Latest Post | Last 10 Posts | Archives

Previous Post: Long wish lists, but few funding ideas

Next Post: Under the bus they go

Posted in:

[The following is a paid advertisement.]

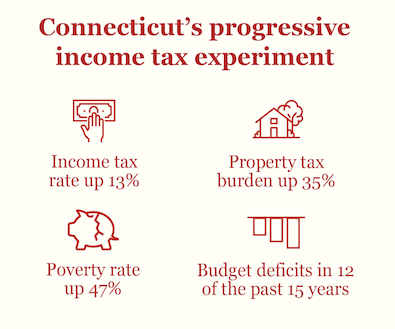

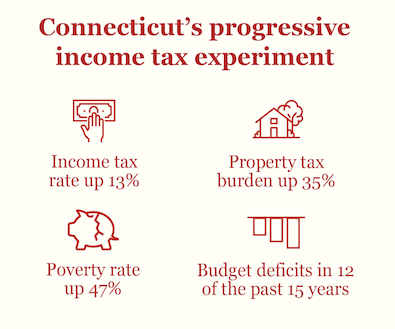

Just one state in the past 30 years has adopted a progressive income tax: Connecticut. The result? Middle-class tax hikes, lost jobs and increased poverty – not to mention chronic outmigration and a financial situation just as dire as Illinois’.

There are harrowing similarities between the Connecticut experiment and Gov. J.B. Pritzker’s push for a progressive income tax in Illinois.

Connecticut lawmakers in the 1990s sold the progressive income tax as a way to provide middle-class tax relief and reduce property taxes. But neither occurred. Instead, the typical Connecticut household has seen its income tax rates increase more than 13 percent since 1999. At the same time, property tax burdens have risen by more than 35 percent.

Pritzker’s argument for the progressive income tax relies on the same myths – that it will allow for middle-class tax relief and lower property taxes, and shore up the state’s finances.

But if Illinois ditches its constitutionally protected flat income tax, Illinoisans will face the same fate as Connecticut – higher taxes for everyone, fewer jobs and an even more sluggish economy.

posted by Advertising Department

Tuesday, Mar 5, 19 @ 11:14 am

Sorry, comments are closed at this time.

Previous Post: Long wish lists, but few funding ideas

Next Post: Under the bus they go

WordPress Mobile Edition available at alexking.org.

powered by WordPress.