Latest Post | Last 10 Posts | Archives

Previous Post: State senator announces Obama endorsement

Next Post: Poll: Duckworth leads by 8

Posted in:

* From the Pew Charitable Trusts…

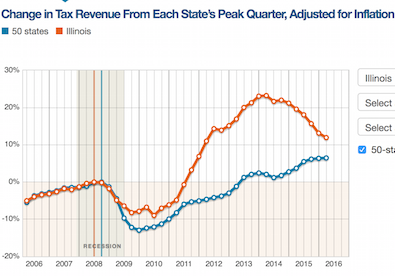

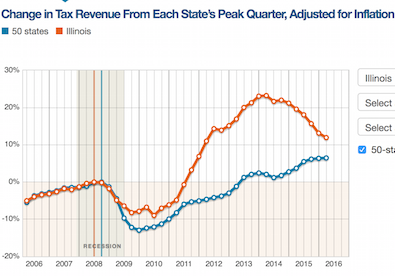

Tax revenue has recovered slowly and unevenly after falling in every state during the Great Recession. By the first quarter of 2016, tax collections had bounced back in 31 states after accounting for inflation. But amid inconsistent growth, receipts had slumped in 17 states at the start of the year

* All 50 states compared to Illinois…

You can click here and compare us to individual states if you want.

posted by Rich Miller

Tuesday, Nov 1, 16 @ 11:41 am

Sorry, comments are closed at this time.

Previous Post: State senator announces Obama endorsement

Next Post: Poll: Duckworth leads by 8

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Easy to see where the temp income tax started and sunsetted.

Comment by RNUG Tuesday, Nov 1, 16 @ 11:44 am

Anything over the 0% mark is an increase in receipts over the peak quarter (mid-2008 for IL), even if it is on a descending trend. And I am surprised to see how well IL did vs. the 50, even after the temporary tax rollback.

Comment by Six Degrees of Separation Tuesday, Nov 1, 16 @ 11:51 am

What am I missing? We’re still doing better than the national average, correct? I guess we’re assuming the downward trend will continue and move us below?

Comment by Robert the 1st Tuesday, Nov 1, 16 @ 11:51 am

== What am I missing? We’re still doing better than the national average, correct? ==

Hard to say, since there is still a 0.75% increase in the income tax rate compared to prior to the increase to 5%.

Comment by RNUG Tuesday, Nov 1, 16 @ 11:56 am

What happened in 2014???? *snark*

Comment by The Muse Tuesday, Nov 1, 16 @ 11:57 am

We’re doing better than Indiana, Wisconsin, and Ohio. But I guess we’ll have to do “downer, downer, downer” and get the free onion before it fits with Rauner and Co.’s TA complainin’, er, talkin’ points.

Comment by Anon221 Tuesday, Nov 1, 16 @ 11:59 am

As I read the chart, all states were measured from their peak prior to the recession. We had a structural deficit at our peak, so we were already in trouble.

Not all of the tax increase was rolled back. We are showing increased revenues because we went from a 3% income tax rate to a 3.75% rate.

Comment by Last Bull Moose Tuesday, Nov 1, 16 @ 12:01 pm

The sharp downturn is because 2014 marks Mike Madigan’s arrival in Springfield, rite?

– MrJM

Comment by @MisterJayEm Tuesday, Nov 1, 16 @ 12:03 pm

Just imagine where we would rank if the chart included the gap between expenses and revenue for all 50 states…for some reason, suddenly I’m nostalgic for the days when everyone kept comparing Illinois to Greece and then to Detroit.

Comment by Earnest Tuesday, Nov 1, 16 @ 12:18 pm

Click the comparison with Illinois, Wisconsin and Kansas. Interesting to say the least

Comment by Morty Tuesday, Nov 1, 16 @ 12:39 pm

Proving that for state government, despite substantially increase revenue every years, there’s never enough money,

Comment by Edmond Dantes Tuesday, Nov 1, 16 @ 12:40 pm

Interesting. NY dropped its top tax rate and threshold in 2012 and has since seen increased revenues.

How much can be attributed to rising tax rates versus actual economic recovery?

Comment by City Zen Tuesday, Nov 1, 16 @ 12:42 pm

Colorado, a flat tax state that has not increased its tax rate during this span, experienced 20% growth.

Growth without a tax hike…what a novel idea.

Comment by City Zen Tuesday, Nov 1, 16 @ 1:06 pm

You can not help but notice the decline after Rauner took over the governor’s office.

Comment by Anonymous Tuesday, Nov 1, 16 @ 1:08 pm

Jobs flee to other states and 3rd world countries combined with very little new job creation in the state.

A higher tax rate will help, at least temporarily, to solve the states budget mess. It does not solve the overall problem.

Outlook: BLEAK

Comment by Federalist Tuesday, Nov 1, 16 @ 1:16 pm

So, wait…then Quinn did something right?

Comment by Belle Tuesday, Nov 1, 16 @ 1:33 pm

In the case of Kansas… there are taxes… and then there are taxes.

From the report: “Kansas’ tax revenue would still be below its peak, however, if not for a 2014 technical change that began redirecting property tax dollars for schools through the state treasurer before distribution.”

http://www.latimes.com/business/hiltzik/la-fi-hiltzik-kansas-economy-20161031-story.html

http://www.kansas.com/news/politics-government/article111182802.html

Comment by Anon221 Tuesday, Nov 1, 16 @ 1:39 pm

Imagine where IL would rank had Madigan, Cullerton and Quinn made the tax hike permanent, instead of mostly temporary?

Comment by anon Tuesday, Nov 1, 16 @ 2:05 pm

=Quinn did something right=

Quinn looks like a strong leader compared to current governor. Quinn looks like the man next to the boy.

Comment by Anonymous Tuesday, Nov 1, 16 @ 2:36 pm

==Imagine where IL would rank had Madigan, Cullerton and Quinn made the tax hike permanent, instead of mostly temporary?==

Increased tax revenues should come from increased productivity and a growing, robust tax base, not tax hikes. Colorado, with its stable and flat tax rate, was already experiencing revenue growth before legalizing marijuana.

Comment by City Zen Tuesday, Nov 1, 16 @ 2:37 pm

==Increased tax revenues should come from increased productivity and a growing, robust tax base, not tax hikes.==

Sometimes tax hikes are necessary.

Comment by Demoralized Tuesday, Nov 1, 16 @ 2:49 pm

Wait, so Illinois tax collections are growing faster than the national average? What’s the problem?

Comment by Ron Tuesday, Nov 1, 16 @ 3:08 pm

Sometimes spending cuts are necessary.

Comment by Blue dog dem Tuesday, Nov 1, 16 @ 4:36 pm

Spending cuts, yes. Amputations, no.

Comment by Anon221 Tuesday, Nov 1, 16 @ 4:52 pm

As an electorate, we get an F.

Rauner over Quinn (this plot makes Quinn look like FDR in retrospect).

Blago II over JBT (see wiretaps from feds).

Oh the places we will go in 2018!

Comment by peon Tuesday, Nov 1, 16 @ 7:16 pm

Zen, perhaps Colorado’s increase is due to its significant population growth.

Comment by Sir Reel Tuesday, Nov 1, 16 @ 9:35 pm

OK, again we have a structural deficit and we should have never let the temp 5% tax sunset. Rauner needs to drop his union busting reforms poorly disguised as a “turn around agenda” and do the tough work of governing by negotiating a budget with cuts and revenue. Govern, get a bite of the loaf but don’t lock the kitchen door until you get your way. MJM will negotiate and he has been saying from day one we need a budget and he is not about to start giving a gov. non budget itmes as a prerequisite for raising taxes. Sure, I will gut my core constituency so you can blame me for a tax increase. snark.

Comment by facts are stubborn things Wednesday, Nov 2, 16 @ 8:47 am

Facts, that’s it in a nutshell. Only problem is that that’s not ‘winning’ to Rauner, and that is the crux of the matter. In addition, by poisoning the well and saying “I’ll let the democrats have their tax increase” means that Rauner needs to announce a revenue increase as having been arrived at by both parties.

Comment by PublicServant Wednesday, Nov 2, 16 @ 9:26 am