* The Daily Line’s Hannah Meisel…

A new poll commissioned by Ideas Illinois, a dark money group formed to fight a ballot question that would change Illinois’ flat income tax to a graduated tax, shows support for the idea is slipping, especially in a key central Illinois media market. […]

Ideas Illinois’ new poll, conducted by We Ask America on May 29 and May 30, found that support for a graduated income tax has fallen to 51 percent among likely voters — 8 percent below the minimum 60 percent threshold of voters needed to approve the measure. A similar poll in February had found a higher level of support — 59 percent — prior to a blitz of television advertising from both sides this spring as Pritzker rolled out his specific proposals surrounding a graduated tax.

The poll also found that opposition to a constitutional change to a graduated tax has risen slightly in the same time period

As more voters have heard from both sides — which featured Pritzker in ads from both Ideas Illinois and the pro-graduated tax group set up by a former Pritzker campaign staffer — Republicans registered the biggest drop in support for the concept of a graduated income tax. While 32 percent of self-identified Republicans supported a graduated tax in February, 21 percent of Republicans support the idea now, according to the poll.

* Jim Dey…

The poll revealed support for the Pritzker tax plan has fallen “despite nearly $5 million in spending by (pro-amendment) Think Big Illinois.”

Why the decline in support?

We Ask America attributed the decline to Ideas Illinois’ attacks on what Pritzker calls a “fair tax.”

“Voters see right through it. While voters right now are seeing the Pritzker messaging, they also don’t like it,” the memo states.

Sampling from the Champaign/Springfield areas, where pro- and anti-tax television advertising has been heavy, found 46 percent “agreed that the constitutional amendment is ‘just a blank check for Springfield politicians to spend more and will hurt Illinois’ economy and force businesses to leave the state.’” The poll indicated 32 percent of respondents disagreed with that statement.

The harder the critics hit that idea, We Ask America concluded, the more opposition there will be to the proposed amendment.

* Daily Herald…

Illinois Gov. J.B. Pritzker said opponents of the proposed graduated income tax plan are intentionally misleading voters who will ultimately decide its fate in November 2020.

“I think opponents of the fair tax certainly are trying to muddy the waters trying to come up with words to make it seem like something it’s not,” Pritzker said Thursday morning in a meeting with the Daily Herald editorial board. “The most recent silliness was a ‘blank check jobs tax,’ which I’m not sure I understand. It really is a crazy notion that they’re putting forward and an untrue notion.”

That phrase was used by former Illinois Manufacturers’ Association President Greg Baise, whose Ideas Illinois opposes the graduated tax and says it will push jobs out of state.

* From the polling memo…

A near majority (46%) agree that the constitutional amendment is “just a blank check for Springfield politicians to spend more and will hurt Illinois’ economy and force businesses to leave the state,” with 32% disagreeing. While 74% of Republicans agree with that assertion, just 25% of Democrats do, but among Independents, 46% agree versus 33% who disagree.

The key here is to persuade Republicans that this is a Democratic trick and to pull away enough indies to deprive the governor of a win.

* However, a big Democratic turnout in a presidential year could allow the proponents to take advantage of this highlighted constitutional provision…

A proposed amendment shall become effective as the amendment provides if approved by either three-fifths of those voting on the question or a majority of those voting in the election.

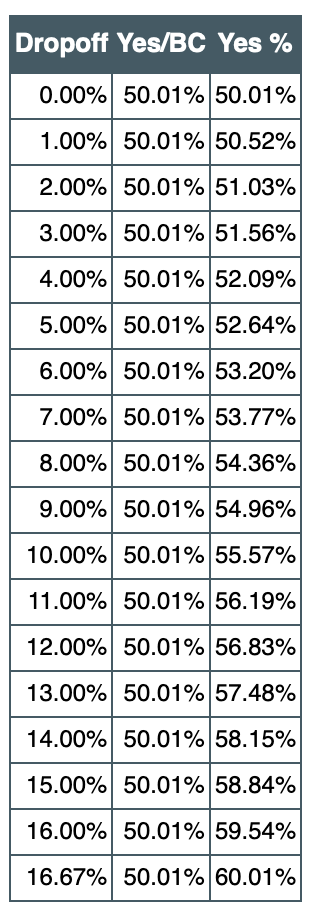

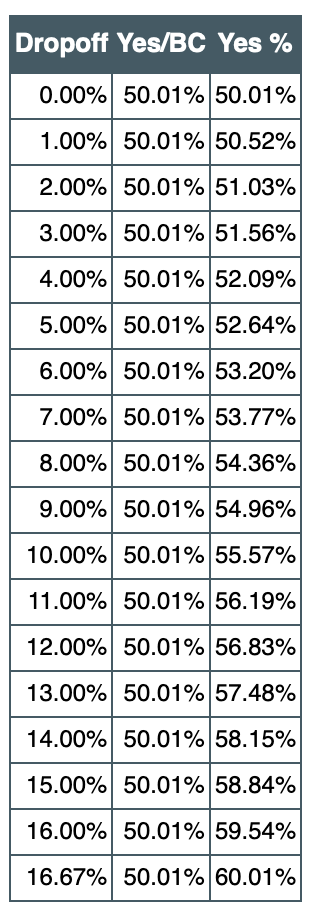

* Since 2010, the dropoff rate (those who took ballots compared to those who voted on the proposed constitutional amendment) has ranged from 8.1 to 17.15 percent. Here’s Scott Kennedy’s chart on the percentage needed to pass compared to the dropoff rate…

…Adding… Think Big Illinois Executive Director Quentin Fulks…

After trying and failing to prevent voters from having a say at the ballot box on the fair tax, opponents are now even more desperate to defend the current unfair tax system. This is nothing more than political posturing – Illinoisans want a tax system that works for everyone, not just the wealthy few. As voters continue to learn the truth about the fair tax, Think Big Illinois is confident they’ll vote for it next November.

Also, Idea Illinois’ memo about reaching 60 percent is here.

- Former State Worker - Tuesday, Jun 11, 19 @ 1:49 pm:

They need to find a way to effectively get across the message that the alternative will be raising the flat tax which will effect everyone. No Constitutional Amendment is needed for that.

- Ducky LaMoore - Tuesday, Jun 11, 19 @ 1:54 pm:

@Former State Worker

They will. And it will be over the top in October 2020.

- Steve - Tuesday, Jun 11, 19 @ 1:55 pm:

If JB can attempt to convince people that flat taxes aren’t fair taxes: expect the opponents of progressive incomes to attempt to convince people that progressive taxes mean a tax increase on everyone and more frequently. You can laugh all this off but a lot of political messaging isn’t exactly truthful.

- OneMan - Tuesday, Jun 11, 19 @ 1:56 pm:

== “despite nearly $5 million in spending by (pro-amendment) Think Big Illinois.” ==

Tbh I really am surprised the spend was that low considering the amount of mail I got and the TV ads.

- DuPage Saint - Tuesday, Jun 11, 19 @ 1:59 pm:

Probably would be easier to raise flat tax then give credits to middle and lower income people somehow. Wait till gas tax increase kicks in and other fees. People will start to notice and blank check argument can be pervasive especially for those who for some reason don’t trust politicians. Plus throw in how legislators increased salary and mileage fees. Going to be lots of commercials

- Steve - Tuesday, Jun 11, 19 @ 2:04 pm:

- DuPage Saint -

You hit it on the head. When many see the higher gas taxes , they might wonder how much higher state income taxes will go. Other places have roads, bridges, and better schools than CPS with much lower taxes.

- City Zen - Tuesday, Jun 11, 19 @ 2:06 pm:

==They need to find a way to effectively get across the message that the alternative will be raising the flat tax which will effect everyone.==

That sounds like a threat.

There’s a long way to go. If JB can manage state funds appropriately, he can build the confidence and trust needed to get this passed. If that new pickleball court is warped, he has no chance.

- Grandson of Man - Tuesday, Jun 11, 19 @ 2:14 pm:

Other relatively-recent polls (a few months back) have shown more support, enough to enact it, so we’ll see. Big Democratic turnout could help get it get enacted, and at this point, Democrats should be enthusiastic about Pritzker. I feared Pritzker failing to get his big issues passed, but he’s succeeded. He and his allies certainly have the financial means and grassroots power to give a strong effort.

The key for Pritzker and his allies is to expose who’s behind the fair tax opposition, the anti-union super-rich who helped nearly tank this state and caused unprecedented damage and debt. This was manifested in Rauner’s governance and BTIA. These are the people who’d rather destroy a state than be taxed at comparable rates to neighbors like Wisconsin and Iowa.

- Former State Worker - Tuesday, Jun 11, 19 @ 2:14 pm:

==That sounds like a threat.==

Which is why I said they need to effectively get this message across to those who are opposed to voting for it. They should be able to find a way to get this message across given the millions of dollars they have backing this otherwise there is no path to 60%.

- Jibba - Tuesday, Jun 11, 19 @ 2:18 pm:

===Other places have roads, bridges, and better schools than CPS with much lower taxes.===

You have already been told that our tax rates reflect the need to pay off the overspending for prior decades when our tax rate was too low to support the spending. This cannot be avoided by bankruptcy or any further meaningful pension reform. Failing to account for this makes comparisons to other places meaningless.

- West Side the Best Side - Tuesday, Jun 11, 19 @ 2:21 pm:

These numbers are from May of 2019. The vote comes in November of 2020. Just another reason to think of dark money groups, and to a certain extent pollsters, as just grifters looking for the next bunch of chumps to throw money at them.

- 47th Ward - Tuesday, Jun 11, 19 @ 2:23 pm:

Even though the tax hike will only affect about 3% of tax payers, and most will get a break or stay the same, I think this is still a big uphill fight.

Most Illinoisans are not rich and never will be, but they all aspire to be wealthy. That gives them pause when considering stuff like this. “Hey, someday when i’m wealthy, this tax hike will hurt me,” is the thinking, sort of a preemptive self-defense mindset.

- Skirmisher - Tuesday, Jun 11, 19 @ 2:24 pm:

Based on my very unscientific monitoring of cafe conversation, I would say the post-session hangover has kicked in. Everyone is now looking with dread at all of the new taxes kicking in on July 1,thereis huge discomfort over all of the radical social program changes (more gambling, legal dope, unrestricted abortion, etc.), and yes, the man on the street despises and distrusts the Illinois political establishment as much as ever. So a new income tax system that sounded reasonable a month ago is now being viewed with renewed distrust. Whoever already said this was correct: JB needs to build a lot of grass-roots trust, and a big dpe ding binge probably won’t do it.

- Responsa - Tuesday, Jun 11, 19 @ 2:30 pm:

From the get go choosing to market it as a “fair tax” instead of what it is -a graduated income tax necessary to pay down state debt- makes the sell harder to the general public, rather than easier.

- Sue - Tuesday, Jun 11, 19 @ 2:30 pm:

Actually Pritzker better hope that a moderate like Joe Biden tips the 2020 ballot. I’d bet a lot of dough that if one of the crazies on the Dem side(Warren,Sanders) is the nominee the Dem Turnout will be down and the fair tax vote goes kaput

- Rich Miller - Tuesday, Jun 11, 19 @ 2:34 pm:

=== I’d bet a lot of dough===

Sue, with your electoral track record, you might not wanna put yourself out there as a willing pigeon.

- ernie the e - Tuesday, Jun 11, 19 @ 2:34 pm:

Simple….IL citizens heard about all the tax increases just passed in Springfield. So, they know that their taxes/fees are going up. This is their one way to fight back….

- Back to the Mountains - Tuesday, Jun 11, 19 @ 2:39 pm:

Polling memo for the opposition says the opposition is gaining steam and the progress is attributable to the opposition. Color me shocked.

Admittedly, I’m a newbie to these parts, so I apologize in advance if this is a silly question, but is a poll done a year before the vote even worth the paper it’s printed on?

- Rabid - Tuesday, Jun 11, 19 @ 2:41 pm:

The millionaire tax vote rebranded into fair tax. Stay with what people voted for, the millionaire tax. Central Illinois can stick it to Chicago millionaires

- Blue Dog Dem - Tuesday, Jun 11, 19 @ 2:46 pm:

Referring to Biden as a moderate is as far fetched as calling Rauner a free market capitalist fiscal conservative.

- RNUG - Tuesday, Jun 11, 19 @ 2:56 pm:

I know We Ask America is a legit pollster, but I didn’t find the actual questions in the news stories. Just how much of a push poll was it?

- Grandson of Man - Tuesday, Jun 11, 19 @ 2:57 pm:

“but is a poll done a year before the vote”

Agreed. It’s probably too early to gauge how the vote will turn out.

“Referring to Biden as a moderate is as far fetched”

Tell that to the leftists who think Biden is too conservative.

- Former State Worker - Tuesday, Jun 11, 19 @ 2:58 pm:

=I’d bet a lot of dough that if one of the crazies on the Dem side(Warren,Sanders) is the nominee the Dem Turnout will be down and the fair tax vote goes kaput=

At least we know there will be one crazy on the ballot with an R next to his name. That will certainly motivate Democrats to come out and vote.

- illinoised - Tuesday, Jun 11, 19 @ 3:39 pm:

I do not have faith in the results of a poll conducted by “dark money group.”

- Wylie Coyote - Tuesday, Jun 11, 19 @ 3:51 pm:

After motorists have paid the higher motor fuel taxes for a few months, I’m gonna guess they’re not going to be in the mood to raise or change any more taxes. They won’t trust lawmakers to not expand the graduated tax threshold levels downward if the amendment were to be approved.

- Cheryl44 - Tuesday, Jun 11, 19 @ 3:55 pm:

I was just about to type something very close to what illinoised said. I don’t believe their poll.

- James Knell - Tuesday, Jun 11, 19 @ 3:56 pm:

Dark money from the 1% is going to try to pull that bitter old Illinois hater club together. Yuck.

- Anon Y - Tuesday, Jun 11, 19 @ 4:17 pm:

They raised all those fees and the gas tax people don’t want to hear about taxes.

- Enviro - Tuesday, Jun 11, 19 @ 4:18 pm:

Illinois has is a backlog of bills that must be paid. The state needs the money that will be generated by a progressive state income tax. If the progressive tax is not passed I would be in favor of an increase in the flat tax. I think the people of Illinois are ready for a progressive state income tax.

- RNUG - Tuesday, Jun 11, 19 @ 4:21 pm:

== That will certainly motivate Democrats to come out and vote. ==

Could be a wash if Nixon’s Silent Majority shows up again …

- A guy - Tuesday, Jun 11, 19 @ 4:33 pm:

There appears to be a sense that Democrats are 100% for this tax. (or that the GOP is 100% against it?)

Not sure we really know. As a motivator to get people to vote though, it’s counter-intuitive to suppose people are going to get jacked to vote for a tax increase. Even on someone else.

- Annonin' - Tuesday, Jun 11, 19 @ 5:07 pm:

Guessin’ Spanky Baise could have a tough time funding this stuff going forward and explaining why he wants folks to support the Rauner Rates (still toxic) especially with the Adams Co. Grand Jury wrap and likely raft of suits from the Poison Plant.

- My thoughts - Tuesday, Jun 11, 19 @ 5:27 pm:

How is this a fair tax when retirees receiving $50,000 or more annually pay no tax?

- PrairieDog - Tuesday, Jun 11, 19 @ 5:28 pm:

“Fair”??

If JB Pritzker pays 3.95% on his millions of income and I pay the same rate on my 50k, how is that not “fair”? 3.95% 0f a million is a hell of a lot more than 3.95% 0f 50k, and everyone with a scintilla of intelligence knows it. The whole point of a graduated income tax is to raise taxes on everyone while being able to justify it by saying “the rich” are paying at a higher rate. Everyone sees through that as well.

- Right Field - Tuesday, Jun 11, 19 @ 5:32 pm:

== You have already been told that our tax rates reflect the need to pay off the overspending for prior decades when our tax rate was too low to support the spending. ==

Yes, and voters will be rightly be asking “so, what reforms have there been to deal with the overspending? Salary increases for legislators?” That’s what people will remember at the ballot box.

- 44th - Tuesday, Jun 11, 19 @ 5:45 pm:

PrairieDog, since the premise, all this “fair” bs is a manipulation, you are left wondering about any of it. Nobody plays it straight and all the spinning and BS have become too much.

- Looking down the Road - Tuesday, Jun 11, 19 @ 6:00 pm:

Don’t forget Chicago. Lightfoot is going to need a big pile of dollars - before the election. How she gets that pile will have an effect.

- Looking down the Road - Tuesday, Jun 11, 19 @ 6:08 pm:

–You have already been told that our tax rates reflect the need to pay off the overspending for prior decades when our tax rate was too low to support the spending.–

Seriously, Why should I stay and pay for it? I didn’t vote for the mentally challenged legislators that were responsible.

- Demoralized - Tuesday, Jun 11, 19 @ 6:36 pm:

==and everyone with a scintilla of intelligence knows it.==

Thanks Mr. Wizard.

Your definition of fair is different than mine and a lot of other people. It doesn’t seem all that fair to me that the guy making millions of dollars pays the same percentage of his income taxes as the guy that makes $50,000.

- SSL - Tuesday, Jun 11, 19 @ 6:52 pm:

Yep, fair is in the eye of the beholder. JB said it wasn’t fair that people like Rauner and him weren’t paying more. He then lowered the bar to include those making 250,000 to be just like Rauner and himself. Not a big leap to think he’ll lower the bar further as the cash crunch continues.

Having said that, I don’t believe the poll. I don’t believe any polls anymore. Wait for the vote.

- Bavette - Wednesday, Jun 12, 19 @ 7:08 am:

There is nothing fair about this tax. It is quite unfair to tax certain people at higher rates than others.

- Demoralized - Wednesday, Jun 12, 19 @ 7:43 am:

==It is quite unfair to tax certain people at higher rates than others.==

Yeah. I feel real bad for those millionaires. The “it’s unfair” argument isn’t a winning one. There are other ones to use. Use them.