Latest Post | Last 10 Posts | Archives

Previous Post: Too late to die young now

Next Post: Question of the day

Posted in:

* This story has not been getting the attention it deserves, mainly because the Civic Federation released its study late Sunday night…

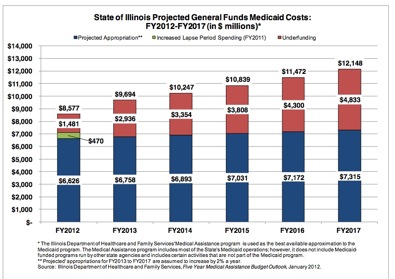

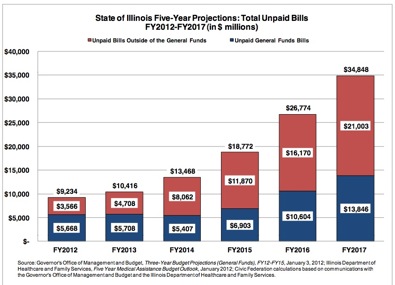

Illinois’ unpaid bills may more than triple to $34.8 billion by 2017 unless lawmakers and Democratic Governor Pat Quinn immediately bring Medicaid and pension spending under control, said a research group.

The “potentially paralyzing” backlog, projected to reach $9.2 billion when this fiscal year ends June 30, would be fueled by an “unsustainable” increase in Medicaid spending, according to the Civic Federation, which calls itself a nonpartisan government research organization.

“Failure to address unsustainable trends in the state’s pension and Medicaid systems will only result in financial disaster for the state of Illinois,” Laurence Msall, president of the Civic Federation in Chicago, said in a press release today.

* More…

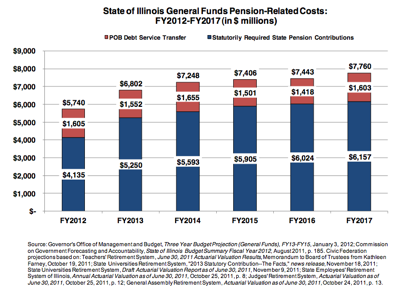

The report points to rising pension costs and medical bills for the poor and uninsured as the primary culprits of increased state spending. Among the Civic Federation’s suggestions for reining in state finances are reducing automatic 3 percent increases built-in to retirement pay for government workers and increasing the cigarette tax.

“It’s a very frightening situation,” Msall said. “It’s one that calls for not half measures, not politically massaged answers. It calls for significant, drastic action by the state of Illinois.”

You’re darned right this is frightening. That report freaked me out when I read it last night. Right to the bone.

* The bad news in words…

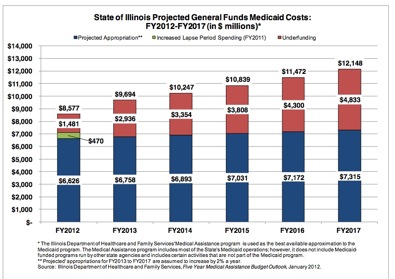

General Funds Medicaid costs are projected to increase by 41.7% from $8.6 billion in FY2012 to $12.1 billion in FY2017, according to a recent analysis by HFS.49 General Funds costs of the program are projected to increase 13.0% between FY2012 to FY2013 due to an anticipated decline in resources from Other State Funds. Between FY2014 and FY2017, program costs are expected to increase at an average annual rate of 5.8%. […]

Unpaid bills increase in FY2012 because the program is underfunded by approximately $1.5 billion. As a result, the backlog of unpaid Medicaid bills is expected to grow to roughly $1.8 billion by the end of FY2012 from approximately $300 million at the end of FY2011, meaning that it will take longer for healthcare providers to be paid. If the increase in Medicaid appropriations were limited to 2% a year going forward, unpaid Medicaid bills would grow to $21.0 billion by the end of FY2017. […]

Annual Medicaid costs can exceed appropriations because State law allows Medicaid expenses, unlike most other State expenses, to be paid from future years’ appropriations.52 This provision of Section 25 of the State Finance Act has repeatedly been used to budget an insufficient amount of Medicaid appropriations to cover costs for a given fiscal year, knowing that the bills will be paid from the next year’s appropriations.

There are no real solutions in this report, either. The Civic Federation wants aggressive cost controls, but they’ll have to be draconian to put this budget into balance.

* And that’s just the Medicaid problem. Here’s the full Monty…

Click the pics for better views.

* Pension funding will cost the state a total of $9 billion from this year’s base in five years. The red is debt service costs on the chart…

That $9 billion isn’t chump change, of course, but it’s nothing compared to how much money will go into the base via Medicaid.

* One of the Civic Federation’s ideas is to tax retirement and Social Security income, as well as increase the cigarette tax by 98 cents a pack. This would put a dent into the stack of old bills, but not a big one. The Tribune, believe it or not, is not dismissing these two ideas out of hand…

All of us can debate these and other Civic Fed proposals. But we suspect many politicians would rather take an easy route this report doesn’t suggest: renewing the “temporary” income tax hikes for years beyond 2014.

Tell us, Governor, where you stand. Candor in these two speeches might restore some of the credibility lost when you (a) pledged during the 2010 campaign to veto any personal income tax increase above 1 percentage point and (b) after the election, signed your 2-percentage-point increase into law.

Tell every Illinoisan, Governor, that “temporary” does not mean “permanent.”

Um, even if the temporary tax is made permanent, that 2017 stack of unpaid bills will still be about $17 billion.

*** UPDATE *** AFSCME has issued a press release which it claims “debunks” the Civic Federation’s report. The union doesn’t challenge the Medicaid projections laid out above, however, and essentially focuses on a demand for a tax hike on the wealthy.

posted by Rich Miller

Monday, Jan 30, 12 @ 10:40 am

Sorry, comments are closed at this time.

Previous Post: Too late to die young now

Next Post: Question of the day

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

I’ve heard that warning before.

www.illinoisrealitycheck.org

Comment by Hallelujah Monday, Jan 30, 12 @ 10:51 am

This is an eye-opener to say the least. But we’ve been hearing about the mushrooming costs of medicaid to Illinois for years. One thing I never read about is whether or not other states are in the same boat. Are others controlling costs better, or are they seeing the price tag double and triple over the years like we are?

Comment by guessing Monday, Jan 30, 12 @ 10:52 am

I thought the civic federation reports were dismissed out right on this blog.

Comment by Fed up Monday, Jan 30, 12 @ 10:58 am

nonpartisan? If the Civic Federation had it’s way all government employees would make minimum wage with zero benefits.

Comment by William Monday, Jan 30, 12 @ 10:58 am

but it doesn’t mean this isn’t true.

Comment by William Monday, Jan 30, 12 @ 10:59 am

People, don’t confuse Civic Federation with Civic Committee. Two very different groups.

Comment by Rich Miller Monday, Jan 30, 12 @ 10:59 am

That’s the part I don’t understand — how do other states manage their Medicaid costs? Are we a high-cost Medicaid provider state? Or is this a universal problem? I suspect (with no data) that we are a high-cost provider state, given the relatively high clout of the docs in our state, but I’d like to know if my hunch is correct.

Comment by Dan Johnson Monday, Jan 30, 12 @ 11:00 am

===we are a high-cost provider state===

We actually have one of the very lowest cost per recipient ratios in the nation, according to the governor’s last budget commission report, which is why squeezing costs outta the system is so difficult.

The real cost driver here is the number of recipients.

Comment by Rich Miller Monday, Jan 30, 12 @ 11:02 am

Make the tax increase permanent. Shred Medicaid spending, including reversing all of Blago’s increases in Medicaid — or else turning it into an HMO. Reset the rate of return to members of the state pension system to something more realistic (the seven percent-and-above returns that have been used since the late 1970s are not sustainable when you never see inflation above half that amount, and the only reason we even got away with them for this long was due to the extraordinary stock market performance in the 1980s and 1990s). Still, even all those things won’t entirely close the gap.

I think in particular the subject of what Blagojevich did with Medicaid needs to be scrutinized closely. Rather like President Bush with the Medicare drug benefit, Blago created expensive new entitlements without overall reform of the system that might have paid for them. And it’s clearly worth comparing these changes with other states; I strongly suspect that they have few parallels elsewhere.

Also, with regard to the pension system, state employees who got in on that two-decade long, stock-market-driven high rate of return have been incredibly lucky. We paid Paul, and unfortunately we now have to rob Peter to cover the cost. The honest thing to do would have been to stick with the rates of return used in the 1960s and 1970s, and bank the 1980s/1990s bull market for a rainy day. But of course that bull market was too tempting to feast on. It’s just that those who want to slash and burn for the sake of it need to at least understand that the employees who are fully on the receiving end of the upcoming retrenchment are getting a very raw deal indeed, and the little history I’ve given helps to explain why and how.

Comment by Angry Chicagoan Monday, Jan 30, 12 @ 11:02 am

Capt Fax….pleeezzzze don’t be so scaredy…..just run around the ‘hood and get all the old geezers addresses so we can cut them off the medicaid rolls.

We know the wing nuts will want more “managed care” in the 312 AC, but guess what? That won’t do the job.

Big Cuts wil be needed in the States of East Mitchell and South Brown too!

Fire, Aim Ready

Comment by CicularFiringSquad Monday, Jan 30, 12 @ 11:06 am

I don’t expect governor quinn to act like a grown up here. Perhaps a brady campaign alumni could weigh in with what his/her former boss would have done in reaction to this report?

Comment by shore Monday, Jan 30, 12 @ 11:08 am

Sorry Rich my mistake

Comment by Fed up Monday, Jan 30, 12 @ 11:10 am

Rich is correct and the number of recipients will increase by 2014 due to the Affordable Care Act. I am a provider and more providers will drop Medicaid so who will take care of sick people

Comment by 10th ward Monday, Jan 30, 12 @ 11:10 am

The interesting thing to see will be how the Governor and his staff react to it. I don’t have a good feel for their capability to face the reality since they continue to just nibble around the edges of controlling expenditures.

Comment by Cassiopeia Monday, Jan 30, 12 @ 11:11 am

According to the Kaiser Family Foundation, 62.4% of Illinois’ Medicaid spending is attributable to optional services that are not federally mandated (http://www.kff.org/medicaid/8239.cfm). The average across all states is 60.4% on optional services.

Trimming optional services has been suggested before and may be necessary this time to cut down on this massive future funding deficit.

Comment by Anonymous Monday, Jan 30, 12 @ 11:12 am

you all say CUT~CUT~CUT!!!! TO Medicaid`~unless you or a loved one is forced to depend on it for healthcare coverage. we have ideas that could cut hundreds of MILLIONS not Billions, but MILLIONS by passing HB30. Pharma product savings alone oule amount to that, then add in the reduced number of hospitalizations and maybe that number gets to the “hundreds of” Millions…when you start using that “B” word, that would amount to fraud~~on the medical billing profession (or upper management should i say)all while we continue to suffer~~and be considered criminals~~~then think of the cost of locking ALL OF US up????

Comment by mike graham Monday, Jan 30, 12 @ 11:17 am

Illinois is in the bottom ten states for Medicaid reimbursement to physicians. Other than increases for a dozen or so primary care services in 2006, across the board increases have not been made since 1999.

Hospitals and nursing homes get the largest share of Medicaid funds. Not sure how they rank compared to other states or when they received their most recent increases.

Comment by Anonymous Monday, Jan 30, 12 @ 11:18 am

Kent Brockman: Professor, now that we know precisely what the danger is, would you say it’s time for our viewers to crack each other’s heads open and feast on the goo inside?

Professor: Mmm, yes I would, Kent.

– MrJM

Comment by MrJM Monday, Jan 30, 12 @ 11:18 am

Did anyone else catch Quinn saying he would be looking for a tax cut for the poorer people in the state? He made this comment over the weekend.

He fights to pass the tax increase.

Then he hands out tax breaks to big corporations.

And now he wants to give poorer folks tax cuts. All the while saying that there isn’t enough money to make the payments he is obligated to make. Doesn’t he understand that he needs money to continue to run the state? Or is he conducting class warfare by appeasing the rich and the poor and putting everything on the back of the middle class? All of the current cuts to education and transportation are going to fall on the people who own property in the school districts. The eliminating of state payments to the teachers pensions are going to fall on the same property owners. The rich will have their tax loopholes. The poor will have their tax cuts. But the middle class who are predominately the property owners will have to pony up big time. This guy needs to go.

Comment by Irish Monday, Jan 30, 12 @ 11:22 am

“We actually have one of the very lowest cost per recipient ratios in the nation…The real cost driver here is the number of recipients.”

How do Illinois’ eligibility requirements compare to other states?

Comment by Anonymous Monday, Jan 30, 12 @ 11:27 am

Geez, maybe if we the feds would help get many of these Medicaid recipients enrolled into private health plans somehow….

Healthcare costs aren’t going away. Here come the Baby Boomers and those dudes want to live forever. And that costs a lot.

Comment by wordslinger Monday, Jan 30, 12 @ 11:44 am

Didn’t the hospitals want their payments held up as part of a deal to get 100%? If that is the case, did the hospitals want them held up permanently? Could this be a flaw in the analysis?

Comment by Bogey Monday, Jan 30, 12 @ 11:45 am

I agree with 10th Ward @ 11:10…

More providers are just going to drop Medicaid knowing they might never receive compensation for their services.

Comment by Regular Reader Monday, Jan 30, 12 @ 11:55 am

Word — True as far as it goes, but as the Baby Boom ages, they’re going to age out of the Medicaid population and get covered under Medicare, which takes them off the state’s dime.

Comment by soccermom Monday, Jan 30, 12 @ 11:59 am

Goodness.

It’s disturbing that we have to learn such things from private organizations and not from public officials. This indicates either:

1.) Our state leaders do not understand the scope of our economic challenges.

2.) Our state leaders do not want us to understand the scope of our economic challenges.

It appears Quinn & Crew are hoping to survive a term or two, just long enough for this to become someone else’s problem. Either that, or they really have no idea what’s coming our way. Or maybe they just don’t care.

Not good.

Comment by Shock & Awww(e) Monday, Jan 30, 12 @ 12:14 pm

Soccermom, understood, I’m talking about healthcare costs overall — private health plans, Medicare, Medicaid, uninsured.

In 2010, healthcare spending was 17.3% of GDP. At the end of 2007, the CBO estimated:

–The results of CBO’s projections suggest that in the absence of changes in federal law:

–Total spending on health care would rise from 16 percent of gross domestic product (GDP) in 2007 to 25 percent in 2025, 37 percent in 2050, and 49 percent in 2082.

–Federal spending on Medicare (net of beneficiaries’ premiums) and Medicaid would rise from 4 percent of GDP in 2007 to 7 percent in 2025, 12 percent in 2050, and 19 percent in 2082.–

We’re just getting started with this issue.

http://www.cbo.gov/ftpdocs/87xx/doc8758/maintext.3.1.shtml

Comment by wordslinger Monday, Jan 30, 12 @ 12:19 pm

Interesting report, particularly the recommendation that Illinois accelerate the move of the elderly and disabled out of nursing homes and state institutions into community based care.

That recommendation would have been particularly more useful if they’d attached a $ to it, from say, moving folks out twice as fast.

Secondly, I think they ignored another great source of revenue, although it requires federal action.

The Streamline Sales Tax Project would allow Illinois to collect between $500 - $560 million in additional sales tax revenue from Internet sales like Amazon.com.

I think there’d also be an additional $300 million from mail-order sales.

I also thought the look at corporate tax expenditures was particularly helpful.

Comment by Yellow Dog Democrat Monday, Jan 30, 12 @ 12:34 pm

Thanks Rich. Data beats hunches.

Do nursing homes get a disproportionate share of Medicaid dollars, particularly relative to the services they provide? Everyone says that nursing homes have a lot of juice, so I wonder whether that shows up in the Medicaid budget.

Of course, I could just read the report….

Comment by Dan Johnson Monday, Jan 30, 12 @ 1:21 pm

Whaaaa??? Am I reading this correctly?

From page 22 of the IHFS annual report, which you can see here: http://www.hfs.illinois.gov/assets/annualreport.pdf

IL Medicaid PAYS FOR 93.3% OF ALL TEEN BIRTHS IN ILLINOIS?

Seriously? That’s surprising. Perhaps it contributes (in part) to the post a few days ago about IL abortions being at a low point?

Anyhow, in general, IL has fairly generous Medicaid coverage, particularly in terms of the income limits (% of Federal Poverty Level, etc.). We cover a broad population. Some states cover residents earning 100% of the FPL, others 150%, others 200%, etc. The income limits also vary depending on the specific type of services being provided.

This actually makes our transition under the PPACA (aka Obamacare) a bit easier, since we already cover a number of patients other states are just beginning to cover.

In terms of reimbursement to providers, however, we lag behind.

The Kaiser Family Foundation & IGPA at U of I are great sources on this topic.

Comment by Shock & Awww(e) Monday, Jan 30, 12 @ 1:30 pm

Shock, here’s some further reading for you.

http://www.chicagonow.com/chicago-muckrakers/2010/10/teen-pregnancy-rates-sky-high-for-some/

Comment by wordslinger Monday, Jan 30, 12 @ 1:45 pm

For what it’s worth, Vaught claimed last year Medicaid funding was cut to bring lawmakers into system reform discussions. If that’s true, perhaps the flat budgets the governor outlined last month add onto that strategy.

Comment by Dirty Red Monday, Jan 30, 12 @ 2:19 pm

So wait a minute, AFSCME, which says state employee pensions cannot be cut because of the constitution says so, is advocating for a special tax on the wealthy, which the constitution says you cannot do.

I’m shocked.

Comment by ILPundit Monday, Jan 30, 12 @ 2:22 pm

And I think YDD is right about the Streamline Sales Tax. I’d very much like to see Durbin’s bill pass. Memory serves me, the Streamline Sales coalition is not something Illinois would qualify for because of how our budget is structured. We’re sort of stuck waiting for the feds to move.

Comment by Dirty Red Monday, Jan 30, 12 @ 2:25 pm

‘Interesting report, particularly the recommendation that Illinois accelerate the move of the elderly and disabled out of nursing homes and state institutions into community based care’

Read that part of the report and just had to laugh. Let’s move them into the community not knowing what the real costs will be. At state facilities the medical and pharmacy costs are included in the cost, but in community settings they are additional costs. I’ll stay out of the salary differences, which are huge due to low rates. Then since many community providers are 501(c)3s, as they buy/build housing, that housing will come off the property tax roles unless rates paid are raised enough to cover the tax cost. End result: people complaining about property tax revenue dropping and the cost of community settings about the same as in state facilities. Yeah, that saves money.

Comment by zatoichi Monday, Jan 30, 12 @ 2:33 pm

You can’t just look at annual Medicaid appropriations and spending. You need to consider the NET GRF cost, after Federal Financial Participation and other offsets. And that the Federal matching percentage for state expenditures for the newly eligible 100% in 2014 through 2016; 95% in 2017; 94% in 2018; 93% in 2019; 90% in 2020 and beyond. Yes, there may be some cases not considered “newly eligible” who could have qualified under the existing standards, but what is the state NET GRF liability? The most recent experience is that the NET State GRF has been flat and that program growth has been largely attributable to more FFP, which may not be as generous in the future, but has covered the preponderance of expenditure growth.

Comment by ANAL Monday, Jan 30, 12 @ 2:49 pm

I wonder if Quinn is having second thoughts about opening up a few more casinos.

Comment by fed up Monday, Jan 30, 12 @ 2:58 pm

All Kids coverage for children whose parents are at or under the 300% federal poverty level threshold. Add in that All Kids covers illegal immigrants as well and it is no wonder Medicaid costs are going through the roof.

It’s about time to roll back that program.

Comment by Not Surprised Monday, Jan 30, 12 @ 3:08 pm

@wordslinger - thank you! Those maps depict quite a stark contrast, don’t they? Appreciate it.

Comment by Shock & Awww(e) Monday, Jan 30, 12 @ 3:13 pm

I, too, would be interested in knowing how AFSCME proposes to get around the constitutional flat tax in their suggestion that we raise taxes on the wealthy. Indeed, Quinn seems to be flirting around the edges when he proposes even more tax breaks for special groups.

As to the 3 percent annual increase in state retiree pensions, wouldn’t that be a part of the protected part of state pension benefits.

Comment by Cassandra Monday, Jan 30, 12 @ 3:21 pm

If only we subjected states to anywhere near the reporting requirements we subject public corporations. This fraud makes Enron and Arthur Anderson look minor.

Comment by WashingtonIrving Monday, Jan 30, 12 @ 4:09 pm

@Dan Johnson:

Illinois spends about 35% of its Medicaid long term care dollars on home and community based services. The other 65% goes to nursing homes, institions like ICF-DDs and IMDs, and so forth. If Illinois spent even a few percentage points more on community based services, a hell of a lot more people would be able to be served. The General Assembly needs to support HFS in making this re-proportioned spending work. What would an Illinois look like where 51% of those dollars are spent on long term care? A lot more people would be in their own homes, which is where the AARP and disability groups say people really want to be.

See Kaiser Family Foundation’s statistics on Medicaid long term care spending. As a comparison, California spends 84% on community based services, 16% on nursing homes and institutions.

Comment by Quill Monday, Jan 30, 12 @ 6:24 pm

Perhaps the Tribune will use the Civic Federation’s new report to give us more editorial advice on how to manage budgets. They seem better at that than they are in actually managing a budget.

From Crains, regarding the Trib’s current bankruptcy: “The media company’s bill for professional fees, mostly for attorneys who represent it in court, totals $212.9 million, and it has spent another $17.8 million on their expenses, according to the company’s December monthly operating report filed with the court last week.”

Comment by steve schnorf Monday, Jan 30, 12 @ 9:09 pm

The state has relatively low Medicaid reimbursement rates, the fewest state employees per capita of any of the 50 states, and an antiquated tax structure that prohibits higher income rates for the rich coupled with a narrow sales tax base that fails to capture the growth in the economy.

Last year Senator Cullerton commissioned a study which concluded that if Illinois copied Indiana’s tax structure the state would realize over $6 billion more a year.

Wouldn’t it make more sense to look at that possibility( yes, and amend the constitution to require the rich to pay more) than to race to the bottom and follow the Texas example of adding millions to the rolls of the uninsured and to lower education achievement?

Comment by truthteller Tuesday, Jan 31, 12 @ 7:15 am

So it looks like the debate is moving from the pensions (big problem but cuts would affect a relatively small group of people) to medicaid costs (skyrocketing with no end in sight). Hey, let’s tax the rich and that’ll solve the problem. I wonder if there is a calculation about just what kind of revenue we would likely realize if we were to raise tax rates on the “wealthy”. How much of a raise would be needed to solve the “problem”? Tax reform has been mentioned. Truthteller says a change in the tax structure to mimic Indiana could realize an increase in revenues by 6billion. That money has to come from somewhere, doesn’t it? A change in the tax code doesn’t print money. It has to come from somebody’s pocket. And from what I see above, that ain’t enough to solve the problem.

Oy.

Comment by dupage dan Tuesday, Jan 31, 12 @ 9:16 am