Latest Post | Last 10 Posts | Archives

Previous Post: Misadventures in campaigning

Next Post: Dems slam Rauner over higher education problems

Posted in:

* SJ-R…

The state collected $300.5 million in tax revenues from 26,873 [video gambling] machines for the 12-month period ending June 30 as terminal numbers have grown each year since gambling began with 61 machines statewide in September 2012, according to an annual wagering report from the Illinois Commission on Government Forecasting and Accountability. The figure topped 27,000 by the end of July and was projected to hit 28,000 by mid-2018. […]

The state averaged 249 new terminals a month in the latest fiscal year, compared with 263 per month in the previous year and an average of 838 a month in the first two years of legalized gaming. Noggle said growth has been spread across the state. Video gambling remains banned in Cook County and Chicago.

State revenue from video gaming totaled $255.2 million from 23,891 terminals the prior fiscal year. Local government revenue from gambling terminals increased to $60.1 million from $51 million the year before.

* From COGFA’s report…

In FY 2017, the State’s share of tax revenues from wagering in Illinois reached $1.310 billion, a 7.9% increase from FY 2016 levels. The continued growth in video gaming tax revenues paid into the Capital Projects Fund ($44 million increase in FY 2017 to $296 million) and the increase ($58 million) in lottery transfers was more than enough to offset the $7 million loss in riverboat gaming transfers… Horse racing related State revenues continued its downward trend generating only $6 million.

Lottery transfers (and other State‐related lottery revenues) comprised 56.3% of total gaming revenues in FY 2017, whereas riverboat transfers comprised 20.6%, and horse racing comprised 0.5%. Video gaming’s growth in Illinois’ gaming market continued in FY 2017, comprising 22.6% of these gaming revenues in FY 2017, significantly up from its FY 2014 value of 9.1%.

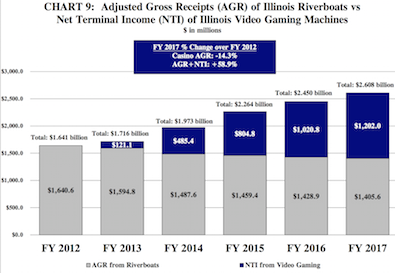

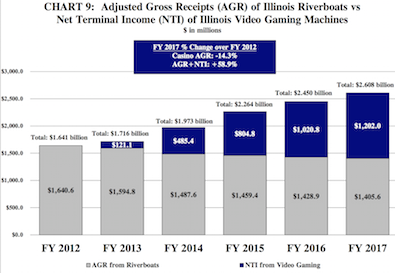

Statewide adjusted gross receipts (AGR) for Illinois riverboats in FY 2017 were down 1.6% from FY 2016 levels, while admissions declined 5.8%. Modest increases in AGR at the casinos in Aurora and Des Plaines were offset by AGR declines at the other eight Illinois casinos. State revenues generated from riverboat gambling totaled $393.0 million in FY 2017, which was a 1.9% decline from FY 2016 levels. Increased competition from video gaming continues to be a major contributing factor for these declines.

Before the addition of Des Plaines, in FY 2011, Illinois had the lowest amount of gaming revenue (in terms of AGR) of the casino‐operating states in the Midwest. The addition of the casino in Des Plaines allowed Illinois to rise ahead of Iowa between FY 2012 and FY 2015. But five consecutive years of declining revenues has Illinois ($1.406 billion in FY 2017) again trailing Iowa ($1.453 billion), in addition to Missouri ($1.719 billion) and Indiana ($2.130 billion). […]

Illinois’ total horse racing handle amount decreased from $593 million in CY 2015 to $571 million in CY 2016, a decline of 3.9%. This decline occurred despite the fact that advance deposit wagering increased $22 million or 15.3% and on‐track wagering increased $2.7 million or 3.2%. These increases were offset by a $37.6 million decline in intertrack wagering and a $10.0 million decrease in off‐track wagering. The overall horse racing handle total in 2016 was 40.1% below levels from just ten years ago. […]

Illinois had the 12th largest lottery in the U.S. in FY 2016, based on total sales. The per capita average of lottery sales in Illinois was $223 which was 23rd out of the 45 lotteries in the U.S. Per capita sales were basically flat at $222 in FY 2017.

* And check out this chart…

Gambling at video terminals is gonna surpass riverboats very soon. The boats would be wise to make bigger investments in that business.

posted by Rich Miller

Tuesday, Sep 12, 17 @ 11:57 am

Sorry, comments are closed at this time.

Previous Post: Misadventures in campaigning

Next Post: Dems slam Rauner over higher education problems

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Just Imagine What ILLINOIS Would Bring In With Recreational Marijuana.

Comment by Shake Tuesday, Sep 12, 17 @ 12:23 pm

Another tax on the poorest people who can afford it.

Comment by Nobody Tuesday, Sep 12, 17 @ 12:30 pm

If the downward trend continues with casinos, they may eventually be hat in hand like the racetracks asking for a state bailout.

Comment by anon2 Tuesday, Sep 12, 17 @ 12:33 pm

So if the casinos got into the video poker business (assuming on the location side, not on the machine side) would they be bound by the casino marketing rules or the video poker marketing which as I understand it are different.

For example, the local video poker place has free play ads on the back of cash register

receipts and no reference to 1-800-gambler.

Comment by OneMan Tuesday, Sep 12, 17 @ 12:36 pm

The figure that SJ-R doesn’t give you is the total amount of money that was put into the machines. That number with the total amount of revenue would give you an idea of how rigged the machines are. By rigged I mean the rate of return they are set to produce. I did some rough figuring a couple of years ago and I got about a 50% rate loss. That would mean on average for every one hundred bet the better will lose fifty bucks.

I think it’s a disgraceful way for the state to garner revenue…

Comment by Mouthy Tuesday, Sep 12, 17 @ 12:39 pm

They need to add video poker to airports. get money from travelers passing through.

Comment by Ghost Tuesday, Sep 12, 17 @ 12:44 pm

On the behalf of my 88 year-old Mother, I would like to say You’re welcome.

Comment by Triple fat Tuesday, Sep 12, 17 @ 12:59 pm

I’m imagining this kind of a chart for revenue from a tax on marijuana.

Comment by Amalia Tuesday, Sep 12, 17 @ 1:04 pm

For casinos to make additional investments, the playing field

would need to be leveled: rule changes, tax changes, addicted

gamblers, land based gaming etc.

Comment by in_The_Middle Tuesday, Sep 12, 17 @ 1:06 pm

Imagine if they expanded casinos in chicago, lake county, rockford, etc. etc…..

Comment by annonymous Tuesday, Sep 12, 17 @ 1:20 pm

A fool and his money will soon part ways.

Comment by Anonymous Tuesday, Sep 12, 17 @ 1:21 pm

==Just Imagine What ILLINOIS Would Bring In With Recreational Marijuana.==

Harrah’s Metropolis and Dispensary

Comment by City Zen Tuesday, Sep 12, 17 @ 1:24 pm

That is a whole lot of $ lost by (mostly) the citizens of Illinois.

Comment by Piece of Work Tuesday, Sep 12, 17 @ 1:39 pm

Given Illinois’ VERY high taxes on riverboats, I’m pretty sure the riverboat owners won’t invest a lot more to generate volume that just goes to the State.

You want great big casinos, tax them like Nevada does… the State takes about 6-7% of gross receipts. In Illinois it’s a progressive tax more like 35% on the average downstate boat and tops out at 50% for the big ones. At rates like that it does not pay to invest heavily.

Comment by Harry Tuesday, Sep 12, 17 @ 1:49 pm

Can riverboats include video gaming under the video gaming law? Or should they give up on the boats and divert investment into video gaming?

The State can largely direct that via its tax policies.

Comment by Harry Tuesday, Sep 12, 17 @ 1:51 pm

Those poor, poor riverboat owners and their high, high taxes. It’s just sad.

Comment by igotgotgotgotnotime Tuesday, Sep 12, 17 @ 2:21 pm

Before the Carey’s pull the plug on Hawthorne and CDI does the same at Arlington, can’t the gaming expansion bill get passed? Where is it?

Comment by DE Tuesday, Sep 12, 17 @ 2:36 pm

Yea but BINGO revenue is way down.

Comment by Blue dog dem Tuesday, Sep 12, 17 @ 2:52 pm

And cook county doesn’t contribute to this revenue source which is mind boggling. CPS could benefit greatly if the funds earmarked (requires new law)

Comment by Anonymous Tuesday, Sep 12, 17 @ 2:54 pm

Anonymous

I will make it one better, CPS could own the machines (or strike deals with the owners of the machines) much bigger take that way.

Comment by OneMan Tuesday, Sep 12, 17 @ 3:29 pm

@ Mouthy

From the Gaming Board’s website: Total video gaming wagers for the last year was $15.4 billion, net revenue after winnings was $1.2 billion.

That’s about a 7.9% house advantage.

https://www.igb.illinois.gov/VideoReports.aspx

Comment by Ebenezer Tuesday, Sep 12, 17 @ 3:41 pm

If boats and casinos are losing revenue but video gaming is creating more why isn’t the State taking the same amount of revenue from video gaming as it takes from boats and casinos?

Boats and casinos give up 50% to the government while video gaming only gives up 33% to the government.

Comment by DuPage Bard Tuesday, Sep 12, 17 @ 4:33 pm

Not marijuana. But fireworks. We blast off such quantity. Much imported from Indy.

Comment by Legalize It Tuesday, Sep 12, 17 @ 4:42 pm

Isn’t it kinfa funny that Cook Co and Bloomberg are preaching the virtues of the soda sin tax? And yet gambling and marijuana could be our saviours?

Comment by blue dog dem Tuesday, Sep 12, 17 @ 4:42 pm

ILLINOIS NEEDS REVENUE. Recreational Marijuana. Also Fireworks..

Comment by Shake Tuesday, Sep 12, 17 @ 4:51 pm

**Isn’t it kinfa funny that Cook Co and Bloomberg are preaching the virtues of the soda sin tax? And yet gambling and marijuana could be our saviours?**

Not quite sure where the humor is… all three would be taxed as “sin taxes” - and all three bring in real revenue.

Comment by JoeMaddon Tuesday, Sep 12, 17 @ 11:09 pm

Joe. But isnt the end game of a sin tax to try and get people to stop these nasty niceties?

Comment by Blue dog dem Wednesday, Sep 13, 17 @ 6:02 am

I think the Illinois lottery needs a revamp. Michigan’s has a lottery which is similar to Keno and is available in most bars and many restaurants.

Comment by Stones Wednesday, Sep 13, 17 @ 8:40 am

So if video gaming is not allowed in Chicagoland, then the money from the taxes should not be going there. If they want in on the tax revenue, then they should contribute. Where is all that tax revenue going exactly? Isn’t gambling revenue supposed to be earmarked for schools?

Comment by CDC Wednesday, Sep 13, 17 @ 8:48 am

CDC - I think video gaming is paying for some capital projects bonds if I am not mistaken.

Comment by OneMan Wednesday, Sep 13, 17 @ 9:44 am