Latest Post | Last 10 Posts | Archives

Previous Post: “Labor peace agreement” stalls gaming bill as McPier refuses temporary site - Plus: A Statehouse roundup

Next Post: Republicans “leaning against” filing their own remap proposal as Dem map tweaked for Latinos and congressional map release date still uncertain

Posted in:

* House Republican Leader Tom Cross unveiled his pension reform proposal yesterday…

The plan, endorsed by the top Democrat and the top Republican in the Illinois House, would require many state employees to pay about 13.8 percent of their salaries into the pension system to keep their current benefits. Or they could keep more of their money but receive lower benefits at retirement. A third option would be a new 401(k)-style investment plan.

Officials said the savings will depend on which options employees choose. But the amount will be billions of dollars over the years to come, with employees contributing hundreds of millions of dollars more, said Sara Wojcicki, spokeswoman for House Minority Leader Tom Cross, an Oswego Republican.

The American Federation of State, County and Municipal Employees complained that the plan would “slash” the pensions of employees or cut deep into their paychecks.

The union said the average pension is just $32,000 a year, which could be their sole retirement income because many public employees do not get Social Security. AFSCME argues that government employees always contribute their share to retirement systems, while state officials have often failed to meet their obligations.

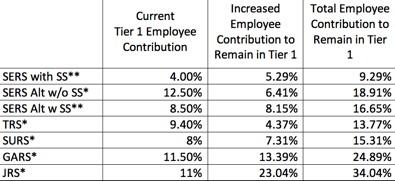

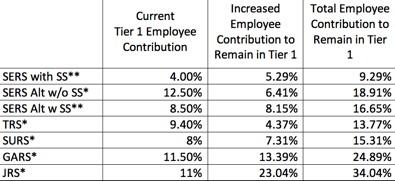

* Click here for Leader Cross’ fact sheet. Click here to read the proposal itself. These are the current employee contribution levels, proposed Tier 1 increases and final proposed contribution rates. Click the pic for a larger image and alternative system contribution rates…

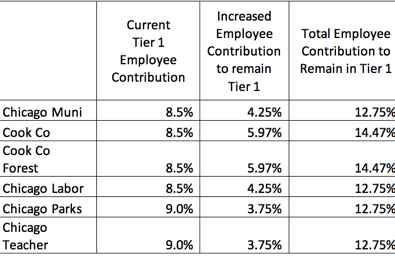

* Proposed Chicago and Cook County rates…

* The media has completely ignored this aspect of the plan, and it’s buried way down in the SJ-R story today…

The Tier 1 contribution rates are subject to revision after the first three years and every three years thereafter. If the contributions become too burdensome, an employee can move down to Tier 2 or Tier 3 but never back up.

In other words, those numbers you see above aren’t final by any means. The contributions will automatically be recalculated every three years, and those contributions could very well be recalculated upwards as people leave the system. That scenario is a huge political nightmare for many, many legislators.

* Subscribers know more about this little twist…

Cross plans to put the state’s judges, who initially were excluded from the latest pension bill, back in this morning via an amendment. Under new contribution levels for public employees who started work before Jan. 1, judges would have to pay 34 percent of their salaries, instead of the current 11 percent, to keep their current benefits.

“Some of our members felt strongly that all of the state systems should be included in the bill,” said Cross spokeswoman Sara Wojcicki when asked why the judges are to be included.

* Also from the SJ-R story…

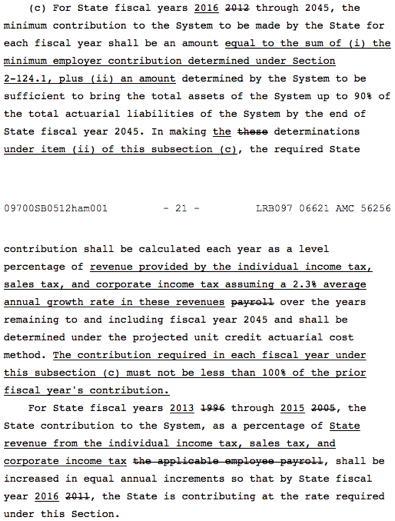

The bill also appears to revise a 1995 law that was designed to bring the pension systems to 90 percent funded by 2045.

From Leader Cross’ analysis…

Each year the state will contribute an amount equal to 6% of the total pensionable salary for

employees. Further, the state will contribute a level percentage of the “big 3 revenues” (sales tax, personal income tax, and corporate income tax) to reach a level of 90% funded by 2045. For FY13-15, there will be a “step up” period to ensure a level percentage of revenue from FY16 until FY45. State revenue is assumed to grow at 2.3% per year, and in no case shall the state contribute less than 100% of the prior year’s contribution.

The language appears to smooth out the ramp-up…

* Tribune…

If the changes are made, Schmitz predicted, the game plan for getting the state’s pension systems funded at a 90 percent level would be achieved by 2045. Further, he said, the state’s pension payment in 2045 would drop from a projected $20 billion to $12 billion if the steps are taken.

posted by Rich Miller

Thursday, May 26, 11 @ 3:25 am

Sorry, comments are closed at this time.

Previous Post: “Labor peace agreement” stalls gaming bill as McPier refuses temporary site - Plus: A Statehouse roundup

Next Post: Republicans “leaning against” filing their own remap proposal as Dem map tweaked for Latinos and congressional map release date still uncertain

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

if this is supposed to include “all of the state systems,” does that mean elected officials and board members, too?

Comment by bored now Thursday, May 26, 11 @ 3:52 am

If I am reading this correctly a union state employee will have to pay an additional 5.29% to stay in the current system starting July 1, 2012. Since they will be getting a raise of 3.75% by that date then they will be paying 1.54% more than they are paying today.

If they fight this reasonable proposal then they are idiots.

Comment by Cassiopeia Thursday, May 26, 11 @ 4:54 am

Unfortunately for those of us who are not union state employees with that nice raise, you are talking 5-6% more and everyone knows they will come back for more.

Interestingly I won’t even get the option for the 401-K because its barred to county workers with 5+ years in.

Comment by crcostel Thursday, May 26, 11 @ 5:45 am

The judges would be hard pressed to file suit which would limit the focus of the constitutional question to themselves, without AFSCME and other unions seeking to become a party to the suit and expand the scope of the litigation.

While some are good, the majority of the political hacks that sit on the bench in Cook County either got themselves appointed, or used the Tomczak style campaign apparatus made available to them to get elected, largely due to the bloated compensation and the rediculous pension formula designed to support their life of luxury upon retirement.

These self entitled; peter principled, Napolean complex challenged officers of the court will never stand for actually having to contribute for themselves at this level when it would be so much easier to pass the responsibility on to all of the rest of us.

Comment by Quinn T. Sential Thursday, May 26, 11 @ 6:09 am

@Quinn T. Sential=These self entitled; peter principled, Napolean complex challenged =LOL Sounds like my former employers.

This is a great analysis of the bill by Capitol Fax. I find it interesting that it is co- sponsored by Cross and Madigan.

Comment by waitress practing politics... Thursday, May 26, 11 @ 6:20 am

Originally, they were going to leave the judges out of the plan altogether on the grounds that they didn’t want to tick off the judges who would be ruling on the constitutionality of the plan. Now they are asking the judges to pay way MORE than any other group — more than 1/3 of their salary if they want to stay in Tier 1. Why such a drastic shift?

Comment by Secret Square Thursday, May 26, 11 @ 6:22 am

This “ticking off the judges” thing is complete baloney. Think about it: if judges allow this reduction for others, they know they will be next. The real distinction- not reported in the papers- is that judges have additional constitutional protections that others don’t.

Comment by Nice kid Thursday, May 26, 11 @ 7:00 am

Each year the state will contribute an amount equal to 6% of the total pensionable salary for

employees.

The current FICA rate is 7.65% for Social Security and Medicare. In the private sector that the anti-government types like to refer to, that is the bare minimum an employer can legally get away with providing.

Comment by Excessively Rabid Thursday, May 26, 11 @ 7:29 am

I’m fascinated by the proposal to smooth out the ramp up in the annual contribution payment. Doing so has always made sense for practical, operational purposes but it’s been a non-starter for so long. The 1995 law that has governed the payment schedule had a lot of good features, but the actual payment schedule was not one of them. The schedule called for modest increases in the 90’s (when coincidentally the state was flush with cash) and much steeper increases this past decade, with very steep increases in the 2007-2011 period. During the Blagjoevich/Filan years every pension proposal they put forth called for a smoothing of the ramp but it never went anywhere because the Speaker and the Republicans a) didn’t trust him to spend freed up money wisely and b) figured the best way to keep him in check was to handcuff him with difficult and rapidly increasing annual contribution obligations.

But now that Blagojevich is gone, Leader Cross is writing the bill and the Speaker is co-sponsoring everyone has found religion. It’s an interesting backstory, but I’m glad that they are finally smoothing out the ramp. It’s the right thing to do and it makes the long term financial management more orderly, predictable and practical.

Comment by The Captain Thursday, May 26, 11 @ 7:59 am

So the bill calls for a ramp up to FY 2016 where it will then be a flat percentages of the big 3 taxes. Why do we need a ramp? Is the pension payment going to get larger? I would assume if it drops by 10%, we could adjust pretty quickly and wouldn’t need a ramp down…

Comment by Anon Thursday, May 26, 11 @ 8:11 am

If this passes, it needs to apply to legislators and judges as well. There has been too much making of rules that the ones making them do not abide by. If you REALLY think this is how to solve the fiscal crisis- by burdening people who have played by the rules, then apply it to yourself as well.

Comment by Richard Afflis Thursday, May 26, 11 @ 8:12 am

Rich, what’s your record for comments on one thread? I have a hunch you might break it today.

Comment by wordslinger Thursday, May 26, 11 @ 8:12 am

the actual contribution rates seem reasonable, but not with the option to increase them every 3 years!

My only complaint is that the purpose of part of the contribtuion formula i to make up for the States failure in the past. The contribtuion rate should be set based on what is needed to support each current employees burden on the system from today forward. The State should then fund the portion they have not funded.

In short, I dont have a problem with the percentages themselves, i.e. the State pays 6% and I pay the rest. I only have a complaint with the extent my contribution rate is based on paying in and ramping up the shortfalls from the past v the burden my pension represents from this day forward. I also think the revise it every 3 years is wrong. this seems like a political tool to once again allow the state to shift the burden for its prior debt to the employees.

The State owes the debt from the past, and going

Comment by Ghost Thursday, May 26, 11 @ 8:29 am

If this is designed to fully fund the system from this point forward it may well pass judicial review. If it is designed to pay off the debt from the past it will not. The fact that the IMRF is not included, because it is well funded, and SERS, having a similar structure to IMRF has a 5.29% increase causes me to question if the second scenario might be true. Do not have the mathematical skills to ever figure that out on my own.

Comment by Bigtwich Thursday, May 26, 11 @ 8:30 am

“I’m Tom Cross and I cut teachers’ pay by more than 46%.” I guess he doesn’t care about electing Republicans anymore.

Comment by So. Ill Thursday, May 26, 11 @ 8:37 am

=I guess he doesn’t care about electing Republicans anymore.=

Hmmm…define “Republicans” today. It seems to be getting more and more difficult to tell the difference anymore–unless, of course, it’s “safe” enough to label yourself as one to drive a point home, or win an election.

Comment by Anonymous Thursday, May 26, 11 @ 8:44 am

The employee may move down but never up, so increase the contributions every 3 years till no one can afford them. Problem Solved! I Can’t believe this!

Every three years, starting in FY16, the actuaries of all systems and funds impacted shall review the contribution rates for employees for accuracy and set the employee contribution rate for the next three years. Once the system reviews the contributions and sets the new rates, the

employees will have the opportunity to elect to move to a different level of benefits.

The employee may move to a different, lower tier of benefits, but they may not move up.

Comment by Griz Thursday, May 26, 11 @ 8:47 am

When you have a contractual relationship, and one party amends the terms of that agreement without any consideration given to the other party to the agreement, it is unenforcable, and will be ruled so. That’s if it passes the constitutional test, specifically stating that it’s a contractual relationship requiring that consideration be given in exchange for any modification to the original terms of that contract.

The law, if it passes, will be challenged, and employees will win. Pay your bills, like the rest of us do.

Comment by PublicServant Thursday, May 26, 11 @ 8:48 am

The state employees in our area lost HMO availability. Our medical costs are going to be brutal. My husband and I worked for hours last night on our budget. If the pension commitments go up to 15.3%, we simply won’t be able to pay our bills. Our paycheck continues to shrink. If we opt for a lower tier, we won’t be able to eat after retirement. We would move but the housing market is so bad, we couldn’t sell our house.

Comment by Kara Thursday, May 26, 11 @ 8:52 am

As far as recalculating the contributions every three years, one of the important factors when calculating the normal cost, is the average age of the employees in the system. The higher it is, the higher the cost. A 22 year old is much more likely to only work for the state for 2 or 3 years, get a refund of his contributions and never cost the state anything (pension wise). The contributions the state made on his behalf will be used for someone else who does stay on, in other words, it all averages out. But the average age in Tier 1 will only get higher since no new employees are allowed in. So unless other factors outwiegh the age (i.e. life expectancy) I would expect the cost to increase every three years. Maybe not dramatically each time, but over 20 years, I’m sure it’ll add up.

Comment by Anon Thursday, May 26, 11 @ 8:58 am

It is against the constitution, the courts will strike it down and then the general assembly has to do their job and actually fund the pensions. But now they will blame the courts when then raise taxes to fund the pensions.

They wouldn’t have to raise any taxes if they funded them all a long. Talk about a penny wise and a pound foolish.

Can we sue all the members of the general assembly who were there over the last 30 years for theft and make them pay the unfunded liability?

Comment by Union Thursday, May 26, 11 @ 9:04 am

Wait, so the GOP has been shrieking all this time about how the Dems put the new maps out late, but meanwhile Tom Cross puts out this pension bill with less than a week to go in session?

God help us.

Comment by just sayin' Thursday, May 26, 11 @ 9:10 am

The media and politicians would have you believe that there is an 80 million price tag coming due tomorrow. That is the amount that needs to be paid out over time if everyone lives to their expected life. The current pension is ok, meaning the money coming in from current employees is equal to the money going out to current pensioners. The problem will exist if everyone went to a Tier 3 system, then no money would be coming in to the pension system and the state would be left on the hook for the millions needed to be paid out when the money in the system dried up.

Comment by Anon Thursday, May 26, 11 @ 9:14 am

I would not oppose and increase in my percentage rate if that 1st list in sers was paying the same as me. I am opposed to paying more when I have not had a raise and looking at increased health care costs for the coming year. Assuming their is coverage in town state IL besided QC.

I also would not oppose this if the state had been paying their share all along.

They get to opt out and pay less- why can’t I when my cost go up and my funding goes down.

I don’t know who is getting BIG raises this year, but it is not University employees. 0% last year and 1% this year. Please note we have never been allowed to pay into SS either.

The ones who need pension cuts and increase work alot higher up than me.

All that is being done is eliminated the middle class who work hard to pay bills and keep up. We will be the poor who will need state and federal assistant get food on the table and pay our medical bills.

Guess the taxper pays either way.

Comment by Stuck and frustrated Thursday, May 26, 11 @ 9:21 am

Casiopia–At this point the raises are not in the budget.

I am waiting for the bill to somehow raise the legislative stipend/per diem or some other way by 14%. It will be an amendment to a bill in the last minute of session. Watch for it.

Comment by He Makes Ryan Look Like a Saint Thursday, May 26, 11 @ 9:23 am

Are University employees included here and I am just missing it? How about legislative staff?

Comment by Anonymous Thursday, May 26, 11 @ 9:24 am

Didn’t SERS get jacked from 4% to 8% back in 2002? That would leave them with a 1.29% increase.

Comment by SAP Thursday, May 26, 11 @ 9:25 am

The only way the Republican party in Illinois can achieve long-term domination over the Democrats is if the Democratic party is cut off from its traditional sources of financial support and voter mobilization, which in large measure comes from unions and other groups that may never forgive the Democratic party for legislating these pension changes. Driving this wedge between the Democratic party and its base is perhaps why there has been such a full-court press to pass this particular set of changes. I find it fascinating that the Democratic legislators would allow themselves to be led into a vote with potentially huge long-term destructive consequences for their party.

There are other alternatives for addressing the pension under-funding, such as pushing to the school districts (agencies, universities, etc) the actuarial costs of raises above CPI and of pensions above the $108K Social Security taxable earnings cap–alternatives that would not have constitutional issues.

Comment by east central Thursday, May 26, 11 @ 9:34 am

“It is against the constitution”

“Membership in any pension or retirement system of the State, any unit of local government or school district, or any agency or instrumentality thereof, shall be an enforceable contractual relationship, the benefits of which shall not be diminished or impaired.”

Depends how one defines “benefits”. I don’t see any reasonable basis for believing that “increasing the costs of participation” is the same as “diminishing or impairing benefits”. The Constitution doesn’t say anything about holding costs level, and there is a difference.

Comment by Chris Thursday, May 26, 11 @ 9:37 am

It also says the Pension is an enforceable contractual relationship. That being the case, the terms of that contract cannot be unilaterally changed by one of the parties to that contract (the state) without consideration being given to the other party (the employee). Point out that consideration Chris.

Comment by PublicServant Thursday, May 26, 11 @ 9:43 am

Looks like the big increase for the judges and GA would be a poison pill for this legislation.

Comment by foster brooks Thursday, May 26, 11 @ 9:52 am

on the comment that: “At this point the raises are not in the budget”

It does not matter if the amounts for the union raises are in the budget. The raises will go into effect whether there are sufficient funds to cover those raises within the agency personal services line items or not. Agencies will have to either not hire new employees, use other funds to cover salaries or institute budgetary layoffs to makeup the differences.

Comment by Cassiopeia Thursday, May 26, 11 @ 10:02 am

Anonymous, university employees are in SURS and legislative staff are either in GARS or SERS. This is serious and complicated stuff. I suspect though that the general assembly will get something ramrodded through again at the deadline and !#@^ it up again.

Comment by Soccertease Thursday, May 26, 11 @ 10:04 am

If an employee opts-out of the Tier 1 pension plan in favor of a 401(k) style plan, will he or she receive a refund of his or her contributions to date? What kind of an impact will that have on the respective retirement funds?

Comment by Old Shepherd Thursday, May 26, 11 @ 10:04 am

Does this Double”CrossQuinn” proposal include IDOT to backpay all of the money that that IDOT owes to the pension plans that they NEVER PAID? Because if it doesn’t, it will all be for nothing, because IDOT will continue NOT to pay the money into SERS. Will Teamsters 916, and AFSCME please start pressing the buttons.

Comment by Arthur C. Nicholas Thursday, May 26, 11 @ 10:06 am

The good news is that if the Democratic Party controlled State of Illinois goes along with passing this legislation into law, then the State of Illinois will NOT BE DEMOCRATIC PARTY controlled after the next two elections.

Comment by Arthur C. Nicholas Thursday, May 26, 11 @ 10:09 am

This will help solve the shortage of office space on the U of I Campus. Tax increase, health care provider switch, pension increase and paltry raises for the past three years equals talented professors leaving.

Comment by Chefjeff Thursday, May 26, 11 @ 10:10 am

If the state isn’t obligated to fulfill its pension payments every year, they can ask state employees to pay whatever rates they want. It still won’t save the system.

Comment by Solomon Thursday, May 26, 11 @ 10:10 am

With the amount of Boomers set to retire in the next 2 - 5 years and all those who opt for a 401k system won’t there be a huge decrease in funding for the pensions. This may be a long term solution after all the Boomers die off, but I only see more problems for the imeediate future. I assume everyone who opts for the 401k gets the amount of their investment back as well

Comment by Generation X Thursday, May 26, 11 @ 10:14 am

-SAP- ‘Didn’t SERS get jacked from 4% to 8% back in 2002? That would leave them with a 1.29% increase.’

The state used to “pick up” the 4% employee contribution so when they quit doing so as part of budget negotiations (2002?) if effect it was a 4% pay cut for employees.

Comment by Soccertease Thursday, May 26, 11 @ 10:14 am

This isn’t politics, it’s theft plain and simple, the abrogation of a contractual and constitutional right.

Comment by Quiet Sage Thursday, May 26, 11 @ 10:31 am

This is the reverse of an early retirement plan, but the result will be the same–a massive exodus of state and university employees who are eligible for any kind of retirement cuz it’s only going to get worse if you stay. If you go now, you may be able to lock in benefits.

Comment by D.P. Gumby Thursday, May 26, 11 @ 10:37 am

Old Shepard– The Tier 3 (401k) option would take out ONLY what you have put in. It is a horrible option for someone who has any significiant time in the system. They do not give you what your retirement is technically worth at that point in time.

Comment by He Makes Ryan Look Like a Saint Thursday, May 26, 11 @ 10:40 am

increase Judges from 11 to 34 % would result in nearly 70 Judges retiring immediately and it could bankrupt the JRS. up until this morning, our elected officals made it clear that Judges would b e exclude for a variety of reason. Sounds like they were laying in the weeds until today………

Comment by court watcher Thursday, May 26, 11 @ 10:40 am

Court– IF it passes without the judges in it, and it comes before the court and is declared constitutional, then they would have been picked up next year anyway. So they might as well get it out of the way now.

Comment by He Makes Ryan Look Like a Saint Thursday, May 26, 11 @ 10:46 am

Constitutional and contractual issues aside, doesn’t this seem unbalanced? If the state and members of the various pension systems are to share in the pain, then why aren’t their contributions equal? Every year the state, which failed to contribute sufficiently to the pension, contributes a fixed 6%. Meanwhile, employees who didn’t create the problem roughly double their contribution. Worse, that doubling isn’t fixed and subject to increases every few years to cover the state’s failure to contribute their part. As Tier 1 becomes less affordable, and more people further from retirement shift to other tiers, it seems that contributions will increase further. Is there something I don’t understand, or is the legislation tremendously unfair and unbalanced?

Comment by AC Thursday, May 26, 11 @ 10:46 am

Your asking Judges to pay 34% of their salary to maintain their pension as is on top of the federal and state taxes and medicare. More than half of their salary would pay for taxes, pension and insurance. Get real.

Comment by Tommydanger Thursday, May 26, 11 @ 10:50 am

why such a high number for Judges? any ideas? Judges currently pay the highest %.

Comment by court watcher Thursday, May 26, 11 @ 10:56 am

What do you get when the state fails to make pension contributions for over a decade, allows a governor to dissolve pension boards, and replace honest well functioning pension boards with people who make the most campaign contributions? You get this mess we have now. The state of Illinois has been on pension holiday for the last 10 years, and Chicago has greatly benefited from the redirecting of pension funds into the city’s coffers. It’s time for congress to come off holiday and pay their bills. Do not ask employees to pick up the tab for this mess.

Comment by Illinois Veteran Thursday, May 26, 11 @ 11:08 am

Which court would rule on the constitutionality of this? Wouldn’t the judges have a conflict of interest?

Comment by not a lawyer Thursday, May 26, 11 @ 11:11 am

I wonder if Cross factors in the State’s cost of contributing to Social Security for the 80% of state employees who aren’t now covered, but who would be if they lose their traditional defined benefit pension? That also means even more coming out of employee paychecks.

Comment by reformer Thursday, May 26, 11 @ 11:13 am

court watcher

Legislators currently pay in 11.5% to GARS, compared to the judges’ 11% into JRS.

I presume the much higher judicial salaries, which translates into much higher pensions, accounts for the higher percentage.

Comment by reformer Thursday, May 26, 11 @ 11:16 am

This is a great plan. I pay more, the fund gets bigger and in a couple of years the general assembly “borrows” from the fund. How about you give me all the money currently in my pension fund and I opt out of all the plans and manage my own pension.

Comment by Bulbous 1 Thursday, May 26, 11 @ 11:19 am

The fact sheet summarized things nicely for the most part. If you take the time to actually digest it, it shows that SERS employees have the worst formula of the State systems and, therefor, receive the least for their existing contributions; this is true for both the previous and current rules.

As to the proposed changes, it appears that employees are being asked to pay not only for their share of the benefits but to also make up the contributions that the State never made. It also says the employee who chooses Tier 1 only has a 3 year guarantee on their payment amount; after that it can be drastically ramped up. There doesn’t appear to be any enforceable guarantee (federal contract language) that the State will make its pension payments in the future. Not a good deal for current employees unless they only have 3 years to retirement.

The bill has lots of language to ensure the State doesn’t lose the federal “safe harbor” exemption. That lets the State contribute the absolute minimum they can get away with under federal pension law.

I would say this is a gamble by the legislature to see if they can get away with it and barely pass constitutional muster and federal law. I give it 50/50 at best. If it passes legal review, they win. If not, then the legislature can blame the judges for the tax increases that will be passed to deal with it.

Comment by Retired Non-Union Guy Thursday, May 26, 11 @ 11:26 am

==Which court would rule on the constitutionality of this? Wouldn’t the judges have a conflict of interest?==

The same court that determined it was unconstitutional for the General Assembly to take away their COLA a couple of years back.

Comment by Pat Robertson Thursday, May 26, 11 @ 11:40 am

amendment passed. voted 6y, 2n, 1p. amendment 1 does not include Judges, Cross said he would “add it when it get to the floor.”

Comment by court watcher Thursday, May 26, 11 @ 12:12 pm

Rich do we know how much goes out in pension payments each year. And given that some boards cushion the amounts why can’t pensions be taxed and this money earmarked back into the system? This would reduce the state and employees contributions to keep the system going.

Comment by DoubleD Thursday, May 26, 11 @ 12:16 pm

So… this latest system (and the calculations) depend on the state making it’s annual 6% payment that it has always been “required” to be made in addition to the employee payments.

The system is screwed now because the state has consistently failed to make its payments.

So, what we will have in 3 years is another big increase to the employees because the state won’t make its payments.

The solution would seem to be to put all of the payment onto the employees (and increase them all 6% now to cover the 6% the state has been “required” to make all these years but consistently failed to do).

Comment by titan Thursday, May 26, 11 @ 12:27 pm

How is the “average” pension number thrown out by the unions calcluated? Are they incluing similar employement periods. What is the “average” pension for all school teachers who retired in 2010 after 25 years of employement? compare apples to apples. There is no one at the bargaining table on government employee pensions who is not in an irreconcilable conflict of interest. Taxpayer guaranteed payments with COLAs for government employees must be eliminated in total. It is the epitome of government immorality to continue these federal, state and local goverment plans for a privileged elite while private sector workers are falling further and further behind. And I don’t believe a single number issuing from either the gov employee unions or government. Why aren’t the books open on the internet for review by all? Why can’t the individual citizen for instance check the pension of a particular Chicago Street and Sanitation worker or a particular suburban school teacher, view the salary history and run our own numbers? Why are government workers on average entitled to a better and more secure retirement than similarly situated private sector workers? Is it starting to seem like government is becoming a pension plan only masquerading as government? Police are thinning out. Some fire stations are consolidating. Some public offices are closing. Services for the poor are deteriorating. But the government employees get to keep their taxpayer guaranteed payments and COLAs just by paying in a little extra. So now their payout may match Social Security and a 401K contrubution, maybe, but they will enjoy no investment risk and guaranteed inflation protection. Wrong. Wrong. Wrong.

Comment by Cook County Commoner Thursday, May 26, 11 @ 12:39 pm

Under “rule of necessity” the state courts would rule on it as there is no other court that could.

Comment by D.P. Gumby Thursday, May 26, 11 @ 12:39 pm

===This is a great plan. I pay more, the fund gets bigger and in a couple of years the general assembly “borrows” from the fund. How about you give me all the money currently in my pension fund and I opt out of all the plans and manage my own pension.===

Can we get this with social security too? It kills me to pay so much of my paycheck to two mandated funds that are so mismanaged and will likely be bankrupt when I am eligible to use them. Good thing my oven is electric.

Comment by Slick Willy Thursday, May 26, 11 @ 12:54 pm

Cook County Commoner …

Using your logic, COLAs should also be eliminated for everyone on Social Security …because we are all “government employees” (taxpayers) who pay into that system

Comment by Retired Non-Union Guy Thursday, May 26, 11 @ 1:12 pm

Me and my wife both work for the state. If this bill passes we will lose $1000 per month out of our pocket.

Comment by Anon employee Thursday, May 26, 11 @ 1:15 pm

“A contract is a contract is a contract!” The free market is principally based on two central concepts: property rights and honoring contracts. If the State of Illinois attempts to contort its LEGAL OBLIGATION and unlawfully abrogate its agreement with state workers, then Illinois has lost all its credibility as a functioning member of the free market.

Yes, the State of Illinois entered into an atrocious deal with union and non-union workers alike; however, simply because the deal is “bad” does not make it somehow revocable. For example, in 2009 my credit card company doubled my interest rate to 30%. Now keep in mind, I signed a contract with said company agreeing that I would comply with any interest rate increase, no matter how outrageous. Well, it took me two years and some supplemental income in music lessons but I managed to pay off the balance of my credit card bill. Hard work and discipline allowed me to overcome my obstacle. The State of Illinois should follow suit.

The State of Illinois has failed to honor its contract with state workers and politicians on both sides continue to prevaricate about the reasons for our current predicament. Simply put, the citizens of Illinois do not want to pay what their representatives agreed upon; however, a contract is a contract is a contract and if you believe in the free market and capitalism, you must honor your contracts.

Comment by What? Thursday, May 26, 11 @ 1:27 pm

Does anyone think this will move to the floor, Senate and Gov this session? Given they have not added the Judges, any thoughts on if they will add it and get it thru this session?

Comment by court watcher Thursday, May 26, 11 @ 1:36 pm

Cook County Commoner …

Services for the poor are deteriorating? Could you give me an example?

Comment by stateworker Thursday, May 26, 11 @ 1:37 pm

–let me get out of this b.s. and manage my own pension. By the time the state gets done with this, I won’t have a dime left.–

I understand the emotion, but at some point you have to put it away. Just as with bonded indebtedness, the state has never been late or missed a pension payment. Just like with Social Security, people have been screaming for 40 years that the pensions won’t be there for folks.

If I recall correctly, in sixth grade they told us we were going to be out of oil by 2000, we were entering a new Ice Age and the killer bees were going to get us all.

You have to stick with you ABCs — Always Be Cool.

Comment by wordslinger Thursday, May 26, 11 @ 1:56 pm

Don’t try to call your state reps today. I keep getting a busy signal.

Comment by Nearly Normal Thursday, May 26, 11 @ 2:40 pm

I’ve not seen any info on where the “6%” number for the state contribution comes from. Does anyone know? Grabbed out of the air?

I had always understood the pension system concept for state employees to be a cost evenly shared between employee and employer. Have others understood that also? What changed here and why?

Is this primarily an effort to limit the state contribution to normal cost so the state can pay off the existing unfunded liability?

Comment by steve schnorf Thursday, May 26, 11 @ 2:49 pm

In reviewing Tom Cross’ summary sheet, I find no rhyme nor reason for the differences between the different retirement plans. What is the basis for making the retirement ages and thresh-holds so different between SERS, SURS, etc.?? Can someone explain?

Comment by D.P. Gumby Thursday, May 26, 11 @ 3:09 pm

As I understand it, a judge with 20 years experience retires at 85% of salary. That’s a much higher percentage that other systems, hence the higher rate of contribution. Though I’m a little unclear because I thought they paid 15% now, not 11%.

Comment by girlawyer Thursday, May 26, 11 @ 3:38 pm

This whole thing seems to have 2 basic bottom-line goals:

1) persuade as many employees as possible who are already eligible to retire under the Rule of 85, or will be within the next 3 years, but who had planned to stick around a little longer in order to maximize their benefits, to bail out now in order to reduce payroll;

2) persuade everyone else to either quit or move into Tier 2 or Tier 3.

Also is there any sign that pressure from the bond market people might be behind this as it was with the last pension reform bill — the one that reduced benefits for NEW hires only?

Comment by Secret Square Thursday, May 26, 11 @ 3:47 pm

Add 4% for spousal annunity and you get the 15%

Comment by court watcher Thursday, May 26, 11 @ 3:48 pm

I agree there will be a rush to retire> Im told some 70 Judges could retire with full benefits today.If they retire. it will be a huge hit on the JRS. That reduces the number of contibutors. There are too may unknowns in this bill. Start from sctatch.

Comment by court watcher Thursday, May 26, 11 @ 3:53 pm

I cannot believe the Dems would go along with this. They have always represented “working” people and have been richly rewarded with the votes they need to be elected. They do this these votes will not be there in future elections.

Comment by Flaming Liberal Thursday, May 26, 11 @ 4:01 pm

===You have to stick with you ABCs — Always Be Cool.===

Thanks. I now have a new phrase to spring on the kids. Should definitely increase my “cool factor” by a few points.

Comment by Slick Willy Thursday, May 26, 11 @ 4:03 pm

Steve,

the 6% figure is what allows the State to use the federal “Safe Harbor” provisions to prevent the retirement plan from being de-certified. Anything less and it doesn’t qualify as a certified retirement plan.

Comment by Retired Non-Union Guy Thursday, May 26, 11 @ 4:58 pm

Soon to be retired, no later than June 30, 2012. A couple years earlier than planned, but I want to help by reducing the headcount.

Comment by Fed Up State Employee Thursday, May 26, 11 @ 5:15 pm

“It is the epitome of government immorality to continue these federal, state and local goverment plans for a privileged elite while private sector workers are falling further and further behind.”

Somehow, I don’t think a thing’s morality is defined by corporate choices.

Comment by jaranath Thursday, May 26, 11 @ 5:33 pm

I am a teacher and just got a 1% raise next year and a 2% raise the following. Now tell me how it wont hurt that much to keep paying more and more for my pension. Get ready for a lawsuit.

Comment by Sparky Thursday, May 26, 11 @ 5:44 pm

Some state agencies, like DCFS, have the state’s pension contribution reimbursed by the Federal Government. So the state won’t save a dime on those 3,000 employees. And perhaps, if the new systems aren’t federally reimbursible, the state may be worse off and end up paying more than if they had left the sytem alone. In any event, that is a lot less federal dollars coming back to the state.

Comment by Jack Thursday, May 26, 11 @ 7:09 pm

—-Author: Flaming Liberal

Comment:

I cannot believe the Dems would go along with this. They have always represented “working” people and have been richly rewarded with the votes they need to be elected. They do this these votes will not be there in future elections.—

Take a lesson from Richard M. Where are you going to go?

The coppers, firemen, streets and sans, and water department workers on the Southwest and Northwest sides absolutely hated Daley.

But they voted for him.

Have you been paying attention to what’s going on in Wisconsin, Indiana, Iowa, Ohio, etc? You think you would get a better deal with the very confused Illinois GOP in power? If you haven’t noticed, those guys can’t agree on lunch, but the tea-partiers would insist that they stick it to you.

You’re getting the best deal that the current environment allows. And you can thank Madigan for that.

You don’t have to be a liberal or conservative, or a Democrat or Republican, or anything in between, to appreciate the mastery of Michael Madigan.

Such patience. Such ice-water in the veins.But when the time comes, he plays the cards perfectly.

I read a lot of history, and I can’t think of many who are that good. FDR. LBJ. Reagan. He’s in that category.

Comment by wordslinger Thursday, May 26, 11 @ 7:46 pm

Madigan is a leader all right. He led Illinois into a deep sea of red. Democrats aren’t all crooks: New York’s pension system is 90% funded and their tax rates appear to be about average. What Madigan did with all that money that should have gone in the pension system, only he knows. But he is putting it on the backs of those who remain after he retires.

Comment by Moving to another state... Thursday, May 26, 11 @ 8:48 pm

My questions. I am relatively new state emp. Knew pension was going bust. I have always cont. to def comp. Can I still do that if I go over to “401(k)”? Also, how calc pre-change bene or if I drop from T1 to T2 or 401(k) later? Why can’t I roll past contrib to 401(k) since obvious I don’t want state to have any control over my ret? Very, very complex proposal.

Comment by sec Thursday, May 26, 11 @ 10:19 pm

It seems that those in tier 1 will eventually be forced to tier II because they will not be able to afford the increased payments every three years. Since no new employees enter system and those in the system quit paying and start withdrawing in retirement, the payments by employees must increase. With no cap that I see to stay in the system the employee might have payments greater than compensation. That is likely for the last few employees still paying into Tier 1. IF markets go down in a year or say three year period, payments into system could increase drastically for the employees.

Comment by mushroom in the dark Thursday, May 26, 11 @ 11:00 pm

If this plan passes and gets challenged in court (as it inevitably will), it will still take months, perhaps a year or more, to fully resolve it since it will also be appealed to higher courts. Also, some kind of injunction or order may be issued to keep the plan from being implemented while the case works it’s way through the courts. But even if that happens, I bet enough state employees will be persuaded to quit or retire earlier than planned to make at least a dent in the payroll portion of the budget — and perhaps THAT is one of the driving forces behind this bill?

Comment by Secret Square Thursday, May 26, 11 @ 11:30 pm

I was less than 4 years from retirement, now it’s 5 because I have to work to pay the additional 5%. It sucks to have to work, but my final average pay will be higher, I’ll get another 1.67% for the additional year, and I’ll have more in my savings account. As long as the COLA and free health insurance over 20 years of service stay, I can live with it. It’s still lousy that I’m paying for all the “sins of the past”.

Comment by Diego Friday, May 27, 11 @ 5:41 am