Latest Post | Last 10 Posts | Archives

Previous Post: Rauner: “Step down” the tax hike

Next Post: McCann has a plan to spend part of one-time revenue boost

Posted in:

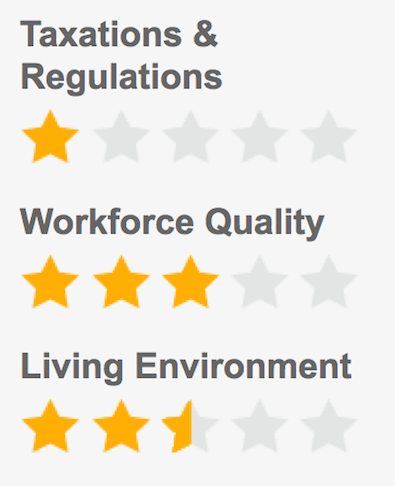

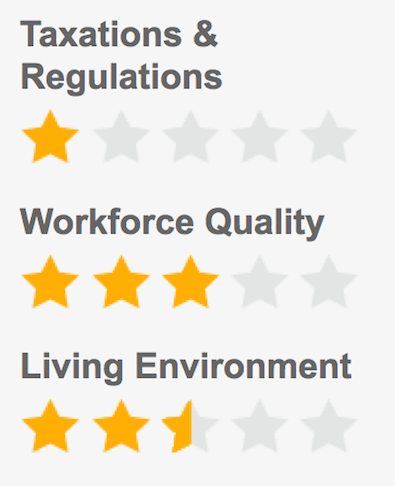

* Chief Executive Magazine ranked Illinois 48th in the nation for business…

Anti-growth hot mess can only coast on Chicago’s economic engine for so long.

And…

Oof.

* Numbers…

State GDP

% Growth ’11-’12: 1.9

% Growth ’11-’12 v. Nat’l Avg. (2.5%): -0.6Unemployment

Unemployment Rate Dec. 2013 %: 8.6

Comparison with Nat’l Rate (6.70%): 1.9Domestic Migration

Domestic Net Migration 2013: -67,313

Rank: 49State Government

State Debt per Capita Fiscal Year ’13 ($): 5,569

State & Local Gov’t Employees per 10k Residents: 503.1

Oy.

* But considering all the screaming about taxes, our state/local tax burden is pretty average…

State-Local Tax Burden

Rate (%): 10.2%

Compared to Nat’l Avg. (9.9%): 0.34%

posted by Rich Miller

Thursday, May 8, 14 @ 10:44 am

Sorry, comments are closed at this time.

Previous Post: Rauner: “Step down” the tax hike

Next Post: McCann has a plan to spend part of one-time revenue boost

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

After this winter, I’d knock off a couple stars for Living Environment too.

If you’re a business, couldn’t you view a higher unemployment rate as a plus, since there’s more labor available?

Comment by drew Thursday, May 8, 14 @ 10:53 am

“But considering all the screaming about taxes, our state/local tax burden is pretty average…”

And that knowledge should inform one’s consideration of their many other concerns.

– MrJM

Comment by MrJM Thursday, May 8, 14 @ 10:55 am

We’ve got big problems.

Too bad many see lower taxes as the silver bullet.

Comment by Walker Thursday, May 8, 14 @ 10:55 am

Anyone surprised to hear the CEO’s trash Illinois. This is the story they want to push to get their way. Anyone want to check on what these guys.

Comment by Norseman Thursday, May 8, 14 @ 10:55 am

Oops: “Anyone want to check on what these guys make.”

Comment by Norseman Thursday, May 8, 14 @ 10:56 am

what is our ranking for corrupt political leadership?

Comment by northshorecynic Thursday, May 8, 14 @ 10:57 am

This is from website:

“California, Illinois, New York, Oregon and others do not have a viable long term strategy for achieving economic balance and therefore will only get worse. Other states such as Texas Florida and Arizona have a growing economy and reasonable rules and regulations and a positive attitude towards business. The former states are steadily declining into disaster territory such as Detroit. The other states will continue to become stronger and stronger. The difference will ultimately be similar to a productive and industrious northern Italy and a lazy unproductive southern Italy. Any attempt to force the productive states to subsidize the unproductive states will result in civil unrest.”

I find it very ironic that these states mentioned are all welfare states, while Texas, Florida, Tennessee, Indiana, South Carolina, Arizona are all welfare states. How about Illinois gets their fair share of federal tax dollars back and then we won’t have a state deficit. It must be nice for states like Indiana to take our federal tax dollars and put them in their state government budget.

For people who don’t believe me here is my sources

http://www.businessinsider.com/red-states-are-welfare-queens-2011-8#!K50U1

http://www.huffingtonpost.com/2014/03/26/republican-states-most-dependent-government_n_5035877.html

Comment by Almost the Weekend Thursday, May 8, 14 @ 11:00 am

Too much regulation? Okay, what specific regulations need to be changed?

Workers comp, sure, but overly generous medical pay reimbursement rates are a major driver of that and reducing those rates will reduce the profitability of the health care industry.

Workforce quality? Does that mean “skilled” or “docile”

Comment by Bill White Thursday, May 8, 14 @ 11:01 am

Fixing the crazy Illinois workers comp laws would really help. Maybe just maybe fixing the schools

Comment by fed up Thursday, May 8, 14 @ 11:02 am

Illinois minimum wage is already higher than the federal minimum. The state raised income taxes 67%. We have bills we can’t pay. So this should be the paradise that big spenders in Washington want for the rest of the US.

What happened?!!!!

Comment by Milo Thursday, May 8, 14 @ 11:03 am

==Other states such as Texas Florida and Arizona have a growing economy and reasonable rules and regulations==

I think I’ll pass on the Texas regulation model. I would prefer it if our fertilizer plants didn’t blow up and kill people.

Comment by Demoralized Thursday, May 8, 14 @ 11:03 am

This post, in a nutshell, is the most frustrating part of our public debate on our business climate. We are an average-tax state. And yet lots of people continually say we are a high tax state. That perception gets baked in until people start to believe it — and, here’s the bad part — it then starts to impact investment decisions based on an incorrect belief that we are a high tax state.

So I get some people have an interest in making the case that we have high taxes. But there are actual negative economic consequences to manufacturing a reputation that we are a high tax state that people should be accountable for. They — and maybe we — need to stop perpetuating the myth that we are a high-tax state, for the sake of our economic growth.

Comment by Dan Johnson Thursday, May 8, 14 @ 11:08 am

“How about Illinois gets their fair share of federal tax dollars back”

That might require building a few more major military bases (I suspect it’s probably too late to reopen Chanute at this point), establishing some new national parks, or maybe building a brand new NASA R&D facility a la Cape Canaveral, the Johnson Space Center or the Jet Propulsion Laboratory.

Comment by Secret Square Thursday, May 8, 14 @ 11:09 am

Does it really surprise anyone that a publication dedicated to the heads of large corporations would prefer states that cater their policies toward them to the detriment of the people that live in those states?

Comment by Ducky LaMoore Thursday, May 8, 14 @ 11:10 am

@Dan Johnson

“We needed to raze the village, in order to save it”

Comment by Bill White Thursday, May 8, 14 @ 11:10 am

None of this is surprising. It is believable because it is what we’ve been hearing for over a decade. We are sliding, not climbing, as a state.

In 2002 after Ryan, we had a shot to do something to bust out of our below-national-average malaise. To end corruption.

We got Blagojevich and Quinn instead.

Nope. Not surprised at all.

Comment by VanillaMan Thursday, May 8, 14 @ 11:12 am

== I think I’ll pass on the Texas regulation model. I would prefer it if our fertilizer plants didn’t blow up and kill people. ==

Right. Illinois has successfully regulated away explosions and death.

Comment by Birdseed Thursday, May 8, 14 @ 11:13 am

Secret Square I totally agree the digital manufacturing hub in Chicago is a start, but pretty sure the GOP thinks Chicago only received the bid because it’s where Obama started his political career.

Comment by Almost the Weekend Thursday, May 8, 14 @ 11:13 am

So we are to thank our lucky stars that Illinois is average when it comes to taxes? Since when is “average” a cause for celebration or a sigh of relief?

Perceptions guide our decision making. We buy or rent homes in areas we perceive to be good towns, neighborhoods, schools. We purchase automobiles and appliances based on our perceptions that they are “good” or reliable instead of lemons. Everyone wants the best bang for their buck, not just average or mediocre. Our perceptions are thus pretty important in decision making.

Perceptions by businessmen and CEO types about Illinois need to be taken seriously. Their perceptions too are pretty important.

Comment by Louis G. Atsaves Thursday, May 8, 14 @ 11:16 am

“How about Illinois gets their fair share of federal tax dollars back”

One of the ways to do that is to shift our state taxes to those that are deductible from federal income taxes paid (so we end up sending less to DC and writing off more of our state taxes). Sales taxes are largely not deductible (in practice). Income taxes are, especially paid by higher income people (when the deduction is more valuable). So raising the income tax — and using a graduated rate — will result in us keeping more of our money in the state and sending less to DC, improving that ratio of federal taxes paid and spent in Illinois.

Comment by Dan Johnson Thursday, May 8, 14 @ 11:17 am

‘Best for Business’ seems like a weird category. E.g. the unemployment rate here is higher than average. Is that good or bad for business? Presumably it’s bad for retail businesses, which need their customers to have jobs so as to have money to buy stuff. But if you were thinking of opening a small manufacturing business, selling the goods mostly out of state, it would be good to have lots of people wanting to jobs and so presumably willing to work cheap.

Comment by UIC Guy Thursday, May 8, 14 @ 11:18 am

@Almost.

Its a good argument. But the lots of fed money can be seen as soc sec and medicare payments. Florida a destination for all the retirees from the NE… You also have to look at border states that require an inordinate amount of $ for border control, services for undocumented, etc. Then of course military bases (army, airforce, nuke bases, etc) are located often near nothing (again southern or western states with lots of open space). And of course bigger western states have way more many miles of federal highways and highway rules than a smaller state (size wise)

Looking at where to start an individual business (short of supporting a specific base/gov facility) generally has little to do with whether you think federal distribution of tax dollars is fair or not.

Comment by RonOglesby Thursday, May 8, 14 @ 11:22 am

I suspect the taxes/regulation factor is mostly local taxes and regulations at all levels. Our State taxes are now middle of the road. So State regulations are an area to explore.

Workforce quality is related to education. We know education in Illinois is on a downward trajectory. So that’s an area to explore.

Living environment is probably a bunch of factors. It would be nice to know what makes up that criteria to see if it’s more than climate and topography which are beyond the State’s control, .

Specific actions related to areas Illinois can improve is what’s needed. More rhetoric about taxes, corruption, etc won’t help.

Comment by Sir Reel Thursday, May 8, 14 @ 11:23 am

same thing as their May 2013 state rankings. CEOs and Chief Exec mag are fixated on taxes, so our corporate tax rate has us near bottom. TX and FL are #1 and #2 last year and this year, they have no taxes. Shocking news…

Comment by PoolGuy Thursday, May 8, 14 @ 11:29 am

Illinois state and local tax rates may be average today but they won’t be for much longer. There is an inordinate amount of debt out there and that pesky little pension problem still has not been definitely resolved by the supreme court.

Comment by Capo Thursday, May 8, 14 @ 11:45 am

Interesting this study says we are slipping towards Detroit when I’ve recently received unsolicited letters from real estate brokers who want to buy my $400k condo, in Chicago.

Comment by M O'Malley Thursday, May 8, 14 @ 11:51 am

“Secret Square I totally agree the digital manufacturing hub in Chicago is a start, but pretty sure the GOP thinks Chicago only received the bid because it’s where Obama started his political career.”

No. It’s because Chris Kennedy (U of IL), and a few others really pitched a fit, and got pols like Sen. Dick to wake up and get into the fight for the grant. Once the pols finally got serious, we were a player. But until then, we were just a nag taking up space on the track.

Btw, it wasn’t just a one party effort.

Comment by Judgment Day (on the road) Thursday, May 8, 14 @ 11:54 am

@ronoglesdy. Your militay base argument is not correct, plently of bases near big southern cities, Little Rock AFB, NAS Corpus Christi, Randolph AFB, NAS Jax, etc.

Comment by M O'Malley Thursday, May 8, 14 @ 11:56 am

@ Sir Reel

=We know education in Illinois is on a downward trajectory. So that’s an area to explore.=

The NEA “Ranking and Estiimates” report for 2013 shows Illinois K-12 public education spending per pupil ranks about 14th among states, and our teacher salaries a disproportioately high 12th.

Our student performance is about 24-26 according to the National Association for Educational Statisics, ranking us behind Texas despite spending about 30% more per student.

We pay for filet mignon in education in Illinois, but only get hamburger with 30% fat.

Until we deal with the structural spending and performance issues in Illinois public education, all our kids will be able to do in Illinois is pick corn and soybeans, while our “best and brightest” take off for Palo Alto, Austin, San Diego and Phoenix.

Comment by Arizona Bob Thursday, May 8, 14 @ 11:58 am

“Too much regulation? Okay, what specific regulations need to be changed?”

You really want to make a difference? At least for small business? Take every single program administered by the IL Secretary of State under what they call “Business Services” and dump those regulations (along with their fees and fines, and crazy record keeping). Yeah, it will cost some bucks in lost revenue - but all that nonsense drives small business crazy, and small businesses get nothing back for it except pieces of paper saying “thank you for your money”.

If you repeal the legislation backing that stuff, you’ll also reduce the SoS workforce. And you will make the life of startups easier.

Will it be a ’short term’ money loser? No doubt. But if you want jobs, this just might be your best bet. b Unless you want to keep pushing $52 mil dollar ‘grants’ out there in election years that accomplish NOTHING USEFUL.

What do you want to do? Because what we are doing currently sure isn’t working…..

Comment by Judgment Day (on the road) Thursday, May 8, 14 @ 12:07 pm

I agree with Arizona Bob. I think he hits it out of the park.

To quote Dan Johnson from higher in the thread “That perception gets baked in until people start to believe it — and, here’s the bad part — it then starts to impact investment decisions based on an incorrect belief…”

Comment by Bobby Hill Thursday, May 8, 14 @ 12:08 pm

==dump those regulations==

That is really what businesses want. Zero regulations. Thanks, but no thanks.

Comment by Demoralized Thursday, May 8, 14 @ 12:09 pm

==and our teacher salaries a disproportionately high 12th.==

How is it disproportionately high? Would you prefer we race to the bottom on salaries too?

Comment by Demoralized Thursday, May 8, 14 @ 12:11 pm

== That is really what businesses want. Zero regulations. Thanks, but no thanks. ==

You don’t like mercury in your drinking water and a complete lack of worker safety protections?

Comment by Formerly Known As... Thursday, May 8, 14 @ 12:13 pm

The net migration rate seems to be consistent over time. The census bureau numbers show the Average annual rate for Illinois to be –61,786 from 1990 to 2000 and –71,854 from 2000 to 2004.

https://www.census.gov/prod/2006pubs/p25-1135.pdf

Looking at some maps by County for 2007 to 2011 it looks like the counties of Champaign, Bloomington, DeKalb, Jackson, Kendall are thriving. In Indiana the real growth seems to be around the cities of Bloomington, Lafayette and Muncie. If it was not for Kendall I could detect a trend.

Comment by Bigtwich Thursday, May 8, 14 @ 12:21 pm

===

== That is really what businesses want. Zero regulations. Thanks, but no thanks. ==

You don’t like mercury in your drinking water and a complete lack of worker safety protections?

===

Uh, generally the Sec. of State business services doesn’t deal with Water safety, do they? That is what he pointed to:

“At least for small business? Take every single program administered by the IL Secretary of State under what they call “Business Services” and dump those regulations (along with their fees and fines, and crazy record keeping).”

Arguing mercury in Water is simply nihilism. Like if you dont want to raise school taxes you are labeled as not wanting children education… Here if you want to dump bus services (or more likely consolidate them and remove a bunch) you want mercury in drinking water.

Comment by RonOglesby Thursday, May 8, 14 @ 12:23 pm

@Judgment Day

Do you mean burdensome tasks such as filing annual corporate reports? I think that is required in all 50 states.

Comment by Bill White Thursday, May 8, 14 @ 12:28 pm

if we have two states north and south illinois split at the illinois river we could get double funding

Comment by Anonymous Thursday, May 8, 14 @ 12:29 pm

How can anyone believe this nonsense? Illinois is doing fine , we have Barack Obama and Dick Durbin. Too many jobs hurts the environment. We don’t want fracking here. The Koch brothers must be behind this survey. The Koch brothers run Chicago . Let’s have a 13% sales tax, not everyone is going to shop off the internet. Enough with this Republican propaganda.

Comment by Steve Thursday, May 8, 14 @ 12:30 pm

Given the lack of critical thinking that often accompanies these agenda-driven reports it seems relevant to suggest one stop and think for a moment. Every report like this one is unequivocally agenda driven. One might think to ask themselves when reading these reports, what, exactly, is the underlying methodological assumptions that are driving these conclusions? Is it good, peer reviewed research? Is it data driven from respectable sources such as BLS, BEA, Census Bureau, NETS, D&B, etc.? Or, is it, as in the case of Chief Executive Magazine’s annual report a function of soliciting opinions? Here we have a dichotomy that to me seems rather obvious: on the one hand we have real research taking place; on the other hand we have a plethora of opinions that most likely do not map with reality. So, what does it come down to in the final analysis? It seems fair to conclude that we like to believe what we like to believe. If this were not the case, then we would bother ourselves to ask harder questions about claims being made as to what is true and what isn’t. As Rene Descartes points out in his Discourse on Method, “At last I will devote myself sincerely and without reservation to the general demolition of my opinions.”

Comment by Skeptical Thursday, May 8, 14 @ 12:33 pm

We’ve got a lot of work to do here.

Comment by A guy... Thursday, May 8, 14 @ 12:39 pm

=== Interesting this study says we are slipping towards Detroit … ===

Let’s be clear, this is not a study. It’s a survey of CEOs.

Comment by Norseman Thursday, May 8, 14 @ 12:42 pm

As bad as the business environment in Illinois has been, it actually could get a lot worse soon. Thus far, California’s bad policies and bad economy had prevented many from moving there, but now that California’s fiscal situation is less chaotic and there’s growing demand from the very influential business diversity to change policies, it means that if states like California, New York or others get their act together, even if Illinois does nothing different, we will lose more aside from what we are losing to places like Texas (which has seen the benefit of bad policy from Illinois, California, NY, etc).

So, the ONLY way to save Illinois is to make it MORE attractive to do business. Otherwise, kiss the future buh-bye.

Comment by Captain America Thursday, May 8, 14 @ 12:54 pm

== Arguing mercury in Water is simply nihilism. ==

Granted. A bit too much for my own good there.

Comment by Formerly Known As... Thursday, May 8, 14 @ 1:05 pm

@Ron:

I’m not sure what’s so onerous about the SoS business services division.

Comment by Demoralized Thursday, May 8, 14 @ 1:12 pm

Work Comp Costs — one of the highest in the country

Liability Insurance Costs — one of the highest in the country

Cost of to form an LLC — one of the highest in the country

http://www.incorporatefast.com/filingfee.asp

Gas Taxes — one of the highest in the country

http://abcnews.go.com/Business/top-10-states-highest-gasoline-taxes/story?id=20093917#6

and on, and on, and on…

Comment by stand Thursday, May 8, 14 @ 1:22 pm

==Cost of to form an LLC — one of the highest in the country==

I’m sure that outrageous $500 fee is preventing all kinds of LLCs from forming.

Comment by Demoralized Thursday, May 8, 14 @ 1:25 pm

“Do you mean burdensome tasks such as filing annual corporate reports? I think that is required in all 50 states.”

There’s a justification - NOT. We’re also 49th in this survey (next to last). The goal is ‘not to be there’. So, when in doubt, do something different. What have we got to lose?

———

“I’m not sure what’s so onerous about the SoS business services division.”

For big business, not so much. For small business, it’s a pain. And if you are a small business, you get nothing back that is useful. They (SoS) nickel and dime you at every turn, and more importantly, it eats up time. And for small business, that’s valuable.

Comment by Judgment Day (on the road) Thursday, May 8, 14 @ 1:26 pm

@Judgment Day

I support reducing the LLC filing fee from $500.

Other than that, what other SoS requirements are excessively burdensome?

Comment by Bill White Thursday, May 8, 14 @ 1:31 pm

@ Demoralized

-I’m sure that outrageous $500 fee is preventing all kinds of LLCs from forming-

My God! Really! It’s called death by a thousand cuts. Or, Illinois death by a million cuts. And yes, $500 is onerous to a start-up that may not may money for a year or two. It’s just $500 here, $1800 filing fee over here, BS business license fee over there. Wake up man! Your attitude is exactly why this state is failing.

Comment by stand Thursday, May 8, 14 @ 1:35 pm

==And yes, $500 is onerous to a start-up that may not may money for a year or two==

Dude, if that’s keeping you from forming an LLC then you probably shouldn’t be thinking about it in the first place.

As I said, the goal is to eliminate all fees and regulations. Just be honest about it.

Comment by Demoralized Thursday, May 8, 14 @ 1:37 pm

== The census bureau numbers show the Average annual rate for Illinois to be –61,786 from 1990 to 2000 and –71,854 from 2000 to 2004. ==

More recent data shows that we were actually making progress in this regard between 2004 until 2011.

Year Net Domestic Migration

2005 -84,933

2006 -74,809

2007 -53,878

2008 -53,045

2009 -48,249

2010 -13,576

2011 -70,342

2012 -73,473

2013 -67,313

Comment by Formerly Known As... Thursday, May 8, 14 @ 1:42 pm

The numbers in that Q-C Times piece appear to differ from the Chief Executive Magazine article and the University of Texas A & M numbers at www.recenter.tamu.edu/data/pop/pops/st17.asp

Not sure why, but it looks like the Q-C piece might have been using Census numbers that run from July 2012 - July 2013, while the others may use Census numbers that run from December - December.

Comment by Formerly Known As... Thursday, May 8, 14 @ 1:51 pm

@Demo

“I’m not sure what’s so onerous about the SoS business services division.”

I didnt bring up Bus Services. Someone else did and your response was a nihilistic argument.

They are but one of the government agencies here that take yet another dollar for this, and that, a few more here and there. They are a good example of fees, and questionnaires, and waiting for replies from them for very little return.

Again. not wanting to have death by 1000 cuts, doesnt mean I want mercury in the drinking water or no regulations. But your argument seems to be either we have what we have today, OR fertilizer plants blow up all over, mercury in the drinking water, and the state collapses in anarchy. There is an in between and Illinois is no where near the middle.

Comment by RonOglesby Thursday, May 8, 14 @ 2:10 pm

@RonOgleby

You nailed it.

@Demo

Can we have a reasonable discussion without all the extremism?

Comment by stand Thursday, May 8, 14 @ 2:14 pm

==Someone else did and your response was a nihilistic argument.==

Wasn’t my response. And I missed the quotations in your response. I was asking a serious question in any event.

==Can we have a reasonable discussion without all the extremism?==

Certainly. I find nowhere that I was being extreme.

Comment by Demoralized Thursday, May 8, 14 @ 2:27 pm

I think we all know the National unemployment is nowhere close to 6.7% or 6.4% or whatever they claim.

Comment by Wally Thursday, May 8, 14 @ 2:28 pm

@Demo

-As I said, the goal is to eliminate all fees and regulations. Just be honest about it.-

Jumping from the cost of filing for an LLC to the statement you made above IS extreme.

Comment by stand Thursday, May 8, 14 @ 2:41 pm

@stand:

I was making snarky statement for effect. Many complain about fees and regulations. I want to know why the ones “we” complain about are so bad. I have no idea all the things the SoS business office does. I know I can go there to find out if a corporation is registered and in good standing and I know I paid them when I needed a blessing to be a notary so I could sign a sheet saying that you are who you say you are. Tell me what is acceptable. That’s all.

Comment by Demoralized Thursday, May 8, 14 @ 2:48 pm

$500 is pretty cheap to protect your personal assets if your business kills somebody due to your negligence.

Comment by M O'Malley Thursday, May 8, 14 @ 2:50 pm

@Demo

I listed 6 burdens on small businesses that are among the highest in the country. There are many more. How about you find me some areas where Illinois government is friendly to small businesses versus the other 49 states?

Comment by stand Thursday, May 8, 14 @ 3:12 pm

Did another of my comments get blocked, Rich? I noticed my comment on the Latino legislators voting against Quinn’s “anti-violence” program was blocked yesterday, too?

Comment by liandro Thursday, May 8, 14 @ 3:28 pm

==I listed 6 burdens on small businesses that are among the highest in the country.==

Sorry, but you haven’t convinced me a $500 fee for LLC registration is a burden.

==How about you find me some areas where Illinois government is friendly to small businesses ==

I don’t know what a small business would consider “friendly.” Maybe I wasn’t far off the mark with my no regulations quip based on your comments.

Comment by Demoralized Thursday, May 8, 14 @ 4:09 pm

Also, @stand, you mentioned gas taxes. I don’t think our gas taxes are high enough based on the work I see that needs to be done to our roads.

Comment by Demoralized Thursday, May 8, 14 @ 4:12 pm

@Demo

I would say the condition of our roads and the amount of taxes generated on gas have a pretty big disconnect in this state. Somehow some of our surrounding states have some pretty decent roads and equivalent or less revenue from gas.

THe solution is often not always more tax revenue.

Comment by RonOglesby Thursday, May 8, 14 @ 4:18 pm

- Captain America - Thursday, May 8, 14 @ 12:54 pm:

I have a friend with a number of small businesses in California and it is just plain awful on a lot of fronts, including regulation and taxation. He’s learned to adapt to it, but it does lead to some different operational practices. If his business didn’t require geographic proximity, he would be in another state. Given what I know about his problems, California is one of the last places I would be looking to emulate.

Comment by RNUG Thursday, May 8, 14 @ 4:55 pm

@Demo

Run the cost of opening a business in Illinois vs. Indiana. Because of regulations, your work comp and liability insurance might be double — or more. You might pay “fees” that other states don’t charge. Ever hear of a “environmental protection control” fee? Your property taxes could be double (or higher if you are in Cook County). And yes, your gas will be higher. You probably don’t know that all our gas taxes aren’t going to the roads. You’ll pay more in sales taxes. and on, and on, and on.

Comment by stand Thursday, May 8, 14 @ 4:57 pm

Well, there is legislation to reduce that LLC fee (SB2776) from $500 (highest in the nation) to $39 (lowest in the nation). It passed the Senate and is in the House Revenue and Finance Committee now. Hopefully it is called for a vote next week.

That would be a specific, concrete helpful step for entrepreneurs.

Comment by Dan Johnson Thursday, May 8, 14 @ 5:01 pm

So the worst states for CEOs are the ones they flock to, where they earn the highest incomes, where they build their mansions: California, New York, Illinois, Massachusetts, Connecticut.

This is some sort of joke, right?

Comment by Cod Thursday, May 8, 14 @ 5:15 pm

@stand:

Also, count me as jaded that this comes from a CEO magazine. Granted I’m stereotyping the CEO here, but I don’t have too much sympathy for a bunch of multi-million dollar salary making CEOs.

Also, did you look at the link? Did you see the nonsense quotes from CEO’s? Anti-growth hot mess? Working with conservative states is easier? It’s like looking at a Republican Party press release. It’s hardly objective.

Comment by Demoralized Thursday, May 8, 14 @ 5:23 pm

I have read thru all these posts and see that things in this State are great! That all the other States that are growing while we aren’t is hogwash because what Illinois does is the only way! That we are well on our way to that Progressive Utopia that has been dreamed about, and nothing will stop us now! That the only way to fix the problems in Springfield is to send them more money! That the people who have left this State and the revenue lost because they did does not matter a bit! That we shouldn’t try to grow the population and the number of jobs, heck we just need to tax those who are creating revenue! Who cares what other States do, Springfield needs our money and fast!

Comment by SO IL M Thursday, May 8, 14 @ 5:31 pm

@Demo

If you are jaded, then just look at the facts of the 6 major issues I raised — and there are more. Ignore the article but understand that this state is extremely unfriendly to small businesses. Small businesses are the ones that can go through hyper-growth. It’s easier for several SB’s to go from 1 employee to 10, than one biggie to go from 1000-10000. Imagine if you were a part-time SB who only expected his sales to be $10000 the first year with $5000 in profit. That $500 LLC fee is 10% of your earnings! We should make things easier for budding entrepreneurs,not harder. They help society by creating minimally 1 job.

Comment by stand Thursday, May 8, 14 @ 5:35 pm

48th isn’t really that bad.

Comment by Howard Thursday, May 8, 14 @ 6:23 pm

Here’s the state of “business journalism” in some circles.

Crain’s has a bizarre story that Walgreens is looking to move it’s corporate hq from Deerfield to the old rat-trap Main Post office over the Congress downtown.

There is not one attributed source in the story. Not by name. Not even anonymously.

How is that journalism? Who would believe such a stupid story?

And who are the chowderhead editors at Crain’s who would even print such unattributed nonsense as news? Are there no standards?

Here’s some real news: Walgreens has a swell corporate campus on Wilmot and Lake Cook roads in Deerfield.

They’ve poured millions into renovating it in recent years. adding amenities such as on-site day care, health club, and a sweet cafeteria.

The old Main Post office is an asbestos-filled firetrap. There’s a reason its been empty forever. The location is terrible, there’s no parking, and it’s a crummy dump not worth spending a penny on.

How did Crain’s buy this stupid story? Where is their news judgement?

http://www.chicagobusiness.com/article/20140508/NEWS02/140509782/walgreen-looks-to-move-hq-to-old-main-post-office

Comment by wordslinger Thursday, May 8, 14 @ 7:42 pm