Latest Post | Last 10 Posts | Archives

Previous Post: Why We Need A Strong Civil Justice System - Molly’s Story: Doctors Unnecessarily Removed Her Breast

Next Post: Everything old is new again

Posted in:

* From Gov. Bruce Rauner’s Decatur speech yesterday…

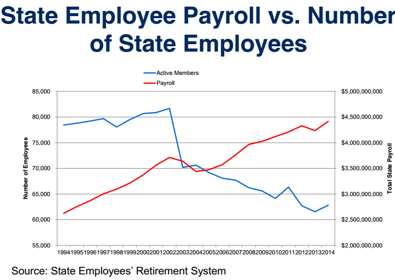

Spending on wages and benefits for state employees has to be brought under control. “There has been a decline in the number of state workers. But the payroll is still going up. I still don’t totally understand this. I think it’s a lot of overtime or manipulation of the system.”

His accompanying chart…

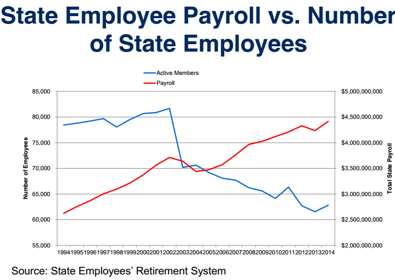

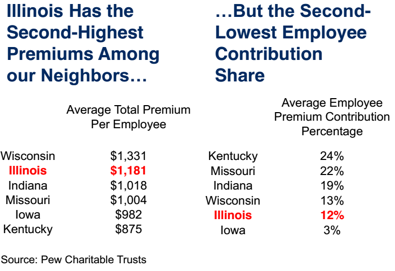

* Rauner also displayed a couple of other related charts. The first covers state worker health insurance premiums, the second covers employee pension costs…

posted by Rich Miller

Wednesday, Jan 28, 15 @ 9:45 am

Sorry, comments are closed at this time.

Previous Post: Why We Need A Strong Civil Justice System - Molly’s Story: Doctors Unnecessarily Removed Her Breast

Next Post: Everything old is new again

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

===Spending on wages and benefits for state employees has to be brought under control. “There has been a decline in the number of state workers. But the payroll is still going up. I still don’t totally understand this. I think it’s a lot of overtime or manipulation ===

“So, like business as usual, I hired a six-figure Chief of Staff, for my wife…”

Rauner amazes me. He does.

Is Rauner oblivious, or just doesn’t care about his hypocrisy?

“The old ways are bad, but THIS hire follows the old ways…”

Optics.

…

Comment by Oswego Willy Wednesday, Jan 28, 15 @ 9:49 am

Going after the middle class in Illinois just plays right into the Dems 2016 election strategy.

Comment by Beans and Franks Wednesday, Jan 28, 15 @ 9:50 am

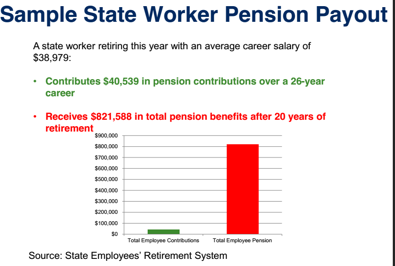

As I commented late last night, I can’t make the numbers on the Pension Payout Chart come out when I try to reverse engineer it. If I do get a model that is close, either the average salary or the Final Average Compensation comes out off by quite a bit.

Comment by RNUG Wednesday, Jan 28, 15 @ 9:50 am

Was there any discussion of the percentage of the “average” that overtime accounts for? Isn’t there an argument that Illinois under staffed status leads to greater overtime, thus skewing simple “average salary” charts like this?

Comment by Anon Wednesday, Jan 28, 15 @ 9:50 am

== Going after the middle class in Illinois just plays right into the Dems 2016 election strategy. ==

I thought this was supposed to doom Rauner in the fall as well, did I miss something?

Comment by OneMan Wednesday, Jan 28, 15 @ 9:53 am

Someone ought to tell Rauner about this thing called inflation, and the concept of present value. And while we’re at it, inflation-adjusted dollars. Also, cherry-picking timeframes he might want to look at too…Just sayin.

Comment by PublicServant Wednesday, Jan 28, 15 @ 9:54 am

AFSCME will have a very difficult upcoming few months. They have run into a foe who can self-fund a PR battle and has already shown that he can win an election. The promised war chest will make a lot of lawmakers queasy. The contract negotiations will be messy.

The numbers just do not look great for AFSCME and its fellow public employee unions. The cost of healthcare for state workers and retirees is very high. And that chart about a worker’s actual pension contribution versus what the state is required to pay is eye-opening and can be used as a hammer by Rauner.

The trick for Governor Rauner is to effectively communicate these issues and why he wants to change the outcomes. If he and his press people can break it all down in a similar fashion to how they broke down issues during the 2014 cycle, then AFSCME better watch out.

Comment by Team Sleep Wednesday, Jan 28, 15 @ 9:55 am

Just spoke with a Human Services Case Manager who earned $26000 in overtime pay last year so taxable salary was $101000. OT is definitely skewing the salary view, but it will significantly impact the pension as well for a lifetime. It may make more sense to hire more staff at lower entry salaries and under tier 2 rather than continue this massive OT to get the work done.

Comment by illilnifan Wednesday, Jan 28, 15 @ 9:56 am

The third chart seems to be of little use except to stir the pot and get emotions boiling. After all, if the ISC rules as expected, the benefits will be due regardless of who contributed what.

Comment by Six Degrees of Separation Wednesday, Jan 28, 15 @ 9:57 am

What’s the takeaway here, Illinois should be more like Kentucky?

Why stop there? Maybe we should adopt the Mississippi model for 21st century government, a booming economy and quality of life.

Makes you wonder why Rauner didn’t choose to make his fortune in Louisville or Jackson.

Comment by Wordslinger Wednesday, Jan 28, 15 @ 9:58 am

It appears Illinois elected a governor and former businessman who doesn’t understand inflation. Yikes.

Comment by From the 'Dale to HP Wednesday, Jan 28, 15 @ 9:59 am

He’s correct. Overtime for SUPERVISORS in the BARGANING UNIT is complete crap. An exec 2 making 20k a year in overtime is BS. Here’s an idea, get people in there who will work/get the work done. And I agree. I’m qualified and more than happy to be Gov Rauner’s wife’s COS for half the salary. I work for the state already, 18 years, and have been making jack squat because of politics. College grad, post grad work, great work experience. But there are Admin Assistants making twice as much as me for doing half the work. Sour grapes? Yes. But with reason and examples to back it up.

Comment by Westward Wednesday, Jan 28, 15 @ 9:59 am

I can make charts say what I want them too also.

Comment by Stones Wednesday, Jan 28, 15 @ 10:00 am

Didn’t Quinn do similar stuff in the run up to the pension campaign? Demonize the state employees to gin up support? Squeezie the Pension Python and all that?

Campaign rhetoric. He still has to get past the GA. I wonder how Madigan, etal, will play this one out? Does he side with Rauner (MJM is FOR SB1, right?) or does he flip and side with the mostly democratic union members. Stay tuned to the next installment of, “As the Gut Scuts”.

Comment by dupage dan Wednesday, Jan 28, 15 @ 10:00 am

IlliniFan hit it on the head. You have people in high decision making positions allowing all this overtime, approving it. It’s freaking crazy!!

Comment by Westward Wednesday, Jan 28, 15 @ 10:01 am

The State Worker Pension Payout chart doesn’t take into consideration the employer contribution or compounding interest returns over the course of the persons service and retirement.

Bad form.

Comment by Phenomynous Wednesday, Jan 28, 15 @ 10:01 am

@illilnifan

Seems like OT just shouldn’t count toward the pension benefit and call it a day really. No idea what the numbers are but that may be a decent bargaining tack… We’ll see I suppose.

Comment by PMcP Wednesday, Jan 28, 15 @ 10:01 am

The average salary may be the four (SERS) year average at the end of employment. Of course the compounding of the employee contributions over that 26 year period are no where to be found.

War between the oligarch and Labor day 2…

Comment by Mouthy Wednesday, Jan 28, 15 @ 10:01 am

Illilnifan has it right. Hire more, lower overtime, and tier new hires with less generous benefits package. That’s prob the right solution.

Comment by Anon Wednesday, Jan 28, 15 @ 10:02 am

- Team Sleep -

The chart also does not include the State’s contribution to funding the pension or the compound earnings growth of the contributions. To use some of the debunking site terms, the chart’s claims are mixed / questionable.

Comment by RNUG Wednesday, Jan 28, 15 @ 10:02 am

Dear Bruce: I’m making today about what I was making in 1998, not adjusted for inflation.

Thank you for noticing.

Skeptic.

Comment by Skeptic Wednesday, Jan 28, 15 @ 10:03 am

Word: BTW, the Capitol of Kentucky isn’t Louisville.

Comment by Skeptic Wednesday, Jan 28, 15 @ 10:05 am

So, the Governor has made his millions managing pension funds, among other things, but now is saying how bad they are?

Comment by spidad60 Wednesday, Jan 28, 15 @ 10:05 am

And the third chart is representative of Tier I employees and retirees (I presume), whose terms are locked in and not representative of current or future Tier 2 employees, whose “return on investment” won’t be quite as staggering.

Comment by Six Degrees of Separation Wednesday, Jan 28, 15 @ 10:05 am

It’s been hinted at a couple times above. Somebody help me out: are these inflation-adjusted dollars in the payroll and pension payout figures? If not, they’re meaningless.

Comment by Ray del Camino Wednesday, Jan 28, 15 @ 10:05 am

Let’s see the same payroll chart with new hires replacing overtime pay for current employees.

I suggest he look into why Illinois has the second highest health insurance premiums. If he reduces that, then the employee percentage of the premium will go up without any contribution change.

Let’s see the Social Security employee contribution vs payout chart for comparison. Also, let’s see the chart with the total contribution from both the state and the employee (because that employer contribution would otherwise be going to that 401K he keeps talking about not back into the state coffers). Let’s also see some investment company charts of 401K investment growth of the same contributions for comparison. Until he does that, he’s just inflaming the masses.

Comment by mythoughtis Wednesday, Jan 28, 15 @ 10:06 am

It looks like the rise in employee salary began its trend when PSAs were included in the union. I think the inccrease could be traced back to that as well as increased overtime for DOC staff.

Comment by Jon Wednesday, Jan 28, 15 @ 10:07 am

I’m paying into an Illinois pension plan, and I want to know: How can I get into the one Rauner is talking about?

And if I can’t, can I try some of what he’s smoking? At least then I can pretend my pension will be awesome.

Comment by Stuff happens Wednesday, Jan 28, 15 @ 10:07 am

This is Rauner’s set up to start outsourcing state jobs. Overtime costs can be controlled better when you outsource work.

Comment by Beans and Franks Wednesday, Jan 28, 15 @ 10:07 am

Overtime is not Pensionable

Comment by Anonymous Wednesday, Jan 28, 15 @ 10:08 am

That chart that lists the percentage contribution from employees to the pension funds seems like what this year is going to be all about.

Does anyone know the impact of a much higher pension fund contribution from state employees to the big picture problem (ballpark). Meaning: if we implemented Kentucky-style contribution percentages of 24% from all state employees, does that cover a tiny bit of the gap, about half the gap, almost all the gap, etc?

I would have to guess since payroll is the biggest expense, that’s real money to close that gap.

Just curious.

Comment by Dan Johnson Wednesday, Jan 28, 15 @ 10:08 am

Re: pension chart.

If the average employee contributes $40k over 26 years, and that represents an 8% contribution, does that mean the average salary is less than $20k?

Comment by tch02 Wednesday, Jan 28, 15 @ 10:10 am

RNUG - yes, but the general (voting) public does not really understand that side either. If you tell Joe Voter that a state worker puts in $2,000 a year for his or her pension and then expects to receive $40,000 a year plus free healthcare premiums then explanation of investments and compounding interest will fall on deaf ears.

Comment by Team Sleep Wednesday, Jan 28, 15 @ 10:10 am

Different electorate in a midterm low turn out Republican leaning election than a Presidential election in Illinois.

Comment by sideline watcher Wednesday, Jan 28, 15 @ 10:11 am

When are the unions finally going to release that promised “killer Ad” that is going to end the Rauner campaign?

Comment by Thunder Fred Wednesday, Jan 28, 15 @ 10:11 am

All this counting and measuring and posturibg and attacking…

Two things to keep in mind;

* 60 & 30

* “Shut down the state”

Rauner can take Myshrooms out to movies, but steak dinners, invite mushrooms to the Mansion for the Super Bowl, but when it comes down to getting to 60 votes and 30 votes in the House and Senate respectively, AND…get the Speaker and senate President to push Bills to get floor votes, all the way to Third Reading…very heavy lifting.

Will the $20 million be used to help with narrative, or be used as a hammer? All 47 GOP House and all 20 GOP Senate members are on board? Rauner still needs 23, (13 House, 10 Senate) Dems to be “green”. Those LLs, they will earn their money.

Then comes Union negotiations.

I have very little to no sympathy for the Unions. Rauner won. Here’s the rub, however. Rauner shuts down the state, here, in Illinois, with rhetoric like the Decatur rhetoric, it could be a PR disaster. Good faith isn’t shutting down the state.

So, as a pragmatist, if Rauner think this may be helping, breakfast or not with MJM, bragging about the breakfast or not, all this IS doing is polarizing a Raunerite governor that needs GOP and Dem votes for an agenda that isn’t too appealing, through charts and numbers and formulas…when talking about families, the needy and workers, and cutting because Rauner personally, doesn’t understand;

“I still don’t totally understand this.”

Rauner may get a lesson in more than government spending, for really no good reason.

Comment by Oswego Willy Wednesday, Jan 28, 15 @ 10:12 am

==I thought this was supposed to doom Rauner in the fall as well, did I miss something? ==

One Man–it’s real now.

Comment by Tom Wednesday, Jan 28, 15 @ 10:13 am

- Mouthy -

It’s not. To get a pension under the normal SERS formula like what is shown (including the 3% AAI), you need a final average compensation of about $70,419.

Comment by RNUG Wednesday, Jan 28, 15 @ 10:13 am

Thanks, Skeptic, but I’m already way down on my state capitals, ABCs and times tables, too. I can cipher like Jethro Bodine.

I was going for largest economic centers, as in, Rauner chose to make his fortune in Chicago, not Louisville or Jackson.

Comment by Wordslinger Wednesday, Jan 28, 15 @ 10:13 am

Where’s the actuarial chart showing what the employee and state contributions (if they had been made without fail as IMRF municipal members have done) would have earned at an “average” 8% or so rate of return at the retirement of this “average” employee?

Comment by Six Degrees of Separation Wednesday, Jan 28, 15 @ 10:13 am

Rauner can propose freezing salaries and raising insurance premiums, if that will help.

Rauner should be careful with how he plans to cut state workers. This isn’t the private sector, where cuts can bring in more money to top executives. In government, drastic cuts without concurrent economic growth could stunt growth. Thousands of Illinois residents could curtail their spending due to cuts, and that can negatively impact the economy.

We can’t be too upset when unions dig in and fight back against being singled out for public worker cuts. After all, how willing are Rauner and his wealthy supporters to pay more in taxes? These people spend untold sums of money so that politicians don’t budge on tax increases for the wealthy.

Comment by Grandson of Man Wednesday, Jan 28, 15 @ 10:14 am

Is he including insurance in the ‘pension benefits’ total? What’s the retirement age?

Comment by Stuff happens Wednesday, Jan 28, 15 @ 10:14 am

Word: Well, I just didn’t want you to fall for the old joke, you know, “Q: How do you pronounce the capitol of Kentucky? Is it LOO-EE-ville or LOO-ISS-ville? A: Frankfort.”

Comment by Skeptic Wednesday, Jan 28, 15 @ 10:16 am

Willy,

Do I really have to explain this to you a third time?

Comment by White Denim Wednesday, Jan 28, 15 @ 10:21 am

Looks good bye to the Union… Now I’m nervous…

Comment by Ah ha Wednesday, Jan 28, 15 @ 10:21 am

Interesting that trying to achieve the often touted “smaller government” by decreasing headcount, actually increased expenses to taxpayers.

A lot to ponder in many of the charts Rauner presented, especially the Dept. of Labor, insurance, and legal expense ones. He’s taking a good, fair look at some of our issues.

The ones clearly out of whack, in some cases deliberately misleading, were the pension ones, and the ones about the “right-to-work”, which came from political advocacy groups. Suspect that “right-to-work” is the ticket to entry to some of the big national funders. It really doesn’t work economically, except for a small segment.

Rauner needs to better vet his sources for some of these data, and apply a little common sense.

Comment by walker Wednesday, Jan 28, 15 @ 10:22 am

Oddly enough, Rauner doesn’t seem to understand compounding investments. I am not an accounting. But, using SURS retirment system, and the $39,000 annual salary in Rauners example, the SURS employee would contribute 8% of 39,000 each year (or $3120) - AND THE EMPLOYER WOULD CONTRIBUTE 8% OF 39,000 each year(or $3120)– for a total annual contribution of %6240.

Using a compounding interest calculator, and starting out with $6240 - and adding $6240 every year for 26 years, at a 7% interest rate, at the end of those 26 years there would be $494,777 in the account. However that would not be withdrawn all at once.

In SURS one gets 2.2% of the salary in retirement for each year they worked. So 26 years times 2.2 = 52.2% of the $37,000 salary or an annual pension payment of $22,308 in retirement.

So from that $494,747 principle at the start of retirement, only $22,308 (plus 3% compounding interest) would be withdrawn annually. So at the end of the first year of retirement there would still be around $$471,000 earning the annual 7% interest.

Maybe someone knows how to do a declining balance, compounding interest calculation, but its not inconceivable that the $494,776 balance at the start of retirement - and the continuing compounding interest of the slightly declining principle after retirement, would put the total account in the $800,000 range over the period of 26 working years and 25 retirement years.

The big flaw in the above example - the State as employer skipped or borrowed or modified its matching contribution each year - which of course drastically reduces the amount of principle to work with - and the compounding interest additions.

Comment by Joe M Wednesday, Jan 28, 15 @ 10:24 am

The State employee/payroll slide is very drastic, but unfortunately not surprising in Illinois. It’s also important to remember that payroll drives the pension costs up. Especially with a guaranteed compounding interest over an average of more than 20 years and you can see one solution to solving the pension issue along with the yearly budget.

Comment by Ahoy! Wednesday, Jan 28, 15 @ 10:26 am

Pensions are part of the total compensation package, not a special perk. In order to be competitive, the state would presumably have to offer an alternative such a deferred comp match, or a higher salary so the employee can self-fund retirement. The important thing is, it’s all compensation. Would the other systems be cheaper for taxpayers? I dunno. Too many variables.

Now, given Illinois’ history of corruption and diversion of the pension payment, I can certainly see an argument for switching to deferred comp, at least for new employees going forward. Because that payment has to be made annually, no matter

what the legislature says. It doesn’t seem like this state can be trusted under either party to fund the pension every year over the long term. Something always comes up. Why would that change?

We Illinois residents got into this mess by not paying attention to what our political leaders were doing. Whatever the solution, it won’t be pleasant, but the legislators and governors who went along with, or even advocated for not making the pension payments deserve special scorn.

Comment by Cassandra Wednesday, Jan 28, 15 @ 10:27 am

RNUG makes an important point. My 401K is worth four times what I contributed to it, but it didn’t cost taxpayers anything. That’s just decades worth of investment returns.

Comment by Elo Kiddies Wednesday, Jan 28, 15 @ 10:30 am

- White Denim -

What are you going to explain to me?

Comment by Oswego Willy Wednesday, Jan 28, 15 @ 10:30 am

What exactly is the “manipulation of the system” that he is talking about?

And, yeah, there is a lot of overtime costs. Want to know why? Because there aren’t enough people to do the jobs that are required.

Rauner clearly has it in for state employees. He has apparently decided to assign blame for the state’s fiscal woes squarely on them. And the public eats that kind of rhetoric up and cheers him on to go after those evil state employees.

To all of you who whine about the attacks on the rich when they are asked to pay their “fair share,” I hope you have the same disdain for this sort of rhetoric. It’s the same sort of class warfare, just in reverse.

I guess a race to the bottom is what we are going for?

Comment by Demoralized Wednesday, Jan 28, 15 @ 10:31 am

Rauner is working for $1 a year. Why should anyone else earn more.

Comment by Anonymous Wednesday, Jan 28, 15 @ 10:33 am

@Elo Kiddies

Exactly! If the state had made its required contributions, it would be awash in money. When you have a 401k, the money is yours and can be passed along to heirs. When you have a pension and you die, and your spouse dies, the remainder is retained by the state.

The state is to blame for this mess, not the workers employed by the state.

Comment by Ducky LaMoore Wednesday, Jan 28, 15 @ 10:34 am

@Observer1 - Are you working?

Comment by PublicServant Wednesday, Jan 28, 15 @ 10:34 am

Ok people the post WW2 labor boom is over. Get over it.

The problem is not the money; the problem is the union work rules. We can always renegotiate the money. At your place of business do you need (have to use) a Teamster to drive’ and pay the grievance for work not performed when you fail to?

Certainly not. Outside of government such things don’t happen. Rauner understands this, and probably made his fortune laying off elevator operaters. Do we have to have minimum staffing levels? Is it safety, or is it just because we always have? How many people can we fit in an IDOT truck?

The ongoing deflation of the American dream has come to the public sector. As somebody said, elections have consequences. Welcome to the outside world.

Comment by The Wall Wednesday, Jan 28, 15 @ 10:34 am

Willy,

That your temper tantrum about how Rauner misses the mark by pointing a finger at overpaid employees completely contradicts your pogrom against a state employee and her new salary.

Comment by White Denim Wednesday, Jan 28, 15 @ 10:34 am

He is not listening.

He is not learning.

He is issuing solutions to problems he admits he doesn’t understand.

He is unwilling to find a compromise.

He is willing to demonize his employees.

AND if he actually succeeds - won’t save our budget, or the state.

He is not governing.

He is an absolute mess. He has been in office for less than a month and he has exposed himself to being a man willing to say one thing during an election, and another, in office.

Any legislator signing up for his team is going to need more than a wad of that $20 million.

He doesn’t understand? - He doesn’t understand a whole lot of things he things he understands!

Comment by VanillaMan Wednesday, Jan 28, 15 @ 10:37 am

SERS employees get OT included in pension calc….two bills have been presented one in 2013 and one in 2014 to stop this practice, but right now this spikes the pension. Also the urban institute has some great charts comparing pay in into SSA and payout. The only problem is the pay in amount has been adjusted assuming return on investment over the life time and includes the employer contribution. I agree with statements made here the chart on pension pay in and pay out is deceiving as the employee pay in amount does not appear to be adjusted to include employer contribution and investment returns. RNUG a project for you to show how the chart should really look if employer contributions were included. The urban institute used a 2% adjustment for investments for the lifetime pay in.http://www.urban.org/publications/412281.html

Comment by illilnifan Wednesday, Jan 28, 15 @ 10:37 am

The average premiums for employees don’t appear to be out of line with neighboring states. And one of his “examples” of good governance - Wisconsin - is higher than Illinois. He’s always quick to compare Illinois to surrounding states. Seems like we are in line with surrounding states on this one.

Comment by Demoralized Wednesday, Jan 28, 15 @ 10:37 am

To suggest that Rauner doesn’t understand inflation or compound interest is missing the boat completely. The reality is that he knows the vast majority of people won’t ask those questions they’ll only hear the subtext - unions are bad and the reason for our problems.

Comment by pundent Wednesday, Jan 28, 15 @ 10:37 am

Don’t use words like “pogrom.” Way over the top.

Comment by Rich Miller Wednesday, Jan 28, 15 @ 10:37 am

Fair enough.

Comment by White Denim Wednesday, Jan 28, 15 @ 10:39 am

Spending 30 years with a state agency in various capacities, I was able to see overtime go from a seldom used or abused benefit to the point that it is virtually uncontrolled and unregulated. Available manpower was the determining factor in its use early on, but became a non-factor in the latter years. I have seen full crews “working” on a holiday (at double time on top of the paid holiday) during which there was no work to be done. I have seen over 100 hours of overtime charged in one two week period that was not even questioned, let alone verified by the supervisors. I was told to let it go. These types of instances are fairly common in my experience, and continue today. Maybe these abuses amount to only a drop in the bucket on the surface, but over the years those drops add up to a flood when the effects on pensions are considered. The integrity of the state workforce is wholly another matter.

Comment by Anonymous Wednesday, Jan 28, 15 @ 10:39 am

Jon may have an explanation for the employees going down/wages going up graph. About 20 years ago or so, supervisors and quite a few job titles weren’t in the union. Since then many titles including a lot of supervisors are now in the union, many making a lot more money.

I’d like to see the same graph for non union employees. I bet the wage growth would be a lot lower.

Comment by Sir Reel Wednesday, Jan 28, 15 @ 10:40 am

- White Denim -,

You Are a Dope.

Telling state workers sacrifice is needed, he will fundamentally change government, and…Rauner believes pensions and benefits are out of whack…

While giving a 10% raise to a CoS for his full time workibg wife, who happens to head an organization that gets state monies…

…and the optics work? lol

Put her on Campaign payroll, no state service time, no putting into a state pension…then talk about fundamental change.

Raunrr does all that, then you don’t have to explain your Dopey “But it’s not the same” drivel.

Comment by Oswego Willy Wednesday, Jan 28, 15 @ 10:40 am

I just took another look at my compounding investment example given above, which at the start of retirement had a balance of $494,776.

$494,776 being invested with a 7% return generates $32,632 in annual interest - which exceeds the first year annual pension withdraw of $22,308. So it would take quite a few years, even with a 3% compounding pension, before any of the beginning principle would start to diminish.

Again, the flaw with the figures is that the State of Illinois as employer skipped, borrowed, or modified its contributions to the pension system.

Comment by Joe M Wednesday, Jan 28, 15 @ 10:44 am

=== - White Denim - Wednesday, Jan 28, 15 @ 10:39 am

Fair enough.===

…since its your blog and I’m a guest…

Yikes.

Comment by Oswego Willy Wednesday, Jan 28, 15 @ 10:45 am

Inflation is a big factor not included in the Salary chart. One would need to be making 1.61 in 2014 for every 1.00 made in 1994. Just sayin.

Comment by PublicServant Wednesday, Jan 28, 15 @ 10:46 am

Word: BTW, the Capitol of Illinois isn’t Chicago.

Jethro Bodine. Lol.

Comment by 47th Ward Wednesday, Jan 28, 15 @ 10:47 am

Regarding overtime, I wonder how much overtime would be worked if it wasn’t paid, but comp time was awarded.

Comment by spidad60 Wednesday, Jan 28, 15 @ 10:50 am

“Drivel” is how many words it takes you to explain how every state worker is overworked and underpaid, right before you harp on how much a particular state employee is paid. Is Rauner right to say it’s time to tighten the belt, or is he wrong? You seem to want to have it both ways. Rauner appointees need to all work for free, everyone else is above reproach. If it’s dopey to notice how dopey that is, then we’re about to make our way into a dopeception.

Comment by White Denim Wednesday, Jan 28, 15 @ 10:50 am

Word, name the body of water to the west. And no, it not Kelsey’s Swamp, it’s bigger than that.

Comment by PublicServant Wednesday, Jan 28, 15 @ 10:50 am

The state payroll issues are much more complicated than the Rauner chart indicates.

The state’s total payroll growth has actually lagged overall salary growth. Bruce’s chart shows the state payroll growing roughly 66 percent since 1994. But the average U.S. worker’s salary has grown almost 90 percent in that timeframe (http://www.ssa.gov/oact/cola/AWI.html).

That comparison is a little apples to oranges and doesn’t necessarily disprove Rauner’s contention that there are fewer employees making more money. But keep in mind, as the state has essentially privatized social services through de-institutionalization over the past two decades, a higher percentage of low ranking jobs are removed from the state payroll. In other words, the near-minimum wage gig of changing a bedpan gets contracted out, but the job of administering the contract (at a much higher salary) remains on the state payroll.

Comment by TR Wednesday, Jan 28, 15 @ 10:52 am

spidad60 “Regarding overtime, I wonder how much overtime would be worked if it wasn’t paid, but comp time was awarded.”

I think you are on to something - watch for comp time and vacation time to sore so folks can go on vacation for several years before retiring…just think of the royal mess this will cause…

Comment by Beans and Franks Wednesday, Jan 28, 15 @ 10:53 am

Two things that would have made this presentation more accurate:

– Cite MEDIAN salaries and pensions rather than averages. Median means the figure that half the group is above and half are below; it is less subject to being skewed by outliers at the top or bottom of the scale.

As an extreme example of how outliers can skew averages: Rauner’s mere prescence at the Richland gathering would have made the “average” income of everyone in the room skyrocket into six, maybe even seven figures, depending on how many were there; it wouldn’t have affected the median income of everyone in the room as much.

– Compare IL healthcare premiums and other benefits to states of comparable population (e.g. OH, MI) rather than merely to neighboring states, since all the immediately neighboring states have only 1/3 to 1/2 the population that we do. To wit:

IL population, 2010: 12.8 million

PA: 12.7 million

OH: 11.5 million

MI: 9.8 million (and dropping)

GA: 9.6 million (and growing)

IN: 6.4 million

MO: 5.98 million

WI: 5.7 million

KY: 4.3 million

IA: 3.0 million

Comment by Secret Square Wednesday, Jan 28, 15 @ 10:54 am

For a long-term fix, offering a full 5% 401K match and standard social security is reasonable and in line with the private sector for new employees. Should not be overly controversial. Will stop the double dipping, spiking etc.

Comment by Very Fed Up Wednesday, Jan 28, 15 @ 10:56 am

White Denim:

Let’s speak really slowly so you can understand.

The issue is not with the First Lady’s Chief of Staff and how much she makes per se. The issue is OPTICS. Understand?

It’s pretty bad OPTICS when you say state employees are overpaid and then hire somebody making $100,000 a year.

Got it?

I don’t care that the person got hired or what her salary is. But you cannot deny that it’s bad OPTICS.

Comment by Demoralized Wednesday, Jan 28, 15 @ 10:57 am

===every===

When someone says “every”, “only”, “never” or “always”, they really have no point.

===Is Rauner right to say it’s time to tighten the belt, or is he wrong? You seem to want to have it both ways.===

No, lol, that’s Rauner…I’m not the one hiring a $100K CoS for a spouse and telling state workers to tighten their belts. You’re pretty comical!

===Rauner appointees need to all work for free, everyone else is above reproach.===

Again, pretty comical, that’s Rauner, not me. Do you think I’m governor?

Your ignorance about what’s going on is making your argument a farce.

No one told anyone to offer that job, or take that job, but if you’re going to fundamentally change government, hire as you wish, bash who is convenient, hypocrisy notwithstanding.

Comment by Oswego Willy Wednesday, Jan 28, 15 @ 10:57 am

==I wonder how much overtime would be worked if it wasn’t paid, but comp time was awarded.==

Union employees get paid out for comp time if they don’t use it by the end of the fiscal year. So, in the end it may not make any difference.

Comment by Demoralized Wednesday, Jan 28, 15 @ 10:58 am

Wall: “Outside of government such things don’t happen” I beg to differ. I have a friend who was a welder (in private industry.) One day he needed a piece of wood to prop up the pipe he was welding, so he grabbed a scrap from the pile. He got formally reprimanded because that was a carpenter’s job. And have you heard about the Musician’s union? Theaters have to pay for “walkers” - people who are literally paid to not play in a show. And the list goes on.

Comment by Skeptic Wednesday, Jan 28, 15 @ 10:59 am

- Anonymous - Wednesday, Jan 28, 15 @ 10:08 am:

Overtime is not Pensionable

You are 100% in error.

Comment by Anonymous Wednesday, Jan 28, 15 @ 11:00 am

A pogrom is a violent riot aimed at massacre or persecution of an ethnic or religious group, particularly one aimed at Jews. The term originally entered the English language to describe 19th- and 20th-century attacks on Jews in the Russian Empire (mostly within the Pale of Settlement in present-day Ukraine and Belarus). Similar attacks against Jews at other times and places also became retrospectively known as pogroms. The word is now also sometimes used to describe publicly sanctioned purgative attacks against non-Jewish ethnic or religious groups.

Sorry, I’m a simple guy so I had to look it up.

Comment by Mouthy Wednesday, Jan 28, 15 @ 11:01 am

Re averages: if my math is correct, anytime Rauner is in a room with 50 or fewer people, everyone in the room becomes an instant millionaire in terms of most recent average annual income

Comment by Secret Square Wednesday, Jan 28, 15 @ 11:03 am

RNUG @ 9:50 am:

= I can’t make the numbers on the Pension Payout Chart come out when I try to reverse engineer it. =

Secret Square @ 10:54 am:

= Cite MEDIAN salaries and pensions rather than averages.=

It makes me wonder if someone who really doesn’t understand how the pensions are calculated is giving Rauner these numbers.

But then if they really do understand the numbers then why does Rauner not get it that this stuff is easily checked and will undergo intense scrutiny? Either way – by cooking the numbers or not understanding them – Rauner is hurting his credibility before he even gets started, at least among some here and in the GA.

The whole thing looked more like a business presentation than a roadmap for governing, but I’m sure if you have an agenda it’s just another way of again justifying to those that don’t know any better that the state employees are overpaid, have excessive pensions, are responsible for the measles outbreak, and are the cause droughts and the war in Iraq.

Comment by Sangamo Sam Wednesday, Jan 28, 15 @ 11:03 am

-Beans and Franks: You’re right about that! Years ago this was offered and some folks took the entire winter off and only worked when their unit got OT in the summer. This practice was stopped, but then re-instituted with a limitation during the Blago era for the newbies, who needed this time to take care of their personal businesses and campaigning interests. So, what did they do? Took the time off, and then padded their OT when supposedly working so they would get more. Their greed was insane!

Comment by Gone, but not forgotten Wednesday, Jan 28, 15 @ 11:07 am

“The whole thing looked more like a business presentation than a roadmap for governing”

An analyst putting together numbers that poorly (*assuming*, for discussion, that they aren’t *intentionally* misleading with the numbers) isn’t likely to get a second chance to make that big of a mistake.

Thus, either (a) not business presentation quality, or (b) intentional obfuscation.

Comment by Chris Wednesday, Jan 28, 15 @ 11:09 am

- Demoralized -,

The irony? Being blind..to optics.

Well said. It’s not about the person or who she is. It is about optics when $20 million is parked, you want to fundamentally change how government works, and then have a “hire” like that, no matter the individual.

Comment by Oswego Willy Wednesday, Jan 28, 15 @ 11:09 am

hated comp time as a manager…if you are so short staffed to need OT when could the time be reasonably taken off later in the year…you are still short staffed so you are delaying the real fix to the problem….sounds a little like what they did with the pension pay in (if you don’t have the money now, do you think you will have more money later)

Comment by illilnifan Wednesday, Jan 28, 15 @ 11:09 am

How could this be that our billionaire businessman Governor doesn’t even understand how the pension system works. I am so angry that he was allowed to make this chart showing pension contributions and earnings that is totally innacurate and an out right lie.

The employee in the fact pattern he identifies under the regular formula would be earning less than $17,000 in pension payments per year and would earn in the $300,000 dollar range over 20 years, not over $800,000.

Someone in the media needs to call him on these lies.

Comment by Bibe Wednesday, Jan 28, 15 @ 11:12 am

“state employees are overpaid, have excessive pensions, are responsible for the measles outbreak, and are the cause (of) droughts and the war in Iraq.”

They’re probably also to blame for global warming AND the polar vortex AND the poor performance of the Cubs, Bears, Illini, et al.

Comment by Secret Square Wednesday, Jan 28, 15 @ 11:12 am

Rauner cares about one thing - breaking the unions, and de-regulating everything big business do not like. His job is also about changing IL from a Democrat to a Republican state.

Comment by Mama Wednesday, Jan 28, 15 @ 11:12 am

@mama:

Mostly right. Just teachers unions, though.

Bruce doesnt have the stones to take on the Police and Firefighters.

Comment by Del Clinkton Wednesday, Jan 28, 15 @ 11:17 am

As someone mentioned earlier, public service administrators (PSAs) being unionized is a major payroll issue in state government. Many PSAs make $110,000 and don’t supervise anyone. Often their bosses who are senior public service administrators (SPSAs) make much less. That being said, the entire personal services is a small portion of the state’s current debt.

Comment by Soccertease Wednesday, Jan 28, 15 @ 11:22 am

- illilnifan -

Feel free to do it yourself. For SERS, all the annual pension fund reports since FY2003 are online, so you could use their actual returns for those years. I would suggest you just use the average stock market gains / losses for the other years so you are modeling real world.

Comment by RNUG Wednesday, Jan 28, 15 @ 11:23 am

@The Wall 10:34 =How many people can we fit in an IDOT truck?=

If more workers ride in one truck, it cuts the number of workers driving another state car or pickup truck to get to the jobsite. A convoy of state pickup trucks with one worker each costs a lot more money.

Comment by DuPage Wednesday, Jan 28, 15 @ 11:24 am

Employee empowerment starts with reducing wages! As long as you don’t think about it, it makes perfect sense.

Comment by Gabe Wednesday, Jan 28, 15 @ 11:25 am

@Gabe - War is Peace too by the way.

Comment by PublicServant Wednesday, Jan 28, 15 @ 11:29 am

@PublicServant To continue this line of thought we had to destroy the state in order to save it. And that thought is as valid as the Laffer Curve.

Comment by former southerner Wednesday, Jan 28, 15 @ 11:32 am

Haha Mouthy I looked it up to. I also looked up optics. Check out the example used at dictionary.com. Cracked. Me. Up.:

(used with a plural verb) the way a situation, action, event, etc., is perceived by the public or by a particular group of people: “Administrators worry about the bad optics of hiring new staff during a budget crisis.”

Comment by Anonymous Wednesday, Jan 28, 15 @ 11:34 am

“looked more like a business presentation than a roadmap for governing” He’s going to run Government like a business, remember? That’s going to work…right?

Comment by Skeptic Wednesday, Jan 28, 15 @ 11:35 am

When you get right down to it, Rauner is a salesman. He knows how to make a successful pitch and how to close. The unions need to understand this and really take it to heart.

Comment by RNUG Wednesday, Jan 28, 15 @ 11:41 am

While respecting Gov. Rauners ideals and intent, it seems to me he is still too ‘green’ to fully understand how state guv works compared to private business. Right now he is listening to a lot of different people telling him a lot of different things and reacting to those things. I think he should be taking some of his time and getting out there and really seeing what is going on in state agencies and offices and get a better feel for the ‘what, when, how” things function - for real, from the real people out there doing the actual work, not from other politicians and people hired to tell him what he wants to hear. And I am not talking about going out and allowing selfies to be taken with him, really sit down and listen. I think more state workers would be willing to give him a chance if he would give them one as well.

Comment by TiredofIT Wednesday, Jan 28, 15 @ 11:42 am

Rauner was made to order for the unions. The optics are amazing. Billionaire wants to reduce pay and benefits of teachers, firefighters, police etc. He is chock full of contradictions and hypocrisy. His figures and presentation gives the unions a smoking gun and Rauner does not even know it. We also have a democratic super majority in the house and senate so nothing happens the first two years without all eyes being on the midterm elections and the democrats wanting something to happen. Remember, legislation begins in the house and senate and not the Executive branch.

Comment by facts are stubborn things Wednesday, Jan 28, 15 @ 12:00 pm

It just amazing me how someone that makes more money in 7 days than most do their entire lives belives that a $66k salary a year is too much.

Comment by Anonymous Wednesday, Jan 28, 15 @ 12:09 pm

Walker and others are correct that the OT is the result of the misbegotten question to keep the employment numbers low. But a second thought…how much blustering is Rauner’s way of trying to say “mine is bigger and I’ll whump you in negotiations and like it” so that whatever happens will seem less bad than we expected, i.e. Posturing for the fight like a gorilla pounding its chest??

Comment by DPGumby Wednesday, Jan 28, 15 @ 12:15 pm

Willy:

1. Illinois under Pat Quinn was paying less for health insurance for state employees than Wisconsin under Scott Walker.

2. You can bet the COS for the First Lady and the Turnaround Team will not be rejecting pension benefits or state health care coverage.

Comment by Juvenal Wednesday, Jan 28, 15 @ 12:17 pm

- Juvenal -,

“But…but…but Bruce is only taking a dollar a year!”

Is that $1 a year…optics?

Evelyn was glad to be “hired”. That’s all we heard. “I was hired.”

Irony there too…

Comment by Oswego Willy Wednesday, Jan 28, 15 @ 12:20 pm

“Oddly enough, Rauner doesn’t seem to understand compounding investments. I am not an accounting.”

(re: pensions)

Of course, Rauner understands it, but he hopes the public does not and/or the resentment factor is so strong that it does not make any difference. Just keep telling the big lie over and over and over and it sticks.

Remember most are on SS and if you are a middle or upper middle income contributor it is a bad deal (better deal for low income workers.) Low rates of return on your money particularly compared to the state pension systems. Thus, they look at their much lower SS checks and are very resentful.

Rauner does understand that and he will milk it for all it isn’t worth.

Comment by Federalist Wednesday, Jan 28, 15 @ 12:21 pm

- facts are stubborn things - Wednesday, Jan 28, 15 @ 12:00 pm:

Rauner was made to order for the unions. The optics are amazing. Billionaire wants to reduce pay and benefits of teachers, firefighters, police etc. He is chock full of contradictions

- facts are stubborn things - Wednesday, Jan 28, 15 @ 12:00 pm:

Rauner was made to order for the unions. The optics are amazing. Billionaire wants to reduce pay and benefits of teachers, firefighters, police etc.

If I recall, he has commented many times that he feels police and firefighters should have a different deal, a better deal than regular state employees. Don’t recall teachers included in those comments…

Comment by Anonymous Wednesday, Jan 28, 15 @ 12:21 pm

=For a long-term fix, offering a full 5% 401K match and standard social security is reasonable and in line with the private sector for new employees. Should not be overly controversial. Will stop the double dipping, spiking etc.=

And there is evidence that the state would actually meet the obligation for a 5% match with regularity? Please share that evidence. Past practice is the best indicator of future performance. Thy haven’t and won’t. BTW- pension spiking is a canard and not responsible for our issues. I always enjoy the “in the private sector…” stuff. It isn’t and both have their pluses and minuses.

The 26 year employee example from the governor failed to explain that that person would not meet the requirement for a full pension.

Thanks TR and Joe M for the information and analysis.

Comment by JS Mill Wednesday, Jan 28, 15 @ 12:22 pm

What is orange and sleeps three?

Comment by The Unknown Poster Wednesday, Jan 28, 15 @ 12:31 pm

@PowerPointinRauner: People, less thoughtful analysis, and more attacking each other. Geesh!

Comment by Cheswick Wednesday, Jan 28, 15 @ 12:32 pm

“If I recall, he has commented many times that he feels police and firefighters should have a different deal, a better deal than regular state employees. ”

If Anonymous is correct, we have the same hypocrisy as Scott Walker. Do the police and fire have ‘pictures’ on all of these people?

Comment by Federalist Wednesday, Jan 28, 15 @ 12:34 pm

If you adjust the top chart for inflation I think it makes Rauner’s points even better IMO.

Unadjusted numbers show a 60% increase in payroll and a 25% decrease in employees since 1994.

In ‘94 there were 78K employees at $2.6B which works out to an average of $33.3K. Adjusted for inlfation (per BLS website) that $33.3K becomes $53.2K. The last year on the chart shows 62.5K employees at $4.4B which is $70.4K.

If you adjust the red line for inflation the ‘94 starting point would be $4.2B, the line would be almost straight across.

If you look at 2004 where the two lines intersect, there were 70K employees at $3.5B for an average of $50K. That $50K adjusted for inflation would be $62.7K today. If salries had increasd only at the level of inflation (per BLS) we could still have those 70K employees at $4.4B.

The two factors for big spike in salaries is the AFSCME contract negotiated by Blago, and then the absorption of most middle management into the bargaining unit at high pay grades.

Comment by LTSW Wednesday, Jan 28, 15 @ 12:34 pm

@VanillaMan

I don’t think he’s really trying to fix the problem. He’s still in campaign mode, and he wants to show action (regardless of results) for the next big campaign.

I remember a semi-recent NPR radio interview with a journalist who has been following Rauner for a while. She believes that Rauner wants to run for president and is just using the governor’s office as a stepping stone…

Comment by Stuff Happens Wednesday, Jan 28, 15 @ 12:35 pm

@JSMIll,

“For a long-term fix, offering a full 5% 401K match and standard social security is reasonable and in line with the private sector for new employees”

Yes, and I have made that same exact proposal previously on this site. Of course, as you say, the 5% matching would have to be in a separate IRA and actually contributed- no IOU’s

However, I doubt if Rauner would want this. What I believe he wants is LESS and a lot less. Perhaps as little as the 6.2% required by SS but placed in IRA type of accounts that his investment buddies can make money off of.

Again, this is all conjecture on my part but I will go ahead and put it out there.

Comment by Federalist Wednesday, Jan 28, 15 @ 12:47 pm

Anonymous it is totally not amazing “how someone that makes more money in 7 days than most do their entire lives believes that a $66k salary a year is too much.” If most of your income is not at risk based on investments or productivity measurements you are basically a underproductive drone from that world perspective. Governor Rauner is a true believer in the justice of the market and competition, you can reject that perspective if you want to, but he is what he is.

Part of the problem during the election was Quinn did not want to attack Rauner’s core beliefs because its like attacking apple pie. So instead he tried to turn the election into a referendum on greed thinking that would work as a proxy argument. It didn’t work.

Comment by Rod Wednesday, Jan 28, 15 @ 12:48 pm

@Stuff Happens

Maybe he does have aspirations of funning for president. But I don’t see that happening in 2016 which means that at least 5 years in the future. In the meantime he’s got a state to run and his ability or inability to do that will dictate his political future. He’s not exactly stepping in to be a gatekeeper for the next 4 years.

Comment by pundent Wednesday, Jan 28, 15 @ 12:49 pm

At least some of the now-unionized managers were probably underpaid by reasonable standards before they were unionized. Over time, does it make much difference? We don’t live in a vacuum. Baby boomers are retiring pretty much as expected I read recently, despite all those stories about 90 year olds going to the office every day. There may be a labor shortage coming up, and state govt would be affected by that, might even have to raise salaries.

Should there be a complete overhaul of state compensation schedules. Absolutely. Will Rauner have the time or inclination to do it. Probably not. All he can probably do is try to slow the increases in salaries, and related pension payouts and maybe shift some new employees to deferred comp with a match. But the rhetoric will be fierce.

Comment by Cassandra Wednesday, Jan 28, 15 @ 1:00 pm

Anyone ask Durkin or Radogno about Rauner’s two presentations?

Have either embraced the power points?

Comment by Oswego Willy Wednesday, Jan 28, 15 @ 1:02 pm

401K is 100% pay as you go. The matching amount would have to be put in full each pay period into everyone’s individual 401K account.

This would forever remove any temptation or ability by lawmakers to make promises they cannot keep or to kick the can down the road. For the life of me I do not understand why state workers would not want this. Competence of politicians from both political parties are the last people on earth I’d want to have to rely on for my retirement security.

Comment by Very Fed Up Wednesday, Jan 28, 15 @ 1:06 pm

- Very Fed Up -

Sounds wonderful!

Now, about that pesky Constitution…

Comment by Oswego Willy Wednesday, Jan 28, 15 @ 1:09 pm

===Competence of politicians from both political parties are the last people on earth I’d want to have to rely on for my retirement security.===

We’re not. We’re relying on the courts and contract law, just like a party to a private sector contract would when the other party to said contract tries to welch on its provisions.

Comment by PublicServant Wednesday, Jan 28, 15 @ 1:11 pm

Let’s run with the 401K idea and know it requires mandatory Social Security…employer match 5% PLUS employer share of FICA at 6.2% for total out of the state pocket of 11.2%. Since 80% of state employees are not in Social Security currently the state match to their retiree plans is around 8%. How would the 401K save the state money?

Comment by illilnifan Wednesday, Jan 28, 15 @ 1:12 pm

Soccertease @ 11:22 am:

=public service administrators (PSAs) being unionized is a major payroll issue in state government. Many PSAs make $110,000 and don’t supervise anyone.=

It was an offer that they couldn’t refuse.

First, the questions used at the hearings on whether the PSAs could unionize (written by consultants) were so skewed about supervisory/managerial duties and responsibilities that it was impossible to find a reason they shouldn’t be included.

Second, the PSAs saw a chance to avoid mandatory furloughs, receive raises, have rights to certain job openings and gain some protection from layoffs by being able to use their seniority. Who wouldn’t jump at that?

By the time the dust settled many SPSAs were also included. At some agencies there were just a handful of non-union merit comp employees left to run the place.

Blago, Quinn and Madigan regularly flogged the non-union merit comp employees with no raises (since 2007?), mandatory unpaid furlough days and fumigation lists and drove them into the union, which allowed for the $110K non-supervisory PSA.

Then they turned around and screamed pension crisis. And so here we are today with the Rauner “solutions”.

Comment by Sangamo Sam Wednesday, Jan 28, 15 @ 1:12 pm

@VeryFedUp

Correct. And how would the state pay for the current benefits owed to retirees and future retirees who already have earned a part of their retirement. The transition costs would be unbelievable.

Comment by Ducky LaMoore Wednesday, Jan 28, 15 @ 1:12 pm

@ Federalist- I have no doubt that you are correct when you state “he wants LESS and a lot less.”

I am not a believer in the idea that government should keep people on the payroll simply to employ people. Given the staffing that I am aware of in state offices I deal with- my experience is that they are pretty thin. But, putting a lot of people out of work or diminishing their income will have a tangible impact on the economy. Middle class workers/earners still do most of the spending in our economy. It is a contributing factor to the slow economic growth in Illinois.

Comment by JS Mill Wednesday, Jan 28, 15 @ 1:12 pm

If anyone in the media is interested in checking into Rauner’s numbers (God help us if they aren’t looking) I’d like to know whether the pension ramp up explains the payroll chart. I believe for at least some employees (not paid out of GRF) the Agency has to pay into SRS the actual cost of the pension payments which may correspond to the uptick in the graph with the accelerated payments that have been actually being made under Quinn.

Comment by Bibe Wednesday, Jan 28, 15 @ 1:16 pm

=This would forever remove any temptation or ability by lawmakers to make promises they cannot keep or to kick the can down the road.= LOL!

Nekritz and Biss also promised a “stronger” pension guarantee. I guess the Constitution is not strong enough.

Comment by JS Mill Wednesday, Jan 28, 15 @ 1:17 pm

Apparently not much was learned by these folks from the mayor’s showdown with the CTU.

We sure could use Topinka to talk some sense right now.

Perhaps Durkin will grow a spine.

Comment by Juvenal Wednesday, Jan 28, 15 @ 1:21 pm

- Very Fed Up -

Sounds wonderful!

Now, about that pesky Constitution…

Nothing unconstitutional with offering current employees a voluntary “opt out” 401k, or new hires a mandatory 401k style pension. Hard to see how you could transition any current retirees to a 401k as they would not be contributing anything in, only taking out. Again, as OW mentions, the already-incurred obligations (which appear to be 99 44/100 guaranteed by an upcoming ISC decision) will only be more poorly fed if current employees (including the net donors of Tier 2) are no longer making payments into the retirement system, but instead to their 401k accounts. The legacy costs are the 800 lb. gorilla of any logical solution.

Comment by Six Degrees of Separation Wednesday, Jan 28, 15 @ 1:27 pm

===We sure could use Topinka to talk some sense right now.===

Miss her something awful right now.

I would love to get Durkin and Radogno’s take on this.

That $20 million better be able to provide more than umbrella for a rainy day, it better provide an impenetrable shield of safety.

Don’t see seats brubg added with that power point for the ILGOP.

Comment by Oswego Willy Wednesday, Jan 28, 15 @ 1:28 pm

@Ducky, that is my concern to about switching to 401K. If none of the new hires are paying into the pension system that is there for retirees and current workers who will. I’d like to see a reasonable estimate on what that would cost the state.

Comment by The Dude Abides Wednesday, Jan 28, 15 @ 1:39 pm

1.) The charts and graphs speak for themselves

2.) Considering the sheer number of six figured salaries in state government, $100,000 for any particular high profile position is not over the top

3.) Is overtime abused? Duh!

4.) Does state government employ hard working people? Yes.

5.) Does state government employ some goldbricks? Yes.

6.) Can the state easily rid itself of the goldbricks? Probably not.

7.) Does the “system” make it easy to distinguish between hard workers and goldbricks? Probably not.

8.) Can the state fix the overtime problem? Maybe.

9.) Will some object to foregoing observations? Of course!

Comment by Keyser Soze Wednesday, Jan 28, 15 @ 1:43 pm

@ illilnifan - Wednesday, Jan 28, 15 @ 1:12 pm:

Let’s run with the 401K idea and know it requires mandatory Social Security…employer match 5% PLUS employer share of FICA at 6.2% for total out of the state pocket of 11.2%. Since 80% of state employees are not in Social Security currently the state match to their retiree plans is around 8%. How would the 401K save the state money.

It won’t!!! But as we all know, the state has underfunded and under this model they would have to actually pay up what they promised.

But this is not what Rauner wants. As I pointed out in an earlier post he wants as little as will meet federal guidelines (c. 6.2%) and have that in IRA type accounts.

Comment by Federalist Wednesday, Jan 28, 15 @ 1:43 pm

Someone should look at the staggering pay raises that are doled out to union members…Lt.s over 90 grand shift commanders over 130 grand. Both afscme and isea are fleecing the tax payer.

Comment by Union boss Wednesday, Jan 28, 15 @ 1:44 pm

Somebody please put up a chart of what Rauner pays his workers in all his companies. And then a chart of his tax returns.

Comment by J. Bradley -retired Wednesday, Jan 28, 15 @ 1:44 pm

I retired from ISU almost 9 years ago and the amount of help was dwindling then. Lots of OT depending on the time of year when I started working there in the late 70’s. But when the extra 150 use it or lose it hours per year of sick time kicked in after FMLA went into effect, it really put a bind on the help that showed up for work everyday. A result of that was extra hours thus causing higher billings to various departments. It was either bill and pay, or high profile services weren’t accomplished. Not a good thing at a university.

I’m not sure if other universities have these benefits on top of benefits, but if they do, they need to stop. in so many ways, it’s killing your good help.

Rauner, if you really want to make a difference, dig deeper and ask questions. Don’t take anything for face value.

Comment by redleg Wednesday, Jan 28, 15 @ 1:47 pm

Rauner does understand that his staff are State employees too?

Comment by Come on man! Wednesday, Jan 28, 15 @ 1:51 pm

“State and local governments lost $1.6B due to prevailing wages alone…” So that $1.6B just went up in smoke? It’s not circulating around the economy somewhere in, oh, I don’t know, someone’s pocket?

Comment by Skeptic Wednesday, Jan 28, 15 @ 2:01 pm

There is a bigger agenda here trying to move people to 401ks as many of you have noted. There is an interesting study done states that have moved to 401Ks www.uco.edu/…/Making%20it%20Wors

I find it interesting that the report notes that actuaries find the costs of the switch to be more expensive than planned and funded liabilities for old plans declined further. In other words it does not solve the problem and actually costs more.

The key is this is complex and Rauner is skillfully presenting this complex situation in a simple way and reinforcing to the general public a belief that public employees are fleecing them. As we can all see, he is building his support base to put pressure on the politicians.

Comment by illilnifan Wednesday, Jan 28, 15 @ 2:15 pm

Oops here is the right link to the report

http://www.uco.edu/central/staff-senate/files/Making%20it%20Worse%20A%20Case%20Study%20in%20Failed%20Transitions%20to%20401k%20Plans.pdf.

Comment by illilnifan Wednesday, Jan 28, 15 @ 2:17 pm

Very Fed Up, the reason why state employees wouldn’t want the 401k is because that isn’t a defined pension. If the investment scene tanks (read: 2008) then your investment tanks. The pension is guaranteed no matter how well the market is doing. You get the amount promised. It’s the state that (read: taxpayers) who get the shaft there.

Comment by dupage dan Wednesday, Jan 28, 15 @ 2:31 pm

Part of the confusion with the Pension Payout Example is that the example is for a SERS worker who also draws Social Security, and thus only makes a 4% SERS pension contribution. The only way to reach a total benefit of $821000 is from a SERS benefit with 3% COLA of about $500,000, with the remainder coming from Social Security. This example therefore does not include the FICA contribution.

Comment by OldIllini Wednesday, Jan 28, 15 @ 2:37 pm

Rauner emphatically denies bashing state emplyees. Then explained that you can never be lost in Illinois if you just remember that the moss grows on the north side of the highway maintainers shovel.

Comment by Anonymous Wednesday, Jan 28, 15 @ 2:42 pm

1)Regarding the example, it is possible they found a person in the SERS database that matches that info (in real numbers not Present Value).

2)I’ve said it to anyone that will listen, transferring new employees into a DC plan makes no sense. It would make more sense to close the plan to new employees and just put them in SS (though best idea is just to keep them Tier 2 imo)

Comment by Name/Nickname/Anon Wednesday, Jan 28, 15 @ 2:42 pm

This is missing the employer contributions. If my 401k i kick in 4% and the employer kicks in 11% each year. And you ignore intetest and compounding interest, the contribution to payout would be skewed. Add in the employer contribution and interest at a 6-8% compunded and its no longer skewed

Comment by Ghost Wednesday, Jan 28, 15 @ 2:52 pm

This gets you close just assuming 7% raises, not hard to come up with an example where more of the total salary falls in the last 4 yrs

Employment

1 16,534.26

2 17,691.66

3 18,930.07

4 20,255.18

5 21,673.04

6 23,190.15

7 24,813.46

8 26,550.41

9 28,408.93

10 30,397.56

11 32,525.39

12 34,802.17

13 37,238.32

14 39,845.00

15 42,634.15

16 44,339.52

17 46,113.10

18 47,957.62

19 49,875.93

20 51,870.96

21 53,945.80

22 56,103.63

23 58,347.78

24 60,681.69

25 63,108.96

26 65,633.32

1,013,468.04

Retirement

1 26,841.94

2 27,647.20

3 28,476.62

4 29,330.92

5 30,210.84

6 31,117.17

7 32,050.68

8 33,012.21

9 34,002.57

10 35,022.65

11 36,073.33

12 37,155.53

13 38,270.19

14 39,418.30

15 40,600.85

16 41,818.87

17 43,073.44

18 44,365.64

19 45,696.61

20 47,067.51

721,253.08

Comment by Name/Nickname/Anon Wednesday, Jan 28, 15 @ 2:52 pm

spidad60 “Regarding overtime, I wonder how much overtime would be worked if it wasn’t paid, but comp time was awarded.”

All of the overtime would be worked where it’s needed. If nobody volunteers then an employee gets ‘mandated’ and HAS to work the overtime.

Comment by Bulldog58 Wednesday, Jan 28, 15 @ 3:02 pm

Everyone needs to be reminded that there is no mandate for the employer to contribute to a 401k. it is voluntary on their part and not necessarily 5%. Also, the 5% would generally be of the amount contributed by the employee, not the total salary as some think. SERS is 1.67% per year, not the 2.2% used in a previous example. Get your facts straight

Comment by anon Wednesday, Jan 28, 15 @ 3:05 pm

Nothing like a pension topic to draw out all “experts”. I used to think that there must be alot of actuaries that chime in on these threads, but then I started to read the content.

When you have a system with over 150,000 members (actives/inactives/retirees) you can identify a retiree with associated data that supports whatever position you want. Unlike some of the so-called self-proclaimed pension experts that contribute to these comment sections, I do believe the “sample” retiree is correct, but it’s one of over 53,000 examples to choose from. So folks suggesting the calculations are incorrect don’t understand the system at all, yet opine as if they are experts.

Everyone should know that you can make factual numbers support your position, all it takes is the right “example” and downplay other information that would accurately shed light on the total picture.

Comment by Must be a pension thread Wednesday, Jan 28, 15 @ 3:10 pm

State workers just keep going without pension reforms and you will end up like the Teamsters Central States Pension Fund - They run out of money in 10 years! Their benefits for existing retirees are about to be cut by 30%.

Comment by blankster Wednesday, Jan 28, 15 @ 3:11 pm

The chart headings use $38,979 implicitly as a salary having something to do retirement pension. But, if you use that as “final average compensation rate,” you wind up with $454,772.49 total for 20 years of retirement. If they want to use the numbers differently they should make that clear.

Comment by Bird Dog Wednesday, Jan 28, 15 @ 3:22 pm

Blankster -

Per the Constitution, retirement promises to state workers can’t be broken, a protection that we should be extending to Teamsters and every other worker in Illinois.

Comment by Juvenal Wednesday, Jan 28, 15 @ 3:23 pm

Willy -

I would love to get Sanguinetti’s take as well. Her husband, you recall, is a lawyer for the Carpenter’s union that has fought vigorously to defend prevailing wage.

Comment by Juvenal Wednesday, Jan 28, 15 @ 3:24 pm

=The chart headings use $38,979 implicitly as a salary having something to do retirement pension. But, if you use that as “final average compensation rate,” you wind up with $454,772.49 total for 20 years of retirement. If they want to use the numbers differently they should make that clear.=

Very true. This presentation omitted key parts, like her “Final Average Salary”. Average salary for her entire years of service has no impact on her actual benefit, which some would argue is part of the “pension problem”.

Comment by Must be a pension thread Wednesday, Jan 28, 15 @ 3:26 pm

Simple facts- state employee wages don’t put a dent in the total expenditures the state has. At one point in the not too distant past, employee wages only accounted for $5 of every $100 the state spent. So that doesn’t fix our problem.

Most examples of pension benefits use 2.2 for each year worked, when a big percentage of employees earn at the 1.67 rate. So those charts are meaningless.

Blaming and expecting employee sacrifices to fix the problems is a pipe dream. It’s like a speck of sand on the beach. If that’s all Wronger has to offer. . . The same old circus. . . Just a different clown

Comment by Is it Rauner or Wronger? Wednesday, Jan 28, 15 @ 3:39 pm

- Juvenal -,

Evelyn could be out there trying to help explain things, if they trusted her.

Confusion is the order of the day.

Comment by Oswego Willy Wednesday, Jan 28, 15 @ 3:54 pm

Knowing very little about how pensions work, that last graph is the killer to me. How much of that is investment driven and how much is State matching?

Comment by Distant Viewer Wednesday, Jan 28, 15 @ 4:02 pm

@blankster 3:11 =State workers just keep going without pension reforms and you will end up like the Teamsters Central States Pension Fund-They run out of money in 10 years! Their benefits for existing retirees are about to be cut by 30%.=

The Teamsters problem is caused by something entirely different. There are 5 retirees for every one working teamster. This was a result of the de-unionization of the trucking industry. There are more truck drivers today then ever, but only a small number are union. Most truck drivers today have no pension at all except social security, a few have a 401k, but if they leave before 5 years they lose the employer match.

The shortage in the state pension funds is the result of the state not paying their required contribution.

Comment by DuPage Wednesday, Jan 28, 15 @ 4:13 pm

There are probably reasons why it makes more sense to pay overtime than hire more workers, especially in agencies where the intake fluctuates seasonally, as I imagine is the case with police, prisons, DCFS, aid applications and such. It costs less to pay overtime periodically than to staff permanently as if the workload was always at its highest level.

Comment by Cassandra Wednesday, Jan 28, 15 @ 4:17 pm

Overtime skewed…you bet! Non-union management get Comp time by the truck loads. Not to mention the padding for working holidays (Mondays) but not working the Sat or Sun before the holiday. Ya I’d say!

Comment by Maxine Wednesday, Jan 28, 15 @ 4:24 pm

The PowerPoint pension example looks highly suspicious, or maybe complete fiction.

While I am not up on the SERS pension system, I have a model of the SURS Tier I system that shows how the math works out. Try out your own assumptions at:

http://illinoispublicpensio.ipage.com/squeezy%20test/questions.html

Comment by John Twig Wednesday, Jan 28, 15 @ 4:25 pm

@Cassandra:

How do you figure there is fluctuation in prisons or police, or for that matter even DCFS?

Comment by Demoralized Wednesday, Jan 28, 15 @ 4:44 pm

==Non-union management get Comp time by the truck loads==

Union folks get a choice between OT and comp time and can get paid for that comp time if they don’t use it by the end of a fiscal year. Non-union folks can only earn comp time and can’t get paid out for it.

Bitter much?

Comment by Demoralized Wednesday, Jan 28, 15 @ 4:46 pm

Can’t get it paid out if they don’t use it that is

Comment by Demoralized Wednesday, Jan 28, 15 @ 4:55 pm

I didn’t see this noted, but the health insurance chart and survey from PEW is based on 2013 average premiums. The State of Illinois negotiated greatly increased premiums and a reduced benefit plan design that took effect in 2014. The chart and 12% average are no longer accurate.

Comment by Scottish Wednesday, Jan 28, 15 @ 4:57 pm

==Overtime skewed…you bet! Non-union management get Comp time by the truck loads. Not to mention the padding for working holidays (Mondays) but not working the Sat or Sun before the holiday. Ya I’d say! ==

In the interest of full disclosure, I don’t get much overtime because it has to be approved first. When I work overtime, it’s because there a problem that needs fixed.

Now, in response to the quote - if someone has to work a Monday on a holiday weekend, then that means they didn’t get their holiday, and they deserve to be compensated for it. Saturday, and Sunday have nothing to do with it … except for the fact that people who didn’t work on Monday got a 3 day weekend that they could do something with. If non-union management is working a lot of overtime, then someone needs to be asking why, is it justified. It may be. I know if I was a non-union management person, I wouldn’t be working any overtime that wasn’t needed…. no matter how much I got paid or comped for it.

Comment by mythoughtis Wednesday, Jan 28, 15 @ 5:18 pm

The Teamster problem was also caused (if I remember correctly) by some mismanagement of the funds in the pension fund. Jimmy Hoffa, anyone?

Comment by mythoughtis Wednesday, Jan 28, 15 @ 5:20 pm

I expected the relationship between State Employee Payroll and number of employees, and no Rich it’s not because of overtime, it’s because of juicy AFSCME contracts and compounding.

Comment by Louis Howe Wednesday, Jan 28, 15 @ 5:29 pm

Brucey Bruce with fire all State workers on July 31st and hire one ones for half the salary and a third of the benefits for twice the work and 80 hour weeks with no extra pay and less vacation and holiday time on 401ks with no match.

I told my wife that she should quit her State job but she has been there 19 years and wants to at least make 20.

Comment by Anonymous Wednesday, Jan 28, 15 @ 6:00 pm

That data is WRONG. I have worked for the state for 14 years and have already contributed more than the bar graph illustrates.what a joke. How about attacking entitlements and pork money instead of Demonizing state employees. UNION BUSTING 101, BOUGHT AND PAID FOR BY CORPORATE AMERICA.

Comment by D Willy Wednesday, Jan 28, 15 @ 6:02 pm

- Louis Howe - Wednesday, Jan 28, 15 @ 5:29 pm:

I expected the relationship between State Employee Payroll and number of employees, and no Rich it’s not because of overtime, it’s because of juicy AFSCME contracts and compounding.

What an angry person you are, you seem to be filled with hate

Comment by Anonymous Wednesday, Jan 28, 15 @ 6:04 pm

IF what is going up is total payroll costs, I suggest you ask Jim Edgar why his 1995 pension law ramp required pension costs increase 400% from FY 2008 to FY 2014. While you’re asking him questions, ask him about his 2nd pension from U of I.

Comment by Smitty Irving Wednesday, Jan 28, 15 @ 6:07 pm

Interesting read here tonight. Although I’m surprised that so many are somewhat surprised by Rauner’s words. Who did you think he was going to go after?

Comment by kimocat Wednesday, Jan 28, 15 @ 6:08 pm

OK. I’ll concede, with enough hours of trying a wide enough range of assumptions, you can get close to the pension slide Rauner used … but one of the assumptions necessary to reach that conclusion is outside what I would consider the normal range (8% raise each and every year for 26 years; == Name/Nickname/Anon == put me on the right track because I was thinking 5%-6% every year would be on the high side).

As someone said above, there probably is such a retiree. I still have to think there was a bit of cherry picking of the SERS data.

Comment by RNUG Wednesday, Jan 28, 15 @ 6:30 pm

One other point of the scenario I did finally construct to more or less match. I have to think the starting salary was on the low side for the time period … but that’s 26 years ago and my memory may not be correct.

Comment by RNUG Wednesday, Jan 28, 15 @ 6:40 pm

In Chicago, for ex, more need for police patrols in the summer, when everybody is outside, more outside festival/entertainment events, especially in the evenings. I think this issue came up in Chicago budget discussions in recent years, since Mayor Rahm, not sure how it came out. At DCFS, since schools make a lot of reports, fewer maltreatment reports when school is out in summer. It’s expensive to staff to the highest possible intake.

Comment by Cassandra Wednesday, Jan 28, 15 @ 6:42 pm

There is a lot of apples and oranges comparisons here. SERS covered employees are covered under Soc Sec and pay 4% employee contribution. TRS covered employees are almost all non-Chicago teachers who are not covered by Soc Sec. I don’t think any plans to make school districts pay FICA would fly. The proposal to have them pick up part of the employer share of the contribution hasn’t picked up enough steam yet.

Comment by LTSW Wednesday, Jan 28, 15 @ 6:46 pm