Latest Post | Last 10 Posts | Archives

Previous Post: SIUC faculty and graduate assistants unions demand remote learning this fall

Next Post: *** UPDATED x1 *** Pritzker launches new $5 million “It only works if you wear it” campaign

Posted in:

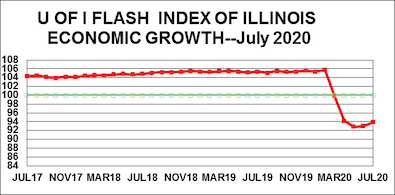

The University of Illinois Flash Index in July continued its gradual climb up from the COVID-19 shock that left the index at 92.8 in May. The July index increased to 93.9 from its 93.1 level in June.

“Despite some recovery in the last two months, the index is still below the 100-dividing line between economic growth and decline,” said University of Illinois economist J. Fred Giertz, who compiles the monthly index for the Institute of Government and Public Affairs. “The renewed prevalence of the virus in some areas indicates a slow, uncertain path for the economy unless an effective vaccine emerges.”

The Illinois unemployed rate also fell to 14.6% from 15.3% the previous month, more than 10 percentage points above the same month last year. The Illinois rate is now 3.5 percentage points above the national level prior to the crisis. This suggests that the Illinois economy has been impacted more severely than the rest of the nation.

In July, individual income and corporate tax receipts were up considerably after adjusting for inflation compared to last year while sales tax receipts were down slightly. Unfortunately, the increase in the two sources was likely the result of the change in the tax filing date to July 15 from April 15.

The Flash Index is normally a weighted average of Illinois growth rates in corporate earnings, consumer spending and personal income as estimated from receipts for corporate income, individual income and retail sales taxes. These are adjusted for inflation before growth rates are calculated. See the full Flash Index Archive.

The growth rate for each component is then calculated for the 12-month period using data through July 31, 2020. For the last five months, several ad hoc adjustments were made to deal with the timing of the tax receipts resulting from state and Federal changes in payment dates that were made to lessen the impact of the closures.

Whew…

posted by Rich Miller

Monday, Aug 3, 20 @ 10:08 am

Sorry, comments are closed at this time.

Previous Post: SIUC faculty and graduate assistants unions demand remote learning this fall

Next Post: *** UPDATED x1 *** Pritzker launches new $5 million “It only works if you wear it” campaign

WordPress Mobile Edition available at alexking.org.

powered by WordPress.

Suspect it will get worse once kids go back to school.

https://jamanetwork.com/journals/jamapediatrics/fullarticle/2768952?utm_source=twitter&utm_campaign=content-shareicons&utm_content=article_engagement&utm_medium=social&utm_term=073020#.XyMU659ENgA.twitter

Comment by Reality check Monday, Aug 3, 20 @ 10:56 am

We’ll see the recovery in fits and starts as the virus flare-ups go up and down.

What could affect it is if companies adopt work from home on a more permanent basis, but that will be a slower change … and may actually result in a smaller permanent workforce.

Faster change comes on the service industry side. Retail and hospitality will be wildly up and down for at least the next year.

Wonder how the underground cash only segment is doing? There seems to be some activity there, but it is hard to know for sure.

Comment by RNUG Monday, Aug 3, 20 @ 1:20 pm