Latest Post | Last 10 Posts | Archives

Previous Post: SUBSCRIBERS ONLY - Supplement to today’s edition and a campaign roundup

Next Post: If Taylorville is REALLY so bad, why does STOP so painfully distort the truth?

Posted in:

* More news from the pension game…

Interviews with legislative leaders, union officials and business leaders suggest that a vote [on the pension reform bill] will probably not take place this week. Pressure from organized labor, incumbents’ nervousness about running for re-election in new districts, concern over inciting primary-election challenges and legislators’ penchant for delay when facing politically treacherous issues are creating a strong headwind.

Ultimately, one person will decide whether to call the pension bill for a vote: Mr. Madigan. According to legislative and business leaders who have spoken to him, he has not revealed his plans. “This might be something he’d rather do in the spring, but he has not expressed that to me,” said Mr. Cross, who is sponsoring the bill with Mr. Madigan. “He doesn’t always explain to you what he’s going to do.”

Reading Speaker Madigan’s mind ain’t easy, but this time he’s pretty clear, regardless of the spin…

Mr. Madigan’s spokesman said the speaker would call Senate Bill 512 as soon as Mr. Cross signaled he was ready. Yet without confirmation from Mr. Madigan that he will have the 30 Democratic votes needed for passage, Mr. Cross is likely to wait.

“When our friends on the other side of the aisle are ready, we’ll be there,” Mr. Cross said. “I’ve been living this issue for so long. I’m ready to get it done.”

SB 512 is Leader Cross’ bill. Cross is the chief sponsor, so he can call the bill whenever he wants, and Madigan has repeatedly said that Cross has full control of the legislation. So the above report is way over-analyzed, to the point of obfuscation. Also, Madigan’s people have told me that the Speaker has never promised Cross that he’d put 30 votes on the pension reform bill. Cross is stalling. Why? Either he doesn’t have the 30 votes he says he has or he truly doesn’t want to move a bill before it’s ready, or both. I’m betting on both.

* Meanwhile, the Washington Post’s editorial page looks at Illinois and other states’ pension reforms…

But there’s a catch… the [pension] reforms mainly apply to new hires, not to the existing state workforce. This was apparently a bridge too far, politically and also legally, because state constitutions and court decisions make it difficult to reduce current pensions. That the governors’ new ideas apply mostly to future hires limits their short-term financial impact. […]

No one said that it would be easy to take on public-sector unions; nor are pensions the sole cause of state and local financial distress. The Democratic governors who have acted, even tentatively, deserve credit.

But the problem is so big that they will eventually have to do more. Sooner or later, state and local governments must further rein in benefits for current employees — so that the cost of providing for public servants tomorrow does not make it impossible to provide actual public services today.

* The state’s pension reform law has been widely panned, particularly by the Tribune. But let’s look at some real numbers, shall we? From the Commission on Government Forecasting and Accountability’s most recent pension report…

• Under P.A. 96-0889 [the pension reform bill for new hires], State contribution for fiscal years 2010 – 2045 will be reduced by $71.1 billion as a result of a second tier of benefits for new hires.

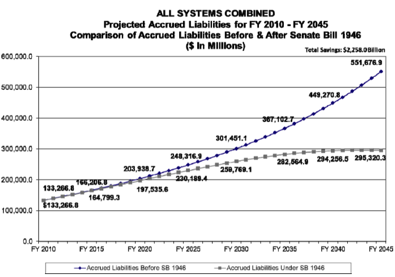

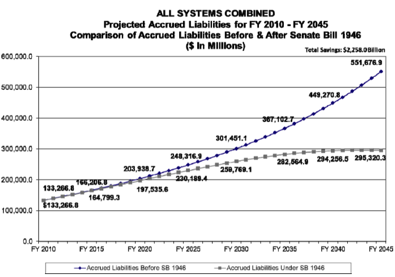

• Under P.A. 96-0889, the projected accrued liability for the five State retirement systems combined in fiscal year 2045 is reduced significantly from $555.7 billion to $295.3 billion. […]

• [Under P.A. 96-0889], the projected unfunded liability for the five State retirement systems combined in fiscal year 2045 is reduced from $55,167.6 million to $29,532.1 million.

That’s pretty significant. And look at the difference that bill made…

• Tier 1 active employees will decline in number until about FY 2018, when total active membership will be roughly equal between Tier 1 and Tier 2 members.

And…

Under P.A. 96-0889, the unfunded liability will increase for a number of years at a faster rate than it otherwise would have, until about FY 2035, when it is projected to decrease. This is because of the decreased accrued liability in FY 2045 which is attributable to a second tier of benefits for new hires. This decreased accrued liability means the State now must reach 90% of a lowered target, and thus contributions will decrease accordingly. While contributions will decrease, in the immediate future liabilities will accrue at much the same pace as they would have before the second tier of benefits went into place since most active employees will be “Tier 1” employees for the foreseeable future.

* Also from COGFA, this almost goes without saying…

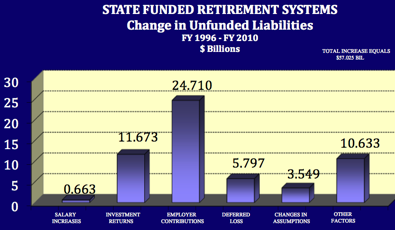

As shown in chart below, the single largest driver of the increase in the unfunded liability has been insufficient employer contributions. Other factors contributing to the growth in the unfunded liability include investment losses when compared to the assumed rate of return, benefit increases, and changes in actuarial assumptions. The category “other factors” encompasses miscellaneous actuarial factors such as rates of termination, disability, and pre-and post-retirement mortality.

* Other important stuff that you should read…

* TRS report raises questions about timing of pension vote

* Ads about Illinois’ pension battle are emotional and poignant, but are they true?

* Illinois pensions by the numbers

* State university chiefs lobby against pension reform bill: In the note, the school presidents and chancellors say their ability to recruit top staff would be hurt if the state shifts retirement costs to individual workers, rather than having taxpayers pick up the tab.

posted by Rich Miller

Monday, Nov 7, 11 @ 4:24 am

Sorry, comments are closed at this time.

Previous Post: SUBSCRIBERS ONLY - Supplement to today’s edition and a campaign roundup

Next Post: If Taylorville is REALLY so bad, why does STOP so painfully distort the truth?

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Rich,

Thanks for the stats and the chart. It clearly indicates that the changes to the pension system for new employees, have reduced state liabilities by billions. Prospective state employees know, prior to accepting the state’s offer of employment, what their total benefit package will be. We now find out that the Civic Committee bill, SB512, would increase state liabilities by 62 billion because increasing the employee contributions, also increases their accumulated contributions to the pension which increases their pension under the money purchase formula. So now Cross says he’s closing that “loophole”, changing the way pension benefits are calculated with the effect of diminishing those benefits. Sounds like that goes directly against the state constitution to me.

SB512 is fatally flawed and should be jettisoned as the garbage it is, and instead of letting the Civic Committee create flawed bills that will end up costing the state billions more, a consensus bill developed after discussions with all parties involved (which includes, gasp, the state employees) is the way to proceed on this issue.

Comment by PublicServant Monday, Nov 7, 11 @ 7:10 am

One safe way to tackle the pension funding issue(which would be lawful but take political courage) is to cap salaries both for teachers and administrators by geographic region- if the salaries received could be capped legislatively then the pension contributions and the pension benefits would be as well- is there any reason why North Shore educators need to make six figure salaries? When TRS was enacted it is hard to imagine that anyone forsaw teachers routinely making more then 100K and administrators routinely making north of 200 plus K

Comment by Sue Monday, Nov 7, 11 @ 8:20 am

Sue,

You just got me athinkin’. In a similar vein, why couldn’t the state cap the salary and benefit level at some amount beyond which the state will no longer pay out? Anything in excess of this amount would be funded 100% by the local authorities, and any pension benefit above a certain amount is the responsibility of the community in which the school resides. Just brainstorming here, I’m sure there are a million (or billion) reasons why it couldn’t be done, but we need to start thinking outside the box on pension reform.

Comment by Cincinnatus Monday, Nov 7, 11 @ 8:35 am

Assuming the constitutional argument were to prevail, the legislature cannot cap the benefit leves directly but by imposing salary caps on all public sector employees (ie no aministrator shall be paid more then X and no teacher will be paid more then Y)which could be revisited periodically or subject to inflation riders, you get to the same place lawfully

Comment by Sue Monday, Nov 7, 11 @ 8:38 am

Oh wow Tom Cross is not following through on promises and completely screwing something up. Shocker. That hasn’t happened in about 10 minutes.

Comment by too obvious Monday, Nov 7, 11 @ 8:44 am

Wouldn’t a cap on salaries interfere with collectively bargained contracts?

Comment by Burnham Wannabe Monday, Nov 7, 11 @ 8:46 am

Capping salaries is not feasible and reducing pension benefits is unconstitutional. However moving the financial burden for pensions for high wage earners to the districts seems quite reasonable. Why not make the districts responsible for the entire pension actuarial cost for the portion of salaries above the SB-1946 cap ($107K)? Why not also make the districts responsible for the full actuarial costs for raises that exceed the CPI by more than a percent or two?

The same could apply to universities and other units of government covered by the state pension systems.

This would impose some financial accountability that does not exist under the current system where much of the pension cost for high salaries and substantial raises is shifted to the state pension systems.

Comment by east central Monday, Nov 7, 11 @ 8:50 am

Burnham- No- the legislature could impose the maximums and then the Unions and Districts would be free to continue negotiations up to the caps- To avoid taking difficult votes periodically, the legislature would be best to let the caps rise by an agreed upon inflation/CPI rate in the initial legislation- Cuomo was thinking about doing this in NY with administrators but he got an overall reform bill passed- if no administrator could make more then an agrred upon salary we wouldn’t have to read about them getting 250K pension annual benefits

Comment by Sue Monday, Nov 7, 11 @ 8:51 am

Why not run all those ideas through COGFA, where they can be vetted? Why not provide time for public comment before trying to ram a law through the legislature?

Comment by PublicServant Monday, Nov 7, 11 @ 8:58 am

Why not approve a constitutional amendment ballot initiative to change the pension provision - if we can change the contracts going forward we can deal with the unfunded backlog. it is crazy that we constitutionally protect the sweetheart deals for union leaders, like the one-day substitute teacher scheme a couple used.

Comment by Alexander Cut The Knot Monday, Nov 7, 11 @ 9:02 am

“Why not run all those ideas through COGFA, where they can be vetted? Why not provide time for public comment before trying to ram a law through the legislature?”

Agree. But they don’t want public comment…the less light the better. I would suggest that before studies are studied and forecasts are forecasted, that budget numbers be configured to what they really are when it comes to total personnel costs. Include consultant and other privatized substitutes for public employees (complete with benefit & other overhead multipliers) into the calculation. Include things like the full personnel costs (privatized or not) of the state Board of Education. Look at how many consultants are taken on board to make up for “reduced headcount” at agencies like IDOT. Then look realistically at what can be cut or revised to optimize total personnel costs, including downstream pension burdens. Factor in constitutional constraints. Factor in the “endemic hiring fraud” that remains an ongoing patronage problem. Then develop a plan. The current considerations are merely an extension of the “public employees (and their unions) are the problem” mantra. And, even if overly generous benefits were granted in some labor negotiations, let’s consider who let that happen.

Comment by JustaJoe Monday, Nov 7, 11 @ 9:17 am

east central: you’re right on target, and this has been discussed in the GA as part of potential pension reform. I have no idea if it’s in the cards right now.

Comment by walkinfool Monday, Nov 7, 11 @ 9:23 am

–Also, Madigan’s people have told me that the Speaker has never promised Cross that he’d put 30 votes on the pension reform bill.–

Then Cross should probably stop implying that he did. The guy doesn’t forget.

Comment by wordslinger Monday, Nov 7, 11 @ 9:23 am

Cross can call the bill if he wants to. Go ahead Tommy boy. Take your best shot.

Comment by Bill Monday, Nov 7, 11 @ 9:35 am

Hey Capt Fax if you add up all the various categories of investment bungling…losses, defered losses, and the true nonsense categories — other assumptions— they collectively beat lack of employer contributions 31.4 to 24.7

Good job by the invevstment wizards, but we bet they will claim they were distrcted by Stuie Levine and all his nasty habits.

Comment by CircularFiringSquad Monday, Nov 7, 11 @ 10:01 am

Before doing further messing with current employees, I don’t know why we don’t simply make income from pensions taxable in Illinois. That would immediately reduce both the unfunded liability and the net outflow to current pensioners by 5%. It would also provide income from private pensions. That does not solve the whole problem but would be a significant step in the right direction.

Comment by jake Monday, Nov 7, 11 @ 10:09 am

I love it when university presidents say they can not recruit “top professors” without maintaining the current level of pension benefits. Probably true, but what about all the not so top professors who generally enjoy the same level of benefits? Ditto for school districts and teacher unions who say they need the current level of pension benefits to attract quality teachers. The one-size-fits-all compensation systems predominantly used in the public sector mean those at the top pull everyone else up. It is not fair to taxpayers paying the compensation, and not really fair to those who do excell.

Comment by Sir Reel Monday, Nov 7, 11 @ 10:16 am

An Amendment to SB512 was filed this morning. It is comprehensive! Can’t tell how it applies to existing employees.

Comment by blogman Monday, Nov 7, 11 @ 10:33 am

from what i recall, the commitment for 30 votes from Madigan was made to Ty Fahner of the Civic Committee, not Cross.

But why should it matter. Let’s go through the fundamentals that are accepted as Truth on this blog:

!) madigan is most powerful person in state

2) madigan can get anything done

with those two premises, what’s the hold up on madigan getting the votes on a bill he co-sponsoring?

Comment by Easy Monday, Nov 7, 11 @ 11:05 am

–But why should it matter. Let’s go through the fundamentals that are accepted as Truth on this blog:

!) madigan is most powerful person in state

2) madigan can get anything done–

Tell that to the voters in his district who want vouchers for private schools.

Powerful is not the same as all-powerful.

Comment by wordslinger Monday, Nov 7, 11 @ 11:12 am

I wish the legislatures would reduce their pensions, they only have a part time job anyway and leave us 9-5 hard working people alone.

Comment by Just Because Monday, Nov 7, 11 @ 11:27 am

I remember the Chicago Tribune editorial board, who seems to the the mouthpiece for the Civic Committee of the Commercial Club of Chicago, urging reform in a series of editorials around a few weeks ago. One of the editorials was put on the front page. I then read that the Tribune filed for bankruptcy a few years ago and got a negative court ruling the other day. I find it ironic that the Tribune is so worried about the state’s finances when it has it’s own problems.

Comment by Grandson of Man Monday, Nov 7, 11 @ 11:28 am

Every pension program is a bit Ponzi-like, dependent on current workers to help support retired peers. I fail to understand how letting new employees out of the retirement system will help pay for benefits to current and pending retirees — unless the legislative and retirement plans administrators assume a 12 - 20% increase in the stock market holdings of the various pension funds…

Comment by Capital View Monday, Nov 7, 11 @ 11:40 am

If Cross was ready to call the bill (ever), that would mean he was trying to be part of the solution. Won’t happen.

Aside from which, I can think of a few other reasons he’d never call it.

I’m amazed he’s still leader, but in the land of the blind…

Comment by Thoughts... Monday, Nov 7, 11 @ 12:10 pm

No matter how pension plans are defined we will always be UNDER Funded when the State fails to make any defined contributions.

What would the liability be IF the State had made timely required contributions?

Comment by JustMe_JMO Monday, Nov 7, 11 @ 12:13 pm

Wait a second, Rich– suddenly Cross has the ability to decide when legislation on the hottest political issue of the moment gets a vote? The bill may not have the 30 votes Cross says it has, but the fact is that Madigan can and does do whatever he wants when it comes to letting bills get to the floor.

Sometimes he gives up control to members for their pet issues, particularly when he has a convenient situational “conflict of interest” concern. But if Madigan wanted this thing to go, it would go. If Madigan wanted that bill to be his, it would be.

He’ll figure out what he wants to do (or not do) with this thing, and he’ll do it.

Comment by WhoElseGoesDown Monday, Nov 7, 11 @ 12:16 pm

Why not make all retirees taxpayers? That benefit is not constitutionally protected. It would not require a costly study at taxpayers expense, Those with small pensions would be “penalized” less than those with larger pensions. All Illinois taxpayers benefitted by ” the underfunded pension or pension subsidized ” reduced tax rates for many years. We have hit the brick wall of reality - pain for all…

Comment by Practical Monday, Nov 7, 11 @ 12:47 pm

==what’s the hold up on madigan getting the votes on a bill he co-sponsoring?==

Maybe he suddenly developed a conscience.

Comment by Bill Monday, Nov 7, 11 @ 12:50 pm

===Every pension program is a bit Ponzi-like, dependent on current workers to help support retired peers. ===

State employees pay 4 percent of salaries to the pension plan, which is a tiny fraction of the annual pension payment.

Comment by Rich Miller Monday, Nov 7, 11 @ 1:15 pm

maybe state employees pay 4%, Surs employees currently pay 8%

Comment by Practical Monday, Nov 7, 11 @ 1:17 pm

Alternative formula employees (State Police) pay 12.5%

Comment by Bingo Monday, Nov 7, 11 @ 1:46 pm

=== As shown in chart below, the single largest driver of the increase in the unfunded liability has been insufficient employer contributions. ===

That is a polite way of saying that the state’s contributions as a result of PA 88-0593 have not been and will not be sufficient to reduce the unfunded liability until about 2031. PA 96-0889 did not change the fact that the payment plan adopted in 1995 called for the unfunded liability to grow well into the future.

Comment by Did The Math Monday, Nov 7, 11 @ 2:13 pm

===called for the unfunded liability to grow well into the future. ===

Yes, but it will be paid off.

Comment by Rich Miller Monday, Nov 7, 11 @ 2:47 pm

Bill, don’t hold your breath. lol

Comment by Rich Miller Monday, Nov 7, 11 @ 2:49 pm

===from what i recall, the commitment for 30 votes from Madigan was made to Ty Fahner of the Civic Committee, not Cross.===

MJM’s people deny that as well.

Comment by Rich Miller Monday, Nov 7, 11 @ 4:16 pm

The GA will be serving up a golden opportunity to Quinn if it passes the Cross pension bill. A veto would go a long way to repairing his relationship with the unions and with other state and university employees. If Quinn were viewed as the only way for these groups to protect their interests, then Quinn would become their top priority for campaign contributions and get-out-the-vote support in 2014, while it might be withheld forever from any legislator that voted for the Cross plan.

Between this and the support that AARP will give him for his position on the utility legislation, Quinn might be in decent shape for election to another term. At the same time, some legislators might see new primary challenges.

Some Democratic legislators might not be too happy with these outcomes.

Comment by east central Monday, Nov 7, 11 @ 5:16 pm