Latest Post | Last 10 Posts | Archives

Previous Post: Gonna be interesting to watch how this plays out

Next Post: SUBSCRIBERS ONLY - Fundraiser list

Posted in:

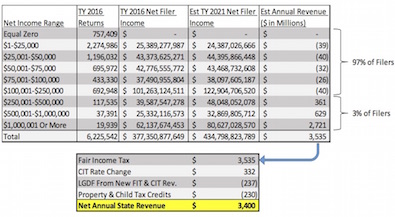

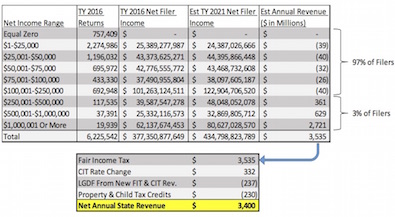

The Governor said the new [graduated income tax] would bring in an additional $3.4 billion per year. That is exactly enough to cover an annual operating deficit estimated at $3.2 billion plus an extra $200 million—the amount recently proposed by the administration to bolster the State’s severely underfunded retirement systems. However, the Civic Federation has not been able to replicate the $3.4 billion number and the Governor’s Office has not yet provided information about the methodology used to arrive at the figure.

* I asked what result the group had come up with and was told today that their numbers crunchers hadn’t yet completed the calculations…

The Civic Federation has not published a revenue estimate because we are still working to gather complete information. We plan to complete our analysis and update our blog when we have additional information.

They were apparently waiting on the same info I was.

The Illinois Policy Institute is claiming that its own numbers crunchers found the graduated tax would yield $2.4 billion in the first full fiscal year. The group has FOIA’d the methodology info, but the governor’s office said yesterday it would need five more days to respond.

* As I noted above, I’ve been asking for the same information, and the governor’s office just sent this to me…

The Governor’s Office of Budget and Management worked with the Department of Revenue to arrive at a realistic projection for the amount generated by the fair income tax.

The team includes longtime respected experts like Deputy Governor Dan Hynes, who served as the state’s comptroller for 12 years; Department of Revenue Director David Harris, a former Republican lawmaker who served in a leadership role for many years on both the revenue and appropriations committees; GOMB Director Alexis Sturm, who has worked in government finance for more than 20 years; and GOMB Chief of Staff Cameron Mock, who has worked in government finance for nearly a decade.

A breakdown of how many tax filers are in each income bracket can be found below.

To reach the 2021 projection, the team used data from the 2016 tax year, the most recent year for which complete data is available. They assumed filers’ income for 2021 would have grown at the most recent respective 5-year compound annual growth rate (CAGR), and to ensure the estimate was conservative, included a one-year income stagnation in the event of a slowing economy.

The team assumed that local governments would receive 6 percent of the new revenue through LGDF and that $230 million of the new revenue would be used for property tax relief and child tax credits.

The team assumed that 10 percent of filers with net income more than $1 million and less than $2 million would try to capture a lower marginal rate. This is an extremely conservative assumption. In reality, only filers who have a net income between $1,000,000 and $1,009,305 would pay more in taxes than they would receive in income above $1,000,000 when the 7.95 percent rate is applied to all their income.

* Click the pic for a larger image…

posted by Rich Miller

Friday, Mar 15, 19 @ 2:48 pm

Sorry, comments are closed at this time.

Previous Post: Gonna be interesting to watch how this plays out

Next Post: SUBSCRIBERS ONLY - Fundraiser list

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

CiT=corporate income tax?

Comment by Blue Dog Dem Friday, Mar 15, 19 @ 2:54 pm

Obfuscating, gaslighting, whatabouting

wailing and gnashing in

3…2…1

Go ahead privileged

Defend the 3%

with everything you’ve got.

Wail for the privileged

Gnash for your beloved.

You’ve known all along that the income gains

will happen for the wealthy

not for the 97%

and yet

you still act the victim.

Pathetic privileged bleating

Comment by Honeybear Friday, Mar 15, 19 @ 3:10 pm

“I asked what result the group had come up with and was told today that their numbers crunchers hadn’t yet completed the calculations…”

You’ll be waiting for a while.

Comment by Honeybear Friday, Mar 15, 19 @ 3:11 pm

If the Pritzker administration is making conservative estimates, maybe we’d gain more revenue than projected.

A fundamental problem with our tax code is unfairness, that the rich are taxed at the same rate as everyone else. That’s why it has to change. We just saw a cruel example of why we need a graduated state income tax. The previous governor, whose income skyrocketed to a few hundred million during his term, purposely hurt a million or more people with much less money in his war on labor and many who make thousands of times less money than him.

much

Comment by Grandson of Man Friday, Mar 15, 19 @ 3:21 pm

Did the team include any of the people at the Department of Revenue who actually crunch the numbers?

Comment by SAP Friday, Mar 15, 19 @ 3:25 pm

How can you say this === the Civic Federation has not been able to replicate ===

When you admit this === has not published a revenue estimate because we are still working to gather complete information ===

IMHO, Civic Fed was being a little disingenuous. Now that you have gov’s info go back give it another shot.

With respect to IPI, who cares what they say. They’re known for misleading information. They can go back to their propaganda campaign.

Comment by Norseman Friday, Mar 15, 19 @ 3:25 pm

Putting aside the fact that I don’t believe anything the IPI says, is the best propaganda IPI has against this plan is that it will “only” raise 2.4 billion dollars?

Aren’t we always minutes away from complete financial meltdown according to those guys? Don’t we want every penny we can get? What is the argument supposed to be here?

Comment by Actual Red Friday, Mar 15, 19 @ 3:32 pm

And without the Marriage Penalty?

Comment by City Zen Friday, Mar 15, 19 @ 3:33 pm

SAP, the IDOR director is listed so I think it’s fair to assume their number crunchers were involved

Comment by Anon Friday, Mar 15, 19 @ 3:36 pm

Dave, when the bottom bracket spends every dollar (more than every dollar) they earn on food, clothes, transportation, and housing, taxing the people who have multiple houses more is the only definition of fair.

Comment by Perrid Friday, Mar 15, 19 @ 3:36 pm

===And without the Marriage Penalty?===

Why can’t you just submit separate returns?

Comment by njt Friday, Mar 15, 19 @ 3:39 pm

If I read the sheet from the Governors office correctly, then their estimates are based on a current rate of income growth for four years plus one year of no growth to account for a recessionary year. It doesn’t say what that rate is, but one can make a very crude assumption by dividing the 2021 total income by the 2016 total income in each of the brackets to get a total percentage increase. Then divide that increase by 4 to account for it rising 4 of 5 years. It’s a crude estimate because it doesn’t account for bracket creep as taxpayers move up in income from one bracket to another.

Anyway doing that shows an assumed annual income increase of less than 1% per year for the brackets under $100,000, but over 5% per year for the brackets between $100,000 and $500,000, and over 7% per year for the brackets over $500,000.

The CPI inflation rate has been around 2% for each of the last three years. If groups like the Civic Federation are basing income on an increase closer to that inflation rate they will get substantially less growth in the upper brackets. That may be the difference between the competing claims.

Comment by muon Friday, Mar 15, 19 @ 3:40 pm

This picture drives the point home pretty well too, Dave. Equality is not Equity

http://i2.wp.com/interactioninstitute.org/wp-content/uploads/2016/01/IISC_EqualityEquity.png?zoom=2&resize=730%2C547

Comment by Perrid Friday, Mar 15, 19 @ 3:40 pm

==Why can’t you just submit separate returns?==

Can you have different filing status on your fed and state tax returns?

Comment by City Zen Friday, Mar 15, 19 @ 3:49 pm

When I ran numbers on the Pritzker tax calculator, a married couple making up to $256,000 per year with no dependents and no property taxes would still get a tax cut. That’s pretty good.

The “marriage penalty” angle is just another attempt to deflect away from the fact that opposition is really about protecting the rich.

Comment by Grandson of Man Friday, Mar 15, 19 @ 4:07 pm

The only anti-progressive tax argument that I’ve heard that makes a lick of sense to me is that it will cause rich people/job creators to leave the state. We can argue about whether that’s true, but at least it makes sense.

The “Trojan Horse” and “doesn’t raise enough revenue” arguments don’t make sense to me at all. They could raise taxes right now. They don’t need a Trojan Horse to do it. And the State needs additional revenue. If they can’t get a progressive tax through, they’ll almost certainly raise the flat rate. The question isn’t whether there should be tax increases. The question is whether everyone’s taxes should go up the same amount or if the rich should bear he brunt of the increases. Arguing against a progressive tax is effectively arguing for a tax increase on the middle class.

Comment by Twirling Towards Freedom Friday, Mar 15, 19 @ 4:23 pm

Has JB’s team put out an explanation for why they switch to a flat tax at $1M? It “only” picks up about 8k max per individual and just makes the whole thing seem more complicated than necessary, potentially leading to yet further confusion among many people on how marginal tax rates usually work

Comment by brickle Friday, Mar 15, 19 @ 4:27 pm

Why would you want to show income for everyone below $250k dropping in an income model right after you passed a minimum wage increase? So, they passed a minimum wage increase and everyone under $250k is somehow going to see less income on average in 2021 than they did in 2016? How does that work?

Comment by Eastside Friday, Mar 15, 19 @ 4:27 pm

CZ, I’m not finding anything precluding you and your spouse being able to file separately for IL returns. Try a different approach, because that horse seems to have been through enough.

Comment by Fixer Friday, Mar 15, 19 @ 4:28 pm

I would like to add to what muon previously said. Pritzker’s team is projecting very high compound annual growth rates in the higher income brackets that are extremely unlikely to materialize. Here’s why: they are assuming, in each income bracket, that income growth that occurred between 2011 and 2016 will be repeated in the 2016-2021 period. So why is that wrong? Because it is well-known empirically that income in these high brackets is closely linked to stock market performance. In the 2011-16 period, as a result of the bounce back from the financial crisis of 2008-9, the S&P 500 returned 14.66% annually - way above the average annual stock return in the long run. That performance will almost certainly not be repeated between the end of 2016 and the end of 2021.

It pains me to say this, because I really like the Governor’s plan and hope it is approved regardless, but in the end it is very unlikely to raise the amount of revenue his team is projecting, even if you assume a static forecast in which no high income folks move out of state.

Comment by Andy S. Friday, Mar 15, 19 @ 4:45 pm

“The team assumed that local governments would receive 6 percent of the new revenue through LGDF”. I thought local governments received 10% of revenues. Maybe I’m missing something?

Comment by Questioning Friday, Mar 15, 19 @ 5:04 pm

Eat the Rich.

Comment by DeseDemDose Friday, Mar 15, 19 @ 6:45 pm