Latest Post | Last 10 Posts | Archives

Previous Post: *** UPDATED x2 *** Quinn says “something not right” about Brady’s refusal, suggests Brady “rethink” his candidacy

Next Post: Post-meeting leader videos, Quinn on Leaders/Rahm and Lisa on Rahm

Posted in:

* 12:57 pm - The day before thousands of protesters are planning to descend on Springfield to decry the governor’s proposed budget cuts, Gov. Quinn is telling legislative leaders today that he wants to increase budget cuts by $400 million.

Quinn also wants to lengthen the lapse spending period by four months, which would give the state even more time to pay bills from one fiscal year to the next.

From the guv’s office…

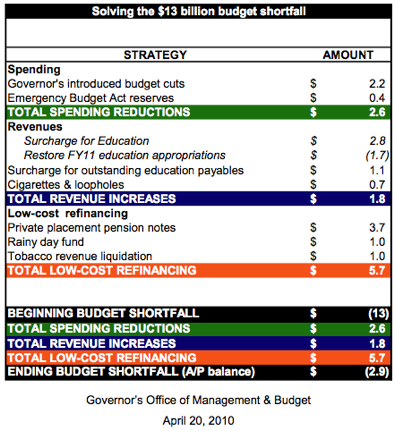

In addition to the proposed $2.2 billion in cuts the Governor proposed on March 10, he is calling for authority under the emergency budget act to cut $400 million additional funds from the budget. This would bring the Governor’s proposed total cuts to $2.6 billion. The Governor is also requesting an extension of the lapse period for payments to vendors in an effort to ensure all payments owed are received. The lapse period would be extended from Aug. 31 to Dec. 31.

Currently, we have more than $6 billion in accounts payable. This detailed plan reduces those bills to $2.9 billion by using strategic measures which include borrowing excess money from other state funds and partially liquidating the revenue from the tobacco settlement. Both of these strategies will net the state $2 billion dollars to help stabilize the budget, pay our bills, refinance our debt and keep people employed.

The truth is we need revenue. The education surcharge will generate $2.8 billion dollars that will be used to fund education while keeping tens of thousands of people employed. Education is a top priority for the Governor. He is committed to raising needed revenue in order to continue to provide excellent educational opportunities for our students.

Governor Quinn inherited these fiscal challenges that were created over several years of budget mismanagement and this detailed plan provides the solutions to get the state back on sound financial footing.

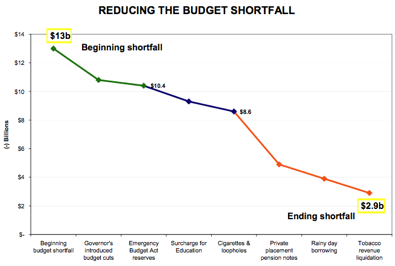

Quinn’s budget office also distributed these two graphs. Click the pics for larger images…

We’ll have video from the post-meeting leader availabilities, so check back.

posted by Rich Miller

Tuesday, Apr 20, 10 @ 1:03 pm

Sorry, comments are closed at this time.

Previous Post: *** UPDATED x2 *** Quinn says “something not right” about Brady’s refusal, suggests Brady “rethink” his candidacy

Next Post: Post-meeting leader videos, Quinn on Leaders/Rahm and Lisa on Rahm

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Take even longer to pay people? That’s going to go over well with the social service agencies tomorrow.

Comment by OneMan Tuesday, Apr 20, 10 @ 1:12 pm

It’s good to see Quinn’s tax increase (”education surcharge”) will be going towards jobs and education.

Comment by jonbtuba Tuesday, Apr 20, 10 @ 1:15 pm

When and where did we get a Rainy Day Fund? Is that the new term for “Fund Sweeps”?

Comment by GOP4EVER Tuesday, Apr 20, 10 @ 1:23 pm

Quinn couldnt manage the local Dairy Queen without driving it into bankruptcy. Illinois is a deadbeat that doesnt pay its bills but somehow Quinn Madigan cullertonkeep cashing paychecksand having their expenses paid. After this weekend there should be one less state employee but that will never happen in Ill. clout rules.

Comment by fed up Tuesday, Apr 20, 10 @ 1:24 pm

Beware of words like “liquidation”. Wish people would just say what they mean.

Comment by steve schnorf Tuesday, Apr 20, 10 @ 1:25 pm

I’m not sure what extending the lapse period does. The fiscal year would still end on June 30 and the bills due would remain the same. It will allow the Comptroller 4 more months of revenue to pay prior year bills but I don’t see how that solves any problems b/c there will still be no extra money. It is simply continuing to take from the next year’s revenues and paying prior year bills. There is no solution in this solution.

Comment by RJW Tuesday, Apr 20, 10 @ 1:25 pm

Where is that $400 million going to be cut from?

Where is the cash flow to pay back the additional borrowing?

How does pushing out vendor payment even further help in the long run?

And, on top of all that, do people realize what messed up budget situation we find ourselves in when cut billions, raise taxes by billions, borrow billions, and we are still in the hole by billions?

Comment by Montrose Tuesday, Apr 20, 10 @ 1:26 pm

Perhaps they are talking about cash flow borrowing (very cheap) into the rainy day fund (currently holds around $240M) which would benefit cash flow (bill payments).

Comment by steve schnorf Tuesday, Apr 20, 10 @ 1:27 pm

Steve Schnorf is right. It’s not like we are liquidating some account. We would be taking pennies on the dollar for future tobacco settlement revenue now and some company would get the full amount later as the yearly payments come in. I would also like to know how long this would be for to see what kind of a deal it is. The tobacco settlement provides funding to the states FOREVER (which most people don’t know).

Comment by RJW Tuesday, Apr 20, 10 @ 1:28 pm

RJW It avoids sending lots of vendors to Court of Claims to be paid

Comment by steve schnorf Tuesday, Apr 20, 10 @ 1:29 pm

True. But it’s still a nightmare from where I sit as you would still be keeping track of the prior fiscal year for half of the current fiscal year.

Comment by RJW Tuesday, Apr 20, 10 @ 1:32 pm

Is the total revenue increase $3.5 or $4.6 billion instead of the $1.8 billion shown in the blue line above?

Comment by Vole Tuesday, Apr 20, 10 @ 1:35 pm

Private Placement Pension Notes? Is that just another typical pension bond deal or something different?

Comment by John Bambenek Tuesday, Apr 20, 10 @ 1:40 pm

- The tobacco settlement provides funding to the states FOREVER -

Ummm, perhaps you know something I don’t, that is extremely possible. But as far as just the settlement payments, there is an end date, correct? Personally, I think that selling part of an asset like the tobacco settlement is much better than an asset like the lottery.

Comment by Small Town Liberal Tuesday, Apr 20, 10 @ 1:45 pm

Quinn also wants to lengthen the lapse spending period by four months, which would give the state even more time to pay bills from one fiscal year to the next.

What Daley said he is doing makes more sense than what Quinn said he is doing. Daley is renegociating with city vendors and leveraging what the city owes vendors to ensure the vendors remain open, yet make cuts that will help the City. This is the art of compromise during tough fiscal times.

What Quinn is doing is what Quinn, the General Assembly, and Blagojevich did over the past five years - force others to bear the costs of working with a deadbeat state government entirely. Quinn’s plans will force bankruptcies, harm credit, and do nothing for the State in the long run.

Daley’s approach is a page directly out of Donald Trump’s business tactics. In the real world, Daley’s approach works. It is also clear that in the real world, Quinn’s approach won’t work, but then he is just trying to get elected to office this November, and is making this all up as he goes along, right? And if he changes his mind, (as the Canoe Czar), Quinn will just flip flop again.

Comment by VanillaMan Tuesday, Apr 20, 10 @ 1:58 pm

Lets see ” Governor Quinn inherited these fiscal challenges that were created over several years of budget mismanagement and this detailed plan provides the solutions to get the state back on sound financial footing. ” Well Acting Gov Quinn has been apart of the mismanagment for the past 7 plus years so I think he needs to look in the mirror and then re think his canadidcy.

Comment by fed up Tuesday, Apr 20, 10 @ 2:04 pm

PQ is hoping that people will just ignore the fiscal sleight of hand he is engaged in while simultaneously trying to brand Brady as an extremist. He was, is and will be incompetent as a governor. Why anyone would vote for him is a mystery. As more people see PQs’ fecklessness as a sign of that incompetence, the more they are likely to either vote for Brady and hope he sticks to the fiscal issues or they stay home and not vote at all.

Comment by dupage dan Tuesday, Apr 20, 10 @ 2:05 pm

First, I give the Administration credit for their efforts here. The former Governor would be doing all the gimmicks on the revenue side without cutting spending, probably adding to it. These guys are thinking and heading in the right direction.

Second, I understand the revenue increases they are showing in their proposed budget, which they are probably going to get very little of. Without showing the surcharge revenue, the cuts jump up to about $4B (which is much closer to where they probably need to be) but that would create real presentation problems.

Having said all that, borrowing doesn’t reduce debt. It simply creates a debit on the other side of the ledger equal to the amount borrowed. So while we can reduce cash flow problems with borrowing (debt), we can’t solve debt problems with debt unless we do some sort of interest rate play like POBs.

Comment by steve schnorf Tuesday, Apr 20, 10 @ 2:12 pm

==lapse spending period by four months==

They keep talking about lapse spending and creditors like they are corporate giants like Apple, Microsoft, and GE. The “Creditor” are schools, veterans homes, and homeless shelters. We have seen the education boondogle before. It is not an educations tax hike. You are going to use the new money for education and sweep all of the old money out just like you did for the lottery. It will not increase state spending on education on cent.

Pat, you were 100 feet from the guy making the decisions for 7 years. You were either part of the problem, or too dumb to know what was happening. Quinn can’t blame the legislature. He has a line item veto. He can throw the budget back at Madigan if he has the cahonies. I’ll not hold my breath.

Comment by the Patriot Tuesday, Apr 20, 10 @ 2:19 pm

So we are spending 50% more then we take in, we have maxed out our credit cards, we are six months behind in paying rent, utilities and other vendors, and we want a little more time to find someone to loan us money. Is that about what’s happening.

Oh, and I have been such a great fiscal manager and I want you to re-elect me.

Comment by CPA Tuesday, Apr 20, 10 @ 2:20 pm

Seriously,

At this point if you had the choice to do business with the state or not would you even bother?

Comment by OneMan Tuesday, Apr 20, 10 @ 2:25 pm

Oneman It would depend on what business you are in, but sure, they are a sure pay even if a slow pay. The state can’t permanently walk away from its debt like GM or the Tribune does.

Comment by steve schnorf Tuesday, Apr 20, 10 @ 2:28 pm

Mr Schnorf,

These guys are doing this cutting at the point of a political knife, not because of some belief in riscal responsibility. Given a rosier financial picture they would be full steam ahead. The failure to address things in a methodical manner that identifies the real problems in state gov’t financing and spending come from a desire to retain the office, not to truly serve the people. PQs failure to do that has turned off many people who wanted him to succeed, myself included. While I am in the GOP camp I am more interested in a stable gov’t as a citizen and employee of the state gov’t. PQs slight movement on a few budget cuts are 2few and 2late. Fumigate!

Comment by dupage dan Tuesday, Apr 20, 10 @ 2:31 pm

If I hear one more political career hack in Springfield decry our State’s problems as “inherited” I may throw myself out my window.

Inherited? These “public servants” [Brady, Quinn, Madigan, Cullerton, Cross, et. al.] have been down there for decades “leading”.

Lead, follow or get out the way…..for any of these hacks to say that these problems were inherited, including but not limited to Quinn, is a slap in the fact to all of us.

Comment by DuPage Moderate Tuesday, Apr 20, 10 @ 2:33 pm

DD, if Brady’s 10 percent across the board is applied only to stuff that the state actually controls (rather than federal money, bond repayments, etc.), then that’s right around $2.6 billion. Quinn’s cuts are now at $2.6 billion.

Comment by Rich Miller Tuesday, Apr 20, 10 @ 2:34 pm

dpd, since this is the first real concerted effort to address our spending problems since GHR vetoed more than a billion dollars in the 03 budget, I applaud it and find it gratifying. I wish many of the cuts didn’t need to be made because they will hurt vulnerable people, but they do need to be made.

Comment by steve schnorf Tuesday, Apr 20, 10 @ 2:38 pm

there’s just no making some folks happy no matter what Quinn does, right DD? He finally is doing something concrete and something he will be accountable for and still the griping goes on unabated…

Comment by Loop Lady Tuesday, Apr 20, 10 @ 2:45 pm

Recent polling shows that a large majority of Americans believe government is too big. We’ve become a society of the “haves” and “have nots”. But it’s “have a public job (and pension)” and “have not had a public job”.

Quinns efforts to trim back spending are admirable. But until Pat Quinn (Career public employee) realizes the distain that voters now hold for taxes, he’ll never have a credible shot at election to governor.

He’s been involved in government forever. That’s a resume that voters are now intent on repudiating.

Comment by Downstater Tuesday, Apr 20, 10 @ 2:54 pm

There’s not any razzle dazzle here. They’re cutting, putting people off, checking the couch cushions for change and looking to borrow for a little while. Barring major GA action, that’s about all they can do.

Comment by wordslinger Tuesday, Apr 20, 10 @ 2:56 pm

@Small Town Liberal -

Yes, I do know something that you don’t. I worked on the budget side of the tobacco deal in the Gov’s office when the settlement was signed. I had to show people the actual legal document that said specifically that the payments would last in “perpetuity” (or as long as the tobacco companies exist). It was basically a settlement providing a never-ending stream of revenue for the states to theoretically fund tobacco prevention and health initiatives (though that was not specified in the agreement). In reality the states can (and have) used tobacco settlement money for whatever they wanted.

In any event, it’s kind of like selling the lottery in return for cash up front.

Comment by RJW Tuesday, Apr 20, 10 @ 3:04 pm

“Education Surcharge”? I’m not sure what that is, but at least he’s not going to raise my taxes.

Comment by Stupid Voter Tuesday, Apr 20, 10 @ 3:05 pm

@Small Town Liberal -

By the way I agree with you. When in a crisis like this we should get as much cash now as we can. Yeah, it’s giving up a $350M revenue stream per year but that $350M a year isn’t doing us much good right now.

Comment by RJW Tuesday, Apr 20, 10 @ 3:06 pm

This table is misleading. Cuts net out at $900 million and total tax hikes are $3.5 billion.

Comment by Hey now Tuesday, Apr 20, 10 @ 3:11 pm

Those aren’t taxes. They are surcharges, loopholes and fees.

Comment by RJW Tuesday, Apr 20, 10 @ 3:12 pm

===total tax hikes are $3.5 billion===

Where are you getting that?

Comment by Rich Miller Tuesday, Apr 20, 10 @ 3:14 pm

2.8 billion income tax + .7 billion cigarette/loopholes = $3.5 billion

Comment by Hey now Tuesday, Apr 20, 10 @ 3:38 pm

Tell your friends that the Spring Session will end on May 7 sine die.

99

Comment by Agent 99 Tuesday, Apr 20, 10 @ 4:04 pm

Last one out of town, turn off the lights in the House and Senate.

Comment by Agent 99 Tuesday, Apr 20, 10 @ 4:06 pm

Rich, their $1.8B number is a net because they restore 1.7 in eduction funding

Comment by steve schnorf Tuesday, Apr 20, 10 @ 4:11 pm

My point was simply that PQ was engaging in cuts now since politically he has to in order to have a snowballs’ chance in hades of getting elected if he doesn’t. PQ doesn’t get any points for that in my book since it was mostly outside pressure that brought him to this point. The GOP was not much better at this during Ryan’s term as it was with Big Jim Thompson. PQ has been all about tax increases and expanding programs and budgets until the political reality poked him in the eye. If he’s looking for an attaboy from the electorate on that account he may have to wait awhile. So many democrats have indicated they are likely to stay home or leave the gov vote blank. Not good for PQ. It ain’t just me saying this - the pols don’t look good for him.

Comment by dupage dan Tuesday, Apr 20, 10 @ 4:19 pm

Hey now is correct in his/her calculations…

Despite the deliberately confusing placing of education expenses in the revenue area and the overuse of color in a spreadsheet, Quinn’s people did a reasonable job substantively of closing some of the budget gap.

What would a similar graph look like for Brady’s budget - start at $13B, go down $2.4B for 10% across-the-board spending cuts, and end at $10.6B?

Comment by Robert Tuesday, Apr 20, 10 @ 5:45 pm

Actually, BBs might have to go back up then from his tax cut, though he would argue that new revenue from stimulated growth would cover that.

Comment by steve schnorf Tuesday, Apr 20, 10 @ 6:19 pm

Clearly, no easy answers to solving this budget situation, if you actually know what goes into preparing a budget. Interesting strategies for trying to manage the deficit over more than one fiscal year. Unfortunately, due to ARRA requirements and MOE, the extension of this lapse period spending will impact state vendors who are already experiencing payment delays of over 100 days - social service providers caring for the developmentally disabled and the mentally ill.

Comment by Leroy Brown Tuesday, Apr 20, 10 @ 6:31 pm

If schools want money, maybe they could ask for fundraising from people who can afford to give, rather than taking more property taxes from everyone, including poor renters and underwater mortgage holders.

When was the last time your local school asked you for a donation (other than club fundraisers by kids) or bequest? Public universities and private schools routinely raise tens of thousands of dollars (if not millions) every year, so why can’t our public schools lift a finger to raise some dollars?

Think of the professional fundraiser job creation opportunities, who could get students hands-on involvement in a very practical skill. Would raising 10% of school budgets be unrealistic? How many billions of savings would that provide the state? Can you think of a better cause for donations than local schools?

Comment by Anonymous Tuesday, Apr 20, 10 @ 6:46 pm

Hey Anonymous,

If you look carefully and the amount that people are donating right now you would see that overall receipts are down in this recession. So, you want people to ramp up for a fundraising campaign to produce millions of dollars for their districts. That means they’ll be touched for the elementary, junior high and high school districts.

I am sure you were being silly, weren’t you?

Comment by DuPage Dan Tuesday, Apr 20, 10 @ 6:52 pm

==At this point if you had the choice to do business with the state or not would you even bother?==

Absolutely. Realistically, anyone who’s in the business of billing governments KNOWS that factoring is often a necessary component. (For those of you who don’t know about factoring, it’s selling your accounts receivables to a third-party at a discount. You get the payment now, less the discount, and the factorer gets the the full amount (their profit) when paid.)

Comment by Squideshi Wednesday, Apr 21, 10 @ 12:41 am