Latest Post | Last 10 Posts | Archives

Previous Post: Do better

Next Post: *** LIVE COVERAGE ***

Posted in:

* Finke…

On a party line vote, a House committee Monday sent the constitutional amendment to bring a graduated state income tax to Illinois to the full chamber for a vote.

The amendment’s proponents, however, dodged questions from House Republican Leader Jim Durkin of Western Springs about whether there are 71 votes in the House to approve the amendment and place it on the November 2020 ballot for voters to consider.

Also, House committees have so far not taken up any of the three companion bills that were approved by the Senate which set the rates that would be in force with the graduated tax, that would eliminate the estate tax in Illinois and would provide some property tax relief if the state puts more money into K-12 education. […]

It was Durkin, who is not a regular member of the committee, who cut to the critical question of whether the supporters of the graduated tax believe they have the necessary 71 votes lined up to put the issue on the ballot. Neither the amendment sponsor, Rep. Robert Martwick, D-Chicago, nor representatives from Pritzker’s office would directly answer the question.

* It’s looking like they have the votes…

All six Republicans on the committee sided with Reick, while all nine Democrats supported the amendment — even one who had stated publicly he was leaning against voting for a graduated tax amendment.

That legislator is Jonathan Carroll, a Northbrook resident who is widely believed to be a swing vote in the 74-member Democratic House caucus. To be put on the ballot, the amendment, which has already passed the Senate, needs 71 votes in the House.

“I still have strong reservations on this,” Carroll said, calling it “way too important of an issue” not to be brought for a full floor vote. He also said his committee vote does not mean he would necessarily vote for the amendment when it comes before the full House.

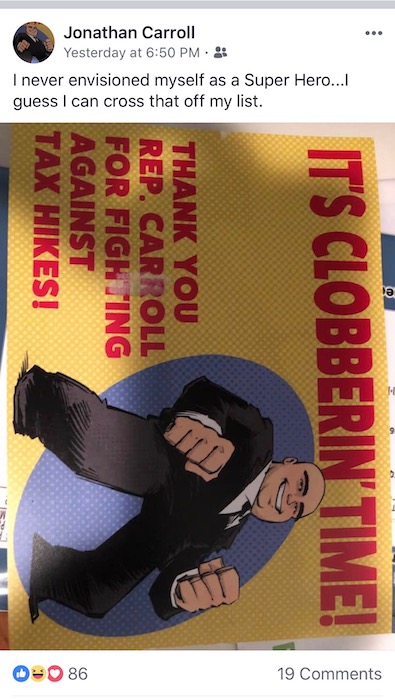

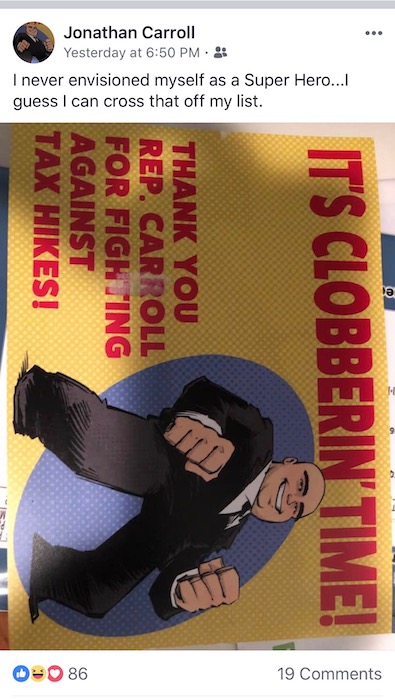

* Rep. Carroll approvingly posted what I think is an Illinois Policy Institute cartoon on his Facebook page over the weekend…

And then he pulled it down.

…Adding… It is indeed an IPI mailer. Click here to see it.

* The House may not get to the rate bill this month. We’ll see…

House Democrats are still negotiating with the governor’s office over the rate structure and potential property tax relief, a key issue for some holdouts.

Illinois income tax calculator: How would Gov. J.B. Pritzker’s proposed graduated income tax affect you?“They want to use that leverage to extract as much property tax relief as they can,” Rep. Robert Martwick, a Chicago Democrat who’s sponsoring the proposed constitutional amendment, said before Monday’s hearing. “When you’ve got a rate structure that’s going to get you enough to close the structural deficit and a little more, then you have to figure out where it fits into the list of priorities.”

Asked during Monday’s committee meeting how a rate proposal in the House will differ from proposals from Pritzker’s administration and the Senate, Martwick said he expects it will be “substantially similar to what we’ve seen.”

I still think the better way is to do everything at once and get it over with.

posted by Rich Miller

Monday, May 20, 19 @ 9:54 pm

Sorry, comments are closed at this time.

Previous Post: Do better

Next Post: *** LIVE COVERAGE ***

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

===I still think the better way is to do everything at once and get it over with.===

Agreed. Too much time for Mushrooms to think that they can actually “think”, might move some Green… to Yellow… or take a walk.

All at once, you lock in the cobbled 71, some in all three, others off on others, but structured to equal 71… all at once.

Nothing is scarier to a fragile nose count is time for Mushrooms to think.

Comment by Oswego Willy Monday, May 20, 19 @ 10:02 pm

===Too much time for Mushrooms to think===

My point is, politically, they should pass a whole lot of stuff at once to create a sort of white noise. It all blends together. Waiting months to pass a rate bill separately highlights that single vote.

Comment by Rich Miller Monday, May 20, 19 @ 10:16 pm

===My point is, politically, they should pass a whole lot of stuff at once to create a sort of white noise. It all blends together. Waiting months to pass a rate bill separately highlights that single vote.===

To that point,

I walked it around in a bland sort of walk, but that’s the “thinking” that gets the worry to fester.

Three different times to take one hit, scary for the follow up votes.

Keeping those wavering while that single vote is highlighted …until another vote happens… makes it tough to keep that member Green for the follow up 2 votes.

Comment by Oswego Willy Monday, May 20, 19 @ 10:21 pm

== Waiting months to pass a rate bill separately highlights that single vote. ==

The rates will almost certainly be at least a small tax cut for most people. Why not wait to pass the rates even until after the people vote on the amendment? Even if representative waiver on the amendment, they can later say “look I cut taxes for almost everyone.”

Comment by Three Dimensional Checkers Monday, May 20, 19 @ 10:30 pm

==Why not wait to pass the rates even until after the people vote on the amendment?==

1) To reduce the uncertainty the opponents will be using to push a “No” vote.

2) So those who vote yes can say “look I cut taxes for almost everyone” right away. (No need to wait on that message.)

Comment by Pot calling kettle Monday, May 20, 19 @ 11:26 pm

Apparently there are enough Democrats in the House that don’t agree with most folks on this blog. Easy to run up the credit card. Hard to make the payments.

Comment by Tim Tuesday, May 21, 19 @ 6:26 am

===Easy to run up the credit card. Hard to make the payments.===

Or… you can be like Bruce Rauner, run up a huge debt by being a deadbeat and passively close social services by having them do work you never intend to pay them for.

- Tim -, you must’ve missed the whole Rauner experiment, lol

Comment by Oswego Willy Tuesday, May 21, 19 @ 6:39 am

Oswego Willy,

You must have been asleep for the decades prior to Governor Rauner when the Dems running the state neglected to pass a balanced budget. I find it surprising that the people running this state (into the ground) seem to forget that this state was in horrible financial condition even before Mr. Rauner thought of running for office.

Comment by Tim Tuesday, May 21, 19 @ 7:34 am

What is with the dithering…especially given the fact that they are ‘punting’ the decision to voters in 2020 anyway

The 2014 non-binding “Millionaires Tax” passed with 60% support.

As of 2019, the Paul Simon institute has it polling with 71% support.

Comment by Jocko Tuesday, May 21, 19 @ 7:44 am

I don’t like what Rep. Carroll did with the cartoon and don’t like the idea that he may be the new Ken Dunkin. And to put the amendment on the House floor only to possibly kill it? That’s no Democrat.

Yingling too. Why put something out on the floor only to be the one to possibly kill it?

“I find it surprising that the people running this state (into the ground) seem to forget that this state was in horrible financial condition even before Mr. Rauner thought of running for office.”

The rich have paid low state income taxes for decades, contributing to the problem. Politicians and voters refused to tax the rich more and instead let the consequences fall much more on those who could least afford it.

Comment by Grandson of Man Tuesday, May 21, 19 @ 7:48 am

- Tim -

I suggested you read McKinney, Vock, and Rich Miller on the history, and you should check out Charlie Wheeler on budgets, and the reality of those too.

Being angry at Democrats ignores a great deal like years of GOP governors (Thompson, Edgar, Ryan) and a GOP senate President for a “decade” (Pate Philip) even Lee A. Daniels made a cameo as a Speaker for 24 months.

Read. Learn. Be an angry partisan on Facebook.

Comment by Oswego Willy Tuesday, May 21, 19 @ 7:52 am

You’re probably right PCK. I guess I can see a lot of the suburban Dems falling back on the “we voted for the amendment to let the voters decide the issue” talking point. That might work better keeping the votes separate.

Comment by Three Dimensional Checkers Tuesday, May 21, 19 @ 8:18 am

We all know sin taxes are regressive taxes so why are we raising sin taxes while eliminating the estate tax.

Sticking it to the little guy again

Bad Politics and bad government, the democrats already have an image problem and if they pass these sin taxes to fill the gap caused by eliminating the estate tax you give working class voters a reason to support the gop. Yeah unions wake up and oppose the sin taxes it’s a direct tax on your members to pay for taxes cuts for the wealthy

Comment by No sin tax Tuesday, May 21, 19 @ 9:08 am

===Sticking it to the little guy again===

Little guys drive on roads, too. Keep that in mind.

Comment by Rich Miller Tuesday, May 21, 19 @ 9:16 am

===while eliminating the estate tax.===

A bill that passed one chamber is not a law.

Comment by Rich Miller Tuesday, May 21, 19 @ 9:18 am

The Dems do this all the time, they add or remove things in legislation to get gop support for the measure and then no GOP vote for it and cry Dems are unwilling to work with them. (ACA for example, nationally)

The gop aren’t going to put a single vote on anything the Dems propose on this issue so pass what you want, Dems. First call a vote on the compromised bill, when no gop vote on it, repeal it and pass what you want. Then blame the gop for sitting on their hands doing nothing while the state was in disarray. Gop only wants to play politics and not solve our problems. 4 years of cuts and no budget have proven we can’t cut enough to fix it

Comment by Cat herding Tuesday, May 21, 19 @ 9:20 am

Yes Rep. Carroll

You’re a super hero

To your lovely Island District of Prosperity

Rep Carroll

Lord of the gated community

Rep Carroll

Defender of the Privileged

Rep Carroll

vanquisher of the poor, disabled and elderly, the stinking undesirable

the commoner.

May they never breach the boundaries of your district and gated communities.

May your businesses and corporations

never have to contribute.

And May your garden and cocktail parties be bliss

May your servants be unseen

Their troubles unknown

But their tax revenues always be available for

TIFs Enterprize Zones and EDGE

Glory be unto profit

Let Campaign contributions flow down like water

and Objectivism like an ever-flowing stream.

Comment by Honeybear Tuesday, May 21, 19 @ 9:21 am

Yes Mr. Miller I am commenting on the house not bringing the estate tax repeal out of committee in afford to get people to see it as a shell game.

Yes little guys do drive on roads and they currently pay a higher percentage of their income to do so with current gas taxes. Let’s just leave the estate tax alone and maybe we wouldn’t need as big an increase to sin taxes.

Comment by No sin tax Tuesday, May 21, 19 @ 9:31 am

–I find it surprising that the people running this state (into the ground) seem to forget that this state was in horrible financial condition even before Mr. Rauner thought of running for office.–

I’m not surprised at all that you give a pass to Rauner for running up the backlog of unpaid bills from $4.5 billion to $16 billion in just 2.5 years.

Your whiny, canned grievance points are unsurprisingly devoid of any facts at all.

Comment by wordslinger Tuesday, May 21, 19 @ 9:36 am

===Let’s just leave the estate tax alone and maybe we wouldn’t need as big an increase to sin taxes===

lol

And what do you propose to do about that hit on GRF when you use estate tax revenues for capital?

Comment by Rich Miller Tuesday, May 21, 19 @ 9:45 am

the senate proposed eliminating it so there is an already planned hit to GRF. isn’t the proposed graduated tax solving that hit? If that’s the case, shift estate to cover capital.

But don’t fix our regressive tax system in one place and make it worse in another, just so a very few people have their estates taxes eliminated.

Comment by No sin tax Tuesday, May 21, 19 @ 10:07 am

===the senate proposed eliminating it so there is an already planned hit to GRF===

LOL

You think the Senate Democrats had… a plan?

That’ll keep me laughing all day.

Comment by Rich Miller Tuesday, May 21, 19 @ 10:19 am

==so a very few people have their estates taxes eliminated.==

You realize we’re talking about people who have well in excess of $4 million dollars (and chose not to make use of a financial advisor) at the time of their passing, right?

Comment by Jocko Tuesday, May 21, 19 @ 10:20 am