Latest Post | Last 10 Posts | Archives

Previous Post: Quinn, Rauner to share the same IEA stage

Next Post: A city lease tax?

Posted in:

* Greg Hinz wrote this before the Senate voted on the city’s pension reform bill. Only one Senate Republican voted for the measure…

Why are the Senate Rs balking when half of the House Rs voted yes? As answered by Sen. Matt Murphy, who usually speaks for Senate Rs on budget and financial matters, they want to see what else Mr. Emanuel will be asking for when he comes back with deals covering police, firefighters and city teachers. And they want to know if the state will have to pony up then.

“If we’re going to be partners in the process, If would make some sense to cut us in on the whole,” Mr. Murphy said.

Particularly sticking in the Senate R’s craw is Mr. Quinn’s budget proposal to send every home owner a $500 property-tax refund. That would help city taxpayers more than suburban ones, Mr. Murphy said, since suburban home values are higher. “So it looks like we’re pouring money into Chicago just at the time when Chicago’s talking about raising property taxes.”

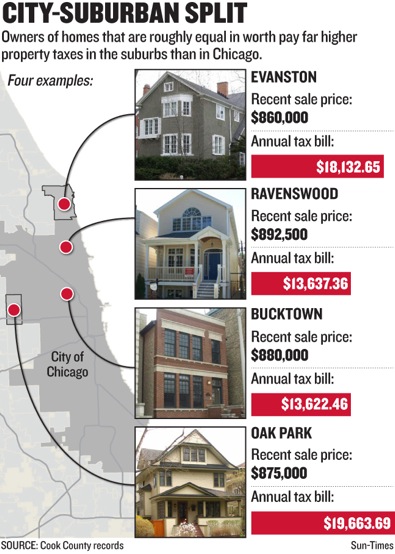

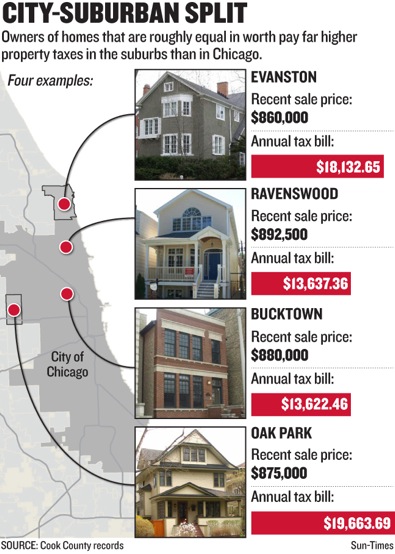

* Murphy does have a point. This graphic produced by the Sun-Times compares city property taxes to some Cook County suburban taxes…

They could’ve looked at the south suburbs and seen even more of a discrepancy, or even Downstate, where property taxes are almost twice as high.

* To the article…

Emanuel aides say the plan would cost the owner of a $250,000 home an additional $58 a year on top of a $4,000 property tax bill for each of the next five years. That works out to $290 per homeowner, to raise a total of $250 million.

Those numbers may prove dramatically low, as some suggest. But Ameya Pawar, the first-term alderman who represents Emanuel’s home 47th Ward, says he’s ready to support a tax increase.

“I will take the tough vote,” he said Tuesday. “I understood when I ran that this term was going to be about pensions. But at some point Chicago has to think about K-12 education.”

Pawar said many homeowners move from his ward to the suburbs when their children are on the cusp of going to high school, unless the kids test into the best public high schools. He says they often tell him, “I’m willing to pay more taxes if you’re willing to give us some stability and equity” in the Chicago Public Schools system.

“The taxes where they move to are higher, but let’s not forget what they get in the suburbs — a complete K-12 system,” Pawar says.

posted by Rich Miller

Wednesday, Apr 9, 14 @ 9:32 am

Sorry, comments are closed at this time.

Previous Post: Quinn, Rauner to share the same IEA stage

Next Post: A city lease tax?

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

If they really want to see high property taxes they should be looking at DuPage or Lake County.

Comment by DuPage Bard Wednesday, Apr 9, 14 @ 9:39 am

Are the Senate Republicans for anything? They seem to do a good job of being for voting no. I don’t even know why they show up to the Capitol if they aren’t going to do anything other than make the Democrats in the Senate do everything on their own. The Senate Republicans don’t need to show up to accomplish that. If anybody out there has some idea of what the Senate Republicans are actually for then I’m all ears because this continued nonsense of being against everything is getting pretty pathetic. They are certainly solidifying their status as a super-minority.

Comment by Demoralized Wednesday, Apr 9, 14 @ 9:39 am

== or even Downstate, where property taxes are almost twice as high.==

We had this discussion in our office a few days ago. People in our office from Chicago were talking about how their property taxes were much less than those downstate. We were all commenting about the fallacy being portrayed by people from Chicago that they have the highest property tax rates when that simply isn’t true.

Comment by Demoralized Wednesday, Apr 9, 14 @ 9:42 am

it is hard for the average voter not to be cynical when this type of charade goes on and on. cut MAP grants in the off years, increase MAP grants before the election. make the income tax increase permanent, but hey, look, a shiny, tho inequitable, check for $500, instead of adjusting the property tax deduction–its all good. tax millionaires and give the money to school kids. then force the schools to pick up teacher pensions.

we are rolling through the various pension systems, to “reform” them, with no guidance yet as to whether they will survive a court challenge. we should revise the term “reform” to “re-form”, as in reformulate. cut benefits, and cross your heart and promise not to short them again.

the legislative calendar, esp as it pertains to constitutional amendments, is full of gimmicks. no comprehensive plan to pay our bills, and set worthwhile priorities within available resources. gimmicks and distractions.

Comment by Anonymous Wednesday, Apr 9, 14 @ 9:45 am

Maybe if the tax increase passes, Chicagoans will do like everyone claims other residents will do if a state graduated income tax were ever to come to be. Leave. They’ll undoubtedly pay far more anywhere they go in the collar counties. $58/year? That’s almost laughable here in Dupage.

Comment by AnonymousOne Wednesday, Apr 9, 14 @ 9:46 am

anonymous 9:45a = Langhorne (rebuilt system)

Comment by Langhorne Wednesday, Apr 9, 14 @ 9:53 am

This is misleading. Evanston and Oak Park have the highest taxes in the burbs. A house in Wilmette would pay taxes comparable with those listed in the City whereas Evanston would have taxes on the same house 50% higher. I’ve looked at precisely this question for houses in those burbs and was shocked at the 50% tax premium to have worse services and higher taxes in Evanston.

Comment by Chicago Cynic Wednesday, Apr 9, 14 @ 9:57 am

Im sure Chicago residents would enjoy the lower sales tax in the burbs and downstate, try buying gas in the city, at the same time even after Rahm Doubled the Avg water bill, water is still reasonable in the city.I wonder if the higher sales tax makes up for the lower property tax. I would agree that if property taxes go up Rahm better find a way to improve the city services that are vastly inferior to most suburbs.

Comment by fed up Wednesday, Apr 9, 14 @ 10:00 am

Sell O’Hare–it should bring in $8-10 billion (if Midway can get $2 billion). Per federal law, operating O’Hare CANNOT provide any revenue to the City, so its not like parking meters. After you sell it, the City’s workforce that does O’Hare work can go to work for the private operator–reducing the City’s future pension obligation.

Comment by funny guy Wednesday, Apr 9, 14 @ 10:03 am

== or even Downstate, where property taxes are almost twice as high.==

Guess that depends on your definition of “Downstate.” I live in a “suburb” of Carbondale. If I were to receive $500 in a property tax rebate…I’d be ahead by about $100.

Comment by Deep South Wednesday, Apr 9, 14 @ 10:05 am

An $880,000 house has a property tax bill of over $23,000 in Springfield. Just sayin’.

Comment by Phenomynous Wednesday, Apr 9, 14 @ 10:05 am

How have they gotten away with the disparity in property taxes? Isn’t this a violation of equal protection?

Comment by Ronin2 Wednesday, Apr 9, 14 @ 10:06 am

Channeling Ben at the Reader. How much of this tax increase will be diverted to TIF funds? I haven’t looked in awhile but last I looked over 25% of the City EAV base was in a TIF district. That money will not go to pension relief. How much less would this increase be per homeowner without the TIFs?

Comment by JeffingingChicago Wednesday, Apr 9, 14 @ 10:14 am

Wow 13K on a house worth 880,000. I pay almost have that much on a house worth less than quarter of that…

I would be over 24K at least in the Oswego 308 district in Aurora..

Comment by OneMan Wednesday, Apr 9, 14 @ 10:22 am

Demoralized,

Go to the Illinois general assembly website and check the bills buried in subcommittees and the Assignments Committee. There you will find what Senate Republicans are for. You’ll see ideas for education reform, term limits for legislators, term limits for leaders, Medicaid reform, workers compensation reform, and others. Ideas that Democrats won’t let see the light of day.

You don’t see them because the Democratic majority doesn’t let the proposals out for votes on the floor. They let their proposals out. That’s why you see Republicans voting no on some big items.

That’s one of the nice things about the majority, you deal with only what you want to deal with.

Senate Republicans help pass bills every day. The vast majority of their votes are green lights. Senate Republicans are against tax increases. The Mayor’s bill is a giant tax increase.

Comment by Befuddled Wednesday, Apr 9, 14 @ 10:25 am

My home in rural central Illinois is worth about $140,000. My taxes are $3,500. In Dupage, my house would be in the $400,000 range. Based on the $880,000 Bucktown numbers, my comparable taxes would be $2,167. Who has a high tax rate? It is the rate, not what you pay based on local market values.

Comment by zatoichi Wednesday, Apr 9, 14 @ 10:28 am

Pawar really nails it in that story. If you live in Chicago and your kid can’t get into one of the selective enrollment high schools (and they have to be nearly Ivy League caliber to pass the entrance test) you’re screwed. As a result many families ending up paying at least 10 grand a year to send their kids to private schools. So the break you get on property taxes ends up getting wiped out by tuition payments.

Comment by Sam S. Wednesday, Apr 9, 14 @ 10:29 am

Oak Park’s median home value is $369k so focusing on the higher end home values seems odd. For lower value homes, particularly closer to the state median of $191k, the exemptions and the proposed $500 credit have more of an impact no the effective tax rate. Probably doesn’t make up the entire difference but it would be a more fair comparison. Much like marginal versus effective rate for income taxes.

Comment by thechampaignlife Wednesday, Apr 9, 14 @ 10:42 am

Taxes in DuPage are much higher the Chicago on residential property. Thus 500 is a much smaller percentage of the tax bill. Also, on some of the tax levis, an additional line and tax is shown for pensions.

Comment by DuPage Wednesday, Apr 9, 14 @ 10:43 am

Rate/value/whatever…

When it comes down to it, a dollar is worth basically a dollar in either Springfield, Aurora or Chicago.

Kind of shocked how much of a lower rate folks in the city pay.

Comment by OneMan Wednesday, Apr 9, 14 @ 10:43 am

“They could’ve looked at the south suburbs and seen even more of a discrepancy, or even Downstate, where property taxes are almost twice as high.”

They could’ve and should’ve. Sorta begs the question, doesn’t it?

Comment by A guy... Wednesday, Apr 9, 14 @ 10:52 am

Pawar is correct. My Plan B if my older son did not test (selective enrollment, IB) or audition (performing arts magnets) into a decent high school was to move to Oak Park. Luckily didn’t have to. And this was after paying (and still paying for the younger one) private school K-8 tuition. Our neighborhood K-8 is better now than when he started, so it is improving for Chicago dwellers, but CPS needs to, as a result, increase the number of seats at these SE or magnet high schools or improve them so that there is a truly complete K-12 experience.

Comment by 32nd Ward Roscoe Village Wednesday, Apr 9, 14 @ 10:53 am

While it hasn’t been a huge secret, it’s gone less noticed how much lower property tax rates are in the city. It was systematic to keep them that way. It was a key incentive to keeping young families in the city. To prevent complete “flight” of the middle class (not just white middle class), rates have been structured to make moving out of those city neighborhoods a less attractive financial option. It wasn’t an accident or an anomaly.

Comment by A guy... Wednesday, Apr 9, 14 @ 11:00 am

“the fallacy being portrayed by people from Chicago that they have the highest property tax rates”

What Chicagoans are saying that? I don’t know *anyone* who doesn’t know that property taxes are higher in the burbs.

“A house in Wilmette would pay taxes comparable with those listed in the City”

Um, no. 2012 tax year composite rates in Wilmette were 7.362 (SD 37) and 7.727 (SD 39). In Chicago, it was 6.396. So Wilmette was 15% or 20% *HIGHER* than Chicago. See: http://www.cookcountyclerk.com/tsd/DocumentLibrary/2012%20Tax%20Rate%20Report.pdf

Comment by Chris Wednesday, Apr 9, 14 @ 11:14 am

===What Chicagoans are saying that?===

You apparently weren’t around for the debate on the “7 percent solution” stuff.

Comment by Rich Miller Wednesday, Apr 9, 14 @ 11:23 am

“You apparently weren’t around for the debate on the “7 percent solution” stuff.”

Guess not. But that was (or, rather, should have been, if those complaining understood even 2 things about property taxes) about the rate of increase, rather than the actual or relative tax rate, or the actual amount of property taxes paid.

But everyone complains about property taxes everywhere, even if the rates are low.

Comment by Chris Wednesday, Apr 9, 14 @ 11:39 am

oh, and PS: “the debate on the “7 percent solution” stuff.””

So, “the fallacy being portrayed by people from Chicago” means the fallacy being portrayed when Blagojevich wasn’t even indicted, and George Bush was the president–aka “old news”.

Comment by Chris Wednesday, Apr 9, 14 @ 11:54 am

Chicago Cynic has it right. I’m in Evanston where are taxes are obscene and the services worthless. In my opinion, this is what “good” government leads to - a City run like the Postal Service - bad service and nothing you can do about it.

Comment by Paddyrollingstone Wednesday, Apr 9, 14 @ 12:01 pm

“I’m in Evanston where are taxes are obscene and the services worthless.”

You can blame Northwestern for a lot of it: Taking much, service wise, without paying in on property taxes. What would Evanston property taxes be like for homeowners if NWU paying property taxes like the business that it actually is?

Comment by Chris Wednesday, Apr 9, 14 @ 12:35 pm

== Emanuel aides say the plan would cost the owner of a $250,000 home an additional $58 a year on top of a $4,000 property tax bill ==

Is there anywhere else in IL — outside Chicago –where the tax bill on a $250,000 home is just $4,000?

Comment by cicero Wednesday, Apr 9, 14 @ 12:44 pm

All the properties on that map are in Cook County.

All property in the state is to be taxed on an assessed value of 33%, EXCEPT Cook county where it was lower. People in areas of Elgin living in Kane county have much higher taxes the their neighbors in Cook county.

Comment by DuPage Wednesday, Apr 9, 14 @ 1:12 pm

After reading Ameya Pawar’s quote above, I can’t help but like the guy for giving a straight answer to a tough question.

I may not know anything else about him. But I know he’s doing something right, regardless of his politics or my own.

Comment by Formerly Known As... Wednesday, Apr 9, 14 @ 1:17 pm

“Is there anywhere else in IL — outside Chicago –where the tax bill on a $250,000 home is just $4,000?”

Oak Brook is lower. Maybe OBT, too.

Comment by Chris Wednesday, Apr 9, 14 @ 1:35 pm

Oak Brook doesn’t have a levy for the municipality Chris. They get socked with everything else though. In the area, about 10% of the tax bill goes to the muni.

Comment by A guy... Wednesday, Apr 9, 14 @ 4:15 pm

The same 800,000 house in Chicago would cost half as much Down State. The cost of living is so much higher in Chicago that you need to look at the big picture and not just property taxes. Property taxes chase many seniors out of their homes. The entire tax structure in the State and the Country is flawed.

Comment by Johnson's Corner Wednesday, Apr 9, 14 @ 4:34 pm

Those tax numbers make me seriously wonder. I pay right at 3% of assessed value on my Condo in suburban Cook county. All of those houses are worth 10x as much, and none of them pay a 3% rate.

I did challenge my assessment, which jumped 20% this year while the appraisal was lower than the last. We’ll see if anything changes.

But now I seriously wonder if there’s a massive rate disparity between the rich and the poor.

Comment by Odysseus Wednesday, Apr 9, 14 @ 4:46 pm