Latest Post | Last 10 Posts | Archives

Previous Post: Only in Illinois

Next Post: Halvorson hedges on guns

Posted in:

* From the Senate Republicans in the wake of the state’s latest credit rating downgrade…

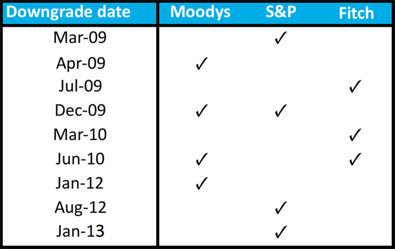

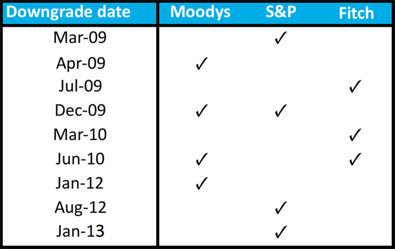

The rating drop from S&P gives Governor Quinn his 11th downgrade since taking office. No other Governor in the state’s history has presided over more credit downgrades than Quinn. In fact, Quinn now owns more downgrades than all earlier governors combined. The previous record holder, Rod Blagojevich, had three downgrades during his time in office.

* The Illinois Policy Institute has posted a couple of useful graphs. First, dates of the Quinn downgrades…

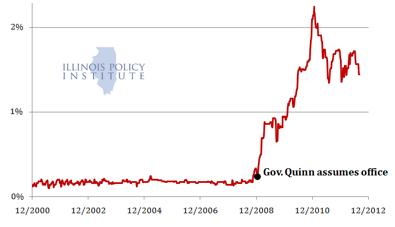

* And here’s the interest premium Illinois pays above AAA-rated states on 10-year bonds…

* Wordslinger had this to say in comments yesterday…

Illinois has and is cutting spending, has raised taxes substantially and is making big-time pension system contributions.

That, of course, gets you regular rating downgrades.

Yet during the Blago years, when spending kept going up, tax rates remained unchanged and pension payments were being blown off, the ratings remained unchanged until his last year or so.

Makes perfect sense.

I would only add that two years ago the state also reformed pensions for new employees, which should save quite a bit of money in the future.

* Whatever you say about Pat Quinn, and you can say a lot, he has at least tried to get the state’s finances in order. He’s made some very tough decisions, unlike his predecessor. Yet, it wasn’t until after both Rod Blagojevich and the big-spending George Ryan were both in prison did Illinois begin to pay a real price for fiscal profligacy.

Seems a bit like CYA for the ratings agencies to me. For all their tsk-tsking about Illinois, either they didn’t really see this coming, or they didn’t care. If they had, we’d have been slammed with big downgrades long ago.

posted by Rich Miller

Wednesday, Jan 30, 13 @ 11:03 am

Sorry, comments are closed at this time.

Previous Post: Only in Illinois

Next Post: Halvorson hedges on guns

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

The ratings agencies are usually slow on downgrading. Check out the way they handled the mortgage mess in 2006-2007. Anyway, Illinois can’t meet its financial obligations to retired government workers. The sooner this is understand the better. If Illinois had California’s weather 290 days a year it could get away with more: but cold weather isn’t most people’s cup of tea.

Comment by Steve Bartin Wednesday, Jan 30, 13 @ 11:16 am

It was the financial collapse and ensuing recession that precipitated these ratings downgrades. That also just happened to closely coincide with Blagojevich being arrested, thus the blame falling on Pat Quinn.

The collapse significantly hurt the already pension systems’ already shaky finances, and lowered Illinois’ tax revenues significantly. Thus the large deficits and the huge unfunded pension liability.

Look at the two different pictures the ratings agencies were presented with.

Pre-September 2008 - State leaders are playing plenty of budget games, but the state is largely paying its bills. There is a large pension shortfall, but Illinois hasn’t raised taxes in years and could do so in a pinch to shore up the pensions.

Post-September 2008/Current: The state has billions of dollars in unpaid bills, despite raising income taxes by 50%, and the pension systems’ unfunded liabilities have only gotten larger.

The ratings agencies should have blown the whistle sooner, but their downgrades are absolutely justified.

Comment by so... Wednesday, Jan 30, 13 @ 11:22 am

Evidence please. “…pension payments were blown off…” By Blago. How so? When? Don’t forget the pension bond deal that put 10billion into pension fund was in lieu of regular payments for two years and every other year pension payments were made as per the GA approved budgets required. Hardly justifies the “blown off” characterization.

Comment by Budgeteer Wednesday, Jan 30, 13 @ 11:25 am

===every other year pension payments were made as per the GA approved budgets required===

2005-06 pension holiday.

Comment by Rich Miller Wednesday, Jan 30, 13 @ 11:27 am

Rich — You describe the IPI table as the amount IL pays “ABOVE AAA” rated bonds. Is that correct? If accurate, my question is, what were the actual interest rates that IL paid on bonds going back to 2000? IL is, no doubt, paying higher rates than it would otherwise have to, but is the actual rate ~1.5+% higher than 10 years ago as the IPI chart would suggest? Given the reports of ‘historically low interest rates’, are IL’s lower or higher than prior IL bond sales? If so, by how much?

Comment by Hyperbolic Chamber Wednesday, Jan 30, 13 @ 11:28 am

As we should have learned from the last bubble, you can’t trust the ratings agencies. That’s not to say that the state doesn’t have a huge problem paying its bills, ignoring the pension for a moment. But Illinois does have strong laws protecting payment on debt. So even if the state takes a hit on interest, which is incredibly low at the moment, there have been no problems selling the bonds so far. Now, when the bond market finally realizes the effects of the Federal Reserve and all other central banks, rates will go up, and then Illinois will be in real trouble because the interest payments will be a big problem.

Comment by RetiredStateEmployee Wednesday, Jan 30, 13 @ 11:30 am

I think it would be instructive to look at actual bond yields over those same years since current yields are at historic lows.

Further reading: http://news.medill.northwestern.edu/chicago/news.aspx?id=214694

Comment by RetiredStateEmployee Wednesday, Jan 30, 13 @ 11:34 am

Or maybe they did see it coming, did care about it, but wrongfully assumed the General Assembly would address the problem before it got to this level of concern.

Comment by Anonymous Wednesday, Jan 30, 13 @ 11:40 am

Of course. Why didn’t I think of that. It’s the ratings agencies that are at fault.

Comment by John A Logan Wednesday, Jan 30, 13 @ 11:45 am

The bond market ratings reflect the bond market, so commentors who don’t understand a market, won’t understand bond ratings. Those seeing untrustworthiness are also displaying an incorrect assumption.

The 2007 market for bonds does not reflect the market realization of the impending government shortfalls. Since then, everything changed.

Bond buyers fall in, and out of, love for as many reasons as buyers in any other markets. Illinois is just another seller, and right now, the buyers ain’t gonna buy. Ask Jaguar how tough it is to make a sale after buyers sense that their is too much instability.

Rating agencies are not necessarily slow. Illinois can do a lot right, but still look like a Studebaker next to Texas’ Toyota. When you are down, buyers are scared away. When you are another loser in a market full of losers, it will take more than 2007’s fake state budget predictions to bounce back.

The Illinois-is-getting-screwed-on-this crowd are vastly overestimating how non-Illinoisans see us.

There is no “fairness” or “rules” here. To big government proponents, welcome to the real world where Zimbabwe is with $200 bucks, regardless of what their countryfolks want to believe.

We are the “Mississippi” of state bonds. Ask the state government there in Jackson how hard it is to override perceptions when you are on the bottom.

Comment by VanillaMan Wednesday, Jan 30, 13 @ 11:52 am

My mother (God rest her soul) once told me in her efforts to shape me up … “Good intentions paved the road to hell.” I don’t think the “Squeezy” campaign has done anything positive to help Quinn’s effectiveness as a governor and leader in getting important legislation passed and put on his desk for his signature. It seems like the downgrades speak for themselves.

Comment by Meaningless Wednesday, Jan 30, 13 @ 12:01 pm

Muni debt has been getting pounded for years because of the rating agencies’ recklessness and greed leading up to the Sept. 2008 financial collapse.

Let’s go to the Wayback Machine:

On Sept. 14, 2008, AIG was rated AA- by S&P.

Over the next two weeks, as the extent of AIGs losses in swaps becomes transparent, the Fed pledges $150 billion to prop them up.

Oops.

On September 15, 2008, Moody’s had Lehman Bros. at investment grade A2, Fitch at investment grade A+. That day, Lehman filed for Chapter 11.

Oops.

It goes on and on. They were sinners, you see.

–WASHINGTON — Conflicts of interest were largely responsible for the disastrous performance of credit rating agencies in assessing the risks of mortgage-backed securities, two former high-ranking officials at Moody’s Investors Service and Standard & Poor’s said Wednesday in Congressional testimony.

The securities issuers pay the agencies to issue ratings, and the agencies’ interests can eclipse those of investors, Jerome S. Fons, who was the managing director for credit policy at Moody’s until 2007, told the House Committee on Oversight and Government Reform.

“While the methods used to rate structured securities have rightly come under fire, in my opinion the business model prevented analysts from putting investor interests first,” he said.

And Frank L. Raiter, who was the head of mortgage ratings at Standard & Poor’s for 10 years, characterized the failures at that company by saying simply: “Profits were running the show.”–

http://www.nytimes.com/2008/10/23/business/economy/23rating.html?_r=0

But now they’ve seen the light. And muni debt issuers are paying for it, even sovereign states that have never missed a payment in nearly 200 years and that no investor in their right mind believes ever will.

Comment by wordslinger Wednesday, Jan 30, 13 @ 12:11 pm

so-’pre 2008-Illinois was largely paying its bills on time’. Where were you living then?

Comment by steve schnorf Wednesday, Jan 30, 13 @ 12:24 pm

I suspect one of the ratings agencies’ larger concerns is the upcoming expiration of our income tax increase.

Comment by steve schnorf Wednesday, Jan 30, 13 @ 12:27 pm

Illinois hasn’t been AAA for 30 years. I think 7 states have a AAA rating right now. The downgrade to municpal credit has been universal. To be sure, Illinois is special - but implying that we would be AAA if we solved pensions, back bills, and balanced the budget is not likely.

Comment by Archimedes Wednesday, Jan 30, 13 @ 12:28 pm

Even if the ratings agencies are full of it, the bottom line is that they can have a pretty large influence, particularly in who is allowed to buy the debt. There are quite a few funds that aren’t allowed to buy debt once it hits the lower grades.

Comment by Anon Wednesday, Jan 30, 13 @ 12:56 pm

==implying that we would be AAA if we solved pensions, back bills, and balanced the budget is not likely.==

Agree. And at the same time, not solving pensions absolutely has an impact on how much interest the state has to pay on bonds.

Comment by Robert the Bruce Wednesday, Jan 30, 13 @ 12:56 pm

=== Even if the ratings agencies are full of it, the bottom line is that they can have a pretty large influence, particularly in who is allowed to buy the debt. There are quite a few funds that aren’t allowed to buy debt once it hits the lower grades.===

Pretty scary power for unregulated entities.

Comment by Norseman Wednesday, Jan 30, 13 @ 1:05 pm

===every other year pension payments were made as per the GA approved budgets required===

From page 48 of the State of Illinois Report of the Pension Modernization Task Force:

http://www.ilga.gov/commission/cgfa2006/upload/112009pensiontaskforcereport.pdf

How did we get here?

The reality is that the primary cause of the State’s unfunded pension liability

is Illinois’s decades-long failure to make its full, actuarially required employer

contribution to the five pension systems. This poor fiscal practice was

codified in the 1995 pension funding bill “P.A. 88-0593,” known commonly as

the “Pension Ramp” bill. During the first 15 years of the Pension Ramp, the

State’s employer contribution was set at levels that continued the practice of

not making the full actuarially required employer contribution, thereby

increasing the unfunded liability amount. This poor fiscal practice was

followed by a $10 billion pension obligation bond issue in 2003 (P.A. 93-

0002), which diverted $2.7 billion of the bond proceeds to cover expenses in

the state’s operating budget, thereby allowing the state to skip part of the FY

03 and all of the FY 04 payment required under the 1995 funding law. In

addition, P.A. 94-0004 reduced the FY 06 and FY 07 payments by $2.3

billion. The deadly combination of nearly 30 years of systematic State

underfunding of its employer contributions to the pension systems, followed

by the cataclysmic decline in asset values caused by the national meltdown

in financial markets over the last year, combined to create an all-time high in

the State’s unfunded pension liability.

Comment by Joe M Wednesday, Jan 30, 13 @ 1:25 pm

–Bond buyers fall in, and out of, love for as many reasons as buyers in any other markets. Illinois is just another seller, and right now, the buyers ain’t gonna buy.–

Never thought Eros played much of a role. But buyers do buy. Illinois bond issues are regularly oversubscribed by a factor of four. Demand exponentially outstrips supply.

The market wants the debt. The rating agencies over the last 15 years or so have not operated in their historic third-party role.

Comment by wordslinger Wednesday, Jan 30, 13 @ 1:39 pm

==Of course. Why didn’t I think of that. It’s the ratings agencies that are at fault.==

Apparently you were asleep during the financial market collapse and the value of the rating agency ratings before then. Come to find out they didn’t mean anything.

Comment by Demoralized Wednesday, Jan 30, 13 @ 1:44 pm

The IPI and the Senate Republicans are only interested in scoring political points. It’s funny with their charts they try to imply this is Quinn’s fault. I think the problem goes back a little before Quinn’s time. There is plenty of blame to go around, but it is hardly all Quinn’s fault. I believe there were some Republicans that might have had a hand in it too.

Besides, it doesn’t really make any difference what the Republicans say. They have no interest in helping to solve the problem anyway. And I’m sure the usual commenters will be on here right there with them saying it’s the Democrats problem. Lots of blame. No substance.

Comment by Demoralized Wednesday, Jan 30, 13 @ 1:47 pm

Blaming Quinn is out of line, but arguing against the downgrades is equally crazy. Fact is the State still has a long road to hoe to find itself financially stable. And if buying a 20 year bond, it’s fair to say there is more risk, however slight, with an Illinois bond than an Iowa bond. Illinois has a lot more long-term financial concerns than just pensions, particularly with health care. I am not convinced the long-term financial situation is as easily solved as many here seem to think.

Comment by Shemp Wednesday, Jan 30, 13 @ 1:59 pm

–There are quite a few funds that aren’t allowed to buy debt once it hits the lower grades. –

Believe me, it would be a disgrace if any state’s debt were lowered to junk status, given the credit rating agencies track record over the last 15 years or so.

But I don’t know that junk status would mean a lack of investors.

Funds can always change their criteria.

The muni bond market is valued at about $2.7 trillion.

The corporate junk bond market is at $1.7 trillion and growing.

There is, at least some, understanding. transparency and regulation in those markets.

On the other hand, the size of the private, largely unregulated, opaque OTC derivatives market — swaps — is estimated at about $640 trillion.

Put it this way: investors are plowing $640 trillion into investments that no one in the world understands, but bring big yields — until they don’t and turn out to be worthless.

Everyone chases yield.

Comment by wordslinger Wednesday, Jan 30, 13 @ 2:35 pm

Word,

You just answered one of the quesiton I was going to ask: aren’t both corporate and individual investors chasing yield?

My second question was going to be: Given the fact the market seems to be “demanding” a higher interest rate on IL bonds, doesn’t that actually make IL bonds attractive to investors even though there is a bit higher risk?

Comment by RNUG Wednesday, Jan 30, 13 @ 2:59 pm

Quinn does deserve more credit on this than many give him, including myself.

The backward-looking nature of ratings agencies exposes inherent shortcomings in their accuracy and weakness in their evaluation capabilities.

Fortunately, one Illinois entity has been in a position of influence and foresight as this problem devloped during the past 30 years: Michael Madigan.

There’s certainly plenty of blame to go around, but it is amazing Madigan shoulders such little blame for Illinois’ current state.

It would be even more amazing if his daughter becomes Governor just as Illinois financial strains comes to a head.

The man is like a ghost you cannot or will not lay a hand on.

Perhaps he can tell us how this all ends.

Comment by Formerly Known As... Wednesday, Jan 30, 13 @ 3:18 pm

“The bond market ratings reflect the bond market, so commentors who don’t understand a market, won’t understand bond ratings.”

That is an incorrect statement. Bond ratings are based on a debt issuer’s ability to repay what they owe. The demand for a particular issue in the bond market is reflected in its yield. The bond market only affects the rating when the yield required on an issue gets high enough to make it less likely that the issuer will be able to make the interest and/or principal payments on time.

Comment by Pelon Wednesday, Jan 30, 13 @ 3:23 pm

Joe M. from the report “…the state’s employer contribution levels was set at levels that continued the practice of not continuing to make the actuarially required employer payments …”

So the “smoking gun” is the Pension Ramp bill PA88-0593. Who do you suppose had a hand in that bill? The invisible hand knows all. Blamming Blago or Quinn is an attempt to distract, obfiscate and rewrite history.

Comment by Fair Share Wednesday, Jan 30, 13 @ 3:33 pm

Rich -

From Pension Junkie, here, May 31, 2012

https://capitolfax.com/2012/05/31/the-next-time-you-blame-the-state-for-skipping-pension-payments-remember-this/

To whit:

Debunking the urban legend of “pension holidays”, and in response to Senator Rodagno, Dragnet’s Joe Friday said it best, “Just the facts ma’am”:

According to Comptroller Topinka’s FY2010 Comprehensive Annual Financial Report (CAFR), the FY2006-2007 pension holiday’s were repaid in the form of additional contributions from FY2008-2010 ( http://www.comptroller.state.il.us/index.cfm/linkservid/083E57BA-1CC1-DE6E-2F48783E3F984EF7/showMeta/0/ p.122)

Comment by Anyone Remember? Wednesday, Jan 30, 13 @ 3:38 pm

–My second question was going to be: Given the fact the market seems to be “demanding” a higher interest rate on IL bonds, doesn’t that actually make IL bonds attractive to investors even though there is a bit higher risk?–

I’m sure it does, as evidenced by the demand for them. But I think the state could work harder driving down the price when demand is exponentially higher than supply.

Delaying a sale is way to do that. But I worry that a lot of times the state has accepted a higher price so they can put out a press release saying “demand for bond offering was oversubscribed four times.”

That’s not a win, to me. I’d like to see the a price closer to the intersection of supply/demand.

Believe me, I worked on a daily basis with the rating agencies for years, and still do, but not so much.

Their analysts are tops, the best. But for many years, their rating committees have been suspect, at best.

I can see, rationally, in comparing Illinois government’s fiscal position (not the state’s economic position), to other states, that Illinois is rated close to the bottom (not last, but at the lower end).

States are sovereign, have virtually unlimited abilities to raise revenues and cannot go bankrupt.

It makes no sense, whatsoever, for any state to be rated lower than other local government munis or, for crying out loud, corporate debt. None.

It’s happened time and time again in the last fifteen years where corporate debt was rated AAA or AA and they were out of business weeks later.

Comment by wordslinger Wednesday, Jan 30, 13 @ 3:47 pm

Rich- for a number of months all of the fans on this blog of continuing to believe the State’s pension mess was not a problem because investors were lining up to buy Illinois debt can now reevaluate as Illinois today had tocancel its 500 million bond sale due to market conditions- The kick the can down the road ended as there is no more road- Illinois needs to reduce its pension indebtedness immediately and the only option left is reduction of benefits- Absent access to the bond market the State is going to come to a screeching halt -Today Athens is in better shape then Springfield

Comment by Sue Wednesday, Jan 30, 13 @ 3:49 pm

Sue:

no one believes pensions are not an issue, as they have been for 60 years (hint: they’re long-term obligations);

investors do line up to buy Illinois debt;

the bond issue has been delayed (as all issuers do from to time), not cancelled;

reduction of benefits are not the only option;

and Athens is not in better shape than Springfield.

Other than that, spot on. Home run.

But please, hit the return button sometime.

Long, winding, single paragraphs are like reading a fever dream.

Comment by wordslinger Wednesday, Jan 30, 13 @ 4:03 pm

Sue

==and the only option left is reduction of benefits==

Ever read the Illinois Constitution of 1970? Specifically, Article XIII:

“SECTION 5. PENSION AND RETIREMENT RIGHTS

Membership in any pension or retirement system of the State, any unit of local government or school district, or any agency or instrumentality thereof, shall be an enforceable contractual relationship, the benefits of which shall not be diminished or impaired.”

Comment by Anyone Remember? Wednesday, Jan 30, 13 @ 4:13 pm

Wordslinger,

What are these other options you speak of? More revenue? That’s a grand plan! Take from the masses(IL taxpayers) and give to a select few(State employees). Maybe cuts in other areas? Everything is already being cut to protect pensions. I’m with the Sue, the can has hit the wall. Drastic action has to be taken with pensions.

Comment by DINO Wednesday, Jan 30, 13 @ 4:16 pm

To Anyone Remember- Be sure to bring a copy of the constitution to the Court of Claims when you fail to get your payments in 8 to 10 years– absent an overhaul that is where the pension programs are headed- As an aside- How come NJ earned a Four percent return last year while ITRS, was under 1 percent- a three percent swing for ITRS would have resulted in 1.2 billion of more $$ available for benefit payments- maybe it is time for someone to visit how the pension funds are being managed for not only the benefit of pension members but the taxpayers as well

Comment by Sue Wednesday, Jan 30, 13 @ 4:20 pm

Sue -

Illinois Supreme Court ruled during Walker years pensioners can sue when pensioners payments are missed, and the Constitutional mention of “enforceable contractual relationship” puts pensioners alongside the bondholders, and ahead of everyone else (barring a change in federal law).

Others far more up on actuarial things than I have come up with proposals to fix this mess (for example, Representative Fortner). You don’t share their optimism?

Comment by Anyone Remember? Wednesday, Jan 30, 13 @ 4:46 pm

Rich, your entire assessment from “I would only add…” to “…big downgrades long ago” is right on, fair, and noteworthy. Indeed, the problem’s been there for eons in Illinois, Quinn HAS diligently tried, paying the piper finally started after they put away George ‘n Rod, and most definitely there’s a lot of CYA going on (they didn’t care or incompetently missed it) which the current Gov. now has to ironically bear the brunt of–for being a Gov., like it/him or not, honestly confronting it! Nutty. And you’re right for the reminder–at least SOME pension/ fund-saving reform WAS passed 2 years ago to get the ball rolling…

Comment by Just The Way It Is One Wednesday, Jan 30, 13 @ 5:18 pm

“What are these other options you speak of? More revenue? That’s a grand plan! Take from the masses(IL taxpayers) and give to a select few(State employees). Maybe cuts in other areas? Everything is already being cut to protect pensions. I’m with the Sue, the can has hit the wall. Drastic action has to be taken with pensions.”

So the state doesn’t pay it’s share for 40 years and now the bill is due…..so lets just cut benefits. As tempting as this is it won’t solve the problem for more than three to four years. You simply cannot cut the pension obligation enough to solve the problem unless you just want to renounce the debt almost totally. Good luck with that! The Cullerton approach, while conceptually legal, doesn’t come close to even making a dent in the long term debt. The Nekritz fiasco, not even remotely legal, cuts more but also falls short. No simple quick fix for fiscal mismanagement that spans almost 60 years. Go figure!

Taking from taxpayers? No the taxpayers have been taking from the pensioners for almost 60 years! Now that the bill is due people are wanting to continue the theft! There is a reason that the clause was put into the state constitution.

Comment by Old and In the Way Wednesday, Jan 30, 13 @ 5:37 pm

ENOUGH IS ENOUGH- The State has been forced to cut back on every program to allow the pensions to continue to vacuum available revenues- Any one recently wonder why the CTA and METRA are raising fairs- answer- absent state subsidies- Anyone wonder why local schools are not getting usual state funding levels- answer- absent state subsidies- How about physician licensing programs? Same answer- Same goes for all other state funded programs- Illinois taxpayers are paying more and getting less so we can continue to fund generous pension programs and other retiree benefits- Something has to change and change fast because the money is not there and raising taxes again is a non-starter

Comment by Sue Wednesday, Jan 30, 13 @ 5:39 pm

It’s amazing that some of y’all truly believe the public will go for a tax hike to save your pensions as-is.

Not. Gonna. Happen.

Comment by Rich Miller Wednesday, Jan 30, 13 @ 5:41 pm

Rich- Thanks for the introduction of sanity to the discussion- there are three and only three issues (1) Revenue- already happened;(2) Benefit reductions- has to happen and let the Supreme Court tell us that it would rather see the State forced into a fiscal restructuring; and (3) Better investment returns- which probably won’t happen until the State imposes some greater oversight into the Pension Funds’ investment parameters-

Comment by Sue Wednesday, Jan 30, 13 @ 5:48 pm

Sue -

So … you’re saying the Supreme Court will ignore the Constitution? If so, what’s the next thing they ignore?

Comment by Anyone Remember? Wednesday, Jan 30, 13 @ 5:58 pm

A rose by any other name……….

The cost shift IS a tax increase! And I believe that the Speaker will get his way on this one. Once the shift is in place it will be altered and probably expanded. Most likely after the courts strike down part of the Nekritz/Cullerton Bills. The ramp will probably also be revised to lower the payments.

Will pensions be altered? Probably, but not as drastic as most want.

Comment by Old and In the Way Wednesday, Jan 30, 13 @ 6:06 pm

Old,

If the state courts eventually find against the retirees, can’t / won’t they continue the fight in fed court since it is, at it’s heart, a contract law issue?

Comment by RNUG Wednesday, Jan 30, 13 @ 6:59 pm

–It’s amazing that some of y’all truly believe the public will go for a tax hike to save your pensions as-is.–

No, that’s not going to happen. It will be tough enough to hold on to the temporary income tax increases.

You can’t get rid of those without replacing them in some other way and hope to tread water.

That mostly impacts the short game, but on the long game, there are other options.

On pensions, we could stop yelling that the sky falling. That would help.

Seriously, does anyone that yells that really crunch the numbers? Past investment performance, projected investment performance? Or, do they rely on what someone “says.”

From my experience, there are very few reporters or “public policy” loudmouths who can count to 20 without taking off their shoes. You don’t want to know how they get to 21.

Anyone want to give us a date when a pension fund goes bust? There have been many such predictions over the last 60 years, anyone got a new good one?

Over the last 30 years or so, I’ve been assured that:

Social Security is bust (many times);

Medicare is bust (many times);

we’re out of oil (many times);

the Earth is freezing;

the Earth if frying;

Japan’s taking over (oldie but a goodie);

the Soviets are taking over (seriously, what were we on?)

the Chinese communists are taking over;

the Chinese capitalists are taking over.

Blah, blah, blah. Short-term gas, masquerading as long-term insight.

I don’t rattle so much, based on that.

I can’t help it if the rating agencies have no humility based on their track record, or no real transparent explanation for their weird ranges of debt evaluation.

But it doesn’t rattle me. Nor should it you.

Comment by wordslinger Wednesday, Jan 30, 13 @ 7:08 pm

Word,

I’m inclined to agree with you.

There have been several realistic proposals, mostly involving resetting the ramp, dedicating current pension revenue streams in the future, more money from the employees, the cost shift, and making the ‘temporary’ tax increase permanent, that can pretty much fix the pension problem.

But there’s one problem in doing most or all that; all it fixes is the pensions. It doesn’t free up any money for anything else; it doesn’t even free up enough money for the rest of the state spending to keep up with inflation. So they have to face the fact the current revenue structure can’t support the current service structure and fix that … and I don’t see that happening in Illinois.

Comment by RNUG Wednesday, Jan 30, 13 @ 7:18 pm

Its fun watching Illinois implode. For ages the kick the can down the road approach has always worked on election day. The only thing that can save Illinois is a burst of inflation…and that possibility is being worked on

Comment by Quipper Wednesday, Jan 30, 13 @ 7:21 pm

Come on Rich, if you want to side with Quinn just come out and say it! He has been the worst govenor in terms of spending and increasing give away programs. He has no interest in curbing spending and is taxing Illinois right into the worst Black Hole ever seen by any state. He can’t make up his mind to save his own life. Give us a Govenor that will make a decision right or wrong and at least we will be doing something.

Comment by Zoble21 Wednesday, Jan 30, 13 @ 8:33 pm

word, actually the Executive Director of TRS says they are going to go belly up in about 20 years.

No fear mongering there.

I suspect “Sue” is a big fan of his.

Comment by Arthur Andersen Wednesday, Jan 30, 13 @ 8:55 pm

Word,

You made a good point about very few people taking the time to analyze the numbers. I do cursory checks on the numbers I see people toss around. I also crunch my own now and then … but it is time consuming even when you know where to find the numbers. Source for these was the SERS annual report, financial section.

Just took the trouble to build a small spreadsheet for SERS showing net value, cash in (employee, employer and earnings or losses), cash out (expenses and all distributions including expenses, refunds, and pensions) for FY2011 back to FY2002 (those reports are online and easy to find the numbers in). This is very simplistic and I’m ignoring funding for all future earned obligations, so we don’t care about the actuarial funding level. All I did was look at cash flow over the recent past.

Results are interesting. Over those 9 years, SERS took in $6.7B more than they paid out. And that included the huge investment losses in 2008 and 2009. All numbers are in millions; negative in parens. I’ve only posted selective columns since it’s hard to format for Rich’s blog.

FYear - net value - cash in - cash out - gain/loss

2011 - 10907.7 - 3312.3 - 1529.6 - 1782.7

2010 - 9201.9 - 2141.6 - 1405.9 - 735.7

2009 - 8477.9 - (1191.8) - 1325.7 -(2517.5)

2008 - 10995.4 - 156.8 - 1240.4 - (1083.6)

2007 - 12078.9 - 2363.4 - 1184.4 - 1179

2006 - 10899.9 - 1537.8 - 1132.1 - 405.7

2005 - 10494.2 - 2227 - 1086.3 - 1140.1

2004 - 9990.2 - 5550.9 - 998.3 - 4552.6

2003 - 7502.1 - 1377.6 - 868.1 - 509.9

I then ran some projections under a few scenarios; all assumed the cash out would grow by the 3% COLA every year. I didn’t try to figure out how many new annuitants would go on the roles every year or how much future employee / employer contributions would increase. In other words, simplistic and pretty much neutral to negative assumptions on average. I’m not going to try to post the columns here (too much typing); you’ll have to take my word on the rest of this.

Conclusions - As shown in the 9 years above, cash in has been exceeding cash out most the time. So while a long way from being “properly” funded, SERS is “healthy” for right now. If everyone stopped paying in, the fund would be broke in about 6 years. But that isn’t going to happen. Unless we hit another major recession like 2008 / 2009 and assuming similar future contributions from both the employees and the state and earnings ($1.9B average), the SERS fund will last until about 2038 (26 years). If you assume the FY11 contribution level ($1.4B) with zero earnings, the fund will last until about 2028 (16 years). If the state continues to follow the ramp and increase the yearly contributions, the fund will last even longer.

It’s anybody’s guess on when the SERS fund will go broke if nothing is done, depending on the assumptions used. But under a number of reasonable scenarios, I don’t think it is going broke any time soon.

And no, I’m not going to crunch the numbers for SURS and TRS (it’s tougher to dig through their reports). I might do GARS and JRS some other day since they follow the SERS format.

Comment by RNUG Wednesday, Jan 30, 13 @ 8:57 pm

Sue @ 4:20,

Don’t know your experience but my mom used to represent a state agency at Court of Claims hearings. It was a thankless job. Basically she ended up agreeing the state owed the money and it was ordered paid. No money left from last year?, not a problem; since you were in the Court of Claims, you were already past the lapse period and in the next year, just take it out of the current year’s approp. End of story.

Comment by RNUG Wednesday, Jan 30, 13 @ 9:53 pm

Zoble21-I hope that was snark. If not, take your medicine for a few days straight, get some rest, and then do some googling to update yourself with real data

Comment by steve schnorf Wednesday, Jan 30, 13 @ 10:32 pm

AA, RNUG, the whole subject starts to wear you out.

The Chicken Littles rule the roost and drive the narrative. And don’t look for any help understanding from most of the media, our host excluded, because numbers ain’t really their thing.

The politics are a little easier to understand.

Ty and the committee boys are part of the national Masters of the Universe club that want to bust the public employee unions because that would be good for …… something, really important, I’m sure.

On the state level, there are more than a few big-time Democrats (cough, MJM) who would love to stick it to many union state employees because they came up under Blago and GOP administrations, anyway.

If you can stick it to the Republican suburbs to pay for their school pensions, the more the better.

Comment by wordslinger Wednesday, Jan 30, 13 @ 10:35 pm

word,

I agree it wears you out. It also runs up my blood pressure that went down when I retired.

Right now my feeling is pass something, get it in court, and let’s see what happens.

Comment by RNUG Wednesday, Jan 30, 13 @ 10:44 pm

RNUG, my head hurts from all the posting today. I appreciate the effort you put forth into that review, but it has a basic flaw. Most of the investment income, or gain/loss as you label it, is unrealized gain and as such can’t be used to pay pensions. One can’t mix a cash flow analysis, or burn rate, with a longer term insolvency projection that takes into account actual expected gains/losses as well as portfolio income.

If you were to take your chart above and substitute only the actual cash distributed from investments, probably only FY 2004 (POB proceeds) would have shown a positive cash flow position.

I have seen the figures for TRS calculated in this fashion and a similar pattern is indicated.

Comment by Arthur Andersen Wednesday, Jan 30, 13 @ 10:46 pm

AA,

I’ll concede your point. Excluding all earnings, 2004 was positive (+1.1B) and 2010 was almost in balance (-64M).

Since the question was how long would the current fund last from now, I’ll still contend that, like a personal retirement portfolio invested in both stocks and bonds, you would gradually liquidate it over time … and my middle assumption of no earnings should still be valid if the current valuations are close to correct and the fund should be good for about 16 years.

Comment by RNUG Wednesday, Jan 30, 13 @ 11:03 pm

For all of you constitutional scholars out there lacking law school degrees- check out the US Supreme Court Opinion involving the State of ( I recall Kansas) which during the Depression renegged on state contracts- The Court( I believe Justice Jackson) opined that the State’s Constitution had to recognize the fiscal emergency facing the State and ruled that the contract need not be enforced- The illinois Supreme Court is a political body and will not order the legislature to impose what would have to be confiscatory tax rates- At some point the unions will have to take a haircut because the money is not there and the Supremes will not bankrupt every other state program to enable the pensions to payout the “promised” benefits- forget the law- the solution has to be based on politics and the politics will not permit more tax increases

Comment by Sue Thursday, Jan 31, 13 @ 7:20 am

Sue, where did you graduate from law school and are you currently practicing?

Comment by Arthur Andersen Thursday, Jan 31, 13 @ 8:06 am

Old and In the Way,

Your name says it all. You, as a state employee, benefited just as much from the money that wasn’t put into the pensions as I did. That money went to the state as a whole, not just non-state employees. As a taxpayer it wasn’t our decision to skip them. We did not tank the market, we did not allow people to live longer, but YOU and others like you want us to cover 100% of the bill. Yes, 100% because pension income is not taxable so you are paying nothing for it. And yes, you can cut pensions enough to solve the problem.

Comment by DINO Thursday, Jan 31, 13 @ 9:03 am