Latest Post | Last 10 Posts | Archives

Previous Post: The big squeeze on higher education

Next Post: Madigan to advance bill to give ALPLM its own board

Posted in:

* From the Center for Tax and Budget Accountability…

Every year, the Tax Foundation publishes its “business tax climate” report, which scores states based on their tax policies. The report always gets a lot of press; in Illinois, which ranked 23rd with a score of 5.21 in the 2017 report, the press is usually accompanied by quotes from politicians and business leaders about how the state needs to improve its tax climate to be competitive with other states like Indiana or Wisconsin.

But should we listen?

Of course, even the Tax Foundation would probably agree that having a good “business tax climate” isn’t a goal in itself. Instead, a good climate is supposed to improve the state’s economy, and lead to more growth, more income, and more jobs.

You might think, then, that states with better “business tax climates” do better on those outcomes — the things we really care about.

Except they don’t.

What CTBA found (click here for charts) is that the Tax Foundation’s business climate scores “have only very marginal relationships to GDP per capita; growth in GDP per capita; median household income; growth in median household income; and growth in jobs.”

* And then there’s this…

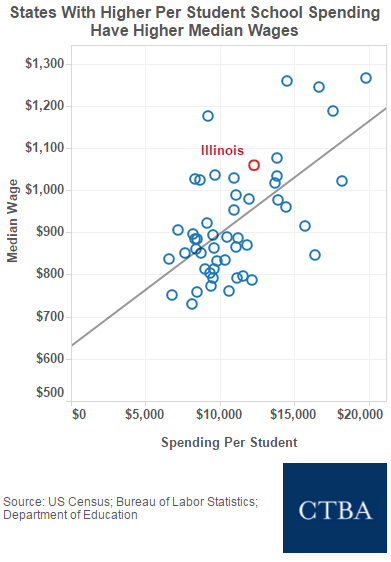

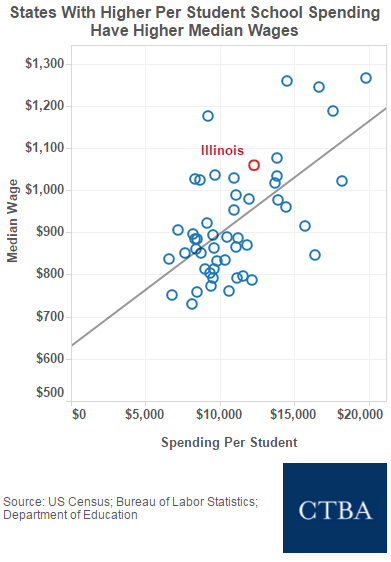

Of course, there’s another policy indicator that does track with a better economy. It’s per student spending on education.

But it will be hard to keep up spending on students if Illinois doesn’t have revenue because we cut taxes to have a better “tax climate” according to the Tax Foundation.

* The last chart…

posted by Rich Miller

Thursday, Mar 9, 17 @ 10:14 am

Sorry, comments are closed at this time.

Previous Post: The big squeeze on higher education

Next Post: Madigan to advance bill to give ALPLM its own board

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

This isn’t what our conservative friends want to hear. Consequently, there must be something wrong with this study, because their premises can’t be wrong.

Comment by Anon Thursday, Mar 9, 17 @ 10:27 am

I’m not sure that the causation works the way that CTBA implies. Wouldn’t it be just as logical to assume that richer states have more money to spend on education, rather than that spending on education causes states to be richer?

Comment by Anonymous Thursday, Mar 9, 17 @ 10:28 am

Although I support higher education spending, my public education taught me that correlation does not imply causation. The story makes just as much sense — probably more sense — in reverse. States with high wages (i.e., rich states) spend more on education.

Comment by Anonymous Thursday, Mar 9, 17 @ 10:40 am

I thought our business climate was just absolutely toxic. This is saying the business tax climate is about middle of the pack?

Comment by illini97 Thursday, Mar 9, 17 @ 10:43 am

Darth Arduin has failed

Comment by Honeybear Thursday, Mar 9, 17 @ 10:56 am

This is what I’ve always believed. What will attract business is a state that is on sound financial footing that invests in education and infrastructure. If lower income tax rates attracted businesses to locate Illinois would be in great shape. (See income tax rates in our neighboring states) I would argue that Rauner’s policies are driving away business. Our financial health has deteriorated under him and education funding has been reduced.

In Minnesota they are now arguing about what to do with their 1.65 billion budget surplus. Their progressive income tax structure seems to be working well for them.

Comment by The Dude Abides Thursday, Mar 9, 17 @ 10:59 am

“I’m not sure that the causation works the way that CTBA implies. Wouldn’t it be just as logical to assume that richer states have more money to spend on education,…”

Right on.

This same outfit reported on January 26 that “[Illinois’ tax policy] is flawed in fundamental ways that lead to both underfunding of core state services like education and public safety…..”

Comment by CapnCrunch Thursday, Mar 9, 17 @ 11:00 am

With several others on this. Higher cost of living states spend more on education. This is a surprise how? If average wages for everyone are higher, presumably that includes teachers, aides, custodians, administrators, construction costs, then it makes sense you have to spend more per student.

Comment by Shemp Thursday, Mar 9, 17 @ 11:09 am

The last chart threw me off. There are 12 states represented on that chart that spend more per pupil than IL. I do know most of those states are located in the Northeast. But only 5 states have higher median wages. What’s the point being made?

I would like to know what states are situated at 11:00 and 1:00 in relation to us. Seems like they get great bang for the buck.

Comment by City Zen Thursday, Mar 9, 17 @ 11:20 am

Holy abuse of statistics, Batman.

What’s the slope of that trendline? How’d they reach that conclusion? Eyeballing the other graphs, it appears that some of them have stronger correlations than their highlighted graph, despite what they say. Show me some numbers. Pictures are lovely, but without underlying data, are pretty worthless.

Comment by ChrisB Thursday, Mar 9, 17 @ 11:22 am

CTBA openly fails to address what’s the chicken and what’s the egg. And they admit they’re addressing correlation and not causation.

Do states that spend a lot on education do so because they have high wages? Or do states have high wages because they spend a lot on education?

There is substantial research from Christina Romer, the former top economist on Obama’s team, showing that higher overall taxes lead to less economic growth.

http://www.nber.org/papers/w13264

It would be good to see similar research showing that the level of spending is what drives educational outcomes. As it is, many countries that spend much less than the US on education achieve much better outcomes.

Comment by Lucci Thursday, Mar 9, 17 @ 11:38 am

The problem with looking at just the tax code is that while taxes are critically important for a growth environment, they can be dwarfed in magnitude by the cost of regulations.

For example, Illinois businesses likely pay more in workers’ compensation than they do in income taxes. And that’s one regulatory line item. There are literally hundreds of other regs that affect the ability to grow.

There are also other important factors beyond taxes & regs. I don’t think anyone would suggest that the tax climate alone is the predictor of economic outcomes. But it’s undeniable that the tax climate matters.

Comment by Lucci Thursday, Mar 9, 17 @ 11:44 am

=Wouldn’t it be just as logical to assume that richer states have more money to spend on education, rather than that spending on education causes states to be richer?=

Illinois has the 5th largest GDP in the US and the 16th largest in the world.

If I understand your argument we should be doing awfully well, but we are not.

What is the difference? Paying our bills.

Comment by JS Mill Thursday, Mar 9, 17 @ 12:18 pm

JS MILL….

Thanks - took the words right outta my mouth.

Comment by TinbyDancer(FKASue) Thursday, Mar 9, 17 @ 12:29 pm

California has the highest GDP in the US and 6th highest in the world but its residents spend less per pupil on education than Illinois.

Comment by City Zen Thursday, Mar 9, 17 @ 12:32 pm

What we DO know is that consumer spending is 70% of GDP.

So, the more discretionary cash consumers have, the more they spend, the more they spend, the greater the GDP, etc., etc.

Low wages = no discretionary cash or spending.

Crushing debt = no discretionary cash or spending.

High healthcare costs = no discretionary cash or spending.

Rent over 1/3 of income = no discretionary cash or spending.

Tax breaks for the ultra- wealthy? Already over- spending - Won’t change GDP.

Comment by TinyDancer(FKASue) Thursday, Mar 9, 17 @ 12:40 pm

“Their progressive income tax structure seems to be working well for them.”

Unconstitutional in Illinois.

Comment by Tone Thursday, Mar 9, 17 @ 12:55 pm

Illinois job growth is anemic because employers know that massive tax increases will be needed to fund the outrageous public employee pensions that our constitution protects.

Insanity.

Comment by Tone Thursday, Mar 9, 17 @ 1:03 pm

Businesses are not stupid generally. They fully understand that massive tax increases are needed to fund the outrageous constitutionally protected public worker pensions.

Comment by Tone Thursday, Mar 9, 17 @ 1:07 pm

Below is a link to all the states by GDP and growth rate.

Obviously, there’s not really any “competition” with the likes of Indiana or Wisconsin when it comes to GDP, despite all those “fleeing businesses” we’ve been hearing about for so many years:

IL: $841.3B

IN: $362.8

WI: $331.3

National growth rate is 2.7%.

IL: 2.6%

IN. 2.4%

WI: 2.4%

So, why exactly must we wreck or neglect the foundations of our economy — higher ed, infrastructure, fiscal position — for some personal political agenda that the governor cannot articulate the economic or fiscal benefits of?

It’s insane.

Rauner isn’t responsible for what happened before January 2015, but he sure wears the jacket for making things worse, by any measure, since then. His screwball agenda is driving everything.

http://www.usgovernmentspending.com/gdp_by_state

Comment by wordslinger Thursday, Mar 9, 17 @ 1:07 pm

Illinois GDP growth is generally in line with our neighbors. But this is due to Chicago region.

The rest of Illinois is like West Virginia, poor and dying.

Comment by Tone Thursday, Mar 9, 17 @ 1:24 pm

=It’s insane.=

Yup. To your whole post.

Politicians are not known for being deep thinkers, basically opportunists so they go for the simple and drone on and on and on.

“Taxes are too high!!” nobody WANTS to pay more. It is easily digestible in seconds.

Now, how is Kansas doing? The incubator for pure “Conservative” trickle down experimentation.

Kansas eliminated income tax for businesses and massively slashed taxes.

Their economy is failing. Bad. Sad, even.

The model has no successful examples.

Funny how well states that pay their bills do.

Comment by JS Mill Thursday, Mar 9, 17 @ 1:53 pm

=Illinois GDP growth is generally in line with our neighbors.=

IN terms of percentage that is correct.

But 2.6% in Illinois equates to about twice as much growth in terms of GDP dollars given the size of Illinois economy (GDP). In fact, Illinois 2.6% is bigger, in terms of GDP dollars than Indiana and Wisconsin combined.

Illinois can afford to pay its bills and should.

Comment by JS Mill Thursday, Mar 9, 17 @ 3:32 pm

–Illinois can afford to pay its bills and should.–

I don’t think that’s the plan.

The backlog of bills has increased from $4.5B to $12.3B (today) since Rauner took office.

I don’t think a sharpie bustout artist like him runs up bills with the intent of paying them. Wasn’t his private sector business model.

Bankruptcy not being an option, I’m guessing there will be a haircut offer down the road: take X on the dollar, promise not to pursue us in Court of Claims, and you’ll be rewarded with another contract that we may or may not pay.

Some people do business like that, in bad faith.

Comment by wordslinger Thursday, Mar 9, 17 @ 3:40 pm

Naperville and CPS spend about the same per student with vastly different results. So I don’t put huge weight in these comparisons.

Comment by Last Bull Moose Thursday, Mar 9, 17 @ 3:47 pm

- Darth Arduin has failed -

Preposterous. Someone told Rich she made a positive impact, and he told us. You can take that to the bank.

Comment by Daniel Plainview Thursday, Mar 9, 17 @ 4:00 pm

== Some people do business like that, in bad faith. ==

That’s why I have said for some time now the only hope the vendors have is convincing a judge that the State acted fraudulently in either awarding individual contracts or continuing / failing to cancel multi-year contracts. Deliberate fraud is the only defense I see to the boilerplate “non-funding” language in the State contracts.

Comment by RNUG Thursday, Mar 9, 17 @ 4:33 pm

–Deliberate fraud is the only defense I see to the boilerplate “non-funding” language in the State contracts–

To me, the fact that the governor issued full vetoes, and never attempted to use the line-item or reduction vetoes, is an indication that he never intended to pay any bills.

Comment by wordslinger Thursday, Mar 9, 17 @ 4:39 pm

- bustout artist -

Word, he’s a “roll up specialist”, and a good one. Just ask Rich.

Comment by Daniel Plainview Thursday, Mar 9, 17 @ 4:46 pm

@Last Bull Moose: Chicago’s student body is 84% low income, 18% English learners, 14% learning disabled, and 4% homeless.

Kids in Chicago don’t get to spend their summers at camp extending their academic learning, or on vacations to visit the museums and historic sites of the nation. Most can’t even afford to go down town.

So yes, Naperville with its 14% student poverty rate, 11% disabled, 6% English learners, 1% homeless performers much better.

But something else to keep in mind when making your comparison is that Naperville pays its teachers about 11% more, on average. So there’s that.

Comment by Yellow Dog Democrat Thursday, Mar 9, 17 @ 10:11 pm

=Illinois GDP growth is generally in line with our neighbors. But this is due to Chicago region.=

I thought Chicago was the damnation of state. Now it’s the salvation?

So, which is it?

Make up your mind.

Comment by TinyDancer(FKASue) Friday, Mar 10, 17 @ 12:34 am