Latest Post | Last 10 Posts | Archives

Previous Post: Obama picks Jackson Park for library site

Next Post: Dueling taunts

Posted in:

* From Sean Stott at the Laborers Union…

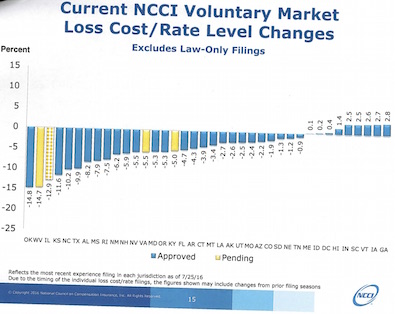

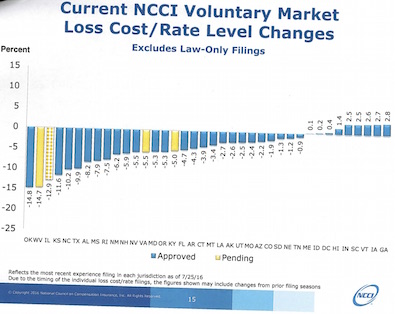

The organization that issues workers compensation advisory rates just released their recommendations for 2017. The NCCI says that Illinois employers should see a 12.9% cut in their WC rates next year - the 3rd largest cut in the nation - totaling more than all of our neighboring states combined.

* The https://drive.google.com/file/d/0B_inyf2A_T9KWmJzQ0ZOdDE2b0k/view?ts=579901aa“>chart…

* The Illinois Manufacturers Association disagrees…

“Nothing in the NCCI filing suggests that Illinois is actually closing the gap when it comes to the high cost of workers’ compensation relative to other states. It is abundantly clear that states like Illinois and West Virginia experiencing significant job loss in manufacturing, construction or mining jobs have also witnessed a reduction in indemnity and medical severity costs. However, the actual cost of workers’ compensation in Illinois remains among the highest in the nation.” - Greg Baise

· Largely as the result of the continued loss of good, high-paying jobs in manufacturing and enhanced workplace safety programs, the National Council on Compensation Insurance (NCCI) offered an advisory recommendation in Illinois with a reduction.

· It is important to recognize that the advisory 12.9 percent reduction in the overall voluntary rate is separate and distinct from insurance company premiums.

· In 2016, only four states including Illinois, Virginia, Kentucky, and West Virginia have received their NCCI recommendations at this time. Last year, NCCI reviewed 38 states and recommended advisory decreases in 27 states (71 percent). In Illinois, NCCI recommended no change in 2015. This year’s recommended decrease follows the national trend.

· The advisory recommendation does not include self-insured companies and excludes 40 percent of the competitive insurance market that have large deductible policies.

posted by Rich Miller

Wednesday, Jul 27, 16 @ 1:49 pm

Sorry, comments are closed at this time.

Previous Post: Obama picks Jackson Park for library site

Next Post: Dueling taunts

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

What utter nonsense.

Comment by blue dog dem Wednesday, Jul 27, 16 @ 1:58 pm

Whatevers Baise

Comment by Honeybear Wednesday, Jul 27, 16 @ 2:02 pm

Was speaking with a roofing contractor on Monday that operates in both Illinois and Texas. I said that I’d always heard Illinois’ rates were 3 times higher than other state. He said, “That’s false, Illinois is 4 times higher than Texas.”

Comment by Downstate Wednesday, Jul 27, 16 @ 2:02 pm

So Illinois uses NCCI as its rate making agency, but when NCCI says that rates should be substantially reduced based upon Illinois’ experience, the business community always says “it’s not good enough”. These reductions are substantial, and no amount of spin can change that.

Comment by unspun Wednesday, Jul 27, 16 @ 2:11 pm

Hooray! The Turnaround Agenda™ worked! Let’s get the General Assembly back here now and pass a real, balanced budget with a Madigan Tax Hike™.

Winnin’!

Comment by Whatever Wednesday, Jul 27, 16 @ 2:26 pm

Greg, call me and I’ll give you the name of my chiropractor because you must be in significant pain after that twisting and contorting of fact and logic.

How can a 12.9% rate cut NOT mean that Illinois is NOT closing the gap on WC costs? Since the 2011 law changes, IL rates have seen a 28.7% cut. Illinois is one of only 3 states that saw average medical costs (which represent 50% of all WC benefits) drop since 2010-’11.

The 3rd largest WC rate cut in the nation does not make the Governor’s job of convincing the public and legislators that Illinois must kick more injured workers out of the system, cut injured workers’ benefits and restrict access to high quality medical care any easier, but one cannot deny that this is a huge dose of good news.

Comment by Sean Stott Wednesday, Jul 27, 16 @ 2:46 pm

==12.9 percent reduction in the overall voluntary rate is separate and distinct from insurance company premiums.==

I don’t really understand this stuff so maybe the answer is obvious, but why wouldn’t the premiums be affected? If they aren’t being affected then perhaps the insurance companies need to explain why.

Comment by Demoralized Wednesday, Jul 27, 16 @ 2:50 pm

If Illinois was on the other side of the chart and NCCI was suggesting a 12.9% rate increase, would the IMA be saying, don’t worry about it, it isn’t bad news?

Comment by My button is broke... Wednesday, Jul 27, 16 @ 2:51 pm

Stott:

Sounds like Baise is inviting you to partner with him to pass legislation making the recommended rate reductions mandatory instead of only advisory.

It’s too bad the Laborers don’t have legislation that would accomplish that and never thought about insurance reform before now.

Comment by Juvenal Wednesday, Jul 27, 16 @ 2:55 pm

- mining jobs -

I’ve got news for you, Baise, those jobs aren’t going away because of workers comp.

Comment by Daniel Plainview Wednesday, Jul 27, 16 @ 3:02 pm

Sean,

Perhaps you can separate your apples and oranges into separate piles and then evaluate each.

NCCI has only rated 4 states this year and we’re 2nd out of 4). So while IL may be decreasing, so it every other states. And last year, while 27 of 38 states saw a DECREASE, Illinois saw no change.

I’ll try to put in in baseball terms so you can understand better. If the Boston Red Sox are in last place in the AL East, and they win 6 games in a row but every other team in the division also wins 5 or 6 games in a row because they’re beating up on the NL Central, then the Red Sox have not closed the gap and they’re still in last place.

Comment by Anonymous Wednesday, Jul 27, 16 @ 3:06 pm

Last year, 27 states did better than Illinois and saw rates decrease while IL stood still.

Comment by Anonymous Wednesday, Jul 27, 16 @ 3:07 pm

Juvenal - We would welcome Mr. Baise’s support for insurance reform (which, for those who don’t know, the Laborers, the IL AFL-CIO & Trial Lawyers have long-advocated) to make sure the benefit cuts and medical fee reductions enacted in 2011 are passed on to Illinois employers.

Comment by Anonymous Wednesday, Jul 27, 16 @ 3:31 pm

Juvenal - We would welcome Mr. Baise’s support for insurance reform (which, for those who don’t know, the Laborers, the IL AFL-CIO & Trial Lawyers have long-advocated) to make sure the benefit cuts and medical fee reductions enacted in 2011 are passed on to Illinois employers.

Comment by Sean Stott Wednesday, Jul 27, 16 @ 3:32 pm

Anonymous 3:06pm:

This rate reduction is not an anomaly. They have dropped 28.7% since 2011 (As fellow Boston fan Will Hunting said, “How do like them apples?”):

2011 -8.8%

2012 +3.5%

2013 -3.8%

2014 -4.5%

2015 -5.5%

2016 (NCCI refused to/could not make a rate recommendation)

2017 -12.9%

I would say that Illinois - and the Red Sox - are rapidly moving in the right direction.

Comment by Sean Stott Wednesday, Jul 27, 16 @ 3:44 pm

@Sean

So was Illinois moving in the right direction last year when there was no change in rates and 27 states saw decreases?

Is Illinois moving in the right direction this year when NCCI has indicated that the loss of manufacturing/construction jobs are a major reason for the reduction? I

I guess if you’re fine losing the construction jobs that employ Laborers then you’re heading in the right direction.

Comment by Anonymous Wednesday, Jul 27, 16 @ 4:22 pm

I don’t think construction jobs can move to other locations.

Comment by NoGifts Wednesday, Jul 27, 16 @ 4:31 pm

Since Illinois requires most employers to obtain Workers Compensation insurance (or self-insurance) a program is established to make sure all employers can obtain it, even if insurance companies don’t want to voluntarily underwrite such insurance. That program is the Assigned Risk Plan. Rates are significantly higher in the Assigned Risk Plan in Illinois than they are in the voluntary market. The rates themselves are higher, typically 20% or 25% higher than the rates for the same operations in the voluntary market. Assigned Risk policies have no Premium Discount. This can add another 10% to the cost of the policy. In the voluntary market, insurance companies commonly offer discretionary discounts ranging from 15% to 50%.

Add it all together, and the Assigned Risk Plan policies are often twice as expensive as the same coverage in the voluntary market.

Comment by Don't Get Me Started Wednesday, Jul 27, 16 @ 4:34 pm