Latest Post | Last 10 Posts | Archives

Previous Post: We really need a capital bill

Next Post: It’s just a bill

Posted in:

[The following is a paid advertisement.]

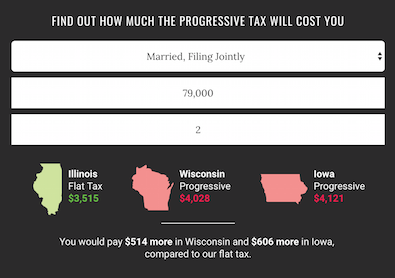

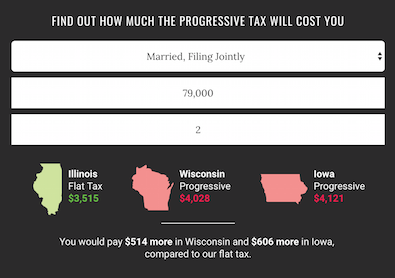

In his Feb. 20 budget address, Gov. Pritzker pointed to Iowa and Wisconsin’s progressive income tax rates as models for a progressive income tax hike in Illinois.

But what would the average Illinoisan’s tax bill look like under those rates?

While Pritzker has said his progressive income tax would only hike taxes on the “rich,” the median Illinois family making $79,168 would see a $516 income tax hike if Illinois adopted Wisconsin’s rates and a $610 tax hike if Illinois adopted Iowa’s rates – 15 percent and 17 percent increases, respectively.

Pritzker specifically said in his budget address that Illinois “can accomplish” a progressive income tax with “a more competitive rate structure than Wisconsin and Iowa.” But what he means by competition is entirely unclear. In fact, a recent Tax Foundation study on Wisconsin’s tax code recommended exchanging its progressive income tax for a flat income tax as one way to make the state more competitive. Both North Carolina and Kentucky have swapped their progressive income taxes for a flat income tax in recent years.

The numbers simply don’t add up for Illinois to pay down billions in debt, fund new programs and still cut taxes for the majority of Illinoisans with a progressive tax.

Whether or not Pritzker calls it “fair,” Illinois families cannot afford another tax hike.

posted by Advertising Department

Thursday, Feb 28, 19 @ 10:12 am

Sorry, comments are closed at this time.

Previous Post: We really need a capital bill

Next Post: It’s just a bill

WordPress Mobile Edition available at alexking.org.

powered by WordPress.