Latest Post | Last 10 Posts | Archives

Previous Post: Morning shorts

Next Post: Murders higher than NY and LA while mayor’s park sucks up cash

Posted in:

* There’s a whole lot to go through in a new, comprehensive poll released by the Paul Simon Public Policy Institute, but let’s start with the media coverage. Daily Herald…

A new poll of Illinois voters finds support for balancing the state budget through cuts rather than tax increases, just so long as the things voters support aren’t on the chopping block.

And that favorites list includes school funding, police and prisons, state parks, help for the needy and a litany of other big-ticket programs that make up the overwhelming majority of state spending.

The head of the Southern Illinois University think tank that commissioned the statewide poll said the findings show people are uninformed about state finances and unable to grasp the depths of budget problems.

“The public really has no idea what the scale and the scope of this crisis is,” said Mike Lawrence, director of the Paul Simon Public Policy Institute.

* Pantagraph…

Absent cuts to those programs, Lawrence, a former Statehouse reporter and top aide to Republican Gov. Jim Edgar, said Illinois will need some kind of tax hike to climb out of its budget hole.

“We need to have a reality check,” Lawrence said.

When it comes to raising money, the poll found that voters supported a graduated income tax, in which wealthier people would be taxed at a higher rate.

But, because such a change in tax policy would likely require a change in the state constitution, it could not serve as a quick fix to the state’s current financial challenges.

* SJ-R…

Sales and income tax increases were soundly rejected, and expanding gambling and selling or leasing state assets such as the lottery were turned down.

Lawrence blames that on voters not understanding how big the budget problem is.

For example, he said respondents want to cut legislative salaries or those of high-paid state employees but noted that would cover only a tiny piece of a budget facing billions of dollars in debt and deficits.

“There’s no painless way out of this budget situation,” Lawrence said. “We need to have a reality check.”

* Now, let’s get to the poll itself.

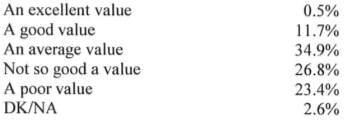

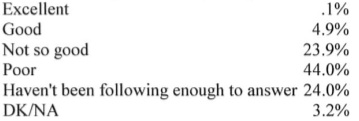

Voters were asked what sort of value they were getting for state services…

Not great.

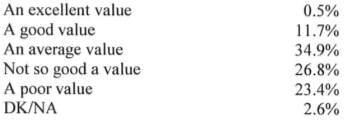

* They were also asked whether they thought their area was getting its fair share of state services…

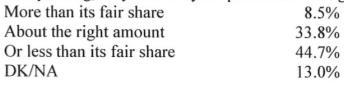

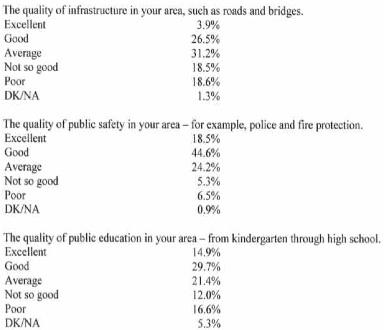

* Respondents rated the quality of several individual state and local services, including these…

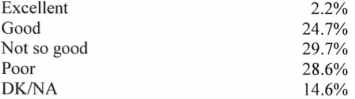

* Most have been following the state budget process and don’t like what they’ve seen. Here’s how they rated the efforts…

* The governor’s ratings are abysmal, of course…

* As are the General Assembly’s…

* Senate President Emil Jones’ numbers aren’t good at all…

* Speaker Madigan’s are better, but not exactly spectacular…

* One more quick point. Here’s what respondents said about revenue generators…

Add income tax brackets with a higher rate for higher incomes? 66% support

Raising the state sales tax? 17% support

Taxing services? 28% support

More gambling? 47% support

Sell or lease the lottery or other assets? 38% support

Discuss.

posted by Rich Miller

Friday, Oct 24, 08 @ 9:49 am

Sorry, comments are closed at this time.

Previous Post: Morning shorts

Next Post: Murders higher than NY and LA while mayor’s park sucks up cash

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

I think the fact that two-thirds of those surveyed support a progressive income tax is really telling. I wonder how much Obama’s tax plan has influenced people’s opinions. Also, it is really interesting in light of the attempt this session to the get a constitutional amendment on the ballot to allow for a progressive tax. There is a clear divide in the legislature’s interest in a progressive income tax and the public’s.

Comment by montrose Friday, Oct 24, 08 @ 9:58 am

==abysmal, of course==

What do you mean!? Over one-third of people said the governor was not ‘poor.’ That is an up day in anyone’s book…

Comment by Vote Quimby! Friday, Oct 24, 08 @ 10:02 am

The Great Satan Madigan tried that, but my allies

PoorJay, the kinfolk caucus and StateWideTom blocked him. Whew!

Perhaps the ConCon Con should push this issue

BTW I noticed my pay SheriffTom getting a lot of boob tube time on that mortgage thing…..Mr Lucky, wake up SlickWillie and get a spcecial session going….Next week will be soon enough.

No one will remember I “suspended” Madigan’s predatory lending law.

Why is everyone doing these silly polls? YOu think there was an election or something.

Hurry

Comment by 2ConfusedCrew Friday, Oct 24, 08 @ 10:06 am

Keep the flat income tax rate but raise it.Then concentrate on getting rid of the gov. and legislators that get in the way of a reasonable(within our means) budget that is crafted in the light of day.

Comment by Leave a light on George Friday, Oct 24, 08 @ 10:08 am

Um, Quimby - 87% said “not so good” or poor and only 3% didn’t know, which means they are in tune with his incompetence. How on earth you could spin that as an ‘up day’ is, well, it’s just hilarious.

On to my original point - while the overall numbers for the GA were not that great, I did find it interesting that Madigan would appear to be getting credit for his efforts to take Blagojevich to the carpet. More people seemed to be aware of Madigan’s efforts than of Jones’ (cough)efforts.

Comment by DzNts Friday, Oct 24, 08 @ 10:11 am

This shows that unless people are considering a personality issue, they simply dont care enough to understand.

Comment by Speaking At Will Friday, Oct 24, 08 @ 10:21 am

Talk about the tail wagging the dog.

Comment by Doggone Friday, Oct 24, 08 @ 10:23 am

This will change once Lisa Madigan gets elected governor.

The press will then take a kinder tone towards state government, and all will be well once again.

Comment by Quotient Friday, Oct 24, 08 @ 10:31 am

“Sell or lease the lottery or other assets? 38% support”

Rich, they actually mention the Lottery and the Tollway in that question. I know selling the tollway is a hot button issue all on its own - I wish they would have broken those two out.

Would have been interesting if there are any legs there.

Generally, though, it is interesting that people respond even somewhat favorably to all these revenue raisers (except sales tax increases), even WITHOUT identifying what the money would be spent on.

People sometimes are willing to choke on revenue they don’t like if it goes to something good.

Comment by GoBearsss Friday, Oct 24, 08 @ 10:33 am

A graduated rate income tax is long overdue, and I applaud the general public for realizing that.

A more important issue - not raised in the survey - is broadening the sales tax to many services, reflecting the fact that we are not a manufacturing and sales economy any more. The tax structure has to be updated to mirror the current social and economic structure, so that “government gets its slice” of economic activities to pay for essential services.

Comment by Capitol View Friday, Oct 24, 08 @ 10:33 am

While this poll seems to find general resistance to revenue-raising measures, reams of past polls have shown that when Illinois residents are asked about tax increases for specific purposes, support is broad and deep. (It’s the converse to this poll’s finding that voters generally support budget cuts but strongly oppose any specific cut.)

If Lawrence had asked, “Would you support an income tax increase to improve funding for public schools, build new roads and bridges, and pay the state’s bills,” for example, I’m confident you would see much higher positive numbers.

Comment by Reality Check Friday, Oct 24, 08 @ 10:35 am

Notice the graduated income tax is the most popular option overwhelmingly.

Vote “yes” on the Constitutional Convention.

Comment by Carl Nyberg Friday, Oct 24, 08 @ 10:36 am

==How on earth you could spin that as an ‘up day’==

Bill wasn’t here yet so I beat him to the punch.

Comment by Vote Quimby! Friday, Oct 24, 08 @ 10:37 am

2ConfusedCrew - your Mike Smith income tax increase bill was cute, but it wasn’t serious.

Brackets tax only the marginal increase. They don’t start from zero.

Your bill would have put a $7,500 tax on $1.

That’s just stupid. Not smart to attempt checkmate with a pawn.

Comment by GoBearsss Friday, Oct 24, 08 @ 10:40 am

The income tax rate shouldn’t be increased. It should be decreased. This year, the IL unemployment rate has been increasing because the high tax rate caused businesses to leave the state. If the tax rate is increased, more IL workers would lose their jobs.

St. Rep. Madigan’s total of excellent & good is about 27%. If Democrats choose a new speaker, whom should they choose?

Comment by Phil Collins Friday, Oct 24, 08 @ 10:41 am

“A more important issue - not raised in the survey - is broadening the sales tax to many services, reflecting the fact that we are not a manufacturing and sales economy any more.”

Actually, it is raised in the survey - only 28% support.

Comment by GoBearsss Friday, Oct 24, 08 @ 10:41 am

If new revenues are needed, there’s a reasonable debate that can be had about instituting a small service tax before going to the well on income (and I think we’ve reached the point of diminishing returns on sales tax).

Too bad Blago poisoned the well on the concept with his post-election blindside.

Comment by wordslinger Friday, Oct 24, 08 @ 10:42 am

The most puzzling thing in this poll is that, when service items are itemized (infrastructure, public safety, education), people express general satisfaction, but when looked at as a whole, people think they are getting shortchanged and getting less than their fair share.

Comment by Six Degrees of Separation Friday, Oct 24, 08 @ 10:48 am

Class warfare or welfare. Tax the wealthy more, more and more. Those dirty capitalist pigs.

While you’re at it, why should the middle class pay anything ?

What a bunch of fools. Why do you think Illinois is in the shape it’s in ? Taxes, Taxes and more taxes. No one wants to do business here. Between the city, county and State, all run by tax and spend democrats this state is in the sewer.

Comment by Maggie Friday, Oct 24, 08 @ 10:50 am

And the poll reinforces what state and federal government have been doing for the last several years to serve the will of the people. Increase services, but don’t collect any more money to pay for them (and if you do, charge “the other guy” for it, not me). Of course, the fulfillment of this policy means borrowing from future generations to pay for today’s largesse. Be careful what you ask for…you may just get it.

Comment by Six Degrees of Separation Friday, Oct 24, 08 @ 10:52 am

Yes, Maggie, the middle class should pay something, for taxes, but the tax burden should be low. Many IL voters support Democrats. Those politicians increase tax rates, and the voters complain. During the next election, many of the same voters support the same people about whom they complained.

Comment by Phil Collins Friday, Oct 24, 08 @ 11:04 am

==The public really has no idea what the scale and the scope of this crisis is.==

First a condition. Stop accepting statements like these as sincere assessments. Claiming that Joe Public doesn’t understand is insulting and deliberately creates a conspiracy within the discussion in that all parties believe that they are somehow not being understood. Stop it!

We live in a democracy. Deal with it! This is the condition we agreed to work within. So it is high time to start respecting one another and listening. A government should reflect it’s citizen’s priorities and values.

People are not stupid. Nor are the answers contradictory. What is required is a creative way to resolve the issues polled within the conditions voters have indicated. The answers to how we craft and present legislation and policies to the public are there. Being close minded or willfully blind due to an ivory tower mentality hinders everyone. While it is fun to endlessly discuss policy possibilities within a framework that Joe Q. Public is a sweet moron is a pointless exercise for all. We call the shots!

Now that said, let’s talk cars! Unlike governments, we actually like cars, and appreciate them more. So let’s use automobiles as our analogy…

If we were discussing a car, it would be clear that customers are unhappy with their cars and won’t be buying from you again. The fact that government thinks it has a monopoly on providing specific services doesn’t mean that they can do whatever they want. Some will try to focus on providing better value and others will try to lower the cost of the service to offset this perception. Once again, if this was a car - then we can either lower the cost of the Edsel, or fix the Edsel so that it doesn’t suck so much.

But first deal with the fact that a majority of voters polled believe they’re stuck with an Edsel!

Demanding more money to fix the Edsel can result in a better car, but customers naturally don’t want to do this. Instead we are hearing that these Edsel customers want wealthy Lincoln and Continental drivers to pay more for their cars, to offset the cost of maintaining their Edsel, and to lower the costs of future Edsel purchases.

So, does this solve the problem of the Edsel, being and Edsel? No. And this is at the root of our problem. Until we stop manufacturing Edsels, we will continue to alter the natural relationship between buyers and their cars in order to keep them from revolting.

How many Illinoians believe government will start giving them something better than an Edsel? Apparently not many. And they all seem to be agreeing that the value of having an Edsel isn’t very high or satisfying.

Now, let’s talk solutions. Do not start raising the cost of Edsel ownership until it is clear that the problems Illinoians have experienced have been resolved and will result in better value. If you were Ford, you would know that passing on the costs of retooling and building a better Edsel can be temporarily passed onto Lincoln and Continental owners. But only as long as these luxury car owners still see a value.

Then you take the monies raised via these luxury car owners and reform the Edsel plants resulting in a better car! You don’t keep building Edsels, and raise the costs of Lincoln ownership! If Blagojevich was running Ford, he would add features to currently leaking Edsels. If Republicans were running Ford, they would cut the price of the currently leaking Edsels. Neither approach works anymore, because voters recognize that the preceived value is temporary and that government is still making Edsels!

Bottom line: Illinoians want reform within the costs they are currently paying. They want better government to give them better tax value. While they are willing to see taxes raised on those classified as wealthy, they still want to see better value for all.

Comment by VanillaMan Friday, Oct 24, 08 @ 11:06 am

Was it Winston Churchill who said ” The best case against democracy. Spend five minutes talking to a voter”.

These are the same people who voted for Blagojevich not once but twice. If he had enough money to run more slick tv ads they would vote for him again.

Comment by Maggie Friday, Oct 24, 08 @ 11:08 am

The only way out of this mess is to raise taxes. Anyone thinking there is another way isn’t paying attention, as Mr. Lawrence points out.

If we the people could get our representatives to make tough decisions, and if we the people would be realistic in our assessments of the mess instead of just calling each other names and protecting the status quo, and if BlagoMadDaleyJones would stop ignoring the fiscal woes of the state, then we could start finding solutions. I just don’t think this is going to happen. More and more I am certain that the only way for this to happen is through the constitutional convention.

Comment by Lefty Lefty Friday, Oct 24, 08 @ 11:09 am

I am a stay at home mom, and I think that if the politicians were to “do more for the people” than I think the numbers would be better. All we residents want is to get herd, and have someone care about us. We aren’t looking for handouts we are looking for lower taxes and lower gas prices. Many politicians think raising taxes is the solution, but really all that is going to do is give Springfield raises and us “regular people” the inability to save money for our children’s education.

Comment by Deeda Friday, Oct 24, 08 @ 11:44 am

Remember every dollar you take is two taken from the people.

Comment by Deeda Friday, Oct 24, 08 @ 11:46 am

Bravo, VM, bravo.

Comment by Bluefish Friday, Oct 24, 08 @ 11:46 am

I would hope that the results indicate that Vanilla Man’s analysis is indeed correct.

However, I tend to agree instead with the majority of commenters that the voting public is more interested in making other people pay more, via a graduated/progressive income tax, than in fixing the underlying problems.

In other words, most people want “tax reform” as once defined by US Senator Russell Long (D-LA): “Don’t tax you, don’t tax me, tax that fellow behind the tree.”

Comment by cover Friday, Oct 24, 08 @ 11:53 am

CV, I’m in total agreement with your assessment that the sales rax needs to be applied to services due to the migration of our economy from goods and manufacturing.

My only fear is that such legislation will be absent some very strict controls and reforms, enabling the likes of Blago, Daley, Stroger, et al to reap a windfall but continue to apply the newfound revenues for questionable or unncessary expenses.

Perhaps repealing home rule for the right to tax services is a good start.

Comment by The Doc Friday, Oct 24, 08 @ 11:54 am

Wow VM, what an amazingly simple explanation. Reform the system! Gee, why don’t people do that. You know the media is just ignoring that budget line item that says: Gov’t waste — $2 billion.

Rather than your excrutiating to read Edsel analogy, how about you start naming some reforms, big reforms that’ll nab a billion-plus in savings each and every year.

How about we close that loophole that doesn’t tax seniors retirement income, even the richest of the rich even though there’s no means testing on numerouls senior aid programs that cost millions and will grow into the billions as the population ages.

You ready to run for office on a tax the seniors plan.

Or will you just stick it to the school children.

Higher college tuition and bigger kindergarten classes, that’s the answer to our budget problems.

I’m sure YOU enjoyed your post, but how about coming up with an idea rather than pontificating about how much more you get it than everyone else.

Also, one could note that Ford learned few long-term lessons from the Edsel. If it had, it’d be in a lot better shape than it is now.

Comment by Michelle Flaherty Friday, Oct 24, 08 @ 12:08 pm

Man, life is sweet on that big rock candy mountain. Lemonade from the spring is sweet and those cops all have wooden legs.

Comment by steve schnorf Friday, Oct 24, 08 @ 12:15 pm

A certain state budget director once opined that there are three ways to balance the budget:

1. raise revenues

2. cut spending

3. fudge the numbers

Comment by Michelle Flaherty Friday, Oct 24, 08 @ 12:19 pm

A low tax imposed on everyone beats a high tax imposed on only a few, because those few will almost always find a way to avoid paying it, thereby defeating the purpose of the tax.

Comment by Secret Square Friday, Oct 24, 08 @ 12:40 pm

would have liked to seen the support or opposition to a dicrease in the overall sales tax and expansion of a service tax.

Comment by Ahoy Friday, Oct 24, 08 @ 2:04 pm

A services / sales tax is like a user tax. You only pay it when you use that service, as opposed to higher taxes on income which could be spent on anything. And even then no one is proposing a tax on health care / medical costs, lawyers’ fees, education, or human services delivered on a sliding fee scale.

As another commentator noted, when the public sees it as a limited tax for specified purposes, they go along - so earmark services taxes revenues to popular programs such as Medicaid, education, or higher ed and use other classic revenue appraoches to pay for the rest.

Comment by Capitol View Friday, Oct 24, 08 @ 3:58 pm

CV,

You mean like the way the state has user fees that are set aside in special accounts to pay for special things only to accumulate money so they can be raided to pay for everything else?

I’m not sure you can sell the public anymore on the idea of this one thing helping that one thing anymore.

Comment by Michelle Flaherty Friday, Oct 24, 08 @ 4:19 pm

MF, I don’t think I would ever say “fudge the numbers”. It just doesn’t sound like me. I think I said “or play “let’s pretend”". And the people on here with simplistic answers are playing “let’s pretend”, aren’t they?

Comment by steve schnorf Friday, Oct 24, 08 @ 6:39 pm

Steve, Schnorf, outstanding. Actually, “An O’ Brother Where Art You” theme works on a number of levels. Stick with us, buddy, we’ll come up with something right eventually.

Michelle, good to see you back. Keep bringing it.

Comment by wordslinger Saturday, Oct 25, 08 @ 12:25 am