Latest Post | Last 10 Posts | Archives

Previous Post: AP and Chicago Tribune - Study: Exelon subsidy would cost $1.6B over 5 years

Next Post: Another day, another dodge

Posted in:

* I’ve seen this very same argument made over and over in recent weeks. Rep. Jeanne Ives, for instance, brought it up during an appearance this week on “Chicago Tonight,” and the Illinois Policy Institute has continually harped on it. Here’s another one from Michael Lucci at the Illinois Policy Institute. Emphasis added…

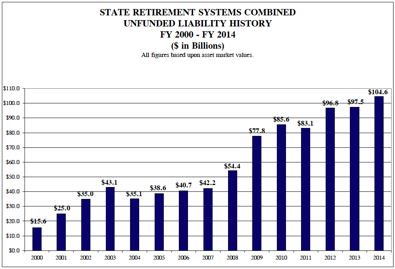

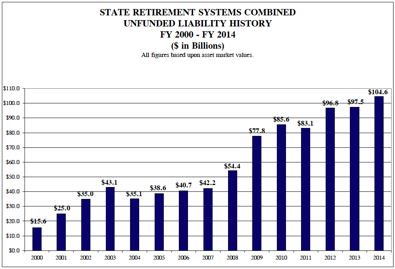

Though the [Illinois Supreme Court] justices pointed to more tax revenue as the answer, recent history proves tax hikes cannot fix Illinois’ pension problem. In 2011, the General Assembly raised income taxes on every household by a staggering 67 percent, bringing in an additional $31 billion in tax revenue that largely went to pension contributions over the next four years. Despite an additional $7.5 billion per year in additional funding, the state’s pension liabilities continued to skyrocket, increasing by $7.2 billion in 2011, then by $11.5 billion in 2012, then by $6 billion in 2013 and $10.5 billion in 2014. The state staggered along with billions more in borrowing and unpaid bills.

For the four years from 2011-2014, during which income-tax hikes brought in an additional $31 billion in revenue for pensions and the Standard & Poor’s 500 index rose for a net gain of 64 percent, the state’s total unfunded pension liability still rose by a staggering $35 billion. These are the makings of a completely broken system.

The essential argument is, the tax hike didn’t work. It doesn’t matter how much money you throw at it, the pension crisis is unsolvable because the unfunded liability continues to rise.

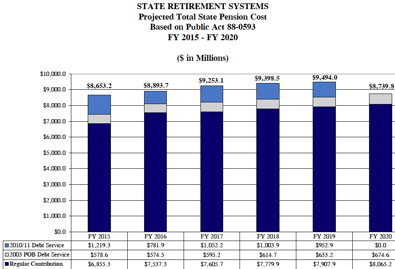

But the important issue for policy-makers and budget-drafters isn’t really the unfunded liability. It’s how much the state has to pay every year to keep up with former Gov. Jim Edgar’s pension “ramp” schedule.

* Even so, let’s look at why the unfunded liability has risen so much. COGFA took a gander back in February…

Yikes. What the heck is going on here?

* Read on…

Chart 1 is based upon calculations using the market value of assets for all years, including FY 2014. The full effects of the large investment losses during FY 2009 and investment gains for FY 2011 are therefore reflected in the bars for these years. These extremely large investment losses are the main reason for the significant jump in unfunded liabilities during FY 2009. The asset smoothing approach, required by Public Act 96-0043, only recognizes 20% of the FY 2009 investment losses during the current year. Chart 1 above recognizes 100% of the FY 2009 investment losses in FY 2009, and is therefore a much more realistic representation of the retirement systems’ true financial condition. In FY 2013, the market value of investment returns were above the actuarially-assumed rate for all systems. This helped control the growth of unfunded liabilities to a certain degree, however they still rose primarily due to insufficient contributions made by the State.

* And…

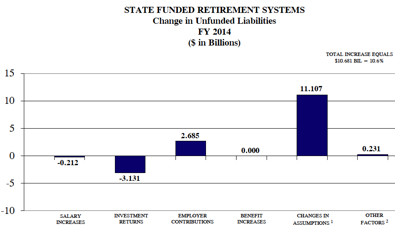

In anticipation of the June 30, 2014 actuarial valuations, the State Universities Retirement System (SURS), the State Employees’ Retirement System (SERS), and the Teachers’ Retirement System (TRS) all voted to reduce their assumed rates of investment return as per a recommendation by the State Actuary. On April 8, 2014, SERS voted to reduce their assumed rate of investment return (ROI) from 7.75% to 7.25% as recommended, with SURS following suit on June 13, 2014. TRS did not receive a specific rate recommendation from the State Actuary but voted to change its ROI assumption from 8.0% to 7.5% on June 24, 2014. Although investment performance far exceeded actuarial expectations in FY 2014, the rate of investment return assumption changes helped contribute heavily to an increase in total accrued liability, and hence, the significant increase in unfunded liability of $7.1 billion in FY 2014.

* Most of the FY 14 jump in unfunded liability was due to those changes to assumed rates of investment return…

Despite the fact that the funds had great real-life returns…

During FY 2014 the total unfunded liabilities utilizing the actuarial value of assets increased to $111.2 billion from $100.5 billion in FY 2013. This equates an increase in unfunded liabilities of 10.6 % over FY 2013, due primarily to actuarially insufficient State contribution amounts and the lingering effects of the investment losses caused by the 2008 financial crisis. In FY 2014, market value investment returns for all five State systems were above the actuariallyassumed rates of return, as shown below:

• TRS- 17.2%

• SERS- 17.5%

• SURS- 18.2%

• JRS- 16.8%

• GARS- 16.3%

* But…

While all systems earned positive returns on a market value basis, the asset smoothing approach, required by Public Act 96-0043, only recognizes 20% of the FY 2014 investment returns. FY 2013 was the last fiscal year that investment losses from the 2008 financial crisis were “smoothed” in the retirement systems’ annual actuarial valuations. With negative returns in the double-digits no longer being recognized, the investment gains of the last five years are now subject to smoothing. This has resulted in a cumulative market value of assets that is now higher than the actuarial value of assets, and therefore the funded ratio using the market value of assets is considerably higher than the funded ratio using the actuarial (smoothed) value of assets

So, a Great Recession accounting gimmick is backfiring on us.

* OK, now on to employer contributions…

The largest factor was the insufficient employer contributions which caused a $38.7 billion unfunded increase [out of $92.47 billion] during the period under review [start of Edgar ramp in FY 1996 through FY 2014] . Changes in actuarial assumptions; including the changes of interest rate assumptions in FY 2014, caused an additional increase of $19.8 billion

And, as anyone who knows anything about the Edgar ramp understands, those insufficient employer contributions were a feature, not a bug. The ramp put off the problem into the future, which is now.

* But the Edgar ramp will pretty much level out for the next few years, and then the state will see a payment decrease in 2020 when the Quinn pension borrowing is paid off…

And, of course, we could just change the ramp, do another obligation bond and lower the targeted funding percentage. That would increases state costs in the long run, but it would take immediate pressure off of us now.

Without revenues from the expired tax hike, which even the Policy Institute admits went to the pension funds, this is a huge problem. With the revenues, it’s a manageable problem.

Unless somebody can come up with a magical solution that can pass muster with the Illinois Supreme Court, however, it’s time we start working on a practical fix while ignoring the doomsday prophets who claim nothing can be done.

posted by Rich Miller

Wednesday, May 13, 15 @ 11:41 am

Sorry, comments are closed at this time.

Previous Post: AP and Chicago Tribune - Study: Exelon subsidy would cost $1.6B over 5 years

Next Post: Another day, another dodge

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

To comply with Rich’s list of banned words from yesterday, I won’t say anything about IPI and the only comment I have is, “Thank you for the explanation, Rich.”

Comment by the Other Anonymous Wednesday, May 13, 15 @ 11:47 am

Great post Rich.

Comment by Juvenal Wednesday, May 13, 15 @ 11:50 am

No fair using math to demonstrate that Illinois isn’t doomed. Math is hard!

Comment by Bill White Wednesday, May 13, 15 @ 11:52 am

Rich

Can you explain the re-amortization proposal? What does it actually do?

Comment by Twr76 Wednesday, May 13, 15 @ 11:52 am

By the very design of the funding schedule (even today now that we are past the ramp and in the level percent of pay territory), the nominal dollar value of the unfunded liability is supposed to continue increasing until 2029 or so. The funded ratio should improve, but not the dollar value of the UAAL. Their argument either demonstrates a willful attempt to falsely skew reality or a total lack of understanding of the pension systems. I’m pretty sure the tax increase has simply become the IPI’s equivalent of #ThanksObama.

Comment by Juice Wednesday, May 13, 15 @ 11:52 am

And thank you for pointing out, as the Tribune, Republicans and others often ignore: the Edgar Ramp intentionally underfunded the pension system.

In fact, it did it in a magical way that created the illusion that the ramp payments were in fact full payments, so that when it came time for Blago to short or skip payments, we ignored that they were already short.

Bad, very bad: and fully endorsed by the Chicago Tribune.

Comment by Juvenal Wednesday, May 13, 15 @ 11:53 am

Anybody factoring this in? http://osa.leg.wa.gov/Actuarial_Services/Actuarial_Information/Life_Expect_tables.htm

Comment by Weltschmerz Wednesday, May 13, 15 @ 11:55 am

it really bugs me that so many people (IPI) use complexity to hide outlandish claims. Most people would read IPI and then Rich, and say “I have no idea what i just read, I’ll default to whichever partisan position I held 5 minutes ago.”

Comment by Johnny Pyle Driver Wednesday, May 13, 15 @ 12:02 pm

I wrote this on here back in 2013 but I think the concept still works:

“I still would like to know why a simple reamortization isn’t considered. Refinance the $97B at 5% for 40 years. Start the payments at $5.9B/yr, increasing 2%/yr for inflation. Under this plan, the annual cost is fixed (in today’s dollars) and the entire amount is paid off in 40 years. The first few years will rack up the unfunded liability back from $0B to $4B but then compounding interest makes the 2%/yr increases on the $5.9B annual payments overtake the interest costs, even factoring in the interest costs on the additional $4B and inflation increasing the $1.7B/yr normal cost. And these numbers only look better when you can introduce new revenue sources such as an increase in employee contribution, taxes on marijuana, wage freezes, cost shifts, etc. I can provide my amortization schedule if anyone cares to double-check my math.”

Comment by thechampaignlife Wednesday, May 13, 15 @ 12:06 pm

This is an incredible synopsis of why “the tax increase didn’t work” reflects flawed thinking. Thanks Rich (and.. can’t believe I’m saying this, but thanks IPI for your part in affirming where the tax increase actually went, even if that wasn’t the intention).

Comment by AC Wednesday, May 13, 15 @ 12:09 pm

I wouldn’t call the changes gimmicks. Pension funds are not just long term, they are indefinite. Smoothing out gains and losses and leaving ROR assumptions steady (an lowered to more realistic long-term trends) despite a few good years of good or bad returns is quite wise.

Comment by Shemp Wednesday, May 13, 15 @ 12:09 pm

Rich,

Thanks for bringing this front and center. Too few people understand how this really evolved and the truth behind the numbers.

Comment by JS Mill Wednesday, May 13, 15 @ 12:14 pm

Great explanation that even a layman can understand

Comment by sunshine Wednesday, May 13, 15 @ 12:15 pm

thechampaignlife - Does your math include the normal cost payments for future service? I believe that is approx. $2 billion for the employer share of the normal cost.

Comment by Salty Wednesday, May 13, 15 @ 12:16 pm

And I don’t know how much the actual liabilities really increased, so much as we now have a more accurate picture than we had before and the liability should have been reported higher in years prior to the actuarial reporting changes and ROR changes.

Comment by Shemp Wednesday, May 13, 15 @ 12:16 pm

Never mind…

Comment by Salty Wednesday, May 13, 15 @ 12:17 pm

Please Rich don’t spoil the talking points of the megarich.

Comment by Liberty Wednesday, May 13, 15 @ 12:25 pm

It will not be good for State Employees.

Comment by Anonymous Wednesday, May 13, 15 @ 12:33 pm

Points made are interesting but the unfunded liability is going to be the gift that keeps on giving. Any downturn in the economy will hinder the process as well. The fact that we had to borrow to make the required payment in the near past is not good. State has a lot of general obligation debt issued with nothing to show for it but high debt service payments.

Comment by Patty Wednesday, May 13, 15 @ 12:34 pm

Can we distribute this on a flyer to the voters of Illinois like the SOS does for constitutional amendments. Maybe, just maybe, enough people would finally understand that this is not a “sky is falling” but a “math management” issue. Thanks, Rich

Comment by D.P.Gumby Wednesday, May 13, 15 @ 12:35 pm

So the added revenue didn’t solve the problem, we’ll just take that away and make it a bigger problem. There should be a banned word written about this kind of logic.

IPI will not tell people that Tier 2 already deals with the long-term problem. The NOW problem is the debt that the state ran up by not paying what was required.

Comment by Norseman Wednesday, May 13, 15 @ 12:42 pm

Unless somebody can come up with a magical solution that can pass muster with the Illinois Supreme Court, however, it’s time we start working on a practical fix while ignoring the doomsday prophets who claim nothing can be done.

Amen, Rich

Comment by Truthteller Wednesday, May 13, 15 @ 12:43 pm

Do you want to see something really scary?

The Edgar ramp schedule was a Jim Reilly production.

Jim Reilly has refinanced the MPEA debt with another ramp schedule that the MPEA will never have the ability to repay and the MPEA currently has a $1.2 billion deduct.

History is repeating itself, courtesy of Jim Reilly.

Comment by Chicago 20 Wednesday, May 13, 15 @ 12:45 pm

Nothing about Illinois government should shock anymore, but it is shocking that not a single politician reacted to the ILSC ruling by saying “well, I guess we better figure out a way to come up with the money.”

Comment by Mostly Harmless Wednesday, May 13, 15 @ 12:47 pm

The best explanation, at least for the length that can be devoted to it on a website, that I have seen so far.

Nothing like it from the politicians, the MSM or groups like the CC, IPI or CC.

Comment by Federalist Wednesday, May 13, 15 @ 12:48 pm

===The fact that we had to borrow to make the required payment in the near past is not good===

Pre tax hike, dude.

===State has a lot of general obligation debt issued with nothing to show for it but high debt service payments.===

And roads, bridges, transit systems…

Comment by Rich Miller Wednesday, May 13, 15 @ 12:54 pm

Someone should call Ives out on her statement that she “overheard” a conversation at lunch from a legislator that is in leadership talking about how much money they are going to make in 2 years. That is a cheap remark. Would love for her to have the West Point courage to name names.

Also, what’s with her calling out her neighbor that is so happy about feeding at the public pension trough again because Rauner got him a state job? Not very civil to eavesdrop or share private conversations.

Comment by ABC Lawyer Wednesday, May 13, 15 @ 1:00 pm

And the borrowing to make the pension payment was bipartisan because the GOP refused to face reality that the state would need to increase revenues to meet its obligations, but whatevs.

Comment by Juice Wednesday, May 13, 15 @ 1:01 pm

It always makes me cringe when organizations like IPI, the Chicago Tribune and similar-minded entities make such statements as, “In 2011, the General Assembly raised income taxes on every household by a staggering 67 percent.”

The NEVER say the income tax rate went from 3% to 5%, nor do the mention that most of our neighboring states have far higher income tax rates than 5%. Nor do they mention that the vast majority of the 41 states that have a state income tax have a top rate of higher than 5%.

Comment by Joe M Wednesday, May 13, 15 @ 1:01 pm

Facts are such stubborn things!

Comment by Facts are stubborn things Wednesday, May 13, 15 @ 1:04 pm

That’s why, to recall something Rich said, funding our pension problems are a “manageable mess” at the 5 percent tax rate, an “unimaginable mess” at lower ones. Not only does the ramp challenge mitigate over time, but Tier 2 kicks more as well.

Comment by walker Wednesday, May 13, 15 @ 1:12 pm

Long time reader, first time poster so be kind. No question the major portion of the shortfall is deferred contributions. However, as highlighted in Rich’s post, the impact of risk on pension accounting is often overlooked. Fully 21% of the shortfall is driven by risk. The change in actuarial return assumption is a recognition that a poor return performance over a short period of time has significant impact on the future actuarial value. Someone is absorbing that risk. In this case that is the taxpayers. This is why the private sector moved to DC versus DB. It’s not the “cost” of pensions — its the risk to get to that “cost.” When you combine weak willed governance with risk you have a recipe for disaster.

Comment by A Watcher Wednesday, May 13, 15 @ 1:12 pm

There you go again shining light and applying logic to things, Rich. Thank you.

Comment by late to the party Wednesday, May 13, 15 @ 1:13 pm

Here is the reamortization schedule I referenced earlier: https://docs.google.com/spreadsheets/d/1×1pClC6qrIRaVwVRHqra-sbCol-e_WSMk7jT7Hfap7M/pubhtml

Hasn’t been updated with current figures but this plan would have shaved $1.4B off the FY16 regular contribution cost.

Comment by thechampaignlife Wednesday, May 13, 15 @ 1:28 pm

Sorry, bad link. Here is the working link: https://docs.google.com/spreadsheets/d/1×1pClC6qrIRaVwVRHqra-sbCol-e_WSMk7jT7Hfap7M/pubhtml

Comment by thechampaignlife Wednesday, May 13, 15 @ 1:31 pm

And the IPI? Well, they are intellectually dishonest, leading a bunch of lazy newspaper editors down over the cliff like lemmings.

Comment by Austin Blvd Wednesday, May 13, 15 @ 1:31 pm

Apparently WordPress does not like 1×1 in a URL. Here is a short URL: http://bit.ly/1PGUJ7F

Comment by thechampaignlife Wednesday, May 13, 15 @ 1:32 pm

There is no “magic” required to modify the pension agreements and appease the Illinois Supreme Court, beyond the magic of political will. This is a political problem in addition to a math problem, obviously. The Illinois Supreme Court is a political creation of the state constitution, whose jurisdiction derives from it, and us. Amend the state constitution.

Under the federal constitution, contracts in the United States are not sacred, and have not been sacred for a very long time. Liberty to contract died when Lochner did. As West Coast Hotel, Blaisdell, and numerous federal cases since have made clear, contracts are subject to the needs of public policy. State workers were made a special class with special protections to attempt to insulate themselves from that New Deal reality, but that can and should be changed. The dire potential consequences of being able to alter contracts as opined by the Illinois Supreme Court have not stopped the Supreme Court of the United States from eviscerating the “sanctity” of contracts for eighty some years and nor should it the State of Illinois.

Amend the constitution, ensuring that the Supreme Court has clear constitutional guidance, and strip public workers of special protections beyond what any other contract between any other parties is afforded in our judicial system. Then we need to reform the pensions through the legislative process such that a reasonable pension is afforded (or better defined contributions going forward), the excesses purged, and current obligations met, while meeting the public policy needs of the people of this state.

Comment by Joseph Lochner Wednesday, May 13, 15 @ 1:38 pm

Mr. Lochner:

Why even have contracts if you say that the state should be able to change them on a whim and do what they want?

There is a reason that the language was put in the Constitution and it was to avoid exactly what is going on.

You can try to reason your way out of what the IL Supreme Court said but no matter how much you twist yourself into a pretzel the answer will always be the same: the state must fund the pensions that have been promised. Why is that so difficult for some of you to understand?

Comment by Demoralized Wednesday, May 13, 15 @ 1:48 pm

How long before the tier2, tier3, tierX state employees overtake us dastardly tier1 employees and the problem starts fixing itself due to “attrition”?

Comment by Jechislo Wednesday, May 13, 15 @ 1:53 pm

I know this unfunded liability is projected way out into the future. But since its projected into the future, does it take into consideration future employee/employer contributions, the future value of money, tier 2 employees, etc. Or is it just projecting costs? Seems skewed if its just costs.

Comment by Poster Wednesday, May 13, 15 @ 1:54 pm

Why on Earth would anyone want to give the government more power to break its agreements?

Comment by Arsenal Wednesday, May 13, 15 @ 1:57 pm

best single blog post - in forevah

congrats

Comment by zonz Wednesday, May 13, 15 @ 2:09 pm

Where is OW? I want to hear what he thinks.

Comment by Mama Wednesday, May 13, 15 @ 2:14 pm

===Where is OW? ===

Golfing.

Comment by Rich Miller Wednesday, May 13, 15 @ 2:16 pm

Lochner, the biggest problem I see with the constitutional amendment is that it likely will be limited by “ex post facto” limitations. In other words, if someone is in the system now with the expectation of receiving a certain level of benefit, a change in the constitution today doesn’t wipe out the previous protection under which the employee accrued previous pension benefits, COLA increases, or retiree health insurance benefits.

If you can’t change the benefits for current employees and retirees and can only impact new or returning employees with a constitutional amendment, what’s the point of changing the constitution? You can give whatever pension benefits you want to new employees, within collective bargaining agreements, right now without changing the constitution.

I think at this point there’s only a few things that can be done to address the cost side of the pension funds:

1) Make pensions for new employees contributory with matching funds from state/employers to be determined by the GA at the end of the fiscal year. 401K like program.

2) Cost shifting of pension funding to schools and other public employers. You can’t affect the percentage of payout, so the only solution is to limit the salary and pension basis levels. This can’t be done by the state for schools and universities. Control is COMPLETELY in the hands of the locals. Of course, a strike prohibition will be necessary so that schools and municipalities can “right size” pension basis salaries and carryovers. This will mean raises and health insurance pickups by schools and muni’s will be very short come by until this crisis is over.

I also think some tax increases will be necessary, but costs of business can be minimized by changes in workman’s comp and unemployment insurance. We also need to rip out all the “wants” in the state budget while protecting the “needs” for those who really need the state help. A whole book will be able to be written about THAT process.

Comment by Arizona Bob Wednesday, May 13, 15 @ 2:21 pm

Demoralized:

The 1920s are calling, and they want their theory of contract law back.

If the state workers wanted to ensure that they’d not be in this situation, they should have demanded defined contributions in rather than guaranteed pensions, and put their money in FDIC backed savings accounts. There is a reason the Pension Benefit Guaranty Corporation (that pays pennies on the dollar) was created in 1974, just four years after the Illinois pension amendment. The state workers wanted to insulate themselves from that reality of dying pensions, and ensure that the state taxpayers assumed all the risk. It was done via a political move and amending the state constitution, and politics is a game that two can play.

Contracts are not sacred. Those who cheer when government modifies the terms of mortgages or loans or insurance policies or suspends foreclosures to protect the little guy are likely the same people arguing that these pensions are sacred immutable contracts.

What the state constitution gave, the state constitution can take away. State workers should not be a special class subject to special protections other than what any other contract is. We certainly should honor the spirit of our obligations, and ensure a reasonable pension to those who have earned it. But public policy and the fiscal health of the state need to trump any false notion of the sanctity of these pension agreements, and the state constitution and law altered as appropriate. Illinois is a sovereign entity, and if bankruptcy is not an option, then a political solution must be. To “pay up” is not the only option, regardless of what the state Supreme Court opines.

Comment by Joseph Lochner Wednesday, May 13, 15 @ 2:22 pm

Bob,

The prohibition against ex post facto laws is a doctrine that affects only criminal statutes. It would not apply in to a change to the pension laws.

In addition, a fun fact about ex post facto prohibitions. That doctrine applies to the criminalization of discrete acts, not “continuing offenses.” They can still get you, for the condition created by the act, if not the act itself.

Comment by Joseph Lochner Wednesday, May 13, 15 @ 2:27 pm

===To “pay up” is not the only option, regardless of what the state Supreme Court opines===

They don’t opine, they rule. So unless you’ve got some bright idea that they’ll approve, you might wanna stop bloviating here.

Comment by Rich Miller Wednesday, May 13, 15 @ 2:29 pm

==We certainly should honor the spirit of our obligations, and ensure a reasonable pension to those who have earned it. ==

==The prohibition against ex post facto laws is a doctrine that affects only criminal statutes. It would not apply in to a change to the pension laws.==

That sounds like you favor changing the pension rules even for benefits that have been accrued to date or for individuals who have already retired? Did I understand you correctly?

==and ensure a reasonable pension to those who have earned it==

What exactly does that mean? Define “reasonable” in your world.

Comment by Demoralized Wednesday, May 13, 15 @ 2:36 pm

Rich, courts opine which is why it is called an opinion. Their opinion contains a legal ruling or order, and the dicta which is opining.

Under current law, the only option per the Supreme Court is to pay up. However, that is not the only option. My bright idea is to have the political will to solve this problem in a manner that takes in account both the obligations we have made to state employees, and the best interests of the people of the State of Illinois. What the state Supreme Court ruled can be made moot.

Comment by Joseph Lochner Wednesday, May 13, 15 @ 2:38 pm

== To “pay up” is not the only option, regardless of what the state Supreme Court opines.==

They didn’t say that was the only option. They hinted at several options. But certainly “paying up” is the only solution. They outlined several ways to get there. Again, no matter how much hot air you are blowing the ruling was pretty clear: the state must pay what it owes and if it doesn’t the Court may force them to do so.

Comment by Demoralized Wednesday, May 13, 15 @ 2:39 pm

Poster- the answer is yes. Thats why the 401K defined contribution idea will only make matters worse. Those contributions would no longer be made into the pension fund in the future. Its a lose-lose situation. As the pension work group members already know, it aint gonna happen.

Comment by grumpy Wednesday, May 13, 15 @ 2:39 pm

State Rep Jeanne Ives really sticks to the Rauner talking points. Hope her neighbor is happy about her talking about him/her on WTTW. State Rep Mike Zalewski really has it on the ball. I think he is someone we should watch in the future for bigger and better things.

Comment by NewWestSuburbanGOP'er Wednesday, May 13, 15 @ 2:44 pm

Rich, great work. Actuarial question - how much of the increase in liability was due to Quinn shrinking headcount from 55K when he took over to just under 50K? If those 5K departing Tier 1s had mostly been replaced by Tier 2s (acknowledge the $ to replace them was scarce, but special fund headcount was held down), would the liability decreased? Actuaries?

Comment by Smitty Irving Wednesday, May 13, 15 @ 2:52 pm

=== * I’ve seen this very same argument made over and over in recent weeks. Rep. Jeanne Ives, for instance, brought it up during an appearance this week on “Chicago Tonight,” and the Illinois Policy Institute has continually harped on it. Here’s another one from Michael Lucci at the Illinois Policy Institute. Emphasis added…

Though the [Illinois Supreme Court] justices pointed to more tax revenue as the answer, recent history proves tax hikes cannot fix Illinois’ pension problem. ===

How come political “leaders” like Ives and the IPI continue to misrepresent the ISC ruling and also deceive the public? I don’t think any educated person interprets the ISC ruling as guidance for fixing the unfunded liability. I thought a tax increase was brought up by ISC as ONE of many options available before invoking the police powers defense. Also, I think everyone knows that additional revenue has to be part of a comprehensive plan to put Illinois on a durable path to financial stability.

Comment by forwhatitsworth Wednesday, May 13, 15 @ 2:56 pm

Reasonable is what the political process needs to determine, and the impediment in the way of that political process, in the form of the 1970 amendment to the constitution, needs to be removed, and constitutional guidance provided to the judiciary to clearly define their role in this matter. I certainly would support our legislators changing existing benefits if they are excessive or unreasonable, but the legislators would need to come to a political compromise on what that means.

As for the “Court may force them to do so” argument. The courts do not exist in a vacuum. They did not spring forth from nature. They are political creations, empowered and bound by our constitution. Their jurisdiction, and the law by which they interpret our legislative acts, is mutable.

While it may be very difficult politically to amend our constitution as required, it most certainly is a valid option, and one I hope we have the fortitude to accomplish. Paying up as currently obliged is not the only solution.

Comment by Joseph Lochner Wednesday, May 13, 15 @ 2:57 pm

== Paying up as currently obliged is not the only solution. ==

Most of that pension debt is ALREADY owed for service ALREADY performed. Tough to negate valid contracts / debt for services already delivered.

Comment by RNUG Wednesday, May 13, 15 @ 3:02 pm

I suspect you would be singing a different tune about the judiciary if the Court had agreed with your opinion.

==I certainly would support our legislators changing existing benefits==

And that is where your opinion goes off the rails with me. You don’t take somebody’s retirement away from them (and I hold that opinion no matter who the employer is - public or private).

Comment by Demoralized Wednesday, May 13, 15 @ 3:06 pm

==Most of that pension debt is ALREADY owed for service ALREADY performed.==

I believe he said that what is already owed should be changed.

Comment by Demoralized Wednesday, May 13, 15 @ 3:07 pm

===The prohibition against ex post facto laws is a doctrine that affects only criminal statutes. It would not apply in to a change to the pension laws.==

So, by this way of thinking, we could amend the Constitution remove the article about a flat income tax and instead institute a progressive tax. And since Ex Post Facto only applies in criminal statutes, we could apply the progressive tax for - say - the last 20 years. That should take care of the pension debt toot sweet.

Comment by Name Withheld Wednesday, May 13, 15 @ 3:08 pm

==The prohibition against ex post facto laws is a doctrine that affects only criminal statutes. It would not apply in to a change to the pension laws.==

So lets see if I have this right: ex post facto prohibitions do not apply to debt contracts, only criminal statutes. OK, sir, then you have just solved the entire $16 Trillion national debt problem. Congress just needs to pass (and the President sign) a law, or a constitutional amendment, stating that coupon interest and principal payments on all bonds issued by the Treasury (even those issued in the past before the amendment is ratified) no longer need to be paid. Then we simply stop making payments and the debt is effectively erased - along with the entire world economy and monetary system, but that is another story.

Comment by Andy S. Wednesday, May 13, 15 @ 3:11 pm

well actually, courts decide (or rule) and explain themselves in an opinion

…………..

- Joseph Lochner - Wednesday, May 13, 15 @ 2:38 pm:

Rich, courts opine which is why it is called an opinion. Their opinion contains a legal ruling or order, and the dicta which is opining.

Under current law, the only option per the Supreme Court is to pay up. However, that is not the only option. My bright idea is to have the political will to solve this problem in a manner that takes in account both the obligations we have made to state employees, and the best interests of the people of the State of Illinois. What the state Supreme Court ruled can be made moot.

Comment by zonz Wednesday, May 13, 15 @ 3:17 pm

Yes - Joseph Lochner - it’s all about politics…

AND

as so many like to emphasize, THE RULE OF LAW.

Maybe study up on both.

Yes, e.g., bankruptcy courts abrogate contracts all the time, but let’s try to stay in the real world - not the fantasy of a state bankruptcy petition.

The fact that A-Bob mentioned ex post facto did not mean he was preaching expertise in law - he was expressing a concept.

———————————-

- Joseph Lochner - Wednesday, May 13, 15 @ 2:57 pm:

Reasonable is what the political process needs to determine, and the impediment in the way of that political process, in the form of the 1970 amendment to the constitution, needs to be removed, and constitutional guidance provided to the judiciary to clearly define their role in this matter. I certainly would support our legislators changing existing benefits if they are excessive or unreasonable, but the legislators would need to come to a political compromise on what that means.

Comment by zonz Wednesday, May 13, 15 @ 3:37 pm

Thank you Mr Lochner. Is it your legal (or personal) opinion that if the “diminished or impaired” provisions of the state constitution were removed by amendment, the pension funds could end COLA and health insurance premium benefits? How about changing the pension basis period from four to ten years? I’d also like to see pension basis to be determined by lifetime contributions, as is SSC, rather than inflated end of career periods. Would that kind of fundamental change be possible?

I still believe that cost shifting to reduce pension basis and cutting new employee pension employer contributions to the bone is the most viable cost cutting method, but hey, at this point EVERY productive solution has to be on the table and implemented to address this nightmare.

Comment by Arizona Bob Wednesday, May 13, 15 @ 3:37 pm

Lochner, even if you’re right about a constitutional amendment that will not have any effect for at minimum of 3 years. What’s your brilliant idea for this this year.

Comment by Norseman Wednesday, May 13, 15 @ 3:38 pm

==EVERY productive solution==

I think the word “productive” is the important point there. To me it’s not productive to work on solutions that do not comport with the guidance the Supreme Court gave in it’s opinion. It left open several options to pursue. Working around “paying up” was not one of those solutions. The state has already done some reform by implementing Tier 2 for new hires. I think that was a pretty good solution. But, the fact remains that what is owed is owed and there’s no way to reduce that, including changing the Constitution. The overwhelming majority of the system liability right now can’t be reduced.

Comment by Demoralized Wednesday, May 13, 15 @ 3:44 pm

THIS

———–

- Demoralized - Wednesday, May 13, 15 @ 3:44 pm:

…I think the word “productive” is the important point

…

what is owed is owed and there’s no way to reduce that, including changing the Constitution. The overwhelming majority of the system liability right now can’t be reduced.

Comment by zonz Wednesday, May 13, 15 @ 3:50 pm

SECTION 16. EX POST FACTO LAWS AND IMPAIRING CONTRACTS

No ex post facto law, or law impairing the obligation of contracts or making an irrevocable grant of special privileges or immunities, shall be passed.

(Source: Illinois Constitution.)

- Not sure I read this as limited to criminal law.

Comment by DeKalb Guy Wednesday, May 13, 15 @ 4:03 pm

Even if the constitution is changed, there is still a pension contract in place that is the source of the unfunded liability. The ISC not only said that the police powers did not apply due to the “impaired or diminished” language - but that the State did not have the horses to make a case for police power if it were permitted.

So - even taking Lochner’s interpretation as correct, the most that could happen with a change in the constitution would be for future limitations on future earnings. Both the State and Federal constitutions do not allow impairment of contract, unless the State is successful in exercising its police power (which the ISC said it failed to justify).

The unfunded liability is a debt that must be paid.

Comment by archimedes Wednesday, May 13, 15 @ 4:09 pm

jechislo, if I remember correctly from a COGFA report back when Tier 2 was adopted, 2024 was the best estimate of when the number of Tier 2 employees passed the number of Tier 1 employees

Comment by steve schnorf Wednesday, May 13, 15 @ 4:39 pm

Joseph Lochner was a bakery owner in the late 1800’s who was part of a groundbreaking labor law case. He worked his employees up to 60 hours per week without additional pay.

Kudos on using one of the most clever Blog handles in quite awhile. Having said that, I’m not as impressed with the rest of your argument. Could you explain the legal reasoning behind your assertion that the ex post facto doctrine only applies to criminal statutes?

You further assert that “Paying up is not the only option.” Can you give us an example of a viable option that does not involve paying up and is constitutional?

If your answer is some constitutional tomfoolery and benefit reductions, don’t bother. Even if you convinced me that such an amendment could be legally tweaked, we don’t have the time to wait. More importantly, no matter what is done to benefits going forward, there is NO alternative but Pay It when it comes to the unfunded liability.

When you can pull only our most knowledgeable troll into your corner, clearly your argument is failing here. Back to the bakery, buddy.

Comment by Arthur Andersen Wednesday, May 13, 15 @ 4:55 pm

Section 16 of Article I of IL Constitutions specifically refers to ex post facto laws and contracts. It does apply.

Comment by Retired and fed up Wednesday, May 13, 15 @ 5:25 pm

So, with this continued attack, are people saying the Supreme Court is just a joke?

Comment by AnonymousOne Wednesday, May 13, 15 @ 5:47 pm

huh?

————

- AnonymousOne - Wednesday, May 13, 15 @ 5:47 pm:

So, with this continued attack, are people saying the Supreme Court is just a joke?

Comment by zonz Wednesday, May 13, 15 @ 5:52 pm

Two words…. Lottery tickets

:D

Comment by ghost Wednesday, May 13, 15 @ 5:56 pm

Supreme Court: Pensions cannot be diminished or impaired. What is so impossible to understand here? I’m feeling like people are intellectually impaired, not to understand the language presented by the court. They behave as if that ruling never came down. Attempts to squeeze MORE money out of public employees continue. They are diminishments. Diminishments! Among the court suggestions were increasing revenue. Lay off those in the public pension funds and look at increasing revenue, whether by taxing services, returning to a higher level than it is or whatever needs to fill the pot from which the money was stolen—or as Nekritz says, “diverted”. If it makes some feel better, public employees will have to pay that higher tax too.

Comment by AnonymousOne Wednesday, May 13, 15 @ 6:11 pm

@joseph lochner: thank you for your most interesting theoretical presentation. No kidding.

Let me know when you have the votes.

Comment by walker Wednesday, May 13, 15 @ 6:33 pm

Lochner is correct that the ex post facto clause applies only to criminal statutes; that is why the next clause refers to impairment of contract. A very good summary of the history is available here:

http://legal-dictionary.thefreedictionary.com/Ex+Post+Facto+Laws

However, Lochner is probably incorrect in his analysis of the ability of states to abrogate existing contracts. On this point, the ILSC did a terrific job of noting that abrogation of contracts has only been very rarely permitted by the US Supreme Court, and that the USSCt has viewed STATE abrogation of ITS OWN contracts with special suspicion.

My own view is that any benefits currently being received by a retiree or earned by an employee could not be changed even if the pension clause of the IL Constitution were repealed because of the Contracts clause of both the IL and federal constitutions. However, I am less certain that changes to future (”unearned”) benefits would be prohibited by the federal contracts clause; however, the ILSC opinion appeared to foreclose those kinds of changes under the state constitution, as well.

I think the only way a diminishment of benefits would survive legal challenges is to change both the state pension and contracts clauses, and then hope for the best before the US Supreme Court on the federal contracts point. As a practical matter, such a strategy is so unlikely to prevail (TWO constitutional amendments? And then pray that a majority of the USSCt thinks it is OK for the state to abrogate a contract? Come on, folks) that it is worthless to even contemplate.

As others have said, the GA needs to quit bloviating and work on a solution. Best options are a combination of restoring some/all the increase in the income tax; taxing retirement income (no, everyone WON’T go to Florida, as New York has shown); and enacting a broad-based services tax.

John Colombo

Comment by jdcolombo Wednesday, May 13, 15 @ 6:41 pm

Many commenters (including me) have used the phrase … “what’s so difficult to understand …” I’ve finally accepted that it’s not really about “understanding” … it’s all about ACCEPTING their part of the responsibility. It’s someone else’s problem … NOT MINE.

Comment by forwhatitsworth Wednesday, May 13, 15 @ 6:49 pm

John Colombo: agree with all of your points. But there are teams of lawyers all over this country trying to figure out how to fight the tide of logic and legal precedent.

We shall see there next big moves. Always thought Rauner was a willing player, but not a leader in this national anti-union movement.

Comment by walker Wednesday, May 13, 15 @ 7:26 pm

“their” not there

Comment by walker Wednesday, May 13, 15 @ 7:27 pm

JD, thank you for your comprehensive and insightful analysis. Much appreciated.

Comment by Arthur Andersen Wednesday, May 13, 15 @ 7:54 pm

Thank you professor! Much appreciated.

Comment by Norseman Wednesday, May 13, 15 @ 8:04 pm

Sorry, channeling AA’s response evidently.

Comment by Norseman Wednesday, May 13, 15 @ 8:06 pm

- Joseph Lochner - Wednesday, May 13, 15 @ 2:57 pm:

Reasonable is what the political process needs to determine, and the impediment in the way of that political process, in the form of the 1970 amendment to the constitution, needs to be removed, and constitutional guidance provided to the judiciary to clearly define their role in this matter. I certainly would support our legislators changing existing benefits if they are excessive or unreasonable, but the legislators would need to come to a political compromise on what that means.

Seriously, who defines and gives constitutional guidance to the ISC and clearly defines their role in this matter?

Comment by Minnow Wednesday, May 13, 15 @ 9:17 pm

Any other unsolvable problems the Legion of Doom wishes to inform the public that they are incapable of dealing with?

Not exactly the spirit that won the west.

Comment by Wordslinger Thursday, May 14, 15 @ 8:55 am