Latest Post | Last 10 Posts | Archives

Previous Post: Kass on Lisa Madigan

Next Post: Dem wants to challenge JBT

Posted in:

* SJ-R…

Illinois’ one-dollar-per-pack cigarette tax increase that took effect a year ago this month is expected to fall $130 million short of initial estimates, meaning it won’t raise quite as much as projected for school capital projects because of the way the funding formula is set up.

The increase, which hiked the state’s 98-cents-per-pack tax to $1.98 last June, is expected to bring in about $212 million in additional revenue for the current fiscal year, which ends June 30.

That’s well short of the $350 million in additional revenue originally projected, according to a monthly report released at the end of May by the Commission on Government Forecasting and Accountability.

A decline in sales that typically follows a significant tax increase is partially why the revenue is falling short, the report states.

Significant stockpiling of cigarettes with older tax stamps is another reason for the shortfall.

* Speaking of taxes…

OfficeMax Inc. is asking the state of Illinois for tax breaks to keep the company’s headquarters in-state after the office supply chain’s merger with Office Depot Inc. is complete.

OfficeMax CEO Ravi Saligram and state Sen. Tom Cullerton made their pitch yesterday during a hearing on the state’s pension crisis. Cullerton is a Democrat from west suburban Villa Park sponsoring legislation to provide incentives if the company keeps at least 2,000 full-time jobs at its headquarters and other non-retail locations.

Naperville-based OfficeMax and Boca Raton, Fla.-based Office Depot in February announced plans to merge. The companies are trying to decide where to locate their combined headquarters.

* Meanwhile…

Gov. Pat Quinn’s administration on July 1 will start paying the wage rate that was promised to thousands of unionized government workers in 2011 and 2012, although Illinois lawmakers didn’t approve extra funding for back wages owed, officials said Wednesday.

Employees in six state agencies will get raises of at least 7.25 percent going forward, starting with the new fiscal year, according to an email sent to the American Federation of State, County and Municipal Employees’ 35,000 members and obtained by The Associated Press.

That includes a 2 percent raise owed in the current contract and the 5.25 percent increase offered in 2011 and 2012 that Quinn reneged on. There will also be some back-money paid, but for the most part, only that which a court ordered set aside in 2012 or leftover funds from this budget year that Quinn officials have promised to put toward the overdue wages.

Not all employees will get what they’re owed for the past two years because lawmakers didn’t act on a supplemental appropriation to cover the $140 million to $160 million price tag, AFSCME director Henry Bayer said in the email.

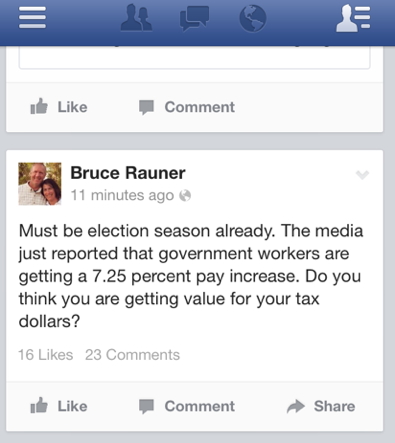

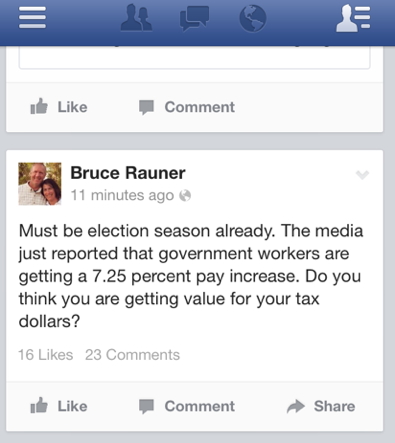

Bruce Rauner reacts on Facebook…

* In other news…

The state agency charged with investigating child abuse claims continues to flounder when it comes to meeting deadlines for initiating and completing investigations, a new audit notes.

In a report released Wednesday, Illinois Auditor General Bill Holland said the Illinois Department of Children and Family Services saw a significant jump in the number of abuse cases that weren’t determined to be unfounded or credible within a required 60-day timeframe.

The audit found that 884 of nearly 65,000 allegations missed the deadline, compared to 115 of 63,000 the previous year. It was the biggest backlog since 2006, when more than 1,000 cases missed the deadline.

* And…

Bookkeeping is sloppy at the Illinois Department of Transportation, where contracts have been hastily awarded for “emergencies” such as trash collection and overtime claims have gone unchecked, according to a state audit released Wednesday.

Other problems in fiscal years 2011 and 2012 included shoddy inventory records and duplicated payments to vendors, according to the Illinois auditor general’s report, which said some problems have festered since 1994.

IDOT officials said they agreed with the findings and promised to improve. The department is led by Transportation Secretary Ann Schneider, who took over in late 2011. She was preceded by Gary Hannig.

* One more…

In March, Gov. Pat Quinn issued an executive order to eliminate or consolidate 75 government panels after the Better Government Association highlighted the waste and perks that accompany many taxpayer-supported boards and commissions.

The aim: trim the bureaucracy and save money.

But on the final day of the just-completed Illinois General Assembly session, the state Senate quietly blocked Quinn’s order, claiming he didn’t have the authority to eliminate 37 — or nearly half — of those panels.

Quinn’s press secretary said the governor was “surprised” by the Senate’s action, which she called “disappointing.”

A spokesman for Senate President John Cullerton, D-Chicago, said his boss is committed to streamlining the numbed of boards and commissions, but it needs to be done through legislation. In other words, it’s the legislature’s call, not the governor’s.

posted by Rich Miller

Thursday, Jun 20, 13 @ 11:24 am

Sorry, comments are closed at this time.

Previous Post: Kass on Lisa Madigan

Next Post: Dem wants to challenge JBT

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

so again, for those of you out there saying that this is a “contrived fiscal emergency,” this is another example of the state of Illinois not having enough money to meet all of financial obligations.

and yes I know there were new pork projects approved this year, but did anyone out there really expect the GA to act in a fiscally prudent manner, and are you really going to argue that there “must not be a fiscal problem since there are new pork projects.” please.

so let’s see….where do we put the money…do we give our state employees raises or do we fully fund our school systems “promised” general state aid?

I guess we will give our state employees raises.

Comment by biased observer Thursday, Jun 20, 13 @ 11:31 am

Yes, Bruce, I do think our state workers deserve the raise they were promised.

Comment by Chavez-respecting Obamist Thursday, Jun 20, 13 @ 11:32 am

—

Employees in six state agencies will get raises of at least 7.25 percent going forward

—

lots of non-gov workers have been 2-3 years without raises (the ones that didnt get laid off).

Comment by RonOglesby Thursday, Jun 20, 13 @ 11:33 am

It would appear the administration is picking and choosing which contractual agreements to adhere to. For instance the contractual agreement with state retirees with 20+ years who thought their retirement benefit included lifetime health care.

Comment by BehindTheScenes Thursday, Jun 20, 13 @ 11:45 am

So then Rauner must be outraged that CEO’s of public companies had thier pay go up 31%

http://www.jsonline.com/business/states-10-best-paid-executives-saw-pay-grow-31-on-average-in-2012-b9928943z1-211705061.html

Comment by Ghost Thursday, Jun 20, 13 @ 11:47 am

@Ron:

Most of this are raises from a prior contract that were owed. And there are lots of non-union govt workers who have had raises in over 5 years. Also, I continue to cry bull with these claims that those in the private sector have it so much worse. Every single one of my friends in the private sector has gotten raises AND bonuses every year. I’m tired of this constant comparison and the insinuation that everybody should be pulled down. Get over it.

Comment by Demoralized Thursday, Jun 20, 13 @ 11:51 am

@Ghost:

Exactly. There is nothing more disgusting to me than rich fat cats like Rauner complaining about how much people get paid and what kind of pensions people get. I have zero respect for gazillionaires complaining about how good the masses have it.

Comment by Demoralized Thursday, Jun 20, 13 @ 11:52 am

@Demo,

I haven’t had one in 3 years. none of my guys in 2.

Comment by RonOglesby Thursday, Jun 20, 13 @ 11:53 am

just not enough money for the state to meet all of its obligations. you are in denial if you don’t see that.

Comment by biased observer Thursday, Jun 20, 13 @ 11:57 am

He is Ghost. He’s outraged that it didn’t increase more. Cuz they’re the creators, ya know.

Comment by PublicServant Thursday, Jun 20, 13 @ 11:58 am

@Ron:

And I haven’t had one in 6 years. I don’t buy into your “lots of people” argument. I’m sorry but I don’t because just like you have anecdotal evidence I have anecdotal evidence to the contrary. And give your guys a raise for pete’s sake.

Comment by Demoralized Thursday, Jun 20, 13 @ 12:06 pm

So does this mean employees and retirees will not have to pay healthcare premiums until all parties receive their back pay? Wasn’t there some “escape clause” the union mentioned?

http://www.sj-r.com/breaking/x1213305072/Quinn-Cant-seek-back-pay-for-state-workers-until-AG-drops-lawsuit#axzz2WUB5Cbdk

Comment by Tsavo Thursday, Jun 20, 13 @ 12:11 pm

$130 million short on the cigarette tax hike. Even an idiot like me saw that coming a mile away. That means Medicaid also loses an additional $130 million in federal matching funds. The tax hike was sold as being for Medicaid, so where did the school capital projects come from? Are they trying to hide that they already spent that $260 million and now the state won’t get it?

The people who made this $260 million mistake are all incompetent, or worse, and should lose their jobs. But it’s Illinois, nobody cares even if they notice such blatantly bad job performance.

Comment by Jeff Trigg Thursday, Jun 20, 13 @ 12:12 pm

Rauner must be one of those uber-capitalists that doesn’t believe in honoring contracts.

I don’t know why he’s down on public employees. He made a fortune off their retirement funds.

Comment by wordslinger Thursday, Jun 20, 13 @ 12:12 pm

@Tsavo:

That “out” clause was related to the new contract. Back pay is something different, though no less important.

Comment by Demoralized Thursday, Jun 20, 13 @ 12:17 pm

DCFS went through a major reorganization last year under its latest director, appointed by Quinn after the previous incumbent resigned, supposedly pursuant to a contracting scandal.

I believe the reorganization included changes in the administration of child protection investigators, who no longer report up through one statewide division, with its own operational management. Rather, they all report only to regional DCFS offices around the state. As part of these changes, some management jobs were to be eliminated. I suppose these changes could have had an effect on statistical compliance although not necessarily a permanent effect.

Comment by cassandra Thursday, Jun 20, 13 @ 12:22 pm

To the first point in the article… Cigarette tax revenues fall short of estimates because of declining sales. What a great problem to have, ya know? It should have been anticipated, though… but still. Maybe, over the long term, declining state health expenditures for these former smokers will offset that shortage?

Comment by FoxValleyPride1 Thursday, Jun 20, 13 @ 12:25 pm

= = OfficeMax Inc. is asking the state of Illinois for tax breaks to keep the company’s headquarters in-state…/ = =

Office Max is asking the state to let them keep their employees’ 5% Illinois state income tax. This is an example of corporate welfare tax breaks that Illinois taxpayers can’t afford.

Comment by Ruby Thursday, Jun 20, 13 @ 12:36 pm

Stockpiling cigarettes? I haven’t smoked in years but NO WAY would I have smoked a cigarette that was “old”. Blech.

I quit years before the taxes and cost went thru the roof. Didn’t pay any attention to the price. Say a nephew smoking and learned that cigs go for 7-8 bucks a pack. I’d chew bark before I paid that price.

Comment by dupage dan Thursday, Jun 20, 13 @ 12:37 pm

Bruce, not all state employees are getting a “7.25% raise”. What some state workers are getting is an accumulation of raises from their previous contract that was not honored, a 4% July 1 2011, a 1.25% January 1 2012 and a 2% on July 1 2013(from the new contract).

Comment by rusty618 Thursday, Jun 20, 13 @ 12:53 pm

I have not had a raise in 15 years - 13 years in row at this point - and not allowed in the union - I can’t have this one either - I could never imagine when I said yes - that this is what life would be like in the state of disrepute

Comment by Marie Thursday, Jun 20, 13 @ 1:10 pm

Declining cigarette sales are NOT a great problem to have for many people and businesses in Illinois. Most smokers change their purchasing habits instead of quitting, at this point. They buy out of state or switch to “pipe tobacco” from the internet or otherwise engage in black market cigarette activity. Lost sales means business owners freeze wages, reduce jobs, raise prices on other items like gasoline or engage in black market activity, unless they are wealthy enough to just pay the tax. Have you seen the reports that half of the packs sold in Cook Cty are missing tax stamps? More police and court time spent chasing cigarette tax scofflaws instead of violent criminals.

Non-smokers live longer than smokers and in the long run add to state health expenditures, and federal expenditures on SS and Medicare as well. Its a myth and a fiction that smokers “cost more” than non-smokers, which is why social engineering is typically a really bad idea. The state could save billions if they handed out free cigarettes to pensioners and got half of them to start smoking. But that would be wrong.

These excessive taxes mostly just accomplish creating and expanding black market activity while sticking it to the lower class that can no longer afford the taxes.

dupage dan - they mostly stockpiled cigarette tax stamps, not the cigarettes themselves. Distributors bought as many tax stamps as they could before the higher tax went into effect. The “pipe tobacco” industry has increased by tenfold since Obama took office and hiked the cigarette tobacco tax from $2.50 per pound to $26.00 per pound.

Comment by Jeff Trigg Thursday, Jun 20, 13 @ 1:15 pm

–OfficeMax Inc. is asking the state of Illinois for tax breaks to keep the company’s headquarters in-state after the office supply chain’s merger with Office Depot Inc. is complete.–

Of course they are. And they will get them, because they are big and can threaten to move, so the state will bend over and the governor will get a very expensive press conference and press release for “saving jobs.”

Meanwhile, if you’re a small business owner, just shut up and don’t be late on your quarterly tax filing or we’ll be knocking on the door.

From Office Max 2012 Annual Report:

Sales: $6.9 billion

Pre-tax income: $669 million

State income taxes (mind you, this is income tax from ALL 49 states where they earned income; they have 900 stores throughout the country): $17.3 million

That’s an effective state income tax rate of 2.6% and is divvied up among 49 states where they earn income. Illinois’ share is unknown.

Net income: $421 million

Don’t believe the hype: Illinois is great for Big Business.

Comment by wordslinger Thursday, Jun 20, 13 @ 1:38 pm

Jeff, I’ll match your anectodal evidence with mine: I haven’t encountered a single smoker (which I am as well) who has switched to internet sales, nor have I ever encountered a pack of black market cigarettes in my travels. However, all (yes, all) of my smoking friends from 10 years ago have quit. the taxes are having the effect they are intended to.

My assertion is just as well sourced and valid as yours. Unless, of course, you count the actual report that said the same thing as being a source.

The vast majority of people do not count the tax they pay to the penny so they can justify their outrage. Most folks just make a decision at the time. This is why conservative economic theories don’t resonate with most people, you think everyone bases their decisions on taxes the way you do.

Comment by Colossus Thursday, Jun 20, 13 @ 1:42 pm

Few on this blog seem to get the connection between salary levels and pension liability. While State employees are due their raises, 7.25% at a time of low inflation is a lot.

The theory is employees pay a % - matched by the State - which is invested and over time, produces the annuity. But the investment returns aren’t guaranteed.

Since pensions are generally based on the last 4 years, the rapid growth in salaries means much higher pensions with little time for investments to produce. I know of a number of State employees who are waiting for their raises to kick in, then they’ll work 4 years and retire.

Comment by Sir Reel Thursday, Jun 20, 13 @ 2:03 pm

I know a number of people who have switched to those e-cigarettes in the past year. Better for their health (or so they say) and cheaper than $8 a pack.

Comment by Bluefish Thursday, Jun 20, 13 @ 2:23 pm

==While State employees are due their raises, 7.25% at a time of low inflation is a lot.==

As was pointed out earlier, the 7.25% raise is the result of not paying raises these employees were entitled to receive over a couple of years. The biggest one (July of 2011), if I recall correctly, was so large because it included a raise originally scheduled for that time plus an earlier raise that was voluntarily deferred.

Comment by Anonymous Thursday, Jun 20, 13 @ 2:24 pm

With regard to the cigarette tax increase, the original budget estimate for cigarette tax revenue of $853 million was revised down because the Department of Revenue was told by the courts that they could not restrict cigarette stamp sales. Stamp hoarding in fiscal year 2012 caused the estimate to be reduced from $853 million to $788 million. So, looks like the revised estimate is right on the money.

http://tax.illinois.gov/AboutIdor/TaxResearch/MarchFY2013RevenueReport.pdf

Comment by numbersgeek Thursday, Jun 20, 13 @ 3:25 pm

65,000 abuse allegations last year? Sheesh, that’s like 1 in every 50 kids. Granted, many of those are probably repeats for the same kids but still…

Comment by thechampaignlife Thursday, Jun 20, 13 @ 3:41 pm

Jeff Trigg - it was a joke.

Comment by dupage dan Thursday, Jun 20, 13 @ 3:54 pm

Sir Reel, research before you spout off. The pension funds’ actuarial assumptions are designed to assume a certain amount of growth in salary levels due to both longevity and cost of living increases. The composite assumption is around 6% annually, or more than enough to handle a one-year hit of 7.25% on one cohort of the active population.

If you want to know why the funding levels are low, it’s because the funding levels were low. Raises, like the infamous “pay spikes” that the Tribbies foamed at the mouth about for years, cost squat in comparison.

Comment by Arthur Andersen Thursday, Jun 20, 13 @ 4:01 pm

Oh, and one more thing, just to place things in perspective. When Rauner and his cronies raise a fund, they get 2% of the take off the top before the first nickel is earned. That’s around $160 million, a big piece of which came out of those lousy public workers’ retirement funds. Do you think anyone ever got a 7.25% raise outta that pile of loot?

Comment by Arthur Andersen Thursday, Jun 20, 13 @ 4:08 pm

I recently quit smoking after more years than I care to say on a pack a day habit. Not smoking is an amazing thing if you can truly stop, not to mention the health benefits and money you can save.

Rauner makes me sick to my stomach. I may pull an R ballot and vote Rutherford if the front runners are Daley and Rauner. Personally I’ve had enough the slick talking plutocrats, I’d hope most voters have as well.

Comment by Farker Thursday, Jun 20, 13 @ 7:21 pm

–When Rauner and his cronies raise a fund, they get 2% of the take off the top before the first nickel is earned. That’s around $160 million, a big piece of which came out of those lousy public workers’ retirement funds.–

AA, I’m sure there will be detailed accounting to come on how much Rauner made off those public worker retirement funds.

Comment by wordslinger Thursday, Jun 20, 13 @ 11:06 pm