Latest Post | Last 10 Posts | Archives

Previous Post: Earth to media: Get over it, please

Next Post: *** UPDATED x2 *** Bad moves all around in congressional races

Posted in:

* It’s not often that you see two leading anti-violence advocates speak up against a new anti-violence initiative, but they’ve obviously just had enough of the budget games…

Two leading groups fighting violence against women and youth rapped Gov. Quinn Thursday for launching a $50 million anti-violence initiative when Illinois has become the biggest deadbeat state in the country by one new survey.

“We are dismayed and disheartened by the governor’s decision to spend $50 million on a new initiative at a time when the state owes millions of dollars to agencies and organizations that are providing critical services and prevention programming in countless communities across the state,” said Polly Poskin, executive director of the Illinois Coalition Against Sexual Assault.

Her organization, which distributes a mix of state and federal funding to 22 rape crisis centers across Illinois, has had its state funding cut 27 percent in the past two years and is owed more than $1.7 million because the state is five months behind in its bills. Because of the funding squeeze, six of those rape-crisis centers may not meet their payrolls by month’s end, she said.

“We are confused by the ability to find dollars in our current budget crisis when our local agencies are still waiting to be paid for fiscal year 2010,” said Vickie Smith, executive director of the Illinois Coalition Against Domestic Violence.

Governors love shiny, new programs. Too often, that comes at the expense of helping improve and fund existing services.

Here’s the governor’s state-paid video of the government press conference where he announced the initiative…

* And speaking of cash-flow problems…

Gov. Pat Quinn pledged Thursday that the state will “soon” come through with promised payments to the Chicago Transit Authority so the agency is not forced to raise fares.

The CTA agreed to cancel proposed fare hikes for this year and next after the state agreed to cover for two years the cost of a loan the Regional Transportation Authority took out to make ends meet. The state has been slow to produce those funds.

“No, they aren’t going to raise fares,” Quinn said at a groundbreaking ceremony for a Salvation Army community center in the West Pullman neighborhood. “We have an agreement that we have with the RTA, and they will get the funds necessary to make sure the fare freeze for this year and next year continues. We’re in a tough economic time, and there aren’t going to be any fare increases at the CTA.”

Quinn said the transit agencies will get the funds “as soon as we possibly can.”

I’ll believe it when I see it.

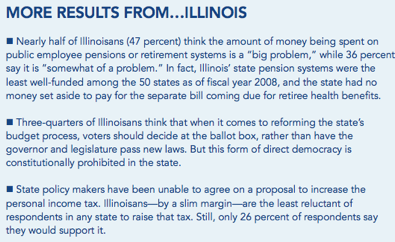

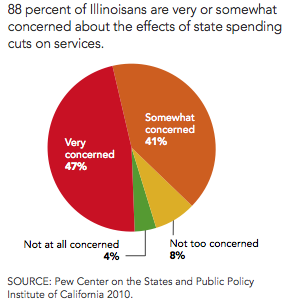

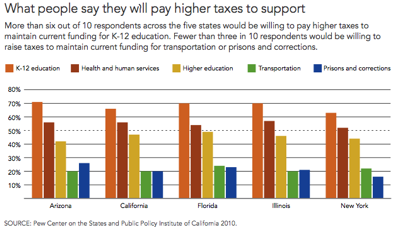

* I told subscribers the other day about a recent poll by the Pew Center on the States. It fits well here, so let’s discuss it. From Pew…

On the revenue side of the ledger, 70 percent of Illinoisans, like respondents in the other four states surveyed, say they would be willing to pay more in taxes to maintain the current level of support for elementary and secondary education, and nearly six in 10 say the same for health and human services.

But when given a choice of several options for raising new money for the state, respondents continue to shy away from broad-based tax increases. Sixty-six percent say they favor raising taxes on alcohol and cigarettes and 54 percent favor expanding gambling, while 60 percent favor raising corporate taxes. But these are not major sources of revenue for the state, so even if they were increased, they would not bridge the gap. And there are other obstacles to these options: For instance, increasing income taxes on businesses is complicated by restrictions in the state constitution.

Just 26 percent of Illinoisans say they favor an increase in the income tax, the main source of state revenue. When asked which option they would prefer if the state had to raise taxes on individuals to keep the same level of services, just 18 percent say they prefer an across-the-board income tax increase; another 18 percent select extending the sales tax to services, and 12 percent say they favor raising the sales tax on all purchases. Nearly half of respondents favor raising income taxes on the wealthy—but that would require a constitutional amendment in Illinois.

It’s always “tax the other guy.” Gaming expansion and higher corporate taxes would fit that mold.

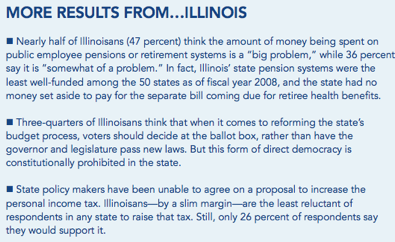

* And check out these responses. Click the pic for a larger image…

I have a feeling that if given the choice, Illinoisans might not do much better than the legislature when it comes to cutting services and raising revenues, especially when the TV ads started blaring. Your thoughts?

* And while everybody’s talking about the capital bill, the public says they’d rather more money be spent on schools…

Ironically, transportation ranks low on the list of priorities for Illinois residents, according to the survey. In fact, only one in five Illinoisans says he or she would be willing to pay higher taxes to maintain transportation funding at current levels.

And given a choice among major areas of state spending—K-12 education, higher education, Medicaid and transportation— more than half of Illinois respondents choose transportation as the area they would least protect from spending cuts. Only 5 percent say it is the area they would most want to protect.

* They don’t much care for borrowing, either, which is probably why Bill Brady has tried to tippy-toe around his $50 billion pension bond scheme…

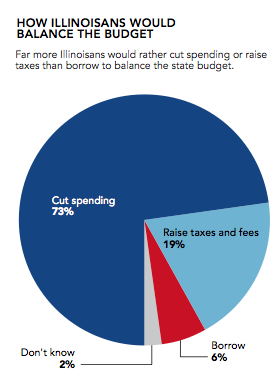

* About half are “very concerned” about spending cuts. As coverage grows, so will that number…

* These next two will give you an idea of how Illinois stacks up with the other polled states. Again, click the pics for larger images…

Discuss.

posted by Rich Miller

Friday, Oct 8, 10 @ 11:17 am

Sorry, comments are closed at this time.

Previous Post: Earth to media: Get over it, please

Next Post: *** UPDATED x2 *** Bad moves all around in congressional races

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

what are the dates for the quinn/brady kirk/alexi publicly televised tilts?

Comment by shore Friday, Oct 8, 10 @ 11:19 am

Quinn is in Aurora today announcing a grant for fixing up the riverfront. Wonder if anyone will ask where the money is for the homeless shelters nearby that are awaiting payments from the state?

Comment by OneMan Friday, Oct 8, 10 @ 11:27 am

I would guess the aversion to income taxes has to do with the number of people who don’t pay any. People who do pay them figure they’re going to get it but good. When Quinn proposed his increase, that’s exactly how it was - it looked like some would get a cut.

Comment by Excessively Rabid Friday, Oct 8, 10 @ 11:28 am

It’s about time somebody in the provider community showed some public outrage. Good for Polly. They are getting jacked, and the politicians want to start new programs.

Other providers should know as long as they keep taking it quietly, things won’t get better.

Comment by Old Milwaukee Friday, Oct 8, 10 @ 11:28 am

Rich, you hit the nail on the head. Everyone wants that which they think is important, no one wants their taxes to go up.

Comment by MOON Friday, Oct 8, 10 @ 11:30 am

Oh, look, a shiny new program. And just in time for the election. What a coincidence. I certainly don’t need anymore proof that PQ ain’t any different than the rest of the pack.

What cynicism on PQ’s part. It goes hand in hand with the folk who overwhelmingly agree that a raise in taxes is needed to solve the states’ problems. Yep, they overwhelmingly agree that someone else should pay more taxes. Sheesh.

Comment by dupage dan Friday, Oct 8, 10 @ 11:34 am

If given a choice, most people want to pay less for more services. That’s just human nature.

There’s a romantic vision that our republican democracy was instituted so the best-and-brightest would rise to the top and govern on the basis of reason, rather than passion.

In reality, sometimes the best you’re going to get with separation of powers and partisanship is to keep one faction form riding roughshod over everyone.

Comment by wordslinger Friday, Oct 8, 10 @ 11:35 am

Without commenting on the viability of the new program I will say that state paid video displays about the most forlorn group of elected officials I’ve seen.

Whatever you do, don’t let anyone being treated for depression watch it because it may put them over the edge.

Comment by Phineas J. Whoopee Friday, Oct 8, 10 @ 11:35 am

These poll results are effectively meaningless, since they are so far removed from the effect of the spending decisions (cut, increase, or status quo). I would be interested to see a similar poll directly tying revenue options to specific programs, or at least categories of programs.

While there is some minimal association with “education vs. transporation” here, it is too broad. What about special education vs. multilingual vs. music vs. arts vs. physed vs. administration vs. etc.? What about mass transit vs. highways vs. trains vs. airports vs. etc.?

And, how about the trust in government factor? Given history in Illinois of not earmarking lottery funds supposedly to support education, why should citizens believe that an “education surcharge” would not go back into the General Fund? I presume that the poll responses are based on revenues being spent appropriately– what happens when they are not?

Comment by Anonymous Friday, Oct 8, 10 @ 11:41 am

This fits exactly with what has been talked about on this site. The bottomline is no one wants their programs cut and no one wants their taxes raised. I would be willing to bet that if people who used the roads the most were surveyed the support for transportation would show an increase.

The Governor, whoever he is and the GA just has to get a set and raise the income tax to begin to meet the State’s obligations. There will be a bit of an uproar but it won’t last. As this survey shows the citizens know it is needed they just don’t want to volunteer to feel the pain. Once the tax is increased the search for cost cutting still has to continue. There are areas that need to be cut.

What has to be avoided is the creating of new programs and unnecessary expansion of programs until we can afford what we have. In my 34+ years of state employment it has always been a struggle to get enough Operation and Maintenance money. No one can cut a ribbon on increases to maintain what we have. Even in these tough times the politicians’ propensity to launch new programs to get points is alive and well as evidenced by the Gov’s $50 million announcement. I just can’t believe what thought process must be going on in PQ’s head to come out and make statements and promises for additional programs and funding when the state is six months behind on paying for basic essential services. I have no confidence in Quinn’s abilty to get us out of this mess because I have seen no indication that he understands the problem. The scary thing is that I don’t see any real ability or knowledge on the other side either.

Comment by Irish Friday, Oct 8, 10 @ 11:55 am

Word,

Sounds rather cynical - I have to agree, however. Thanks for the pick me up.

Comment by dupage dan Friday, Oct 8, 10 @ 11:56 am

Wait a minute the CTA was talking about raising fares this year? Did Quinn make CTA agree to free fare hikes for two years?

Comment by Levois Friday, Oct 8, 10 @ 11:56 am

Illinois should change its nickname from the Prairie State to the Something for Nothing State- that’s what everyone wants….

Comment by DuPage Dave Friday, Oct 8, 10 @ 11:59 am

At 1:00pm today Pat Quinn will be in Elgin as part of his “Free Candy for Everyone Tour” to announce state funding of an $11 million riverfront promenade project. This project is being touted by the incumbent State Senator and State Rep with strong encouragement of the Mayor of Elgin. One must wonder, with the state in such dire financial condition, with many critical infrastructure projects going unfunded, that this type of vanity project even gets put on a list of capital projects much less gets priority.

Comment by WRMNpolitics Friday, Oct 8, 10 @ 12:03 pm

We have a State EITC (Earned Income Tax Credit). It’s constitutional. Double, triple, quadrupal that sucker at the same time you raise income tax rates and you have a de facto progressive income tax.

Comment by Sacks Romana Friday, Oct 8, 10 @ 12:25 pm

Polly Poskin and Barb Shaw know each other very well. They have been at their work for decades. I can only imagine how the private conversations went.

When government funds groups, it is a difficult business because the group always thinks it has to exist ad infinitum. New strategies come along, and new groups appear. That always means the old groups are not happy. The one part that I sympathize with is that their bills have not been paid. they should be paid. but that does not mean that their work should continue to be funded at the same level.

violence work has changed dramatically since the 1980s. there are many new strategies that need funding. in Chicago a group was brought in from either Philly or Baltimore for the CPS and this disturbed Gary Slutkin and his folks.

that’s the nature of operating in a not for profit. if you get government funding, you cannot always believe that the funding will continue. change with the times, or the times will change you.

Comment by Amalia Friday, Oct 8, 10 @ 12:29 pm

it appears the irony of the results is lost on nobody. of course, you don’t see anyone really making the case that government is not only an essential part of our economy — the latest job report showed a decrease in jobs because state and local governments are scaling back dramatically — it is absolutely critical in a free market economy like ours. it’s not just people who want something for nothing, corporations do, as well (like good roads, a predictable financial system, and a degree of public safety). someone does have to pay for this, and i’m still shocked that i pay less state and local taxes here in illinois than i did in florida. there’s something very wrong with that picture…

Comment by bored now Friday, Oct 8, 10 @ 12:30 pm

I’m so sick of Quinn making a campaign statement with every move he makes as Governor.

Comment by NW Side GOP Friday, Oct 8, 10 @ 12:33 pm

Sacks Romana, there’s only so much of that you can do before it’s ruled unconstitutional.

Comment by Rich Miller Friday, Oct 8, 10 @ 12:41 pm

There are many human services owed over $1M. If an organization has saved some financial reserves (like most companies should) they are simply not being paid (and eating into those reserves to pay bills) to provide expedited payments to groups who have run out of cash and there are thousands of them. Since October 1, tens of thousands of people who are not eligible for Medicaid have been cut from mental health services due to the funding cuts. Some portion of these people will do ‘OK’, others will struggle without the support system that has helped them remain independent at minimal cost. As those groups getting expedited payments start to close, where are the people they serve go to and what happens to all the currently employed staff go on unemployment? That $50M is a nice PR move, but what happens when the ERs start to seriously fill and mayors start screaming to do somethng with ‘those people’ hanging around. It’s the same basic story, as long as it does not directly hit me yet, it’s really not a serious problem. This problem will get far worse.

Comment by zatoichi Friday, Oct 8, 10 @ 12:43 pm

Projects like these virtually ensure that a large number of citizens become skeptical about the severity of the state’s budget crisis. And indeed, Quinn hasn’t been talking about his plans for the budget crisis much lately himself, other than to say the budget is Blago’s fault, as he goes about the state handing out taxpayer largesse to riverfront projects and the like and pretends it’s coming from him. Well, it is, but he’s not paying. Didn’t our Blago used to do this stuff, to great condemnation. Is Lawrence Msall just another whiner? Maybe Quinn knows something we don’t know? Why do I have to pay more taxes if Quinn can sign two-year no-layoff clauses with state employee unions and give huge raises to his executive staff, in addition to spreading tens of millions around the state for various feelgood projects of dubious urgency.

I suppose it is possible that Quinn is now hoping for an infusion of cash from the feds. He could be right. With 2012 coming up and the economy still stagnant, the WH is going to be desperate to bring down the unemployment rate by November 2012. One way to reduce or at least not increase unemployment is to increase grants to the states thereby, among other things, reducing government layoffs. Government layoffs are starting to have a real impact on the national economic figures, as was the case today. The feds may not be able to force or cajole private businesses to hire but they can always borrow money and make the jobs themselves. Looks like that may be where we are heading. In that case, why punish the middle class with an income tax increase, since we’ll be paying the federal debt in the future.

Comment by cassandra Friday, Oct 8, 10 @ 12:45 pm

===change with the times, or the times will change you. ===

They’re mostly concerned with late payments. And budget cuts have come without reason.

Comment by Rich Miller Friday, Oct 8, 10 @ 12:53 pm

88% are somewhat or very concerned about the impact of spending cuts, yet only 19% want tax increases. I guess that proves the old adage: everybody wants to go to heaven, but nobody wants to die.

The electorate is split. The General Assembly is split. The candidates for governor are split. The commenters on this blog are split. I think Illinois could use some leadership on how best to navigate through the very troubled fiscal waters ahead, but I just don’t see much leadership from anyone coming anytime soon.

Regardless of who wins the Governor’s race, I suspect the impasse will last for the foreseeable future. That’s kind of depressing, isn’t it?

Comment by 47th Ward Friday, Oct 8, 10 @ 1:01 pm

Rich, I did post that the late payments are wrong. Budget cuts often come without reason. It’s not nice, but it’s how it happens sometimes. Smart not for profits, just like businesses, change their name to evoke a new mission, expand their reach. gotta evolve.

Comment by Amalia Friday, Oct 8, 10 @ 1:22 pm

This delusional attitude in the public is the direct result of the Reagan/Roesser etc. myth that gov’t and taxes to pay for it are the problem and are bad. Rather than the responsible social compact that we all share an obligation to pay for the services, the public has been brainwashed by this “greed is good” mentality of selfishness. We will continue to be damned by these dysfunctional governments so long as the electorate buys into these phony philosophies.

Comment by D.P. Gumby Friday, Oct 8, 10 @ 1:26 pm

Mr Gumby,

You have it exactly 180* wrong, IMO. It was/is the philosophy of conservatives that the gov’t is not the place for these services to exist in the first place, since the gov’t is not good at administering said services. While the obligation to assist those in need surely exists, the gov’t serves mostly to perpetuate itself first and the services come second. That is were the problem lies.

Comment by dupage dan Friday, Oct 8, 10 @ 1:35 pm

So 70% of the people approve of additional taxes to support education. I just wonder how many of those 70% pay any material amount of taxes to begin with

Comment by Sueann Friday, Oct 8, 10 @ 1:42 pm

Sueann- Any group comprising 70 percent of Illinois citizens contains a majority of taxpayers. Basic math says so.

Maybe you should go peddle your stuff someplace else.

Comment by DuPage Dave Friday, Oct 8, 10 @ 1:52 pm

This Gov is just throwing out programs as election kibbles to shaky parts of the old Blago permanent campaign bunch. The giveaways are not made “new” or “innovative” just by using buzz words like “peer” and “mentor” and paying participants essentially to be served in the “program.” PAY OUR BILLS FIRST!

Comment by Alas.... Friday, Oct 8, 10 @ 3:13 pm

PS God bless Barbara Shaw and send her some under eye concealer. Hope she is in great health.

Comment by Alas.... Friday, Oct 8, 10 @ 3:19 pm

Well I am sure this program will succeed, because in Quinn’s words “We mean business.”

Ready for the Brady response “If Governor Quinn really meant business on violence prevention he would not have approved an early release program that released thousands of violent criminals back onto the streets to continue committing violent acts on honest law abiding citizens.”

3, 2, 1….

Comment by Jaded Friday, Oct 8, 10 @ 3:32 pm

–You have it exactly 180* wrong, IMO. It was/is the philosophy of conservatives that the gov’t is not the place for these services to exist in the first place, since the gov’t is not good at administering said services.–

DD, what services are you talking about exactly, on the State of Illinois level? It seems to me there are a lot of smart folks at the agency level administering them. If you disagree with the program itself, that’s another story.

As far as taxes go, I think grownups should be able to sit around a kitchen table, bite the bullet, and figure out a way to pay the folks they’ve contracted with in a 30-day cycle. That’s running the state like an ethical business (by the way, there are plenty of businesses out there who are even worse than the SOI on paying).

If you don’t want the service after that, fine. But pay your debts in a reasonable time frame.

Comment by wordslinger Friday, Oct 8, 10 @ 4:07 pm

– Sacks Romana, there’s only so much of that you can do before it’s ruled unconstitutional. —

Actually, three other flat-income-tax states have Earned Income Tax Credits that are two to *four* times the size of Illinois’ microscopic EITC: Indiana, Massachusetts and Michigan.

We have plenty of room to grow our IL EITC reasonably.

Comment by Linus Friday, Oct 8, 10 @ 4:19 pm

wordslinger,

“But pay your debts in a reasonable time frame.”

Amen, brother (or sister). Much easier to do if you stop spending on new programs. Bullet trains? Boardwalks? No cut contracts? Airport expansions? These are only some of the future debt we’ve seen from Quinn in the past couple of weeks.

STOP SPENDING MONEY YOU DON’T HAVE!

Comment by Cincinnatus Friday, Oct 8, 10 @ 4:20 pm

It seems that in Quinn’s mind, the obligations to the nonprofits have already been discharged since they will be paid off by December 31 (he says). Ditto the CTA. Complaining about delays is just quibbling. Then there are other monies that the legislature said he had discretion for–he’s spending those like they said he could. It may be a fairytale but it makes for stress-free days and nights for the incumbent/candidate. And I must say again, he really doesn’t seem to worried about the budget.

Comment by cassandra Friday, Oct 8, 10 @ 4:25 pm

Cincy, that’s all Mickey Mouse stuff. The heavy lifting of the GRF is in education, health, social services, corrections and public safety.

More cuts (there already have been some) are going to be made there, along with some new revenues. It will be ugly all the way around.

But at least don’t be a deadbeat.

That’s like saying you can solve the federal deficit by cutting pork barrel.

Comment by wordslinger Friday, Oct 8, 10 @ 4:26 pm

The report states 55% percent of Illinois residents think their state and local tax systems need “major” changes… Saying “only” 26% support an income tax increase when giving other choices are presented in the question that are not viable solutions needs to be taken into account. Illinois leads all trouble states in answering this nuanced question.

What people really want doesn’t matter to Madigan and the Republicans. But when the finger finally gets pointed at MJM, it will finally be a new day for Illinois.

Comment by FDR Sunday, Oct 10, 10 @ 12:28 am