* From the Pritzker administration…

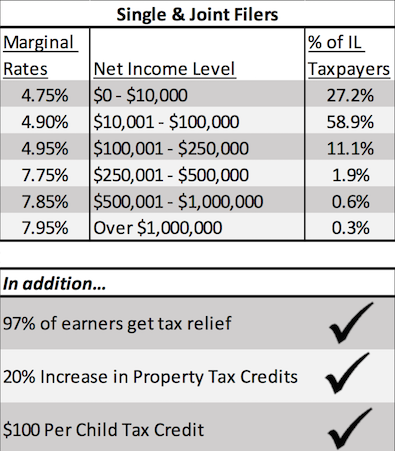

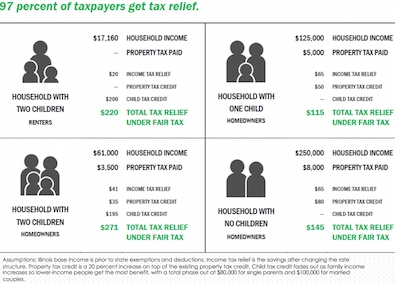

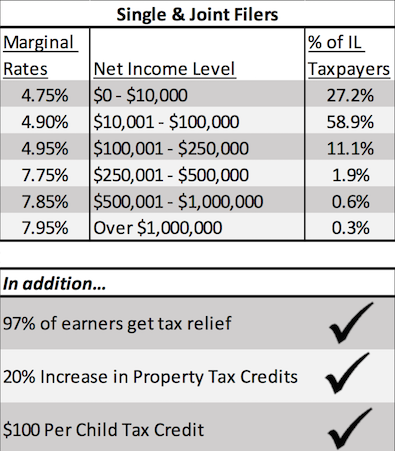

• Filers at or below $250,000 – 97% of taxpayers – will have lower tax bill

• 20% increase in current Property Tax Credit

• From approx. $500 million (@ 5.0%)to $600 million (@ 6.0%)

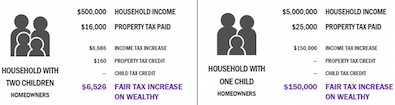

• Top rate of 7.95% for net income over $1.0 million

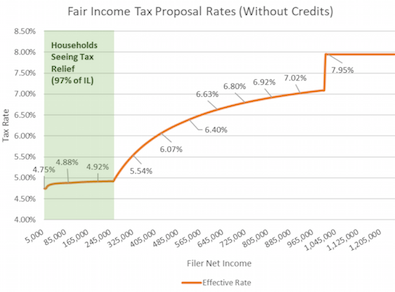

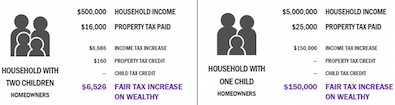

• Once income reaches $1.0 million, entire income is taxed at 7.95% rate

• Corporate Income Tax rate to match top Fair Income Tax rate (7.95%)

• $100 per child Child Tax Credit for:

• Single filers under $80K (phase-out starting @ $40K)

• Joint filers under $100K (phase-out starting @ $60K)

More in a minute.

…Adding… Click here for the entire presentation.

…Adding… The rates…

* More…

* Lower income…

* Higher income…

The governor is planning a 2 o’clock press conference. Watch the live coverage post for immediate updates.

…Adding… House GOP Leader Jim Durkin…

The House Republican Caucus stands united in opposition to a $3.4 billion tax increase on Illinois families and businesses.

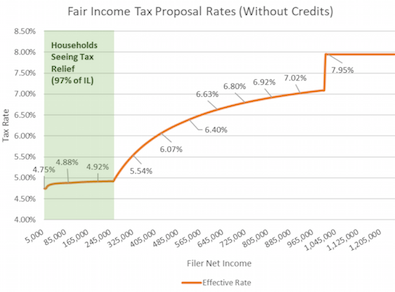

…Adding… Applying the top rate to all income once that income hits $1 million is unusual. Usually, graduated taxes only apply to income earned above a certain rate. That is the case with Pritzker’s plan until taxpayers reach a million bucks. So, I’m assuming those close to that level will do whatever they can to avoid reaching a million dollars on paper, because that would hugely jack up their tax bills. But, hey, they could also hire somebody or give some cash to charity to stay below a million.

Also, the state’s current corporate income tax rate is 7 percent. This proposal would raise that rate to 7.95 percent.

The current personal income tax rate is 4.95.

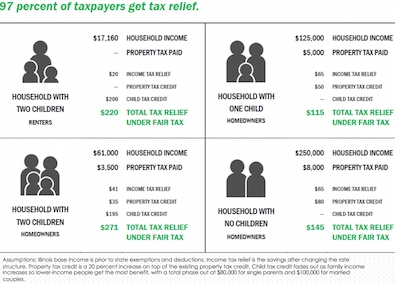

…Adding… If your property tax bill is $6,000 per year, you currently receive a $300 annual state income tax credit. That credit would rise to $360 under this plan. Sixty bucks a year ain’t a lot of relief.

…Adding… Ideas Illinois Chairman Greg Baise…

“We can’t trust Springfield politicians – the same people who in the last 8 years have raised taxes twice – with a blank check,” Ideas Illinois Chairman Greg Baise said. “Today’s proposal is just a massive jobs tax on Illinois families and will destroy the Illinois economy and further accelerate people fleeing the state.”

Key Questions for Governor Pritzker

Are you going to lock these rates into the Constitution, so voters know EXACTLY what they are voting on?

Illinois has had 2 tax increases in the last 8 years - can you promise that these tax rates will not change?

Have you done an analysis on what this jobs tax will do to job creators?

In the past, you have said that this will pay for schools, infrastructure, pensions, and social services along with a property tax break – is this enough money because the math doesn’t seem to add up.

Do you trust the legislature to be responsible or will this be another blank check to raise taxes whenever they want?

…Adding… Factor in the Personal Property Tax Replacement tax on corporations, and the rate corporations pay will rise from its current 9.5 percent (8.5 percent for partnerships, trusts, and S corporations), to 10.45 percent (9.45 percent for S corps etc.). That’ll give us one of the highest in the nation.

…Adding… SEIU Illinois State Council President Tom Balanoff…

“Illinois’ current tax code puts undue burden on the working people of our state, making it harder for them to put food on the table for their families and get ahead. Governor JB Pritzker campaigned on a promise to overhaul this unfair system, and today he is making good on that pledge.

“Governor Pritzker’s plan lowers tax rates for 97 percent of Illinois taxpayers while making sure the wealthy pay their fair share. This proposal will put our state on the path towards fiscal sustainability and good governance.

“The janitors, healthcare and home care workers, security officers and more of SEIU support Governor Pritzker’s fair tax plan, which will make Illinois a better, more equitable state for working families.”

- J IL - Thursday, Mar 7, 19 @ 11:57 am:

Not bad JB…not bad. However, as they say, the proof is in the details!

- Honeybear - Thursday, Mar 7, 19 @ 11:57 am:

Wait….wait…..I’ve got a couple more minutes on the popcorn in the mic.

I so want to watch how the ILGOP

wails and gnashes their teeth.

I so want to see what they do.

Do they go with “class warfare”

Do they go with “disinformation” (Everyone pays)

Do they just start screaming and pounding tables?

Oh the anticipation

- Notorious RBG - Thursday, Mar 7, 19 @ 11:59 am:

When does IPI start robocalling about this? Can’t wait to hear them to correct their fear-mongering from last week about how taxes for all residents earning over $11k/year were going to go up…

- Peoples Republic of Oak Park - Thursday, Mar 7, 19 @ 12:00 pm:

I know I am from Oak Park, but this reasonable.

- Chicagonk - Thursday, Mar 7, 19 @ 12:00 pm:

Any estimate on the revenue this would produce or is this revenue neutral

- My Button is Broke... - Thursday, Mar 7, 19 @ 12:01 pm:

Surprised they have the same brackets for single and married filers. Makes it a little more simple, but introduces a marriage penalty.

- Sue - Thursday, Mar 7, 19 @ 12:01 pm:

The top rates are very high compared to other states. The shocking thing is telling the vast majority that paying either 4.9 or 4.95 is a tax reduction from the current flat tax is really insulting.

- very old soil - Thursday, Mar 7, 19 @ 12:02 pm:

Any revenue estimates?

- Oswego Willy - Thursday, Mar 7, 19 @ 12:02 pm:

Let the discussions begin.

97%… hmm.

- Austinman - Thursday, Mar 7, 19 @ 12:03 pm:

Revenue is 3.5 Billion

- Grandson of Man - Thursday, Mar 7, 19 @ 12:04 pm:

Excellent, at a quick glance. Eighty-six percent of us would get a tax cut and 97% would get a cut or no change. The top rate is not outrageously high, so there can’t be too much crying. But there will be, from those who want the most vulnerable and government employees to take big cuts.

Go ahead, run against tax cuts for 86% of Illinoisans.

- RNUG - Thursday, Mar 7, 19 @ 12:04 pm:

== • Once income reaches $1.0 million, entire income is taxed at 7.95% rate ==

As phrased, that’s not a marginal rate, it is a flat rate.

Is that a typo? If not, that is definitely a millionaires tax surcharge.

- Steve - Thursday, Mar 7, 19 @ 12:06 pm:

Can JB collect the revenue? Or will some of the 1% move out?

- lake county democrat - Thursday, Mar 7, 19 @ 12:06 pm:

Looks pretty shrewd to me.

Chicagonk - flier says it would bring in $3.4 billion.

- RNUG - Thursday, Mar 7, 19 @ 12:07 pm:

== • Corporate Income Tax rate to match top Fair Income Tax rate (7.95%) ==

Clawing back all the corporate tax breaks? Again, will hit mostly the wealthy.

- Sue - Thursday, Mar 7, 19 @ 12:07 pm:

How can any of you argue that the 4.9 and 4.95 is a tax cut. Come on the flat rate today is 4.99. Be serious

- Fixer - Thursday, Mar 7, 19 @ 12:07 pm:

Seems reasonable, but as other have mention the details will need to be seen to know what else is changing with this. As it stands, my household will pay a little less in taxes, but it’s nice to see we won’t be paying in more.

- Snapper - Thursday, Mar 7, 19 @ 12:08 pm:

===As phrased, that’s not a marginal rate, it is a flat rate.

Is that a typo? If not, that is definitely a millionaires tax surcharge===

Doesn’t appear to be a typo. If you look at the last example, the $150,000 increase on the earner making $5,000,000 is a full 3% increase from the current rate with no marginal rates calculated.

- Steve - Thursday, Mar 7, 19 @ 12:09 pm:

Those who make over 250K must really feel “taxed” given the cut back recently in the SALT limit of 10K. That could be a federal and state tax increase in a very short period of time! Some people might be getting a smaller pay increase to pay for these tax increases.

- Fixer - Thursday, Mar 7, 19 @ 12:09 pm:

Sue, 4.99 is greater than 4.95 and 4.9. Seems pretty simple to me.

- City Zen - Thursday, Mar 7, 19 @ 12:10 pm:

“Once income reaches $1.0 million, entire income is taxed at 7.95% rate”

So a flat tax?

- wordslinger - Thursday, Mar 7, 19 @ 12:11 pm:

–When does IPI start robocalling about this?–

IPI should be on board for this. As you can read in their ad today here, they believe the rich get richer in states with graduated income tax systems. I’m sure Griff and Uiehlein are dancing in the streets, based on that scholarship.

That, of course, steps all over the message that the rich bail when taxes go up, but sometimes you just throw the spaghetti bowl at the wall and see what sticks.

- 47th Ward - Thursday, Mar 7, 19 @ 12:11 pm:

$3.4 billion in additional revenue seems like that’s enough to balance the budget at current spending and pay some back-logged bills a bit faster.

I don’t see how you get enough dough to fund education at a level that moves the needle on property tax relief.

Also, any word on whether the brackets/rates are linked together so that an increase in one requires an increase in all?

- Powdered Whig - Thursday, Mar 7, 19 @ 12:11 pm:

This doesn’t look so much like a graduated/progressive income tax as it is a binary income tax. Under 250k you pay roughly the same as now. Over 250k you get a pretty sizable increase.

- RNUG - Thursday, Mar 7, 19 @ 12:11 pm:

Not much reduction for most people, but we all knew it couldn’t cut very much for the middle class if the goal was to raise more revenue.

- Montrose - Thursday, Mar 7, 19 @ 12:11 pm:

“How can any of you argue that the 4.9 and 4.95 is a tax cut. Come on the flat rate today is 4.99. Be serious”

If this is the strongest opposition talking point in response to this proposal, the progressive tax proponents are in a good place.

- wordslinger - Thursday, Mar 7, 19 @ 12:14 pm:

Opponents better hurry and try to knock down that 97% before it sets.

If they can’t, hasta la vista, baby.

- Anon in BB - Thursday, Mar 7, 19 @ 12:14 pm:

Any indication that they have accounted for those in the top 3% packing up and moving? Their projections seem to be based on status quo and there would be no significant out-migration of the top 3%.

As for the tax cut for those making under $250,000, it looks like they are counting the slight increase in property tax relief and the slightly reduced rates on earnings from 0-10,000 and 10,000 to 100,000 to come up with their tax cut numbers.

- Anonymous - Thursday, Mar 7, 19 @ 12:14 pm:

Sue, you are ignoring that the property tax deduction is doubled. And yes when I was taught math 4.9 is lower than 4.95. Would you like your current rate raised to 5 percent since you think the difference is de minimis?

- Rich Miller - Thursday, Mar 7, 19 @ 12:16 pm:

===the flat rate today is 4.99===

The flat rate today is 4.95.

- pool boy - Thursday, Mar 7, 19 @ 12:17 pm:

What is their definition of income? Does this include income that is not currently taxed?

- thoughts matter - Thursday, Mar 7, 19 @ 12:17 pm:

==How can any of you argue that the 4.9 and 4.95 is a tax cut. Come on the flat rate today is 4.99. Be serious==

Also note the increase in tax credits, which reduce the effective tax rate even further.

- Anonymous - Thursday, Mar 7, 19 @ 12:17 pm:

JB did good job with this.

- Sue - Thursday, Mar 7, 19 @ 12:17 pm:

Monstrosity- here is an argument. Taxes went up 60 percent two years ago and now Pritzker is proposing an 80 percent increase for the upper income residents. You can rest assured that anyone thinking of relocating will have a much easier decision. Lose one or two people like Ken Griffin and the State will rue the day it does this

- Illinois Resident - Thursday, Mar 7, 19 @ 12:17 pm:

Agree with RNUG. In a perfect world, it would be nice for lower income folks to pay an even lower tax rate then proposed. Said that, the state needs tax revenue. So all in all, seems like a good plan.

- Jibba - Thursday, Mar 7, 19 @ 12:18 pm:

The JB tax cut might get me $200. Just keep it. Make the state better.

Do away with the property tax credit while you’re at it. Almost not worth the time to look up the PIN.

- Honeybear - Thursday, Mar 7, 19 @ 12:18 pm:

Oh thanks Sue

I forgot a possible ILGOP response

Victim

yeah tax victim

That’s good

- City Zen - Thursday, Mar 7, 19 @ 12:19 pm:

Where are the married tax brackets?

- Lester Holt’s Mustache - Thursday, Mar 7, 19 @ 12:21 pm:

== opposition talking point in response to this proposal,==

They haven’t yet gotten to “everyone making over $250K will immediately move to Florida.” That one should be coming in the next hour or so.

- Nick Name - Thursday, Mar 7, 19 @ 12:22 pm:

===The House Republican Caucus stands united in opposition to a $3.4 billion tax increase on Illinois families and businesses.===

What part of “97% of taxpayers will have a lower tax bill” did you not understand, Leader Durkin? But hey, thanks for sharing.

- Anonymous - Thursday, Mar 7, 19 @ 12:22 pm:

To folks like Sue, a small reduction in taxes is insignificant but raising them in the same amount is a catastrophe.

- OneMan - Thursday, Mar 7, 19 @ 12:22 pm:

So the property tax credit is 1% of your property tax bill?

Might I suggest (it isn’t going to happen) that the property tax credit is graduated based off of what your property tax rate is vs some sort of state mean? So folks in the south suburbs of Cook County get more relief than some others.

- Chunga - Thursday, Mar 7, 19 @ 12:22 pm:

Do these rates apply to retirement income?

- Illinois Resident - Thursday, Mar 7, 19 @ 12:23 pm:

Sue - Scare tactics don’t work. The rich have historically underpaid a fair share of the overall tax burden. The new proposal corrects that.

- Reality Check - Thursday, Mar 7, 19 @ 12:24 pm:

Applying the 7.95 to all millionaires’ income - instead of just the marginal amount over a million dollars - would NOT “hugely jack up” their tax bill. A millionaire would pay about 8k per year more this way than if they paid lower rates up to 1M. That’s eight-one-thousandths of their income, or eight-tenths of one percent.

- levivotedforjudy - Thursday, Mar 7, 19 @ 12:24 pm:

JB’s team threaded the needle on this. Very hard to argue against those rates and not look like Montgomery Burns.

- Gogo Yubari - Thursday, Mar 7, 19 @ 12:26 pm:

@Anonymous 12:22 pm took the words right out of my mouth. Plus, I have little doubt Sue would sing the praises of any GOPer who procures the same relief. Party before all else. SMDH

- twowaystreet - Thursday, Mar 7, 19 @ 12:26 pm:

The tax reduction is a little underwhelming for under 100,000. Unless the alternative is that if we don’t get the progressive income tax then the flat tax rate will go up.

- Blue Dog Dem - Thursday, Mar 7, 19 @ 12:27 pm:

Fair enough.

- Anonymous - Thursday, Mar 7, 19 @ 12:27 pm:

Bye, bye taxpayers that pay the brunt already. May as well move to CA.

- City Zen - Thursday, Mar 7, 19 @ 12:29 pm:

==Do these rates apply to retirement income?==

Retirement income is household income. And they said “fair”…

- Amalia - Thursday, Mar 7, 19 @ 12:29 pm:

as Pool Boy stated above, what is the definition of base income? pensions are not currently taxed in Illinois. how will this proposal affect pensions?

- Skeptic - Thursday, Mar 7, 19 @ 12:30 pm:

“We’ve had 2 tax increases in the past 8 years…” Well, if it weren’t for one particular former Governor, (a) There would have been half as many and (b) we would have been in far better shape financially. So there’s that.

- Big Jer - Thursday, Mar 7, 19 @ 12:32 pm:

In the article below London has reclaimed the top spot as the best city for wealthy individuals to live in.

Chicago is 6th on the list of best city for wealthy to live.

https://www.dailymail.co.uk/news/article-6778599/London-best-city-world-wealthy-individuals-live-in.html

While many commenters on Capitol Fax justifiably complain about taxes especially property taxes, IMO what they are losing site of is how taxes in Chicago and Illinois are unequal and regressive.

Here is another article supporting the regressiveness of Chicago and Illinois taxes.

https://www.politifact.com/illinois/statements/2018/dec/02/lori-lightfoot/are-chicago-residents-among-nations-most-taxed/

The Politifact article shoots some holes in the whole high tax burden meme. i.e. it depends.

Chicago is also one of the top financial centers in the world which probably relates to the amount of wealth. Rich has limits on the amount of links so you can google Investopedia World’s top financial cities.

As far as the wealthy leaving, where are they going to go?? In 20 years the southern half of the country will be an uninhabitable oven in spring and summer and the coasts will be underwater. Look around where all the weather related disasters have been in the US, i.e. not the Upper Midwest.

- OneMan - Thursday, Mar 7, 19 @ 12:32 pm:

== The rich have historically underpaid a fair share of the overall tax burden. ==-

The thing is, everyone has their own definition of fair. Illinois started the income tax with a flat rate and has had it for a long time it seems for a long time folks either thought it fair or not worth the effort to change.

For example, I might think it would be fair if Chicago’s school tax rate was the same as mine is in Oswego, but it isn’t, Chicago’s rate is significantly lower, I don’t think that is fair for Chicago’s school kids. I suspect a Chicago property taxpayer would disagree.

As this fight begins, it will be interesting to see how the hearts and minds are going to be won. Because IMHO unless the ratio of rates or something is specified it isn’t going to be hard to use all sorts of scare tactics on the no side of the amendment, because the FUD is going to be easy to identify. Because I don’t think it will be hard to convince voters that just because they may pay less under JBs plan now, that down the road the legislature isn’t going to jerk them over as well.

- RNUG - Thursday, Mar 7, 19 @ 12:33 pm:

== how will this proposal affect pensions? ==

Not clear at the moment.

My guess is it does not tax retirement. Doing so would create a voting block opposed to changing to a progressive tax.

- CPA - Thursday, Mar 7, 19 @ 12:33 pm:

This is really underwhelming.

- Nick Name - Thursday, Mar 7, 19 @ 12:33 pm:

===Bye, bye taxpayers that pay the brunt already===

The brunt? We have a flat tax. The only people paying “the brunt” right now are the poor. 4.95% of $20,000 is a much bigger burden than 4.95% of $1 million.

- wordslinger - Thursday, Mar 7, 19 @ 12:33 pm:

Pretty muted responses from Durkin and Baise. I suspect they were caught flat-footed.

I know he’s just been under the knife, but Baise’s idea to lock proposed rates into the Constitution is absurd on its face. Weak comeback.

They’re going to have to do a lot better to beat that 97% message.

- Da Big Bad Wolf - Thursday, Mar 7, 19 @ 12:34 pm:

==IPI should be on board for this. As you can read in their ad today here, they believe the rich get richer in states with graduated income tax systems.====

Lol. All their propaganda about “income inequality” and the hand wringing about how this will hurt the middle class will get thrown in the trash and replaced with “class warfare”.

- City Zen - Thursday, Mar 7, 19 @ 12:35 pm:

==The tax reduction is a little underwhelming for under 100,000.==

As I stated many times in the past, the goal was to market a generic tax cut to the largest swath of voters possible. It didn’t matter if the reduction was $1,000 or $1. This allows the marketing campaign to keep the message simple.

- Montrose - Thursday, Mar 7, 19 @ 12:35 pm:

I think Greg Baise’s response is really interesting. Their tact is going to be we can’t trust the government to not do other bad things in the future. They aren’t attacking the proposed rate structure (yet). That signals Pritzker’s folks probably got the rates more or less right.

- Occasional Quipper - Thursday, Mar 7, 19 @ 12:36 pm:

These are just teaser promotional rates to get it passed. Once it passes and it doesn’t generate enough revenue, then ALL of the rates are going to go up for everyone.

- wordslinger - Thursday, Mar 7, 19 @ 12:36 pm:

–Have you done an analysis on what this jobs tax will do to job creators?–

Yes, 97% of consumers will have a lower tax bill, giving them more money to spend to create jobs.

Who else “creates jobs” besides consumers? If they ain’t buying, you ain’t selling.

- RNUG - Thursday, Mar 7, 19 @ 12:36 pm:

Nobody has mentioned it yet, but the alternative shown in the presentation was raising the flat income tax rate to 5.95%

- Anonymous - Thursday, Mar 7, 19 @ 12:37 pm:

This is an outstanding proposal. Apparently this is what BPIA was working on.

- Responsa - Thursday, Mar 7, 19 @ 12:37 pm:

==Do these rates apply to retirement income?==

An important question to have answered before many can assess the impact on themselves and their families. The fact that the words “97% of earners” was used and then the phrase “household income” is in the presentation leaves the issue of retirement income look somewhat vague and fluid in this plan.

- Rich Miller - Thursday, Mar 7, 19 @ 12:38 pm:

===My guess is it does not tax retirement===

That is correct.

- ike - Thursday, Mar 7, 19 @ 12:38 pm:

Anon @ 12:27 - what? The people paying the “brunt” of the state’s taxes are 97% that would be getting a tax decrease under these rates, not the less than 3% who would see a tax increase.

- Grandson of Man - Thursday, Mar 7, 19 @ 12:38 pm:

“$3.4 billion in additional revenue seems like that’s enough to balance the budget at current spending and pay some back-logged bills a bit faster.”

That’s very important. Fiscal responsibility is a beautiful thing, raising revenue, funding services adequately and paying bills, to signal to businesses that we are worthy of investment.

We are not planning on right wing cuts, so right now it’s best that we disabuse ourselves of that. I know some are going to keep screaming cuts, but it’s a waste of breath, policy-wise. Many of us worked very hard for the harsh cuts to not happen, and it culminated in the 2018 election results.

- Illinois Resident - Thursday, Mar 7, 19 @ 12:39 pm:

OneMan - Fair tax rates IMO can start with the premise that if you make a lot of money you get to pay more on a percentage basis then others that make a lot less, IE progressive income tax.

- Anonymous - Thursday, Mar 7, 19 @ 12:40 pm:

Look at these naysayers.. “This is just a ploy to jack up rates later” … “5.95 to 5.9 is not a real taxcut” .. Good grief, do you guys read this stuff or just spew it?

No true tax cut would be 0.05 percent.. You cant make this stuff up.

- Illinois Resident - Thursday, Mar 7, 19 @ 12:41 pm:

Da Big Bad Wolf - LOL - Great point.

- RNUG - Thursday, Mar 7, 19 @ 12:42 pm:

== These are just teaser promotional rates to get it passed. Once it passes and it doesn’t generate enough revenue, then ALL of the rates are going to go up for everyone. ==

Don’t lock the rates into the Constitution. But it would be reasonable to lock in a restriction the rates could only be changed once every 5 or some number of years.

- Homer Simpson's Brain - Thursday, Mar 7, 19 @ 12:43 pm:

Anonymous 12:27pm, surely you jest. The top marginal tax rate in California is 13.3 percent. All these protests about taxing the rich are much ado about nothing.

- Rich Miller - Thursday, Mar 7, 19 @ 12:43 pm:

To the anonymous commenter who announced that you and your family are leaving. I deleted you because your IP address is registered to JP Morgan Chase in New York.

lol

- Mike - Thursday, Mar 7, 19 @ 12:45 pm:

Only issue I have is this seems to penalize married couples disproportionately.

- Lucky Pierre - Thursday, Mar 7, 19 @ 12:45 pm:

Who else creates jobs but consumers?

I guess the people that put their life savings into these enterprises did.not build them after all

Where are these consumers? Certainly not all in Illinois

- Illinois Resident - Thursday, Mar 7, 19 @ 12:45 pm:

Anon @ 12:39 - Bye.

- njt - Thursday, Mar 7, 19 @ 12:46 pm:

===To the anonymous commenter who announced that you and your family are leaving. I deleted you because your IP address is registered to JP Morgan Chase in New York.===

Must be Ken using a remote access in his new apartment /s

- the Patriot - Thursday, Mar 7, 19 @ 12:46 pm:

Will this have a JB crapper clause? I can get out of paying if I pull the crapper out of my house.

I know two indisputable facts. 1. No matter how much you raise taxes, Mike Madigan lacks the skill to balance a budget.

2. You can’t trust a billionaire who tells you he believes he should pay more when he took the toilets of of a house to not pay what he is paying now.

People are not leaving because you raise their taxes 25-30%, they are leaving because they were already paying tens of thousands more than they will in another state.

- Da Big Bad Wolf - Thursday, Mar 7, 19 @ 12:47 pm:

==These are just teaser promotional rates to get it passed. Once it passes and it doesn’t generate enough revenue, then ALL of the rates are going to go up for everyone.==

First of all there’s no guarantee this tax change will pass the GA.

Second “teaser promotional rates?” You do realize that any tax rate increase gets debated in the general assembly and senate and is covered by the media everyday. This isn’t like one individual getting a credit card and not reading the fine print.

- Earl Hickey - Thursday, Mar 7, 19 @ 12:48 pm:

Will retirement income be taxed?

- njt - Thursday, Mar 7, 19 @ 12:48 pm:

==Nobody has mentioned it yet, but the alternative shown in the presentation was raising the flat income tax rate to 5.95%===

RNUG, good point. Also option 1 to “Cut discretionary spending by 15%”. I’d like to see the ILGOP articulate that to the voters.

- Reality Check - Thursday, Mar 7, 19 @ 12:49 pm:

“In his 2017 book, The Myth of Millionaire Tax Flight: How Place Still Matters for the Rich, Stanford University sociologist Cristobal Young questioned whether wealthy people are really so mobile.

“Young’s research, based on 13 years of tax data for every U.S. millionaire, says the opposite is more accurate. Only about 2.5% of millionaires moved to new states each year, and not all went to lower-tax states.

“One reason is that millionaires tend to be older people with deep roots in their communities. They have family and business ties. They like living where they do.

“Yet clearly, somebody has been moving. Who is it?

“Answer: mostly young people, particularly recent college graduates. They are four times as likely as millionaires to move in any given year, and taxes aren’t the reason. They follow jobs and educational opportunities.”

- that “collectivist” lefty rag, Forbes https://www.forbes.com/sites/patrickwwatson/2018/05/10/high-taxes-dont-make-rich-people-move/#3fab4dd425e3

- wordslinger - Thursday, Mar 7, 19 @ 12:50 pm:

–Lose one or two people like Ken Griffin and the State will rue the day it does this–

Yes, the 12.8 million should worship the billionaire.

Meanwhile, back on Planet Earth, Griff is originally from no-income-tax Florida, and has had a $250 million Palm Beach spread for years.

So why didn’t he move his company to Florida years ago, over state income taxes?

Could the reason be that he made his $9 billion personal fortune by having his company hq in Chicago?

Would that have been incentive to stay in Illinois, the fact that you banked $9 billion here?

Heck, you don’t even know if Griff pays state income taxes. Dudes with that kind of cash have all sorts of razzle-dazzle outs.

- Grandson of Man - Thursday, Mar 7, 19 @ 12:51 pm:

“I know two indisputable facts. 1. No matter how much you raise taxes, Mike Madigan lacks the skill to balance a budget.”

So you’re against tax cuts for 97% of taxpayers, so that terrible Madigan will have less of 97% of people’s money to waste on unbalanced budgets? Lol, lol.

- Steve - Thursday, Mar 7, 19 @ 12:53 pm:

Many naive workers who think they will not be paying more in income taxes will be paying for it as some firms try to coddle the higher paid employees by paying them more and stiffing the lower end employees over time. I could see this happening as some law firms.

- Huh? - Thursday, Mar 7, 19 @ 12:53 pm:

Paying a couple of hundred bucks less in income taxes isn’t even a flash in the pan. To me this is a reprise of the federal tax plan. Yes we paid lower taxes, but the amount was so tiny as to be meaningless.

A family of 3 making $17,160 has their income taxes reduced by $20.

A family of 4 making $61,000 has their income taxes reduced by $41.

Oh, golly, gee whiz now I can go buy a cup of coffee and a donut at Casey’s.

Where is the middle class tax relief? $41 isn’t it.

- Fixer - Thursday, Mar 7, 19 @ 12:53 pm:

For those of you griping about this, please show us the alternative plan that helps this state. Four years, and Rauner couldn’t do it. Durkin couldn’t do it. Greg, IPI, all of those opposed to this couldn’t show any sort or realistic plan to actually help this state. And I say realistic because cutting benefits for union retirees, doubling health care expenses for employees, wouldn’t make much if any of a dent in what needs to be done here.

Four years, nothing to show for it.

- Da Big Bad Wolf - Thursday, Mar 7, 19 @ 12:53 pm:

==Will this have a JB crapper clause? I can get out of paying if I pull the crapper out of my house.==

Wow the Patriot, you make over $250,000 marginal rate? Good for you.

As to your idea it’s a good one. Maybe outhouses could become the new status symbol. Outhouses would show the world that you are rich.

- njt - Thursday, Mar 7, 19 @ 12:53 pm:

===Could the reason be that he made his $9 billion personal fortune by having his company hq in Chicago?===

Obviously they can just pack up the computers and move Citadel, CBOT and CBOE. /s

- benniefly2 - Thursday, Mar 7, 19 @ 12:55 pm:

I am surprised that the line was drawn at $250k. I would have thought it would have been a bit lower than that to allow a slightly larger cut to the less than $100k crowd. Personally, if it had been up to me, I would have made the cut line 2.5 times the median household income in Illinois, with the top one kicking in at 10 times the median household income. It may have given a little incentive to raise incomes occasionally in the general a rising tide lifts all boats kind of way.

- Rich Miller - Thursday, Mar 7, 19 @ 12:57 pm:

===I would have made the cut line 2.5 times the median household income in Illinois===

That would be about $150K. Lots of firefighters married to teachers make that much.

Nope.

- wordslinger - Thursday, Mar 7, 19 @ 12:57 pm:

–To the anonymous commenter who announced that you and your family are leaving. I deleted you because your IP address is registered to JP Morgan Chase in New York.

lol–

Super genius.

- Earl Hickey - Thursday, Mar 7, 19 @ 12:59 pm:

Agree with all the comments that retirement income will not be taxed. However, if that is not the case , does this proposal run the risk of coming up short on revenue? Also , since this won’t be implemented for 2-3 years, what happens in the interim?

- wordslinger - Thursday, Mar 7, 19 @ 1:00 pm:

– No reason to stuck around for this.–

I suggest a warm, sunny location with remedial English courses at the local c.c.

- Iggy - Thursday, Mar 7, 19 @ 1:00 pm:

Nice brackets now drop the term fair tax because someone who makes 250K being taxed at almost the same rate as someone who makes 1 million is not fair. This is not well thought out.

This plan doesn’t make Millionaires flee Illinois. They will have the capacity to absorb this. The super rich already know how to report their income in Florida or Delaware. The people that will be hurt the most will be the most people just breaking the 250K mark. These are young families with working white collar professionals. Young Attorneys, doctors, software engineers and the like might not be apart of this bracket now, but in 10 years they will be. And in 10 years they will have moved out of this state to work in a state that doesn’t depend on the upper middle class to carry the entire state.

If you honestly want to pretend that 250K for a couple is rich, then you honestly don’t care about people staying in this state.

- Homer Simpson's Brain - Thursday, Mar 7, 19 @ 1:01 pm:

One of the best ways to raise revenue and cut state spending is to give low income workers massive raises. And no the minimum wage hike won’t cut it. Think of all the savings on CHIP/All Kids and Medicaid. If employers are obstinate about paying decent wages, we could raise billions just by clawing back all Medicaid spending from employers.

- Downers Delight - Thursday, Mar 7, 19 @ 1:02 pm:

Huh? at 12:53, Zen at 12:35, and OQ at 12:36 have it spot on. There’s little reduction in taxes so that the messaging is easier to get it passed. And don’t get me wrong, I’ll take an extra couple hundred bucks. But to sell this as a true tax cut is disingenuous and likely won’t be. Fair tax will be the selling point.

- Illinois Resident - Thursday, Mar 7, 19 @ 1:02 pm:

Huh? - The plan raises $3.4 billion in new revenue for our state. Any tax cut for 97% of our residents while raising that much money is a good thing.

- DJ - Thursday, Mar 7, 19 @ 1:02 pm:

Pritzker’s quoted rates mean nothing in a state where Dem majority in General Assembly raised tax rates 60 pct in 2011 and 32 pct in 2018

- El Conquistador - Thursday, Mar 7, 19 @ 1:03 pm:

Seems fair and reasonable on rates. Get it done JB.

- Cubs in '16 - Thursday, Mar 7, 19 @ 1:03 pm:

Correct me if I’m wrong, but JB never promised a large tax break for all. He promised a more fair system. Some of y’all are complaining about a modest income tax reduction and property tax break. Good grief, that’s still better than having your taxes raised. Plus, in theory, as the state’s financial situation improves taxes can be reduced again proportionally. That’s why you don’t want to lock those rates into the Constitution. But I think this is as good as we could’ve hoped for considering the severity of the problem.

- Ole General - Thursday, Mar 7, 19 @ 1:04 pm:

-To the anonymous commenter who announced that you and your family are leaving. I deleted you because your IP address is registered to JP Morgan Chase in New York. -

It would be very helpful if you understood basic internet design and use. Here’s a question for you, where is my IP address registered? O wait, NYC too, is that because I am troll or my VPN locates me there? JP Morgan Chase employees in Chicago use the company VPN, which ahem, is located in NYC.

- Illinois Resident - Thursday, Mar 7, 19 @ 1:04 pm:

Iggy - You do know now marginal tax rates work right? $250K will remain at the lower rate and then up from there. Unless you are at $1 million and above.

- Rich Miller - Thursday, Mar 7, 19 @ 1:06 pm:

===JP Morgan Chase employees in Chicago use===

Fine. What’s he gonna do, request a transfer to New York?

- SaulGoodman - Thursday, Mar 7, 19 @ 1:07 pm:

This is really well done and really hits the sweet spot of good policy, good politics, and fiscal responsibility. Well done #TeamJB.

- Curious - Thursday, Mar 7, 19 @ 1:08 pm:

@Rich

I acknowledge I am ignorant of how IP addresses work, but it doesn’t make sense to me why anyone who lives in NY would so aggressively follow your blog as to comment on this post (no offense). Isn’t it more likely that the IP address pinged to Chase in NY for a different reason (work computer, moved from NY, etc?) and therefore their comment is still valid?

- Mike - Thursday, Mar 7, 19 @ 1:08 pm:

Initial rates. These will be changed and increased on middle-class families.

- Six Degrees of Separation - Thursday, Mar 7, 19 @ 1:08 pm:

===If you honestly want to pretend that 250K for a couple is rich, then you honestly don’t care about people staying in this state.===

I too am surprised at the 2.8% tax jump for earners of $249,000 to $251,000. Guessing they will try to put as much into their 401k as possible to reduce immediately taxable income, for those who are just over the line.

- Steve - Thursday, Mar 7, 19 @ 1:09 pm:

The Illinois millionaires are going to asked to pay much more. Here’s the take from Crain’s

“The biggest surprise in the package is that taxpayers with incomes above $1 million would be hit with the top rate on all of their income. That would likely mean those households would undertake tax-avoidance strategies aimed at keeping their income on paper from exceeding that threshold.”

“https://www.chicagobusiness.com/government/pritzker-tax-plan-hits-millionaires-even-harder-expected

- Illinois Resident - Thursday, Mar 7, 19 @ 1:10 pm:

Six Degrees of Separation - Read up on marginal tax rates and how they work.

- Chris Widger - Thursday, Mar 7, 19 @ 1:11 pm:

==I too am surprised at the 2.8% tax jump for earners of $249,000 to $251,000. Guessing they will try to put as much into their 401k as possible to reduce immediately taxable income, for those who are just over the line.==

At least based on the graph in the presentation (”Fair Income Tax Proposal Rates (Without Credits)”), the jump at $250k doesn’t sweep in all income below $250k, so unlike the jump at $1M, there’s not a strong incentive to manipulate your income to stay below the $250k threshold.

- Norseman - Thursday, Mar 7, 19 @ 1:11 pm:

It’s on the table and the GOP has already staked out it’s position that they don’t want a seat at it. Next up, the false propaganda campaign from IPI to try and scuttle the amendment resolution.

A lot of money and effort will be spent in the next 1 1/2 years on the battle.

- Chris Widger - Thursday, Mar 7, 19 @ 1:11 pm:

==Six Degrees of Separation - Read up on marginal tax rates and how they work.==

Fine, but his confusion here is far more warranted since there actually is a jump at $1M that does not work the way that traditional progressive tax brackets work.

- Curious - Thursday, Mar 7, 19 @ 1:12 pm:

Just caught up and got my answer on the IP address. Rich, I would imagine anyone who is making over $250k at Chase has more options available to them other than requesting a transfer to NY…

- City Zen - Thursday, Mar 7, 19 @ 1:13 pm:

==I am surprised that the line was drawn at $250k.==

Lines are drawn to be erased.

The key bracket is $100-250K. You can raise this rate all you want and still not touch over 80% of tax filers.

- Downers Delight - Thursday, Mar 7, 19 @ 1:13 pm:

IR, it is remarkable how many people do not grasp the concept of a marginal rate whether just by never studying it or by marketing from anti-tax folks. Sorry for non-IL reference, but look at the response to AOC’s 60 Minutes interview where she mentioned the possible 60% or 70% top marginal rate. Those same folks live in IL and will oppose this the same way, possibly without knowing what it means.

Iggy at 1:00, someone making $300,000 would pay less than $1500 extra under the new plan with a marginal rate near 5.25%, only 30 basis points higher than someone earning $250,000/year.

- Perrid - Thursday, Mar 7, 19 @ 1:14 pm:

“in the last 8 years raised taxes twice”

man, you gotta try HARD to be so deceptive. It was raised to 5% temporarily, fell back down to 3.75%, and then was raised to 4.95%. He’s technically right but he is hoping with every fiber of his being for being to misunderstand him. Pretty gross.

- Powdered Whig - Thursday, Mar 7, 19 @ 1:14 pm:

Ok - My wife and I fall in the $250-$325k range, and will be impacted by the changes. Probably to the tune of about 10k a year. I do think that the structure could actually be more progressive and not what seems to be a binary split (The rates below 250k are basically the same as are the rates for those at 250 and above.) With this said, I am not going to move over 10k. There are plenty of reasons why people decide to live where they do. This tax rate may cause some people to leave, while for others it will not be a factor. I happen to like where I live, and am not going to move and start a new life elsewhere over 10k.

With this context in mind, I think there is too much focus here on who will move, who will stay, etc. The argument should be strictly a financial one. What type of revenue will this structure provide and what does that mean for the overall budget. What will this mean for school funding, infrastructure projects, social services and pension funding. These are the topics we should be debating.

The fiscal condition of the state is at stake. Does this proposal get us on a road to fixing the state’s finances? If it does, then I am on board. If it doesn’t, then I am not. If we lose a few people here and there, then so be it as long as the long term health of the state is stronger for it.

- Michelle Flaherty - Thursday, Mar 7, 19 @ 1:14 pm:

OMG THE SKY IS LITERALLY FALLING

Never mind, that’s just snow, again.

Interesting stuff. Should make for a good debate.

- Illinois Resident - Thursday, Mar 7, 19 @ 1:14 pm:

Public Announcement -How Does The Marginal Tax Rate System Work? The marginal tax rate is the rate of tax income earners incur on each additional dollar of income. As the marginal tax rate increases, the taxpayer ends up with less money per dollar earned than he or she had retained on previously earned dollars.

- Ole General - Thursday, Mar 7, 19 @ 1:17 pm:

-Fine. What’s he gonna do, request a transfer to New York? -

I have no idea. Maybe go work at the several regional or national banks spread throughout the US.

It’s besides the point. You’ve pulled this excuse numerous times about deleting various commentators with non-Illinois IP addresses. IP address location is the absolute lowest form of identification on the internet. The social media giants don’t even use it because it provides minuscule information. Yet, the Luddites on this board treat it as 24k Gold.

- Illinois Resident - Thursday, Mar 7, 19 @ 1:18 pm:

Powdered Keg - How are you coming up with $10K in more tax? If you make $325K, you are paying an extra 2.8% on $75K only. So $2,100.

- Downers Delight - Thursday, Mar 7, 19 @ 1:19 pm:

Whig at 1:14, even at the max $325k level, you are only paying the higher rate on the additional $75k, which at 7.75% rate instead of the current 4.95% rate would only amount to an additional $2100. Even more reason to stay!

- Illinois Resident - Thursday, Mar 7, 19 @ 1:20 pm:

Sorry - Powdered Whig

- Powdered Whig - Thursday, Mar 7, 19 @ 1:21 pm:

=== Powdered Keg - How are you coming up with $10K in more tax? If you make $325K, you are paying an extra 2.8% on $75K only. So $2,100. ===

Thanks for the info. I thought that I read that the rates were all flat rates, but I re-read it an see that only applies to those over $1mil.

FYI - my handle is Powdered Whig, but I actually like Powdered Keg better.

- Mike - Thursday, Mar 7, 19 @ 1:22 pm:

Why are we enshrining a marriage penalty into the Consttution?

- Illinois Resident - Thursday, Mar 7, 19 @ 1:22 pm:

Downers Delight - Finally someone else that understands how taxes work.

- Steve - Thursday, Mar 7, 19 @ 1:22 pm:

In Illinois those who make over 500K already pay 22.8% of the entire state income tax. They will be asked to pay more.

https://nalert.blogspot.com/2019/02/blank-check-illinois-lawmakers-file.html

- Grandson of Man - Thursday, Mar 7, 19 @ 1:24 pm:

There have to be GOP legislators in districts where many people would get cuts. Isn’t this appealing to them? How can they scream about cutting taxes then refuse to cut taxes? I’d think Pritzker and his allies would give them financial cover for their votes. What’s the primary opponent going to say, “I’m against tax cuts for 97% of Illinoisans?”

- Nacho - Thursday, Mar 7, 19 @ 1:25 pm:

==In Illinois those who make over 500K already pay 22.8% of the entire state income tax. They will be asked to pay more.==

Yes, the people who have the most money pay the most in taxes. And the problem with that is…?

- regnaD kciN - Thursday, Mar 7, 19 @ 1:25 pm:

Some of the comments have focused on high income earners and the likelihood that they will depart for greener pastures because of the higher rate. Something lost in the discussion is that most of the uber rich don’t get a paycheck like normal folks and the volatility of their income in general is much greater than the 97% who will not be affected by the high rate. Also, there are ads currently being run in Florida newspapers touting residents of several states to consider moving their domicile to Florida but I can’t say if they are being swamped with business.

- Illinois Resident - Thursday, Mar 7, 19 @ 1:25 pm:

Powdered Whig - Congrats on the nice income and am glad that it does not affect you much. And that is the point, Ken Griffen et al need to pay more not everyone else.

- Anon324 - Thursday, Mar 7, 19 @ 1:27 pm:

==Why are we enshrining a marriage penalty into the Consttution?==

“We” aren’t. The rates will not be in the Constitution, unless the Baise thinking wins out (Spoiler alert: it won’t).

- Jeff Parker - Thursday, Mar 7, 19 @ 1:28 pm:

===What’s he gonna do, request a transfer to New York?===

Who wouldn’t try to evade Illinois taxes and move to the modern day tax haven of Manhattan? /s

- City Zen - Thursday, Mar 7, 19 @ 1:29 pm:

==4.95% rate would only amount to an additional $2100==

Don’t worry, Powdered Whig. That extra $2,100/yr, earning a 7% rate or return every year over 25 years, would only amount to $142,000. A mere drop in the bucket to a jet-setter such as yourself.

You have a pension, no?

- West Side TB - Thursday, Mar 7, 19 @ 1:29 pm:

It could be worse. While a few hundred dollars is certainly less, it is hardly “relief”. I had expected something a little closer to the 3.75 rate we used to have for lower incomes. This is the bare minimum he could propose to still say taxes aren’t increasing on “middle class”. Probably, that’s what he had to do to limit the top end and the associated flight of the rich from the state.

- Honeybear - Thursday, Mar 7, 19 @ 1:32 pm:

“They will be asked to pay more.”

and…..so…..?

- Border Bound - Thursday, Mar 7, 19 @ 1:34 pm:

So much for shared sacrifice - let the 3%ers pay the bills. Eat the rich, I guess. That’s why I’m border bound. And thanks in advance for all the well wishes.

- Illinois Resident - Thursday, Mar 7, 19 @ 1:35 pm:

City Zen - Keep advocating for the top 3% instead of the bottom 97%. Good job.

- DER - Thursday, Mar 7, 19 @ 1:37 pm:

I am fortunate to be in the category of people whose taxes would go up under this plan, which I support because it’s good policy and the state needs it. With that said, two thoughts: (1) I did read an interesting analysis that millionaires in certain locations stay because their industry demands it (e.g. Silicon Valley, entertainment in L-A, finance in New York), and that Illinois doesn’t have that kind of pull — so even with the research showing that millionaires don’t move that much (thanks, Reality Check), we may lose a few more here than those states did. But overall I don’t think that changes the calculus. (2) When Ideas Illinois says “In the past, you have said that this will pay for schools, infrastructure, pensions, and social services along with a property tax break – is this enough money because the math doesn’t seem to add up.”, are they trying to have it both ways by attacking the tax increase for not being big enough? Opponents are not going to succeed with a messaging strategy of “This tax increase is too big! Also, it’s too small!”

- Demoralized - Thursday, Mar 7, 19 @ 1:37 pm:

Ole General

I’d have banned you by now. Arrogance is unbecoming and you’ve got it ten-fold.

- City Zen - Thursday, Mar 7, 19 @ 1:37 pm:

==Keep advocating for the top 3% instead of the bottom 97%.==

But I got the math right, no?

- Demoralized - Thursday, Mar 7, 19 @ 1:39 pm:

Well, at least a conversation can start now that is based on actual numbers instead of the imaginary ones many of you have been using.

I think it’s a good outline for a new rate structure. Given that most taxpayers won’t see their rates go up and will even receive a modest cut I think they’ve got an excellent argument to make to get this thing passed.

- Fighter of Foo - Thursday, Mar 7, 19 @ 1:39 pm:

So 2 teachers in the collar counties making 125k a piece. 4 kids. 400 k home. 12k in property taxes. Drive old cars. They are rich? There’s only 11.1% of tax payers in this position I don’t trust the numbers. Also, anyone notice they are punishing those that get married and have kids. So if we had kids and not marry I fit in the Dem party better? That’s a horrible message. If that example is a rich person. We’re in trouble

- SaulGoodman - Thursday, Mar 7, 19 @ 1:40 pm:

**Nice brackets now drop the term fair tax because someone who makes 250K being taxed at almost the same rate as someone who makes 1 million is not fair.**

Thanks for showing that you don’t understand the proposal OR understand how marginal vs effective tax rates work.

- Lucky Pierre - Thursday, Mar 7, 19 @ 1:41 pm:

A ban on smug, arrogant know it alls?

That sure would hit a lot more people than just Ole General

- ZC - Thursday, Mar 7, 19 @ 1:43 pm:

Actually writing these rates into the Constitution would be insane. That’s wholly apart from whether they are good rates or not.

If Greg Baise really thinks these rates should be in the Constitution, I can’t take him seriously.

- Demoralized - Thursday, Mar 7, 19 @ 1:44 pm:

==The House Republican Caucus stands united in opposition==

OK. Then I don’t want to hear any complaints from anyone about the Governor not engaging in negotiations. There’s nothing to negotiate with them.

- ZC - Thursday, Mar 7, 19 @ 1:45 pm:

Ack, I’m sorry, just read more of CapFax. I really think writing the rates into the Constitution is a bad idea, but best wishes for a speedy recovery Mr Baise

- City Zen - Thursday, Mar 7, 19 @ 1:47 pm:

== Also, anyone notice they are punishing those that get married==

Yes. Yes I have.

Big difference between one parent earning $150K and two parents earning $150K. This would be a nice place for ILGOP to step in and lobby for married brackets. Too bad they’re all in on the don’t pass line.

- NeverPoliticallyCorrect - Thursday, Mar 7, 19 @ 1:49 pm:

Of course this had to happen. This state is still on a trajectory to fiscal ruin unless they start collecting more income. But please don’t claim this is more fair unless you’re willing to admit that fair is defined by the person with the power to take your money. But if fair means everyone being treated equally, which is apparently what the Dems want in every other are of life, then a flat rate is the fairest.

- Nacho - Thursday, Mar 7, 19 @ 1:49 pm:

Pretty clear they planned for the inevitable sleight of hand regarding marginal vs. effective rates from the opposition when they came up with these numbers.

- Illinois Resident - Thursday, Mar 7, 19 @ 1:50 pm:

Fighter of Foo - The example you gave would have state income tax reduction based upon the new plan. You can’t make this stuff up.

- Huh? - Thursday, Mar 7, 19 @ 1:51 pm:

Illinois resident - I will agree that a tax cut of $41 is a tax cut. Don’t expect me to be excited about it. Expect me to feel betrayed by the hope that the touted relief for the middle class just isn’t what was advertised.

A family earning $5 million is going to pay an extra $150k.

Compare that to a family making $61k, they get a $41 break.

The proportion of wealth that is being taxed is still on the middle class earners. The wealthy once again get off easy while the middle class gets soaked.

- Anonymous - Thursday, Mar 7, 19 @ 1:51 pm:

Fighter of Foo - Who said they were rich? They fall below the $250,000 cutoff with exemptions factored in and would only pay the marginal difference. Rich is that million dollar marker.

- Anonymous - Thursday, Mar 7, 19 @ 1:51 pm:

This is what happens when it turns out the pensions can be paid for. Look at this comments section. So much for the pension cut fantasy.

- Anon - Thursday, Mar 7, 19 @ 1:53 pm:

With the marginal tax rates, a family making $325K would be paying roughly $2000 more per year. State income tax on $325k would be slightly more than $18,000 as opposed to slightly more than $16,000 under the current flat rate. This is without factoring in the new credits.Isn’t that how it would work?

- 61820 - Thursday, Mar 7, 19 @ 1:55 pm:

There’s a reason why progressive tax schemes operate on the margin. It will mean something like a $30,000 hit for crossing the threshold. Taxing all dollars at the high rate for earners over $1M gives a huge incentive to avoid taxes by moving income (or people) out of state. My guess is that the revenue effect of this provision, which seems to be a major component of the new revenue, is vastly overstated.

- Nacho - Thursday, Mar 7, 19 @ 1:55 pm:

==But if fair means everyone being treated equally, which is apparently what the Dems want in every other are of life, then a flat rate is the fairest.==

Depends on your definition of treating people equally. Even if it’s the same percentage of income, a flat tax has a greater impact on the lives of those who earn less due to the declining marginal utility of money.

- Steve Rogers - Thursday, Mar 7, 19 @ 1:55 pm:

Border Bound: Ok, I’ll play. Give me a reason why the rich shouldn’t pay more in taxes. Here’s a few: I guess they don’t need public schools because their kids go to private schools. I guess they don’t need police protection because they live in gated communities. I guess they don’t need highway maintenance because they fly everywhere in their private jets. I guess they don’t need government because they get to make all their own rules. If you want a nice tax break, go to Kansas or Oklahoma and tell me how their massive tax cuts worked out.

- Illinois Resident - Thursday, Mar 7, 19 @ 1:55 pm:

Huh? - I agree with what you are saying. Would I prefer the top rate higher and the middle rates even lower. Yes. However, all in all, this plan is a lot better then the current flat tax system and our state will be in a much better financial situation.

- Honeybear - Thursday, Mar 7, 19 @ 1:58 pm:

Again I’d like to add that 78% of US workers live

paycheck to paycheck

78%

so

Fighter of Foo

2 teachers making 125 each?

uhhhh……..

show me the paystubs cupcake.

Stop shilling for the upper 3%

stop shilling for the privileged

Stop obfuscating, gaslighting, and whatabouting

Pay your fair share

- The Dude Abides - Thursday, Mar 7, 19 @ 1:59 pm:

So if 97% of taxpayers will receive a tax cut but there’s unanimous opposition to this by the GOP Legislature someone is going to have some explaining to do. It will just confirm what a lot of folks believe anyway, that the GOP is in the pocket of the wealthy and big business.

Laying it out like this was clever by Pritzker. Most folks aren’t against raising taxes as long as their taxes aren’t going up.

- RNUG - Thursday, Mar 7, 19 @ 2:02 pm:

== However, if that is not the case , does this proposal run the risk of coming up short on revenue? ==

Presentation says it will generate $3.4B more. *IF* you don’t add much new spending, it should cover the annual structural deficit and allow paying down some of the backlog.

- Honeybear - Thursday, Mar 7, 19 @ 2:03 pm:

“Lines are drawn to be erased”

Oh man yet another type of wail

“They’ll change it to worse later” EEEeeeek

Not

It’s going to be a lift to just pass this.

It would be political suicide

to change it soon after.

Stop Obfuscating

Stop Gaslighting

Stop Whatabouting

Pay your fair share

and you thought you got rid of fairshare with Janus

PAYBACK my friend

- Illinois Resident - Thursday, Mar 7, 19 @ 2:04 pm:

The Dude Abides - Agreed. It is almost a perfect bracket from the standpoint that if you are against it, you must be a supporter of only the richest 3% in our state.

- Original Rambler - Thursday, Mar 7, 19 @ 2:09 pm:

Fixer 12:53. Thank you thank you thank you. Any criticism of a PIT I read here by LP, Sue, Anon or others is pretty much disregarded until they point to a constitutionally legal plan to address our fiscal issues.

While I think this is a nice start by JB’s team it is only that. By the time the sausage is made I’m sure there will be tweaks or wholesale changes to his rates and/or tiers. I’m just glad he did this to get the ball rolling.

- Anonymous - Thursday, Mar 7, 19 @ 2:10 pm:

Rich is there an annalys of this plan vs the Civic Fed of everyone paying 6%. Which seems more fair. Thanks

- OneMan - Thursday, Mar 7, 19 @ 2:10 pm:

==“We’ve had 2 tax increases in the past 8 years…” Well, if it weren’t for one particular former Governor, (a) There would have been half as many and (b) we would have been in far better shape financially. So there’s that.==

Yeah, the Democratic legislature passing a temporary tax increase that was signed by a Democratic governor (Pat Quinn) resulted in that.

Glad you noticed.

Or was it all of the sudden progressives who want to ‘fix’ the income tax system didn’t have the courage to make the increase permanent and were looking to make a Republican governor wear the jacket on it long term?

I guess I also missed all the permanent tax increases passed by Democratic governors?

- The Big Salad - Thursday, Mar 7, 19 @ 2:11 pm:

==Pay your fair share==

Please, tell me what mine is and how you determined it. Will I finally be paying my fair share with this increase? Will you?

Spell it out.

- Original Rambler - Thursday, Mar 7, 19 @ 2:12 pm:

I’d like to add my appreciation for the measured comment by Powdered Whig at 1:14. Nice to see someone who would be negatively affected make a lucid analysis without threatening to move.

- Lucky Pierre - Thursday, Mar 7, 19 @ 2:13 pm:

Honeybear here are the numbers on the more than 30,000 members of the 6 figure (not including benefits) educators club in Illinois that costs taxpayers $3.7 billion annually.

It pays to be a bit skeptical next time you hear “it’s all about the kids.”

https://www.forbes.com/sites/adamandrzejewski/2018/06/04/the-exclusive-100000-club-meet-30000-members-at-the-illinois-teachers-retirement-system-trs/#69a554896129

- benniefly2 - Thursday, Mar 7, 19 @ 2:19 pm:

Yeah… I knew it was $150k and it would snag more folks. However, a $150k household income puts one solidly in the 85th percentile of all households in the United States. At some point, I figure you have to cut off the ‘middle class’ designation. I cut it off at the top 20%. Others cut it off at 90% or 60%. Some cut it off at ‘if you less money than Jeff Bezos’.

Regardless, I admit my plan wouldn’t have nearly as good of chance of passing a statewide referendum as the current one does.

- brickle - Thursday, Mar 7, 19 @ 2:20 pm:

Seems like a pretty solid opening offer.

- Fighter of Foo - Thursday, Mar 7, 19 @ 2:22 pm:

Honeybear. My example was just that. If 250 is the threshold with cost of living in the western suburbs. With a few kids and 2 parents working. That ain’t rich. That couples taxes will double. Those 11% allegedly. Spare me the communistic talking points. We have college debt that we will be lucky to pay off before the kids go. Oh, and divorce my wife to save a buck. Better?

- cover - Thursday, Mar 7, 19 @ 2:23 pm:

= So, I’m assuming those close to that level will do whatever they can to avoid reaching a million dollars on paper, because that would hugely jack up their tax bills. But, hey, they could also hire somebody or give some cash to charity to stay below a million. =

Funny one, Rich! That might actually be the ultimate test of who really is a “job creator”, the 1.4% or the consumer who demands goods and services.

- Fighter of Foo - Thursday, Mar 7, 19 @ 2:27 pm:

Honeybear. You rail against the rich all day on here. Then talk about the working man. When do you actually, you know, work? Or is thinking of ways of spending other people’s money the union way now? You don’t have to be one side or the other. There’s a middle. It would be nice if people could find it.

- Rich Miller - Thursday, Mar 7, 19 @ 2:27 pm:

===cost of living in the western suburbs.===

Median household income in Wheaton is $91,241.

https://datausa.io/profile/geo/wheaton-il/

It’s $110,676 in Naperville.

https://datausa.io/profile/geo/naperville-il/

- RNUG - Thursday, Mar 7, 19 @ 2:27 pm:

== What will this mean for school funding, infrastructure projects, social services and pension funding. ==

My gut take is this increase BY ITSELF won’t be funding any of this at a very high level. The increase is estimated at $3.4B; the annual budget deficit is around $2B. That leaves about $1.4B in ‘unallocated’ money. With that wish list, it won’t make all that much of an impact.

Now if you ADD in JB’s bonding plans and the pension kick the can plan (not that I agree it is a good idea), then there should be some money for noticable increased spending on all that list.

My concern is that JB is using about every budgetary trick in the book to reach a more or less balanced budget … leaving nothing in reserve for a possible recession.

- Honeybear - Thursday, Mar 7, 19 @ 2:28 pm:

Nice try LP

Maybe you should read the article first.

Only 20,000 on that list of 100k are working.

and and and

stop obfuscating

stop gaslighting

stop whatabouting

Because that 20,000 includes administrators and any district employees. As a matter of fact I didn’t see a single actual teacher sited. (I will admit it if I missed one) But all the examples were superintendents and administrators.

I’m tired of your ilk

using the dark arts

of number manipulation.

Stop obfuscating

Stop gaslighting

stop whatabouting

Pay your fair share

- Honeybear - Thursday, Mar 7, 19 @ 2:29 pm:

leaving nothing in reserve for a possible recession.

Sometimes you gotta roll a hard 6

- City Zen - Thursday, Mar 7, 19 @ 2:30 pm:

==I guess I also missed all the permanent tax increases passed by Democratic governors?==

Thompson passed a temporary increase in 1983. Because who doesn’t love limited time offers?

- Anonymous - Thursday, Mar 7, 19 @ 2:33 pm:

Fighter of Foo - it’s pretty clear you don’t teach math. A couple making $250,000 will get a cut unless you are saying they make that after accounting for all their deductions. Even if you are claiming the latter, it’s a marginal rate on the amount they earn over $250,000.

- Compuders - Thursday, Mar 7, 19 @ 2:33 pm:

- It would be very helpful if you understood basic internet design and use. Here’s a question for you, where is my IP address registered? O wait, NYC too, is that because I am troll or my VPN locates me there? JP Morgan Chase employees in Chicago use the company VPN, which ahem, is located in NYC. -

Actually with split tunnel VPN configurations your normal internet traffic is sent out your home gateway and only work resource traffic is sent over the vpn.

- Fighter of Foo - Thursday, Mar 7, 19 @ 2:33 pm:

250 k in Naperville ain’t rich gang. 400k home. 12k property tax. 3-4 kids. What’s the fair share? Dang. Should have not tried to better myself.

- Illinois Resident - Thursday, Mar 7, 19 @ 2:34 pm:

-If 250 is the threshold with cost of living in the western suburbs. With a few kids and 2 parents working. That ain’t rich. That couples taxes will double.-

Fighter of Foo - Are you being dishonest or do you just not understand how marginal tax rates work? These hypothetical folks you keep talking about would have a state tax decrease under the new plan, not an increase.

- Rich Miller - Thursday, Mar 7, 19 @ 2:34 pm:

===if you ADD in JB’s bonding plans and the pension kick the can plan===

He’s got several current revenue plans on the table as well.

- DER - Thursday, Mar 7, 19 @ 2:34 pm:

I am fortunate to be in the 3%, and I am in favor of this proposal. A few other things: (1) I appreciate Reality Check’s point that millionaires don’t actually move as much as people think, although I did find persuasive one earlier analysis that it’s harder for the rich to move when they’re tied to an industry that has a clear headquarters (e.g. finance in New York, entertainment in L-A, Silicon Valley). So that’s potentially an issue but to me not one that overrides good public policy. (2) I ran some numbers more than a decade ago that showed that a small decrease in taxes on the 97% doesn’t cost the state much, and an increase on the top 3% brings in a lot of revenue — that’s just how these things work. So this feels like a sound approach. (3) It is true that overall Illinois has a higher tax burden. The theory of action has to be that with a stabilized state budget the state will be able to do more to fund schools, easing pressure on local property taxes. Whether that actually happens or not, who knows, but it seems likely to succeed at least in some of the communities hardest hit by property taxes — towns in south Cook with exorbitant property tax rates and not a lot of rich people. (4) Ideas Illinois is clearly trying to raise the prospect that this is just the first bite at the apple, and that eventually taxes will go up more. I’m always skeptical of slippery slope arguments with a legislature — drawing lines is what legislatures do, and if at some point in the future people would prefer some different set of rates they’ll change them (I don’t take seriously the notion that the rates could somehow end up in the Constitution). But it’s a legitimate point to raise. Of course, one counterargument is that without this Constitutional change any tax increase would have to be on everybody, which would only worsen our existing regressive system. (5) Finally, I was struck by this “question” from Ideas Illinois: “In the past, you have said that this will pay for schools, infrastructure, pensions, and social services along with a property tax break – is this enough money because the math doesn’t seem to add up.” I doubt that it will be a winning strategy to attack this proposal by arguing, “The tax increase takes too much money! Also, the tax increase doesn’t take nearly enough money!”

- Joe M - Thursday, Mar 7, 19 @ 2:34 pm:

==The top rates are very high compared to other states.==

Really Sue. Let’s see: Iowa top rate: 8.98% –

Minnesota: 9.85% — Wisconsin: 7.65%

Sure there are a number of states with lower top progressive rates. But one could also say, “The top rates are low compared to other states” and be just as accurate.

- Stumpy's bunker - Thursday, Mar 7, 19 @ 2:35 pm:

Honeybear@11:57 am:

The answer to your question seems to be your #2 option as evidenced by Durkin’s response:

- The House Republican Caucus stands united in opposition to a $3.4 billion tax increase on Illinois families and businesses. -

Disinformation it is.

- Skeptic - Thursday, Mar 7, 19 @ 2:38 pm:

“Yeah, the Democratic legislature […] resulted in that.” Well, if you think paying the bills and reducing the debt is a bad thing, then I guess there’s no point arguing with you.

- City Zen - Thursday, Mar 7, 19 @ 2:40 pm:

== Let’s see: Iowa top rate: 8.98%==

Iowa let’s you deduct each and every penny in federal income taxes paid before determining you state’s taxable income.

Is Illinois offering the same?

- Illinois Resident - Thursday, Mar 7, 19 @ 2:43 pm:

City Zen - Keep fighting for the 3%. Because who cares about everybody else right.

- I Miss Bentohs - Thursday, Mar 7, 19 @ 2:44 pm:

As a Republican these all are fine with me as I am happy we do not hurt those making under $200,000 … except I am confused by the household rate being the same for married and single … I am very anti-antifamily. Also, I do wish we could lower the taxes on those married with kids making low incomes. Maybe that can come when we are a fiscally responsible state year after year (I crack me up)

- Honeybear - Thursday, Mar 7, 19 @ 2:45 pm:

“If 250 is the threshold with cost of living in the western suburbs. With a few kids and 2 parents working. That ain’t rich.”

No it is. I’m laughing my head off at the irony that I’m spouting anti State worker talking points back at you.

You can’t say

Stateworkers are too highly paid when the median household income is 80k

and then say 250,000 is not rich.

It is to the 97% of the people of this state.

Rich just hit you with Suburban median incomes.

It says a lot that you think that folks will struggle with 250k income.

Wow….

Your middle is 250k?

It’s sad how disconnected from the financial reality of 97%.

I’m truly delighted that I am under your skin.

call me whatever you want

You’re going to pay your fair share

Mr. 250k is not rich

- Montrose - Thursday, Mar 7, 19 @ 2:49 pm:

My hunch is the provision that taxes all income at the higher rate for folks making over a $1 million is a bargaining chip. The give will be shifting only the income over $1m being at the highest rate. In reality, that compromise probably won’t decrease the projected revenue a whole lot.

- Anonymous - Thursday, Mar 7, 19 @ 2:49 pm:

==Pritzker’s quoted rates mean nothing in a state where Dem majority in General Assembly raised tax rates 60 pct in 2011 and 32 pct in 2018 ==

Only partly true. DJ, will you also acknowledge that the same Dems who raised taxes in 2011 also set in place a tax cut for 2015?

- Big Jer - Thursday, Mar 7, 19 @ 2:50 pm:

BTW:

Chicago is 7th on the list of cities with people worth $30 million or more . As of 2018 Chicago had 3,255 people worth $30 million or more.

And for all those “the rich are going to leave” meme, that 3,255 number was a 7% increase from the previous year.

Can you say #not progressive/graduated enough, wealth tax, financial transaction tax, etc?

- Anonymous - Thursday, Mar 7, 19 @ 2:54 pm:

==Keep advocating for the top 3% instead of the bottom 97%.==

But I got the math right, no?

No, Zen, you didn’t. The alternative to the new 7% rate is not the current rate, unless you’re willing to specify real cuts to existing spending. Without that, the alternative JB is proposing is a flat 5.95% rate, so that the loss over time with i7% interest (good luck with that) is not nearly as high as you say.

- Honeybear - Thursday, Mar 7, 19 @ 2:55 pm:

Great post DER,

Thank you

You are not amongst those I attack

You are loyal Illinoisan

Smart and reasoned

and ready for dialogue

Thank you thank you

Just excellent

- City Zen - Thursday, Mar 7, 19 @ 2:56 pm:

==Keep fighting for the 3%==

But I got the math right, no? You know, the math that explained how much of his working family’s retirement savings would be diminished from the tax hike. The post…from earlier…$140K? You with me there? You still haven’t verified.

Honeybear, why no love for the suburbanites? We pay the top teacher salaries in the state and our polo ponies are well fed.

- Demoralized - Thursday, Mar 7, 19 @ 2:57 pm:

==It pays to be a bit skeptical next time you hear “it’s all about the kids.”==

So you have to be low paid for it to be about the kids? That’s an absurd argument, though not a surprising one coming from the likes of you.

- City Zen - Thursday, Mar 7, 19 @ 2:58 pm:

==unless you’re willing to specify real cuts to existing spending.==

Why would I? The presentation already listed those out.

- Lester Holt’s Mustache - Thursday, Mar 7, 19 @ 3:01 pm:

If nothing else, we can definitively say that JB has at least offered a more sound plan to fix Illinois finances than term limits and redistricting reform. This plan alone makes him a better governor than the last guy.

- Dirt Poor - Thursday, Mar 7, 19 @ 3:16 pm:

No SALT workaround for small businesses? Seems like the master of tax avoidance could get this done. Perhaps allow pass-through entities to pay the state income tax on the entity level. My understanding is the new tax law allows any taxes conducted in trade to be fully deductible and not subject to the SALT limit.

- Fred Y - Thursday, Mar 7, 19 @ 3:36 pm:

This is insane — I make $650k a year and already feel like I’m living paycheck-to-paycheck…

- RNUG - Thursday, Mar 7, 19 @ 3:47 pm:

== He’s got several current revenue plans on the table as well. ==

Good point Rich.

I know the State needs lots of money but I’m still concerned he’s planning on everything except loose change from the couch cushions.

- Cubs in '16 - Thursday, Mar 7, 19 @ 3:48 pm:

===This is insane — I make $650k a year and already feel like I’m living paycheck-to-paycheck…===

Maybe you need to take a long, hard look at your lifestyle choices. Just sayin’.

- The Original Name/Nickname/Anon - Thursday, Mar 7, 19 @ 3:58 pm:

==This is insane — I make $650k a year and already feel like I’m living paycheck-to-paycheck… ==

Is this a joke?

- wordslinger - Thursday, Mar 7, 19 @ 4:01 pm:

===This is insane — I make $650k a year and already feel like I’m living paycheck-to-paycheck…===

Stay out of the clubs, Contreras. Hit .270 with 20 taters and you’ll score big in arbitration after this season.

Plus, dude, you travel first class and get that meal money on the road….

- Anonymous - Thursday, Mar 7, 19 @ 4:56 pm:

How does a person’s retirement income fit in? Will it be used to determine total income and property tax deduction. Will retirement income still not be taxed, if so how will it be exempt?

- Anonymous - Thursday, Mar 7, 19 @ 5:01 pm:

The old everyone else pays less, and people say as long as I do not have to pay more. Then we find out it does not raise as much money as we were told, and the rates have to go up in the future. It all boils down to do you trust government?

- JS Mill - Thursday, Mar 7, 19 @ 5:02 pm:

@Fred Y- you need to learn to live within your means or cut 15% on the expenditure side.

- The Big Salad - Thursday, Mar 7, 19 @ 5:05 pm:

==You’re going to pay your fair share==

The brazenness with which you go around telling people to pay their fair share while having precisely zero justification as to what, exactly, is fair…is astounding to me. So, again:

Spell it out.

- wordslinger - Thursday, Mar 7, 19 @ 5:11 pm:

–My concern is that JB is using about every budgetary trick in the book to reach a more or less balanced budget … leaving nothing in reserve for a possible recession.–

A reserve fund is a fiction when you still have an $8B backlog of old bills. Like saying I have $2K in “savings” but $25K in overdue credit card debt.

Historically, the $4B in dedicated funds have been swept for cash flow.

- Anonymous - Thursday, Mar 7, 19 @ 5:14 pm:

The absolute maximum tax reduction for anyone (on just the bracket changes alone) is $65.00. That’s the overall maximum reduction for anyone with no kids and no property.

$20 decrease (total) on the first $10,000

$45 decrease (total) on the next $90,000

The tax cliff at $1,000,001 (where it stops being marginal and goes to flat) equates to an $8,565.08 penalty (10% additional total tax bill for making that extra $1).

- Huh? - Thursday, Mar 7, 19 @ 5:31 pm:

The more I think about this proposal, the angrier I get. To call a 0.05% tax cut on income up to $100k meaningful is an insult.

Pritzker ran on a platform to make the income taxes “more fair”. Make the wealthy pay more, while reducing the taxes on the middle class.

The pittance of reduced income taxes for the middle class is a worthless gesture and lip service to the campaign promise.

How is it fair for an earnings of $100k to pay essentially the same amount of income tax when an earnings of $5mill pays a piddling $150k extra.

- Honeybear - Thursday, Mar 7, 19 @ 6:20 pm:

Huh, as my father used to say

“ nobody promised you a rose garden.”

There were a lot of considerations

And

One hell of a lot of revenue needs

Your emotions about it are yours

I can’t change them. Yet

I’m very glad to see the 3%

Pay a lot more.

- Anonymous - Thursday, Mar 7, 19 @ 6:35 pm:

Ya’ll realize that these rates are not the actual rates that will be “vote” on, right?

The only thing JBP wants is to have the constitution changed so he can put in a progressive tax.

After that the “real” rates will be “vote” on.

If he was so concerned with protecting the 97% from high taxes, he’d be pushing for constitutional changes that actually protect them from high taxes, not open doors for future increases.

- Anonymous - Thursday, Mar 7, 19 @ 6:47 pm:

Boy the conspiracy crowd is rabid today.