Latest Post | Last 10 Posts | Archives

Previous Post: SUBSCRIBERS ONLY - Campaign news

Next Post: Isabel’s afternoon roundup

Posted in:

* Press release…

A new report from the Institute for the Public Good proposes a bold solution to Chicago’s deepening fiscal crisis: a Corporate Income Inequality Tax targeting corporations that spend millions on high executive pay.

The report shows how a corporate excise tax on the privilege of doing business in Chicago measured by 5% of the cost of payroll for employees that earn more than $200,000 on corporations with more than $8 million in annual payroll can generate more than $1.5 billion in new revenue for the city. It would also create a Small Business Growth Fund—$50-$100 million annually in grants and revolving loans, supporting the very businesses that have anchored our neighborhoods for generations but have struggled to compete against deep-pocketed corporations and big-box chains.

At a time when Chicago ranks fourth in the U.S. for number of millionaires, yet one in five residents experiences food insecurity, the city faces a choice: continue down a path of austerity or hold high-profit corporations accountable and fund a future rooted in equity, not cutbacks.

Corporations have been benefiting from the largest tax cut in U.S. history under the Tax Cuts and Jobs Act of 2017 and studies have revealed that benefits flowed only to the very top—49% to firm owners, 11% to executives, and 40% to high-income workers (those in the top 10% within their firms). No benefits were seen by low-paid workers.

For decades, Chicago has let big corporations off the hook while slashing public services. Chicago can’t afford to leave money on the table for city services that keep our communities safe, healthy, and livable. This report shows how taxing corporations with extreme executive compensation could support everyone in Chicago when it comes to housing, safety, and care.

* From the report…

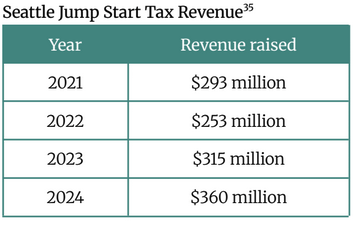

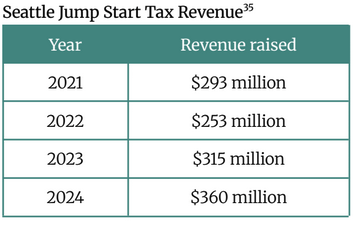

This type of payroll expense tax was adopted by Seattle in 2020, called JumpStart. Each year, this tax measure has outperformed its goals, while driving economic growth within Seattle.

One of the primary narrative detractors to a corporate-related tax measure is that it is a “job killer” - akin to the language Mayor Rahm Emanuel used in 2014 during his campaign to eliminate the Head Tax. When looking at Seattle from 2020 - 2025, we see that narrative as purely political. When looking at the BLS (Bureau of Labor Statistics) employment data for Seattle, we see steady growth across the overall workforce from pre-implementation through to post implementation.

Factoring in the fact that implementation was in 2020 during a time when jobs started to grow again after a plummet due to COVID, job levels have exceeded that of 2019 and early 2020 levels.

When looking specifically at “Professional & Business Services” job growth, we see a similar trend - levels that have continued to be higher than 2019.

Though we do not attribute job growth to this revenue measure, we can derive the counterfactual - that the measure did not create job loss.

The Seattle Experience - What Was Learned

Seattle’s JumpStart Tax was implemented in 2021, focusing on structuring what was an excise tax on payrolls exceeding a certain threshold (to hold harmless small businesses) - inclusive of stock grants and RSUs. This has allowed for Seattle to include the shifting dynamic of executive pay (from salary to equity) into the tax measure.

The implementation of this tax far outpaced the initial revenue projection of $219 million, helping them fill sizeable budget gaps in the last 2 years, as well as materially invest more into affordable, low-income and green social housing, as well as small business support and equitable development initiatives.

* Seattle revenues…

* The Question: Should the state allow Chicago and other home rule municipalities to establish this payroll expense tax? Take the poll and then explain your answer in comments, please.

posted by Rich Miller

Wednesday, Jul 23, 25 @ 1:28 pm

Previous Post: SUBSCRIBERS ONLY - Campaign news

Next Post: Isabel’s afternoon roundup

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

No. Illinois is already very uncompetitive in many business metrics. Illinois is already up against right to work states and zero state income tax states. Why become even more uncompetitive?

Comment by Steve Wednesday, Jul 23, 25 @ 1:52 pm

I voted No. This is just another attempt to distract from MBJ’s incompetence.

Comment by Three Dimensional Checkers Wednesday, Jul 23, 25 @ 2:00 pm

$200k seems like a low bar for this proposed tax. That’s a middle income for professionals in the Loop.

Comment by Six Degrees of Separation Wednesday, Jul 23, 25 @ 2:03 pm

Voted yes. The question was not “should city x impose” the tax; it was “should the state allow” the option. Allowing cities to debate and potentially try it is fine; trying new options is a good way to test new ideas.

Comment by Pot calling kettle Wednesday, Jul 23, 25 @ 2:05 pm

==$200k seems like a low bar for this proposed tax. That’s a middle income for professionals in the Loop.==

LOL. What a woefully out-of-touch statement.

Yes! Put this thing in place! The United States has some of the worst wealth inequality in the world–we need to disincentivize wealth hoarding and encourage its redistribution via legal means like payroll expense taxes!

Seattle’s approach of using it to build up community resources is wonderful. YES YES YES!

Comment by Ukrainian Village Usurper Wednesday, Jul 23, 25 @ 2:07 pm

Yes, because it’s needed, it works, the wealthy get federal tax cuts and it lessens reliance on state government. Why should Chicago be hampered because the vast majority of downstaters vote to protect the wealthiest, even against tax cuts for themselves? If progressive taxation kills jobs, America would have been an economic backwater from FDR to Reagan’s tax cuts. The last two recessions hit after Republican tax cuts. Don’t fall for the usual right wing scare tactics.

Comment by Grandson of Man Wednesday, Jul 23, 25 @ 2:10 pm

=== Yes! Put this thing in place! The United States has some of the worst wealth inequality in the world–we need to disincentivize wealth hoarding and encourage its redistribution ===

So now earning $200k per year is wealth hoarding? I believe you are the one who is out of touch. $200k a year is not that much nowadays in light of the large increases in inflation and cost of living.

Comment by Remember the Alamo II Wednesday, Jul 23, 25 @ 2:22 pm

My instinct was to vote no, since it’s so easy for a company to avoid paying the tax (the workers themselves don’t pay) to move outside of city limits. But it’s clearly worked–as a revenue raiser, at least–for Seattle. So maybe?

Comment by Benjamin Wednesday, Jul 23, 25 @ 2:22 pm

The bar is too low and the 5% rate too high. I don’t believe this would draw much support as suggested.

Comment by Lincoln Lad Wednesday, Jul 23, 25 @ 2:26 pm

I voted no but mainly due to a lack of trust for this admin. but something like this could help.

@Steve- check this out:

https://www.newsweek.com/map-shows-states-best-worst-quality-life-2100141

CNBC released their annual quality of life report. Two of our neighbors,Indiana and Missouri (gasp) were listed in the bottom 10 of the country. Tennessee was rated as the worst btw. Illinois wasn’t at the top, but we did ok.

People are not leaving Chicago, especially high earners for Indiana, Iowa, or Missouri.

Comment by JS Mill Wednesday, Jul 23, 25 @ 2:27 pm

Let Home Rule really be Home Rule. Service tax, income tax, head tax , corporate tax let a home rule city figure out what they need and don’t blame the state for your own incompetence.

Comment by DuPage Saint Wednesday, Jul 23, 25 @ 2:30 pm

Absolutely. If the Chicago City Council believes this is their best method for enhancing revenue, I’d love for them to prove it.

They continually advocate for higher taxes. Give them the ability to prove their theory.

Comment by Downstate Wednesday, Jul 23, 25 @ 2:33 pm

No. I can’t believe people still don’t get it. It is not a revenue problem; it’s a spending problem. When the hole is huge and the legislation they keeping putting in Front of the Governor is for higher pensions too many folks don’t get it.

Comment by Tim Wednesday, Jul 23, 25 @ 2:34 pm

Tim, we hear you — really, we do. But the truth is, most consumers and residents keep paying without much fuss. Whether it’s apathy, an inability (or unwillingness) to move, or genuine support for taxes, the end result is the same. Voters have consistently shown they’re okay with paying more. Sure, once in a while a politician in a swing district might lose their seat over a tax hike, but let’s not pretend that’s shaking up the supermajorities in the General Assembly or City Council. At the end of the day, people vote for what they want — and apparently, what they want is more taxes. Who are we to argue with democracy?

Comment by Yes Wednesday, Jul 23, 25 @ 3:07 pm

Voted yes. To paraphrase Willie Sutton, “tax the wealthy, that’s where the money is”.

Comment by don the legend Wednesday, Jul 23, 25 @ 3:37 pm

I think they may run into an Article 9 issue. While a city or tax income tax is not directly addressed, there is this language.

SECTION 2. NON-PROPERTY TAXES - CLASSIFICATION,

EXEMPTIONS, DEDUCTIONS, ALLOWANCES

AND CREDITS

In any law classifying the subjects or objects of

non-property taxes or fees, the classes shall be reasonable

and the subjects and objects within each class SHALL BE TAXED UNIFORMALY.

Obviously, it will come down to what a court would say, but I don’t think it would stand as proposed.

Comment by RNUG Wednesday, Jul 23, 25 @ 3:38 pm

No.

Illinois’ restrictions upon Home Rule taxing authority (income, personal property, etc.) are prudent. If you want to see how out of hand it could get, look at Missouri, their personal property taxes on vehicles, and the “issues” caused (vehicles fradulently registered in Illinois, lack of renewal stickers leading to “problematic” interactions with law enforcement, etc.).

Comment by Anyone Remember Wednesday, Jul 23, 25 @ 3:48 pm

Remember the Alamo II — $200k is not that much? Brother, I would die for that kind of compensation. I live comfortably off of ~$63k a year. I own property. I eat well. I go to the gym. I have fun.

Your perception is totally distorted when the average salary in Chicago is in the $70k/yr range.

Comment by Ukrainian Village Usurper Wednesday, Jul 23, 25 @ 3:59 pm

Give it a whirl

Comment by Annonin' Wednesday, Jul 23, 25 @ 4:01 pm

Business owner, I voted yes but $200k is too low a threshold. Yell at me all you want but that’s going to capture a lot of non-executive jobs in many industries for something advertised as targeting executive pay.

Comment by ChicagoVinny Wednesday, Jul 23, 25 @ 5:12 pm

“we need to disincentivize wealth hoarding and encourage its redistribution”

I believe that was the credo for Marx/Lenin/Stalin.

Comment by Downstate Wednesday, Jul 23, 25 @ 9:16 pm