Latest Post | Last 10 Posts | Archives

Previous Post: SUBSCRIBERS ONLY - House vs. Senate softball game

Next Post: Pritzker calls for impeachment proceedings against Trump, demands Rauner speak up

Posted in:

* Bloomberg…

With less than two weeks left in the regular legislative session, Illinois lawmakers and Governor Bruce Rauner are still divided on how to end the worst-rated state’s nearly three-year budget impasse. Investors aren’t pleased.

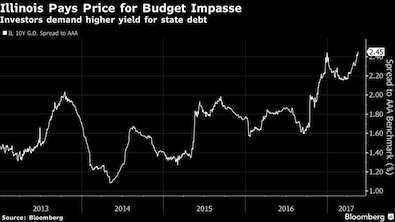

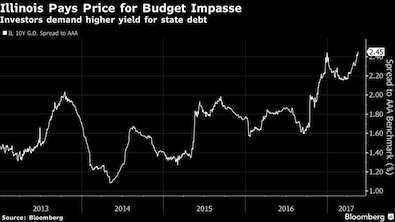

Bondholders are demanding yields of 4.49 percent on Illinois’s 10-year bonds, some 2.45 percentage points more than those of benchmark tax-exempt debt. That’s the biggest gap since the Bloomberg indexes began in January 2013.

After May 31, a three-fifths majority will be required to pass anything, making a deal even more difficult to reach. Senate Democrats advanced several bills that had been considered part of a bi-partisan compromise on Wednesday, but they were unable to pass a spending plan for lack of Republican support.

“We’re two weeks away from the 31st and that’s the deadline that’s set,” said Dennis Derby, a money manager in Menomonee Falls, Wisconsin, at Wells Fargo Asset Management, which holds Illinois bonds among its $40 billion of municipal debt. “They’ve had substantial time to work on this. So far we haven’t seen any substantial progress.”

* Chart…

posted by Rich Miller

Thursday, May 18, 17 @ 11:47 am

Sorry, comments are closed at this time.

Previous Post: SUBSCRIBERS ONLY - House vs. Senate softball game

Next Post: Pritzker calls for impeachment proceedings against Trump, demands Rauner speak up

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Rauner’s buddies stand to make a lot of money on this.

Comment by DuPage Thursday, May 18, 17 @ 12:03 pm

Griffin and Rauner make millions off nano-second advantages in trades; this is most likely even more lucrative for them.

Comment by cdog Thursday, May 18, 17 @ 12:26 pm

@DuPage - then perhaps Madigan & Co. should stop running up deficits. Stick it to Rauner and slash spending and privatize the government workforce to take the pension liabilities off the books!

Comment by Jerry Thursday, May 18, 17 @ 1:20 pm

OMG Wells Fargo hustler gets to comment….like we should be listenin’ It is fun to think about how much Griffie et al are makin’ and how aboutDopeyDucts 65 admitted conflicts of interest…let’s chart those gains.

Comment by Annonin' Thursday, May 18, 17 @ 1:21 pm

So is Rauner still a “fiscal conservative” in some eyes?

The combination of fiscal recklessness and social Darwinism in this administration is just beyond belief.

Comment by wordslinger Thursday, May 18, 17 @ 1:44 pm