Latest Post | Last 10 Posts | Archives

Previous Post: SUBSCRIBERS ONLY - Today’s edition of Capitol Fax (use all CAPS in password)

Next Post: Looking on the bright side

Posted in:

* Greg Sargent at the Washington Post asked economist Gabriel Zucman to crunch some numbers…

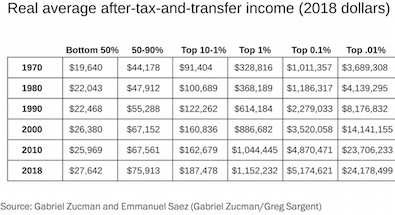

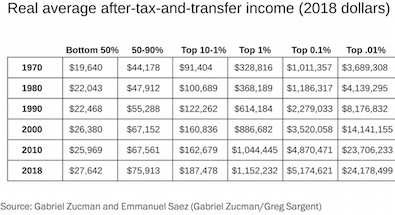

The top-line finding: Among the bottom 50 percent of earners, average real annual income even after taxes and transfers has edged up a meager $8,000 since 1970, rising from just over $19,000 to just over $27,000 in 2018.

By contrast, among the top 1 percent of earners, average income even after taxes and transfers has tripled since 1970, rising by more than $800,000, from just over $300,000 to over $1 million in 2018.

Among the top 0.1 percent, average after-tax-and-transfer income has increased fivefold, from just over $1 million in 1970 to over $5 million in 2018. And among the top .01 percent, it has increased nearly sevenfold, from just over $3.5 million to over $24 million.

I’m emphasizing the phrase “after taxes and transfers” because this is at the core of Zucman’s new analysis. The idea is to show the combined impact of both the explosion of pretax income at the top and the decline in the effective tax rate paid by those same earners — in one result.

Accompanying chart…

posted by Rich Miller

Tuesday, Dec 10, 19 @ 9:29 am

Sorry, comments are closed at this time.

Previous Post: SUBSCRIBERS ONLY - Today’s edition of Capitol Fax (use all CAPS in password)

Next Post: Looking on the bright side

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

“Mr. Dabrowski, Greg Bishop on line one desperately needing you to spin this story.”

Comment by efudd Tuesday, Dec 10, 19 @ 9:34 am

What was that George Orwell saying “some pigs are more equal than others”.

The lowest are unable to reap the rewards of the American dream, while the top of the pile cry crocodile tears of not having even more money.

Comment by Huh? Tuesday, Dec 10, 19 @ 9:38 am

This is the fallacy that tax cuts for the wealthy will stimulate job growth.

Comment by Huh? Tuesday, Dec 10, 19 @ 9:40 am

8 years of the Hope and Change and the net effect was the rich got richer

Comment by Lucky Pierre Tuesday, Dec 10, 19 @ 9:40 am

Zucman has comes under some major questioning of data and methods by Phillip Magness.

https://www.aier.org/article/new-evidence-that-soaring-inequality-is-a-myth/

https://tinyurl.com/twodccs

Comment by Steve Tuesday, Dec 10, 19 @ 9:42 am

Huh- LOL - what do you call 3.3 percent unemployment and 260 thousand jobs created just in November. Not our fault you aren’t participating

Comment by Sue Tuesday, Dec 10, 19 @ 9:43 am

LP

You really are a piece of work. Everything that happens is the Democrats fault. Do you have any analysis that isn’t a knee jerk hyperpartisan analysis?

Do better. Stop being lazy in your “analyses”

Comment by Demoralized Tuesday, Dec 10, 19 @ 9:45 am

I have long thought that the incredible income disparity is our country’s ultimate Achilles’ Heel, with the GOP refusing to acknowledge as a problem and the Democrats’ inability to deal with it.

Comment by Paddyrollingstone Tuesday, Dec 10, 19 @ 9:45 am

A BGA analysis shows that the incomes of the wealthiest in Illinois had risen the most in a period after the 2011 tax hike. These analyses show why it’s so very important that we get the graduated income tax in our state. We should not keep overburdening students, social services, vendors, public servants, other taxpayers, etc., with our state’s financial problems. The wealthiest must pay a higher state income tax.

Comment by Grandson of Man Tuesday, Dec 10, 19 @ 9:46 am

==Not our fault you aren’t participating==

Blame the victim

Comment by Demoralized Tuesday, Dec 10, 19 @ 9:47 am

Demoralized why so selective in calling out hyper partisan analysis from just the Republican side of the aisle?

Your clinging to the view that nothing is ever the Democrats fault in Illinois or nationally is noted.

Comment by Lucky Pierre Tuesday, Dec 10, 19 @ 9:52 am

- Grandson of Man -

What’s a fair marginal tax rate (state and federal combined) on the upper 1% now that there is a SALT limit?

Comment by Steve Tuesday, Dec 10, 19 @ 9:53 am

Sue, folks are participating. It’s just that someone has to keep paying for the rich to get richer. It turns out that the folks who are paying are the rest of us:

https://www.cbsnews.com/news/minimum-wage-2019-almost-half-of-all-americans-work-in-low-wage-jobs/

Comment by Travel Guy Tuesday, Dec 10, 19 @ 9:55 am

Sue, you think the tax cuts are directly responsible for job growth almost exactly 2 years after they went into effect? After almost 2 years?

Look at any chart of the labor force or employment, you’ll see a pretty linear growth rate since 2010. The rate changed a bit in 2014, it got faster, but since then it’s been pretty steady. As in, the tax cuts didn’t change much when it comes to the number of jobs.

https://www.bls.gov/web/empsit/cps_charts.pdf

Comment by Perrid Tuesday, Dec 10, 19 @ 9:56 am

Couple of thoughts, remember that Gabriel Zucman helped craft Elizabeth Warren’s tax plan – so there is a political angle to the article. Secondly Gabriel Zucman, like his counterpart Piketty is open to criticism for not factoring in that capital accumulation has any effect on wage growth (it does). Secondly in a modern society how does rising wage inequality harm society (besides politically)

https://www.newyorker.com/news/the-political-scene/the-french-economist-who-helped-invent-elizabeth-warrens-wealth-tax

Comment by Donnie Elgin Tuesday, Dec 10, 19 @ 9:57 am

===Huh- LOL - what do you call 3.3 percent unemployment and 260 thousand jobs created just in November. Not our fault you aren’t participating===

But…the whole point of this is that people on the low end ARE participating and getting demonstrably, disproportionately less than those on the high end. I mean, that’s literally the entire argument.

Comment by Stuck on the Third Floor Tuesday, Dec 10, 19 @ 9:58 am

In its unanimous rejection of the graduated income tax, the ILGOP supports protecting the richest at all costs and letting the state’s burdens continue falling on those with much less wealth. That’s not good at all, not having even a few Republicans supporting tax cuts for the lowest incomes while raising taxes very fairly on the highest.

Comment by Grandson of Man Tuesday, Dec 10, 19 @ 10:00 am

==Your clinging to the view that nothing is ever the Democrats fault in Illinois or nationally is noted.==

I’ve never done that. Once.

However, you’ve done nothing but blame the Democrats for everything. You’re the guy that defended Rauner for 4 years as never having fault in anything. Look in the mirror LP. If you want to see a partisan hack you’re it.

Comment by Demoralized Tuesday, Dec 10, 19 @ 10:01 am

==Demoralized why so selective==

And, what I do is call out your consistent nonsense. And I’ll continue to do so until you want to offer some intelligent analysis of anything beyond your usual tired old talking points. It’s time for you to just go away.

Comment by Demoralized Tuesday, Dec 10, 19 @ 10:02 am

This picture is far worse when one adjusts for inflation.

Comment by Can Tuesday, Dec 10, 19 @ 10:02 am

Grandson, you really need another song other than “I hate successful people”.

Comment by Tater Salad Tuesday, Dec 10, 19 @ 10:03 am

==But…the whole point of this is that people on the low end ARE participating and getting demonstrably, disproportionately less than those on the high end. I mean, that’s literally the entire argument.==

Exactly. The rich get richer and are leaving everyone else further and further behind. And some see absolutely no problem with that. I think that’s the saddest part. I don’t blame rich people for being rich. Good for them. But I do think we’ve got a wealth problem in this country. Everyone should be benefitting and they just are not. That’s a problem that needs to be dealt with. Because evidently the faux trickle down theory doesn’t work.

Comment by Demoralized Tuesday, Dec 10, 19 @ 10:04 am

Tater Salad

Are you suggesting that only rich people are successful? Are you really defining success by who has the most money??

Comment by Demoralized Tuesday, Dec 10, 19 @ 10:05 am

Bill Clinton made a modest tweak to top tax rates and produced the best economy of my lifetime, as well as a budget surplus for the first time anyone could remember. So of course George W. Bush undid it and we’ve never fully returned to it.

Comment by lake county democrat Tuesday, Dec 10, 19 @ 10:06 am

(Sigh)

In Illinois, if you want to make an argument that revolves around “hate successful people” or “stop going after the rich”, you’re gonna loss the argument.

The best thing for the progressive tax, as an example, would be the Raunerites left saying, in a disparaging way, “it’s taxing the wealthy” or the “millionaires’ tax”

The economic war dividing this country, in Illinois, revolves around the current POTUS, who he is, and talking down and around those not as well off, by any measure.

That’s not gonna work here.

So… if it makes ya feel good to “the Democrat hates successful people”… you are continually going to face a backlash here, and the voters are prepared to vote against anything this POTUS has dividing people by wealth.

Just sayin’, but feel free to feel good you typed it.

I’d make a different economic case, but…

Comment by Oswego Willy Tuesday, Dec 10, 19 @ 10:09 am

==So of course George W. Bush undid it==

I think 9/11 had something to do with that. As did the big banks “too big to fail” fiasco at the end of his term (their greed got the best of them).

Comment by Demoralized Tuesday, Dec 10, 19 @ 10:09 am

Demoralized,

No, far from it, but having a good paying job or running a lucrative business is considered one element of success in our society, like it or not.

Comment by Tater Salad Tuesday, Dec 10, 19 @ 10:13 am

Yes completely unfair that Chance the Rapper has more wealth than me, also Oprah Winfrey, Michael Jordan, JB Pritzker, Penny Pritzker, Kanye West, and Jay Cutler. Once the fair tax amendment passes, go ahead and raise the marginal rate to 90% on income over $250K; nobody needs that much income to live on anyway.

Comment by Angry Republican Tuesday, Dec 10, 19 @ 10:15 am

===The 1 percent is making more money and paying less taxes===

My guess is that few of the people here defending this arson the top 1%. That’s how this pathetic ideology of wealth worship works. They get saps like you to go to bat for more tax cuts and give aways for the wealthy, like the wealthy are somehow entitled to it because they are our betters.

(Deleted) that. The graduated income tax in Illinois is just the start.

Comment by 47th Ward Tuesday, Dec 10, 19 @ 10:17 am

Bill Clinton’s was a pro business Democrat. Times sure have changed

“Clinton signed the Omnibus Budget Reconciliation Act of 1993 into law. This act created a 36 percent to 39.6 percent income tax for high-income individuals in the top 1.2% of wage earners. Businesses were given an income tax rate of 35%. The cap was repealed on Medicare. The taxes were raised 4.3 cents per gallon on transportation fuels and the taxable portion of Social Security benefits were increased.

Clinton enacted Small Business Job Protection Act of 1996 which reduced taxes for many small business. Furthermore, he signed legislation that increased the tax deduction for self-employed business owners from 30% to 80% by 1997. The Taxpayer Relief Act reduced some federal taxes. The 28% rate for capital gains was lowered to 20%. The 15% rate was lowered to 10%.”

https://en.wikipedia.org/wiki/Economic_policy_of_the_Bill_Clinton_administration

Comment by Lucky Pierre Tuesday, Dec 10, 19 @ 10:18 am

Honest question since I can’t read the full article behind the firewall. Does the income capital gains from investments or just salary for their employment?

Comment by FormerParatrooper Tuesday, Dec 10, 19 @ 10:19 am

Are in, not arson. Although they are burning down our democracy with this BS.

Nobody is saying “share the wealth,” we’re saying we are tired of paying our taxes AND your taxes. Enough is enough.

Comment by 47th Ward Tuesday, Dec 10, 19 @ 10:19 am

* income from capital gains…. sorry for typo, on my phone.

Comment by FormerParatrooper Tuesday, Dec 10, 19 @ 10:20 am

** In Illinois, if you want to make an argument that revolves around “hate successful people” **

It’s the same tired attack by those who have no defense for keeping the fair tax. It is the sneering contempt of rich right wingers toward many other people who are successful but not wealthy, just because they advocate for fairness.

The real class warfare is the wealthiest refusing to pay a higher state income tax, which they could easily do, and pushing for cuts to the most vulnerable, poor and middle class.

Comment by Grandson of Man Tuesday, Dec 10, 19 @ 10:24 am

47th, last time I checked the only person paying my taxes was me., and I’ve never met a poor lobbyist, so spare us.

Comment by Tater Salad Tuesday, Dec 10, 19 @ 10:27 am

-The economic war dividing this country, in Illinois, revolves around the current POTUS, who he is, and talking down and around those not as well off, by any measure.-

It’s kind of confusing since Trump isn’t doing too well with the wealthy congressional districts.

https://tinyurl.com/tbuzsek

Comment by Steve Tuesday, Dec 10, 19 @ 10:28 am

===Zucman has comes under some major questioning of data and methods by Phillip Magness.===

That’s because he is using households, like the FED, which artificially deflates the income inequality gap. If you’re going to link poorly written and researched articles try and read the sources they cite.

Comment by njt Tuesday, Dec 10, 19 @ 10:33 am

=== It’s kind of confusing since Trump isn’t doing too well with the wealthy congressional districts.===

It’s not confusing at all. Supporting a party led by a racist president and an administration in its midterm lacking empathy and ethics, they will turn their back on things.

The old, angry, white, rural folks who are “confused” to what the tax cuts meant, for example, and their farm is in foreclosure, and still they back this POTUS, it’s confusing.

Comment by Oswego Willy Tuesday, Dec 10, 19 @ 10:33 am

Tater, it’s OK if you don’t understand how shifting the tax burden from the wealthy to people like you works. Lots of people don’t understand that. Unfortunately, the wealthy understand all too well.

Comment by 47th Ward Tuesday, Dec 10, 19 @ 10:35 am

Americans from all tax/income brackets are amazingly generous. According to “Giving USA” a record 427 Billions was given to Charity in 2018. Additionally The United States of America is the world’s most generous country over the last 10 years, according to the CAF World Giving Index 10th edition

https://givingusa.org/giving-usa-2019-americans-gave-427-71-billion-to-charity-in-2018-amid-complex-year-for-charitable-giving/

https://www.cafonline.org/docs/default-source/about-us-publications/caf_wgi_10th_edition_report_2712a_web_101019.pdf

Comment by Donnie Elgin Tuesday, Dec 10, 19 @ 10:35 am

===What’s a fair marginal tax rate (state and federal combined) on the upper 1% now that there is a SALT limit?===

Reconfigure capital gains taxes and eliminate carried interest.

Comment by njt Tuesday, Dec 10, 19 @ 10:39 am

-Are you really defining success by who has the most money??-

Tator Salad is absolutely doing just that.

saying that the moneyed are “successful”

sure

successful at exploiting low wage workers

successful at avoiding paying their fair share in taxes.

Successful at a life of leisure where their money makes money. Not by labor

Successful at extending their privilege in every way.

Yeah, they are successful

Comment by Honeybear Tuesday, Dec 10, 19 @ 10:43 am

You may or may not not believe this, but the signs of the current income / wealth inequality were there as early as the mid-70’s if you were looking at the trends. I remember telling Mrs RNUG in the mid-80’s this split between the 90% and the 10% was coming …

Comment by RNUG Tuesday, Dec 10, 19 @ 10:50 am

-The old, angry, white, rural folks who are “confused” to what the tax cuts meant, for example, and their farm is in foreclosure, and still they back this POTUS, it’s confusing. -

It’s good that you know what their self-interest is, better than they do.

Comment by Steve Tuesday, Dec 10, 19 @ 10:51 am

There are so many examples of why we need a graduated income tax in Illinois. One of the best is the former governor, whose income tripled to $188 million while he was trying to drastically cut state workers and bust unions. That’s not even the whole of it. He starved government and hurt so many while he was waging his labor war, and while he made hundreds of millions of dollars and refused fair taxation. That is class warfare.

Comment by Grandson of Man Tuesday, Dec 10, 19 @ 10:53 am

=== It’s good that you know what their self-interest is, better than they do.===

LOL

Its not my farm. It’s also not my fault that places like southern Illinois want a 51st state, even though She-Caw-Go, and the collars, sends more money to them then they could raise for themselves.

People are silly that way. Prolly why it’s confusing.

Comment by Oswego Willy Tuesday, Dec 10, 19 @ 10:54 am

I realize this chart is structured to make a point, but it would be nice to see a bit more granularity in the chart, say every 10% bracket. I suspect the 80% - 90% didn’t do that badly.

Comment by RNUG Tuesday, Dec 10, 19 @ 10:55 am

In 2016 the top 1% of taxpayers accounted for more income taxes paid than the bottom 90% combined. The top 1% of taxpayers paid about 37.3% of all income taxes, while the bottom 90% paid about 30.5%.

Comment by Pick a Name Tuesday, Dec 10, 19 @ 11:17 am

===I remember telling Mrs RNUG in the mid-80’s this split between the 90% and the 10% was coming===

When the top marginal tax rate goes from 70% to 28%, more inequality is coming. But it really seemed like we hit a sweet spot in the 90s… 40% top marginal rate. Income was taxed as income no matter how it was made. Budgets balanced. General peace. Inequality was still a problem, but it felt like it could be managed. Now we are mired in 2% growth, trillion dollar deficits, more tax cuts for the wealthy, endless wars. We really messed up. But hey, keep pushing that QE and keep the party going until our economy is a total house of cards. RIP Paul Volcker

Comment by Ducky LaMoore Tuesday, Dec 10, 19 @ 11:19 am

- Pick a Name -

Someone needs to look out for the 1%, always glad to see you do it.

Thanks.

Comment by Oswego Willy Tuesday, Dec 10, 19 @ 11:19 am

Pick an Name

That raw dollar argument is a classic obfuscation people make when discussing taxes and the rich and gets away from the real issue being discussed here.

You’re looking at raw dollars and now the effective tax rate these people are paying. I pay a higher effective tax rate than some of those in the top 1%.

Comment by Demoralized Tuesday, Dec 10, 19 @ 11:20 am

“and not the effective tax rate”

Comment by Demoralized Tuesday, Dec 10, 19 @ 11:20 am

And who would have thought. People making less money pay less aggregate dollars in taxes. Real genius analysis there.

Comment by Demoralized Tuesday, Dec 10, 19 @ 11:22 am

===I pay a higher effective tax rate than some of those in the top 1%.===

In 2011, Mitt Romney paid 13% in federal taxes. Being self-employed, I paid more than that in FICA, not counting my actual income taxes. He literally earned 1000 times what I did.

Comment by Ducky LaMoore Tuesday, Dec 10, 19 @ 11:24 am

Demo, who helps the Treasury more, Rauner or Rauner-like taxpayers or you and me?

Comment by Pick a Name Tuesday, Dec 10, 19 @ 11:28 am

“signs of the current income / wealth inequality were there as early as the mid-70’s” In fact, I just read a blurb (written 50 years ago) that income disparity (rich/poor, black/white, north/south) didn’t change appreciably between 1949 and 1969. So you could argue that “mid-70’s” is about 30 years into the signs.

Comment by Skeptic Tuesday, Dec 10, 19 @ 11:34 am

=== who helps the Treasury more,===

Actually, it’s those who “pay their share”, they help the treasury more.

But please, tell me how Rauner pays his share, then as governor tried to starve social services like LSSI for an agenda.

That Rauner, what a hero.

Comment by Oswego Willy Tuesday, Dec 10, 19 @ 11:35 am

A few years ago, there was a story about how Warren Buffett, 3rd richest person in the world, paid a lower effective tax rate than his secretary.

There is a disconnect when someone with $85 billion has a lower effective tax rate than a secretary.

Who in the past 50 years benefited more from the tax code? The billionaire or the secretary? It is obvious that the billionaire has won.

Comment by Huh? Tuesday, Dec 10, 19 @ 11:38 am

=== A few years ago, there was a story about how Warren Buffett, 3rd richest person in the world, paid a lower effective tax rate than his secretary.===

This is the reason why phonies who focus on *amount* versus *rate* miss the idea how “money works” because the rate and income after taxes for the middle class at a higher rate than the 1% is not… understood… it’s understood, it’s the “too bad” mentality being justified with a phony premise.

Comment by Oswego Willy Tuesday, Dec 10, 19 @ 11:44 am

=It’s kind of confusing since Trump isn’t doing too well with the wealthy congressional districts.=

Not confusing at all. It’s a con game and the constituents of the wealthy congressional districts are smart enough to see it for what it is.

The people that cheer the virtues of the “Trump Economy” typically aren’t suburban voters. They’re the ones getting their pockets picked. But Trump makes them “feel” good which is at the root of any good con.

Comment by Pundent Tuesday, Dec 10, 19 @ 11:47 am

-Actually, it’s those who “pay their share”, they help the treasury more. -

Warren Buffett sure is a master at avoiding his “fair share” while suggesting others pay more in taxes.

https://www.barrons.com/articles/warren-buffetts-nifty-tax-loophole-1428726092

Comment by Steve Tuesday, Dec 10, 19 @ 12:00 pm

Raise the state income tax on the wealthy, and don’t forget to include the wealthy retirees. Raise all the revenue you can. It’s the only way to see if the grand experiment that is the State of Illinois will truly work.

Will those new revenues be used to address the unfunded pensions and benefits? Will they be used to shore up the hollowed out government services? Maybe, but there’s no guarantee. That’s how we ended up where we are. Mismanagement, Incompetence and Corruption, that’s the real state motto. But hey, let’s give it one more try.

If it doesn’t work you can put a fork in this state once and for all.

Comment by SSL Tuesday, Dec 10, 19 @ 12:02 pm

==Demo, who helps the Treasury more, Rauner or Rauner-like taxpayers or you and me?==

I’d be glad to give up paying taxes if I don’t help the treasury. You’re still missing the point. Because you don’t want to see the point.

Comment by Demoralized Tuesday, Dec 10, 19 @ 12:27 pm

=== Secondly in a modern society how does rising wage inequality harm society (besides politically)===

A recent book answers that question. THE INNER LEVEL: How More Equal Societies Reduce Strees, Restore Sanity, and Improve Everyone’s Well-Being by Richard Wilkinson and Kate Pickett (2019, Penguin). The authors cite scores of studies that show as inequality rises, so does obesity, mental illness, crime, etc.

Comment by anon2 Tuesday, Dec 10, 19 @ 12:28 pm

Take a look at https://wallethacks.com/average-median-income-in-america/

Then try to make sense out of the table. The top 1% starts at $250K, and averages $1M. In other words, averages are not a good way to look at the data. Then look at where these people live. Making $250K and living in Manhattan doesn’t make you rich.

The data are presented in a certain way, and you have to dig deeper to find out what is going on.

Comment by Old Illini Tuesday, Dec 10, 19 @ 12:29 pm

Tax deductions are one of the most successful con games in history. The government funds programs by providing tax breaks to people who spend money as the government wishes. This can be Section 8 housing or electric vehicles. The spending on these programs is hidden in the tax code. The first part of the con is that government looks smaller than it really is.

The people who use the deductions then report lower taxable income and lower tax rates on their gross income. These people, who are usually rich, can then be excoriated for not paying their “fair” share of taxes. This is the second prong of the con.

Comment by Last Bull Moose Tuesday, Dec 10, 19 @ 12:29 pm

Raise the taxes on the wealthy congressional districts controlled by Democrats?

They just did by curbing SALT deductions

How did that go over with all of the progressives?

Comment by Lucky Pierre Tuesday, Dec 10, 19 @ 12:31 pm

@Lucky P

Well they are controlled by Democrats now. They weren’t before the “tax cuts.” Your straw man arguments are too much sometimes. Targeting political opponents using the tax code isn’t exactly what we are thinking when we say we want a fair tax code. In fact, just the opposite.

Comment by Ducky LaMoore Tuesday, Dec 10, 19 @ 12:54 pm

To begin to bridge the US economic equality gap, which is a worldwide problem, the Democrats need a 2020 majority in both the House and Senate, plus the Presidency; then they will have two years to craft a plan that attracts enough support to pass both houses with not a single GOP vote. Even if Dems win both houses, their majority will be a narrow one and centrist Democrats will probably not go along with anything radical, like a wealth tax.

To win universal Democratic support, a compromise package would have to be popular and saleable with the voters in Democratic districts, and would probably undo many of the 2017 changes regarding deductions while raising the bracket percentage on the highest incomes. Without new legislation, the gap will continue to widen.

Comment by James Tuesday, Dec 10, 19 @ 1:04 pm

Lucky - changes in the Salt deduction were from Trump and the Republican party tax cuts for the wealthy (since they needed the middle class to pay for the rich’s tax refrunds).

This is the reason why republicans in the burbs, like Peter Roskum (my previous rep), lost their elections to “progressive” candidates.

But keep making up your own reality.

Comment by ike Tuesday, Dec 10, 19 @ 1:13 pm

== the Democrats need a 2020 majority in both the House and Senate, plus the Presidency; ==

Not likely in 2020. By and large, voters prefer divided government. Although we’ve seen it a couple of times recently, the same party controlling the House, Senate and Presidency is fairly rare.

Comment by RNUG Tuesday, Dec 10, 19 @ 1:54 pm

Demo, look at the state of Illinois and Chicago’s financial condition. The demise didn’t happen because the state and city didn’t bring in enough money. It happened because of gross mismanagement and corruption.

Our real estate taxes are out of control, our sales taxes are out of control(there is a part of Springfield that charges 10.75% sales tax, reportedly the highest in the nation) and our gas taxes are very high.

We can talk all we want that not many people are moving out of state, discussions would moving companies say otherwise.The overall tax burden in Illinois is crippling. Wait till the next recession.

Comment by Pick a Name Tuesday, Dec 10, 19 @ 1:54 pm

Changes in the SALT deductions were mostly tax hikes on the wealthy Ike, who used to be able to deduct 100% of their state income and property taxes.

They lowered the rates and raised the deductions.

who do you think pays the highest property taxes? the middle class or the owners of large expensive homes

You can see the results for yourself, look at the cratering real estate market for luxury homes with high property taxes in Illinois

Most middle class people received a net tax cut

Comment by Lucky Pierre Tuesday, Dec 10, 19 @ 1:59 pm

Ike - I am confused. The SALT deductions hit the upper middle class the hardest, as they no longer could fully deduct the considerable income tax and property tax in the place where they live (e.g.,Westchester County). How the middle class is gored in this is a mystery, unless you make the argument that the SALT caps in high tax, high expense jurisdictions affect the middle class as well. The middle class is paying slightly less than before under the new tax plan, a good thing until you look at our monstrous deficit and realize the money to be collected is with the middle and upper middle classes. Of course, a state like Illinois has such huge debts taxing their way out of it is really difficult (note in the greatest bull market the 5 pension fund deficit increased by 4B dollars, an amount greater than the Fsir Tax is expected to collect). My tax mentor was Justice Ginsburg’s husband, hardly a conservative, and his work with foreign jurisdictions did reflect that relatively low rates with a very broad base (no loopholes or deductions) was the ideal as economic decisions could be made exogenous to tax considerations. This answer could be different today because disparity in incomes has increased-but I am not sure that is the right focus - as what would benefit us most is having the bottom 20 percent live better than they do.

Comment by Rogermortimer Tuesday, Dec 10, 19 @ 2:29 pm

Lucky & rogermortimer - the changes to SALT do not help middle class people.

The new tax law was designed to help the wealthy at the expense of the middle class.

https://www.forbes.com/sites/howardgleckman/2018/09/24/high-income-households-would-benefit-most-from-repeal-of-the-salt-deduction-cap/#53b1e3583936

https://www.cbsnews.com/news/tax-returns-2019-salt-deduction-cap-middle-class-homeowners-hit-by-the-new-tax-law/#

https://www.americanprogress.org/issues/economy/news/2019/12/10/478598/repealing-salt-cap-not-top-priority-reforming-2017-tax-law/

Comment by ike Tuesday, Dec 10, 19 @ 3:07 pm

Pick a Name

You’ve switched topics. Pick a topic and stick with it.

Comment by Demoralized Tuesday, Dec 10, 19 @ 3:13 pm

==overall tax burden in Illinois is crippling==

And that will not change, progressive income tax or not.

You can raise income taxes on just the “wealthy” all you want, but that won’t change the fact your current onerous overall tax burden will remain onerous.

Comment by City Zen Tuesday, Dec 10, 19 @ 3:14 pm

==The new tax law was designed to help the wealthy==

Of course it was. They didn’t even try to hide that fact. Who is the only demographic for which the tax law does not expire? The wealthy. There seems to be this misguided theory that if the wealthy do well so will everyone else. Well, that theory hasn’t worked out very well. Look at the growing gap between the wealthy and everyone else.

Comment by Demoralized Tuesday, Dec 10, 19 @ 3:14 pm

City Zen

Then leave. Because I’m growing tired of the constant whining by some people. If you don’t like it then leave. And don’t let the door hit you.

Comment by Demoralized Tuesday, Dec 10, 19 @ 3:15 pm

Any statement that Illinois’ tax burden is wrecking the wealthiest, whose incomes have risen the most, is a blatant lie.

Comment by Grandson of Man Tuesday, Dec 10, 19 @ 3:32 pm

Demoralized- not a particularly bright thing for anyone to say- CT is grappling with a huge decline in revenues due to just 3 ultra wealthy residents moving to FL. The Dem Senate President in NJ fought back efforts by His new Governor to impose a wealth tax fearing a similar outcome. I wouldn’t be shocked if more then 5 percent of Illinois income tax is paid by just 25 families or fewer

Comment by Sue Tuesday, Dec 10, 19 @ 3:47 pm

- Sue -

Illinois is NOT Connecticut.

Comment by Oswego Willy Tuesday, Dec 10, 19 @ 3:51 pm

Grandson and Demo, just become wealthy and your issues and whining will stop. It is not easy to be wealthy(unless you inherit, which most don’t) you just have to be better.

If it was easy, everybody would do it.

Comment by Pick a Name Tuesday, Dec 10, 19 @ 3:52 pm

=== which most don’t===

I mean, ask the Walton family… Donald Trump… lol

You “know”…

Comment by Oswego Willy Tuesday, Dec 10, 19 @ 3:54 pm

OW- CT as recently as 25 years ago was the place NY and NJ residents moved to to avoid their higher tax states in another 10 years given our trajectory and assuming passage of Big Boy’s fair tax- Illinois May be more like CA then WS

Comment by Sue Tuesday, Dec 10, 19 @ 3:56 pm

Try to be someone who lives paycheck to paycheck, or poor and sick, in a world of right wing austerity and then talk about hardship. Rauner made at least $333 million while holding the state budget hostage and hurting the most vulnerable, to try to slash middle class workers. Please, spare the crocodile tears of the wealthiest and their shills.

Comment by Grandson of Man Tuesday, Dec 10, 19 @ 3:59 pm

- Pick a Name -

What’s next, you going to explain how your kids “earned” you paying for their college?

I mean, good on you for doing that for them, but are you going to say that was earned “by them”?

I come at this so very earnestly;

The GOP here in Illinois, they need to attract folks in the collars, and places like the 6th and 14th districts.

Ya wanna say in those districts that the gross amount matters, and only matters when it come to taxes, the miss is how much of the non 1-3% that look at taxes and say… “I realize this is all a ruse for the uber-wealthy to scam those it might help by making it a class and race issue. I’m out”

If the nominees are Ives and Oberweis, I don’t see either expanding the GOP chances, especially if the GOP decides to make all this a “millionaire tax” that’s unfair to the wealthy.

It’s such poor politics here in the overall Illinois, it’s embarrassingly bad.

Comment by Oswego Willy Tuesday, Dec 10, 19 @ 4:03 pm

- Sue -

Hartford ain’t Chicago.

CT, NJ, RI, suburbs of NYC.

Where are their economic engines *inside* their borders.

Chicago is the economic engine that Illinois hosts… for the Midwest.

Again, Connecticut isn’t Illinois

Comment by Oswego Willy Tuesday, Dec 10, 19 @ 4:07 pm

Demoralized - Happy Holidays.

Comment by City Zen Tuesday, Dec 10, 19 @ 4:27 pm

Most of our neighbor states have progressive income taxes, with higher rates, and they’re doing better financially than us. Minnesota has the highest income tax rate and the highest incomes in the region, as well as a budget surplus.

Comment by Grandson of Man Tuesday, Dec 10, 19 @ 4:30 pm

Grandson lest you forget our real estate taxes are double to triple what our neighbors in surrounding states are paying and our sales tax is much higher. When JB hits us with 8 percent- adding in our other tax burdens we will be the 3rd or 4th highest taxed state. Stop looking to spend other people’s money

Comment by Sue Tuesday, Dec 10, 19 @ 5:48 pm

Right, because Illinois is immune to onerous tax rates, unlike Connecticut.

Comment by AnotherAnon Tuesday, Dec 10, 19 @ 5:54 pm

Sue, the high tax and spend crowd always conveniently ignores other taxes in these discussions.

Comment by AnotherAnon Tuesday, Dec 10, 19 @ 5:56 pm

=== the high tax and spend crowd===

Careful, don’t hyperventilate, lol

=== always conveniently ignores===

Friend, no one forgets, we’re all taxpayers.

Keep up.

Comment by Oswego Willy Tuesday, Dec 10, 19 @ 6:02 pm

I am not a subscriber to the Washington Post so I cannot read the linked article. However, the table herein does not show that the rich are paying less in taxes; it just shows that their after tax incomes have increased more. This could be because their before tax incomes increased so much that they have more left over after taxes despite paying higher effective rates than in 1970. You cannot directly compare the 37% maximum marginal rate today with the 70% or higher rates that prevailed in the 70’s. The 1986 tax reform legislation got rid of a plethora of loopholes that the rich used to reduce their effective tax rates. Prior to 1986 virtually no one with a high income paid the stated rates. I think the real story is that the wealthy have benefited tremendously from disinflation (which caused massive increases in the prices of financial assets that they primarily hold), and the bottom 80% have been hurt by globalization, outsourcing and automation. It is primarily these forces that have led to the increase in inequality, not deliberate government policy.

Comment by Andy S. Tuesday, Dec 10, 19 @ 11:05 pm

The Fair Tax will give some property tax relief to a lot of people. A big problem with our tax system in Illinois is that property taxes pay too high a share of education. Those with the lowest incomes pay the highest share of their incomes in SALT. The Fair Tax starts to address this problem.

The previous governor, a multimillionaire who got rich in part off of the public sector and got astronomically richer during his term, wanted to tear the savings out of middle class workers in many ways, via state and local government workers and workers who get paid the prevailing wage. That is plainly immoral, when the wealthiest’s incomes grow the most and they pay the lowest share of SALT, which is in part because of the flat state income tax.

Comment by Grandson of Man Wednesday, Dec 11, 19 @ 8:43 am