Latest Post | Last 10 Posts | Archives

Previous Post: *** UPDATED x3 - Sterigenics responds - Pritzker won’t commit to immediate special session - Durkin introduces new bill *** Sterigenics consent order approved by DuPage judge

Next Post: SUBSCRIBERS ONLY - Campaign update

Posted in:

* Center Square editor Brett Rowland…

For the past 40 years, we’ve seen more of the same tax-and-spend policies that have left the state’s pension systems dangerously underfunded and the state’s credit just a notch above junk status.

The state’s fiscal problems are mainly about “borrow and spend.” The state essentially borrowed money that should’ve gone to the pension funds in order to spend that cash on operations and programs. That practice kept state taxes artificially low for decades. If they had either raised taxes enough to make the full pension payments (particularly after increasing pension benefits) or cut spending (or both), we wouldn’t be in this mess today. But, no. Raising taxes and making cuts were just too hard for them. When you see or hear the phrase “unfunded liability,” it’s really just massive debt that was allowed to accumulate.

Gov. Pat Quinn literally borrowed billions of dollars to make the state’s pension payments for two years before the state finally raised taxes in 2011. And then the tax hike partially rolled back in 2015. The state made all of its pension payments during the resulting budget impasse, which meant it had to essentially borrow money from its vendors to stay afloat. And then the state borrowed more money to pay off many of those vendors. As of today, the state’s bill backlog is $6.6 billion, so that debt is still not paid off.

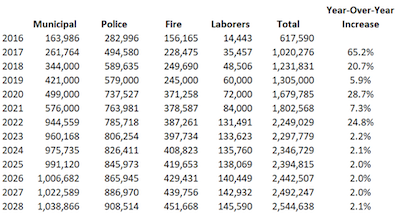

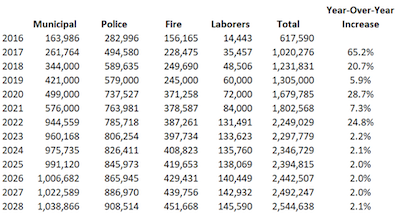

* While we’re on this topic, this chart of Chicago’s pension funding ramp is from Forbes contributor Elizabeth Bauer…

They have two big bumps ahead, and then the payment increases become far more manageable.

* However…

The world’s collapsing interest rates have just made survival that much harder for Illinois’ pension funds, most of which are built on the assumption that they can earn around 7 percent on their investments. Interest rates have fallen below zero percent in Europe, while US 30-year interest rates fell below 2 percent for the first time in history. Ten-year rates here are now at 1.5 percent, also near their lowest level ever.

Low rates are particularly hard on the most underfunded pensions because those funds are forced to keep more of their money in short-term, low-yield bonds so they can cover near-term pension payouts. Low rates also hammer the smaller police and firefighter pensions around the state because they, by law, are forced to keep large parts of their investments in bonds.

Expect funding levels to continue their descent across the state.

* Related…

* Illinois ranks 3rd worst on pension plan funding

posted by Rich Miller

Friday, Sep 6, 19 @ 11:49 am

Sorry, comments are closed at this time.

Previous Post: *** UPDATED x3 - Sterigenics responds - Pritzker won’t commit to immediate special session - Durkin introduces new bill *** Sterigenics consent order approved by DuPage judge

Next Post: SUBSCRIBERS ONLY - Campaign update

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

It may not be pretty, but both Chicago and Illinois will muddle through … they don’t really have any other good choices. Depending on the specific fund, it took from 10+ to 40+ years to get into this mess, so you can’t fix it overnight. Just have to stay consistent and try not to kick the can too far.

Comment by RNUG Friday, Sep 6, 19 @ 12:11 pm

So if interest payments cost below zero percent borrowing is a good idea. Maybe we should borrow from European banks.

Comment by Da Big Bad Wolf Friday, Sep 6, 19 @ 12:13 pm

The US is one of the few remaining global economies to still have positive interest rates. Negative interest rates are coming. Banks are already planning for it.

The Pension Monster must be fed with significant cuts, punishing taxes, rewriting pension law, or bankruptcy. Pick your poison(s).

We will either remain in servitude to the Pension Monster, or we’ll slay him. Those are the only options.

Comment by Downstate Friday, Sep 6, 19 @ 12:13 pm

== The state made all of its pension payments during the resulting budget impasse ==

Keep in mind these were the artificially lower statutory payments, and not the actuarially required payments. Those are about $4 billion higher right now than the statutory required payments.

Comment by Smalls Friday, Sep 6, 19 @ 12:16 pm

“For the past 40 years, we’ve seen more of the same tax-and-spend policies”

Illinoisans saw the right wing in action with Raunerism. It was overwhelmingly rejected: the class warfare on unions waged by the rich and privileged, the political hatred and obstruction, the brutal cuts to social services and higher ed, the stiffing of businesses and explosion of debt, and so on.

Comment by Grandson of Man Friday, Sep 6, 19 @ 12:18 pm

==They have two big bumps ahead, and then the payment increases become far more manageable.==

In 3 years, Chicago has to start conjuring up an extra $1 billion per year every year for pensions than they do today.

Look out, Chad and Trixie.

Comment by City Zen Friday, Sep 6, 19 @ 12:22 pm

Thanks for the op ed Grandson. Under MJM’s watch for nearly 50 years, how has Illinois fared? Under Dem mayors in Chicago for 90 years, how are the finances in the city?

I heard someone in the administration touting they had reduced the bill back load by 6-7 billion dollars. What they didn’t state was it was accomplished with borrowed funds.

Comment by Pick a Name Friday, Sep 6, 19 @ 12:25 pm

If we go to negative interest rates then we refinance the state debt pension and all.It then shrinks over time.

Comment by Not a Billionaire Friday, Sep 6, 19 @ 12:27 pm

===Then we refinance the state debt pension and all===

Yeah, right. We’re gonna sell $150 billion in state bonds. OK.

Comment by Rich Miller Friday, Sep 6, 19 @ 12:28 pm

===Yeah, right. We’re gonna sell $150 billion in state bonds. OK.===

This idea is still out there:

https://dailyillini.com/news/2018/01/29/university-professor-develops-model-address-pension-crisis/

Comment by someonehastosayit Friday, Sep 6, 19 @ 12:46 pm

==Under MJM’s watch ==

You do realize we’ve had several years of Republican Govenor’s over the years don’t you? Or are you satisfied with spouting your hyper-partisan talking points without any concern for facts?

==What they didn’t state was it was accomplished with borrowed funds.==

I think the income tax increase had a little to do with it. Would you rather go back to the Rauner years of simply not paying the bills?

Comment by Demoralized Friday, Sep 6, 19 @ 12:48 pm

The pension crisis was caused by the State not paying its share of the, for lack of a better word, premium. State employees have 4% deducted every pay period. They have no choice in the matter. The legislature, on the other hand, made conscious decisions to short change the pension funds.

So those of you who are advocating stiffing the State employees, go read the ILSC rulings.

Comment by Huh? Friday, Sep 6, 19 @ 12:48 pm

==rewriting pension law, or bankruptcy==

Neither of those are even options

Comment by Demoralized Friday, Sep 6, 19 @ 12:49 pm

====- RNUG - Friday, Sep 6, 19 @ 12:11 pm:

It may not be pretty, but both Chicago and Illinois will muddle through … they don’t really have any other good choices. Depending on the specific fund, it took from 10+ to 40+ years to get into this mess, so you can’t fix it overnight. Just have to stay consistent and try not to kick the can too far.====

The problem with letting RNUG have the first comment on a pension post, is that no matter how far down I scroll, I know I won’t find a better one.

Comment by Ebenezer Friday, Sep 6, 19 @ 12:55 pm

I feel like the GA should be able to set the ratios of income sources (i.e., how much comes from sales tax vs. income tax vs. corporate, etc.).

But actuaries, with a fiduciary duty to the state, should set the actual tax rates year to year based on the enacted appropriations and revenue projections.

Not politicians with an interest in keeping taxes artificially low.

Comment by thechampaignlife Friday, Sep 6, 19 @ 12:59 pm

The link to the ranking of states and funding is quite interesting. There’s no clear ideology on what kind of state decides to operate a well funded pension plan. But, one thing is clear: decisions were made to put appropriate money aside. Hats off to Wisconsin , South Dakota , and Tennessee for being at the top.

Comment by Steve Friday, Sep 6, 19 @ 1:14 pm

“Illinois ranks 3rd worst on pension plan funding”

Just 47 steps to the top, man.

– MrJM

Comment by @misterjayem Friday, Sep 6, 19 @ 1:16 pm

The one truth about Madigan is that he is not capable of balancing a budget. He has to give too much money away to maintaint control. Another truth is that father time is still undefeated. One day Madigan will be gone, and conversations about options will be relevant. Until then, he will keep digging the hole and throwing the dirt on his legacy. It is just who he is.

Comment by the Patriot Friday, Sep 6, 19 @ 1:20 pm

“Illinois ranks 3rd worst on pension plan funding”

Add to that a shrinking base of residents to tax to fund them…”Illinois has lost population every year since 2014. In all, the state’s population has declined by more than 157,000 in that time”

https://www.wbez.org/shows/wbez-news/population-loss-in-illinois-is-driven-by-larger-numbers-of-people-leaving-for-other-states/f1bf43a4-0e93-407c-8240-7c3b9d58547b

Comment by Donnie Elgin Friday, Sep 6, 19 @ 1:26 pm

==he will keep digging the hole==

I get Madigan is part of the problem. But this notion that he’s gotten us to where we are all by himself is absurd. I can think of whole list of people to blame.

Comment by Demoralized Friday, Sep 6, 19 @ 1:28 pm

==all by himself is absurd.==

He drafted every budget in the last 40 years except 2. One Governor in 40 years tried to do a budget without Madigan, he didn’t pass a budget for 2 years.

Comment by the Patriot Friday, Sep 6, 19 @ 1:31 pm

Verizon did a hundred billion in bonds . I own some. Wall Street does trillions in bond financings. Now that assumes we hit negative interest rates.

Comment by Not a Billionaire Friday, Sep 6, 19 @ 1:35 pm

== Illinois ranks 3rd worst on pension plan funding ==

I’d turn that around and say:

Illinois. At least we’re not Kentucky.

Comment by Demoralized Friday, Sep 6, 19 @ 1:39 pm

I will never forget the debate when the Illinois House voted to suspend pension payments for the first time. Tom Cross and Mike Madigan were yelling at each other when Cross complained nobody was listening to his warnings and hiding behind their computers talking, and Madigan yelling back saying it wasn’t Cross’s job to manage the body.

Maybe Cross wasn’t so wrong after all.

Comment by Just Me Friday, Sep 6, 19 @ 1:43 pm

Also despite what counterpoint says Illinois pensions invest in far more than bonds and the rates of returns have been in the 7 percent range. The lower rates juice stocks because a negative interest rate bond makes the 2 percent dividend stock market look great.

Comment by Not a Billionaire Friday, Sep 6, 19 @ 1:45 pm

The pensions will continue to crowd out other state services and local taxing bodies will have no choice but to continue raising taxing rates. The debt is unsustainable–it will continue to get worse before it gets better.

Comment by Romeo Friday, Sep 6, 19 @ 1:46 pm

==The debt is unsustainable–it will continue to get worse before it gets better.==

All is not lost. Governor Pritzker was able to keep his committment to pay the full state contribution to the pension funds this year.

Comment by Enviro Friday, Sep 6, 19 @ 1:51 pm

commitment (Sorry, I should have used spell check.)

Comment by Enviro Friday, Sep 6, 19 @ 1:56 pm

Pritzker wanted to kick the pension can as soon as he took office. Only a robust economy that yielded $1.5B in unexpected tax revenue prevented him from trying to do it. What do you think he’s going to do if we do in fact go through an economic slowdown? Those tax revenues won’t be there, but the can will.

As for the pension debacle Illinois finds itself in, there isn’t much any individual can do about it. But you can do a lot to make sure you aren’t here when the powers that be start handing out the bill. Start planning your own exodus.

Comment by SSL Friday, Sep 6, 19 @ 2:04 pm

=They have two big bumps ahead=

Disagree. 65.2, 20.7, 28.7 and 24.8 percent increases are more than two and bigger than bumps. I’d add the 5.9 and 7.3 percent increases in there as well. From a timing standpoint this gets even worse as odds are favorable for a recession right when these demands for more tax revenue will hit.

Comment by Flat Bed Ford Friday, Sep 6, 19 @ 2:04 pm

TRS is well diversified with investment returns of over 8% in recent years.

“At the end of FY 2018, TRS maintained approximately 35.9 percent of its investments in publicly-held companies around the world, approximately 23 percent in bonds and other fixed-income securities, approximately 14 percent in real estate worldwide, approximately 13.2 percent in private equity opportunities and the remainder in various alternative investments, including hedge funds and commodities.”

Comment by Enviro Friday, Sep 6, 19 @ 2:05 pm

===Disagree. 65.2, 20.7, 28.7 and 24.8 percent increases are more than two===

Dude, 65.2 and 20.7 are in THE PAST. Can you not read???

Comment by Rich Miller Friday, Sep 6, 19 @ 2:09 pm

=Dude, 65.2 and 20.7 are in THE PAST. Can you not read???=

Whoopsy. Would like to blame it on being Monday or something but that’s not right either. I’m going to get a jump on the weekend now.

Comment by Flat Bed Ford Friday, Sep 6, 19 @ 2:21 pm

===Thanks for the op ed Grandson. Under MJM’s watch for nearly 50 years, how has Illinois fared? Under Dem mayors in Chicago for 90 years, how are the finances in the city?===

And yet here we sit on pins and needles waiting for the magic cuts that will appear.

To the post, taxes will go up and life will carry on. The tab must be paid.

Comment by njt Friday, Sep 6, 19 @ 2:33 pm

== letting RNUG have the first comment ==

Just happened to visit the blog right after Rich posted the story. Sometimes I don’t see a story until midnight.

Comment by RNUG Friday, Sep 6, 19 @ 2:34 pm

“Illinois ranks 3rd worst on pension plan funding”

On the bright side, we rank higher at funding our pensions than we do funding services for people with developmental disabilities.

Comment by Earnest Friday, Sep 6, 19 @ 2:56 pm

People don’t consider the path ahead + the current baseline. It wouldn’t be a big deal to raise real estate taxes by 100% (for example) if you earn some amount of appreciation and the tax increase is over 20 years and you are starting at a lower level.

In downstate Illinois, we are already being taxed at 2.5% to 3% of our homes fair market value, annually. And we only earn 1.5% appreciation. There isn’t much left to squeeze.

I’ve been looking at homes in Sangamon County for 12 months now. 1/3 of the homes I see (between $220k and $350k) are listed for less than they were purchased for. Another large group of homes are listed for more but will most likely sell for less. Last year only 35 homes sold > $500k in Sangamon County. The real estate market is contracting w/o tax increase.

Comment by Merica Friday, Sep 6, 19 @ 3:00 pm

Madigan has been a happy distraction for Democrats and their supporters. Right wingers deluded themselves into thinking that they’d win by constantly attacking Madigan. But behind the attacks are policy ideas that most of us don’t want, and that’s what right wingers refuse to come to terms with. So some or many think that they’ll get their desires when Madigan is gone. Democrats stood strongly against Raunerism and anti-union attacks, with some of them having come from union households themselves. Who’s going to vote for the austerity and cuts that right wingers want?

Comment by Grandson of Man Friday, Sep 6, 19 @ 3:01 pm

Does anyone have the ANNUAL cost to the state pension system by year for the next 30 years? Not the total, but each year

Unfunded liability is the amount you don’t have today in an account that could pay all future payments.

Comment by Publius Friday, Sep 6, 19 @ 3:06 pm

Madigan has had a big influence on pension funding but he alone didn’t vote for the situation the pension funds are in. It was the work of many politicians , over many years. Don’t be surprised if current workers (who didn’t create this problem) are expected to pay much more upfront for their pensions.

Comment by Steve Friday, Sep 6, 19 @ 3:21 pm

=They have two big bumps ahead, and then the payment increases become far more manageable.=

Only if everything goes according to plan and the investment returns come in as projected. If we hit a recession and those actual returns drop, or if the pension system Boards decide to change any of their actuarial assumptions (which they often do) we could see big jumps in payments again.

Comment by Not Out of the Woods Friday, Sep 6, 19 @ 3:26 pm

==Does anyone have the ANNUAL cost to the state pension system by year for the next 30 years?==

Page 111: http://cgfa.ilga.gov/Upload/FinConditionILStateRetirementSysApril2019.pdf

Comment by City Zen Friday, Sep 6, 19 @ 3:48 pm

So what would some solutions be? There has been talk about eliminating the AAI but that cannot be considered sane. A person retires at 60 and lives the rest of their lives at the exact same amount of money? Even Social Security which is meant to be a supplement, not total liveable income, awards COLAs. Teachers don’t have social security. A teacher’s pension was intended to be their income in retirement. Not humane or reasonable. If we are in as dire a situation as some say, there needs to be some drastic change. Proposals? Cutting a pension in half would only result in SNAP and other government subsidies for many. State would be paying one way or another for low pensioners. So?

Comment by Ano Friday, Sep 6, 19 @ 4:04 pm

“Don’t be surprised if current workers (who didn’t create this problem) are expected to pay much more upfront for their pensions”. Steve, this is also considered a reduction of benefits, which the ISC ruled against. If the state wants current employees to contribute more than the current 4% than the employees would have to be offered an enhancement for that increase. I think this will happen WAY down the road, (20 years or so), for Tier 2. Like paying more in exchange for lowering the age of 67 for retirement. The State and tier 2 employees have plenty of time in their favor.

Comment by Just A Dude Friday, Sep 6, 19 @ 4:15 pm

We’ve done pension cuts and flat tax hikes. Time for different reform, to have the wealthiest pay more and reduce the burdens of those from lower-income communities who are leaving the state—to shift the SALT burden more onto the highest incomes.

The people from African American communities where there’s outmigration don’t want right wing policies. We owe it to them to help them, starting with a graduated income tax.

Comment by Grandson of Man Friday, Sep 6, 19 @ 4:32 pm

- Just A Dude -

If the ISC will not allow some changes (which is possible), pensions could become an item in the budget every year if the pension funds get diminished to virtually nothing.

Comment by Steve Friday, Sep 6, 19 @ 4:38 pm