* Moody’s…

Moody’s Investors Service has upgraded the State of Illinois’s general obligation (GO) rating to Baa2 from Baa3. In connection with this action, ratings on Build Illinois sales tax revenue bonds were upgraded to Baa2 from Baa3, and annual appropriation bonds issued by the Metropolitan Pier and Exposition Authority Ratings were upgraded to Baa3 from Ba1. Total debt affected amounts to about $33 billion, including $27.7 billion of general obligation bonds, $3 billion of Metropolitan Pier and Exposition Authority bonds, and $1.9 billion of Build Illinois bonds. The outlook remains stable.

RATINGS RATIONALE

The upgrade of Illinois’ GO rating to Baa2 from Baa3 is supported by material improvement in the state’s finances. The enacted fiscal 2022 budget for the state increases pension contributions, repays emergency Federal Reserve borrowings and keeps a backlog of bills in check with only constrained use of federal aid from the American Rescue Plan Act. Illinois still faces longer-term challenges from unusually large unfunded pension liabilities, which are routinely shortchanged under the state’s funding statute. These liabilities could exert growing pressure as the impact of federal support dissipates, barring significant revenue increases or other fiscal changes.

* Press release…

Governor JB Pritzker hailed the state’s improved bond rating from Moody’s Investor Service on Tuesday, the first such rating upgrade from a credit rating agency in more than 20 years. Since taking office, Gov. Pritzker has tirelessly focused on strong and responsible fiscal management, working with the General Assembly to hold the line on spending while making key investments to strengthen Illinois’ outlook.

Moody’s last upgraded the state’s bonds in June of 1998 and today’s upgrade credited “material improvements,” with only “constrained use of federal aid,” including increased pension payments, repayment of federal borrowing and keeping the bill backlog in check.

“I promised to restore fiscal stability to Illinois, and Moody’s ratings upgrade demonstrates that Illinois’ finances are heading in the right direction for the first time in two decades. A ratings upgrade pays momentous dividends for taxpayers, and the people of Illinois deserve credit for their incredible resilience and determination,” said Governor JB Pritzker. “This upgrade is the result of many leaders working together on a strong fiscal plan and putting that plan in place, and I would like to especially thank Speaker Welch, President Harmon, Leader Greg Harris, Senator Sims, Comptroller Mendoza and Treasurer Frerichs for their partnership. I also applaud Moody’s for answering our request to take a fresh look at the State and their willingness to listen to our progress and our plans.”

Moody’s upgraded Illinois’ rating on its General Obligation bonds from Baa3 with a stable outlook to Baa2 with a stable outlook, and also upgraded the Metropolitan Pier and Exposition Authority ratings to Baa3 from Ba1 based on the state’s support. Build Illinois bonds were upgraded to Baa2 from Baa3.

* Some recent history…

On June 1, 2017, Standard and Poor’s Global Inc. and Moody’s Investors Service, credit rating agencies, downgraded Illinois’ credit rating. S&P also said that it might downgrade the state’s credit rating further if the state failed to adopt a budget. The downgrade placed the state’s credit rating at one step above a junk rating (a low rating which indicates the state is a high risk investment). At the time of the downgrade, the state had not passed a budget in two years due to disagreements between the Democratic state legislature and Republican Governor Bruce Rauner. According to S&P analyst Gabriel Petek, “the rating actions largely reflect the severe deterioration of Illinois’ fiscal condition, a byproduct of its stalemated budget negotiations, now approaching the start of a third fiscal year.” Prior to this downgrade, Illinois’ credit rating was the lowest in the country. If downgraded again, Illinois would become the first state to receive a junk rating from a credit agency.

…Adding… Daily public schedule update…

What: Gov. Pritzker to address Moody’s upgrade of the state’s bond rating, the first rating upgrade from a credit rating agency in more than 20 years.

Where: Illinois State Capitol, Governor’s Office, Springfield

When: 4 p.m.

Watch live: https://www.Illinois.gov/LiveVideo

…Adding… Speaker Welch…

There’s consensus—not only have all three rating agencies upgraded our state’s outlook, but now Moody’s has given Illinois a full credit upgrade. Thanks to responsible and balanced budgets, as well as sound economic policy decisions, we continue to move our state toward financial stability. This is yet another example that we can support all Illinois families, invest in our communities, provide high-quality state services to those in need, all while improving our fiscal health.

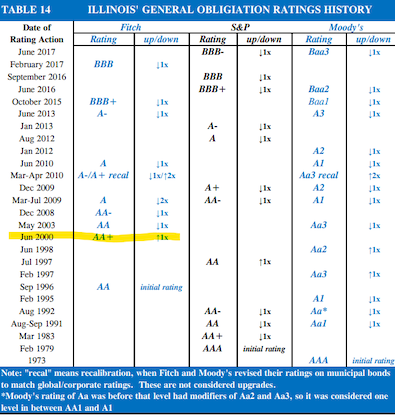

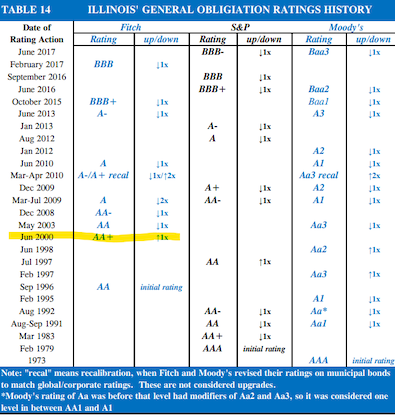

…Adding… Historical chart…

…Adding… Comptroller Mendoza…

“I couldn’t be happier that our hard work is producing results: the first rating upgrade for Illinois in two decades from Moody’s Investor Services,” Illinois Comptroller Susana A. Mendoza said. “This means lower costs for Illinois taxpayers. As you have seen in recent months, even in the middle of a global pandemic, my administration has successfully paid down a backlog of bills that just four years ago hit $16.7 billion — down to $2.9 billion today — and did so while prioritizing the most vulnerable people in our state.

“As your state Comptroller, I vowed to stay laser-focused on paying down the backlog of bills and earning a credit upgrade. Governor Pritzker, leaders of the General Assembly and I all agreed to use better-than-expected revenues this year to pay down bills and we did not over-commit the federal stimulus funds which – it should be noted here – have not yet arrived and are not the reason we were able to pay down these bills.”

As Moody’s said in its announcement today that it was raising the state’s status to Baa2 from Baa3, “The enacted fiscal 2022 budget for the state increases pension contributions, repays emergency Federal Reserve borrowings and keeps a backlog of bills in check with only constrained use of federal aid from the American Rescue Plan Act.”

…Adding… Senate President Harmon…

Stability and responsibility produce results. You don’t need to ruin people’s lives to have sound fiscal policies and positive outcomes.

I want to thank Governor Pritzker and Speaker Welch for their teamwork in helping us find a better way forward.

…Adding… Senate GOP Leader McConchie…

“The change is encouraging but claiming victory with federal money is misleading the people of our state,” said Illinois Senate Republican Leader Dan McConchie (R-Hawthorn Woods).

“Like someone trying to hide a hole in the wall by covering it with wallpaper, the governor and Democratic majorities are trying to ‘paper over’ the state’s ongoing systemic budgetary and economic issues. For example, we still have over $140 billion in unfunded liabilities for the five state retirement systems. The Chicago pension system is still projected to run out of money in six years. Meanwhile, state pension payments continue to consume a quarter of Illinois’ operating budget, which is billions of dollars that can’t be used to fund schools, increase public safety, or improve our transportation systems.

“Illinoisans deserve systemic, structural changes to our long-standing issues - not lies about our financial status. The truth is, that without the influx of federal aid, our state would very likely be looking at yet another credit downgrade.

“When the federal money dries up, as it will, the governor and his party will no longer be able to pretend that there’s no hole in the wall.

“Today is a positive step, but there will come a day when the governor and his party run out of other people’s money. Unfortunately for the people of Illinois, that day is coming sooner, rather than later.”

- AlfondoGonz - Tuesday, Jun 29, 21 @ 3:14 pm:

I would have voted for anyone over Bruce Rauner in the general. Anyone. I’ve been surprised and impressed by JB. But I wonder how easy it was to surprise and impress, considering impressions are relative and the Rauner admin would have been better off if they were just worthless.

- Chicago Cynic - Tuesday, Jun 29, 21 @ 3:15 pm:

Hallelujah

It’s long past time. The whole credit reporting business is a scam. Illinois has never missed a payment. Never. And it never should have been this low, even with Governor Junk’s destruction of our state.

- Roadiepig - Tuesday, Jun 29, 21 @ 3:15 pm:

Finally. Things improve when you pay your bills. Such a hard concept for so many people

- Oswego Willy - Tuesday, Jun 29, 21 @ 3:17 pm:

Maybe someone read the constitution too?

No?

Oh.

Good news, 20 years in the making, never missed one payment during those 20 years.

- Lucky Pierre - Tuesday, Jun 29, 21 @ 3:32 pm:

The destruction of the state budget began 20 years ago when guess what party took over complete control of Springfield.

- very old soil - Tuesday, Jun 29, 21 @ 3:35 pm:

Man. What a buzzkill for Bailey and the rest of his ilk.

- Demoralized - Tuesday, Jun 29, 21 @ 3:45 pm:

Obviously this is good news. But the naysayers will continue their tired bad mouthing of the state. They evidently preferred the Rauner plan, which was to completely destroy the state.

- Publius - Tuesday, Jun 29, 21 @ 3:46 pm:

It’s about time. Should have never been lowered to begin with. The ratings are for sale.

https://youtu.be/Kj2W_EqKzuw

- Chicago Cynic - Tuesday, Jun 29, 21 @ 3:48 pm:

Ding ding ding. And the winner of the historical revisionism award goes to LP, conveniently ignoring the seven downgrades caused by his favorite governor, Governor Junk.

- Nick - Tuesday, Jun 29, 21 @ 3:49 pm:

This has been a long time coming.

- Oswego Willy - Tuesday, Jun 29, 21 @ 3:51 pm:

Don’t be too hard on - Lucky Pierre -…

The bot programming doesn’t know how to respond.

It’s more fun reading and mocking it. There’s no honesty to it.

- City Zen - Tuesday, Jun 29, 21 @ 3:51 pm:

Great news. Or not. I forgot if we’re supposed to care about these things.

- Oswego Willy - Tuesday, Jun 29, 21 @ 3:56 pm:

=== Great news. Or not.===

Should we revisit your feelings on the downgrades?

I kid, I *kid*

- Donnie Elgin - Tuesday, Jun 29, 21 @ 4:01 pm:

Great news, the short-term fiscal situation is improving. Knowing that Welch has stated it will be “next couple of years” before another run at the graduated income tax CA. 2023 will be an interesting budgeting/election year.

“These liabilities could exert growing pressure as the impact of federal support dissipates, barring significant revenue increases or other fiscal changes”

- Just Me 2 - Tuesday, Jun 29, 21 @ 4:05 pm:

Obviously this is due to the Trump tax cuts.

- Anyone Remember - Tuesday, Jun 29, 21 @ 4:12 pm:

“And the winner of the historical revisionism award goes to LP … .” Perhaps “factually unaware” ??

The Bot might fry it’s coding if shown the historical fact in 1985 (FY 1986 appropriation bills) James Thompson reduction vetoed all retirement appropriations to “60% of payout” - the appropriations had been voted out of the GA at “100% of payout” by Senate President Phil Rock and … House Speaker Mike Madigan. And GOP Leaders Pate Philip and Lee Daniels supported Thompson’s vetoes.

- Grandson of Man - Tuesday, Jun 29, 21 @ 4:17 pm:

It’s great news and not the least bit surprising that the professional debt scolds try to spin this into a negative.

Who among the debt scolds voted for Rauner and/or Trump? Because if they did they have absolutely no business criticizing anyone.

- Arsenal - Tuesday, Jun 29, 21 @ 4:22 pm:

==The destruction of the state budget began 20 years ago when guess what party took over complete control of Springfield. ==

20 years ago, George Ryan was Governor.

- Oswego Willy - Tuesday, Jun 29, 21 @ 4:27 pm:

===George Ryan was Governor.===

(Bot programming activated… GHR… )

“It was the combine”

(Programming reset)

To the post, snark aside,

It’s good news, it’s not the full turnaround or complete fiscal deliverance, but these small, and very important and necessary steps, need to start with “one” or two or three… and there’s so much work to do, what this does is give credence to the arrow pointing upward, and now keeping the state moving upward will still mean tough decisions…

… even if ignoring the constitution allows for the grifting on bonds to continue.

I’m happy. Doesn’t mean anything is done

- Grandson of Man - Tuesday, Jun 29, 21 @ 4:38 pm:

“20 years ago, George Ryan was Governor.”

Also, most (if not all) of today’s GA members were not around 20 years ago, same with the governor. They have little or nothing to do with our historical finances.

Today’s GA and governor are being very responsible, and it shows in the credit ratings. Too bad for the right wing, who pretends to care about debt only as a means to attack opponents.

- Blake - Tuesday, Jun 29, 21 @ 4:45 pm:

Yes it is something important to care about & great news. Since Illinois is 50th in bond rating, who is 49th? How far to go to get to 25th/26th of the 50 states?

- Keyrock - Tuesday, Jun 29, 21 @ 4:50 pm:

Thanks Bruce Rauner, Without you taking Illinois to new lows, we couldn’t have improved this much.

- JoanP - Tuesday, Jun 29, 21 @ 4:56 pm:

= the naysayers will continue their tired bad mouthing of the state. =

Like the genius who had a letter in the Trib this morning, noting that Jean Baptiste Point du Sable moved away, “the same thing many Chicagoans today are wisely doing”.

The writer neglected to mention that du Sable became quite wealthy as a trader here.

- Huh? - Tuesday, Jun 29, 21 @ 4:58 pm:

Does this mean the the governor works for the rating agencies now? /s

- Out of Illinois - Tuesday, Jun 29, 21 @ 4:59 pm:

It is better news, but the state’s credit still sucks. Wake me up when they actually do something that might solve the problem. I will either celebrate or move.

- Rich Miller - Tuesday, Jun 29, 21 @ 5:01 pm:

===Wake me up when they actually do something that might solve the problem===

Did you vote for or against the progressive income tax?

- Rich Miller - Tuesday, Jun 29, 21 @ 5:11 pm:

===a letter in the Trib this morning===

That editorial board is changing, so we may not be seeing as many of those letters https://twitter.com/McQuearyKristen/status/1409976411117457418

- Oswego Willy - Tuesday, Jun 29, 21 @ 5:18 pm:

Thanks, Rich… self named “Statehouse Chick” twitter is seemingly selective for viewers I’m told.

Guess she could do a podcast for IPI, maybe join Proft on his national show, Jacobson stays on the local screed…

Her buyout application “was not accepted”

Maybe?

“Kristen, the way we see it, we decline your offer to a buyout, and frankly, if you wanna go, by all means. Where are you going to go, NOLA?”

- JoanP - Tuesday, Jun 29, 21 @ 5:25 pm:

Whoa, Hurricane Kristen is leaving? That *does* likely portend a change.

- The Dude Abides - Tuesday, Jun 29, 21 @ 5:40 pm:

We’ve got a long way to go but for the first time in along time we can say that we’re moving in the right direction. The Governor deserves some credit. Sixteen months is an eternity in politics but I feel pretty good about JB’s re-election chances right now, especially given the current state of the ILGOP.

- Al - Tuesday, Jun 29, 21 @ 6:06 pm:

I still believe the SEC & U.S. Attorney’s office should prosecute Governor Rauner for engaging in a Conspiracy to manipulate Illinois bond prices. He proclaimed budgets did not matter. That he could manage a $30 billion entity without one. He was deliberately deceptive and the purpose was the grease in the ‘puts’ which would become valuable as the bond prices fell.

- Lincoln Lad - Tuesday, Jun 29, 21 @ 6:06 pm:

Q foretold this, it’s a key step to restoring Trump to office. That makes no sense? You probably don’t understand the alien influence. It’s all there. /s

- Ducky LaMoore - Tuesday, Jun 29, 21 @ 6:32 pm:

“Q foretold this”

No. I think it was just JB’s turn to use the secret Jewish space laser. And he turned it on Moody’s. /s

- Powerhouse Prowler - Tuesday, Jun 29, 21 @ 7:27 pm:

Good job JB and your team.