Latest Post | Last 10 Posts | Archives

Previous Post: Rutherford initiates online buzz, but will wait until January to announce

Next Post: Question of the day

Posted in:

* From the New York Times…

A Times investigation has examined and tallied thousands of local incentives granted nationwide and has found that states, counties and cities are giving up more than $80 billion each year to companies. The beneficiaries come from virtually every corner of the corporate world, encompassing oil and coal conglomerates, technology and entertainment companies, banks and big-box retail chains.

The cost of the awards is certainly far higher. A full accounting, The Times discovered, is not possible because the incentives are granted by thousands of government agencies and officials, and many do not know the value of all their awards. Nor do they know if the money was worth it because they rarely track how many jobs are created. Even where officials do track incentives, they acknowledge that it is impossible to know whether the jobs would have been created without the aid.

Oy.

* More…

Caterpillar has received more than $196 million in local aid nationwide since 2007, though it has chastised states, particularly its home base, Illinois, for not being business-friendly. This year, Caterpillar announced a new plant in Georgia, which offered $44 million in incentives. Local counties chipped in free land and other aid, including $15 million in tax breaks and $8.2 million in road, water and sewer repairs.

The company, whose profits are soaring, recently froze workers’ pay for six years at several locations, arguing that it needed to remain competitive. A spokesman for the company, Jim Dugan, said it employed more than 50,000 people and invested billions of dollars nationwide.

Yes, the company has invested lots of money. But now maybe some of you understand why Senate President John Cullerton wants publicly traded corporations to disclose their state income tax payments.

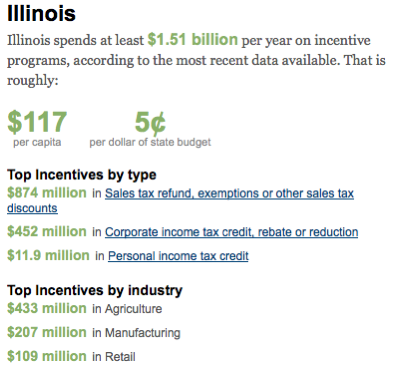

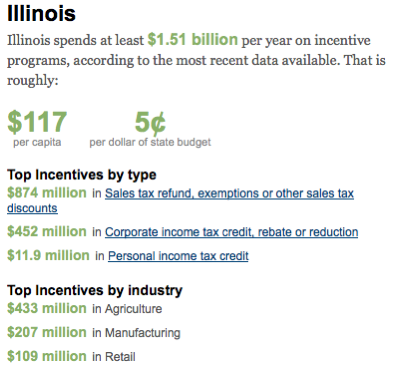

* And if you still don’t, there’s this from the NYT’s database…

Notice that almost a quarter of those incentives go to agriculture. Farmers can’t exactly leave.

Also notice that the incentives are higher than the amount of revenue generated by last year’s corporate income tax hike.

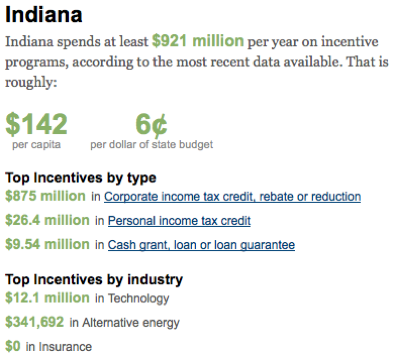

* But as much money as we’re paying, check out the far higher per capita rate in Indiana…

It’s a function of the game. When your neighbors are doing it, you have to try and keep up.

posted by Rich Miller

Monday, Dec 3, 12 @ 10:59 am

Sorry, comments are closed at this time.

Previous Post: Rutherford initiates online buzz, but will wait until January to announce

Next Post: Question of the day

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Sifting through that database is remarkable. Plus, there are virtually no results in yet for 2011.

Would be interesting to discover how much of our new revenue from the tax increase went towards corporate welfare.

Wouldn’t it be crazy if we handed out more in new tax breaks to people and corporations than we generated in new tax revenue… hmmm…… couldn’t be, could it?

Comment by Formerly Known As... Monday, Dec 3, 12 @ 11:08 am

time to start consolidating states. that way there aren’t as many choices for corporations to shakedown. the race to the bottom is awesome!

Comment by b Monday, Dec 3, 12 @ 11:14 am

At least make these corporations march with Quinn in a parade, or hand out state flyers for crying out loud!

Comment by PublicServant Monday, Dec 3, 12 @ 11:20 am

50 governors, 50 very expensive “job-creating programs” of dubious effectiveness…

Tons of press releases, all featuring “hero” governors.

You might as well print those releases on gold leaf.

Gee, you don’t hear the chamber of commerce types yelling for the government to get out of the way with these programs.

Comment by wordslinger Monday, Dec 3, 12 @ 11:32 am

Romney was right, but he failed to paint the whole picture. Politicians are elected bc of the gifts they handout, but their gifts are not limited to the 47% Romney mentioned.

Comment by Lil Squeezy Monday, Dec 3, 12 @ 11:44 am

I believe we should have less incentives and better policy such as workers comp reform, better funding education and public works. I will say that I think Indiana and Wisconsin spend their money a little smarter, geared more toward Technology and Manufacturing, industries that can leave and are not tied to land, although, there is not a breakdown on of the Agriculture subsidies.

In the end, I think one of Illinois biggest problems is reputation. We just look silly with our budget problems and lack of serious business dialogue at the Capitol.

Comment by Ahoy! Monday, Dec 3, 12 @ 11:48 am

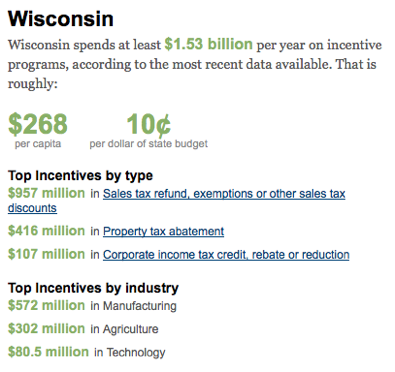

Oh, so that’s what everyone means when they say Wisconsin is more business friendly, they give away twice as much as us per person.

I’m glad I finally understand this.

Comment by Small Town Liberal Monday, Dec 3, 12 @ 11:51 am

This article doesn’t seem to include the $85 mm to cme/cboe.

Comment by soccermom Monday, Dec 3, 12 @ 12:43 pm

Illinois actually keeps pretty good records of tax expenditures: http://www.ilcorpacct.com/corpacct/

The state has been rated #1 in tax expenditure transparency by Good Jobs First, which provided one of the sources for the Times database. It is also showing some effort at recapture when companies aren’t holding up their ends.

Of course many incentives are local and do not show up in the database. Home rule communities grant property tax rebates and enter sales tax sharing agreements. TIF is a huge giveaway program but only Chicago’s TIF incentives are included.

Some local economies have been ravaged not just by the Great Recession but by cannibalism practiced in their own backyards.

Comment by yinn Monday, Dec 3, 12 @ 1:13 pm

We should do away with these programs and forbid local governments from offering incentives as well. If we believe we should subsidize businesses to locate here, then pay them from the General Revenue Fund and let them compete with all the other programs each year for the available tax dollars. Companies will continue to come to Illinois, primarily Chicago, without the incentives because this is where the executives want to live and where they can find employees to do the work. Our economic development policy should be stable, fair taxes and quality public services. Period. People dependent upon election and campaign contributions should not be allowed to negotiate exclusive tax deals with corporations or individuals.

Comment by anon Monday, Dec 3, 12 @ 1:23 pm

I think the incentives should be tied to instate payroll, and instate means living here 9 or more months of the year. They also can not count payroll for jobs that pay less then 20 k a year.

If a company is paying good wages to employees who pay income tax in state then let’s help the company. If they pay so little that we subsidize their employees like Walmart etc then no incentives

Comment by Shocking Monday, Dec 3, 12 @ 1:25 pm

For all the complaints from neighboring states about how bad a business climate Illinois has, we seem to be able to attract companies with lower bribes so we must have something going for us. But I will second the call for a national ban on intra-country incentives. Illinois can’t stop providing incentives by itself but, banded together with the rest of the states, we can focus on keeping jobs in the U.S. regardless of location and we’d all be better off for it.

Comment by thechampaignlife Monday, Dec 3, 12 @ 1:32 pm

So much for the “invisible hand” of the free market directing resources efficiently. All these incentives (along with tax deductions, breaks, etc.) do is distort the market. I wonder how many were granted/esstablished under the free market party (Republican)? I also wonder how Illinois’ and the national economy would perform if a like amount had been invested in infrastructure and R&D.

Comment by Sir Reel Monday, Dec 3, 12 @ 1:34 pm

As someone very familiar with nonprofits, this particularly chaps my derriere. If a nonprofit recieves a dime from the government, the government demands metrics (data) upon metrics and transparency that would make a CEO’s head explode.

Yet, give for-profit companies hundreds of millions of dollars in benefits, and you require bupkis in the form of metrics that hold them accountable for the benefits they received?! You can’t even tell if your policies are actually working based on data?

What a joke.

Comment by Left Leaner Monday, Dec 3, 12 @ 1:36 pm

is there a way to break out the amount of funding this represents as a loss to school districts in each state? Also are corporations like NASCAR included in these figures?

Comment by Barbie Monday, Dec 3, 12 @ 1:45 pm

Apparently this cry that states are financially experiencing “tough-times” is bogus. They have plenty of money when they choose to.

Comment by Crime Fighter Monday, Dec 3, 12 @ 1:57 pm

Companies have many choices and those choices reach beyond our state and nations borders. This is the natural evolution of the free market system. Just like a shopper looking for the best deal, companies are also looking for the best deal. This is the basic principle of a free market system. Romney may have had it backwards when he said, “Corporations are people too.” It is more accurate to assume that all people and their families are small corporations. We clip coupons and look for the best deal. If State’s and communities want to compete for new jobs and retain current jobs, they need to have coupons (incentives) and best deals (lower taxes) to win over the customer (companies with jobs).

Comment by Endangered Moderate Species Monday, Dec 3, 12 @ 1:58 pm

Sorry, EMS — the average voter does not have access to a well-connected lobbyist to help us get 50 percent-off coupons

Comment by soccermom Monday, Dec 3, 12 @ 2:11 pm

But we are not talking about “coupons” here. Location choices include a myriad of factors and “all else being equal” rarely, if ever applies. And taxes, as a percent of overall operating costs, is a very small percentage of the equation. Tax incentives are very rarely the distinguishing factor when choosing between competing locations. Look at Boeing. Chicago makes sense because of O’Hare and the fact they have a significant oversees client base. Or Motorola moving operations downtown because that is where it can attract employees who want to live in the city and all it offers. Incentives also foster the perception or reality of corruption as some are “favored” while most are not.

Comment by anon Monday, Dec 3, 12 @ 2:16 pm

FY2011 Tax Expenditure Report:

http://www.ioc.state.il.us/index.cfm/linkservid/B0F39EC1-1CC1-DE6E-2F48E706F850E182/showMeta/0/

Comment by Dirty Red Monday, Dec 3, 12 @ 2:21 pm

Our pension funds at work.

Comment by Ret. Prof. Monday, Dec 3, 12 @ 2:38 pm

I would take issue with what they are counting. All but $2M in Agriculture is what they count as Sales Tax Exemptions. Agricultural inputs, like most not at retail sales, are exempt because they are inputs into a type of manufacturing process, and not sold for consumption. However, if they want to coutn these tyoes of exemptions, they should count all of them. Are newspapers and magazines counted because they are exepmt from sales taxes? What about sales to charitable or religious organizations? Using the NYT standard, I would think the biggest beneficiary of Illinois Sales Tax Exemptions would be…govenment itself. All of the tax exempt purchases that are made at all levels would far exceed anything in the private sector.

Comment by McLean Farmboy Monday, Dec 3, 12 @ 2:39 pm

Soccermom-

The State business incentives are spelled out with specific rules and criteria that must be met by applying companies. The DCEO web page has information about these programs. They include programs such as Community Development Block Grants, Illinois Finance Authority financing, Advantage Illinois. AgriFirst. Business Development Public Infrastructure Program, IDOT Economic Development Program and Large Business Development Program. Many small and large business’ have received assistance through State financing and grant programs. Most of these companies worked with their local economic developers and DCEO representatives. Larger companies hire Business Development Consultants, a few may be lobbyists but the majority are not. The consultants are being paid by the companies to compare all costs in each State being considered for a project. We should be very proud that the State of Illinois has provided incentives over the years that have assisted large and small businesses create jobs and add monies to our economy. We need private sector investment in our State. The private sector is the engine that allows the State government and its entities to be able to function. The last thing we want to do in this economy is “cut off our nose to spite our face”.

Comment by Endangered Moderate Species Monday, Dec 3, 12 @ 2:41 pm

In a word, unbelievable…

Comment by Loop Lady Monday, Dec 3, 12 @ 2:55 pm

EMS - And we all know DCEO has always followed its own guidelines, state rules, and federal law. - Not!

Comment by Crime Fighter Monday, Dec 3, 12 @ 3:16 pm

Crime Fighter- Can you provide an example of what you are alluding too? It is much easier to have a discussion from a position of fact rather than from a position of innuendo. It would be like me saying,”I read the book ‘Too Politically Sensitive’, and I now know that all Crime Fighters do not follow guidelines, state rules, and federal law.”

Comment by Endangered Moderate Species Monday, Dec 3, 12 @ 3:28 pm

The New York Times article contains clear evidence that the entitlements that must be cut are the corporate welfare entitlements, not social security and medicare. This has created a race to the bottom for the American middle class.

Comment by Ruby Monday, Dec 3, 12 @ 3:41 pm

I’m okay in principle and practice with giving tax incentives to corporations and businesses to relocate to Illinois or to stay here, and we don’t seem to be too exorbitant, compared to our neighbors. Wisconsin has been posting jobs losses, so it’s not getting a big bang for it’s incentives dollar.

I have a problem when corporations blackmail states and threaten to take their businesses elsewhere if they don’t get breaks. I also don’t it like it when these types of corporations and others support anti-labor and anti-government agendas, like they do in ALEC. When they are looking for any government subsidy to help themselves and yet are preaching the virtue of unfettered capitalism and shrinking government, and are anti-labor, that’s too hypocritical.

Corporate profits are at record highs, yet wages are at the lowest-ever share of GDP, according to an article published today. One reason wages are doing so poorly compared to corporate profits is the cheaper overseas labor markets.

http://money.cnn.com/2012/12/03/news/economy/record-corporate-profits/index.html?section=money_topstories

Comment by Grandson of Man Monday, Dec 3, 12 @ 4:05 pm

@Ruby:

I’m not disputing your belief that corporate welfare should be cut, but those “entitlements” don’t come anywhere close as far as monetary value as Medicare and Social Security.

*********

As for the topic at hand, my main beef with this is the constant whining that corporations engage in vis-a-vis taxes and the “business climate.” Instead of whining about taxes, maybe they should be whining about the unequal treatment businesses are getting in terms of handouts.

Now, that’s not to say that I don’t fully understand the need to “keep up with the Jones’.” You can’t very well sit by while other states pour from the gravy boat.

Comment by Demoralized Monday, Dec 3, 12 @ 4:05 pm

In conclusion, we got played, but only half as bad as the cheeseheads.

I feel better already.

Seriously, the problem here is that no State or Governor will ever “unilaterally disarm” or be the first to stop feeding the beast. The political fallout from losing a Cat plant or a Fortune 500 HQ is too high. On the other hand, the State of Washington has not fallen into the Pacific Ocean since Illinois paid a gazillion clams for its 150 HQ jobs to move to Chicago.

Comment by Arthur Andersen Monday, Dec 3, 12 @ 4:35 pm

Oops.

Add “Boeing” after “paid” in the above post and my rant will make much more sense. I think.

Comment by Arthur Andersen Monday, Dec 3, 12 @ 5:22 pm

“This is the natural evolution of the free market system.”

I understand what you are saying, but I hate seeing the term “free market” used to describe anything related to government incentive programs.

Generally, these programs are the opposite of a free market system. Companies who receive an incentive from the government receive an unfair advantage which is often at the expense of their competitors. For instance, in my small town, a national pharmacy chain opened a store with assistance from the city. As part of the agreement, the city is prohibited from offering the same incentive to another pharmacy chain. That makes it extremely difficult for another chain to compete in the town.

Instead of “natural evolution of the free market system,” how about we use the “natural evolution of the competitive crony capitalistic system?” I think that is a much more accurate description.

Comment by Pelon Monday, Dec 3, 12 @ 5:46 pm

“This is the natural evolution of the free market system.”

This is actually more like government picking winners and losers, not the free market syslem.

Comment by Ruby Monday, Dec 3, 12 @ 5:57 pm

For some local ratification of the Times’ findings: I’m part of a local journalism project that just did some reporting about the City of Evanston’s record in this area, where there’s been a lack of follow-up by the City after companies were awarded incentives, and the jobs which were supposed to be part of the quid pro quo for these tax breaks have yet to materialize.

Here are the links for more info:

http://www.howardtoisabella.com/2012/11/made-in-evanston-not-by-evanstonians/

http://www.howardtoisabella.com/2012/11/is-evanston-waffling-on-job-creation/

Comment by Toni Gilpin Monday, Dec 3, 12 @ 7:18 pm

It’s crony capitalism, and it blows.

It is a bipartisan problem, both parties are rotted to the core.

Comment by VanillaMan Monday, Dec 3, 12 @ 8:05 pm

Governments giving breaks to corporations is probably impossible to stop but the complete lack of oversight, follow-up and planning is what makes me crazy. Most states do hardly any analysis to see how effective these state subsidies are. What is the point of increased growth and employment if you also have increased poverty–hi Texas

Comment by Chitownmom Monday, Dec 3, 12 @ 11:02 pm

Obviously to consider a tax break one needs to know what tax revenue has been received, but much tax revenue is generated by the law firms that employ Cullerton and Madigan?

Comment by Mark Tuesday, Dec 4, 12 @ 5:35 am