiest. We would have been off the cliff.

Negotiate and reach compromise on the rates and brackets.

Negotiate and reach compromise on the window when rates can be changed.

ILGOP green on the CA and green on the rate bill.

The ILGOP needs to understand the $37b - $32b leaves a difference of $5billion. Now. This year. On track to be $25b in FY19, per GOMB Jan 2016. A credit shark and bankster’s dream come true.

Question — What is Rauner’s magic bullet to stop this financial chaos? I doubt the ILGOP knows because they are too afraid to ask.

Comment by cdog Wednesday, Apr 27, 16 @ 4:05 pm

If the proponents of the tax increase could also tell me what programs to cut I would be more inclined to listen to their argument (well, a little bit anyways). But all I hear is “we want more money, we want more money, we want more money.”

Maybe that isn’t what they’re saying, but that is what I’m hearing.

Comment by Not It Wednesday, Apr 27, 16 @ 4:13 pm

You might blend the taxes and require that the progressive tax can never be more than 50% of the expected revenue to be generated from total taxes and that all future tax hikes must be done proportionally to both “systems”: that might reassure the 1% that they won’t routinely get soaked for more taxes without the politicians having to answer to tax hikes for everyone.

Comment by lake county democrat Wednesday, Apr 27, 16 @ 4:21 pm

==If the proponents of the tax increase could also tell me what programs to cut I would be more inclined to listen to their argument==

I think you have it backwards, opponents of the tax increase need to identify cuts sufficient to allow for the backlog to be paid down, because mathematics requires it.

Comment by AC Wednesday, Apr 27, 16 @ 4:37 pm

==For all of the talk about Illnois needing more revenue to fund a minimum 4 billion dollar deficit how does this solve the problem?==

It’s insanity to suggest that revenue not be part of the solution. Unless you want the state to look like what it does now (universities on the brink of closure, social service agencies dropping left and right, etc.), which it would look like if you do spending cuts alone, revenue is going to have to be part of the equation.

And the problem is much bigger than $4 billion.

Comment by Demoralized Wednesday, Apr 27, 16 @ 4:39 pm

It would be nice to know precisely where they got that 12,330 number. Trying to use the IRS Statistics of Income to figure out who would pay this tax on business income would not be simple, and I doubt they have done it. “Pass-through” businesses do not report AGI, only individuals do, so who exactly is in their table? According to the IRS Statistics of Income for 2013, less than 62,000 individuals with AGI over $1 million reported positive business income, so are they claiming that 20% of those individuals were Illinois residents or are at least subject to Illinois tax? If they really mean pass-through businesses, and just stated the wrong measure of income being reported, 12,330 of those businesses could have hundreds of thousands of owners, not all individuals, not all residents of Illinois and not all with AGI over $1 million, while there may be a bunch of smaller businesses that pass through income to Illinois residents with AGI over $1 million.

Comment by Whatever Wednesday, Apr 27, 16 @ 5:16 pm

–* But the group is also misleading as heck. Check out this bit of Tax Foundation “analysis”…

Despite the more than $30 billion raised by the temporary tax increases, Illinois still has over $7.2 billion in unpaid bills

That mountain of unpaid bills was a whole lot lower before the tax hike partially expired. And it’s that high now because the tax hike expired, not “despite” the 2011 tax hike.

I mean, really. C’mon, people.–

They’re just liars.

That’s their bit, that’s what they do, that’s why they get paid. They lie and perform tricks for money.

There’s a word for that.

Comment by wordslinger Wednesday, Apr 27, 16 @ 6:00 pm

I did not say revenue is not the problem. Obviously more revenue is needed. Where do they propose we get the rest? Pretty important question and anyone who thinks this is all they are asking for is a bit naiive. They should put the entire package on the table, including the cuts and additional revenue. Fooling people into thinking they can pay lower rates than they are now while we can just soak the rich is incredibly dishonest

Comment by Lucky Pierre Wednesday, Apr 27, 16 @ 6:21 pm

Whatever,

I think the stat we need is related to K-1 filings.

Every shareholder of an s-corp gets a K-1. The K-1 is the vehicle of the pass-through and lands on the 1040 to calculate your AGI.

The K-1 totals are after the corp paid the IL corp tax.

Of course this pass through income is only part of the income of an individual, especially an individual that is banking $500k + per year. There would also most likely be a W2, some 1099s, some cap gains, etc.

So how many IL taxpayers are shareholders of S-corps and get a K-1 higher than $500k?

I have two s-corps, work very hard, and have never come near that number. I would have a tax cut under Lang’s plan.

Do the math ILGOP!

Comment by cdog Wednesday, Apr 27, 16 @ 6:52 pm

So these pass throughs have an opportunity to incorporate and pay a lower rate.

Comment by burbanite Wednesday, Apr 27, 16 @ 6:57 pm

Could one of these fools in the GA cut spending? This state is a laughing stock of corruption and mismanagement.

Comment by Tone Wednesday, Apr 27, 16 @ 7:03 pm

Tone, tell us what you’d cut? I’m really curious to hear.

Comment by PublicServant Wednesday, Apr 27, 16 @ 7:08 pm

It is interesting to look at the Rauner’s form 1040 from 2014.

Line 17 is where their pass through income is listed. They actually had a loss of $7.6m on that portion of their return. Of course neither the Schedule E or the K-1s are provided so the details of the loss remain private.

Their income was much more substantial than their line 17 loss. I guess their small business, partnerships, etc., didn’t do so well in 2014.

Interest, dividends, capital gains, and sale of business property (line 14, form 4797) made up the largest portion of the impressive $57.5m AGI.

A very minuscule portion of the Rauner’s total income, if any, would have been affected by this 11.25% fire alarm being cranked up by these protectors of the current unfair system.

BTW, I still haven’t heard how many jobs Rauner created lately.

http://www.illinois.gov/gov/Documents/Press%20Releases/Rauner-2014-Tax-Returns.pdf

Comment by cdog Wednesday, Apr 27, 16 @ 7:15 pm

how did Minnesota survive and then thrive with a tax increase?

Comment by foster brooks Wednesday, Apr 27, 16 @ 7:45 pm

“There’s a nice chart at the bottom showing the rates and brackets for all the states.”

Excellent resource. Thanks for the link. I see that in many other states, the income tax is more progressive than what is proposed here. I had a disagreement about this plan when I first saw it.

I think this plan asks for too much from the highest earners and not enough from others. I would like to see something more akin to other states, where the burden is spread out among incomes that are not at the top.

I definitely believe the wealthy should pay a higher state income tax but don’t believe they should be singled out to pay such a disproportionate share.

Comment by Grandson of Man Wednesday, Apr 27, 16 @ 7:48 pm

Again talk of the income tax change without the real estate, sales,gas, etc changes is really just pocket pool.

I would hope any of these “leaders” would realized the taxpayers pay dearly here in Illinois and it is not just on income.

Comment by cannon649 Wednesday, Apr 27, 16 @ 9:30 pm

- Rich Miller - Wednesday, Apr 27, 16 @ 3:06 pm:

===How much of that money is reinvested back into the business?===

“Please be so kind as to Google “Adjusted Gross Income.”

Yeah, still doesn’t include principal payments. By far the biggest part of my “adjusted gross income” is spent on principal payments that, if not made, would completely shut down my revenue.

AGI also doesn’t include equipment purchases that aren’t put into service the same year, which has raked me. Through me into a wildly, artificially bracket even though none of that money ever came close to my personal bank account.

Comment by Liandro Wednesday, Apr 27, 16 @ 9:32 pm

Old blue kinda needs to chime in here as that small business owner. Unfortunately the last recession damn near crippled many small businesses. Years of losses drained years of profits. Too high of burden makes creating a nest egg impossible. I have often thought that a consecutive year tax has merit. Meaning show profits for ‘x’ amount of years in a row and your tax rate is ‘y’ . Complicated but doable. Let’s be creative, we will only get one shot at a progressive tax. Let’s make it work.

Comment by Blue dog dem Wednesday, Apr 27, 16 @ 10:25 pm

==how did Minnesota survive and then thrive with a tax increase?==

A quick search showed that Minnesota has four brackets, starting at 5.35% at $1 of income, and ending at 9.85% for income over $154K. That seems high, but I’m guessing that if Illinois adopted ALL of MN’s tax code, including sales and property, the average Illinois taxpayer would see a substantial decrease in their annual tax outlay. The high earners, however, would get clobbered. The question is, would total tax receipts go up, or down, if IL taxes mirrored that of MN? I’m game to look seriously at doing that, but remember, MN also taxes retirement income, and has a much lower number of local taxing bodies, that’s what it would take for me to sign on. Has anybody done the math?

Comment by Anonymous Wednesday, Apr 27, 16 @ 10:32 pm

For Tone,

Universities across the state have actually seen decreased state appropriations at least since 2007 and (iirc) before that. So there have been cuts.

Comment by Bryan Thursday, Apr 28, 16 @ 7:23 am

worried that the floodgates will open…put in the amendment all income tax hikes in illinois to be subject to voter approval at the next regularly scheduled election.

Comment by atsuishin Thursday, Apr 28, 16 @ 10:00 am