Latest Post | Last 10 Posts | Archives

Previous Post: Expect delays for your Lottery winnings if there’s no budget

Next Post: Question of the day

Posted in:

* One of the big objections the governor and some Republicans have to the new House Democratic property tax freeze proposal is how the HDems exempt pension payments from their four-year freeze.

The Illinois chapter of Americans For Prosperity use Springfield as an example for why this exemption could blow a big hole in a freeze…

Exempting pensions from a property tax freeze would fail to address a substantial contributing factor to our highest-in-the-nation property taxes. Take Springfield, for example. Here in our fair capital city pension payments consume 80% of all property taxes paid to the city.

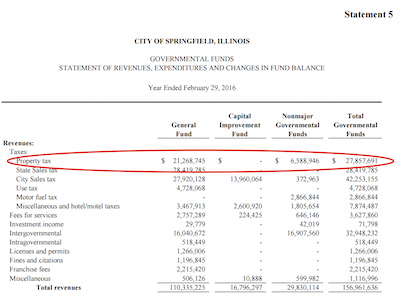

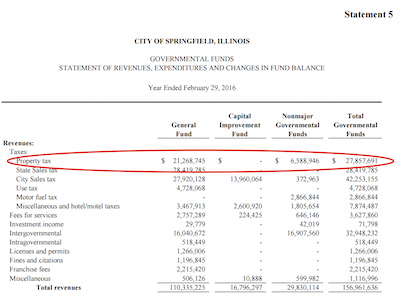

The first image is from Springfield’s FY2016 CAFR [Comprehensive Annual Financial Report] (pg. 10) showing property tax revenue of $27.9M. The second image is a Sangamon County Clerk’s Office 2016 Levy and Rate Report showing the city’s property tax extensions for pensions totaled $22M, or 80% of all property taxes paid by Springfield residents to the city. Clearly exempting pensions from a freeze will have little effect on ever-increasing property taxes.

* You can click on the images for the original documents…

* So, what does this mean? Well, in Springfield, at least, including pension payments in a freeze could create a serious squeeze at the local level. While polls shows that people hate their property taxes, they’re probably not gonna love reduced services, either.

And there is a real problem with the unfunded liability levels for police and fire pensions. Those funds weren’t subjected to the same requirements as other municipal pension funds, so lots of local governments skimmed and skipped payments. Taxes will have to rise to pay for that and/or governments will have to cut.

* Meanwhile, here’s an AFP press release on the HDem proposal…

“This legislation is a step backwards if we are to deliver true property tax relief to Illinois homeowners and small businesses. Exemptions for debt service and unpaid pensions render meaningless any promises of taxpayer relief,” said AFP-IL Director Andrew Nelms. “Our property tax burden is driving families and jobs from our state. Illinoisans acknowledge that their sky-high property taxes are a problem and legislation to implement a meaningful freeze would be a welcome sign that our lawmakers understand the gravity of the problem. Illinois lawmakers should instead pass a long-term property tax freeze with no exceptions. Beleaguered Illinois homeowners and businesses deserve true tax relief.”

* And for the other side, here’s Phil Kadner…

House Speaker Michael Madigan was the latest to join the chorus. Madigan over the weekend said he would agree to a property-tax freeze, if the governor were prepared to spend more state money on the Chicago Public Schools.

Madigan is largely responsible for creating this problem. He has never been a champion of spending on public education outside of Chicago. And his law firm has made a fortune on property-tax appeals cases.

This state is rotten to the core. Instead of addressing the real problem, the state budget and state debt, Rauner and Madigan want to appease taxpayers by freezing their property taxes, which will hurt public schools.

It’s a bait-and-switch tactic to make voters feel better about a state that can’t pay its bills. With the ship of state taking on water, elected officials want to throw your children overboard.

*** UPDATE *** From Springfield’s budget director William McCarty…

Rich,

Our pension obligation issue is more pronounced than that 80% calculation would lead you to believe. The nonmajor governmental portion of property taxes collected are from SSAs and the increments from TIF districts. Absent SSAs and TIF, most of that money would go to other taxing districts, not Springfield.

It is likely that in the next fiscal year, police and fire pension obligations will exceed the city’s General Fund property tax revenue for the first time ever (i.e. 100%+) Even if we were to include the city’s true portion of the tax increment monies, I would venture to guess we would still be at or near the 100% level next year. In the past, we paid for the library, debt service and other items from property taxes. Those days are gone.

One other thing, the City of Springfield component rate of total property taxes has not been increased since 1984. Our taxes have increased due to development and increases in valuation, not a change in the rate.

posted by Rich Miller

Tuesday, Jun 27, 17 @ 2:15 pm

Sorry, comments are closed at this time.

Previous Post: Expect delays for your Lottery winnings if there’s no budget

Next Post: Question of the day

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Once told a crowd of voters, the best way to know you’ve got a dishonest pol, is if he runs for state office on a platform of controlling or lowering your property taxes.

Comment by walker Tuesday, Jun 27, 17 @ 2:20 pm

Kander is on the money and not fooled by the nonsense coming from Springpatch.

Comment by JS Mill Tuesday, Jun 27, 17 @ 2:21 pm

Lots of local governments made the minimum payments that the Dept of Insurance “required” and still saw their plans tank because they never rebounded after 2001. The Dept of Insurance minimum’s were always ridiculously low anyway and typically far below actuarial suggestions. Combine that with actuarial rate of return assumptions that were good for pre-2001 earnings and you got the straw to break the camels back.

One more reason it is ridiculous to have hundreds of individual plans around the State for fire and police while a single IMRF plan operates like a well oiled machine for every other local govt employee.

Quit treating the symptoms and treat the problems.

Comment by Shemp Tuesday, Jun 27, 17 @ 2:32 pm

Kander is halfway right. Property tax freezes don’t impact state funding. But it is not a cut. No district will lose any current funding. They just won’t see increases. That’s different than a cut. Let’s just be accurate in our condemnation.

Comment by NeverPoliticallyCorrect Tuesday, Jun 27, 17 @ 2:33 pm

Rauner doesn’t want a budget.

Comment by Real Tuesday, Jun 27, 17 @ 2:33 pm

My understanding, as written, the “freeze” will be a cut if the EAV drops in your community. And that is not uncommon downstate.

Comment by Shemp Tuesday, Jun 27, 17 @ 2:35 pm

idea.

Let’s freeze the property taxes at the highest in the country, then, we can go for the HAT TRICK by trying to score the highest sales tax and income tax in the country.

Comment by cdog Tuesday, Jun 27, 17 @ 2:40 pm

Pension money must come from somewhere. But the real angle is that the Governor wants bankruptcy changes at the federal level to allow IL to wipe out all pension debt and, therefore, who cares if pension debt get paid.

Comment by Just Sayin' Tuesday, Jun 27, 17 @ 2:41 pm

This is terrible public policy. We are telling local governments “do what we did” kick the pension can down the road. Way down the road.

Comment by Captain Ed Smith Tuesday, Jun 27, 17 @ 2:41 pm

“How can I create a crisis at the local level if pension payments are exempt?” - Crisis Creatin’ Rauner

Comment by Ole' Nelson Tuesday, Jun 27, 17 @ 2:43 pm

Why does Rauner want the state to take over local governments finances. Isn’t the act of freezing property taxes a power grab by the state. Locally elect d officials are responsible for your property taxes. If Rauner wanted to lower property tax he should have ran for school board

Comment by Really Tuesday, Jun 27, 17 @ 2:45 pm

The “freeze” will also be a cut as fuel, insurance, salary, construction, general supply costs and expenses of school districts and other local government continue to rise.

That is what Rauner wants. Starve local government, thinking that will weaken teacher and other unions. He wants local government agencies to do pay cuts to employees. Same thing for state universities. Starve them and hope there will be pay cuts to faculty and staff.

Comment by Joe M Tuesday, Jun 27, 17 @ 2:45 pm

>> Pension money must come from somewhere. But the real angle is that the Governor wants bankruptcy changes at the federal level to allow IL to wipe out all pension debt and, therefore, who cares if pension debt get paid.

Comment by BBG Watch Tuesday, Jun 27, 17 @ 2:45 pm

Two words. Municipal Bankruptcy.

Comment by LTSW Tuesday, Jun 27, 17 @ 2:50 pm

Dems bill a good start to a freeze compromise if Rs want one. Rs would have to agree to exempt CPS and Chicago, who will continue to need local control over levies(by elected officials) just to get through the next few years.

It should be clear now that Rauber will not get the freeze he wants with collective bargaining and prevailing wage changes and his latest goalpost move demanding voter-initiated levy reductions. I can’t see the Dems agreeing to add those now or later–there are just too many (quite reasonable) objections from local governments.

There might be something the Dems can yet give to make the bill more enticing to Rs–maybe backing off somewhat on the pension exclusion language, but I don’t expect that would be enough.

So if Rauner wants to campaign on “I’m the Governor who froze your property taxes”, he’d better get on board. Otherwise this bill is as good an excuse as any for him to blow up the entire package and resume his whining to “the taxpayers”.

R legislators–just stay in line and wait for instructions, got that?

Comment by James Tuesday, Jun 27, 17 @ 2:50 pm

Bankruptcy, even if law would eventually allow, would not wipe out pension liability. They would still have to settle. The state would also have to liquidate.

Comment by Iron Tuesday, Jun 27, 17 @ 2:54 pm

==by trying to score the highest sales tax and income tax in the country.==

We have a log ways to go as far as income tax goes. Our 3.75% rate is about the 2nd lowest top rate of the 40+ states that have an income tax. And it is nowhere even close to some of our neighboring states:

Iowa: 8.98%

Wis: 7.65%

MO: 6%

KY 6%

Yes, IN only has a 3% rate, but they add another couple of percent onto one’s state tax bill for local county taxes.

Comment by Joe M Tuesday, Jun 27, 17 @ 2:54 pm

Yes, Springfield pays $21 million in property taxes to city government.

But it pays $45 million in sales taxes to city government.

If I were a retailer or consumer in Springfield, I’d be very nervous about the Governor’s proposal.

City government is legally obligated to pay the pensions. if property taxes are frozen, pensions will be used to leverage a sales tax hike.

Comment by Free Set of Steak Knives Tuesday, Jun 27, 17 @ 2:56 pm

Rich,

Our pension obligation issue is more pronounced than that 80% calculation would lead you to believe. The nonmajor governmental portion of property taxes collected are from SSAs and the increments from TIF districts. Absent SSAs and TIF, most of that money would go to other taxing districts, not Springfield. It is likely that in the next fiscal year, police and fire pension obligations will exceed the city’s General Fund property tax revenue for the first time ever (i.e. 100%+) Even if we were to include the city’s true portion of the tax increment monies, I would venture to guess we would still be at or near the 100% level next year. In the past, we paid for the library, debt service and other items from property taxes. Those days are gone.

One other thing, the City of Springfield component rate of total property taxes has not been increased since 1984. Our taxes have increased due to development and increases in valuation, not a change in the rate.

William McCarty

Director, Springfield Office of Budget & Management

Comment by Bill McCarty Tuesday, Jun 27, 17 @ 3:07 pm

- LTSW - Tuesday, Jun 27, 17 @ 2:50 pm:

Two words. Municipal Bankruptcy.

YES!

Comment by Ron Tuesday, Jun 27, 17 @ 3:14 pm

Property taxes are a local issue NOT a state issue.

Comment by City worker Tuesday, Jun 27, 17 @ 3:15 pm

Rich et al,

What are the actual budget bill(s) numbers to read that came out of committee today?

Saw the property tax number but looking for the rest.

Thanks!

Comment by Hit Em With the Hein Tuesday, Jun 27, 17 @ 3:20 pm

I agree that Rauner’s long term goal is to bankrupt the State and at least Chicago. Rauner believes that will allow them to reduce the Pensions and weaken the Unions. As for the Pensions, I think he has miscalculated. I do not see how any Bankruptcy Law can trump the Diminishment clause of the IL Constitution. Maybe RNUG can provide some insight.

Comment by Miscalculation Tuesday, Jun 27, 17 @ 3:46 pm

I have a slightly different take on it. I think the politicians know a pension shift is coming for the school districts and / or that the Tier 3 plans may not meet safe harbor rules; either one will require more local money. If either of those scenarios happen and the property tax is frozen, then school funding is, in effect, cut because the pension / SS payments will have to come out of current monies.

The underfunded police / fire are also an issue. With a frozen property tax, those pensions will squeeze out other village / township / city / county priorities.

If you have any intention of honoring those pensions (and right now the IL SC says you have to), then you have to exempt pension funding from the freeze. But if your intention is to bankrupt government through using pensions to drive out all other services, then including pensions in the freeze is the way to go.

Comment by RNUG Tuesday, Jun 27, 17 @ 3:49 pm

If debt service P&I payments are exempt from the freeze then couldn’t local governments issue debt to continue spending and then raise property taxes to repay the debt?

Comment by Lucci Tuesday, Jun 27, 17 @ 3:55 pm

==Our 3.75% rate is about the 2nd lowest top rate of the 40+ states that have an income tax. And it is nowhere even close to some of our neighboring states:==

All our neighboring states tax retirement income.

Comment by City Zen Tuesday, Jun 27, 17 @ 3:59 pm

==But if your intention is to bankrupt government through using pensions to drive out all other services, then including pensions in the freeze is the way to go.==

I wouldn’t say paying deferred compensation is deliberately trying to bankrupt government. It’s part of employee compensation so it should be included in any freeze like any other expense. After all…”if only the state made its pension payments all these years…”

If pensions are driving out all other services, then the other factors of compensation are too expensive.

Comment by City Zen Tuesday, Jun 27, 17 @ 4:05 pm

Anyone who wants a property tax freeze either:

1. Has no idea how property taxes are calculated and what goes into the calculations, or

2. Wants to intentionally harm local taxing districts, especially school districts — the bulk of whose employees are unionized.

With Gov. Gaslight, it’s definitely 2, though I imagine his superstars also fall under 1.

The only way to legitimately ease Illinois’ property tax burden is for the state to fulfill its constitutional obligation to adequately fund education. And to do that we need to raise our income taxes to a level comparable to every state around us and, preferably, amend the state constitution to allow for a progressive income tax, just like every state around us save Indiana.

Comment by Nick Name Tuesday, Jun 27, 17 @ 4:11 pm

To the Update:

As I said, freeze property taxes w/o a pension exemption, you better be prepared to pay much more in sales taxes.

Comment by Free Set of Steak Knives Tuesday, Jun 27, 17 @ 4:13 pm

== I wouldn’t say paying deferred compensation is deliberately trying to bankrupt government. ==

-city zen-, I believe government debts, including pensions, should be paid. We can discuss if other components, like salaries, are out of line or if the governmental unit was irresponsible in not providing proper funding because they wanted to deliver other services without raising taxes.

The point I was trying to make is, if you remove the ability of local government to increase revenue when needed, then you are acting like the Governor and using a crisis to create opportunity to achieve an aim: squeezing government programs.

Comment by RNUG Tuesday, Jun 27, 17 @ 4:17 pm

==It’s a bait-and-switch tactic….elected officials want to throw your children overboard==

It is easy to understand why Rauner is for this (reduces funds for teachers, that is for teachers’ unions in Rauner’s mind), but DEMS are caving because (as Rich reminds us) a property tax freeze is so popular (even if it does not actually freeze any one person’s property tax).

Comment by winners and losers Tuesday, Jun 27, 17 @ 4:23 pm

It’s very sad so many are cheering for bankruptcy. I was raised that bankruptcy is wrong and just plain irresponsible. Sure it’s an easy way out of paying your debt. But it’s not right

IL needs to pay up Period. No weaseling out of your responsibility

Comment by Nick Tuesday, Jun 27, 17 @ 4:36 pm

Local property taxes are levied into several funds. Some funds and some parts of funds are not capped. Why? Because the local govt has little control over those expenses. Thus, life-safety repairs, social security, and IMRF are taxed as required. A property tax cap will not limit those expenditures; thus, it will likely result in cuts to other areas. Property taxes are already under the control of local elected officials; a tax cap is disfunctional Springfield spread disfunction to local governments.

Comment by Pot calling kettle Tuesday, Jun 27, 17 @ 4:36 pm

== - Miscalculation - @ 3:46 pm: ==

I did reply to you. From some reason, it is not showing on my smartphone but it does show up on my computer.

Comment by RNUG Tuesday, Jun 27, 17 @ 4:38 pm

== Sure it’s an easy way out of paying your debt. But it’s not right

IL needs to pay up Period. No weaseling out of your responsibility ==

A bankruptcy judge would look at the tax cut and throw the case out of court. Illinois has the ability to pay; the politicians just don’t have the will to …

Comment by RNUG Tuesday, Jun 27, 17 @ 4:46 pm

Illinois does not exist in a vacuum. Residents of this state have one of the highest state and local tax burdens in the nation.

Comment by Ron Tuesday, Jun 27, 17 @ 4:50 pm

If your’e spending 80% of property tax revenue on paying people for services that were performed 20 years ago, you’re bankrupt.

Comment by Captain Obvious Tuesday, Jun 27, 17 @ 4:54 pm

- Captain Obvious - Tuesday, Jun 27, 17 @ 4:54 pm:

If your’e spending 80% of property tax revenue on paying people for services that were performed 20 years ago, you’re bankrupt.

LOL, so true.

Comment by Ron Tuesday, Jun 27, 17 @ 4:58 pm

Bankruptcy is used the world over for individuals and entities that are insolvent. Time for Illinois to get into the 19th Century.

Comment by Ron Tuesday, Jun 27, 17 @ 4:59 pm

===Property tax freezes don’t impact state funding. But it is not a cut. No district will lose any current funding.===

Is not a property tax freeze effectively a cut if there is any amount of inflation greater than zero (0)? If there is some amount of inflation the number of dollars of revenue stays the same with the freeze but the ‘buying’ power of each dollar has decreased.

Comment by Small town taxpayer Tuesday, Jun 27, 17 @ 5:00 pm

Property tax revenue is just one of the revenue streams for cities, so the fact that 80% of property tax revenue goes towards pensions tells you very little about the true impact of pensions on a city’s budget. For example, my gift revenue is 100% consumed by the purchase of merchandise. That doesn’t mean I can’t pay my mortgage.

Comment by Pelonski Tuesday, Jun 27, 17 @ 5:07 pm

Bankruptcy may be used world over but it still isn’t right for individuals companies or states to live beyond their means and make bad choices and then go crying to the courts to bail them out of a self inflicted situation at the detriment of the innocent who is owed

Comment by Anonymous Tuesday, Jun 27, 17 @ 5:41 pm

Why does anyone on this blog waste their time speaking about bankruptcy. It’s not allowed under Illinois law and guess what- as long as the Dems rule the roost it is not gonna ever happen since bankruptcy would allow municipalities to undermine collective bargaining obligations

Comment by Sue Tuesday, Jun 27, 17 @ 6:33 pm

==Is not a property tax freeze effectively a cut if there is any amount of inflation greater than zero (0)? ==

Take a look at your local school district teacher contracts the past decade. I’ll use my old district as an example. Teachers got 3% yearly COLA increases over a period in which CPI was 1%.

If there is a “cut” with a freeze, the employees are already be way ahead of the game.

Comment by City Zen Tuesday, Jun 27, 17 @ 6:56 pm

NickName. I fully understand how and why property taxes work. After decades of total state and local government overspending and over promising, we must all share in the pain needed to get this fiscal ship in order. From the little town to the smallest county. From the biggest school district to the smallest. We must all pay the price of reduced services.

Comment by Blue dog dem Tuesday, Jun 27, 17 @ 8:29 pm

==The only way to legitimately ease Illinois’ property tax burden is for the state to fulfill its constitutional obligation to adequately fund education. And to do that we need to raise our income taxes to a level comparable to every state around us==

This is what the states around us spend per pupil on education, per the US Census Bureau:

Indiana = 9,566

Iowa = 10,313

Kentucky = 9,316

Wisconsin = 11,071

Missouri = 9,597

Illinois = 12,228

We spend $2,000 more per pupil than all our neighboring states. With 2 million students, that’s $4B a year from all funding sources. Imagine an extra $1.5B for higher ed and social services and $2B in property tax relief.

I agree, let’s follow our neighbors.

Comment by City Zen Tuesday, Jun 27, 17 @ 10:25 pm

City:

We used to have another commenter who advocated spending less on education. Now we’ve got you. Thankfully none of those in charge agree with you.

Comment by Demoralized Wednesday, Jun 28, 17 @ 7:41 am

Also, where would you cut that $4B from in school budgets? I suspect given your little rants the first place you would look is teacher salaries. I’ve got a friend who’s a teacher and he makes about $50K a year after 20 years. I think he should make more.

Comment by Demoralized Wednesday, Jun 28, 17 @ 7:44 am

===Take a look at your local school district teacher contracts the past decade. I’ll use my old district as an example. Teachers got 3% yearly COLA increases over a period in which CPI was 1%.

If there is a “cut” with a freeze, the employees are already be way ahead of the game.===

Meanwhile many of us in other districts have endured freezes and increases of 0.5% or 1% while also seeing our colleagues lose their jobs.

Comment by historic66 Wednesday, Jun 28, 17 @ 8:15 am

Demoralized

Please refer to the original commenter that stated we should follow our neighbors lead. That’s what our neighbors do.

75% of the country spends less per pupil on education than Illinois. CA, MN, OH all spend less than us. Have they fallen off the map?

Comment by City Zen Wednesday, Jun 28, 17 @ 9:40 am

== I’ve got a friend who’s a teacher and he makes about $50K a year after 20 years. I think he should make more.==

Well, in my district he’d make around $75,000. How about your teacher friend calls my district teacher and ask for $12,500 and split the difference? They are union brothers, no? We are one?

Comment by City Zen Wednesday, Jun 28, 17 @ 9:43 am

lol, - City Zen -

You have candidates run on spending “less” per student, il show you a losing candidate.

And you even paying attention? The discussion is no district losing money. What district says “yes, less money, woo-hoo!”

If your argument is that teachers make too much money, at least be honest you are anti-teachers

“too much on students”… I needed a good belly laugh. Yeah, that’s a solid plan.

Comment by Oswego Willy Wednesday, Jun 28, 17 @ 9:50 am